OANDA Canada Review

Forex Broker OANDA (Canada) offers commission free trading with 69 currency pairs via OANDA Trade, MT4 and TradingView trading platforms. We review all features the broker offers and give our thoughts on them.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our Findings Of OANDA Canada

OANDA (Canada) is our pick for Canadians looking for spread trading through CFD products. Of the three trading platforms. OANDA Trade is unique as it allows trading with partial lots while MetaTrader 4 supports Expert Advisors (EAs) and TradingView has chart trading.

You can trade 69 currency pairs to trade with along with commodities and indices Lastly, high-volume traders will appreciate the rebates with the Elite Trader program. We gave OANDA a score of 91 out of 100.

Note: OANDA Canada is regulated by the CIRO and only accepts residents of Canada. OANDA Canada does not accept residents in the Alberta province.

| 🗺️ Tier 1 Regulation | CIRO, ASIC, CFTC, NFA, FCA, MAS |

| 🗺️ Tier 2 Regulation | MFSA |

| 🗺️ Tier 3 Regulation | FSC-BVI, IFFA |

| 💰 EUR/USD Spread | 1.5 pip average |

| 📊 Trading Platforms | OANDA Trade, MT4, TradingView |

| 💰 Minimum Deposit | $0 |

| 🎮 Demo Account | Yes (Unlimited) |

| 🛍️ Instruments | CFDs – Forex, Commodities, Bonds, Indices |

| 💳 Funding Methods | Debit Card, PayPal, Wire Transfer |

What we say about OANDA

While OANDA provides multiple currency-related services, our review focuses on their online brokerage.

With OANDA, you can trade forex, indices, commodities, bonds and treasuries. We found the range of available currency pairs impressive – 69 in total. The broker also offers 21 bullion trading products. Gold and silver can be traded against ten different fiat currencies, as well as against each other.

We found OANDA’s standard account spreads to be similar to those of other brokers. The broker does not charge a commission, and spreads start from 0.6 pips.

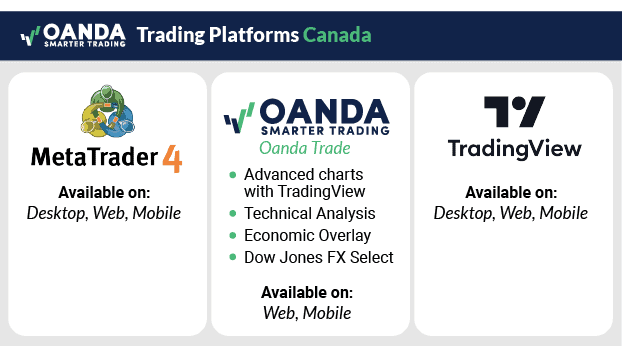

And we appreciate that OANDA offers three different platforms. OANDA Trade, the broker’s own app, is available via the web and for mobile. The web version comes with free access to advanced charts by TradingView; technical analysis tools by Autochartist; and the latest financial news from Dow Jones FX Select. OANDA Trade also supports trading in partial lots.

If you like to use Automation, you can use EAs with MetaTrader 4 (MT4), while if you are a technical trader, you may prefer TradingView for its more than 100 charts and indicators.

OANDA also distinguishes itself from other brokers because of its Elite Trader program. If you trade at least USD 10 million monthly, you’re eligible for rebates of 10% to34% on average on your trading costs. These savings make OANDA a valid option for high-volume traders.

OANDA isn’t without weaknesses. We wish OANDA Trade were available as a download for desktops, and it surprised us that the broker doesn’t offer stocks. We’d also like to see a commission-based, raw spread account option.

Overall we gave OANDA a score of 92 out of 100. It ranks #1 among the CIRO-regulated brokers we reviewed and #9 of all brokers we have reviewed across the globe. You can read more about how we score brokers here.

Note: OANDA Canada is regulated by the CIRO and only accepts residents of Canada. OANDA Canada does not accept residents in the Alberta province.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

- Elite program for rebates

- Three trading platforms to choose from

- Fast execution speeds

- Partial lots for better money management

- Automated trading strategies with MT4

- No desktop version of OANDA Trade

- No share CFDs

- No negative balance protection

- No guaranteed stop loss

Quick Overview of Key OANDA Canada Features

| Standard Account | |

| Trading Model | Market Maker |

| Pricing | Spread only |

| Commissions | None |

| Minimum Deposit (to open an account) | No minimum |

| Forex Leverage | Up to 50:1 |

| Forex Markets | 69 Currency Pairs |

| Other Trading Markets | Indices - 20 Bulllion - 21 Commodities - 9 Treasuries - 6 |

| Rabates Available | Elite Trading Program - Rebates of 10% to 17% |

| Inactivity Fee | $10 CAD If no activity after 1 year |

| Trading Platforms | OANDA Trade MetaTrader 4 TradingView |

| Automation Available? | Yes - With MetaTrader 4 |

| Regulation | CIRO (formerly IIROC) |

| Unique Feature 1 | Rebate Program |

| Unique Feature 2 | Standard, micro and mini lots and everything in between (with OANDA Trade) |

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

The overall rating is based on review by our experts

Trading Spreads with OANDA

To review OANDA’s spreads, we opened an account and placed live orders. Ross Collins, our Chief Technology Researcher, also tested the average spread for major forex pairs. He found that spreads varied from 0.90 pips on the EUR/USD currency pair to 2.1 pips on the USD/CAD:

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| OANDA Average Spread | 0.9 | 1.9 | 1.78 | 1.54 | 2.1 | 1.52 | 3.41 | 2.99 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.6 | 1.8 | 1.5 | 2.0 | 2.2 |

Because these are variable spreads, they only capture a specific moment in time. You can’t assume they’ll be the same when you trade, but they do provide a useful benchmark.

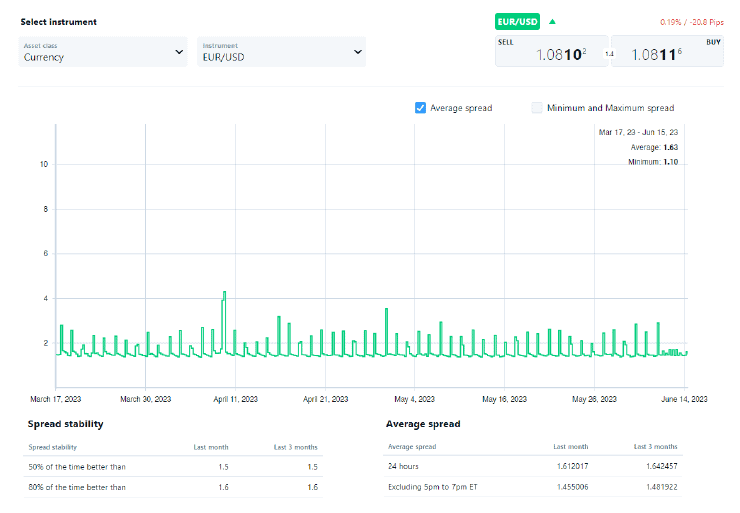

We also took a deep dive into the recent history of the EUR/USD currency pair. Over the past three months, the EUR/USD averaged 1.64 pips. In May 2023, it averaged 1.61 pips, with a minimum of 1.10 pips.

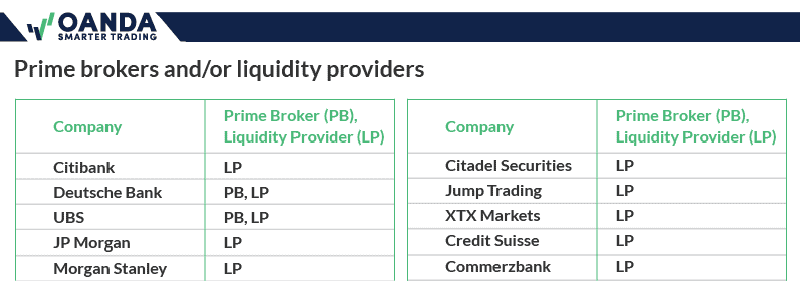

How OANDA Source Their Spreads?

OANDA is a market maker. To guarantee that your order fills, the broker may sometimes act as a counterparty. Below are some of the liquidity providers OANDA uses as a measure to ensure their spreads are consistent with the market.

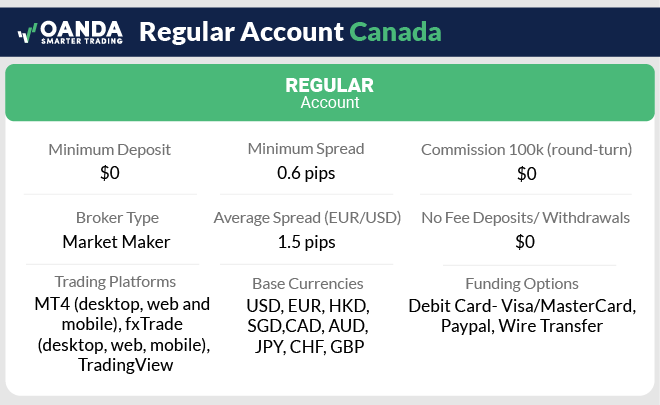

Account types on offer

OANDA (Canada) offers a single standard account with no extra commission costs. Upgrading its Elite Trader Program can lead to cost savings in the form of rebates and premium trading benefits.

Standard Account

Whether you’re an experienced trader or a beginner, OANDA (Canada)’s Standard account should meet your needs. As we discussed above, spreads for major pairs like the EUR/USD start from 0.6 pips with this account type. In reality, they tend to fall closer to 1.0 to 1.6 pips.

If you’re new to trading, a standard account simplifies your trading experience. You won’t struggle to calculate how much it costs to open or close a position because you’re only concerned with the spread.

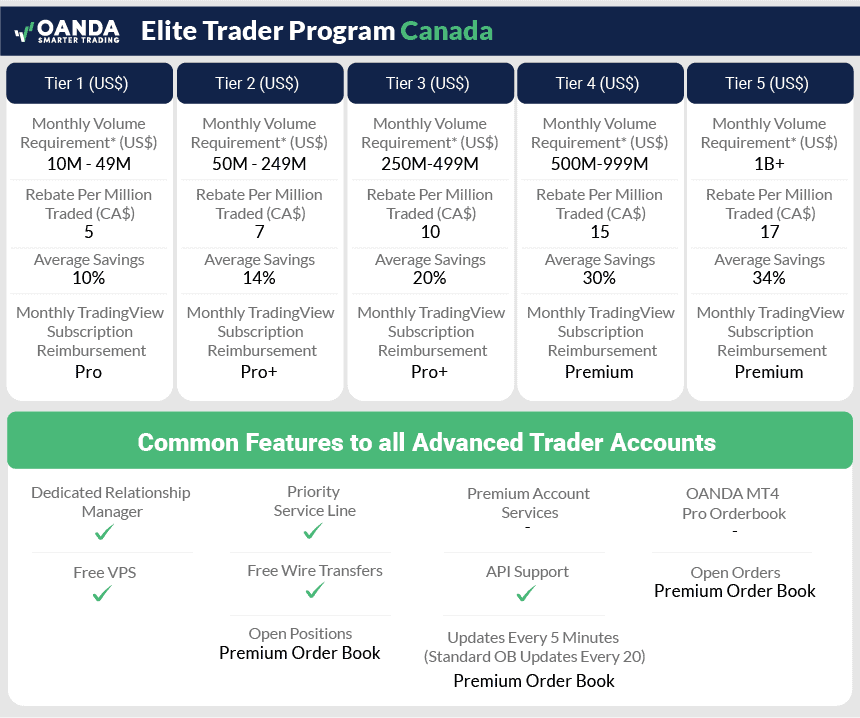

High-Volume Trading Accounts – Elite Trader Program

OANDA (Canada) offers discounts to high-volume traders through the Elite Trader Program. If you meet their trading volume requirements each month, OANDA pays a rebate. You can use this to recoup some of your trading costs.

For example, if you trade USD 300M during a calendar month, OANDA will give you CAD 10 for every USD 1M traded. That means a rebate of CAD 3,000 credited to your trading account.

OANDA will also subsidize some TradingView subscriptions for Elite Traders members. That can add up to over CAD 720 in savings in annual fees. Taken together, I think the rebates and subsidies make the Elite Trader Program an excellent choice for high-volume traders.

Summary of Elite Trader Program benefits:

- Reduced trading costs of up to 34%

- Dedicated account manager

- Free VPS

- Free wire transfers

- Monthly TradingView plans reimbursed

- Access to OANDA’s MT4 Pro Orderbook

Verdict on OANDA Canada Trading Spreads

OANDA Canada offers competitive spreads for major forex pairs. Its standard account, which features low fees and access to a straightforward trading platform, is suitable for new traders. The broker also allows very low trade sizes so traders can open positions for one unit. This could be useful if you want to test a trading strategy in a live environment.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

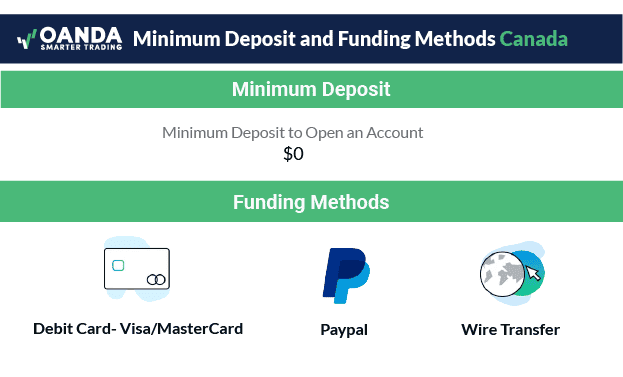

Minimum Deposits and Funding Methods

When reviewing a broker, making a deposit should be secure and seamless with low fees. OANDA matches this by providing three fee-free funding methods that can get you trading the markets fast. Below are the funding methods available:

Debit Cards Backed by MasterCard or Visa

You can easily fund your trading account using your MasterCard or Visa debit card. OANDA does not require a minimum deposit, and the funding process is immediate. You cannot make deposits with a credit card.

Bank Wire Transfer

Like the debit card funding method, bank transfer has no minimum or maximum deposit limit. However, it is slower than depositing via a debit card, which takes up to 5 business days.

PayPal

You can also use your personal PayPal account to fund your trading account by using the e-check method. This method can take up to 6 days.

Withdrawing from OANDA

Regarding withdrawals, like most regulated brokers, OANDA returns the funds to the source. If you funded your trading account with a wire transfer, OANDA deposits your funds into the same bank account.

How long does it take to Withdraw from OANDA?

Withdrawal times depend on how you funded your account.

- Debit card: One to three business days

- Wire transfer: same business day

- PayPal: One business day

Verdict on OANDA Canada Deposits and Funding Methods

OANDA offers different methods to deposit and fund your trading accounts. It’s good to see that they accept funding from traditional forms and PayPal, giving you a choice of how you wish to deposit. This gives you an option of secure and trusted funding methods for your OANDA account.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

Trading Platforms

What we liked about OANDA is that they provide you with access to multiple trading platforms. OANDA Trade is rich with indicators and charts and unique as you can trade partial lots. MetaTrader 4 brings automation and flexibility thank to Expert Advisors while TradingView should be your choice if you like technical analysis.

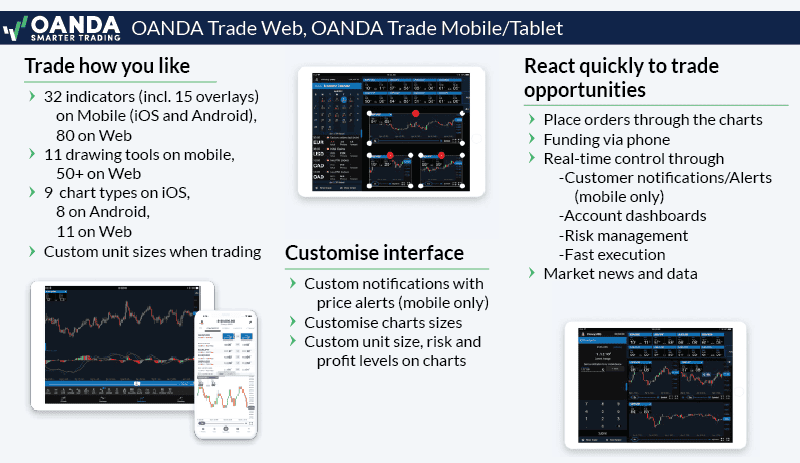

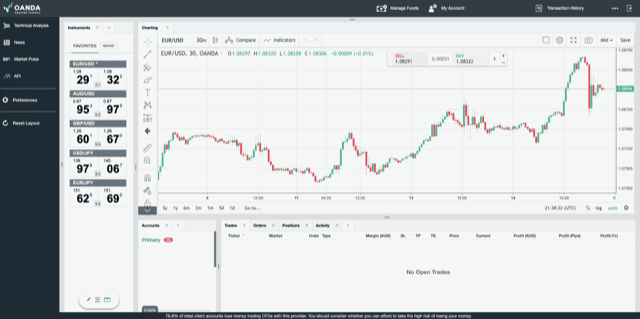

OANDA Trade Web Platform

This is OANDA’s award-winning proprietary trading platform that you can use on your mobile phone or desktop. You can access the full range of trading products directly from the charts. This platform compiles all of OANDA’s trading technology into one.

As part of this OANDA Review, I wanted to go through the OANDA Trade platform so we could understand what it has to offer. Upon loading the OANDA Trade platform, you can see the interface is designed to be as clean as possible to avoid distractions. This is a good design because some platforms are cluttered with notifications and news that can be distracting while trading.

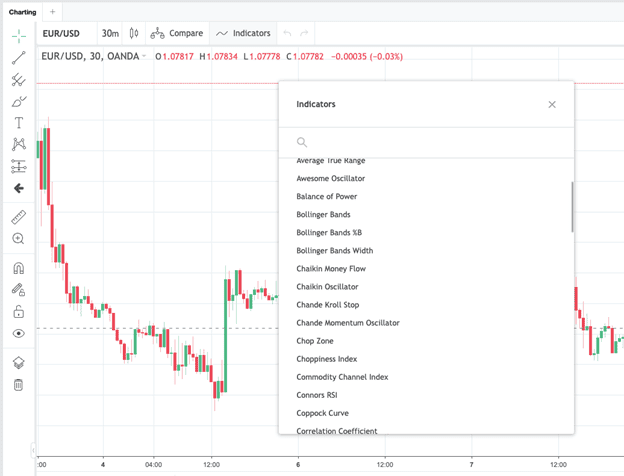

Another thing I instantly noticed was the charts. Suppose you are familiar with TradingView’s charts. In that case, you will be at home with the OANDA Trade platform because TradingView powers OANDA’s charts. This means you get access to the same drawing tools and 100+ indicators.

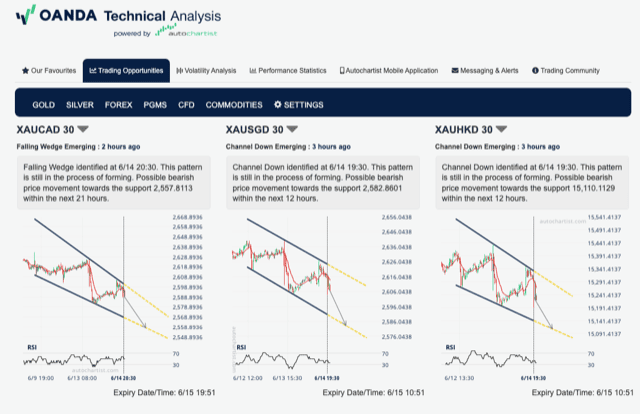

OANDA provides access to Autochartist for free if you have a live trading account. Autochartist analyses forex pairs automatically to identify technical chart patterns with a simple-to-follow breakdown.

These chart patterns cover various analysis types, from support and resistance level breakout alerts, to head and shoulder formations. Each alert comes with its own analysis and price levels you can look for before trading.

This can be an excellent tool for traders to find new trading opportunities. Or even use it as a confirmation bias tool alongside your own strategies.

Although Autochartist is a perfect option with OANDA, so is having access to a wide range of trading indicators.

The OANDA Trade platform comes pre-built with 100+ trading indicators that you don’t have access to on other broker’s platforms, or you would have to pay for with the MT4 platform.

You can find the common indicators like moving averages, Bollinger bands and the RSI tools – they come as standard. However, you can also find rare indicators, like the Hull moving average or the SuperTrend indicator.

Customisable Unit Sizes for Greater Trade Management

One unique feature that we liked should you be using the OANDA Trade platform or app is the ability to customise the size of your trade to precise amounts. While the usual trading practice is to trade using standard lots, mini-lots (0.1) and micro-lots (0.01), OANDA Trade gives you the flexibility to trade with sizes that are not round figures (i.e. 0.15). This is the first time we have seen a broker offer this, and we can see why a scalper would appreciate this feature, it is a useful option as it gives you more control over how much you risk.

To summarise, key features of OANDA Trade include the following:

- In-house trading platform developed by OANDA

- Technical analysis tools to help make better trading decisions

- Trade performance analytics

- Customise layouts

- Depth of market access

- Fast execution speeds

- Access to Autochartist

I think that most traders would use the OANDA Trade platform instead of TradingView or MT4 due to its customisable trade sizes, which allow for more accurate risk management and position sizing. Plus, you do not have to download the OANDA Trade platform for it to work on your desktop or mobile, unlike MT4, which requires you to download it to your desktop to work.

OANDA Mobile Platform

Most brokers have their trading platforms available to trade on mobile devices. The OANDA Trade mobile app offers the full range of CFD markets, advanced charts, and plenty of indicators to trade on the move.

We tried the OANDA Trade web app and noticed the interface needed to be more organised than the web version. When you first load up the app, it is quite chaotic. Fortunately, you can customise the layout and change the default setup.

However, when it comes to mobile trading, the main reason why traders download mobile apps is for notifications.

To receive notifications when your trades have been executed or closed is essential, especially when you are away from your trading station. Or a notification when a price alert has been triggered, indicating you to recheck the markets and review your analysis.

One thing I did notice while on the mobile app is that it has all the functionality of its web version should you wish to trade from the mobile app.

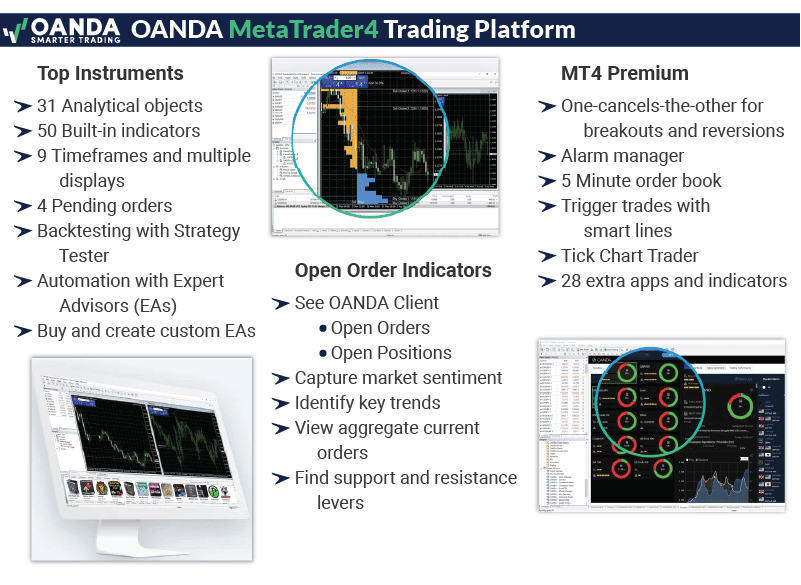

MetaTrader 4 (MT4)

Virtually every Best MT4 Brokers with their accounts and for a good reason. It’s reliable, customisable and secure. So you can easily set up the MT4 platform how you would like.

MetaTrader 4 offers the option to customise the MT4 platform with bespoke indicators and deploy Expert Advisors to automate your trades. OANDA Trade needs these features. In addition, the OANDA MT4 premium plugin enhances the MT4 terminal with features not even available on the OANDA Trade platform, such as the MT4 Open Order Indicator.

This tool shows aggregated buy and sell orders placed by OANDA’s traders, so you can clearly see where potential areas of support or resistance levels are through the orders on the screen.

OANDA has applied their proprietary plugin, which enhances the MT4 platform even further, giving you a more robust set of tools to trade from.

Two features we liked about the OANDA MT4 plugin:

- The intraday market scanning too. This allows you to find trading ideas that match your trading criteria automatically. Whenever a match is found, it alerts you that a potential trade matches your trading criteria.

- The automatic chart pattern recognition tool. This tool finds trading opportunities that match common chart patterns, like a bull flag or a wedge pattern. This can help traders locate potential trade setups easier while trading using the OANDA MT4 platform.

Other key features of MT4 include:

- Automated trading strategies through Expert Advisors

- OANDA’s proprietary MT4 plugin

- Access intraday market scanning

- Automatic chart pattern recognition

- Automated alerts

- MT4 Premium Upgrade

- Access One Cancels The Other (OCO) orders for breakouts or reversions

- Trigger actions with the alarm manager

- Tick-chart trading

- 28 new apps and indicators bespoke for MT4 Premium

- MT4 open order indicator

- See aggregate OANDA client open orders and open positions.

Unfortunately at this time, OANDA does not offer it more advanced MT5, only MT4.

To learn more about the differences between these trading platforms, read our full MetaTrader 4 vs MetaTrader 5 comparison.

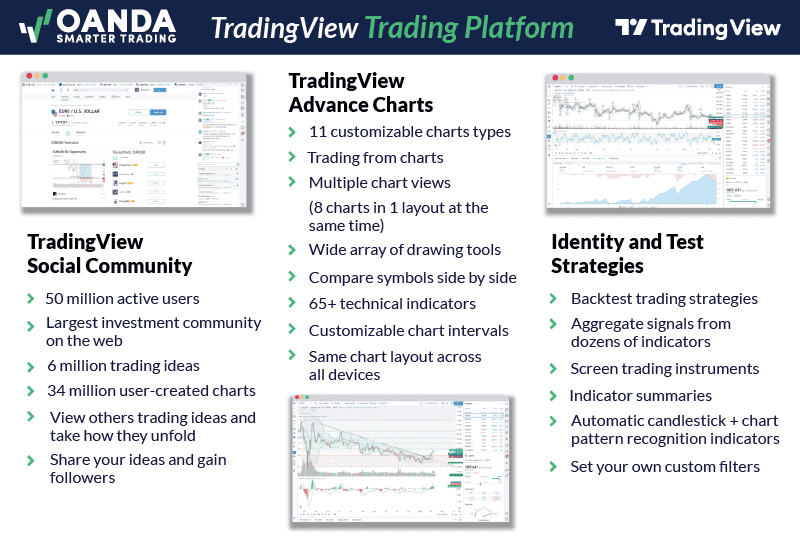

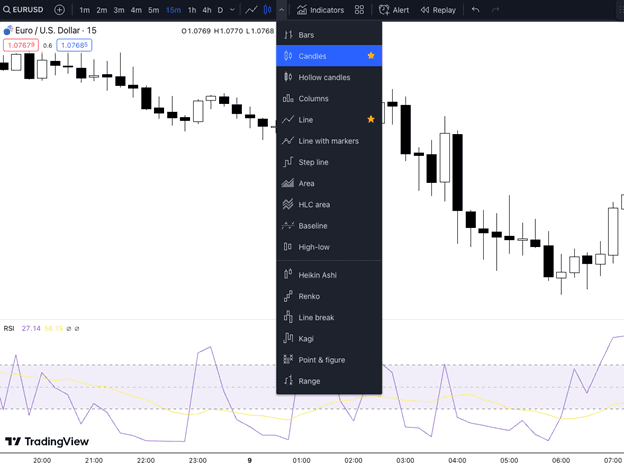

TradingView

TradingView offers a simplified trading platform with features you’d typically pay extra for. It is quickly becoming one of the largest trading platforms in the world, with over 50,000,000 traders. OANDA was one of the first brokers to offer TradingView and is the second most popular broker choice for this platform with 90,400 users.

By offering TradingView as a platform for OANDA Canada clients to trade, you can combine the excellent execution services from OANDA and the advanced trading tools TradingView provides for free.

TradingView comes with many features to improve the quality of life for a trader. We particularly like the overlay chart feature. This enables you to apply two or more assets on the same chart, which makes comparing them easy.

TradingView also offers more customisation to its powerful charting packages that you can take advantage of.

Most platforms offer the standard chart types like:

- Line

- OCHL Bars (Open Close High Low)

- Candlestick

This is great for most traders. However, some traders prefer different chart types and sometimes have to pay extra for the privilege.

TradingView gives you access to 17 chart types for free.

Some of the advanced chart types included are the Renko and Heikin Ashi charts. These are alternatives to the candlestick pattern that traders like to use because the Renko is based on price movements and not time, like the candlestick pattern.

If you are a renko trader, using TradingView through OANDA Canada could be a great partnership.

The key features are the following:

- Highly interactive, responsive & mobile friendly charts that work with all devices

- 100+ pre-built trading indicators included

- 17 types from a line chart to Renko

- 50+ drawing tools

- Trade on the charts

- Backtest your trading strategies on the charts

- Find trading ideas from real traders that share them within the TradingView community.

Verdict on OANDA Canada Trading Platforms

What we like is that OANDA offers multiple options for traders for free. Their proprietary OANDA Trade platform provides a user-friendly experience with a range of trading products and direct chart trading. It also integrates with Autochartist for free, which adds value by giving automatic analysis for potential trading opportunities.

Including TradingView and MT4 platforms enhances the trading experience with additional trading tools. It allows traders to choose the platform they want to use.

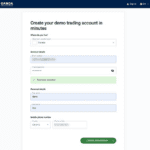

Demo Account

Best Forex Demo Accounts are the perfect resource for “trying” before you buy when opening new brokerage accounts.

We found that opening a demo account with OANDA is very easy. It took just a few clicks and some details to open the account. All we had to do was enter our phone and email details, which are common with most forex brokers.

The demo account is ready immediately, and they provide you with trading platforms you can use.

The trading platforms available for the demo account at the time were:

- OANDA Trade Web

- OANDA Desktop

- MT4

Each one has a convenient download link, which we liked so you can start immediately.

You can use the demo account to explore OANDA Trade’s features. However, we were unable to access the Autochartist software. This is understandable because it would allow traders to use the demo account instead of a live trading account for this feature.

With that said, the demo account offers its full range of products and trading tools for you to experience. So you can test their market orders, view their charting tools, and access the trading admin just like a live account.

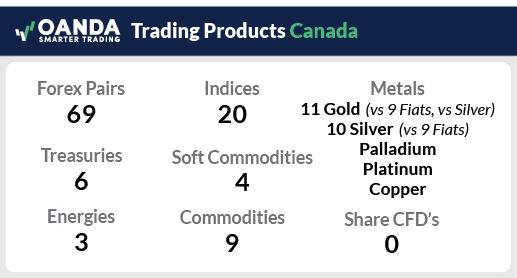

Products and Leverage

OANDA provides market access exclusively to forex and CFDs. They provide five different trading instruments. These are forex, bullion (metals), commodities, indices and bonds. While OANDA does not offer shares, its extensive selection of currency pairs enables them to customise its technology and research specifically for these products.

In addition to a comprehensive range of forex pairs to trade, OANDA (Canada) has an extensive metals market available. You can trade not only the standard metal crosses (gold/usd, silver/USD) but also Best Brokers for Gold CFD Trading with nine different currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, and SGD. This can open up the bullion market to more trading opportunities for OANDA (Canada) clients, which is perfect if you are a commodities trader.

Below is the list of trading instruments:

- 69 forex pairs

- 21 Bullion (Metals)

- 9 Commodities

- 20 Indices

- 6 Bonds

As far as leverage goes, all Forex trading accounts come with 50:1 Leverage. This is the maximum leverage allowed by the CIRO for retail traders. OANDA uses Margin Trading rather than leverage on its website.

Verdict on OANDA Canada Products and Leverage

OANDA’s strong focus on forex trading allows them to specialise and excel in this market. They offer 69 forex pairs covering every cross most traders would need. In addition, access to bullion, commodities, indices and bonds. They provide traders with various market options.

Leverage can be up to 50:1 for certain currency pairs (but is generally lower). You can reduce the leverage should you wish to limit your risk.

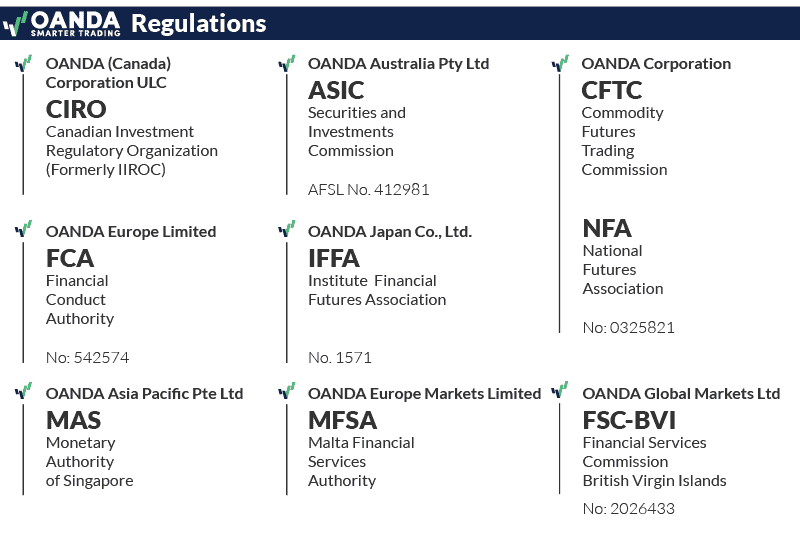

Broker Trust and Safety

1. Regulation

OANDA (Canada), a subsidiary of OANDA Corp. established in 1996, is regulated by six tier‑1 regulators, one tier‑2 regulator, and two tier‑3 regulators. It holds regulatory authority in the following countries: US, UK, Canada, Australia, Singapore, Malta (Europe) and The British Virgin Islands. With 9 different regulators we give the OANDA group as a whole, a trust score of 96 out of 100.

| OANDA Safety | Regulator |

|---|---|

| Tier-1 | CIRO (Canada) - Canadian Investment Regulatory Organization ASIC (Australia) - Australian Securities & Investment Commission CFTC (USA) - Commodities Future Trading Commission NFA (USA) - National Futures Association FCA (UK) - Financial Conduct Authority MAS (Singapore) - Monetary Authority of Singapore |

| Tier-2 | MFSA (Malta) - Malta Financial Services Authority |

| Tier-3 | FSC (British Virgin Islands) - BVI Financial Services Commission IFFA (Japan) - Institute of Financial Futures Association |

Being regulated by the appropriate Forex regulator that manages the jurisdiction of your country (or region) means you are better protected as the broker has to follow specific frameworks to ensure they can maintain their regulatory license.

OANDA Canada is regulated by The Canadian Investment Regulatory Organization (CIRO). This organization was previously known as The Investment Industry Regulatory Organization of Canada (IIROC). Of the 9 regulatory bodies the OANDA corporation is a member of, only this one is relevant for clients of OANDA Canada.

OANDA Canada accepts clients from all provinces and territories across Canada except Alberta. This is because local Alberta Securities Commission rules have rules that don’t make it worthwhile for most Forex brokers (including OANDA Canada) to accept clients from this region.

Other factors that contribute to high trust score include a rating of 4.52 out of 5 from over 14,400 reviews on the TradingView website. The TradingView website also awarded OANDA the title as Most Popular Broker 3 years in a row for 2020, 2021, and 2022.

Another notable factor we considered for trust is the age of the broker. OANDA has been around since 1996 and since 2006 in Canada.

2. Reputation

There are 550,000 monthly searches for OANDA each month on Google, making it the 7th most popular Forex Broker. Similarweb in August 2025 shows a similar story with the broker the 8th most visited, receiving 7,047,000 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 49,500 |

| Germany | 40,500 |

| India | 33,100 |

| United Kingdom | 27,100 |

| Spain | 22,200 |

| France | 22,200 |

| Switzerland | 22,200 |

| Italy | 18,100 |

| Japan | 14,800 |

| Canada | 12,100 |

| Philippines | 9,900 |

| South Africa | 9,900 |

| Colombia | 9,900 |

| Singapore | 9,900 |

| Portugal | 8,100 |

| United Arab Emirates | 6,600 |

| Brazil | 6,600 |

| Australia | 6,600 |

| Mexico | 6,600 |

| Malaysia | 6,600 |

| Netherlands | 6,600 |

| Nigeria | 5,400 |

| Thailand | 5,400 |

| Austria | 5,400 |

| Poland | 4,400 |

| Cyprus | 4,400 |

| Turkey | 4,400 |

| Kenya | 4,400 |

| Hong Kong | 4,400 |

| Argentina | 4,400 |

| Sweden | 4,400 |

| Indonesia | 3,600 |

| Pakistan | 2,900 |

| Greece | 2,900 |

| Ghana | 2,900 |

| Taiwan | 2,900 |

| Mauritius | 2,900 |

| Ireland | 2,900 |

| Saudi Arabia | 2,400 |

| Bangladesh | 2,400 |

| Peru | 2,400 |

| Vietnam | 2,400 |

| Egypt | 2,400 |

| Morocco | 1,900 |

| New Zealand | 1,600 |

| Jordan | 1,600 |

| Tanzania | 1,600 |

| Sri Lanka | 1,300 |

| Chile | 1,300 |

| Algeria | 1,300 |

| Dominican Republic | 1,300 |

| Uganda | 1,300 |

| Ecuador | 1,000 |

| Panama | 1,000 |

| Venezuela | 880 |

| Costa Rica | 880 |

| Ethiopia | 720 |

| Uruguay | 720 |

| Cambodia | 590 |

| Bolivia | 590 |

| Uzbekistan | 480 |

| Botswana | 390 |

| Mongolia | 70 |

|

|

49,500

1st

|

|

|

40,500

2nd

|

|

|

33,100

3rd

|

|

|

27,100

4th

|

|

|

22,200

5th

|

|

|

22,200

6th

|

|

|

22,200

7th

|

|

|

18,100

8th

|

|

|

14,800

9th

|

|

|

12,100

10th

|

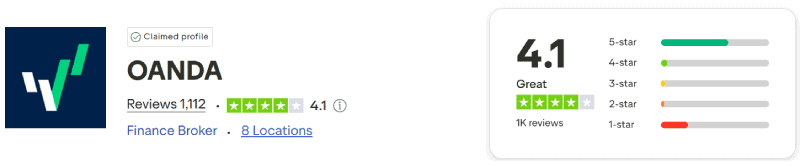

3. Reviews

As of 2026, OANDA has a TrustPilot score of 4.1 out of 5 stars, based on over 1,000 reviews. Many traders express that they are generally happy with their execution speeds, as well as the deposit and withdrawal processes.

Verdict on OANDA Canada Trust and Safety

With 25 years of industry experience, OANDA is an industry veteran with a stellar reputation worldwide. Regarding client accounts and money protection OANDA is one of the most regulated companies in the world.

This means that OANDA has to follow specific Canadian laws and regulations to maintain its license and hold client money. These strict laws and rules help ensure that OANDA offers a secure trading experience.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

Customer Service and Support

We think customer service and support should be a top priority for all brokers, regardless of size as this can lead to a more positive and less stressful trading experience. Fortunately, we found that OANDA Canada offers many trading tools to provide immediate support. Access to support is via the following channels:

- Self-help Portal (i.e. FAQ).

- Dedicated Account Managers for Account Holders

- Support channels – Email, Technical support via Phone, Live Chat/Bot

If using live chat via the brokers website, you will be greeted by a chat bot who will try to answer your questions. If the chat bot cannot assist, you will be able to chat with someone from the customer services team.

Verdict on OANDA Canada Customer Service and Support

Overall, OANDA has used their industry experience to provide the fastest support options available to its clients based on the severity of the support needed.

We found this resource was beneficial for new customers who had inquiries regarding an OANDA account setup and getting started because it provided immediate access to the most frequently asked questions, which saved them time and effort.

Education and Research

Education

Most forex brokers have educational articles and videos on their websites to help traders understand critical concepts of forex trading. This also helps introduce you to their platform.

With OANDA, the education on their website provides a solid foundation for beginners. Going over the fundamentals and how trading indicators work. This would be good for new traders to read through.

However, they do hold webinars and live events, which consist of webinars discussing different trading strategies.

One thing we found impressive is the option to participate in live market analysis with one of OANDA’s analysts. This over-the-shoulder experience provides an opportunity to learn about current investment trends and gain insight into what to look for in real-time. It’s a valuable tool for improving knowledge of the markets and identifying opportunities.

Research

OANDA also provides its traders with top research and analysis tools. They are easily accessible through their Trade platform. What we like about the research provided is that the newsflow and research are purely forex focused.

When trading forex, focusing on company-specific news is redundant. This means you can eliminate the need to pay attention to news related to specific companies, as it is not directly relevant to forex trading. This can save you time by finding the detailed analysis you want to read about.

Below is a quick overview of what they provide.

Live Market Analysis

- Hosted weekly

- Real-time analysis of the forex, indices, bonds and commodities markets

- Learn about current market trends and themes for free

MarketPulse

- Share forex media resources like news and videos.

- Shares market insights

- Economic calendar with impact analysis

- Weekly articles describing the week ahead based on the analyst’s opinion.

Autochartist Technical Analysis

- Free on the OANDA Trade platform

- Provides automatic technical analysis to highlight specific chart patterns

- Traders can use this to find potential trading ideas.

Verdict on OANDA Canada Education and Research

Even though OANDA provides education on their website, you will find the best education after opening an OANDA account. The webinars offered to their clients provide much more value and go into more detailed trading methods.

For example, recently, they held a webinar to teach how to do “Top-down” analysis which is helpful for a forex trader to learn. A live trading account includes all of this for free.

OANDA also offers a great set of market research tools that are freely available for all Canadian clients. That can add value to traders by helping them keep up with their platform’s latest economic and market-moving news.

How to Open an Account with OANDA

We went through the exerciser of opening an account with OANDA. We ratedAccount Opening with OANDA a 12/15 as the exercise was mostly seamless.

You can open an account with OANDA in two ways:

1. Via their website

2. Via their demo account

Both take you through the same process of completing a standard questionnaire. This is a common procedure when opening a trading account, as they must ensure that it suits you.

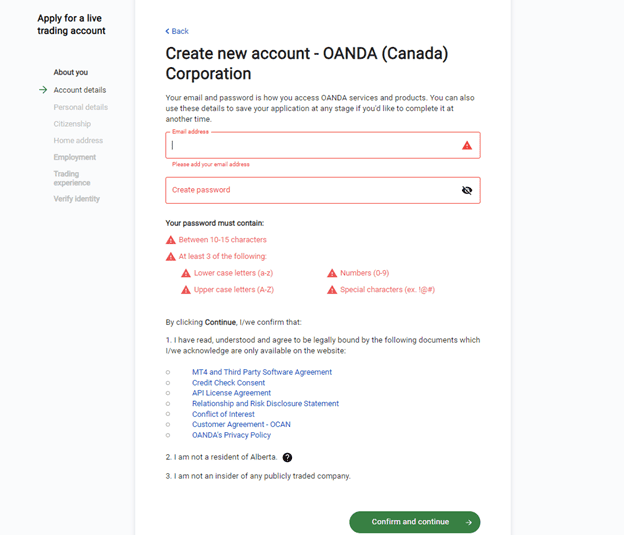

Steps to open a trading account with OANDA Canada.

Step 1: Click to sign up and provide an email address and password. You will use this to access your OANDA Canada account.

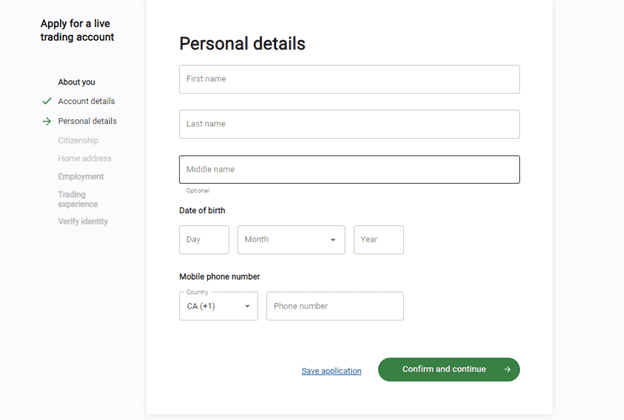

Step 2: Provide your personal details. OANDA requires this for Know Your Customer (KYC) checks.

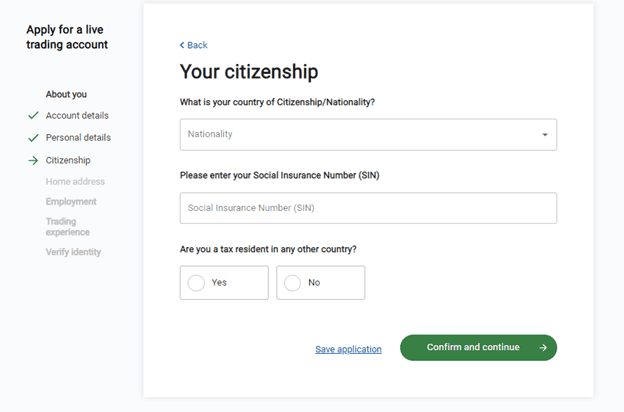

Step 3. Provide your citizenship details. OANDA Canada needs this as they can only accept Canadian residents and cannot accept residents from Alberta. Your information is safe and secure with OANDA as the financial regulator CIRO requires they have processes in place to achieve this.

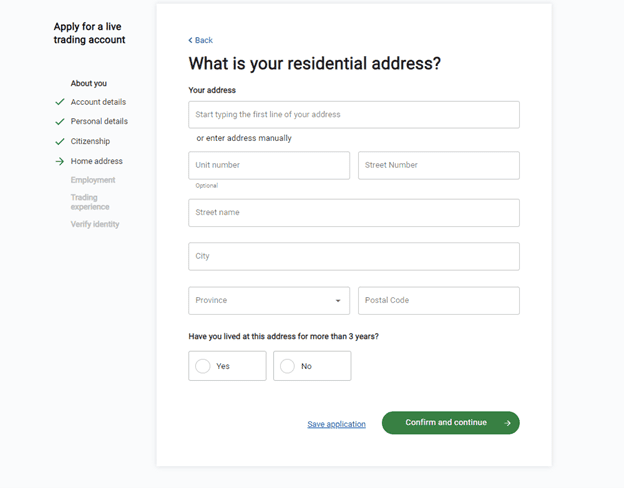

Step 4. Enter your residential details. OANDA will ask you for your previous address here if you have lived there for less than three years.

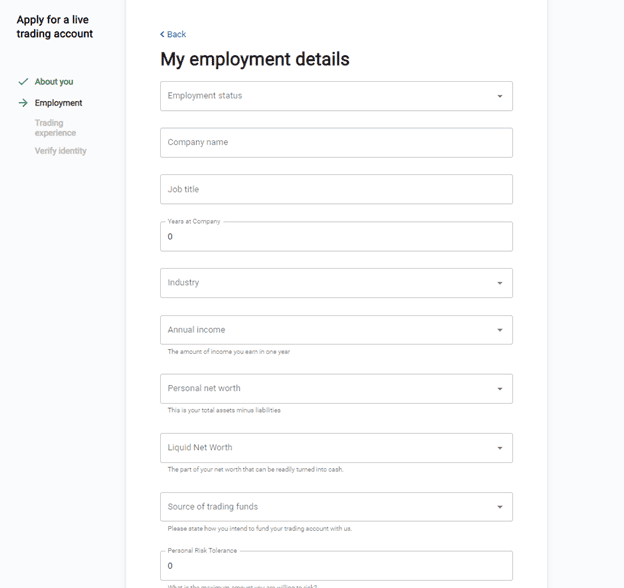

Step 5: Provide you employment details. This is to ensure that their trading account is suitable for your current circumstances.

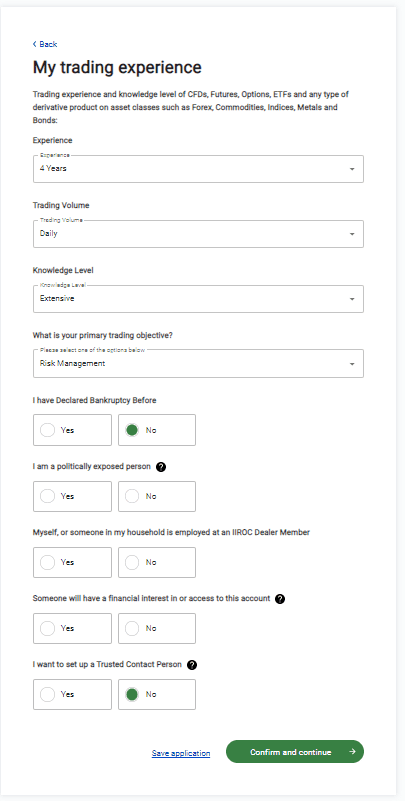

Step 6: Highlight your trading experience. OANDA is a responsible broker and needs to make sure you understand what trading entails.

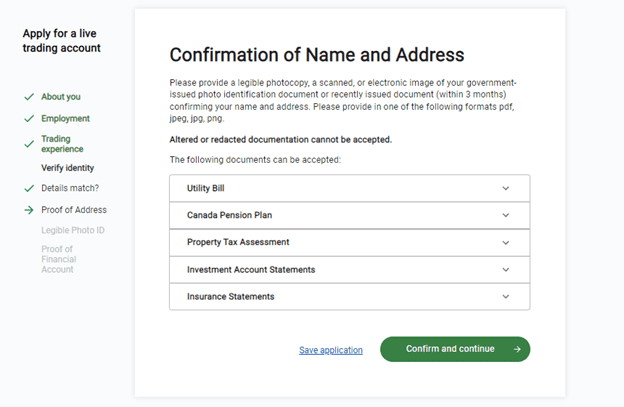

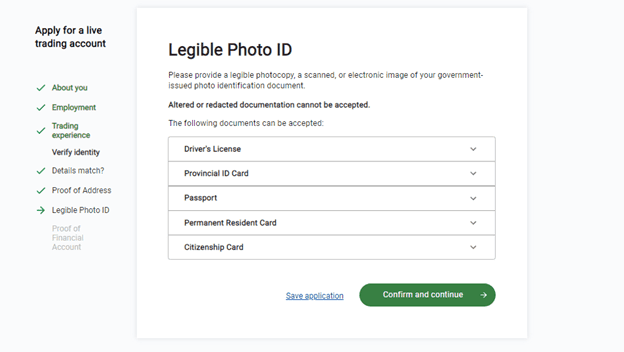

Step 7: Upload a scanned or electronic image via pdf, jpg or png with proof of address along with your name. A photocopy will also be accepted.

Step 8: upload a photo ID.

Step 9: The final part of opening an account with OANDA Canada is proof of financial account. This is simply a photo of your bank or credit card statement.

Account Verification Process

Once you have successfully submitted your application to OANDA, it can take 24-48 hours for your trading account to activate entirely.

During that time, an onboarding team member will be in touch by phone or email. They will either confirm the verification of your account or ask for more supporting documents needed to verify your account.

At this point your account will be activated and you can fund the account. You will also be assigned an account manager.

Verdict on OANDA Canada Account Opening Process

Opening trading accounts can seem tedious, but you must remember that OANDA Canada is regulated and must follow standard procedures to ensure they can offer you the best service possible.

With that said, OANDA’s account opening process is smooth and efficient. You follow the instructions, upload your documents, and you can open an within 24-48 hours.

Our Overall Verdict on OANDA Canada

OANDA provides a full Canadian brokerage service backed by its wealth of experience. The forex broker is highly regulated, which ensures trust and safety for its clients.

With low trade sizes and no minimum deposits, it is undoubtedly attractive for new traders, especially with the free demo account, market research, education, and advanced charting tools.

OANDA also offers a well-rounded service for experienced traders with low spreads and fast execution times for limit and market orders.

Therefore, based on this OANDA review, we recommend OANDA to Canadian traders looking for an established broker with the latest trading platforms and market research.

Affiliate receives a commission for accounts opened through the link on this page.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

Compare OANDA Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.