Best Social Trading Platforms

Good forex social trading platforms include tools that enable copy trading, socialising and learning from the best traders. Popular platforms include MetaTrader 4, eToro and ZuluTrade. See the best social trading platforms brokers offer.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

See our forex brokers with the best social trading platforms

- eToro - Best Broker Overall for Social Trading

- Pepperstone - Best Social Trading Platform for MetaTrader 4

- BlackBull Markets - Best Social Trading Platform for MetaTrader 5

- IC Markets - Best Social Trading Platform with Low Trading Costs

- Darwinex - Best Social Trading Community

- FP Markets - Best Social Trading Platform with MyFXBook and AutoTrade

- Fusion Markets - Best Social Trading Platform with Duplitrade

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

What Are The Best Social Trading Platforms?

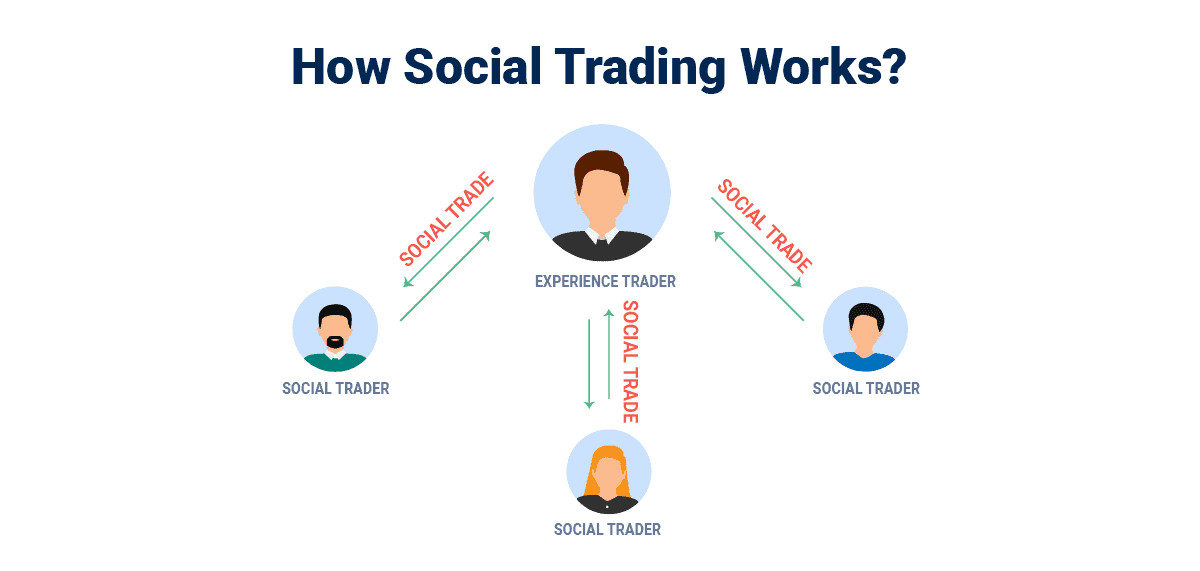

A great forex social trading platform will allow you to socialise with and learn from experienced traders. This requires specific tools and integrations, not all supported by every broker or trading platform. We reviewed top forex brokers’ features to identify the best for social and copy trading.

1. eToro - Best Broker Overall for Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

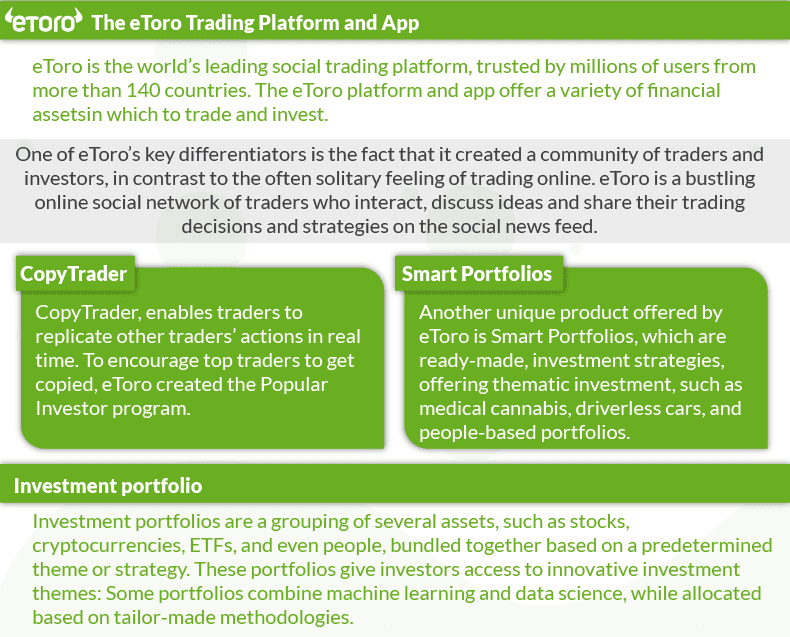

We liked eToro for its strong commitment to community-driven trading since 2010. Drawing inspiration from platforms like Facebook and Twitter, its user interface features a central newsfeed. Traders can comment on each other’s positions, and standout performers rise to prominence through the Popular Investor Program. This platform showcases their profiles to entice new members, making it our top pick as the Best Broker Overall for Social Trading.

Pros & Cons

- Good for casual and professional traders

- Unique social and copy trading tools

- Worlds largest community of social traders

- Limited range of tradable products

- Average trading costs and speeds

- US $200 minimum deposit

Broker Details

We picked eToro as the best platform for social trading based on its ground-up commitment to trading as a community activity. Founded in 2010, the Israeli brokerage modelled its interface on platforms like Facebook and Twitter, adding a newsfeed to the main dashboard and allowing users to comment on other traders’ positions. The Popular Investor Program accords successful traders quasi-influencer status, with the platform pushing their profiles to new users for inspiration.

Key Features

- Copy trader to find and copy other leading traders

- Investment portfolios – stocks grouped by theme

- Large crypto CFD trading range

- Share trading ideas with the eToro community

- Social trading specialist

Don’t let the friendly design fool you – we consider eToro a Tier 1 broker, on par with more ‘serious’ brokerages like IC Markets or IG. In addition to the Australian Securities and Investment Commission (ASIC), eToro is regulated by the Cypres Securities and Exchange Commission (CySEC) and the UK’s Financial Conduct Authority (FCA).

eToro Has the Largest Trading Community – Over 31 Million Users

As of February 2025, eToro claimed over 31 million users located in 104 countries. While not all of those users are active, that’s by far the largest community of social and copy traders of any brokers. (Remember, other brokers may boast more funded accounts, but not all of those will be engaged in social trading or visible to you if you’d like to copy their strategies.)

Why does this matter to us? Because the larger and more diverse the community of any social trading platform, the better for you. This is one instance where quantity does add up to quality. All the analytical tools and automation in the world won’t do you much good if you’ve only got a few hundred traders to mimic or if the ones available to copy aren’t successful.

eToro Social Trading Platform Features

Maybe you’re brand new to trading forex, CFDs or crypto. Maybe you’re interested in day trading but don’t have the time to develop a full-fledged trading strategy or closely monitor market movement. Or perhaps you’re an experienced trader interested in earning passive income while honing your technical analysis. eToro has you covered.

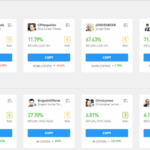

The broker’s social trading platform allows you to replicate the trading activity of other account holders with a proven track record of excellence. We used the Popular Investor Program inside the broker’s proprietary trading platform to search for investors to follow and were impressed with the granularity of the search filters. We were able to refine our results based on risk score, number of followers, preferred markets, maximum drawdown and recent performance to generate a concise list of portfolios to follow.

We also like that eToro doesn’t force you to go all-in on a specific trader. We allocated a portion of our account balance to a popular investor based in Singapore and kept some under our own management, which made it easy to see where we could build on her strategy.

If you’re already an experienced trader wondering if you’d benefit from joining the Popular Investor Program, the answer is yes! If eToro considers your strategy viable and you amass a following, you may be eligible to receive payments equal to up to 2.5% of your assets under management or of the total amount other users allocate to copying your activity.

Other features of the eToro platform that we appreciated include:

- OneClick Trading allows you to open the same position across multiple trading sessions with ease

- Stop Loss, Trailing Stop and Take Profit orders help you to manage risk and maximise profits

- ProCharts tool enables you to compare charts for different financial instruments across timeframes

- Smart Portfolios take the guesswork out of building a portfolio

- CopyTrader allows you to mimic the positions of top traders on the platform – up to 100 at once!

eToro Takes Copy Trading to the Next Level

Remember, social trading relies on exploiting the wisdom of crowds to develop a strategy and doesn’t necessarily involve copying another trader directly. Copy trading, on the other hand, is exactly that. If you like the idea of day trading but just don’t have the time to devote to learning technical analysis or want to pick up some passive income, copy trading is for you.

While some brokerages shy away from copy trading for regulatory and business reasons, eToro goes the other way entirely. The broker offers some of the most sophisticated copy trading supports on the market, such as:

- CopyPortfolios bundles together a set of financial instruments

- Top Trader Portfolios bundles together a set of best-performing trading strategies from more experienced traders

- Partner CopyPortfolios allows traders with more trading experience to create, promote and manage their own CopyPortfolios and attract new investors

We did note that CopyPortfolios require longer investment periods and are designed to minimise long-term risk. On the one hand, that means you can generate up to double-digit annual returns. On the other, you’ll need to make a minimum deposit of US $5,000.

After you invest in a CopyPortfolio, eToro’s broker investment committee takes over the management of your capital. Each portfolio is subject to in-depth analysis and rebalances automatically in order to maximise gains. You won’t pay any management fees, however.

How to Open an eToro Account

If you’re sold on eToro and ready to begin copy trading, you’re in luck. While not the speediest of processes, opening an account with eToro isn’t as labour-intensive as with some other brokers.

eToro also scored 85/100 for funding methods – higher than all but two other Tier brokers. You can add money to your newly created account using just about any method imaginable – from bank transfers to digital wallets.

Step 1.

After clicking one of the big, green ‘Sign Up’ buttons on the eToro website, you’ll be directed to choose your username. More importantly, you’ll need to confirm that you accept the terms of service and acknowledge that eToro will have access to some of your data. Whether you read through these policies is up to you – but we strongly suggest that you do.

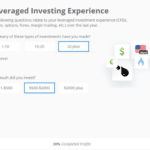

Step 2.

Next, you’ll need to answer some questions about your knowledge of and experience with day trading. Don’t get hung up on ego if you’re new to day trading or leveraged products – answering honestly helps eToro recommend appropriate profiles and portfolios for you to copy.

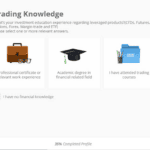

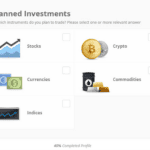

Step 3.

eToro asks you to indicate which markets you intend to trade for an obvious reason: it needs to configure your account correctly. If in doubt, select all the markets that interest you – you can always cut back later.

Don’t be shy when it comes to sharing your reason for day trading. Different financial goals support different levels of risk, and eToro needs this info to match you with the appropriate niche in its community. Put another way, if you’re after short-term returns, you won’t benefit much from copying strategies that will fund a downpayment four years from now (and vice versa).

Step 4.

For regulatory reasons, eToro asks that you confirm certain details about your financial and employment situation. These won’t apply to most people, but if you find yourself unsure, we suggest contacting customer service to clarify. We tried this out and found them highly responsive. Our email query received a reply in less than 24 hours.

Step 5.

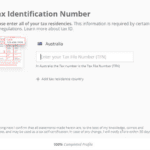

As with all other regulated brokers, you’ll need to provide tax information to complete your account.

Step 6.

Provided all goes well, you should receive an email within 24 hours inviting you to verify your account and add funds. eToro requires a minimum deposit of US $50, but we added US $500 just to see how quickly the funds would arrive. eToro credited our account in less than 12 hours.

Step 7.

Once you’ve verified and funded your account, it’s time to choose the traders you plan to follow. eToro provides a curated list based on your responses to the account opening questionnaire, but you can also choose your own after running targeted searches.

Our Verdict on eToro: The Best Social Trading Platform Overall

eToro offers more than just a social trading platform – it’s a true global network of like-minded retail investors and traders dedicated to sharing ideas and enriching their knowledge. The simplicity of the design makes it accessible to beginners and an easy on-ramp to copy trading for those more accustomed to technical analysis. We would’ve preferred not to pay a minimum deposit, however.

*Your capital is at risk ‘68% of retail CFD accounts lose money’

2. Pepperstone - Best Social Trading Platform for MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

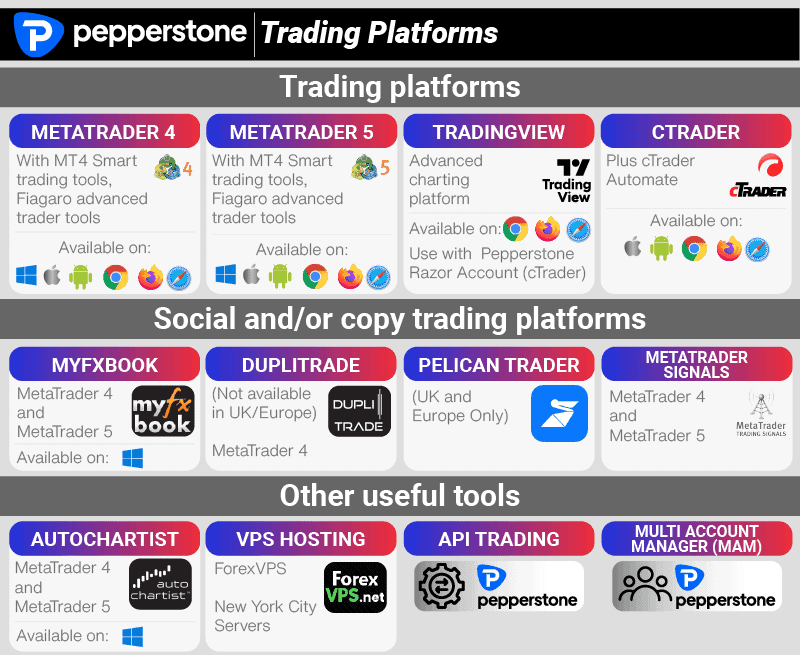

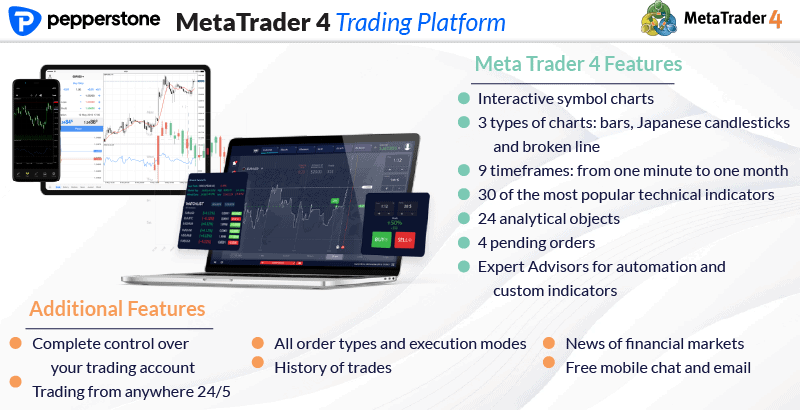

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked Pepperstone, hailing from Melbourne, for its top-notch selection of social and copy trading integrations on MetaTrader 4. Its swift execution times and reasonable trading fees consistently stand out in our reviews. This time was no exception, as we ranked it second.

Pros & Cons

- Use MyFXBook for copy trading

- Tight spreads on MT4

- Fast execution speeds with MT4

- No guaranteed stop-loss orders

- Limited education resources

- Limited crypto products

Broker Details

We’ve always had a favourable view of Melbourne-based Pepperstone in our reviews, and our recent experience further solidified this perception. We placed this notable MetaTrader 4 broker in the second spot, attributing this ranking to its commendable array of social and copy trading integrations, as well as its swift execution speeds and competitive trading costs.

- 3 social/copy trading 3rd party options

- 4 Trading platform options

- Standard and Commission based trading

- Fastest execution speed

- Easy account opening

Pepperstone’s MetaTrader 4 Trading Platform Features Multiple Social Trading Tools

Venturing into the world of Pepperstone, we were granted access to a broad spectrum of social trading networks. This came alongside tools tailored for mirror trading and automated copy trading without sidelining MetaTrader 4. For avid forex traders keen on dabbling in social trading yet reluctant to part with the familiar MetaQuotes interface, Pepperstone is an ideal choice.

When we tested Pepperstone’s trading platform offering specifically for social and copy trading, we were impressed by the variety of tools and integrations. Based on our count, you can take advantage of:

- Three social networks plus an auto trading feature (MyFxBook AutoTrade, MQL5 signals, and Pelican)

- Three dedicated copy trading platforms (DupliTrade, RoboX and Mirror Trader by Tradency)

- Mirror Trader by Tradency and MyFxBook and MQL5 trading services are a great fit for scalping copy trades.

Copy Trade Across a Range of Trading Platforms

If, on the other hand, you’re not wedded to MT4, Pepperstone provides two other powerful platforms that support trading signals. Additionally, Pepperstone’s top-rated execution venues get your order executed at a lightning-fast processing speed of 30ms – as advertised on the broker’s website.

Our team put the broker’s claims about execution speed to the test and were pleasantly surprised. Not only was Pepperstone on target, but we also found that it offered the fastest Execution Speeds for market orders of any social trading broker (85ms).

If you’re looking for technical tools to confirm trading signals, Pepperstone offers an impressive range. You’ll have access to the Smart Trader Tools package, Autochartist market scanner, API trading, cTrader Automate, and the broker’s own technical indicators.

Pepperstone Offers Copy Trading with Competitive Spreads

Real-time copy trading of professional traders requires low spreads to generate a profit. According to testing by Ross Collins, our Chief Technology Researcher, Pepperstone’s average spread on the most popular financial instruments is 0.16 pips EUR/USD and USD/JPY spread and 0.30 points on CFDs (Pepperstone’s Razor trading account).

Pepperstone also saves you money on trading commissions – you’ll pay US $3.5 per 100,000 units traded per side. The low trading costs open the door for short-term trading systems like scalping, which are cost-sensitive.

Our Verdict on Pepperstone: The Best Social Trading Platform for MetaTrader 4

We recommended Pepperstone based on the copy trading and social networks available when trading with MT4 (the most popular forex platform). We also rated Pepperstone the Best Forex Brokers In Australia for 2025 based on execution speeds, trading costs, customer service, and trust.

3. BlackBull Markets - Best Social Trading Platform for MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

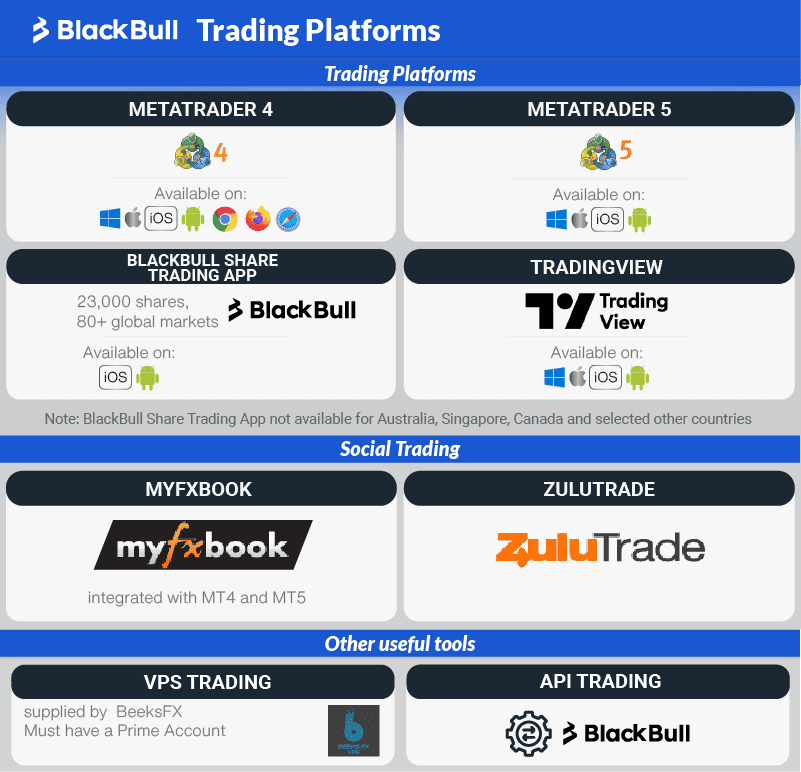

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakcBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We appreciated exploring BlackBull Markets for its rapid execution and diverse social trading tools, and it’s a top pick for seasoned MT5 traders. While its regulatory framework may differ from some, the high leverage it offers remains a significant drawcard. Licensed by both the Kiwi Financial Markets Authority (FMA) and the Seychelles’ Financial Services Authority (FSA), BlackBull emerges as a noteworthy option for enthusiasts of forex social trading on MT5.

Pros & Cons

- Multiple social trading services on MT5

- Fast execution speeds

- Offers high leverage

- Charges a withdrawal fee

- Limited research tools

- Lacks other major Tier 1 regulators

Broker Details

A relatively fresh face in the online brokerage landscape, New Zealand’s BlackBull Markets entered the scene in 2014. While it’s only licensed by the Kiwi Financial Markets Authority (FMA) and the Seychelles’ Financial Services Authority (FSA) — not offering as expansive regulatory protection as some other brokers we’ve delved into — we were nonetheless drawn to its swift execution, arsenal of social trading tools, and considerable leverage, deeming it a worthy contender for seasoned MT5 traders.

Key Features:

- Our winner for execution speed testing

- Highest leverage 500:1

- MetaTrader 4 and 5 trading platforms

BlackBull Markets MetaTrader 5 Social Trading Features

If you’re interested in social trading or copy trading and thinking of giving BlackBull Markets a go, you’ll find that the broker provides comprehensive support for:

- ZuluTrader integration for social trading

- MyFXBook integration for copy trading

- The broker’s own proprietary web app for copy trading: BlackBull CopyTrader

Where this broker really stands out, however, is order execution speed. BlackBull operates on a no-dealing-desk model with straight-through processing, which shaves precious milliseconds off your order execution time. BlackBull took first and second place in our Execution Speeds test, clocking in at less than 75ms for both market and limit orders.

BlackBull also offers exceptionally high leverage for non-professional traders: 500:1. Leverage allows you to amplify the success of your strategy exponentially but can also lead to catastrophic loss. Proceed with caution.

Our Verdict on BlackBull Markets: The Best Social Trading Platform for MetaTrader 5

We recommend BlackBull Markets for experienced MetaTrader 5 traders using a scalping strategy that relies on fast execution speeds. This broker topped our lists for execution across almost all order types. We also think it’s a good fit for anyone ready to use leverage to amplify trading profits (and to accept the losses if things don’t work out).

4. IC Markets - Best Social Trading Platform with Low Trading Costs

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We’ve taken a deep dive into IC Markets, a well-regarded forex broker that set its foundation in 2007. For those keen on ZuluTrade, we believe IC Markets is the top choice with its favourable trading costs. Operating under the banner of International Capital Markets Pty Ltd, they’re stringently overseen by ASIC here in Australia. Over in Europe, it goes by IC Markets (EU) Ltd, falling under the watchful eyes of CySEC in Cyprus. For traders mindful of expenses, this platform offers a mix of reliability and affordability in social trading.

Pros & Cons

- Good choice of social trading services

- Tight spreads with no commissions

- No deposit or withdrawal fees

- Social trading limited to MetaTrader platforms

- $200 minimum deposit

- Lacks its own proprietary trading platform

Broker Details

Founded in 2007, IC Markets is a reputable, multi-regulated broker focused primarily on Forex trading. From our experience, we believe it’s the top forex broker compatible with the social trading software ZuluTrade.

IC Markets trades under the banner of International Capital Markets Pty Ltd, overseen by the ASIC here in Australia. Over in Europe, it operates as IC Markets (EU) Ltd, falling under the regulatory wing of Cyprus’ CySEC.

Key Features:

- Our winner for lowest spreads with standard accounts

- Has some of the best overall trading costs

- World largest broker by trading volume

- Choice of 3 trading platforms

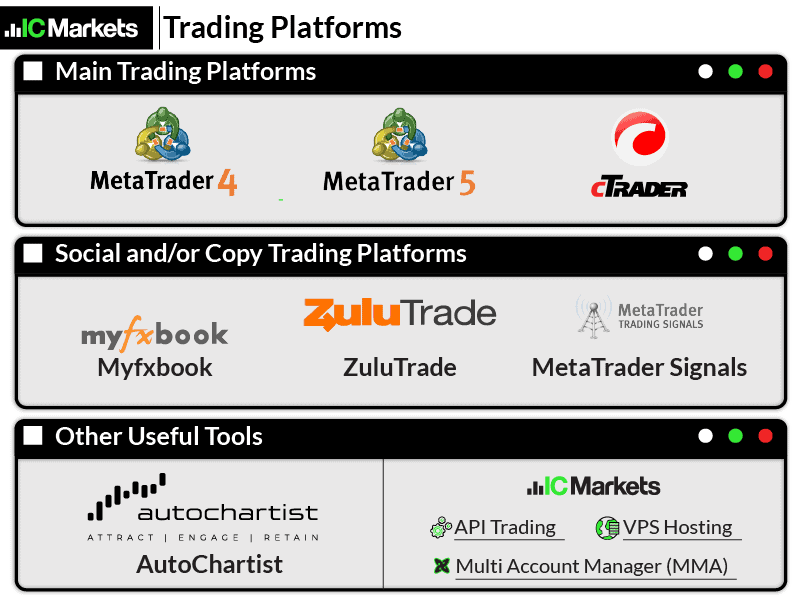

IC Markets Social Trading Features

IC Markets combines an extensive social trading community powered by ZuluTrade with:

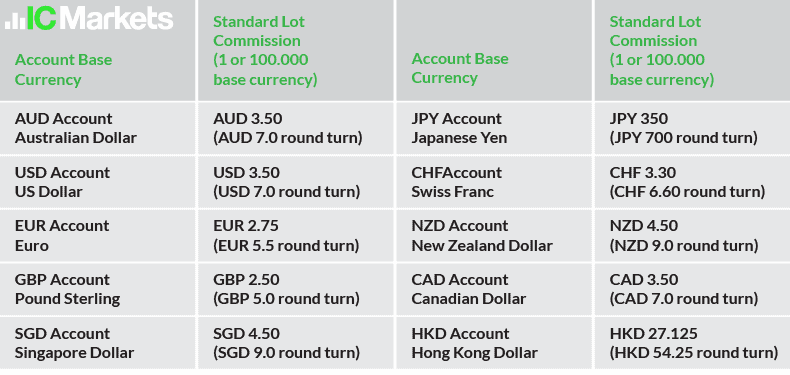

- Raw interbank spreads starting from 0.0 pips (EUR/USD average spread of 0.1 pips)

- Fair trading fees of US $3.5 per standard lot round turn

- Seven different financial markets (exclusive access to bonds and futures)

- Low latency and fast order execution speeds for precise replication of the signal providers

- Collocated VPS services for uninterrupted copy trading services

ZuluTrade is one of the leading social trading platforms, which means you have access to input from a community of over 100,000 experienced traders from 192 countries. ZuluTrade assigns every trader a score, called their Zulu Rank, which you can use as a guide when selecting someone to follow. According to the platform, a trader’s ZuluRank takes into account overall performance, exposure, stability, and minimum equity required, among other factors. If you find someone you like, ZuluTrade allows you to trade based on their trading signals free of charge.

You’ll also benefit from ZuluGuard, an advanced account protection tool. ZuluGuard monitors the performance of your strategy 24 hours a day, 7 days a week. If your losses moves beyond a pre-calculated exit amount, ZuluGuard will automatically close out your positions. Not quite a guaranteed stop loss order, but close.

ZuluTrade also offers a simulative tool that you can use to test possible earnings or losses of particular strategies without the need to go live. Into automated or algorithmic trading, you’ll find ample support in Zulutrade.

IC Markets Has the Lowest Trading Costs

We analysed trading costs for Standard and RAW accounts for all Tier 1 regulated brokers we regularly cover and found that IC Markets topped both lists. A more in-depth analysis that included other indirect trading costs put IC markets in our top five for ‘Value for Money’, with a score of 80/100.

The average tested spread cost for an IC Markets Standard account is just US $9.63. That means you only need the market to move US $10 to start generating profits. Compare that to the average overall – US $14.09 – and you see the savings.

Spreads for the RAW account can dip as low as 0.0 pips, but our tests found they hovered closer to 0.3 pips. Still, that’s impressive and puts IC Markets in the top five of our tested brokers.

Our Verdict on IC Markets: The Best Social Trading Platform with Low Trading Costs

In wrapping up, our journey with IC Markets underscored its strength as an ideal partner for ZuluTrade enthusiasts. It shone through with its low spreads, efficient withdrawals, cutting-edge tech, swift execution, and bustling community of 100,000 active traders. It’s also worth mentioning that ZuluTrade’s platform conveniently extends to Android, iPhone, iPad, and Windows phone users.

5. Darwinex - Best Social Trading Community

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend Darwinex

We’ve genuinely appreciated our experience with Darwinex, thanks to its innovative blend of social investing and professional trading. Launched in 2012, it stands firm under the regulatory guidance of the UK’s FCA. Its unique approach sets Darwinex apart: it seamlessly merges seasoned traders working in the global financial sphere with keen investor funds. If you’re after the best social trading community, Darwinex ticks all the right boxes.

Pros & Cons

- Low spreads

- Excellent copy-trading platform

- Wide range of trading strategies to copy

- $500 minimum deposit

- Fees on e-wallet withdrawals

- Lacks market research resources

Broker Details

We ranked Darwinex among the top social trading brokers for its innovative approach to combining professional trading with social investing. Founded in 2012 and regulated by the UK’s FCA, Darwinex connects experienced traders operating in the global financial markets with investor capital.

Key Features:

- 24/7 customer service

- Used by over 10,000 traders

- MetaTrader 4 and MetaTrader 5 platforms

- Blogs educating beginners about trading

Darwinex Social Trading Features

Darwinex’s take on copy trading is, predictably, more sophisticated than the standard model. Rather than imitate another investor’s strategies, you’ll invest in a strategy itself. For example, we monitored the performance of several strategies, known as DARWINS, run by professional traders, and selected two in which to invest. The DARWIN rose when a trader’s strategy worked, and we made money. When a trader miscalculated, the associated DARWIN dropped – along with our profits.

Darwinex currently offers more than 2,000 liquid alpha strategies to invest in. The underlying instruments encompass all the popular tradable instruments, including currency pairs, shares, commodities, or stock indices. Be aware that Darwins don’t correlate with the market.

Darwinex combines social trading with:

- Direct market access (DMA) on over 300 financial instruments

- Commissions starting from $2.5

- Co-located servers at London Equinix LD4 Data Centre for fast order speed

- Interbank liquidity through SaxoBank and LMAX

- Select from over +2,000 trading strategies

Darwinex curates the traders (or DARWINs) available for investment based on the quality of the strategy and track record. The broker grades a trader’s strategy on a 0-10 scale based on factors like risk management, experience, timing, consistency and scalability. These factors combined represent the so-called DARWIN investor appeal (DarwinIA) score (D-Score).

While we like the transparency around methodology, it bothered us that Darwinex doesn’t disclose a trader’s historical performance or share a trader’s active positions. We think those two data points make a big difference when evaluating a strategy’s investment potential.

Our Verdict on Darwinex: Most Innovative Approach to Social Trading

An unorthodox take on social trading makes Darwinex an interesting choice if you want something out of the box. Unlike traditional social trading platforms, Darwinex does not allow social interactions between traders and investors. Instead, you’ll invest in a strategy called a DARWIN, based on its overall performance record. When the strategy makes money, so do you. (And vice versa.) The broker’s risk management algorithms ensure that your money remains protected from reckless trading activities.

6. FP Markets - Best Social Trading Platform with MyFXBook and AutoTrade

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

We’ve had a solid run with FP Markets, undeniably one of the heavyweights in the CFD and Forex scene, fully licenced by ASIC. Boasting 15 years in the financial services arena and a trophy cabinet glittering with over 40 international awards, they’ve garnered significant trust among traders. Their credentials are further bolstered with a second licence from CySEC. If you’re scouting for the best social trading platform seamlessly integrating both Myfxbook and AutoTrade, FP Markets should be right up your alley.

Pros & Cons

- Tight spreads on the RAW account

- Choice of platforms for social trading on

- Solid range of trading instruments

- Limited forex pairs compared to others

- Shares limited to MT5

- MyFXBook Autotrade interface is outdated

Broker Details

One of the standout names in the realm of CFD and Forex, FP Markets, has made its mark with a solid 15-year track record in the financial services arena, further cementing its position with over 40 International Awards. Boasting ASIC regulation, its reliability quotient further elevates with a secondary licence from CySEC.

Key Features:

- Tight spreads with RAW account

- 4 Trading platforms – MT4, MT5, cTrader and TradingView

- Over 60 Forex pairs

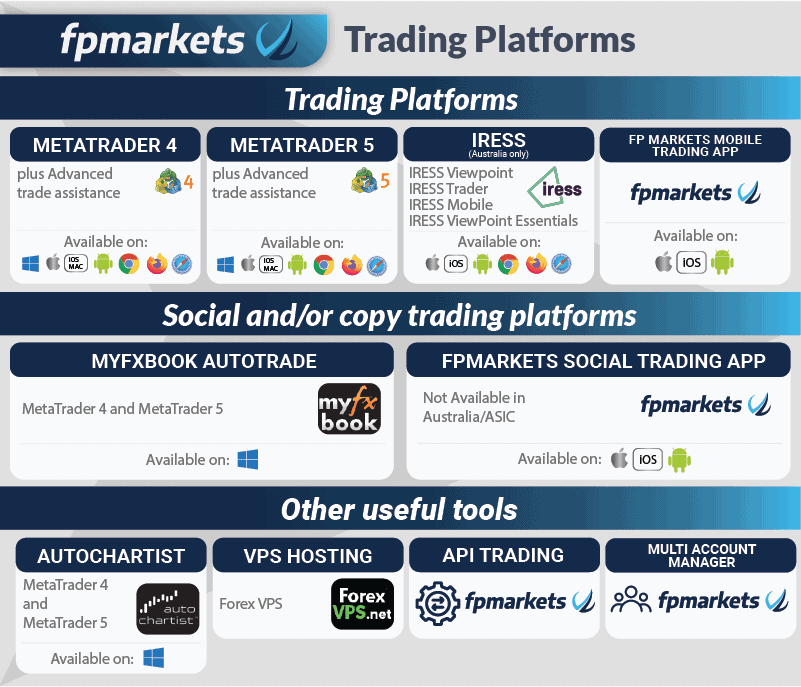

FP Markets Social Trading Features

FP Markets’ alignment with the true ECN model and its raw pricing sets it apart as the preferred platform for social trading, particularly with MyFXBook AutoTrade. Given the broker’s collaboration with a substantial roster of liquidity providers, we observed spreads for major currency pairs beginning at a mere 0.0 pips on the Raw ECN Account. To add to the appeal, the average spread for EUR/USD consistently hovered around 0.1 pips.

Spreads are kept ultra-tight on other tradable assets as well (see table below).

| Cryptocurrency (Bitcoin) | Spot Metals (Gold) | Energies (WTI Oil) | Indices (S&P500) | |

|---|---|---|---|---|

| Raw Average Spreads | $5.7 | 0.2 points | 0.03 points | 0.50 points |

FP Markets combines the automated social trade services MyFXBook and AutoTrade with a range of additional perks. We especially liked:

- Over 60 major, minor and exotic FX pairs.

- Over 10,000 CFD instruments, including shares, exchange traded funds (ETFs), indices, commodities, and cryptocurrencies.

- Tier 1 liquidity providers.

- Tight spreads. Our analysis of historical price data found that over 84% of the time, the EUR/USD spread sits at 0.0.

- Scalping and high-frequency EAs.

Our Verdict on FP Markets: The Best Social Trading Platform for MyFXBook and AutoTrade

Navigating the waters of FP Markets, we realised its strength in facilitating a broad range of trading systems to be copied directly into your account through AutoTrade, courtesy of Myfxbook.com. By linking your live trading account on FP Markets’ MT4 platform to the MyFXBook tool, it becomes a breeze to find and replicate a fitting trading system. With the MirrorTrade feature ticking along automatically, every trade gets mirrored to your account without you lifting a finger. Plus, there’s no need to splurge on a VPS rental; FP Markets includes it in the account package.

7. Fusion Markets - Best Social Trading Platform with Duplitrade

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

We’ve been quite taken with Fusion Markets, especially when it comes to speed of execution and razor-tight spreads for any broker compatible with DupliTrade. While the popular automated trading software DupliTrade focuses on copy trading over the social aspect, it pairs brilliantly with the offerings of Fusion Markets. For those leaning towards a scalping strategy, this platform surely has the complete toolkit to elevate your trading journey. If DupliTrade’s your go-to, Fusion Markets is undoubtedly a top contender in the mix.

Pros & Cons

- Fast execution speed

- Tight spreads with low commissions

- 15+ DupliTrade approved strategies to copy

- Limited choice of signal providers

- High deposit fee via bank transfer

- Not the largest range of trading products

Broker Details

We rated Fusion Markets as the best forex broker compatible with DupliTrade due to its speedy execution and ultra-tight spreads. DupliTrade is a popular automated trading software that focuses entirely on copy trading features and discounts the social aspect. If you plan to implement a scalping strategy, then Fusion Markets has everything you need to succeed.

Established in 2017, Fusion Markets operates under the banner of Gleneagle Asset Management Limited. Based in Melbourne, this broker carries the trust and credibility of an ASIC licence.

Key Features:

- Our winner for the lowest spreads

- Our winner for lowest commissions

- Among the best brokers for execution speed

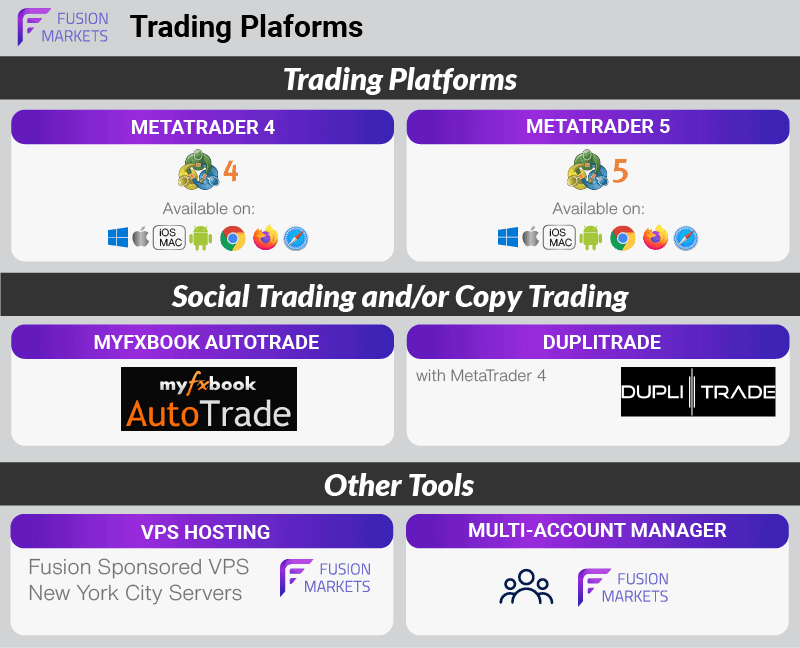

Fusion Markets Social Trading Features

Fusion Markets combines the leading copy trading solution powered by DupliTrade with:

- The lowest commission on your trade is US $2.25 per standard lot (US $4.5 round-turn commission)

- Proprietary trading tools (Analyst Views, Technical Insights, and Market Buzz)

- Two trading account types suitable for different trading styles

One of our pivotal reasons for leaning towards Fusion Markets was its seamless integration of DupliTrade for MetaTrader 4. DupliTrade, renowned for its user-friendly copy trading platform, empowers traders to mirror the strategies of successful trading veterans. We observed that DupliTrade cherry-picks their recommended traders, highlighting only those boasting a solid performance history and extensive experience in the domain. The platform prides itself on its rigorous trader selection mechanism, which ensures users can access a curated array of tested trading strategies.

However, a bit of transparency was missed, as neither DupliTrade nor Fusion Markets shed light on the intricacies of their selection methodology, which would’ve instilled added confidence. Additionally, we did find the linkage process of DupliTrade to MT4 via Fusion Markets’ multi-account manager tool slightly cumbersome.

| Minimum Deposit | Account Base Currencies | Compatibility | Copy Trading Feature | Signal Providers | Social Network | Track Record | |

|---|---|---|---|---|---|---|---|

| Fusion Markets | $5,000 | AUD, EUR, GBP, JPY, SGD, and USD | MT4, MT5 and cTrader | Yes | 12 Trading Strategies | No | Verified |

FusionMarkets also allows you to automate your trading based on trading signals from selected successful or professional investors. Last but not least, the platform’s user-friendly interface makes selecting, adjusting or removing strategies straightforward.

Our Verdict on Fusion Markets: The Best Social Trading Platform for DupliTrade

Fusion Markets crafts an environment conducive to automated copy trading. It stands out with competitive trading overheads, a robust trading software backbone, and unwavering adherence to regulatory norms. In line with many of its forex broker contemporaries, Fusion Markets allows traders to dabble in copy trading through a complimentary demo account before transitioning to real-money trades.

Ask an Expert