Best CFD Trading Platforms

To help choose a broker that offers CFD trading in the United Kingdom, we compared the spreads of UK CFD Brokers, trading platforms and features. All 2025 CFD brokers listed are FCA-regulated, with offices in the UK.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The July 2025 best UK CFD trading platform list is:

- Pepperstone - Best CFD Broker for UK Traders

- Plus500 - Top CFD Trading Platforms For Beginners

- eToro - Best CFD Broker In UK For Social Trading

- City Index - Good CFD + Spread Betting UK Broker

- CMC Markets - Best Range Of CFD + Currency Pairs

- XTB - Largest CFD Range of ETFs and Indices

- AvaTrade - Best Fixed Spread FCA Regulated CFD Broker

- Interactive Brokers - Best Broker for Day Traders

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

57 |

FCA CySEC |

- | - | - | - | 1.70 | 2.3 | 1.4 |

|

|

|

140ms | $100 | 71+ | 15+ | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

66 |

FCA ASIC, MAS |

- | - | - | - | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $150 | 84+ | 25+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

69 |

FCA BaFin |

0.5 | 0.9 | 0.6 | £2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 338+ | 19+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

51 |

FCA CySEC, BaFin |

0.9 | 0.14 | 0.13 | - | 0.9 | 1.4 | 1.3 |

|

|

|

160ms | $250 | 49+ | 16+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CySEC CBI, KNF |

- | - | - | - | - | - | - |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

52 |

FCA CBI |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 100+ | - | 30:1 | 500:1 |

|

What Is The Best CFD Broker For UK Traders?

To determine the best platforms for Contract For Difference traders we first shortlisted only the FCA brokers. We then determined the different types of CFD traders in the UK and aligned that with the most suitable broker factoring in features, fees and trading platforms.

1. Pepperstone - Best CFD Broker For UK Traders

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Due to its superior software and competitive spreads, we recommend Pepperstone as the top choice for CFD trading in the UK. Funding an account is straightforward, offering numerous cost-free deposit and withdrawal options, including credit cards and e-wallets. Additionally, their 24/5 customer support is top-notch, ensuring traders receive timely assistance whenever needed.

Pros & Cons

- Select from 5 trading platforms

- Choice of social/copy trading tools

- Over 1200 CFD trading products

- No swap-free account in UK

- PayPal is only e-Wallet option

- Simple risk management tools only

Broker Details

Pepperstone Had Advanced Software And Tight Spreads

In 2024, Pepperstone hit some major home runs at the Investment Trends Awards, winning 5 main categories. We agree. As such, our top UK CFD broker in 2024 was Pepperstone. This was based on several criteria for CFD providers in the United Kingdom, with Pepperstone having superior:

- Pricing – Competitive spreads for currency pairs and CFD instruments (EUR/USD spread starts from 0.0 pips)

- Trading Software – The choice of 5 CFD trading platforms. MetaTrader 4, MetaTrader 5, cTrader and TradingView

- Regulation – Integrity through regulation across the globe, including the Financial Conduct Authority (FCA) for UK clients

- Trading Tools – A leading range of leading indicators, foreign exchange trading tools, and markets

The tight spreads offered by Pepperstone for a large range of asset classes (+700 CFD instruments) result from the deep price competition among different liquidity providers.

According to our group of analysts, presented below are some of the main characteristics of this online broker.

Pepperstone Trading Accounts

Before we move onto Pepperstone’s diverse range of CFDs, it’s worth noting the broker’s competitiveness concerning forex trading via the broker’s two account types: a Standard Account or Razor Account.

The Standard Account is a great choice for beginners, thanks to its commission-free pricing structure. Minimum spreads are also as low as 0.6 pips for major currency pairs, very competitive for a no-commission account.

As shown in the table below, this is some of the best commission-free pricing currently available to retail traders.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

You can use this account with MetaTrader 4, MetaTrader 5, and Capitalise.ai.

The second option is Pepperstone’s ECN-style pricing structure via its Razor Account type. This account allows you to trade institutional-grade spreads from 0.0 pips plus commission and is ideal for algorithmic traders using Expert Advisors (MetaTrader) or cBots (cTrader).

There are two types of Razor Accounts, one for MetaTrader trading platforms and one for cTrader and TradingView platforms.

If you use MetaTrader, commission fees are $3.50 (£2.25) per side per 100k traded. cTrader and TradingView commission is a USD $6.00 (round-turn) converted to your base currency for each lot.

When compared to other top forex brokers below, Pepperstone’s average spreads are ultra-competitive for spread-based accounts.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

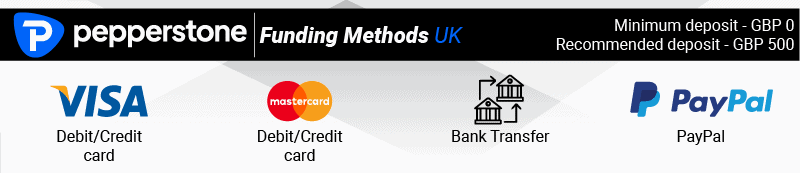

Minimum Deposit and Funding Methods

There is no minimum deposit requirement for Standard or Razor accounts, although the broker recommends at least $200 to get started.

When opening an account, funding methods include standard bank transfer, credit card options, and popular online payment methods such as BPay, PayPal, Skrill, and Neteller.

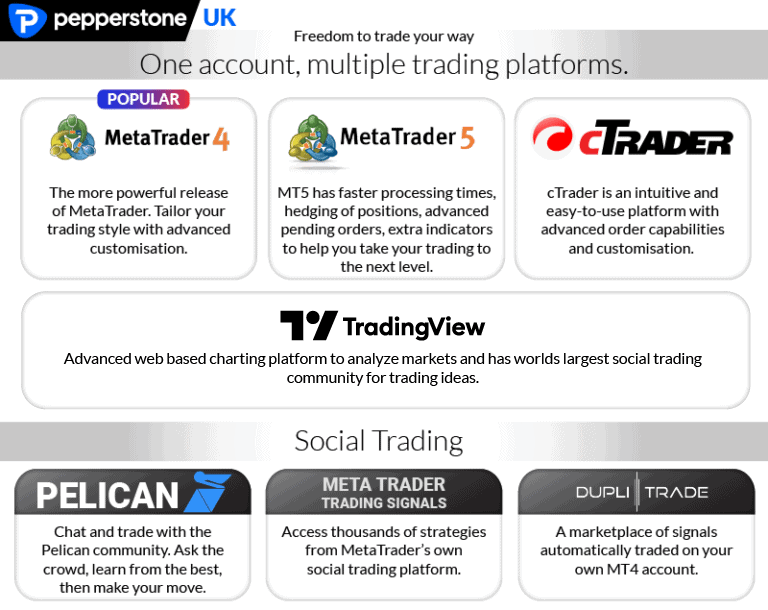

Pepperstone Trading Platforms

Integrated with high standards of security and fast order execution, Pepperstone offers leading CFD trading platforms, including:

- MetaTrader 4 (MT4) by MetaQuotes Software

- MetaTrader 5 (MT5) by MetaQuotes Software

- cTrader by Spotware Systems Ltd

- TradingView by TradingView Inc.

In addition to trading platforms, you can social trade with DupliTrade, Pelican, and MetaTrader Signals.

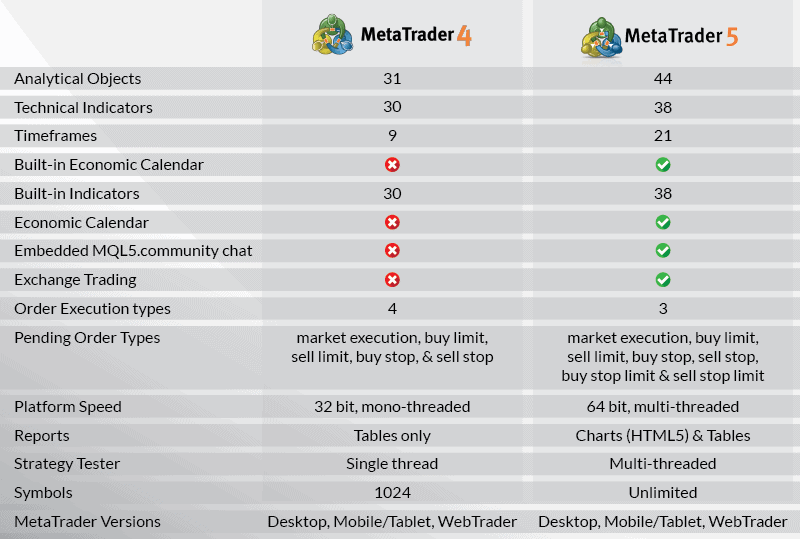

MetaTrader 4 and 5 Trading Platforms

Most traders with Pepperstone are likely to use one of the MetaTrader trading platforms.

MetaTrader 4 is the most popular trading platform in the Pepperstone platform suite and is, in fact, the most popular platform worldwide. This platform has all the essential features to trade successfully, including a huge library of expert advisors to automate your trading.

MetaTrader 5, while not (yet) as popular as MetaTrader 4, is much the same but with more features. So if you want greater trading analysis, MT5 can be a better choice. MT5 is also better for trading centralised products such as stocks and certain ETFs, Indices, and Cryptos.

Both MT4 and MT5 can be accessed through your phone, tablet, or PC.

Some of the main MT4 features include:

While less popular, cTrader is a worthy competitor and alternative to MetaTrader. Users of cTrader appreciate its user-friendly interface, fast entry and execution, Depth of Market pricing, and extra charting feature. Automation is available through the use of cBots with cTrader Automate.

Pepperstone also offers a range of additional trading alternatives for algorithmic trading. This platform is excellent for traders who need to learn to code since you can create algorithms without writing your own scripts.

With over 100 types of charts that you can trade directions within, TradingView, as an advanced charting tool, is one of the best choices for deep trading analysis.

A range of social trading platforms is also available, including Pelican. It is an innovative, all-in-one mobile app exclusive to UK clients and DupliTrade.

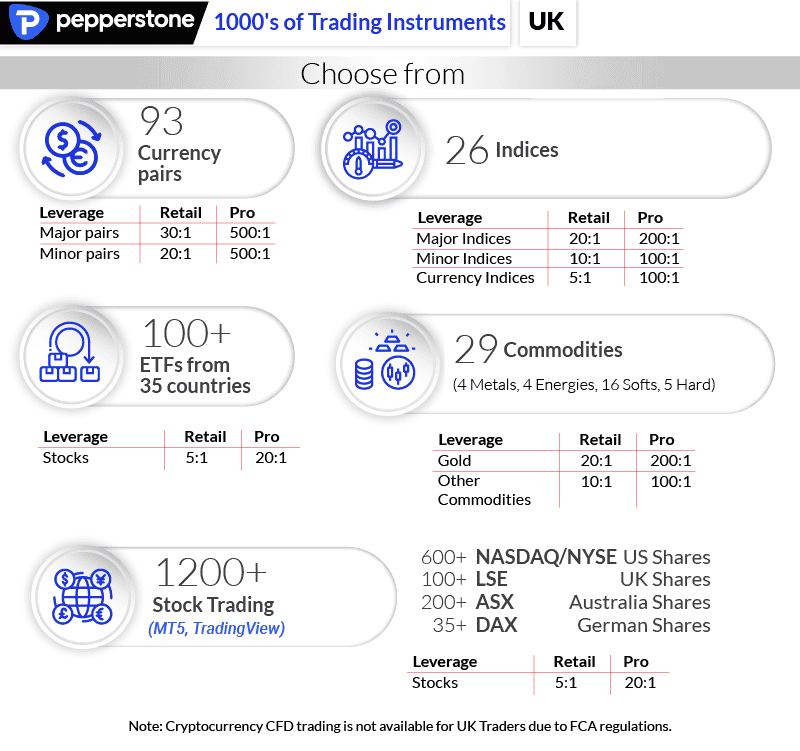

Pepperstone Trading Products

Pepperstone’s retail investor accounts allow UK-based traders to trade on Contracts for Difference (CFD) on 4 financial markets (not including spot Forex currency pairs). These include:

- Index CFDs (25 major stock markets)

- Share CFDs (900+ companies listed on global stock exchanges)

- Commodities CFDs (20 top commodities)

- Currency index CFDs (ability to trade the US dollar index)

Please note, although Pepperstone has offered Cryptocurrency CFDs (i.e. Bitcoin and Bitcoin Cash) to UK traders in the past, recent changes to FCA regulation mean cryptos are no longer available to retail UK traders. Professional traders, however, will be able to trade Cryptos.

Our Pepperstone CFD Broker Verdict

Overall, the advanced software solution coupled with tight spreads makes Pepperstone the best broker for CFD trading platforms. Funding your account is easy, with various fee-free deposit and withdrawal methods such as credit cards and e-wallet options. Pepperstone also offers great 24/5 customer support.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Plus500 - Top CFD Trading Platforms For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$0

Why We Recommend Plus500

We recommend Plus500 for UK traders just starting their journey in the CFD market. This provider stands out with its user-friendly trading platform, demo accounts for practice, round-the-clock support, and valuable educational resources. Furthermore, they offer more accessible entry costs than other UK forex brokers.

Pros & Cons

- Excellent CFD trading platform

- Low spreads with no commissions

- Top risk management tools for beginners

- Basic education videos

- Inactivity fee if no trades in 3 months

- Lack of market analysis resources

Broker Details

Plus500 Offers A Trading Platform With Risk Management Tools

When it comes to CFD trading, Plus500 is our top CFD provider for beginners. It is because Plus500 offers a tremendous proprietary trading platform with helpful risk management tools such as guaranteed stop loss. The provider also has access to various financial markets (+2000 CFD contracts) and instruments from different sectors.

Beginner traders will also appreciate the free demo account, which gives new UK clients the opportunity to practice trading without risking their own money:

- Easy-to-use proprietary trading platform available on mobile (iOS and Android)

- Educational materials (Plus500 Trader’s Guide)

- Risk Management Tools for trade protection

- Webinars and Forex trading guides

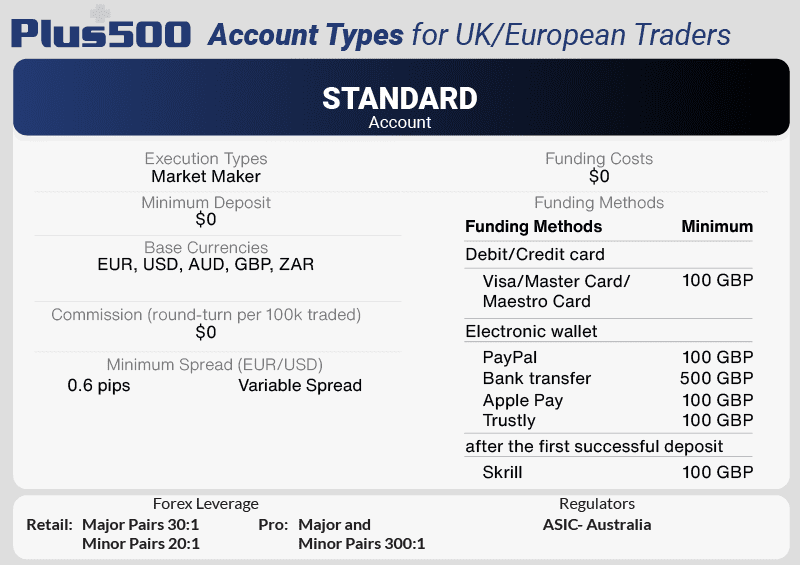

Plus500 Trading Accounts

UK-based traders can open CFD accounts with an FCA regulated brokers by depositing only GBP 100. Plus500 offers most of its CFDs with the following advantages:

- 0% trading fees (deposits, data feed, opening and closing trades, rollovers, etc.)

- 0 commission trading (Plus500 only charges the bid/ask spread)

- No deposit or withdrawal fees which is a great advantage for opening a small trading account

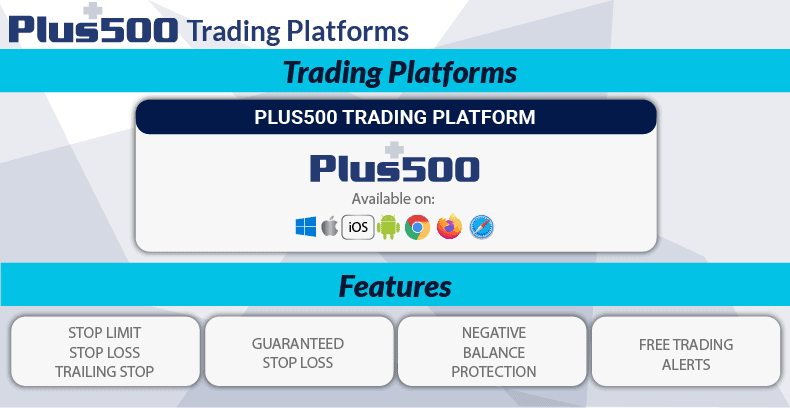

Plus500 Trading Platforms

We’ve found that Plus500 only offers one trading platform, which is their proprietary platform. That said, this platform has an abundance of selling points that are particularly suitable for beginners.

It is easy to use and performs well on both mobile and as a WebTrader. There are also great charting features, with 110 indicators and 20 drawing tools.

Elsewhere, there are great order customisation tools. These include stop limits, stop losses, and guaranteed stop losses. It will help control your risk and provide negative balance protection, which safeguards against market volatility in case a position hits negative territory.

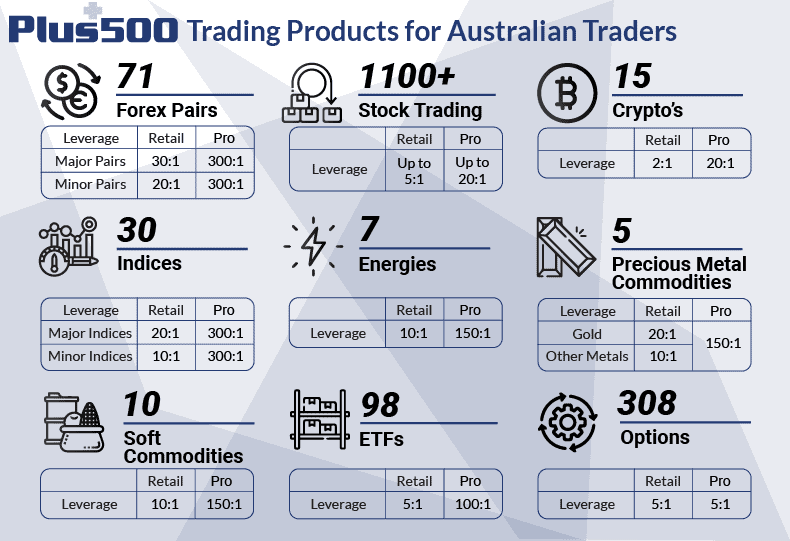

Plus500 Trading Products

Plus500’s product list is solid, with 71 Forex pairs and over 1100 stocks as highlights for UK traders.

While there is a smaller range of indices, commodities, and ETFs, what caught our attention was the 308 options they offer as an alternative investment avenue. This certainly sets their product range apart from many other brokers we’ve come across.

As with other UK brokers on this list, cryptocurrency trading is prohibited (unless you qualify as a professional trader) due to FCA regulations.

Plus500 Broker Verdict

In summary, Plus500 is a great option for UK and London traders new to trading. The CFD provider offers an easy-to-use trading platform, demo accounts, 24/7 support, educational resources, and lower entry costs in comparison to the other best forex brokers in UK industry.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

3. eToro - Best CFD Broker In UK For Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro as the premier choice for social trading in the UK. Their reputation in this arena is well-earned. eToro boasts an intuitive proprietary platform that’s particularly suited for beginners. Moreover, traders have access to a comprehensive range of stock CFDs and ETFs to diversify their portfolios.

Pros & Cons

- Intuitive trading platform built for copy trading

- Offers a decent selection of trading products

- Can review performance of other traders to copy

- Slightly more expensive to trade

- No support for other platforms

- Withdrawal fees

Broker Details

eToro Provides Great Tools For Social Trading

We’ve found eToro to be a top-tier social trading CFD broker in the UK, boasting a massive community of over 20 million investors spanning over 100 countries. Traders like us can use their award-winning CopyTrader platform to trade alongside some of the world’s best.

Some of the main advantages include:

- Copy top traders without management fees

- eToro’s social community, where traders can share thoughts and ideas with other traders from all over the world

- The CopyTrader feature can be tested in demo mode so you can get used to this technology

- eToro’s proprietary platform is intuitive and user-friendly

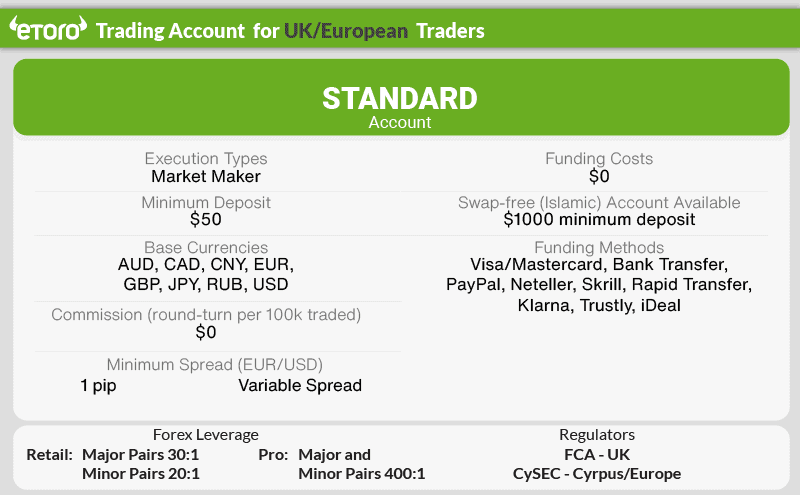

eToro Trading Accounts

Much like our experience with Plus500, eToro offers just one primary account type for UK clients – the Standard account. This comes with no commissions and features a minimum variable spread of 1 pip for EUR/USD, an aspect we considered when calculating trading costs.

All you require to open this account is $50, with no funding costs. This keeps costs low and easier to manage, particularly suited for beginner CFD traders.

A swap-free Islamic account is also available, which complies with Sharia Law. You will need $1000 to open an Islamic account to get started. Unlike other brokers we’ve encountered, eToro does not replace the swap by widening the spread or charging an administration fee.

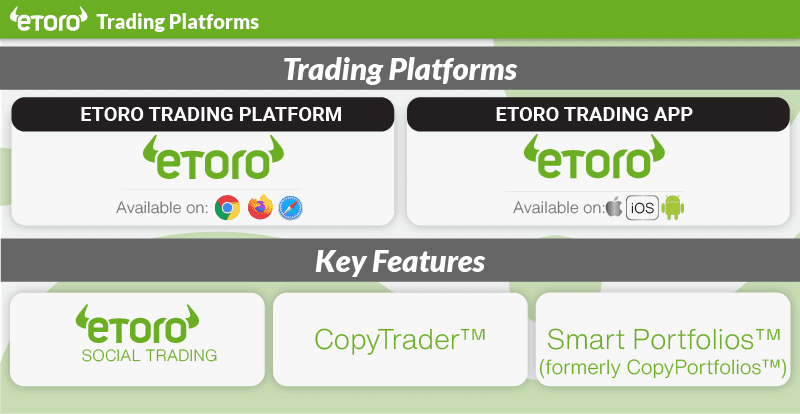

eToro Trading Platforms

eToro stands out for its range of in-house platforms, from the flagship eToro trading platform to its social trading, CopyTrader platform.

With their proprietary platform, eToro seamlessly merges regular, self-directed trading and copy trading. Charting is also a highlight, especially if you utilise ProCharts, which gives you access to 66 indicators and 13 drawing tools. We’ve accessed the eToro platform both via WebTrader and their mobile app.

As additional social trading tools, eToro offers their CopyTrader and Smart Portfolios for individual CFD traders (CopyTrader) and those who prefer a fund manager style approach (CopyPortfolios) to copy successful, expert trader strategies worldwide.

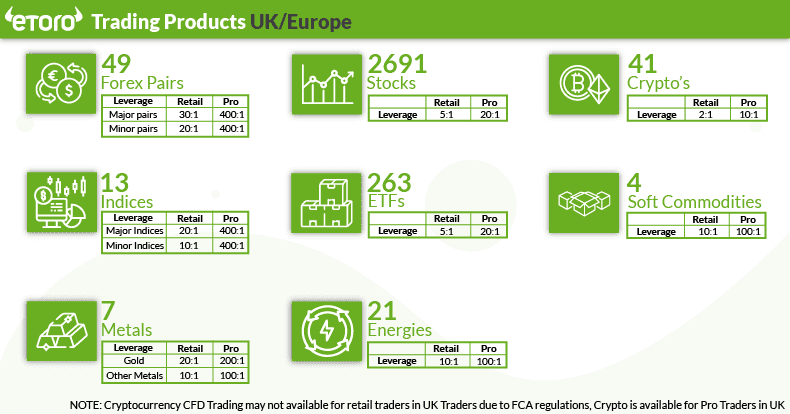

eToro Trading Products

Through CFDs, UK traders have market access to different instruments. Although they don’t own the underlying asset, they can participate in the movement of the tool. Of course, there is a risk warning because the position can result in a win or a loss.

eToro clients with CFD accounts can have access to the following markets:

- ETFs – over 263 instruments

- Stocks – you can find stocks based on the sector or exchange

- World Indices from three continents (Europe, Asia, and the US)

- Commodities – 30+ instruments, including oil, gold, natural gas, platinum, silver, etc.

- Currency forex trading – 49 pairs are available with tight spreads, including the GBP crosses for the United Kingdom traders

eToro Broker Verdict

It’s undeniable that eToro has cemented its reputation as a premier social trading broker. But that’s not its sole strength. eToro’s user-friendly proprietary platform and an expansive range of stock CFDs and ETFs make it an excellent choice. Their tools, like the CopyTrader for individual traders and Smart Portfolios for a more collective approach, further enhance the trading experience.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

4. City Index - Good CFD + Spread Betting UK Broker

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

We recommend City Index for traders seeking a reliable CFD and spread betting broker in the UK. Their multi-award-winning status and top-tier proprietary platform sets them apart in their suitability for spread betting. Importantly, for many traders, there’s no tax on capital gains when using their platform for this purpose.

Pros & Cons

- User-friendly Web Trader platform

- Free performance analytics tools

- Excellent range of markets for spread betting

- Can only spread bet with Web Trader

- Trading on MT4 has limited trading products

- Does not offer 24/7 support

Broker Details

City Index Offers Tight Spreads And Competitive Commissions For Spread Betting

City Index has the best UK spread betting platform and is an award-winning broker, winning the 2021 best CFD broker from the Online Personal Wealth Awards.

Our choice to opt for City Index for spread betting was influenced by their competitive spreads, starting at just 1 point for primary indices like the FTSE 100 and an equally appealing 0.5 points for forex pairs such as the EUR/USD. Trading with spread betting is tax-efficient for UK residents because they do not pay capital gains tax (CGT) or stamp duty.

Furthermore, City Index gives UK traders the opportunity to trade with:

- CFD trading on +8000 financial instruments

- Guaranteed Stop Loss

- Powerful, award-winning CFD platform (Best Platform for the Active Trader 2021 – ADVFN International Finance Awards)

- Competitive commissions for share CFDs

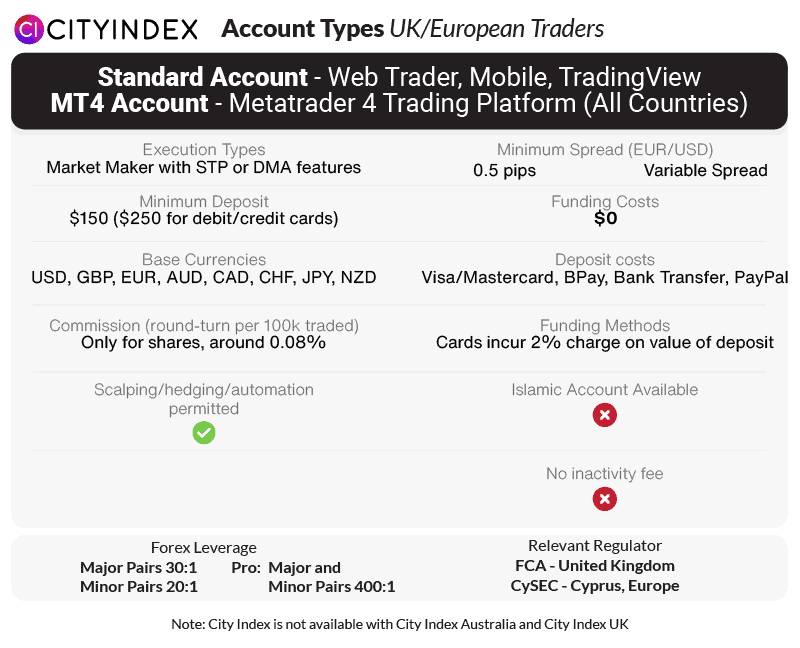

City Index Account Type

You can open one of two account types with City Index: a Standard or MT4 account. The main difference between these accounts is the platform offered.

Using the standard account granted us access to the exclusive City Index Trading platform, with features like guaranteed stop-losses and smart signals. On the other hand, the MT4 account brought us to the familiar grounds of MetaTrader 4.

While City Index products are mostly variable, some are fixed at certain times of the day. You can find out which spreads are fixed using their Market360 feature.

We found their spreads competitive, with Forex starting at a mere 0.5 pips and major indices at 1 pip. A significant cost advantage for us was the commission-free Forex trading and a reasonable commission of around 0.08% for share CFDs.

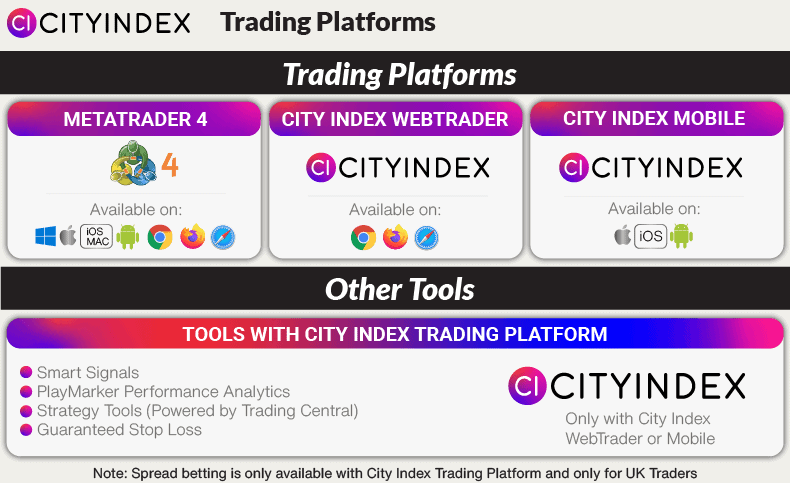

City Index Trading Platforms

City Index offers either the popular MetaTrader 4 or its own award-winning proprietary trading platform, available via the web or on your mobile device.

While MT4 certainly lived up to its reputation, City Index’s platform enhanced our trading experience, offering a comprehensive CFD product range, top-notch trading tools, and several advanced functionalities.

In terms of additional trading tools, the City Index Trading Platform offers Smart Signals, Performance Analytics with PlayMaker, advanced charting with TradingView, and Market Buzz with Trading Central.

Traders using the City Index Platform can also protect their trades with a guaranteed stop-loss. This type of order is not available with MetaTrader 4.

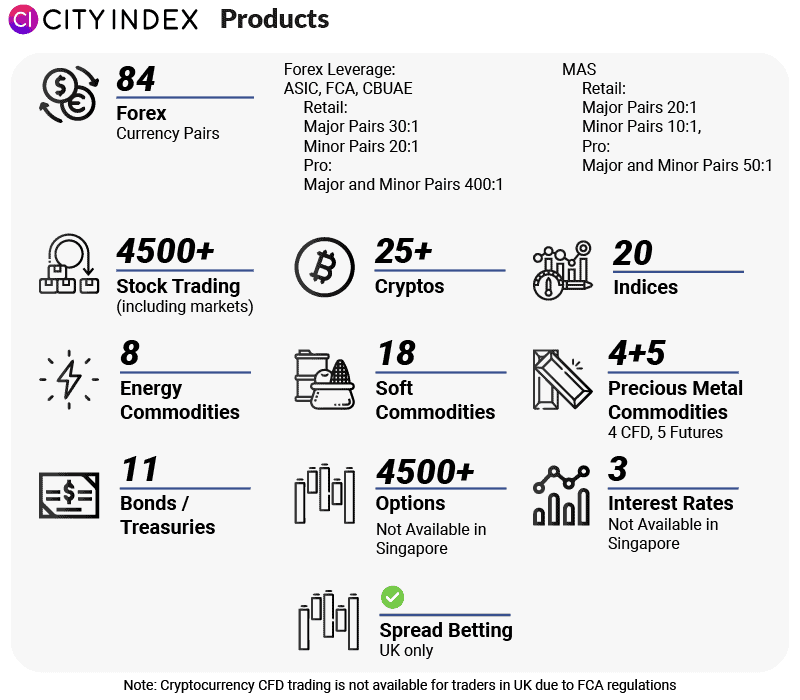

City Index Trading Products

City Index gives UK spread betters access to 8000+ CFD instruments from different markets and allows spread betting on:

- Indices (20 major indices)

- Shares (+4500 global shares)

- Forex (84 currency pairs)

- Commodities (+25 commodities)

- Metals (9 major metals, including Gold, Silver, Copper, Platinum, and Palladium)

- Bonds (11 bond markets)

- Interest rates (3 interest rate markets)

With access to several markets and the right conditions of leverage, UK traders have the tools to execute their trading strategies flawlessly. Moreover, with no cost of commissions, given the fact that the only cost is the spread when the order is executed, they can participate in the market’s movements under competitive conditions.

City Index Broker Verdict

In conclusion, our experience with City Index underscores its reputation as a distinguished CFD broker, further bolstered by an exceptional in-house platform. City Index emerges as a front-runner for those eyeing spread betting, especially given the tax benefits on capital gains. Combining this with their tight spreads, competitive commissions, and extensive market access makes City Index one of the top 5 brokers to consider as a UK spread betting platform.

Your capital is at risk ‘71% of retail CFD accounts lose money with City Index’

5. CMC Markets - Best Range Of CFD + Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We highly recommend CMC Markets’ Next Generation platform for those looking to access a vast range of CFD and currency pairs. With over 9500 products, this platform stands out, especially for share trading. The broker offers competitive account options and commissions, further sweetened by access to a broad spectrum of markets. For traders seeking diversity and versatility, this is a top choice.

Pros & Cons

- Excellent proprietary trading software

- Extensive selection of share CFDs

- Low minimum deposit

- Lacks social trading tools

- Too many products may overwhelm beginners

- No live chat is available

Broker Details

CMC Markets Has A Large Array Of Share CFDs And Low Commissions

Having tried out CMC Markets, we can attest to the strengths of their flagship Next Generation trading platform. One of the standout aspects that drew us in was their low commission structure. Further, the sheer volume of share CFDs that CMC Markets made available to us, as UK traders, was impressive.

Major benefits of CMC Markets:

- Tight spreads and low commissions

- Access to thousands of instruments (over 10,000)

- Risk management tools (guaranteed stop-loss order or GSLO)

- Tax-efficient (for UK traders through the use of spread betting)

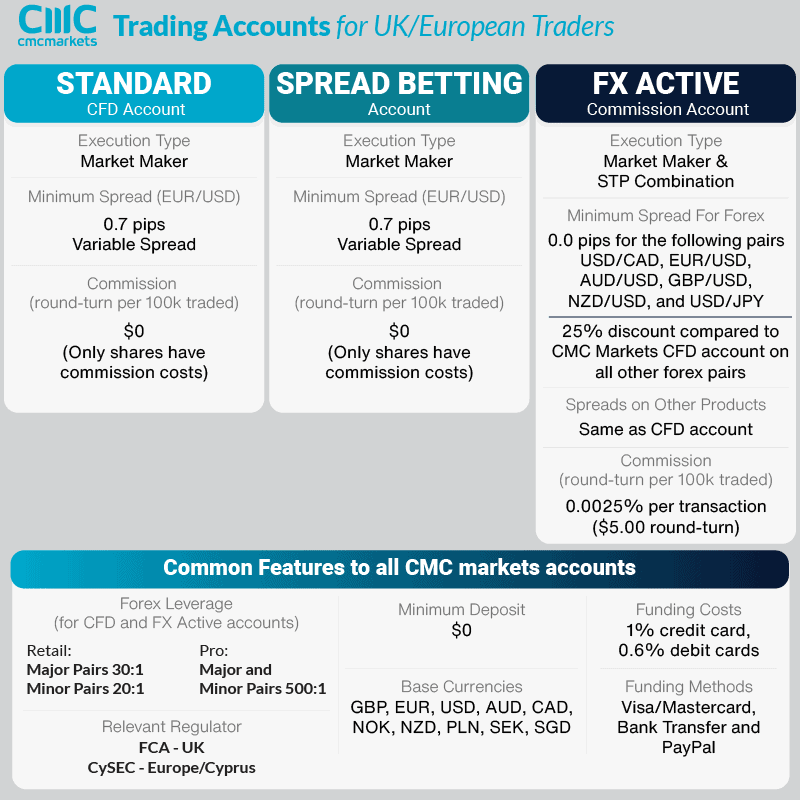

CMC Markets Account Types

At CMC Markets, we were presented with two primary trading account options, catering to either spread betters or CFD traders:

Spread Betting account offers zero-commission trading and spreads starting at 0.3 points. This account is unique to UK traders and CMC Markets as a broker.

CFD account: with this account, you will only pay a commission when trading shares, which starts from 0.10% or 2 cents per share for US and Canadian-listed shares.

Opening either account didn’t demand a minimum deposit, though we’d suggest an initial amount of at least GBP 200. It’s worth noting that using a credit card incurs a 1% fee, while a debit card attracts a 0.6% charge. However, bank transfer incurs no charges.

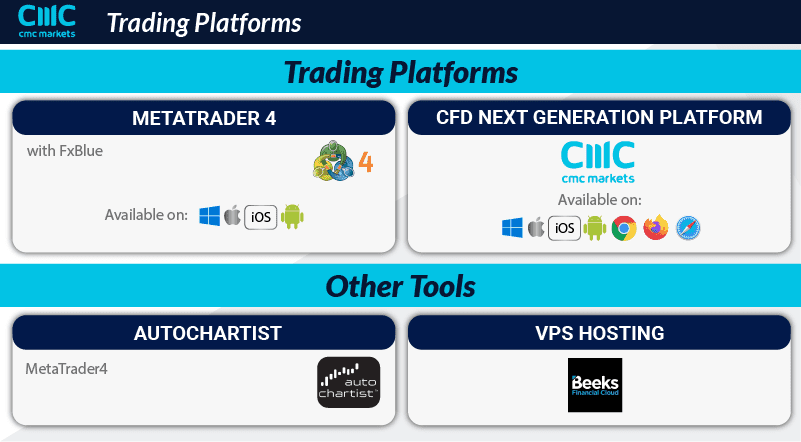

CMC Markets Trading Platform

Much like our experience with City Index, CMC Markets offered us the option of a third-party trading platform and their top-notch proprietary platform, Next Generation.

We found the Next Generation platform among the industry’s finest, boasting a speedy and reliable experience complemented by an array of powerful tools and features. Notably, the comprehensive charting, with its 80 technical indicators, 40 drawing tools, and 60 attachable candlestick patterns, was a highlight for us.

The broker also offers MT4, a solid platform for FX trading. It has its own plugins, including AutoChartist (as a charting algorithmic tool) and FX Blue, a free web-based service for analysing and publishing your trading results.

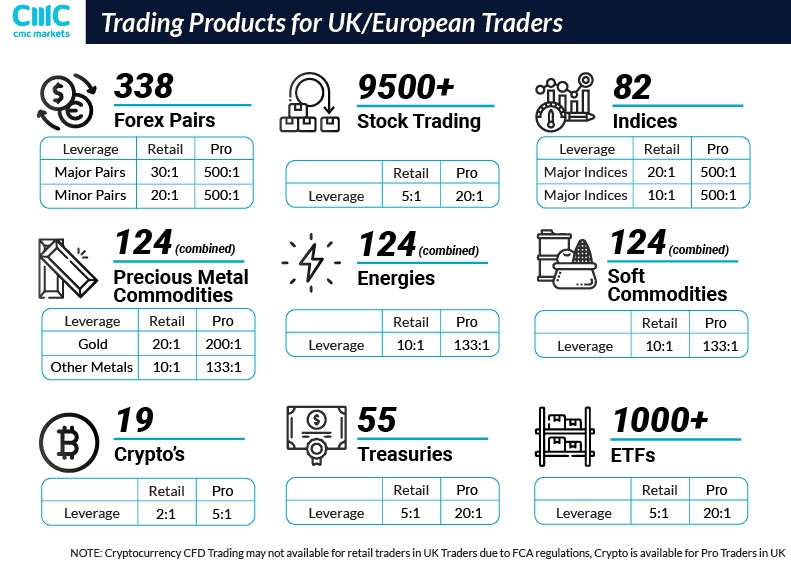

CMC Markets Trading Products

With CMC Markets, our trading horizons expanded significantly. They offer one of the broadest instrument ranges we’ve encountered, especially in the shares category, boasting over 9,500 global shares (including renowned names like Apple and Rio Tinto). The share distribution across continents was as follows:

- American shares (US – 4,330 shares and Canada – 572 shares)

- European shares (UK – 894 shares and EU states – 1,593 shares)

- Australian shares (392 shares)

- Asian shares (1820 shares)

There is also a huge range of Forex pairs (338 due to using inverse quotes), 82 indices, 124 commodities, 55 treasuries and a whopping 1000+ ETFs. This gives you plenty of trading choices regardless of your trading preference.

CMC Markets Broker Verdict

To sum up our experience, the Next Generation platform from CMC Markets is a stellar choice, especially for those keen on trading shares, given its vast product range and superior features. Their competitive accounts, commission structure, and extensive market access add to their appeal. CMC Markets doesn’t enforce a minimum deposit policy, but UK traders need funds in their trading accounts to buy and sell CFDs.

*Your capital is at risk ‘70% of retail CFD accounts lose money’

6. XTB - Largest CFD Range of ETFs and Indices

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.4

AUD/USD = 1.3

Trading Platforms

MT4, xStation 5, xStation Mobile

Minimum Deposit

$0

Why We Recommend XTB

We recommend XTB’s xStation 5 for traders searching for an extensive range of ETFs and indices. This platform not only offers a diverse array of instruments but also boasts competitive spreads and low commissions. Furthermore, XTB has established itself as a trusted brand globally, ensuring peace of mind for traders venturing into ETF trading.

Pros & Cons

- Excellent selection of ETF products

- Commission-free trading on ETFs

- Low trading spreads

- No longer supports MT4 platform

- Has an inactivity fee

- Limited market analysis and tools available

Broker Details

Having engaged with XTB, we can confidently say it’s one of the prominent international forex brokers catering to UK traders, especially those seeking a comprehensive range of ETFs (Exchange Traded Funds). Our trading endeavours were significantly enhanced through XTB’s xStation 5 trading platform, which boasts a user-centric interface, innovative tools, and extensive educational materials.

One of the factors that any UK trader must consider is access to different instruments because it will offer new trading opportunities. On this note, XTB provides a wide variety of markets, especially regarding ETFs, with 138 Exchange Traded Funds available.

Overall, XTB has several benefits:

- Trusted multi-asset broker

- Excellent xStation trading platform

- Zero-dollar commissions for share CFDs (UK-only)

- Comprehensive educational content

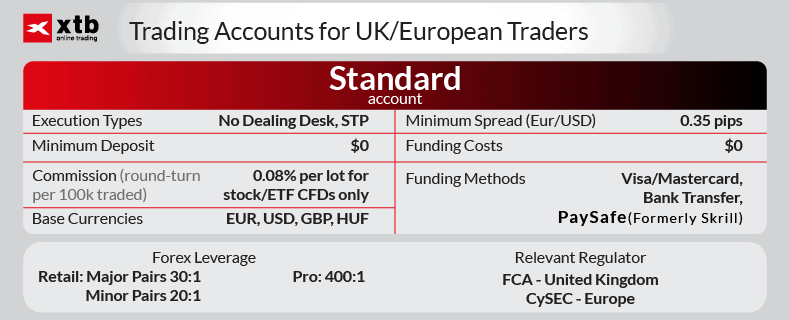

XTB Trading Accounts

XTB offers 1 type of trading account for UK retail traders: the standard account. Features include:

- A minimum spread of 0.35 pips (for Forex instruments)

- Zero commissions for Forex and no funding costs

- Commissions of 0.08% for stocks and ETF CFDs

- No minimum deposit required

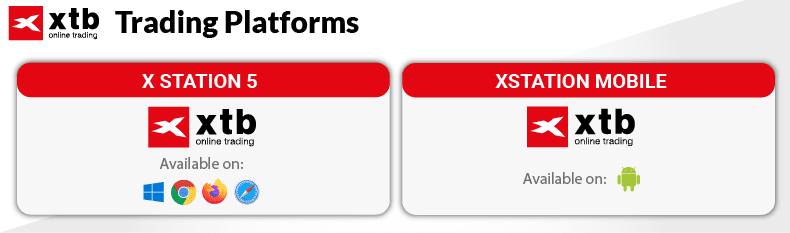

XTB Trading Platforms

Only one platform is available for UK traders, but it is a good one: XTB’s proprietary, X Station 5, as a WebTrader or on mobile.

X Station 5 combines a minimalist, clean design with advanced trading tools in an easy-to-use platform that will suit any level of trader.

Highlights include 30 drawing tools, 39 technical indicators, economic news releases at the charts’ bottom axis, and colour-coded heat maps to show top-moving assets.

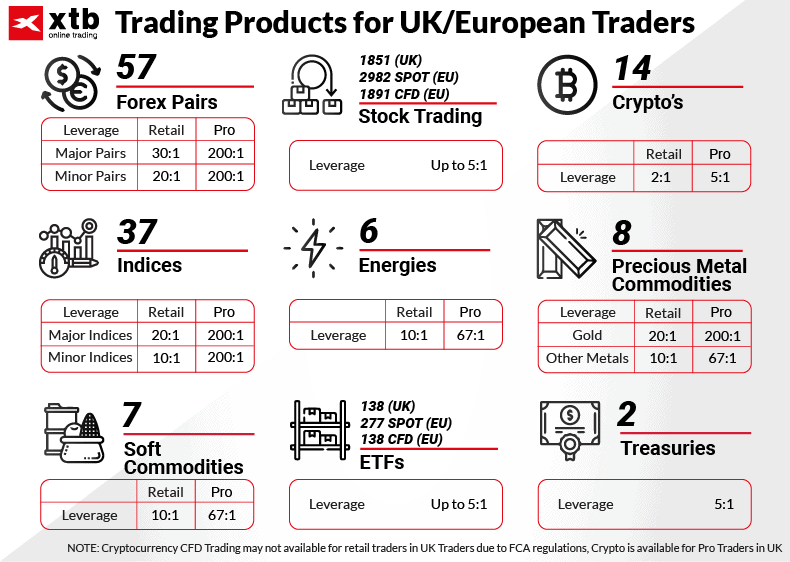

XTB Trading Products

XTB offers a vast array of 1851 share CFDs in the UK, 57 Forex pairs and the largest number of ETFs (138) available to trade on this list.

The only market you will not have access to as a UK retail trader is Crypto CFDs, given FCA regulations, unless you are a Pro Trader in the UK.

XTB Broker Verdict

To wrap up our experience, XTB’s xStation 5 emerged as a premier platform, particularly for those keen on trading ETFs. The platform’s expansive instrument range, competitive spreads, low commission structure, and global reputation make it a top choice for traders worldwide.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. AvaTrade - Best Fixed Spread FCA Regulated CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

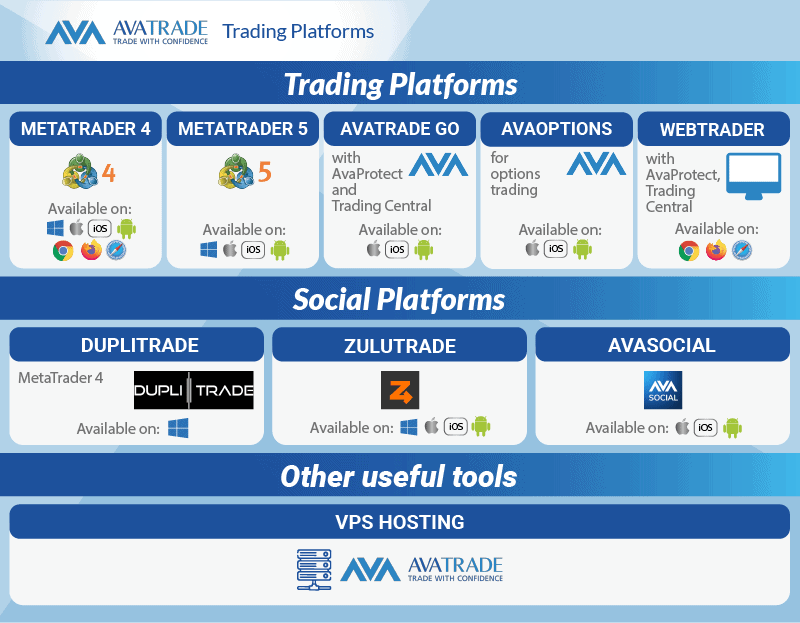

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade for those seeking a fixed spread FCA-regulated CFD broker in the UK. With its cost-effective fixed spreads, AvaTrade presents many advantages, including a broad selection of proprietary and third-party trading platforms. They also offer social trading options and a diverse mix of CFD products, catering to various trading preferences.

Pros & Cons

- Competitive fixed spreads

- Has a solid choice of trading platforms

- Top risk management tools with AvaProtect

- AvaProtect only available on AvaTrade

- High inactivity fees

- Customer support can be slow

Broker Details

AvaTrade Has A Wide Range Of Trading Platforms And Social Trading Options

AvaTrade has the best and most diverse range of CFD trading platforms on this list. These include both popular MetaTrader platforms and AvaTrade’s three proprietary platforms: AvaTradeGo, AvaOptions, and AvaSocial.

The broker is unique because it offers fixed spreads, making it different from other brokers that mostly provide variable spreads. This gives it an advantage in the high-risk (and potentially high-cost) world of CFD trading.

Having fixed spreads means spreads remain locked in no matter the circumstances. Typically, a fixed spread is 2-3 pips on average, while variable spreads can be anywhere from 1 and 4 pips, even higher in extreme market volatility.

Indeed, AvaTrade has a lot going for it, including:

- Low-cost, fixed-spread broker

- Extensive trading platforms for CFD trading

- Solid proprietary platforms, AvaTradeGo, and AvaOptions

- Great social trading with their AvaSocial platform

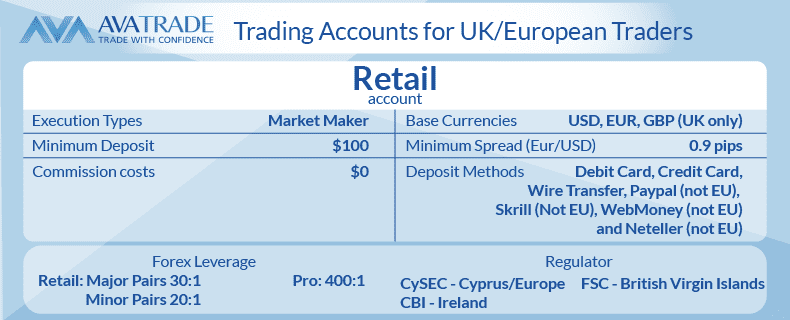

AvaTrade Trading Accounts

AvaTrade’s Retail account is intended for retail traders acting as a standard account with zero commissions. While minimum average spreads are slightly wider at just under a pip, having fixed spreads means the prices will not vary in volatile market conditions. As such, this account is well-suited for beginners or risk-averse traders.

To open an account, you need $100, and to fund it, you can use a range of methods, including debit/credit card, PayPal, and Skrill.

AvaTrade Trading Platforms

As mentioned, AvaTrade has an extensive range of proprietary, third-party, and social trading platforms well suited for CFD trading.

It includes the full MetaTrader suite of MT4 and MT5, two of the most popular third-party trading platforms, as the broker’s own AvaTradeGo, AvaOptions, and AvaSocial platforms.

MT4 and MT5 are both designed for CFD trading, although for the full range of products, we recommend using MT5.

AvaTrade Go With AvaTrade Go, you also have access to Trading Central.

There are also two third-party social trading platforms, DupliTrade, which you can integrate with MT4, and ZuluTrade, one of the market’s most popular copy trading platforms.

AvaTrade Trading Products

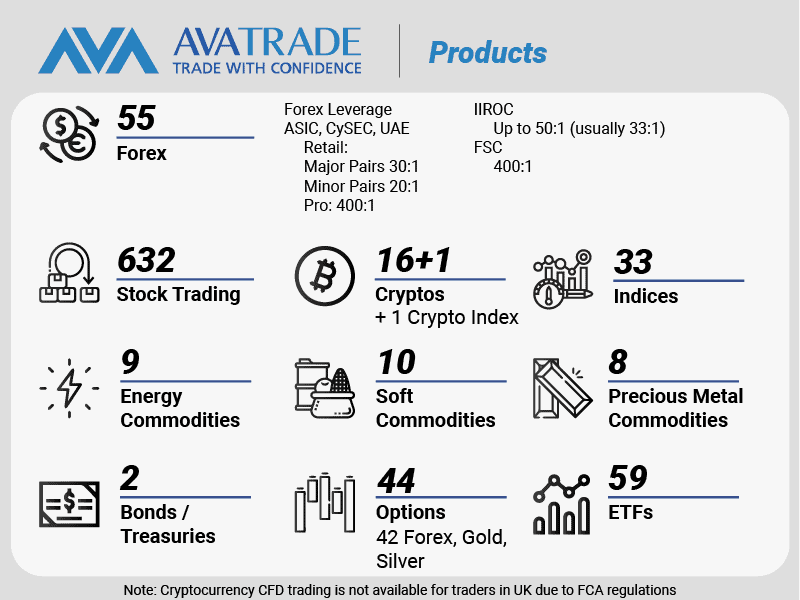

AvaTrade offers a little of everything, with Forex, stocks, indices, commodities, bonds, ETFs, and options all available to trade.

It includes a good mix of 55 Forex products and 632 stock CFDs. You can also trade 44 options with the AvaOptions platform, 42 of which are Forex instruments.

See below for the full product range, including a disclaimer on cryptocurrency trading, which is prohibited in the UK.

AvaTrade Broker Verdict

In addition to being a low-cost, fixed spread broker, AvaTrade offers UK traders many benefits, including an extensive range of proprietary and third-party trading platforms, social trading options, and a solid mix of CFD products to choose from.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

8. Interactive Brokers - Best Broker for Day Traders

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We recommend IB for day traders in the UK, given its low costs, outstanding software capabilities, and swift execution. With one of the most varied market ranges, it’s no wonder they’ve gained global recognition. Their accolades, such as the Best Online Broker award in 2020 by Barron’s, further reinforce their leading position in the industry.

Pros & Cons

- Large range of financial instruments to trade

- Low trading fees

- IBKR platform offers excellent trading tools

- IBKR is not user-friendly

- Lacks a choice of third-party trading platforms

- Has a minimum commission of $2 per trade

Broker Details

Having explored the offerings of Interactive Brokers Group, a seasoned global brokerage with a rich 40-year history, we can vouch for its commitment to providing superior trade execution, direct access, and clearing services across diverse markets. Our comprehensive review indicates that IB’s trading conditions and software are top-notch for UK day traders.

A notable feature of IB is the ability for traders like us to delve into many asset classes, such as stocks, options, futures, foreign exchange, bonds, mutual funds, ETFs, and spot commodities, all under one integrated account. Additionally, they offer the option to access several assets via CFDs.

Advantages of signing up with IB:

- Access to 135 global markets

- A superior array of advanced trading tools

- Lower commissions for active traders

- Competitive spreads

Interactive Brokers Trading Accounts

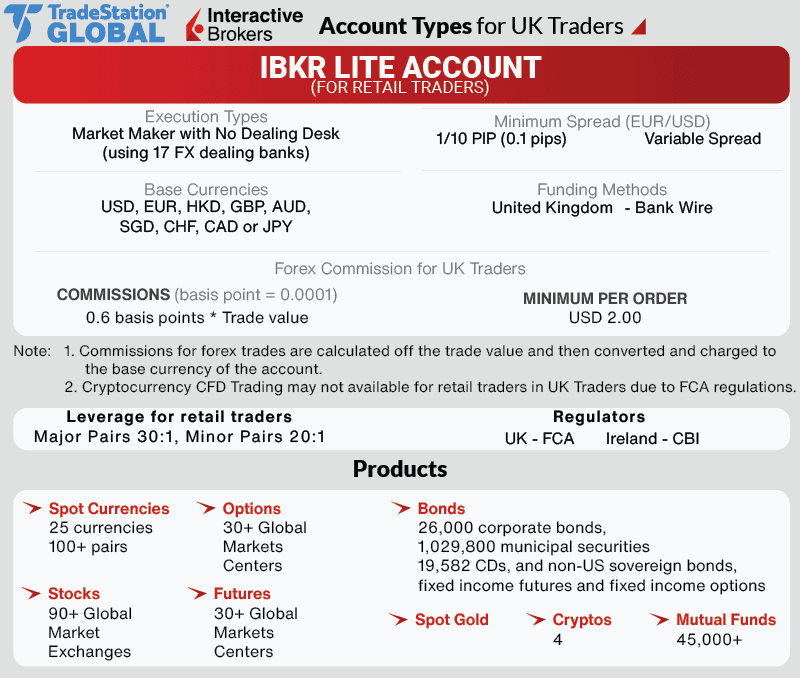

IB offers one account for retail traders, their IBKR Lite Account. As you can see from the image below, the account features are complex, so it is suited for more experienced traders.

To break it down, commissions will vary based on your monthly trading volume. Essentially, the more you trade, the cheaper your commissions will be (e.g. if you trade more than USD 5 million a month, you will pay 0.08% of a basis point x the trade value). As such, this account is designed for more sophisticated active day traders.

Spreads are ultra-competitive, starting at 0.1 pips for major Forex pairs.

You can only transfer via bank wire in the UK to fund your account.

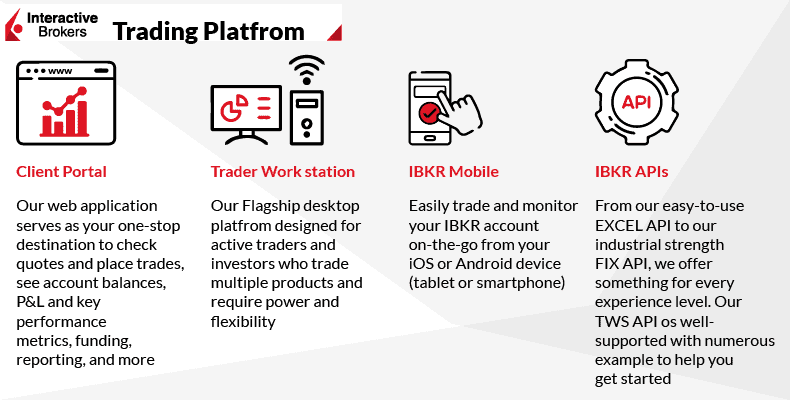

Interactive Brokers Trading Platforms

Day traders have a choice of desktop and web-based trading platforms and mobile apps for iOS and Android devices.

IB Trader Workstation is the broker’s flagship desktop trading platform, which ensures direct access to comprehensive trading, order management, charting, and watchlist tools.

Clients can use more than 100 order types and algos aimed to reduce risk, accelerate execution, allow privacy, ensure price improvement, time the market, or just simplify the trading process via advanced trading features.

Client Portal is IB’s simple and intuitive web-based platform, visualising key account metrics at a glance and granting access to detailed price quotes, advanced charting tools, and IB’s live news stream.

The IBKR Mobile app also allows direct access to account management tools and more than 135 markets while on the go. It features two-factor authentication for greater account security and provides the same market-moving data as the broker’s desktop platform.

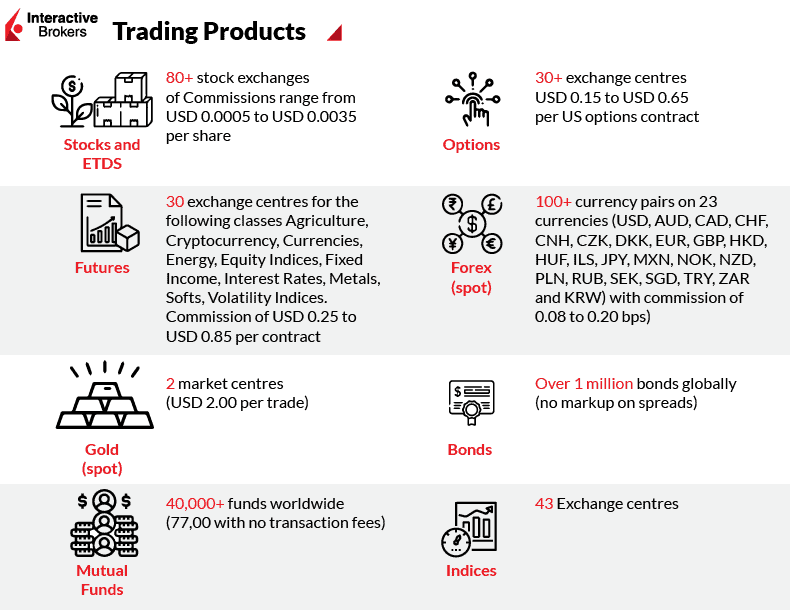

Interactive Brokers Trading Products

Interactive Brokers offers one of the most diverse product ranges in the industry. As a UK client, you can access 135 international markets in 33 countries.

This includes over 100 currency pairs, stocks, ETDs on over 80 stock exchanges and a whopping 1 million bonds (including municipal securities). Of particular note are the over 40,000 mutual funds available to trade, unique to IB.

No other broker offers the sheer number and range of instruments for UK traders that we’ve come across.

Again, this highlights that IB is targeting more sophisticated traders who want variety and plenty of CFD trading options.

Interactive Brokers Verdict

Based on our hands-on experience, Interactive Brokers emerges as the preferred choice for UK day traders due to its cost-effective structure, unparalleled trading software, and vast market range. Many accolades further endorse its global recognition, including being crowned the Best Online Broker in 2020 by Barron’s.

Ask an Expert