Best Social Trading Platforms UK

We think the best social trading platforms in the UK are MetaTrader Signals, eToro, DupliTrade and TradingView. Social tools allow you to share trading ideas and copy trade signal providers and leverage their success.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the best social trading platforms is:

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA CySEC, ASIC |

0.06 | 0.23 | 0.27 | £2.25 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CySEC CBI, KNF |

- | - | - | - | - | - | - |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

57 |

FCA CySEC |

- | - | - | - | 1.70 | 2.3 | 1.4 |

|

|

|

140ms | $100 | 71+ | 15+ | 30:1 | 300:1 |

|

What Is The Best UK Social Trading App?

We compared the trading platforms offered to UK Traders to find the best providers based on different trading needs. Key consideration was the trading platform, popularity of the software and of course, trading fees.

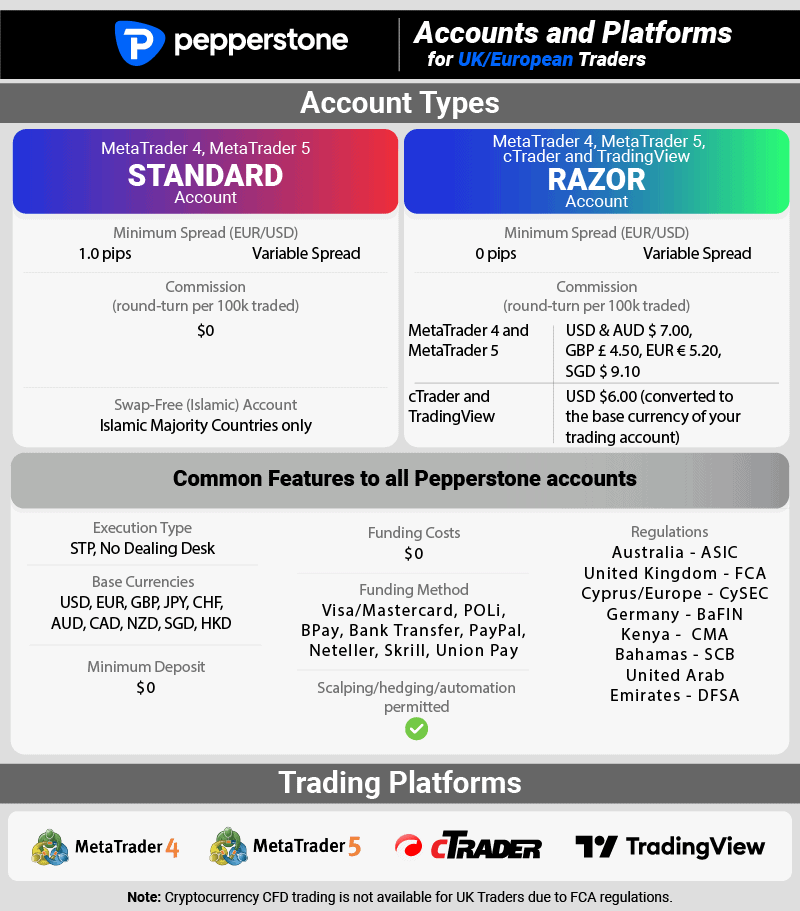

1. Pepperstone - Best Social Trading Platform UK

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We think Pepperstone’s selection of social trading platforms sets it apart, while most brokers might only have one social trading option, Pepperstone has 3. With access to leading social platforms; MetaTrader Signals, DupliTrade and social networking with TradingView, you’re equipped with the tools to follow the strategies of successful traders that can enhance your trading experience.

Pepperstone is our top-rated broker overall. We gave them a score of 98/100 for their low trading costs, range of trading platforms including MT4, MT5, cTrader and TradingView, and a large range of markets to trade, such as 92 currency pairs.

Pros & Cons

- Offers the best platforms for social trading

- Fast execution speeds

- Low trading fees

- Limited crypto markets in the UK

- Educational materials need updating

- Demo account is limited to 30 days

Broker Details

Pepperstone’s social trading tools are quite expansive compared to other brokers, offering a choice of platforms, including DupliTrade, MetaTrader Signals, and TradingView.

Of the 3, we thought DupliTrade was the most interesting social trading platform that we tried. This software allowed us to automate our trading by duplicating the activity of other traders in the DupliTrade community. What we like is that DupliTrade has a lengthy auditing process that signal providers must pass before they are available for us to copy. This auditing process gave us confidence in the quality of the providers on their database.

DupliTrade has filters that help us find the right providers for our trading style. These filters help learn a bit about the provider, the provider’s trading history and trading style. While testing, we chose “Ivory” strategy provider, which traded off price action on major pairs.

We liked that you can see how long each strategy has been running and how many other traders follow the strategy, adding social proof to improve trust. DupliTrade made it very easy for us to set up our strategy as it automatically uses your MetaTrader 4 account to mirror the trades.

Our tests, led by head analyst Ross Collins, highlighted that Pepperstone not only offers some of the lowest spreads in the industry, averaging 0.1 pips on EUR/USD, but also has the fastest execution times, with limit order speeds recorded at 77ms. This efficiency is crucial for social trading, ensuring you can execute trades with minimal slippage.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

2. Eightcap - Has TradingView For Social Networking

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We recommend Eightcap if you wish to use the TradingView trading platform. This platform has a community of 50M+ users to social network with, meaning there are plenty of experts you can learn from when trading. While you can’t directly copy other traders, TradingView tools encourage you to share market insights, create educational content and follow peers for trading strategies.

Our tests found Eightcap averages one pip on EUR/USD with no commissions (with their standard account), which we think are impressive low spreads. Case in point, our research found the industry average to be 1.24 pips. If you want lower, their RAW account has spreads averaging 0.06 pips for EUR/USD.

View Eightcap ReviewVisit Eightcap

Fund an Eightcap account and unlock a TradingView Plus plan worth £33.95 per month

*Your capital is at risk ‘74% of retail CFD accounts lose money’

Pros & Cons

- Tight average spreads

- Offers TradingView platform

- Good choice of market analysis research

- Customer support is not 24/7

- Lacks mirror trading tools

- The market range is limited

Broker Details

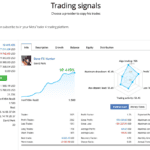

Not many people realise that TradingView is much more than its excellent charting tools. We think the social trading aspect is a hidden gem, considering you have access to the thoughts of over 50,000,000 traders.

In our testing, we liked the way TradingView has layered the chats tool alongside the chart as you can monitor conversations with others in the community while performing your analysis.

As we were trading, someone commented that they posted their full chart to the chat so you could open and review it yourself, which we thought was far better than other platforms where traders mention the price levels, letting you see what they see and making it easier to agree or disagree with them.

Eightcap impresses further with an excellent average spread across the forex majors based on our testing. The broker offered an average spread of 1.06 pips with no commissions on its Standard account across the top 5 major currency pairs.

To put this in perspective, Eightcap’s average was 0.46 pips, lower than the industry average of 1.52 pips.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

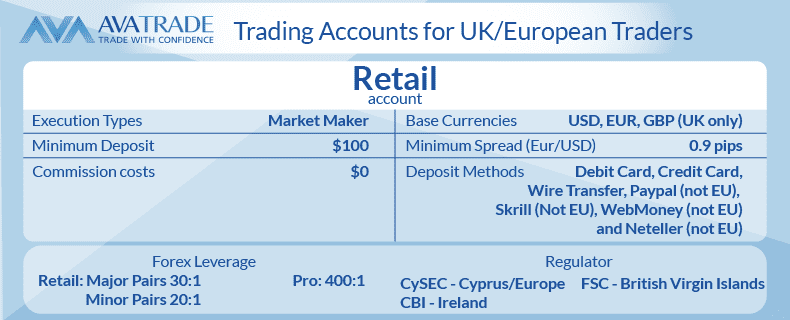

3. AvaTrade - Good Broker With Fixed Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We found AvaTrade unique given they are a market maker but encourage social trading. To social trade, you can choose between AvaSocial, DupliTrade and MetaTrader Signals. We found AvaSocial to be the most interesting offering as they were built in partnership with Pelican Trading.

Key features of AvaTrade we wish to mention are their (near) fixed spreads, a feature that can help you average your trading costs over time and the ability to trade Forex as options.

Pros & Cons

- Provides competitive fixed spreads

- AvaSocial allows you to copy trade

- Offers a decent range of markets

- It doesn’t offer RAW spread accounts

- Market research tools are limited

- Has inactivity fees

Broker Details

While testing the AvaSocial app, we felt that AvaTrade did an excellent job at highlighting the latest and best traders available to copy with its Discover page. For example, the app was updated daily, showing which traders were performing well, which we liked as it made it easier to find new traders to follow.

The AvaSocial platform isn’t just about copying other traders; you can build a network of traders to chat and discuss the markets with. This part of the app was responsive, and receiving push notifications to our phones prevented us from missing any updates.

AvaTrade is one of the few brokers to offer fixed spreads in the UK, and they surprised us with their competitiveness. The fixed spreads averaged 0.9 pips on EUR/USD, which is impressive compared to variable spreads offered by brokers like Plus500, which offer 1.7 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

We think fixed spreads are ideal if you like to trade with volatile markets. You’ll know your costs ahead of time without having to dodge a trade because the broker makes the spreads more expensive.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

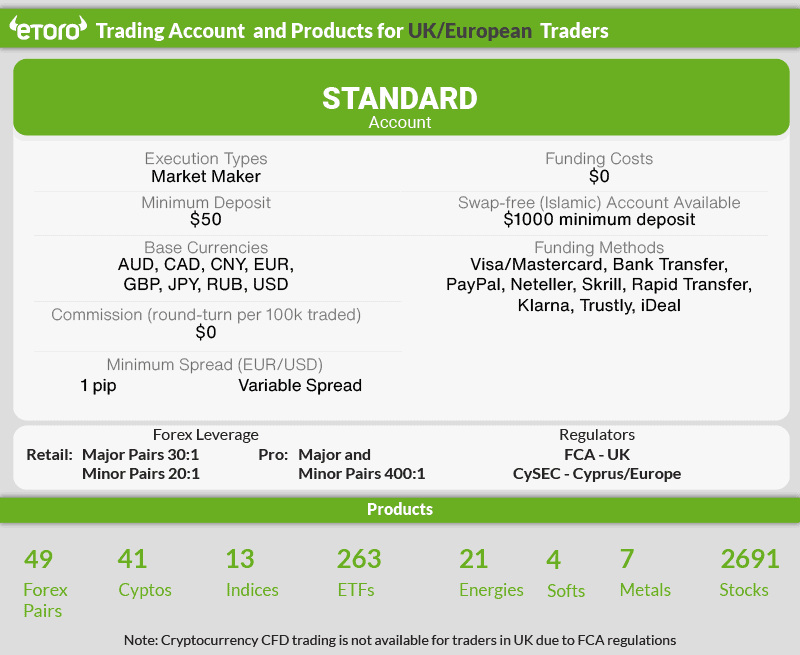

4. eToro - Best Broker For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

Unlike other social trading tools we have reviewed, which are 3rd party tools, eToro is a pure social trading platform. eToro lets you easily find and follow top traders, sharing their analysis and enabling you to copy their trades directly while transparently showing the trader’s historical performances. Which we think helps instil trust when choosing a copy trader. We also like some of their unique AI-generated tools like the SmartPortfolios.

Plus, eToro offers a solid range of markets, allowing you to copy traders from different markets to diversify your risk.

Pros & Cons

- Excellent copy trading platform

- 30,000,000 traders to copy from

- No commissions on stock trading

- No support for third-party platforms

- No RAW spread pricing is available

- Has withdrawal fees (£5)

Broker Details

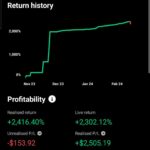

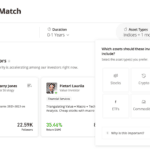

eToro’s CopyTrader platform is the easiest to use out of all the others we’ve tested. With features that simplify filtering its 30,000,000 traders, we could finely tune the criteria to find traders that meet our high requirements.

We tried eToro’s simplified “matching” tool by selecting the “big picture” metrics I’m interested in, and it returned the top traders we can copy that match our essential criteria. This is a valuable tool if you are unsure what you want in a trader’s performance but know your basics like markets to trade and risk levels.

One of the filters we liked was that you could choose which markets your copy trader specialises in. This gave us the idea to build a portfolio of copy traders across different markets to diversify our risk. We could then divide our funds and allocate them via a percentage with eToro’s Copy tools, making it easy to fund and manage the Copy Traders.

As a broker whose core focus is on its trading platform, we were also impressed with its competitive spreads, averaging one pip on EUR/USD and commission-free trading on stocks.

eToro combines an excellent trading platform built specifically for social trading and a brokerage service with decent trading costs and a range of products.

We like eToro’s CopyTrader platform as it provides a suite of tools that make it easy to find the traders you want to follow and copy. They do this by providing verified trading metrics like:

- Return on Investment (ROI)

- Number of profitable trades in the past 30 days

- Number of followers

- And much more

Plus, the broker has over 30,000,000 traders on its platform, which shows its popularity and range of traders from whom to copy.

As a broker whose core focus is on its trading platform, it also offers competitive spreads averaging one pip on EUR/USD and commission-free trading on stocks, helping lower the cost of social trading.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

5. Admirals - Top Broker With MT4 Social Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.6 AUD/USD = 0.5

Trading Platforms

MT4, MT5, Admirals Platform

Minimum Deposit

$100

Why We Recommend Admirals

We recommend Admirals as the top broker for MT4 social trading tools, particularly for their access to MetaTrader Signals, a solid range of financial instruments, and competitive spreads. This feature lets you find and copy traders directly within the MetaTrader 4 platform, streamlining your trading experience.

Furthermore, Admirals stands out for their competitive pricing, with one of the lowest average spreads on the top 5 major forex pairs at just 1.04 pips. This is significantly below the industry average by 0.48 pips, making it an attractive option for low-spread trading.

Pros & Cons

- Offers excellent plugins for MT4

- Offers CFD and Spread Betting markets

- Competitive spreads

- Has withdrawal fees

- Has a minimum deposit requirement

- Customer support is limited on weekends

Broker Details

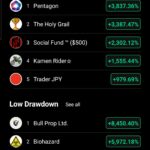

Admirals offers access to the MetaTrader Signals through its MT4 accounts, which opens up the platform to find and follow trading signals within the MetaTrader 4 platform.

We like to look for transparency with copy trading services, so we were impressed with MetaTrader Signals performance analytics, which included all the essential metrics we like to review, such as:

- Max drawdown

- Trades per week

- Growth

- Amount of subscribers (good for social proof)

In addition, you can find reviews left by users of the signals, which again can help instil trust (but I’d take it with a pinch of salt).

In our testing, Admirals had competitive spreads, some of the lowest available at 0.6 pips on EUR/USD, and were commission-free. We emphasise commission-free, as other brokers we’ve reviewed that have spreads around 0.5 pips are from the RAW pricing accounts, which have commissions attached to each trade.

Admirals also offers a great selection of 4,000 markets covering forex, indices, stocks, and commodities, giving you plenty of opportunities to use the MT4 social trading tools.

*Your capital is at risk ‘74% of retail CFD accounts lose money’

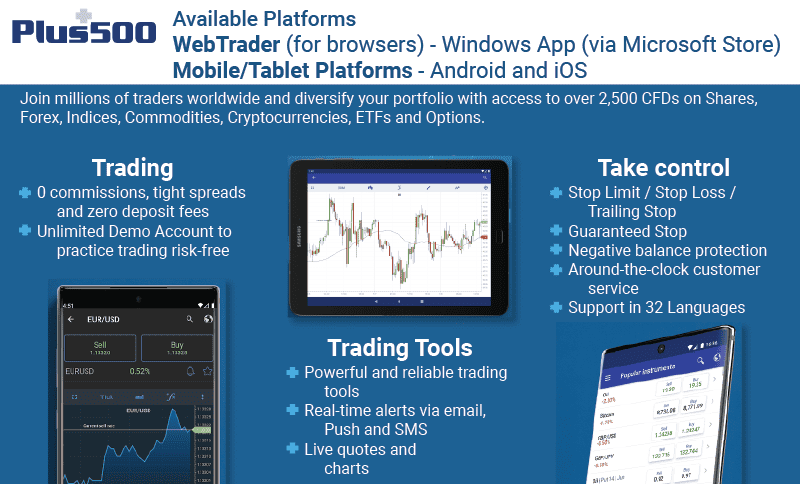

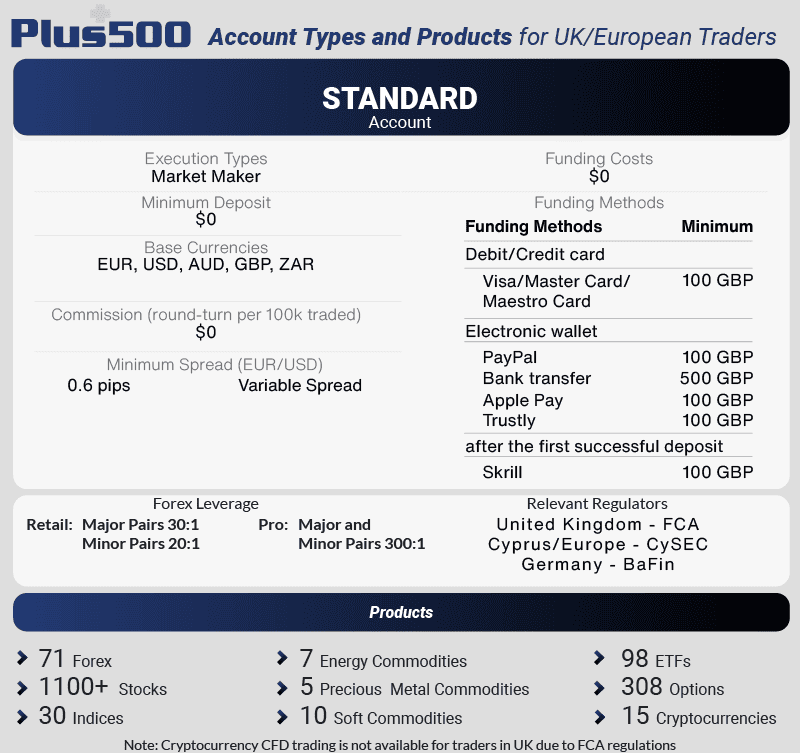

6. Plus500 - Top Mobile Social Trading App

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

To be clear, the Plus500 trading app does not have social trading in the sense that you can connect with other traders, but we think they have an interesting feature called “Insights+”. +Insights gives you the overall trading bias of the 400,000 strong Plus500 trading community. This tool allows you to view market sentiment, letting you see statistics on what Plus500 traders are buying and selling so you can find new trading ideas.

You can access the insights+ data across Plus500’s 1200+ markets to trade, including shares, ETFs, forex, indices, and commodities.

Pros & Cons

- Excellent trading platform

- Sentiment-based analytics with insights+

- Decent range of markets

- Has an inactivity fee

- It does not offer MetaTrader or TradingView platforms

- No tools to automate trades

Broker Details

We tested the Plus500 app (available on iOS and Android) and found it has 13 chart types, 11 time frames, 119 indicators and 21 drawing tools. Having so many features surprised us as trading apps usually have more limited charts and indicators due to the smaller screen space. We found the platform very easy to use and like how it closely mirrors the Plus500 WebTrader version. The app however isn’t perfect; two weaknesses we wish to highlight are that you cannot sync mobile data with web charts and that there is a lack of news and research tools.

On the topic of social trading, we thought the insights+ tool helped us when making trading decisions. +Insights analyses the open and pending positions of over 400,000 customers in real-time. We like that the tool automatically collects the activity and shows you the top trending assets and whether traders are buying or selling, making it easy to analyse. Other sentiment tools include Trading Central and Factset.

While Plus500 stands out for its social trading capabilities, it’s worth noting that the spreads are slightly wider, averaging 1.7 pips on EUR/USD compared to its peers. We should also highlight that Plus500 doesn’t provide access to third-party platforms like TradingView or MetaTrader 4. So, if this is an issue, a brokerage like Pepperstone would be better.

*Your capital is at risk ‘80% of retail CFD accounts lose money’