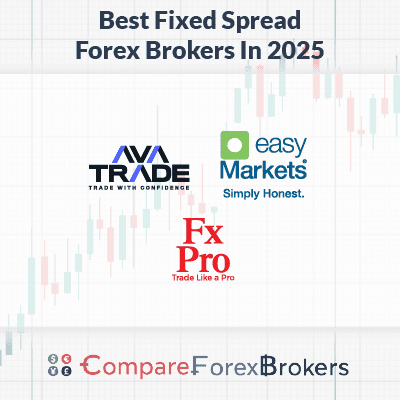

Fixed Spread Forex Brokers

To help you find the best fixed spread broker for forex trading, our team has compared the top brokers with fixed spreads based on the financial services they offer, such as the different currency pairs, CFDs, trading platforms, account types and fixed spreads available.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our 2025 found shortlisted the following brokers offering fixed spreads:

- AvaTrade - Best Forex Broker With Fixed Spreads For Day Trading

- EasyMarkets - Top Broker With Risk Management Tools

- FxPro - Great Forex Broker With Fixed Spreads On MT4

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

52 |

ASIC, CySEC FSA-S, FSC-BVI |

- | - | - | - | 0.70 | 0.90 | 0.90 |

|

|

|

155ms |

$200 (Standard) $3,000 (Premium) $10,000 (VIP) |

62+ | 17+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

What Are The Best Fixed Spread Forex Brokers?

Fixed spreads are set by the broker and don’t change regardless of market conditions or volatility. The benefit here is that you know what price you’re getting before you trade. Very few of our list of the Best Forex Brokers In Australia offer fixed spreads so we shortlisted below the forex brokers offering this feature.

1. AvaTrade - Best Forex Broker With Fixed Spreads For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

At AvaTrade, we appreciate the predictability of trading costs with fixed spreads, a boon for day traders navigating market volatility. Surprisingly competitive at 0.9 pips on EUR/USD, these fixed spreads match up well against variable spreads from other brokers.

With MetaTrader 4, MetaTrader 5 for automation, AvaTradeGO platform for risk management and AvaOptions for Options trading, the assurance of fixed spreads enhances our trading confidence, ensuring we always know our spread before entering the market.

Pros & Cons

- Low fixed spreads

- Top risk management tools

- Decent range of markets

- Social trading available

- High inactivity fees

- Some products limited to AvaTradeGO platform

- Lacks market research tools

Broker Details

Our fee tests found AvaTrade’s EUR/USD spread of 0.9 pips to be competitive, considering it’s a fixed spread with no additional commission. This means the spread won’t widen during volatile market conditions or price spikes, potentially saving you money when day trading.

Our fee tests found AvaTrade’s EUR/USD spread of 0.9 pips to be competitive, considering it’s a fixed spread with no additional commission. This means the spread won’t widen during volatile market conditions or price spikes, potentially saving you money when day trading.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

We like that the broker provides access to multiple platforms, including MT4, MT5, Web Trader, AvaTradeGO, and AvaTrade Options. After testing the platforms, the AvaTradeGO mobile app impressed us with its built-in market sentiment feature, which conveniently displays the sentiment alongside the current market analysis.

Tools like this can be valuable for day traders. They provide a quick snapshot of where other market participants believe the market is heading, which can help validate trading ideas.

AvaTradeGO had a decent selection of 80+ technical indicators and chart types for a mobile app. It even provided trading signals with the live account, Making It a solid pick if you need to react to market movements while on the go.

The availability of social trading platforms like AvaSocial and DupliTrade is a plus. We appreciate that AvaSocial allows you to connect with thousands of other AvaTraders, copy their trades, and even discuss strategies, which can accelerate the trading learning curve for beginners.

On the other hand, DupliTrade offers a more impersonal approach, mirroring specific price action and indicator-based strategies that target different markets and trading approaches. We found DupliTrade’s transparency helpful, as you can see the entire trading history, strategy type, and performance metrics before deciding to follow a strategy.

For example, while exploring DupliTrade, we tried the strategy Alpine, which focused on swing trading and trend-following strategies on FX Majors. As you can see, a lot of verifiable information is available on each trading strategy, including a performance breakdown per asset traded and trading history.

This transparency can help improve the integrity of DupliTrade’s strategies and instil confidence should you choose to copy them.

To mirror the trades from DupliTrade, you must authorise your MT4 account with the service and broker, which takes 2 minutes to complete. After this, your MT4 account would instantly copy the strategy’s trades.

Thanks to their price stability, we think fixed spreads can positively impact your social/copy trades. Since you have no control over the timing of your trades, the trader or strategy may enter when volatility spikes. With a variable spread broker, you would be charged a wider spread to enter during this time, while the fixed spread broker would remain the same.

During our tests, we found that AvaTrade offered a decent choice of trading products, including 55 forex pairs, 632 shares, 33 indices, 27 commodities, and 17 crypto markets. Although it’s not the widest choice compared to other brokers we’ve tested, the available markets covered highly liquid markets that are ideal for day trading, like EUR/USD.

2. easyMarkets - Top Broker With Risk Management Tools

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.4

AUD/USD = 1.5

Trading Platforms

MT4, MT5, TradingView, easyMarkets Trading

Minimum Deposit

$200

Why We Recommend easyMarkets

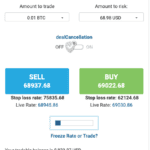

easyMarkets stands out for providing free guaranteed stop-loss orders with each trade, a feature for which other brokers typically charge a premium. Despite this, spreads are still low with EUR/USD being 0.8 pips. The platform further offers distinctive risk management tools like dealCancellation and Freeze rate.

We think all these tools make easyMarkets the top choice for safe trading for beginners and a good choice for scalpers since spreads are predictable.

Pros & Cons

- Competitive fixed spreads

- Free guaranteed stop-loss orders

- Unique risk management tools

- Great range of trading platforms

- Can’t use free guaranteed stop loss on MT4

- Customer service can be unhelpful

- No copy trading features

Broker Details

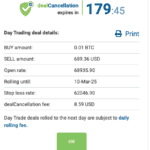

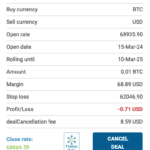

After opening a Standard easyMarkets account with fixed spreads, we were impressed by the unique risk management features built into their easyMarkets Trading Platform.

The standout feature of easyMarkets is its free guaranteed stop loss order (GLSO) on all trades, which eliminates the need to pay the premium that other brokers typically charge for this service.

While placing our trades, we noticed that the GLSO is included with every trade; however, you cannot normally enter a guaranteed stop-loss like on the MT4 platform. Instead, they ask you how much you want to risk in your trade, which varies between 1-10% of your trade size.

This makes it simple for beginners, but we found that this limited our control as we had to choose between fixed risk levels set by easyMarkets. That being said, you can modify the stop loss to set it to a level you want.

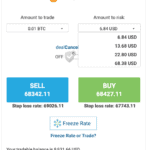

During our tests, we found the dealCancellation tool particularly useful. It allows you to cancel an order up to 6 hours after opening it—a feature we haven’t encountered elsewhere. While a fee is associated with this service, the ability to reverse a losing trade if the market moves against you can be invaluable.

We tested this feature to see its cost impact on our trading by opening a trade, which cost $8.45 for the trade to be protected for 3 hours. This effectively became a 10% stop loss of the position, and we could cancel the order and return any losses up to our original stop loss ($68 risk).

This is an interesting feature and useful if you think the market may not rebound and you may not recover your losses. However, we think it only becomes beneficial if you lose more than the premium paid.

Additionally, the Negative Balance Protection offered to all retail traders prevents your trading balance from going below $0.00, providing an extra layer of security.

In addition to the easMarkets Web Platform, you can access other trading platforms, including MetaTrader 4, MT5, and TradingView. However, only the easyMarkets Web Platform can access the risk management tools.

Interestingly, easyMarkets is the only broker offering fixed spreads with TradingView, an excellent trading platform with over 100 indicators and automated market screeners. These screeners allow you to find new trades based on your specific criteria, which we found to be a valuable tool during our testing.

Using easyMarkets’ Standard account, we tested their spreads and found they offered 0.8 pips on EUR/USD, slightly lower than AvaTrade’s 0.9 pips.

| Broker | EUR/USD | AUD/USD | EUR/GBP | EUR/JPY | GBP/USD | USD/JPY | USD/CAD |

|---|---|---|---|---|---|---|---|

| AvaTrade | 0.9 | 1.1 | 1.5 | 1.8 | 1.5 | 1 | 2 |

| easyMarkets (Web/App) | 0.8 | 1.5 | 2 | 2.2 | 1.4 | 1.5 | 2.3 |

| IronFX (standard) | 1.8 | 2.2 | 1.8 | 2.2 | 1.7 | 1.8 | 1.8 |

| HYCM | 1.5 | 1.8 | 2 | 2 | 2 | 1.8 | 2 |

| InstaForex | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| ForexCT | 4 | 4 | 3 | 5 | 5 | 4 | 5 |

| FxPro | 1.96 | 2.34 | 2.19 | 2.1 | 2.14 | 1.82 | 2 |

| IFC Markets | 1.8 | 2 | 1.8 | 2.5 | 3 | 1.8 | 3 |

| FIBO Group | 2 | 3 | 2 | 3 | 3 | 3 | 4 |

| Average Spread | 1.8 | 2.2 | 2 | 2.2 | 2.14 | 1.8 | 2.3 |

easyMarkets offers a good choice of trading products, including 62 forex pairs, 64 shares, 26 indices, 29 commodities, and 20 crypto markets. This range allows you to trade the most popular markets while benefiting from easyMarkets’ fixed spreads and unique risk management tools.

3. FxPro - Great Forex Broker With Fixed Spreads On MT4

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$0

Why We Recommend FxPro

In our evaluation, FxPro scored 61/100, excelling in overall trading experience, platform diversity, and market selection. Notably beneficial for MetaTrader 4 users, the broker provides valuable tools like the TradingCentral MT4 plugin and VPS services for enhanced automated trading.

While fixed spreads are confined to 10 major currency pairs in the MT4 Fixed account, FxPro stands out for those seeking both fixed and variable spreads. The flexibility to choose between instant and market execution on MT4, along with support for MT5, cTrader, and the FxPro trading platform, adds to its appeal.

Pros & Cons

- Great choice of trading tools

- No-commissions with fixed spreads

- No minimum deposits

- Instant or market execution

- Inactivity fees

- Spreads are higher compared to the industry

- Fixed spreads only available on 10 FX pairs

Broker Details

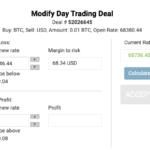

To test the broker, we opened FxPro’s MT4 Fixed account, which allows us to access their fixed spreads exclusively through the popular MT4 platform.

While this may seem limiting, MT4 is a powerful platform with numerous features, including 30+ indicators, three chart types, and nine timeframes. Additionally, MT4 enables you to write Expert Advisors (EAs) programs that automate your trading strategies.

We think fixed spreads can help smooth out your trading costs while using Expert Advisors to automate your trades, balancing automated trades entered during calm and volatile times.

By leveraging EAs, you can execute trades all day based on your predefined strategies, and fixed spreads ensure that your average trading costs remain predictable, regardless of market volatility or price spikes.

We were impressed to find that FxPro offers e-books on how to backtest and optimise your Expert Advisors, a resource we haven’t seen from other brokers. These guides provide insights into the various features and how to use them effectively, which can be invaluable as you can use these tools to improve your strategies quickly.

If you want to automate your Expert Advisors across multiple markets and trading sessions (24/5 trading), we found FxPro’s Forex Virtual Private Server (VPS) decent. We like the fact that the VPS service provider, Beeks FX, will help you install the VPS, making it accessible to beginners and experienced traders.

While testing the VPS, we found it ran smoothly with four MT4 platforms open, running four expert advisors simultaneously. We think this is excellent as it allows you to run multiple strategies simultaneously through multiple MT4 instances without overloading the VPS.

The benefit of using a VPS is that it allows you to run your Expert Advisors all day with reduced latency. The VPS is stationed next to the Equinix Data Centre in LD4 London. This means you execute your EA trades faster, with minimal downtime, without the need to keep your computer running constantly.

One factor that encouraged us to recommend MT4 for FxPro is the broker’s integration with the TradingCentral MT4 plugin. This feature allows you to receive market analysis directly within your MT4 platform, eliminating the need to log into the TradingCentral website separately.

We believe this is a significant quality-of-life improvement, as you’ll have all the new trading ideas generated by Trading Central readily available within your trading platform.

Our analyst, Ross Collins, tested FxPro’s execution speed, an essential factor in forex trading, especially when using EAs. His findings highlighted that FxPro achieved a market execution speed of 138 ms, making it the fastest fixed spread broker we’ve tested.

| Market Order Rank | Broker | Market Order Speed |

|---|---|---|

| 1 | FxPro | 138 |

| 2 | easyMarkets | 155 |

This impressive speed is achieved through FxPro’s hybrid trading model, which combines its role as a market maker (enabling fixed spreads) with no-dealing desk execution. This combination results in sub-1-second execution speeds, ensuring your trades are executed while minimising slippage and lag.

During our testing, we found FxPro’s spreads more expensive than easyMarkets and AvaTrade’s offerings. FxPro’s fixed spread on EUR/USD was 1.96 pips, almost double the cost of their competitors.

| Broker | EUR/USD | AUD/USD | EUR/GBP | EUR/JPY | GBP/USD | USD/JPY | USD/CAD |

|---|---|---|---|---|---|---|---|

| AvaTrade | 0.9 | 1.1 | 1.5 | 1.8 | 1.5 | 1 | 2 |

| easyMarkets (Web/App) | 0.8 | 1.5 | 2 | 2.2 | 1.4 | 1.5 | 2.3 |

| FxPro | 1.96 | 2.34 | 2.19 | 2.1 | 2.14 | 1.82 | 2 |

Also, we noticed a limitation on FxPro’s MT4 fixed spreads, which are only available for ten currency pairs. The fixed spreads are limited to the following pairs.

| Broker | EUR/USD | AUD/USD | EUR/GBP | EUR/JPY | GBP/USD | USD/JPY | USD/CAD | GBPJPY | EURCHF | USDCHF |

|---|---|---|---|---|---|---|---|---|---|---|

| FxPro | 1.96 | 2.34 | 2.19 | 2.1 | 2.14 | 1.82 | 2 | 2.7 | 3.28 | 2.43 |

So, if you want access to a broader range of markets, we’d suggest choosing AvaTrader or easyMarkets.

Ask an Expert

Are fixed spreads better than variable spreads?

Variable spreads are lower than fixed spreads so you will pay less however fixed spreads are more stable. When a major economic or political event occurs, variable spreads can change and this change can be dramatic which may lead to significant losses, especially if you are using leverage. While these economic events are rate which makes variable spreads are the better option most of the time, fixed spreads can end up being the safer option. Beginner traders, in particular, may wish to consider fixed spreads.