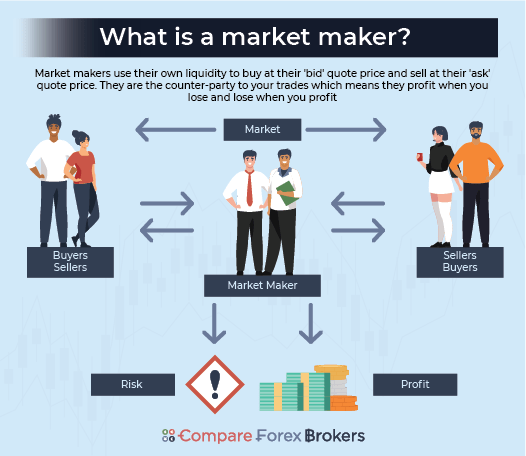

Best Market Maker Forex Brokers

Good market makers Forex brokers should have low spread costs and no commissions. We look at the best market makers to trade with.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

The Freeze Rate tool allows you to freeze the price, giving you some breathing room to set up and execute your trade. The price is frozen for 3 seconds, which may be very useful in volatile conditions.

The Freeze Rate tool allows you to freeze the price, giving you some breathing room to set up and execute your trade. The price is frozen for 3 seconds, which may be very useful in volatile conditions.

Ask an Expert