Best Forex Brokers In Malaysia

I have tested the top forex brokers with Tier-1 regulations like ASIC or MAS that accept Malaysian traders because the Securities Commission of Malaysia (SCM) does not regulate brokers directly. Muslim Malaysian traders should choose a swap-free Islamic account.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The top forex brokers in 2025 for trading forex and CFDs in Malaysia are:

- Octa - Best Forex Broker For Malaysia Overall

- FP Markets - Good Broker With Solid Range of CFD Markets

- Pepperstone - Top Broker For Forex Trading

- IC Markets - Lowest Spread Forex Broker

- Eightcap - Top Platform For Trading Crypto And Forex

- ThinkMarkets - Top Forex Broker For Islamic Trading

- FxPro - Good cTrader Forex Broker

- IG Group - Great Range of Trading Platforms

- FXTM - Highest Leverage CFD Broker

- eToro - Most Advanced Social And Copy Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

88 |

CySEC MISA, FSCA, FSC-M |

- | - | - | - | 0.90 | 1.40 | 1.70 |

|

|

|

81ms | $25 | 35 | 32 | 1000:1 | 1000:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Who Are The Best Malaysian Forex Brokers?

I’ve tested over 60+ brokers and narrowed my list to 10 of the best forex brokers for Malaysia in 2025. The brokers placed on my list performed well in my tests, like trading costs, execution speed, swap-free trading accounts, and trading platforms. Below, I have paired up their best features for Malaysian traders based on my findings.

1. Octa - Best Forex Broker In Malaysia

Forex Panel Score

Average Spread

EUR/USD - 0.9

GBP/USD = 1.2

AUD/USD = 1.5

Trading Platforms

MT4, MT5, OctaTrader

Minimum Deposit

$25

Why We Recommend Octa

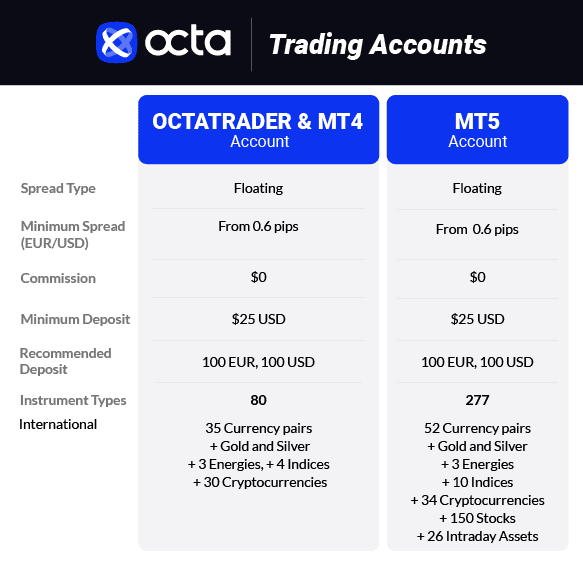

Octa topped the list this year as it offers excellent trading costs with low spreads averaging 0.90 pips, fast execution speeds (91ms), and swap-free trading accounts for everyone.

For these trading conditions, I scored Octa a solid 88/100 in my overall review which was also boosted by the generous 1:1000 leverage available. You have MetaTrader 5 which will suit experienced traders with its advanced technical analysis, while OctaTrader offers a great experience for beginners with the Pattern Recognition tools.

Pros & Cons

- Swap-free trading

- Low spreads with no commissions

- Social features on OctaTrader

- Leverage 1:1000

- Copy Trading With OctaFX Copy Trading App

- 24/7 Customer support in local languages

- Lacks phone support

- No TradingView or cTrader

- Product range on OctaTrader is slightly limited

Broker Details

Lowest Trading Costs With No Swap Trading

When I was opening my Octa account I was impressed when I found that there are no hidden charges or swap fees, which is typically limited to Islamic accounts. Having no swap fees makes the broker a top pick if you want to hold positions longer than a couple days.

This means that you can take advantage of Octas 150+ share CFDs by holding onto them without paying extra for the privilege. If you trade shares, I’d highly recommend considering Octa for this feature alone.

Octa is an ECN broker with a twist, they only offer a spread-only pricing Standard account which eliminates the need of paying commissions. I was impressed with the spreads while using the broker as they started from 0.60 pips on EUR/USD, but drifted and stabilised at 0.90 pips during the Asian trading session.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Considering you do not pay commissions, the spread-only pricing is competitive. Especially when you get the spreads towards the 0.60 pip offer, which can make it cheaper than traditional ECN brokers.

The Octa account doesn’t have other fees like inactivity or withdrawal costs, so you only pay through the broker’s spreads which simplifies your costs while providing great value.

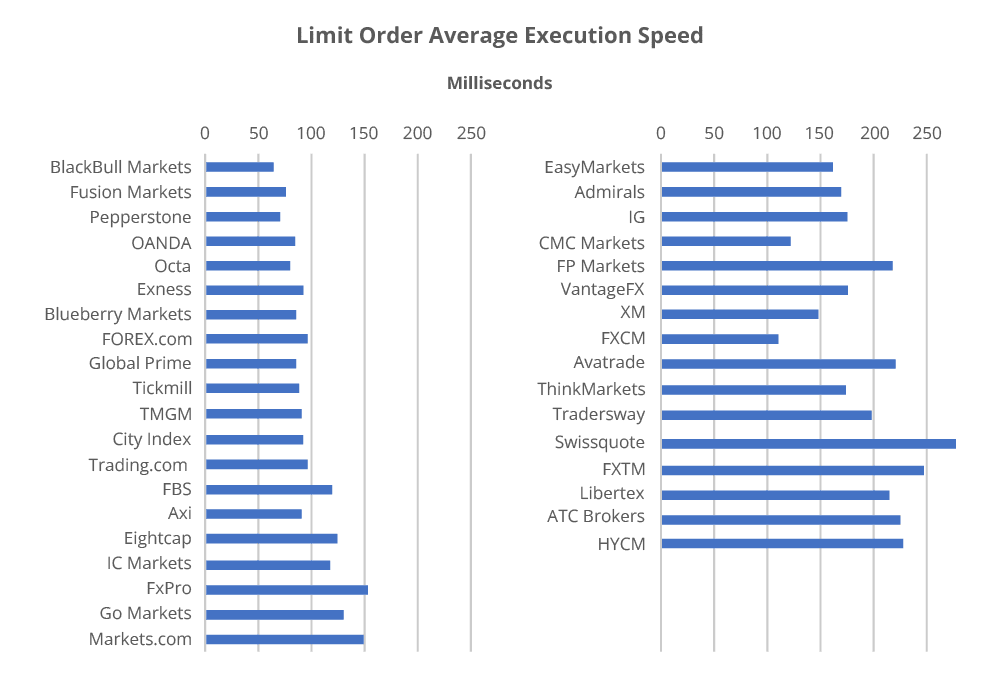

Ranked 4th For Fast Execution Speeds

Octa don’t neglect their trading services by cutting these costs either. In our tests, Octa placed 4th place for execution speeds with market orders averaging 91ms, making them a decent pick if you scalp and don’t like commission accounts.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| Blackbull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| Octa | 4 | 81 | 4 | 91 | 6 |

| OANDA | 5 | 86 | 5 | 84 | 2 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

| Trading.com | 13 | 114 | 14 | 138 | 15 |

| FBS | 14 | 135 | 17 | 118 | 12 |

| Axi | 15 | 90 | 8 | 164 | 25 |

Advanced Trading Tools With Multiple Platforms

With the broker’s ECN services you can access MetaTrader 5’s advanced tools including Depth of Markets that lets you see the order flow, so you can find hidden liquidity zones.

If you prefer a platform that focuses on execution and technical analysis, the OctaTrader is my pick with its Pattern Recognition tool that helps identify support and resistance levels.

2. FP Markets - Good Broker With Solid Range of CFD Markets

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

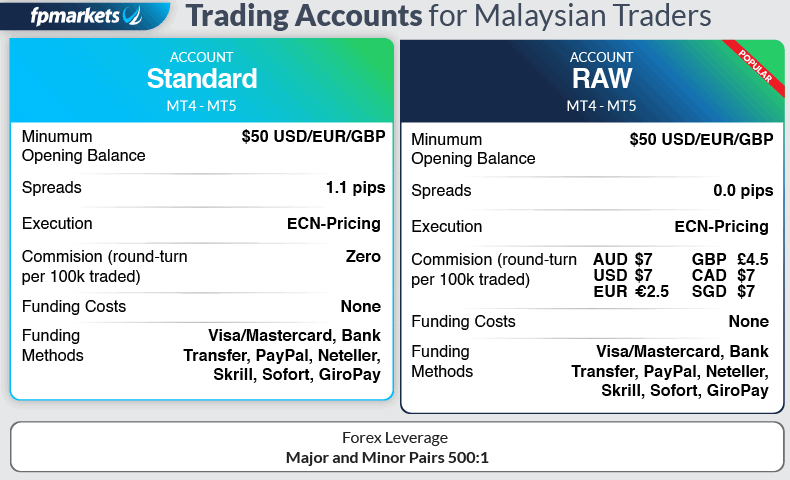

FP Markets scored 86/100 for its decent trading conditions and range of CFD markets. This range gives you a solid variety of assets including 800+ share CFDs and 63 forex pairs, so you can trade popular markets like Amazon and EUR/USD.

You’ll also find FP Markets has low trading costs with its Raw account averaging 0.20 pip spreads on EUR/USD with cheap commissions at $3.00 per lot traded. If you scalp, you’ll like that the broker has fast market order speeds reducing requotes and slippage.

Pros & Cons

- MT4, MT5, cTrader and TradingView platforms

- Leverage 1:500

- ECN pricing and the lowest spreads

- Social Trading with FP Markets Social and Myfxbook

- Lacks specialised automation tools

- Could offer more third-party tools

- Average educational resources

Broker Details

Wide Range of Markets For Malaysian Traders

FP Markets offers a wide range of markets for Malaysian traders which covers major markets from forex pairs to ETFs. Breaking their listing down, I found they offer 63 forex pairs, which isn’t the largest in Malaysia but covers the 7 major and 20+ minor pairs. So you’re not really missing out in my opinion.

I like that the broker offers 11 cryptocurrencies, giving you exposure to higher-risk assets while providing 800+ share CFDs including popular companies like Apple. If you like to trade more niche products, you can trade 13 commodities (soft, energy, gold, and silver), 46 ETFs, and 19 indices.

Low Standard Account Trading Costs

You’ll find that the trading costs are decent too. The Standard account lets you pay through wider spreads with no commissions and was averaging 1.19 pips on EUR/USD in our testing, which is competitive in Malaysia.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

I found you’ll get tighter spreads through the broker’s RAW account, which averaged 0.20 pips on EUR/USD with a $3.00 per lot traded commission. Not only are the spreads below the industry average, but the commission is roughly 15% cheaper than other brokers like ThinkMarkets.

| Broker | USD |

|---|---|

| FP Markets | $3.00 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| FxPro | $3.50 |

Fast Execution Speed On cTrader

FP Markets also performed well in our execution speed tests achieving an average market order speed of 96ms, anything below 100ms is excellent for scalping with. With the fast market order speeds, you’ll be able to take advantage of cTrader’s one-click trading feature to get your orders matched fast.

If cTrader isn’t your favourite platform, I like that FP Markets also makes TradingView, MetaTrader 4, and MT5 available – giving you a solid choice of how you want to trade.

3. Pepperstone - Top Broker For Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

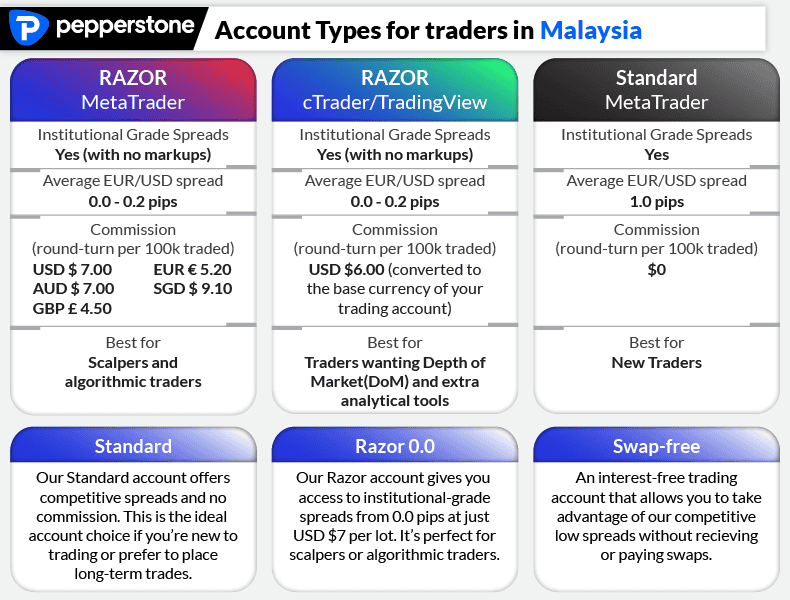

I rated Pepperstone highly in my broker tests, scoring 98/100 as it provides solid trading conditions for forex trading. You can trade 93 forex pairs (upgraded for 2025), while paying zero-pip spreads on the Razor account providing the cheapest account for forex trading.

The broker also achieved excellent limit order execution speeds (77ms) in testing, allowing faster pending orders helping you avoid missed entries.

Pepperstone delivers multiple trading platforms including cTrader, MT4, MT5, and TradingView which allows for any trading style to take advantage of Pepperstone’s excellent trading conditions.

Pros & Cons

- The best order execution speed

- Leverage of 1:200 for Forex with negative balance protection

- Tight spreads for Standard and RAW accounts

- MT4, MT5, cTrader and TradingView Platforms

- Good 3rd party tools – Myfxbook, DupliTrade, Signals

- Solid but not exceptional educational tools

- Swap-Free account has an admin fee every 10th overnight

- The commission per side is $3.50 USD for the Razor Account

Broker Details

Razor Account Offers 0 Pip Spreads

One of the reasons I’ve rated Pepperstone so highly is that it’s a broker that delivers zero-pip spreads in our tests on its Razor account.

My analyst, Ross Collins, tested Pepperstone’s spreads (along with 14 others) to see how long on average the brokers offer zero-pip spreads. According to Ross, Pepperstone offers EUR/USD at 0.0 pips 100% of the time (outside of rollover), which backs up my experience on the MetaTrader 5 platform.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| IC Markets | 97.83% |

| Eightcap | 97.83% |

| FP Markets | 97.83% |

| ThinkMarkets | 94.93% |

Trading EUR/USD with zero-pip spreads makes scalping or day trading cheap and easier for you to turn a profit as you don’t have to wait to cover the spread. Instead, you’ll be paying a fixed commission of $3.50 per lot, which keeps your trading costs the same regardless of market volatility.

Excellent Selection Of Forex Pairs

With access to 93 forex pairs, you get access to one of the largest collections of currency pairs to trade covering all major, minor, and most exotic pairs. Only IG Group (110) and CMC Markets (330+) offer more pairs from my testing.

Fast Limit Order Speeds

In Ross’ Execution Speed test, he gathered the average limit and market order execution speeds over 24 hours using his MT4 platform with the ExTest_ForExpat and Broker Latency Tester EAs.

Pepperstone came 3rd place overall thanks to its fast 77ms limit order speeds which means your stop-loss and take profit orders will execute fast. If you’re a breakout trader, you’ll also benefit from these near-instant execution speeds when placing your pending orders.

As for using the broker, you have multiple trading options, which include TradingView and cTrader for excellent technical analysis tools. Or, you have MetaTrader 4 and MT5 if you want to automate your trades.

4. IC Markets - Lowest Spread Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

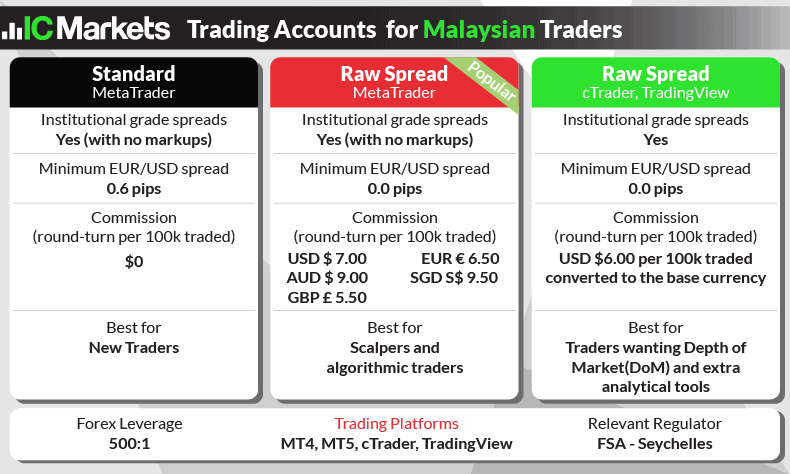

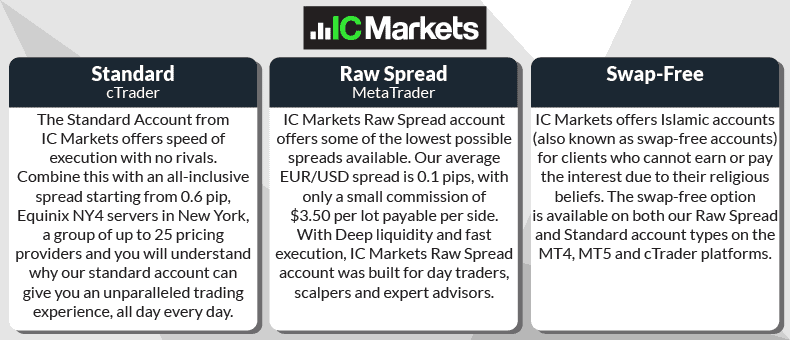

IC Markets is my top choice for low spreads, achieving excellent results for both Standard and Raw account spreads in my trading cost test and scoring 9/10. The broker achieved lowest spreads on its Standard account with EUR/USD averaging 0.73 pips in our tests, making it my best account for spread-only pricing with no commissions.

With 2,250+ CFD markets to trade you’ll benefit from lower trading costs with access to MT5, MT4, cTrader or TradingView. All of these factors combined, plus excellent customer service placed IC Markets in my overall top 5 forex brokers with a score of 93/100.

Pros & Cons

- Best spreads with RAW and Standard accounts

- Leverage of 1:1000 with negative balance protection

- Trading platforms MT4, MT5 and cTrader on desktop or mobile

- Choice of commission-based or spread-only trading

- Social trading with ZuluTrade and IC Markets app and Signals

- No crypto account funding option

- Swap-free account charges an administration fee

- No Autochartist or Trading Central

Broker Details

Lowest Standard Account Spreads

While I was using my IC Markets Standard account, I noticed how low the spreads were during the Asian trading session, which is thanks to its 25 pricing providers. My analyst confirmed that IC Markets had the lowest spreads for Malaysia after testing the broker against 15 other brokers.

By using the IceFX SpreadMonitor on his MT4 platform, Ross was able to accurately collect the average spread data to get his results. Although he did this for both the RAW and Standard account, it was the Standard account that impressed me with an average EUR/USD spread of 0.73 pips.

This placed IC Markets in first place, slightly ahead of Octa, and was 34% cheaper than the industry average (1.11 pips). IC Markets’ Standard account also held the top spots across the 6 forex pairs tested as you can see below:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Tight Raw Account Spreads

The RAW account was equally as impressive in Ross’ tests with EUR/USD averaging 0.19 pips. Although, you have the added cost of trading commissions which are $3.50 per lot traded. Interestingly, I find the Standard account is cheaper out of the two accounts which is rarely the case when it comes to Standard vs RAW accounts.

See how IC Markets compares with your broker’s spreads with our Spread Pricing Tool below:

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Excellent Selection of Trading Products

You can benefit from low trading fees with its diverse range of markets, including 61+ forex pairs, 1,600+ stock CFDs, 25+ indices, 26+ commodities, and 18+ crypto markets.

To trade these markets, you can choose to use the cTrader, TradingView, MetaTrader 4, or MetaTrader 5 platforms. All of these platforms delivered similar spreads with no price lag in my tests, so you won’t get penalised for choosing one platform over another.

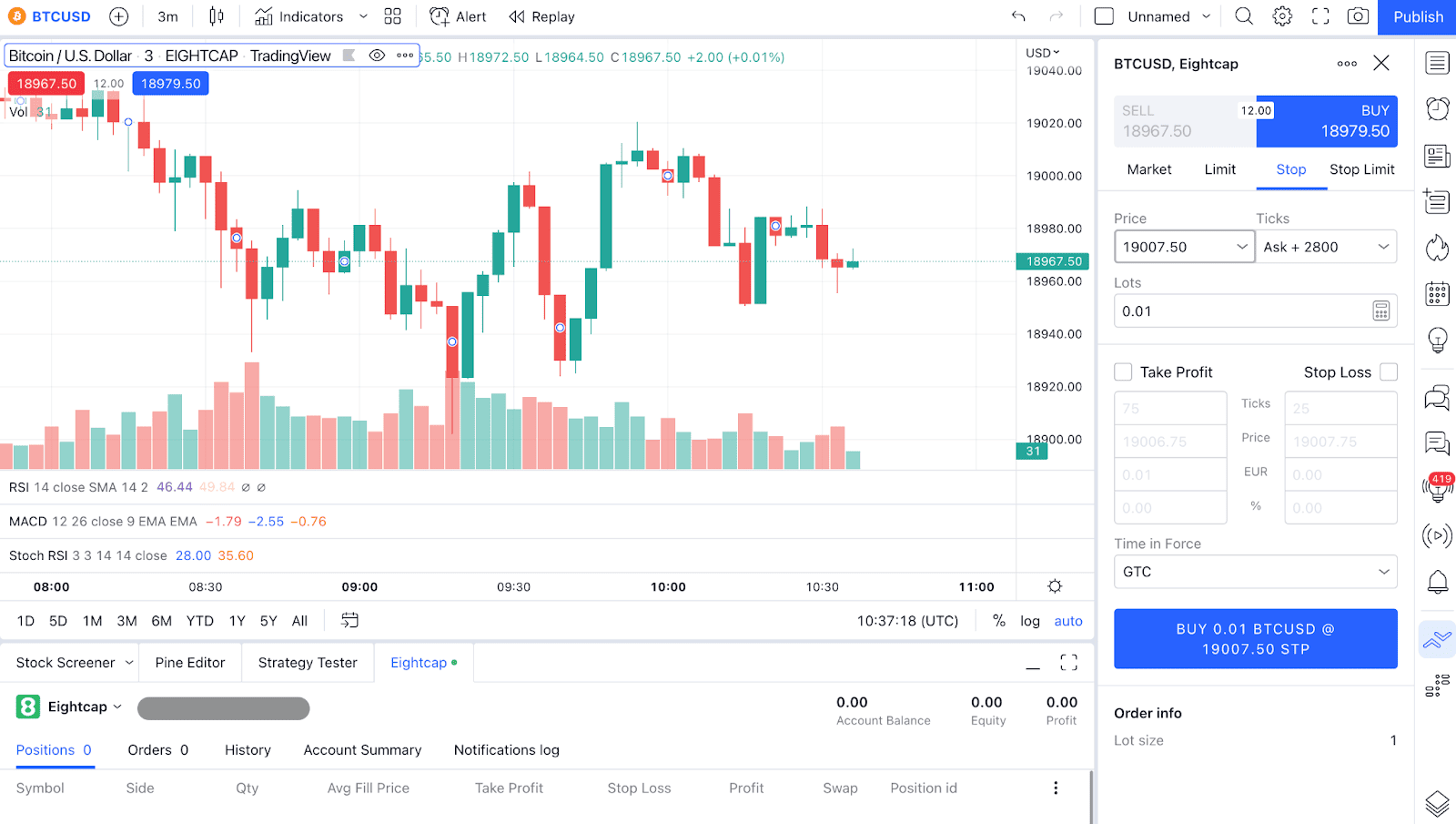

5. Eightcap - Top Platform For Trading Crypto And Forex

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

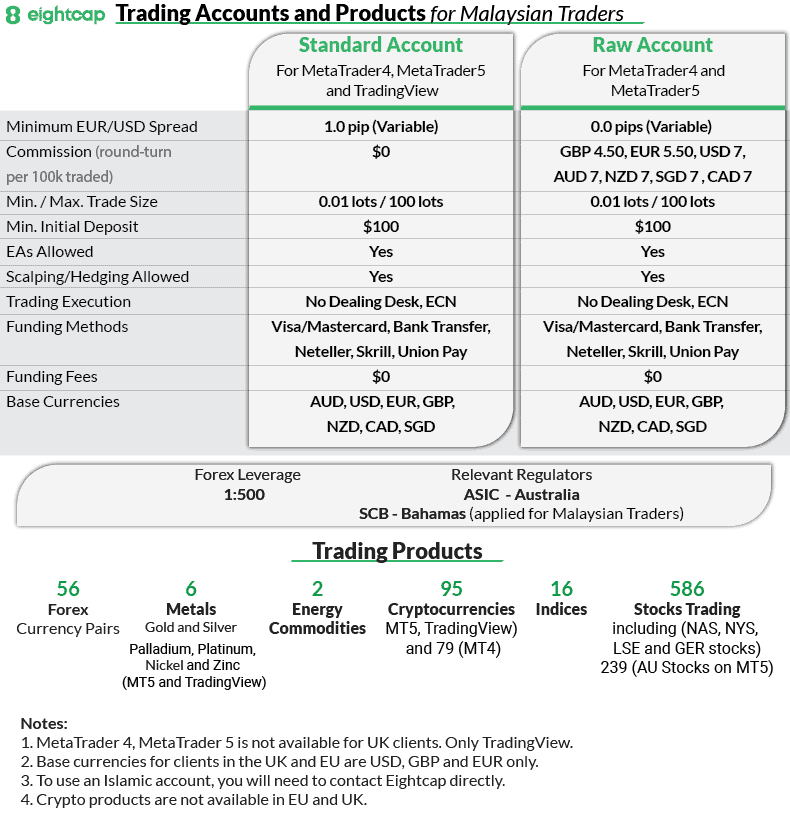

Low spreads and variety of markets helped give Eightcap 96/100 in my tests. Eightcap offers 95+ crypto CFDs making it the largest in Malaysia covering Bitcoin, Ethereum and altcoins like PEPE and DOGE, giving you a solid platform to trade these high-volatility markets.

As for forex, the broker offers 55 pairs including the majors and minors with tight spreads on its Raw account averaging 0.20 pips on EUR/USD.

Trade with multiple trading platforms (MT5, MT4, and TradingView) but also extra tools like Capitalise.ai that helps automate your strategies without knowing how to code.

Pros & Cons

- Tight spreads

- Extensive crypto offering

- Automated trading tools

- Limited range of trading tools

- Lacks 24/7 client support

- No copy trading tools

Broker Details

Eightcap Has The Largest Cryptocurrency Selection

Eightcap has positioned itself as the best cryptocurrency broker by offering 95+ cryptocurrencies, which is the largest collection from a regulated forex broker available to retail traders. The markets cover major coins like Bitcoin while offering altcoins like DOGE if you want to trade volatile pairs.

In the table below, you’ll see from my research how Eightcap offers over 3x as many as its nearest competitor (eToro).

| Broker | No. of Cryptocurrencies |

|---|---|

| Eightcap | 95 |

| eToro | 114 |

| Pepperstone | 27 |

| Plus500 | 15 |

| BlackBull Markets | 16 |

| FP Markets | 12 |

| FXTM | 11 |

The added benefit of using a forex broker is that you are trading with a fully regulated forex broker, who are obligated to provide transparent trading conditions and financial protections.

This gives you peace of mind, as I know that not all crypto exchanges are regulated which means they do not follow the same rules and regulations as forex brokers.

Great Choice of Trading Platforms for Forex and Crypto Trading

You have a solid choice of trading platforms for executing trades and performing technical analysis, these are TradingView, MetaTrader 4, and MetaTrader 5 – all have access to cryptocurrencies.

I used TradingView while performing my review as I like that you have access to 110+ indicators out-of-the box making it easier to set up your strategy and get going. If you need custom indicators or automate your trades, then MT4 and MT5 are better alternatives.

Capitalise.AI Automates Your Trading Strategies

To make automation available to everyone, I like that Eightcap provides Capitalise.AI which is a no-code solution turning manual trading rules into automated strategies.

When I tested Capitalise.ai, producing an automated strategy takes less than 10 minutes as you tell the AI your trading rules (including risk management), then it creates your automation. Then it deploys your strategy in one-click to your MT4/MT5 trading account, making the process easy.

6. ThinkMarkets - Top Forex Broker For Islamic Trading

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.1

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

I found that ThinkMarkets offers Islamic accounts for both its Standard and ThinkZero (Raw) accounts, so you’ll get to trade with low spreads and no swap-fees making the accounts Sharia compliant.

This is a positive because in my tests the ThinkZero account provided zero-pip spreads on EUR/USD 100% of the time, making your only cost being the $3.50 commission. You also have leverage of 500:1 on forex majors and access to 4,000+ markets from forex to share CFDs – providing a solid Sharia compliant multi-asset trading account.

Pros & Cons

- Tight spreads for Standard and RAW accounts

- MT4 and MT5 trading platforms

- ThinkTrader Mobile App that integrates with MT4 network for copy trading

- Leverage of 500:1 for Forex

- Limited range of trading products available

- ThinkZero RAW Trading account has a $500 minimum deposit

- Don’t publish their average spreads (potential lack of transparency)

Broker Details

ThinkMarkets Offers Islamic Accounts

If you’re seeking an Islamic Account, I found ThinkMarkets offers the best choice as the broker allows you to have Islamic fees on its Standard and ThinkZero accounts. Unlike other brokers, ThinkMarkets don’t force you to choose an expensive account to receive a swap-free account.

The swap-free accounts can avoid charges for 6 nights, allowing for short-term trading. However, I noticed that if you leave positions open for 7 nights or more, you are charged an administration fee of $10 per lot. So as long as you close your positions on the 6th night, no fees will be charged.

ThinkZero Has Tight Spreads From 0 Pips

Out of the two accounts, ThinkZero is the better choice from my tests if you focus on forex trading. ThinkZero accounts also charge $3.50 per lot traded, which is in line with the industry average, but offers its spreads from 0.0 pips.

Like Pepperstone, ThinkMarkets also produced zero-pip spreads in my analyst’s tests but only EUR/USD remained at zero 100% of the time.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| ThinkMarkets | 95.65% | 100% | 91.30% | 91.30% | 91.30% | 100% | 94.93% |

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% | 98.55% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% | 97.83% |

If you want a streamlined pricing experience, the Standard account offers wider spreads, averaging 1.10 pips on EUR/USD, below the industry average. Plus, you don’t have to pay any commission.

ThinkMarkets’ Delivers Market Variety

You aren’t limited to market variety with the Islamic account either, I found ThinkMarkets has 4,000+ markets to trade.

This includes markets like 46 forex pairs and 4,600+ share CFDs which have no-swap fees making them better for short term and intraday trading. Other markets include 27 cryptocurrencies, 7 commodities, 352 ETFs, and 16 indices.

7. FxPro - Good cTrader Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.32

GBP/USD = 1.7

AUD/USD = 1.95

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why We Recommend FxPro

FxPro is my best choice for cTrader forex broker as I found the broker’s services compliment the platform well. You have competitive spreads from 0.20 pips on EUR/USD on its cTrader account with leverage up to 1:2000 – allowing you to scale your account with less margin.

With FxPro being an ECN broker, you get fast execution speed which helps you scalp the markets to avoid requotes and price slippage that can negatively impact your trading performance.

Pros & Cons

- MT4, MT5, cTrader and FxPro Platforms

- Fixed spread with instant execution available with their standard account

- Leverage up to 1:2000 (dynamic)

- Over 70 currency pairs

- High minimum deposits for Pro, RAW+ and Elite accounts

- Swap free account uses a 3-night grace period before applying swaps

- Charges an inactivity fee

Broker Details

FxPro Pairs Well With cTrader

Out of the brokers tested, FxPro provided the best support with the cTrader platform. The cTrader is a decent platform with a wide choice of 67 indicators (more than MT4 and MT5), with extra volume-based tools like VWAP.

If you require advanced charts, cTrader has 130 timeframes with custom chart types like Renko, Heikin-Ashi, and candlestick charts allowing you to trade based on price or time.

With cTrader’s features, I think scalpers will benefit most from this platform. For example, I found it offers the Depth of Market tool letting you view the liquidity provider’s order books to see where other traders are placing their open orders.

I use this for determining market sentiment or areas of liquidity to help time your trades better, this adds another layer to your analysis using RAW data. Plus, I like that you can one-click trade directly from the Depth of Markets tool, making executing your trades faster than using order tickets.

FxPro’s cTrader Account Has Low Trading Commissions

To use cTrader, I found FxPro requires a different pricing structure from its Standard account which is a commission based account. FxPro’s cTrader Account has reasonable spreads averaging 0.20 pips but has cheap commissions at $3.50 per lot traded – making it a low cost trading account.

cTrader is an excellent platform that I think fits most traders, however, I have developed a trading platform tool to help find your perfect trading platform match. Check it out below:

8. IG Group - Great Range of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

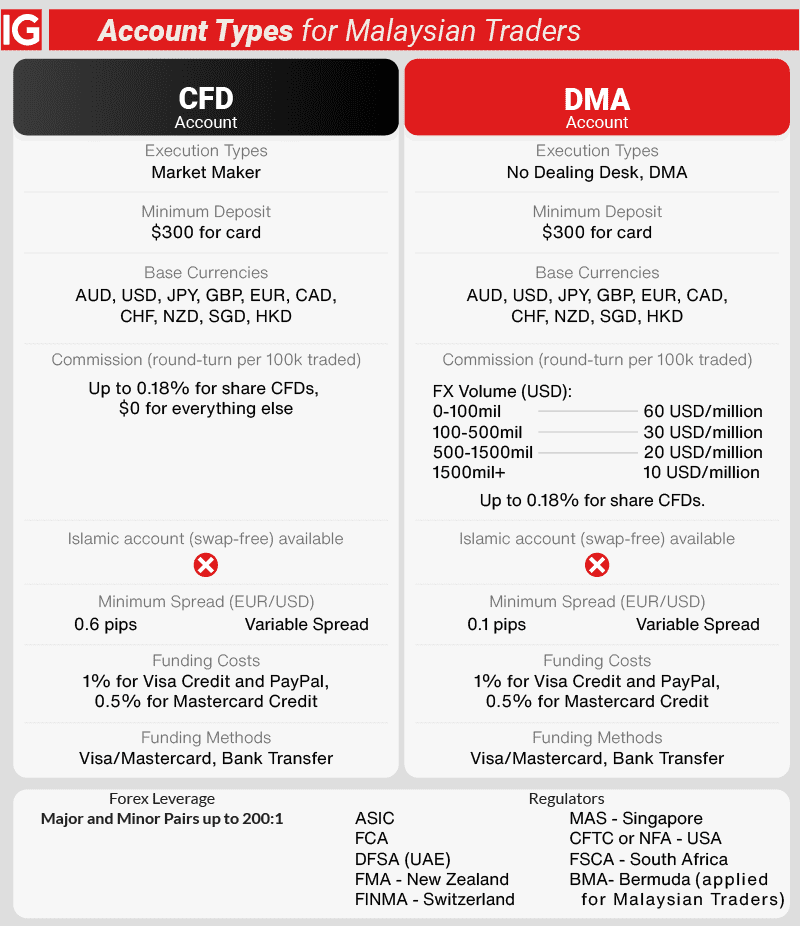

I gave IG Group 78/100 in my tests for its large range of markets and decent selection of trading platforms giving you a variety of ways to analyse the markets. You can trade with top platforms like TradingView (new for 2025), ProRealTime, MetaTrader 4, and L2 Dealer (for pros).

For me, the IG Trading platform is my standout pick with its trading signals and large choice of indicators like pivot points and Bollinger Bands for breakout trading. You can trade with low spreads and access 17,000+ markets with the account, while other platforms are limited.

Pros & Cons

- 17,000+ Products, the largest of all brokers

- IG Trading Platform, MT4 and L2 Dealer trading platforms

- Good selection of trading platforms, including solid proprietary web trader

- Low Leverage – only 1:200

- Market maker so orders may have rejections

- Lacks a swap-free account option for Islamic traders

Broker Details

Decent Range Of Trading Platforms

In my tests I found IG Group had a decent collection of trading platforms, allowing you to choose from IG Trading Platform, MetaTrader 4, TradingView, ProRealTime, or L2 Dealer. I used the IG Trading platform during my tests as it’s the only way to explore all of the financial instruments IG Group offers.

While using the platform, I like that it offers a solid choice of indicators (40+), including Ichimoku and moving average indicators with 30+ drawing tools, providing a solid foundation for performing technical analysis.

The IG platform makes it easier for you to day trade thanks to its Signal Centre tool that provides you trading signals from two top providers, PIA First and Autochartist. These signals have expert commentary on multiple markets including forex, indices, and commodities.

If you like to automate your trades, then you will need to use ProRealTime or MetaTrader 4 as these are the only platforms to offer this feature.

Access 17,000+ Markets On IG Group

IG Group has the largest selection of CFD markets in Malaysia, with over 17,000+ financial instruments. You can trade 110+ currency pairs, 13 cryptocurrencies, 13,000+ share CFDs, 41 commodities, 2,000+ ETFs and 14 bond markets making IG Group a top broker multi-asset broker.

You get decent spreads on the broker’s Standard account which can average 1.13 pips on EUR/USD during Asian trading sessions. With the broker offering such a variety of markets, I found their costs across the assets to be relatively competitive, especially on gold where the spreads averaged $0.50.

9. FXTM - Highest Leverage CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2

AUD/USD = 2

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

FXTM has the largest leverage I’ve tested for Malaysian traders with 1:3000 on forex majors, making it a great pick to scale your trading performance with smaller margin requirements.

The broker also has its Advantage Plus account offering tight spreads averaging 0.1 pips on EUR/USD with $2.00 commissions (lowest in my testing). With high leverage, and cheap trading costs I think FXTM is a great choice if you’re a scalper.

Pros & Cons

- Leverage of up to 1:3000 available

- Micro account option

- Lowest commissions at $2.00 per lot

- High minimum deposit requirement

- Wider than average spreads

- Charges a withdrawal fee

Broker Details

Highest Leverage Broker For Malaysian Traders

FXTM’s leverage is the highest among the brokers in Malaysia I’ve tested. Through its Mauritius entity, FXTM accepts clients from Malaysia and offers up to 1:3000 on forex majors. This is significantly higher than the rest of the brokers, who offer a maximum of 1:100 if regulated by Labuan International Business and Financial Centre (IBFC).

I used the Advantage Plus account, and found that FXTM’s leverage scales on the trade size, making lower trading sizes have larger leverage, ideal if you have lower funds.

For example, if you trade less than 1 lot size you can access 1:3000 leverage on forex majors. If you trade more than this your leverage will be 1:1000, which is still much higher than most brokers in Malaysia.

However, the increase in leverage for smaller accounts will increase the risk of being stopped out, potentially costing you more and making it harder to trade.

Tight Spreads and Cheap Commissions on Advantage Plus

The reason why I chose the Advantage Plus account is for its competitive commissions, charging $2.00 per lot traded, a saving of ~42% compared to the industry average. Spreads on the account were also tight averaging 0.1 pips on EUR/USD from my analysts tests.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

FXTM doesn’t shine when it comes to its market range, however. I found it to offer 300+ CFD markets, which isn’t the largest in Malaysia, but it does cover the major markets like 42 forex pairs and 11 commodities.

10. eToro - Most Advanced Social And Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

I think eToro is a great choice for copy trading as they have set the bar high with their CopyTrader platform, which has simplified the way you copy trade. With eToro being the broker and platform, I find eToro can achieve complete transparency when it comes to copy trader performances.

The broker has 7,000+ trading products, where you can copy trade with spread-only pricing from 1 pip on EUR/USD and no commissions on all assets (including share CFDs).

Pros & Cons

- Social and copy trading tools unique to the platform

- Excellent selection of cryptos to trade

- No commissions on any markets

- Limited account types and trading platforms

- Lacks trading tools for advanced strategies

- Higher trading costs than comparable brokers

Broker Details

CopyTrader Makes Copy Trading Beginner-Friendly

eToro’s CopyTrader is my favorite copy trading platform compared to other top options like DupliTrade or ZuluTrade. The CopyTrader platform simplifies finding and automatically mirrors your trader’s positions instantly, replicating the success (or losses) achieved by your chosen traders.

Finding a trader is easy with the platform’s filter tool, allowing you to choose metrics such as total trades per week, number of followers, and assets traded. You can customise these to narrow down the 2 million+ copy traders to ones that match your investing profile in seconds.

The data eToro holds on each trader helps promote transparency, especially when it comes to delegating your money to trade. eToro provides full trading history, including date stamps and running PnL every for every trader helping you gauge the top traders.

Plus, as a market maker, eToro sees all of the trades placed, so no one can skew their stats to attract traders fraudulently.

Low Spreads With No Commission Account

While opening my eToro account I was impressed that there are no commissions on the account (even on share CFDs), which simplifies your trading costs. I also found the spreads to be low with eToro with spreads from 1 pip on EUR/USD, especially compared with other copy trading platforms like ZuluTrade who have larger markups.

Ask an Expert