Best TradingView Brokers

TradingView has 3 million+ users, making it one of the fastest-growing trading platforms for Forex traders. With over 100 indicators, it is popular for technical analysis. We look at the best brokers with TradingView.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

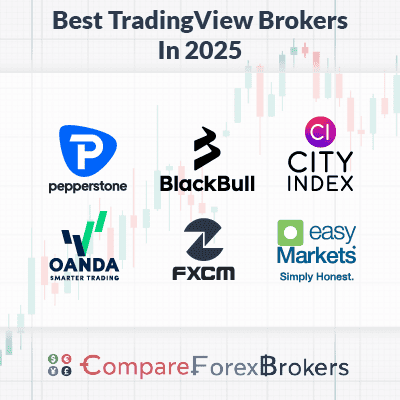

Our Top 6 TradingView Forex Brokers are:

- Pepperstone - Best Overall TradingView Experience

- BlackBull Markets - Top Broker For High Leverage and Fast Execution

- City Index - Lowest Spreads With Using TradingView

- OANDA - Best Range Of Forex Pairs with TradingView

- FXCM - Good Upgrade To TradingView Pro For Free

- easyMarkets - Good Charting With Fixed Spreads

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

77 |

ASIC, FCA, CySEC CIRO, BaFin, FSCA |

0.30 | 0.90 | 0.40 | $4.00 | 1.3 | 1.8 | 0.7 |

|

|

|

150ms | $50 | 42 | 7 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

52 |

ASIC, CySEC FSA-S, FSC-BVI |

- | - | - | - | 0.70 | 0.90 | 0.90 |

|

|

|

155ms |

$200 (Standard) $3,000 (Premium) $10,000 (VIP) |

62+ | 17+ | 30:1 | 500:1 |

|

Who Are The Best TradingView Brokers?

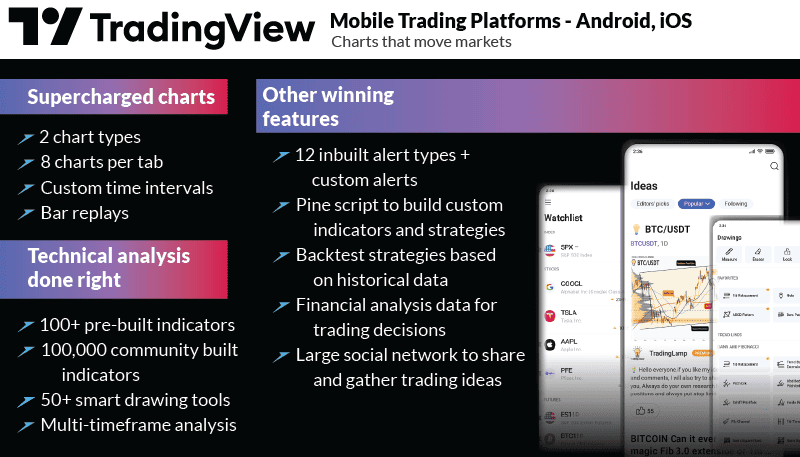

TradingView is a popular trading platform with industry-leading charting tools, real-time market data, and a loyal community. To fully utilise the TradingView platform, you must find a broker offering the platform to integrate your brokerage account. We have compiled our list of the best brokers to use TradingView with on this page.

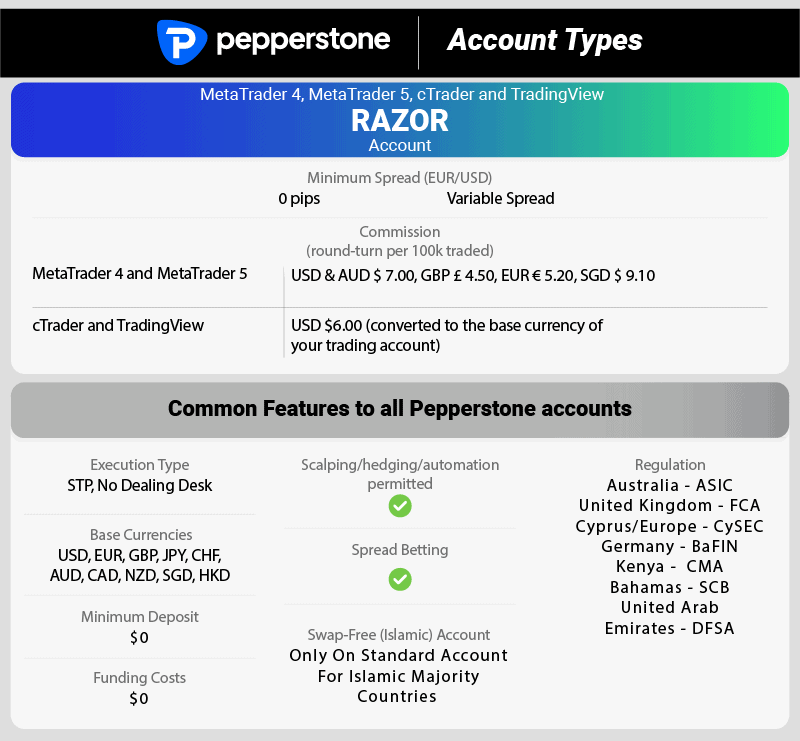

1. Pepperstone - Best Overall TradingView Experience

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.40

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked Pepperstone for its seamless integration with TradingView. They provide complimentary access to essential TradingView features and boast speedy execution, straightforward account setup, and a diverse range of markets. It’s no wonder we rate Pepperstone a solid 97/100 for the best overall TradingView experience.

Pros & Cons

- Competitively low spreads

- Easily Integrates with TradingView

- Trade over 1,200 markets

- Doesn’t accept US traders

- No guaranteed stop-loss option

- No Standard account with TradingView

Broker Details

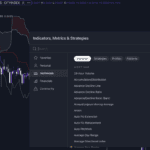

TradingView is one of our favourite trading platforms. It offers over 100 technical indicators, such as Bollinger Bands and MACD, and advanced drawing tools, like Anchored Volume Profiles.

We tried the platform and found it easy to analyse the markets. It had a feature that snapped the drawing tools directly to the price, helping us place our drawings on the charts faster and with accuracy.

Adding indicators to the chart was simple too. We liked that we could set up a default template allowing us to rotate between the 1200+ markets on Pepperstone without adjusting our indicators or chart types. It also kept all the drawings we applied to previous markets, which is a bonus, as MetaTrader 4 deletes them after you accidentally close the chart window.

However, we found that the free trading account simultaneously limited us to just two indicators on a single chart. Platforms like MetaTrader 4 and 5 do not limit us. If you want more than two indicators, subscribe to TradingView and receive more features.

To get the most out of TradingView, we think having a broker who can provide the best trading environment is important, so Pepperstone is our top pick.

In our tests, we found that the broker offered two trading accounts. A standard account is spread only (with no commission), meaning all the trading costs are bundled into the spread, making it a straightforward transaction. The standard account had decent spreads, averaging 1.12 pips on EUR/USD, which is better than the industry average of 1.24 pips based on our findings.

If you want tighter spreads, we recommend choosing the Razor account. Our analyst found that Pepperstone offers zero-pip spreads on its major pairs 100% of the time, significantly reducing your trading costs.

With zero-pip spreads, your only trading costs become the fixed commission ($3.50 per lot traded), allowing you to trade without worrying about market volatility affecting your spreads.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘82% of retail CFD accounts lose money’

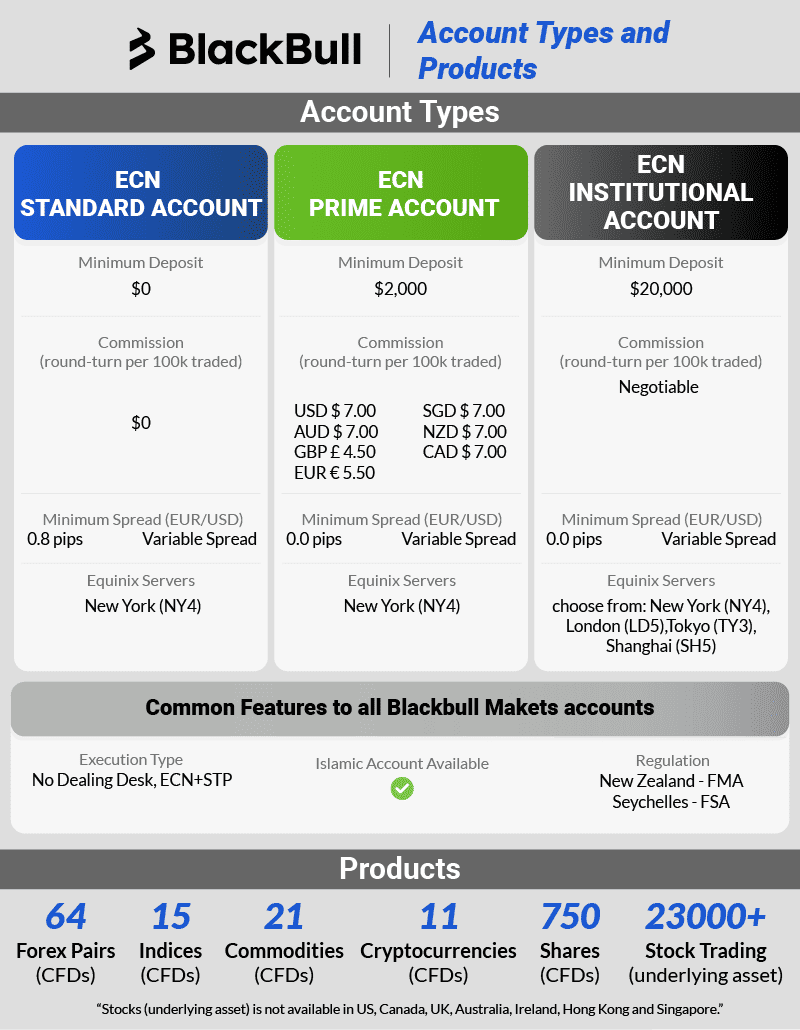

2. BlackBull Markets - Top Broker For High Leverage and Fast Execution

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

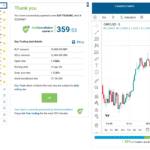

We liked BlackBull Markets’ generous offering of TradingView Pro at no cost, provided you trade at least one lot each month. TradingView Pro elevates your analysis with indicators per chart, and you can view two charts in a single layout. Plus, with server-side alerts, you’ll always be in the loop for potential trading prospects. BlackBull Markets is the top broker for those seeking high leverage and swift execution.

Pros & Cons

- Excellent execution speeds

- Offers high leverage

- Good selection of trading products

- Charges a fee to withdraw funds

- Lacks major Tier 1 regulators

- High minimum deposit for ECN Prime account

Broker Details

We’ve tested over 20 brokers to find the fastest for limit orders and market order execution. Our analyst, Ross Collins, found that BlackBull Markets is the overall fastest, with an impressive 72ms limit order speed and 90ms market order speed.

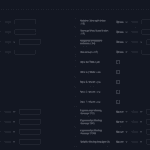

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Pepperstone | 2 | 77 | 2 | 100 | 3 |

| FXCM | 3 | 108 | 3 | 123 | 4 |

| City Index | 4 | 95 | 4 | 131 | 5 |

| easyMarkets | 5 | 155 | 5 | 155 | 6 |

Having fast execution speeds is vital as it lowers the chance of platform-to-market lag. This speed ensures your trades are executed as fast as possible while limiting potential price slippage, which can be costly.

In addition to its fast execution speeds, we found that the broker offers high leverage for its traders, as high as 1:500. This is far higher than that of brokers regulated by ASIC and the FCA, which restrict retail traders’ leverage to 1:30.

BlackBull Markets can offer high leverage as it is regulated by the New Zealand Financial Markets Authority (FMA) but still accepts clients from Australia.

We think that high leverage allows experienced traders to enhance their risk with lower trading accounts and scale their trading success without depositing more margin, like with ASIC-regulated brokers.

For example, a one-lot trade with an ASIC broker requires a margin of $3,500+ compared to the $210+ required by BlackBull Markets. Although you’ll have lower margins to trade large positions, the higher leverage will also increase your risk.

BlackBull Markets also offers TradingView, allowing you to use advanced charts to analyse the markets while benefiting from high-leverage trading accounts and fast execution speeds.

Based on our testing, we think that if you like to scalp the markets, the broker provides excellent conditions for the TradingView platform to benefit from its one-click trading feature. We liked this feature as we could place our trades from the chart without completing the order ticket.

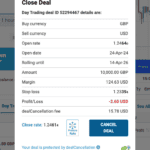

Instead, it directly executes our trades at market price, allowing us to enter the scalp as fast as possible. After all, we found that filling out the order ticket took too long and that we missed potential scalps using this method.

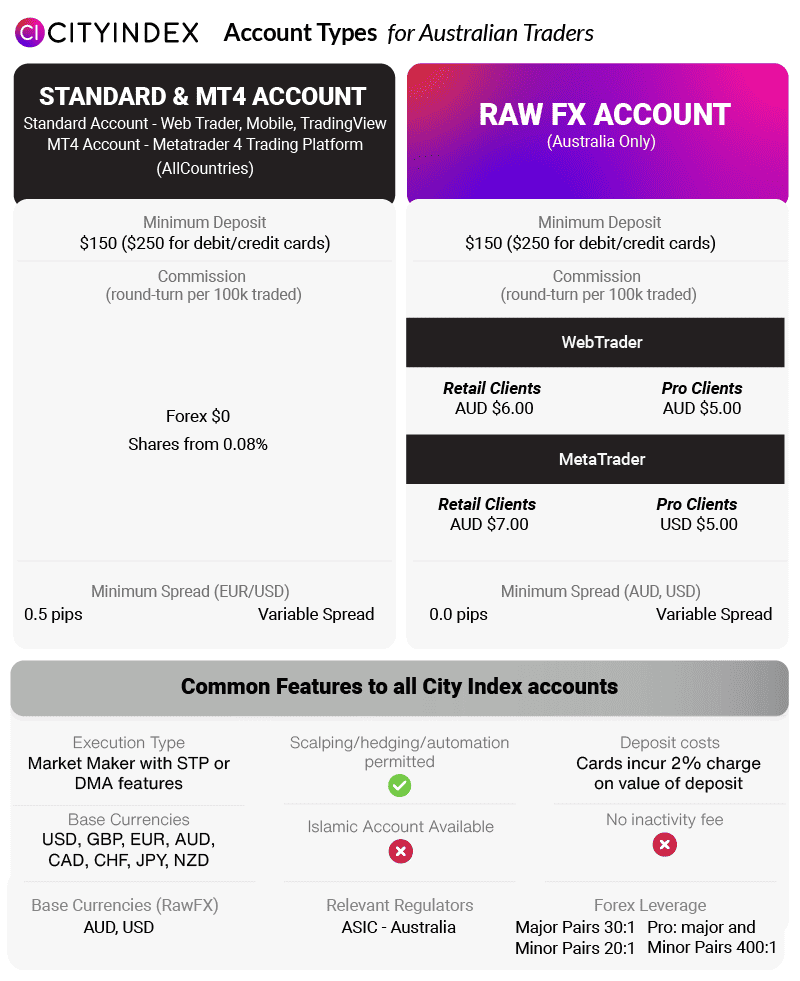

3. City Index - Lowest Spreads With Using TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

We liked the City Index RAW FX Account, specifically tailored for Australian traders. It boasts some of the lowest spreads in the industry, complemented by highly competitive commissions. If you want to minimise trading costs, the City Index RAW FX Account presents a persuasive option for TradingView users.

Pros & Cons

- Low trading spreads

- Free performance analytics tools

- Solid choice of trading instruments

- Charges inactivity fees

- No 24/7 customer support

- You can’t manually change leverage levels

Broker Details

Out of the TradingView brokers we’ve tested, City Index had the lowest spreads, with its Raw FX Account averaging 0.07 pips on EUR/USD, much lower than the industry average of 0.22 pips.

To access these tighter spreads, City Index charges a fixed commission of $2.50 per lot traded, which is $1.00 lower than the industry average. This one-dollar savings can save you a fortune over time, especially if you trade frequently, making City Index one of the lowest commissions in Australia.

| Broker | USD |

|---|---|

| City Index | $2.50 |

| Blackbull Markets | $3.00 |

| Pepperstone | $3.50 |

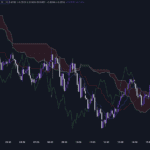

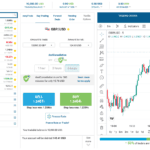

By offering TradingView, City Index offers one of the best platforms for analysing the markets with low trading costs. The platform is well known for its advanced charting tools and popular indicators like Ichimoku and Bollinger Bands. We also liked that you can browse and use community-made technical indicators.

This community tab opens up new technical analysis opportunities to explore and potentially find a method that makes finding new ideas easier. Each indicator is rated so you can see which ones are popular and try them for free.

During our tests on the platform, we also liked that you can interact with other traders via social trading with a comment-based system, like Twitter, or in a live chat focused on each asset. This feature lets you share and review other market ideas in real-time.

You can even screenshot and publish your trade ideas for others to critique and provide feedback, which is a good mechanism for determining what you did right (or wrong) in your trading history.

With our Raw FX account on TradingView, we found the broker made all of its 4,500+ markets available on the platform, including 84 currency pairs, 20 indices, 30+ commodities, 4,500 stocks, and 25+ cryptocurrencies.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

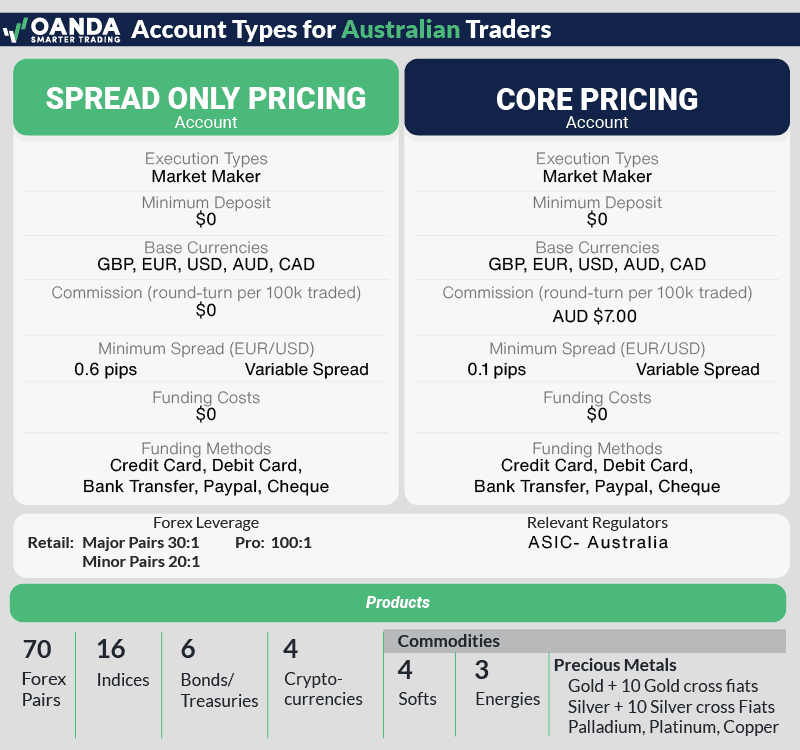

4. OANDA - Best Range Of Forex Pairs with TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We liked OANDA’s approach, even though the pure TradingView platform isn’t available in Australia. Their flagship platform, OANDA Trade, incorporates TradingView charts, making it a powerful tool for traders. Being pioneers in adding TradingView to their platform lineup highlights their forward-thinking approach. With a comprehensive feature of currency pairs and indices, cryptos, bonds, and commodities, OANDA emerges as a top pick for traders seeking a broad range of Forex pairs using TradingView.

Pros & Cons

- Access a large variety of forex pairs

- Provides excellent research tools

- Competitive spreads

- Doesn’t offer share trading

- Lacks 24/7 customer support

- No social or copy trading tools

Broker Details

We found OANDA to offer the best range of forex pairs during our tests, with 69 currency markets available on TradingView. This extensive range covers majors, minors, and exotic pairs for those seeking higher volatility.

For other markets, OANDA offers 16 indices and 20+ commodities for other markets, but surprisingly, it doesn’t offer any share CFDs.

OANDA is one of a few brokers that only provides a Standard account, limiting the ways to pay for its brokerage services to spread-only pricing. With our live account, the spreads are lower than expected, offering 0.60 pips on EUR/USD, placing it as the lowest spread broker for standard accounts.

| Broker | EUR/USD |

|---|---|

| OANDA | 0.6 |

| City Index | 0.7 |

| Pepperstone | 1.12 |

| Blackbull Markets | 1.2 |

| FXCM | 1.3 |

| Industry Average | 1.24 |

With this in mind, it didn’t matter that they don’t offer Raw spread accounts, as the standard account spreads would be just as low when you factor in the commission charges.

TradingView offers access to OANDA’s full spectrum of currency pairs, and if you like to monitor them, TradingView’s Market Scanner is a solid option. The scanner lets you enter specific parameters, such as price change or crossing, an indicator like a moving average, and it will show all markets that meet these parameters.

We liked this scanner because it allowed us to automatically filter the markets that matched our trading criteria. We monitor multiple currency markets for new opportunities all day, and when a market matches the scanner, you can click on it and validate the potential trade idea. This scanner helps speed up finding markets to trade by pre-qualifying each market based on our metrics, saving you from watching the charts all day.

A unique option with OANDA is to use its proprietary trading platform, OANDA Trade, which has TradingView’s charting built into it. This allows you to benefit from TradingView’s charts and use OANDA Trades’ settings that let you trade lower unit sizes from one unit, which can help you transition from demo to live trading without risking too much at the start.

With the OANDA Trade platform, you can also access Autochartist analysis, which gives you free trading signals to follow. If you use the TradingView platform, you can do this; you just need to log into your OANDA Trade platform.

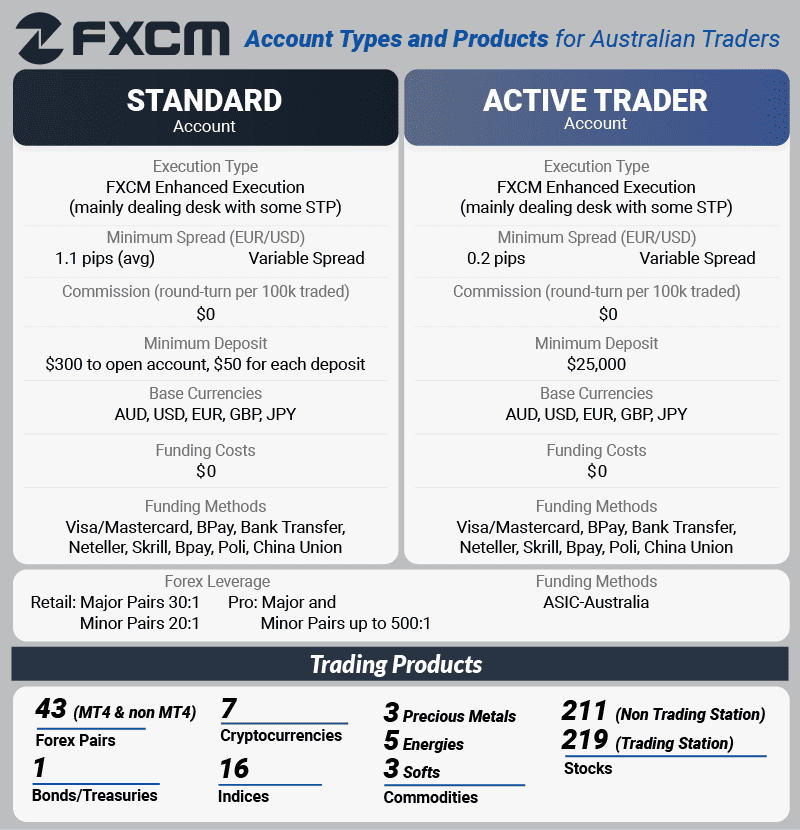

5. FXCM - Good Upgrade To TradingView Pro For Free

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

We liked FXCM’s offer, providing a TradingView Pro account complimentary for an entire year when you establish a trading account with them. It presents a fantastic chance to delve into the enhanced features of TradingView Pro. Coupled with FXCM’s merits, like a vast selection of currency pairs and favourable spreads, traders can genuinely harness TradingView Pro’s capabilities for analysis and trade execution.

Pros & Cons

- Offers TradingView Pro for free

- Provides market analysis resources

- Solid selection of trading tools

- Product choice is limited

- Wire transfers have withdrawal fees

- Charges an inactivity fee

Broker Details

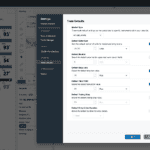

While exploring FXCM, we found that FXCM offers free TradingView plan upgrades based on how much you want to deposit. The minimum deposit to be eligible for a free upgrade to a paid account is $300, easily achievable for most traders. After the deposit, you will get a coupon to add to your TradingView account, unlocking the subscription plan.

As good as TradingView’s free account, it has limitations, such as the number of charts open at a time and the number of indicators allowed on a single chart. This free account can be a setback for traders who trade multiple markets or require more than two indicators on a screen to analyse the markets.

By receiving the free subscription, TradingView unlocks more features, such as:

- More historical data,

- 20 price alerts,

- Multiple watchlists,

- Five indicators per chart

- No adverts

Although the above may not be necessary for every trader, the threshold to get the free TradingView upgrade is so low that it’s worth getting anyway. Since the broker has a $50 minimum deposit, increasing it to at least $300 makes logical sense to enjoy the upgraded TradingView.

From our testing, we found that FXCM’s Standard account spreads were on par with the industry average, averaging 1.30 pips on EUR/USD. The broker does offer a way to reduce trading costs through its Active Trader account, which gives you cash rebates for your trading activity if you trade in large volumes.

In addition to the trading costs, FXCM offers a solid range of markets on TradingView. With a single account, you can easily switch between different markets, trading 42 currency pairs, 16 indices, 11 commodities, seven cryptocurrencies, and 210+ share CFDs.

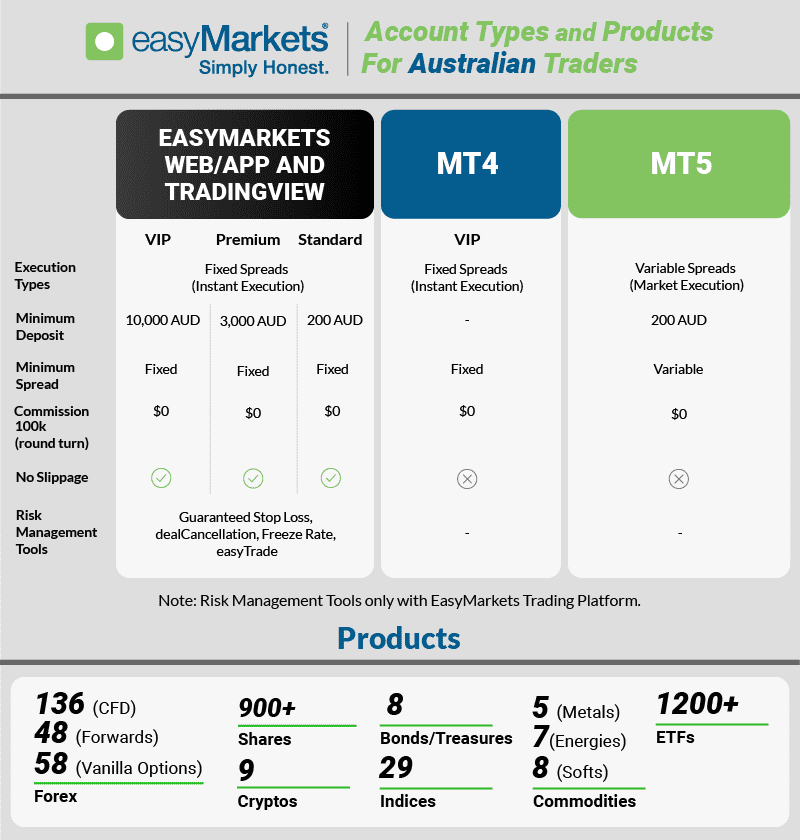

6. easyMarkets - Good Charting With Fixed Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.4

AUD/USD = 1.5

Trading Platforms

MT4, MT5, TradingView,

easyMarkets Trading

Minimum Deposit

$200

Why We Recommend easyMarkets

We liked easyMarkets for its unique offering of fixed spreads in conjunction with TradingView. What stands out is their guarantee on all stop-loss orders, a feature especially beneficial for newcomers wary of slippage in volatile periods. This blend of fixed spreads and assured stop losses on TradingView ensures a more consistent trading experience.

Pros & Cons

- Low fixed spread trading account

- Decent choice of trading instruments

- Guaranteed stop-loss orders are free

- Customer support is limited to 24/5

- Slightly wider spreads than the average broker

- No RAW spread trading account

Broker Details

easyMarkets is one of a handful of brokers to offer fixed spreads on TradingView, allowing you to keep your trading costs the same even during volatile trading periods. Fixed spreads can be an ideal option if you trade multiple markets and want to avoid sudden widening of spreads, which makes the cost of trading expensive.

In our experience, fixed spreads tend to be more expensive than variable spread brokers as they always account for potential market volatility. This normally puts off traders looking for fixed spreads, as you typically want the lowest spreads.

The good news is that after reviewing easyMarkets, we found the broker’s fixed spreads were just as low, if not better than those of other variable spread brokers in our tests. The broker offers its EUR/USD fixed spreads at 0.80 pips, 0.44 pips lower than the variable spread industry average, which is impressive.

| Broker | EUR/USD (Average Spread) | Fixed/Variable |

|---|---|---|

| City Index | 0.70 | Variable |

| OANDA | 0.60 | Variable |

| easyMarkets | 0.80 | Fixed |

| FXCM | 1.30 | Variable |

| Pepperstone | 1.12 | Variable |

| BlackBull Markets | 1.20 | Variable |

A unique feature we found with easyMarkets is that they provide free guaranteed stop-loss orders with every trade you place. We think this is excellent as it means you’ll never suffer negative price slippage on your losing trades, saving you money when the markets become volatile.

As good as the TradingView platform is, easyMarket has some interesting risk management tools available on its proprietary platform while still benefiting from TradingView’s charts.

In particular, the dealCancellation feature of the easyMarket platform stood out. It allows you to cancel your position if the markets move against you, something we’ve never seen before.

We tested this feature against a standard GLSO and found its utility decent for risk management. When a traditional GLSO would close our position once the price hit the GLSO, dealCancellation kept our trade open, allowing the trade to rebound back into profit.

In particular, we think this tool would be useful for beginners, especially if you accidentally trade during volatile announcements. During these announcements, your trades can whipsaw from profitable to tapping your stop loss before returning.

For example, if you had an open position when the non-farm payrolls are announced, entering with a dealCancellation can protect you from the price spikes it generates. Using the dealCancellation gives you the breathing room to withstand large market volatility before the price is typically stable afterwards.

Ask an Expert