No Dealing Desk Brokers

No Dealing Desk (NDD) forex broker provides tight spreads by connecting you with liquidity pools through ECN, STP and DMA trading. This is different from market makers who are your counterparty. Our experts give our top No Dealing Desk brokers.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

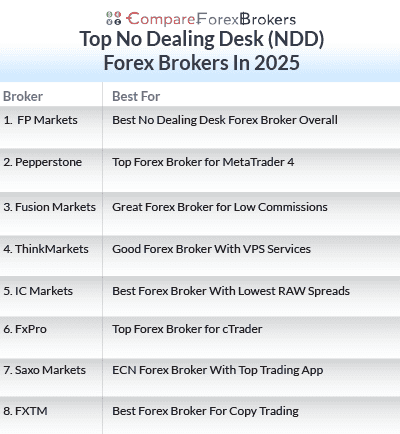

See our selection of the best forex brokers with no dealing desk:

- FP Markets - Best No Dealing Desk Forex Broker Overall

- Pepperstone - Top Forex Broker for MetaTrader 4

- Fusion Markets - Great Forex Broker for Low Commissions

- ThinkMarkets - Good Forex Broker With VPS Services

- IC Markets - Best Forex Broker With Lowest RAW Spreads

- FxPro - Top Forex Broker for cTrader

- Saxo Markets - ECN Forex Broker With Top Trading App

- FXTM - Best Forex Broker For Copy Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

What Are The Best Forex Brokers With No Dealing Desk?

1. FP Markets - Best No Dealing Desk Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why I Recommend FP Markets

If you are a scalper, I highly recommend going for FP Markets because of having consistently low RAW spreads. This broker has been around since 2005, earning its reputation as one of the most-trusted providers in Australia.

My testing found that FP Markets offers zero-pip spreads an impressive 97.83% of the time (outside rollover). Meanwhile, the RAW spreads are what’s impressive — they are tight even when they don’t offer zero spreads. The broker averages just 0.1 pips on EUR/USD, significantly lower than the average of 0.22 pips. Trading is also available with both MT4 and MT5 which presents greater flexibility for retail traders.

Pros & Cons

- Low trading costs

- Offers MT4, MT5, cTrader and TradingView platforms

- 24/7 customer support

- The trading app has basic features

- IRESS platform requires a large minimum deposit

- Not all shares available on MT5

Broker Details

I named Australia-based FP Markets as the best NDD Forex broker in the forex market for a good number of reasons. Among these are fast market execution speeds, low trading costs, and huge range of shares via the IRESS platform.

Competitive NDD Spreads

As an NDD broker, FP Markets offers very competitive spreads for all its retail investor accounts. For the Standard account, they achieved average spreads of 1.30 pips for the trade executions I made on 6 major currency pairs. This is impressively lower than the industry average of 1.52 pips.

However, the RAW account is where FP Markets outpaced all other market participants, with average spreads of 0.22 pips for the USD-backed majors. This compares favorably to the industry average of 0.44 pips for RAW accounts, placing the broker 5th overall in my list of the top 40 NDD brokers.

FP Markets achieves these low spreads by funnelling bid and ask prices for quotes directly from a diverse pool of tier-one liquidity providers including Barclays, BNP Paribas, and CitiBank. That way, the broker achieves the best price by giving you direct access to the financial markets.

Fast Market Order Execution Speeds

Based on the results of my tests, FP Markets offers fast market order execution speeds, with an average market order speed of 96ms. This puts them 4th among the 20 brokers I assessed. With full transparency, having speeds under 100ms is fast, so my live market orders often resulted in less slippage, lowering my overall trading costs.

DMA Access to 10,000 Shares

Unlike most NDD brokers, FP Markets doesn’t just offer pricing the same as ECN brokers but also gives you direct market access (DMA) via the IRESS platform if you’re a trader within Australia’s jurisdictions.

What I like about DMA trading is that you can see your orders in the queue and the full depth of the book through the IRESS platform. Through IRESS, FP Markets gives you access to a huge range of 10,000 shares via either IRESS ViewPoint or IRESS Trader.

2. Pepperstone - Top Forex Broker for MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Scoring an impressive 98/100 in my review, Pepperstone stands out as the highest-rated broker in the foreign exchange market. I have two main reasons for giving them this high rating. One is for having low average spreads of 0.1 pips with their Razor account, made possible through deep liquidity pools. Second is for having a fast execution speed of 77 ms for limit orders.

I also liked that Pepperstone helps you make the most of the MT4 platform by offering 3rd party tools. These include MyFXbook, DupliTrade, and Signals for copy trading.

Pros & Cons

- Offers excellent MT4 trading tools

- Fast execution speeds

- Low trading fees

- Lacks guaranteed stop-loss order

- Crypto range is limited

- Demo account expires

Broker Details

Following my comprehensive analysis of brokerage services, Pepperstone emerged as the top MT4 forex broker for its competitive spreads, rapid execution speeds, and extensive MT4 trading tool add-ons.

Competitive RAW Spreads

As an NDD broker, Pepperstone offers highly competitive RAW/ECN-like spreads, with an average of 0.10 pips for EUR/USD. Compared to the industry average of 0.22 pips, they are a winner with no doubt.

While you can opt for a commission-free Standard account, I personally recommend the commission-based Razor account for its lowest spreads.

Fast Execution Speeds

To give you an accurate review, I put Pepperstone to the test to determine the broker’s order execution speed performance compared to other no dealing desk (NDD) forex brokers.

Among the top 20 MT4 brokers that I tested, Pepperstone ranked third overall, boasting execution speeds of 77ms for limit orders and 100ms for market orders.

This efficiency translates to reduced latency, ensuring more precise spreads at execution points and minimal slippage even on high-leverage trading.

Advanced MT4 Trading Tools

Pepperstone provides a diverse range of platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, catering to various trading preferences.

Notably, the Smart Trader Tools add-on enhances the MetaTrader 4 platform with 28 smart trading apps, giving Pepperstone an edge in my list of MT4 brokers.

Among the 28 apps available, the Mini Terminal came as the standout feature for me. During my trades, this tool has allowed for easy setup of new order templates, including setting stop loss and take profit orders. In my opinion, this will be key in getting precise risk management for all future orders.

3. Fusion Markets - Great Forex Broker for Low Commissions

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why I Recommend Fusion Markets

If you’re conscious about trading costs, I recommend Fusion Markets as the best forex broker for low commission trading. Based on my tests, they performed best among their competitors, charging the lowest commission of just $2.25 per lot traded.

This is significant savings, especially because brokers charge around $3.48 per lot on average. Alongside these impressive savings, you also access a decent range of markets, including forex, indices, commodities, and shares.

Pros & Cons

- Tight RAW spreads with low commissions

- Solid range of trading tools

- Fast execution speeds

- Lacks TradingView platform

- Charges an inactivity fee

- Educational resources are limited

Broker Details

ASIC-regulated Fusion Markets, based in Melbourne, Australia, features a very low per lot commission of only $2.25. I also found that they offer very competitive Forex dealing spreads, which has been one of the reasons why I had given them top marks in my recent assessment of NDD brokers.

Lowest Commissions and RAW Spreads

My estimation found that Fusion Markets boasts the lowest forex commissions, charging just $2.25 (AUD or USD) per side, or $4.50 per round-turn trade. This is notably lower than the industry average of $3.50 per side.

Moreover, the broker offers RAW/ECN-style spreads, averaging 0.22 pips for the six major USD currency pairs, significantly undercutting the industry average of 0.50 pips for the same pairs. With 90 tradeable forex pairs available, you can benefit from these low costs across a wide range of products.

Fast Execution Speeds

In addition to having cost advantages, Fusion Markets impressed me with its swift execution speeds — ranking second in my tests.

With execution speeds of 79ms for limit orders and 77ms for market orders, Fusion Markets ensures rapid order processing. These speeds, well below the 100ms threshold, can minimize you order latency and reduce slippage, enhancing the overall trading experience.

Platform Diversity

Fusion Markets offers three robust trading platforms: MT4, MT5, and cTrader. While these platforms provide a standard trading experience from my testing, they offer ample diversity in tools and features to cater those with various trading preferences.

This selection ensures that regardless of your trading style and appetite, you’ll have access to the tools needed to execute strategies effectively.

4. ThinkMarkets - Good Forex Broker With VPS Services

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why I Recommend ThinkMarkets

I recommend ThinkMarkets, an Australia-based NDD broker, for offering tight spreads and a VPS service for automated trading. I also found that the broker’s RAW account offers low spreads starting from 0.1 pips.

If you prefer trading without commission, I highly suggest going for ThinkMarkets’ Standard account. Spreads for this account averaged 1.1 pips for EUR/USD in my tests – significantly better than the industry average.

Pros & Cons

- Offers a decent VPS service

- Low average spreads

- No minimum deposits for the standard account

- ThinkZero account unavailable on ThinkTrader platform

- Trading tools provided are limited to ThinkTrader only

- Client support can be slow after hours

Broker Details

If you’re trading forex, ThinkMarkets (formally ThinkForex) is one of my top recommendations for no dealing desk brokers and CFDs. First reason is because they offer competitive spreads and has a solid proprietary platform. Second, ThinkMarkets has an excellent VPS service for reliable, stable, and fast trading.

Competitive Spreads

Based on my published spread analysis, both of ThinkMarkets’ main retail investor accounts offer competitive spreads. The broker’s Standard Account features no commission with average spreads of 1.22 pips for the 5 most traded currency pairs, significantly lower than the industry average of 1.52 pips.

Comparatively speaking, ThinkMarkets’ ThinkZero account (RAW/ECN) came out to have better spreads, averaging 0.20 pips for the same 5 most traded pairs. These low spreads put the broker 4th on my list overall, much lower than the 0.44 pip industry average.

Diverse Range of Platforms

While ThinkMarkets offers you both MetaTrader platforms, it is the broker’s proprietary platform, ThinkTrader, that surprisingly stood out to me.

I found the platform’s interface to be both user-friendly and powerful, boasting an impressive 120 charting technical indicators, 50 drawing tools, and 19 chart types.

The defining feature from my experience is the TrendRisk scanner, which monitors currently unfolding setups on various instruments, saving me time when looking for trading opportunities. I have been given a possible entry price, stop-loss level, and target level. And, most significantly, a calculation of a risk/reward ratio.

I also liked that you can access real-time news reports from FX Wire Pro to stay up to date on the latest market developments.

Excellent VPS Service

ThinkMarkets offers an excellent VPS service through its partnership with ForexVPS, one of the most trustworthy VPS providers in the market. From my testing, I was able to set up my account in 5 minutes and enjoy fast and reliable connection speeds with 24/7 technical support.

5. IC Markets - Best Forex Broker With Lowest RAW Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

If you’re looking for the lowest RAW spreads, I recommend IC Markets as the best forex broker. They stand out for having low average RAW spreads, just 0.02 pips on EUR/USD with the RAW account, based on my tests.

Along with these low spreads, IC Markets offers fast execution speeds and access to various trading platforms. These features combined make it a top choice, earning a strong rating of 84/100 from my assessment.

Pros & Cons

- Lowest average spreads

- Offers MetaTrader and cTrader platforms

- No fees for withdrawing

- Has a minimum deposit

- It doesn’t have its own trading platform

Broker Details

With NDD execution, IC Markets leads the pack when it comes to tight variable spreads. Not only does the broker offer some of the lowest spreads I’ve tested for a RAW Account, but they also provide a range of other benefits.

These include a diverse selection of trading platforms, a wide range of markets, and robust social and copy trading tools.

Lowest RAW Spreads

When I tested the USD-backed majors using the RAW account, IC Markets averaged 0.32 pips, placing third among RAW/ECN-style accounts, just behind Fusion Markets and City Index.

I also found that IC Markets offers the lowest spreads for the commission-free Standard account. My results showed average spreads of 1.03 pips for the 6 major currency pairs, compared to the industry average of 1.48 pips. The next closest competitor, CMC Markets, had average spreads of 1.11 pips for the same pairs.

With these low spreads, I highly recommend IC Markets for high volume Forex traders, especially if you’re using scalping trading strategies or algorithms and has a need for super-tight dealing spreads.

Top ECN Trading Platforms

While IC Markets doesn’t have a proprietary platform, the broker offers a variety of popular platforms such as MetaTrader 4, MetaTrader 5, and cTrader. They also provide social and copy trading options through ZuluTrade, Myfxbook, and cTrader Copy.

If you’re a user of MetaTraders, I personally recommend using MetaTrader 4 due to the Advanced Trading Tools add-on. The line-up includes 20 additional trading tools which can enhance the overall trading experience.

What stood out to me is Market Manager. It has given me a comprehensive overview of my trading activity, including watch lists, open positions, account activity, open tickets, and recent price activity.

Solid Range of Markets

IC Markets offers a diverse range of trading products, including 61 forex pairs, over 1600 share CFDs, and a selection of indices, commodities, bonds, and cryptocurrencies.

I also discovered that it’s possible to trade futures CFDs on four underlying index and commodities futures markets. This broad range of markets ensures you have access to all major asset classes which could greatly enhance your trading opportunities.

6. FxPro - Top Forex Broker for cTrader

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro stands out as one of the few brokers offering cTrader, an excellent alternative to MT4, known for having cleaner interface and faster performance. When you trade with cTrader on FxPro, I found that you gain access to RAW spreads, which average at just 0.32 pips on EUR/USD.

What this means is that you can trade more effectively with lower costs, enhancing your trading experience and potentially leveling up your trading success.

Pros & Cons

- Decent average RAW spreads

- Top market analysis provided

- Offers VPS services for cTrader

- Minimum deposit required

- Charges inactivity fees

- Higher spreads if you don’t use cTrader

Broker Details

FxPro is my top cTrader NDD broker, offering a diverse platform experience by incorporating cTrader Copy and cTrader Automate tools for copy and algorithmic trading. The broker also has a variety of execution methods that includes fixed and variable spreads, which is unique for an NDD broker.

Top cTrader Broker

Among FxPro’s array of trading platforms (MT4, MT5, cTrader, FxPro app), the broker’s cTrader offering is the one that truly shines.

During my testing, cTrader impressed me with its user-friendly interface, featuring a clear layout that simplifies navigation between ‘copy’ and ‘automate’ trading. Moreover, the platform offers sample cBot APIs, making it easier to get started with algorithmic trading.

Before transitioning to live trading, I highly recommend that you utilize cTrader’s backtesting functionality to assess various products on the same cBot using historical data.

Variety of Execution Methods

FxPro provides a variety of execution methods, including instant, market, and fixed execution modes. This is a solid line-up which I never saw from other NDD brokers. You’ll obtain the most advantage using Expert Advisors (EAs) in MT4/MT5 but for cost-effectiveness, I suggest using cTrader.

By opting for cTrader, you’ll pay commissions of $3.50 per side (the industry standard) but enjoy spreads as low as 0.2 pips. Additionally, the platform offers advanced charting tools, including 55 indicators, 26 timeframes, and advanced take profit and break-even stop orders, surpassing the offerings of MT4/MT5.

7. Saxo Markets - ECN Forex Broker With Top Trading App

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.7

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why I Recommend Saxo Markets

If you’re looking for an ECN forex broker with a top trading app, I highly recommend Saxo Markets. What’s impressive is that their trading app packs all the same tools and features as the desktop platform, SaxoTraderGO, while being more accessible.

It has extensive charting package and technical analysis tools, which I often find lacking in other brokers’ apps. Essentially, you’re getting a full power of a desktop trading experience right in your pocket. Based on my experience, this makes it easier to trade on the go without losing access to crucial tools.

Pros & Cons

- A large range of markets

- Excellent mobile trading app

- Well regulated

- Minimum deposit required

- No MetaTrader 4 is available

- Lacks 24/7 customer service

Broker Details

Saxo Markets has a longstanding history as a highly trusted broker, functioning both as a multi-asset trading and investment bank. As well as having one of the largest asset ranges I’ve seen, they have an excellent proprietary app, SaxoTraderGO, that competes with the best NDD brokers.

Commission-Free Trading

Saxo Markets provides three trading accounts which all feature no commissions (Classic, Platinum, and VIP), but only the Classic account is accessible to most traders. However, it’s worth noting that the average spreads for the EUR/USD pair on the Classic account are 1.2 pips, which is wider than the industry average of 1 pip for an account of its type.

To access the lowest spreads in the Platinum and VIP accounts, you would need to deposit significant amounts of AUD 300,000 (Platinum) and $1,500,000 (VIP), which may not be suitable if you want to keep it slow and steady while starting out.

On the other hand, Saxo offers an extensive range of over 8000 leveraged and investment products across 10 different asset classes. This includes products as varied as options, ETFs, futures, and mutual funds.

Excellent Proprietary Trading App

Saxo Markets offers three outstanding platforms: SaxoTraderGO, SaxoTraderInvest, and SaxoTraderPro in addition to MT4 and TradingView. However, I think SaxoTraderGO is the platform you’ll find most beneficial.

SaxoTraderGO has an intuitive, clean design, while featuring rich charting which include 62 indicators, multi-device syncing, and an abundance of market analysis tools. I found that the platform uses the same technology and advanced tools that hedge funds use, which highlights the sophistication of the platform.

What I found most valuable is really the mobile trading app, which combines a user-friendly interface with extensive market analysis features. This will be particularly helpful if you’’ll be trading major currency pairs, as you could access related videos, news headlines, and trading signals to make informed trading decisions.

8. FXTM - Best Forex Broker For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 0

GBP/USD = 0

AUD/USD = 0.5

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why I Recommend FXTM

I recommend FXTM as the best forex broker for a wide range of markets, ideal if your trading strategy involves multiple markets. The broker offers an impressive 12,000+ markets — one of the most extensive ranges available.

Additionally, FXTM’s low average RAW spreads, coming at just 0.32 pips on EUR/USD, placed them among the top 3 in my testing.

Pros & Cons

- A large range of markets

- Decent educational resources

- Low average RAW spreads

- Only offers MT4 platform

- Minimum deposit required

- Trading commissions are average

Broker Details

FXTM stands out for having an impressive copy trading features via FXTM Invest platform. I also thought the broker’s low RAW spreads and quality educational resources stood out.

Competitive Spreads

As a NDD broker, FXTM offers very competitive RAW spreads from my extensive published spreads analysis. The broker averaged 0.22 pips for the five most traded currency pairs, ranking among the top 5 NDD brokers I tested.

Top Copy Trading

While FXTM is a MetaTrader-only broker, it distinguishes itself through FXTM Invest, their superior copy trading service. Through FXTM Invest, I found that you can follow experienced traders, referred to as strategy managers, whose risk management principles and trading systems align with your expectations.

In this framework, FXTM Invest allows you to choose a strategy that suits your risk tolerance and trading goals. So whether you prefer high-risk strategies or aim for short-term results, the choice is entirely yours.

Quality Educational Resources

FXTM has one of the best education centres compared to any other broker on this list. If you’re a beginner trader then there are tutorials and articles throughout the website to help you start your journey.

Ask an Expert

Great stuff! Do no dealing desk brokers offer better execution speed on trades?

Yes, since your orders do not not need to be routed through a dealing desk, the order can be processed immediately.