Lowest Spread Forex Brokers

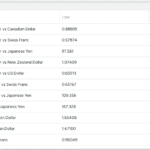

Each month, the team compare the published average spreads of ASIC regulated forex brokers. We combined these findings in April 2024 with our own tests to determine the lowest spread forex brokers for Australian traders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

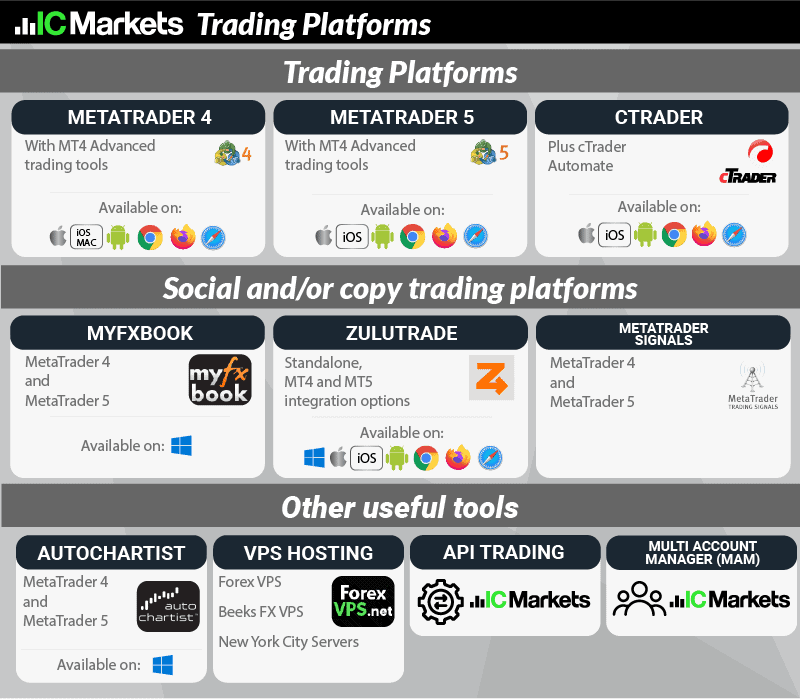

We think the MetaTrader 5 platform pairs nicely with IC Markets as the broker allows you to fully utilise all of MT5’s features, such as the depth of market tools. These tools provide valuable insights by displaying the order book and revealing an instrument’s real-time supply and demand.

We think the MetaTrader 5 platform pairs nicely with IC Markets as the broker allows you to fully utilise all of MT5’s features, such as the depth of market tools. These tools provide valuable insights by displaying the order book and revealing an instrument’s real-time supply and demand.

Ask an Expert

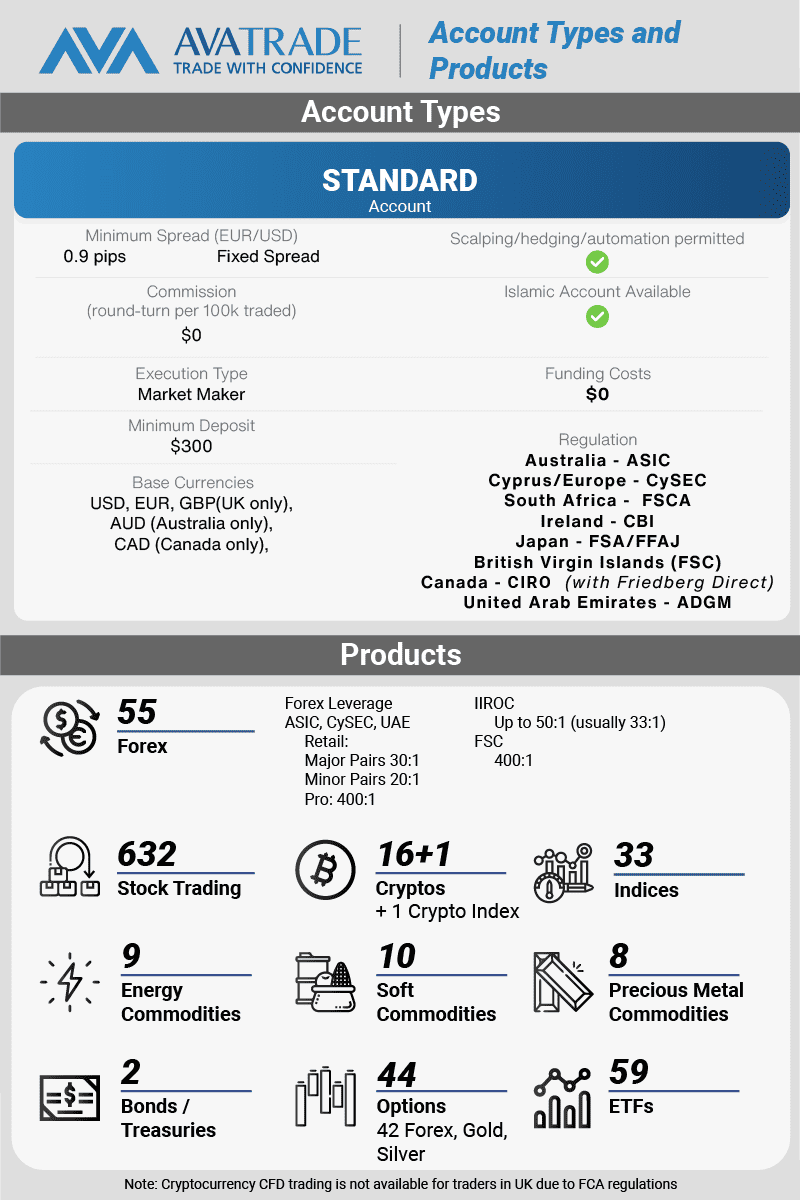

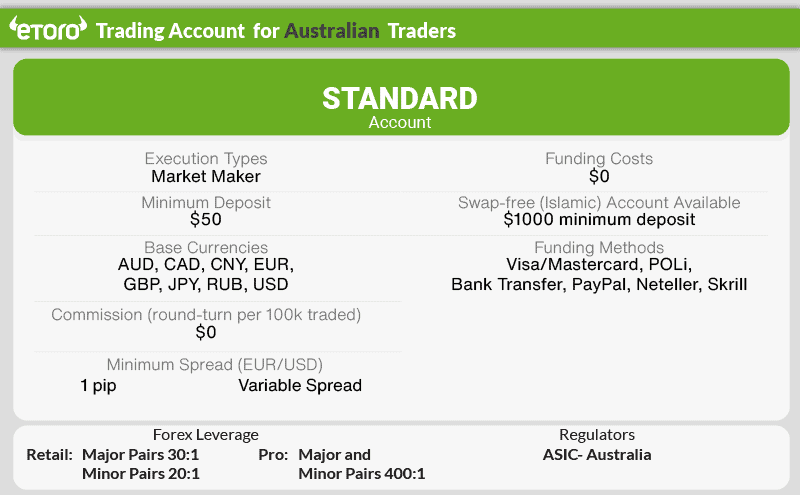

Generally, what account is better to get the lowest fees? A standard or ECN account?

Generally, an ECN account is cheaper than a standard account however this will vary depending on the spread for the standard and ECN account and the commission for the ECN account.

Looking for broker with lowest spread for xauusdi live in United States

The USD does not permit CFD trading but does allow spot trading. You can see our best brokers for spot trading on the best regulated forex brokers in USA page.

How about fxcc, valutrade,axitrader, and assetfx. They are also have such account with low commission and tight spread but not “zerro” spread

Hi Eddy

We have not previously reviewed FXCC and ValuTrades so can provide too much information about them at this time. Axi (formerly AxiTrader) are regulated in Australia (ASIC), UK (FCA) and UAE (DFSA) so they are a reputable broker in terms of regulation. Unfortunately, Axi doesn’t publish their average spreads, so lack transparency in this aspect. AssetFX is not a regulated broker so we can’t recommend them

I saw that brokers charge an overnight fee. How does this work as I thought currency markets are global?

Overnight fees are sometimes called swap fees or rollover fees, these fees are applied if you hold an open position overnight which means when trading markets close. While currency markets are global so technically never close since at least one of the Sydney, Tokyo, London and New York forex sessions are operating at any time during the work week, brokers apply overnight fees if your position is open at 17:00 New York time (which equates to 00:00 platforms time)

Swaps fees mean you will either be charged interest costs or earn interest on your open positions. Whether you are debited or credited will depend on factors such as the price movement of the currency pair, the interest rates in each country of the currency traded, the swaps points of the broker’s counterparty.

Overnight positions for Wednesday to Thursday carry a credit/debit charge of triple rate to account for the settlement of trades over the weekend since these days since the markets are closed these days meaning there are no swap rates charged.

Why IC Market is not appearing in the final list though they are in the top 2 in the above 2 tables ?

I don’t see IC Markets on this list but certainly, IC Markets is a top broker and one well worth considering. It was a toss up between IC Markets and some other brokers when we made this list

Is there a zero spread broker?

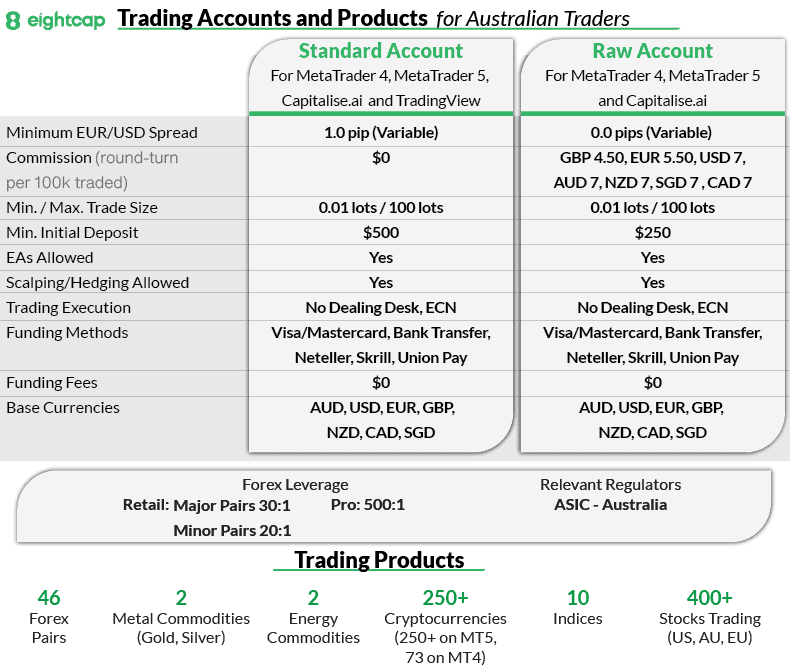

If you are after zero spreads, look for a no dealing desk or ECN style broker. You will know these brokers because they have a commission account, these accounts can achieve zero spreads because you pay commission in addition to the spread. You then need to time your buy in for when the spread is zero pips. Brokers include Pepperstone, IC Markets, Fusion Markets, Eightcap.

Does Eightcap offer MT5?

Hey John , yes Eightcap does offer mt4/5.

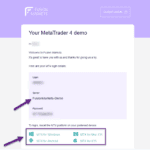

Is meta trader 4 also used in prop firms?

Yes that is correct MT5 can also be used with a prop firm.

Is a zero spread account good?

Zero spreads mean you don’t have a spread cost when trading, so zero spreads generally work in your favour

Could you further explain, is the terminology zero spread markup (I guess the bid-ask spread will always exist)?

Rather than mark up the spread to include the commission as occurs with a standard account, you pay the commission outside the spread. In this sense the spread has not been marked up by the broker.

What does 0.60 pips mean?

A pip means “percentage in point” and is the smallest whole unit price movement of a currency pair. Most currency pairs are quoted to the 4th decimal using fractional pips so if you have 0.0006 this would convert to 6.0 as a whole pip. So if you see 0.60 then the quote is in pippettes which is 0.00006 (I.e) to the 5th decimal.