Understanding how to read a spread in forex along with factors that affect the spread will help you be a better trader. profitability of trading. On this page we explain what a Forex spread is and how it works.

What Is A Spread?

The spread is the difference between the buy and sell rate when exchanging the two currencies that make up a currency pair. If you are not familiar with concepts like pips, base currency and quote currency and factors that impact the spread, this page will help clear up these concepts so you can better understand what a spread is.

Each time you enter into or exit a trade in any currency pair, you pay the spread. The spread is the major cost when trading so it helps to understand how forex price spreads work.

- Forex spread is the difference between the bid and ask price of a currency pair and is the cost you pay to trade the pairs

- Factors such as market volatility, liquidity, economic indicators, and supply & demand affect forex spreads.

- Choosing a low-spread forex broker with competitive commissions can reduce trading expenses while increasing market opportunities.

Spreads In Forex

When you trade a currency pair with your forex broker, you’ll notice that each pair has two different numbers – a bid, and an ask.

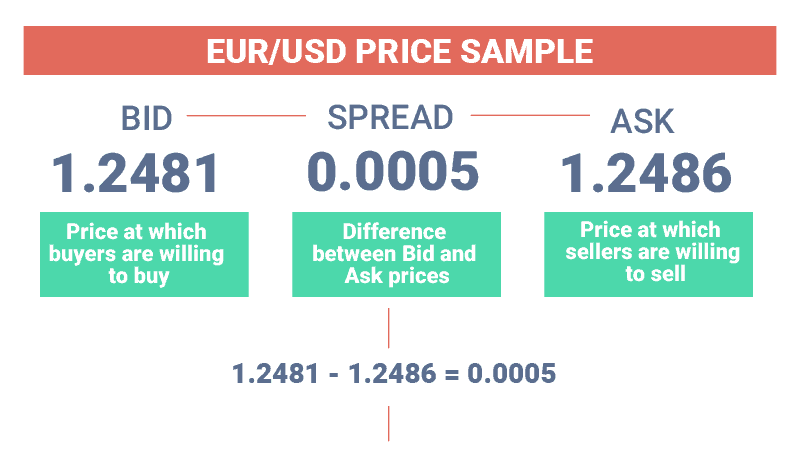

The bid is the highest price currently offered to purchase the currency, and the ask is the lowest price currently offered to sell the currency. The difference between the bid and ask prices is what’s known as the spread.

How Currency Quotes Work

When it comes to trading forex, currencies are always quoted against another currency.

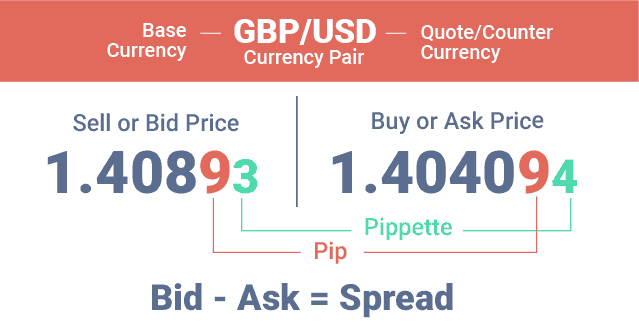

For example, the GBP/USD, which is the British Pound (GBP) quoted against the U.S. Dollar (USD). In this example, the first currency (GBP) is known as the base currency, and the second currency (USD) is known as the quote currency. If the GBP/USD exchange rate is currently trading at 1.3, it means that to purchase one U.S. dollar, you will need to pay 1.3 British pounds.

Understanding Forex Spreads

So, we’re clear on how currencies are quoted, next, let’s examine what forex spreads are, and why understanding them is so important for succeeding as a trader.

The foreign exchange market is a huge, global, double-sided auction. By double-sided, we mean that there are both many buyers and many sellers at any one time. When we open up our trading platform and we look at our currency quotes, you’ll notice that each currency has two numbers: a bid and an ask.

The bid price is the highest your broker is willing to purchase the currency for, and the offer is the lowest that the broker will sell the currency to you. The size of a currency spread is a hugely important factor for active traders, as it effectively acts like paying a toll to enter and exit a currency position (on top of any forex commissions you’re paying). There are no commissions when spread betting in the UK from the top spread betting brokers in UK.

For example, imagine you’re a day trader, and you’re in and out of a currency 10 times per day.

If the spread between the bid and the ask is .1% (one-tenth of one percent), you may be forgiven for thinking that it’s an insignificant amount, but it’s not…

You’ll be paying that .1% every time you enter and exit a position for each lot. With 10 trades per day, that’s 20 times you’ll need to pay the spread. If you do the math, that .1% 20 different times ends up as 2% of the value of the size you’re trading.

What that means is that to simply breakeven, you’ll need to capture 2% of the movement in your chosen currency pair in a single day, a huge ask for even the best day traders.

How to Measure a Currency Spread

Currency spreads are measured in pips, which is the smallest unit that a currency can move. A pipette is 1/10 of a pip and so if a more accurate representation than a pip. To work out the spread of a currency, you need to subtract the bid price from the ask price.

For example, imagine the AUD/USD is trading with a bid of 0.68707, and an ask of 0.68717.

By subtracting the bid price from the ask price, we can see that the AUD/USD spread is currently 10 pips with our broker. Meaning that if we were to enter or exit a position, we would pay 10 pips each time (plus brokerage).

What Affects Forex Market Spreads?

Forex spreads can vary wildly, depending on a range of factors. The time of day can affect the spread. Most forex volume is traded around the opening time of major global financial cities.

So, when Sydney, Tokyo, London, and New York Forex trading hours commence, at around 8 am or 9 am in each city, lots of volume is traded and spreads are often tight.

When it gets to midday and later in these cities, less volume is traded, and we often see forex spreads widening.

The volatility of a currency pair can also affect spreads. When a currency is highly volatile, perhaps from economic news forex brokers will often elect to widen spreads as a way of their own internal risk. More liquid currency pairs, such as the EURUSD and GBPUSD, generally have tighter spreads than more obscure currency pairs, such as ones with the Norwegian Krone or Israeli Shekel.

Different brokers will offer different spreads on the same currency. This is due to the broker’s internal risk profile, and the broker’s own access to the greater forex market. The most important thing you can do in relation to forex spreads is pick the Best Forex Brokers in UK and keep an eye out for major economic news that could affect your chosen currencies.

Types of Forex Spreads

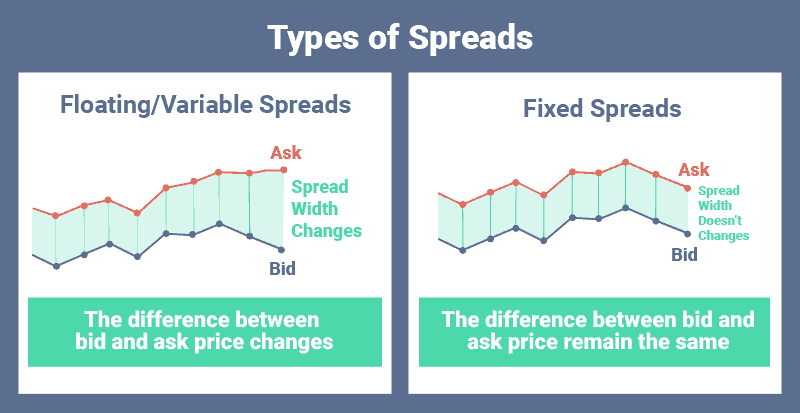

It is important for traders to understand the different types of forex spreads offered by forex brokers. The two most common types are fixed spreads and variable spreads.

Let’s take a closer look…

1. Fixed Spreads

Fixed spreads are where a forex broker will give you a set spread on a particular currency, for example, 5 pips, and will rarely change it. Lowest Fixed Spread Brokers usually operate as Market Maker Brokers or dealing desk brokers, which are taking the other side of client transactions.

The benefit of a fixed spread is that you often know exactly what spread you’ll be able to trade at. But, on the flipside, these brokers will sometimes reject your trade and requote you when they don’t want to accept your order.

2. Variable Spreads

Variable spreads are spreads that are always changing, ebbing and flowing with the market.

The reason they change is that these spreads are often just prices passed through to you by your broker. They reflect the true underlying currency price on the global forex market. These spreads will often widen and tighten depending on the supply and demand for the currency, as well as the time of day, and even the time of the year (American summer and the holiday season tend to be quiet).

Variable spreads mostly use market execution which means you won’t receive requotes as the trade will be executed at the next best price. Most No Dealing Desk Brokers have variable spreads as they use STP or ECN execution.

Forex Spreads and Trading Strategies

The spread of a currency affects different trading strategies in different ways.

In short, the more active of a trader you are, the more you should be careful about the size of a spread, as you’ll be paying it much more often than a longer-term trader. Let’s examine the effects of forex spreads on a few common types of forex trading strategies.

1. Event-Driven Strategies

Event-driven strategies, commonly referred to as news trading is where forex traders will look for macroeconomic news such as the Fed raising interest rates, or comments by political leaders. When these market-altering comments are made, or news released, the trader will often try to quickly enter a trade and ride the price wave as the market digests the new information.

What we often see around major news releases is that spreads widen. This works hand in hand with the burst of volatility that can come with market-altering news, also causing spreads to widen. Traders using event-driven strategies should be picking brokers with the lowest spreads, watching out for upcoming economic news and always keeping an eye on the size of the spreads in their chosen currencies.

2. Scalping

Scalpers are the gun-slingers of forex market. Scalp trading involves entering and exiting the market in a very short period of time – as little as a few second to a few minutes at the very most. The idea is to profit from small increments frequently.

Many scalpers will be in and out of the market anywhere from 5 to 30 times each trading day. Since these traders are paying the spread so many times throughout the day, it’s absolutely imperative that they minimise the cost of the spreads they need to pay.

3. Swing Trading

Swing traders will look to enter trading positions and hold them for anywhere from a few hours, to a few days, or even a few weeks.

A swing trader might make 3-5 trades per week. Looking for moves that are anywhere from 100 to 1000 pips. Since these traders aren’t entering or exiting positions so often, the size of the spread is less important. The size of moves a swing trader is chasing is also a factor. If you’re making 100 pips on a winning trade, paying a 2 pip spread to enter and exit isn’t such a big deal.

Summary

Understanding how forex spreads work is a fundamental building block in understanding how to trade currencies successfully. Currency spreads are unfortunately often overlooked by newbie traders, but they’re an incredibly important factor that can greatly affect the profitability of your trading.

The most important thing is to compare forex brokers in the UK first before jumping into trading.

Frequently Asked Spread Questions

What Is A Good Forex Spread?

Depending on whether the currency is a major or minor trading pair, a good spread can be anywhere from 5 pips, down to a fraction of a pip. It also depends on the market environment and time of day, spreads tend to be tighter when there’s more trading volume, which generally happens as global financial cities wake up.

How Do Forex Spreads Work?

The spread in the foreign exchange market is calculated by subtracting the bid price, which refers to the rate buyers are willing to purchase a currency, from its ask price, what sellers will accept. This difference needs to be paid by forex traders when they make trades and can vary depending on liquidity and prevailing market conditions.