eToro vs OANDA 2025

We compared Forex brokers eToro with OANDA using essential trading factors like trading platforms, spreads, and minimum deposits. To test, we opened the trading accounts and used the platforms. Read on to see our findings.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 33:1

Minor Pairs 33:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors to help you decide between eToro and OANDA.

- eToro requires a minimum deposit of $200 in Australia and $50-$100 in the EU, while OANDA has no minimum deposit requirement.

- eToro offers 46+ cryptocurrency CFDs, significantly more than OANDA’s 4+.

- OANDA supports MetaTrader 4 and has a greater choice of trading platforms and risk management tools.

1. Lowest Spreads And Fees – Tie

When we look at the average standard account spreads for eToro and OANDA across various forex pairs, we see some interesting patterns. eToro has a consistent spread of 1 for EUR/USD and USD/JPY, but it increases to 2 for GBP/USD, EUR/JPY, and AUD/JPY. On the other hand, OANDA maintains a lower spread, with 0.92 for EUR/USD, and slightly higher for EUR/JPY at 1.5.

In my opinion, OANDA seems to offer more competitive spreads, especially for the major currency pairs like EUR/USD and GBP/USD. This could mean lower trading costs for you if these are the pairs you frequently trade. However, eToro’s consistent spreads across different pairs might be more appealing if you prefer predictability.

| Standard Account | eToro Spreads | OANDA Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.5 | 1.2 | 1.6 |

| EUR/USD | 1 | 0.92 | 1.2 |

| USD/JPY | 1 | 1.2 | 1.4 |

| GBP/USD | 2 | 0.9 | 1.6 |

| AUD/USD | 1 | 1.1 | 1.5 |

| USD/CAD | 1.5 | 1.5 | 1.8 |

| EUR/GBP | 1.5 | 1.16 | 1.5 |

| EUR/JPY | 2 | 1.5 | 1.9 |

| AUD/JPY | 2 | 1.3 | 2.1 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

Comparing these to the industry average, both eToro and OANDA have their strengths. While eToro’s spreads are generally higher, they are still within a reasonable range. OANDA, on the other hand, consistently beats the industry average, offering more cost-effective trading. As always, it’s crucial to consider these costs in the context of your specific trading strategy and volume.

To make trading fees easier to understand, we created a calculator. Select your currency, trade size, and pair to get the fee.

Our Lowest Spreads and Fees Verdict

eToro has its strong points, but look elsewhere if you’re a trader on a budget. In addition to an average spread of 1,5 pips, the administrative charges add up. From a $50 minimum deposit to a $5 withdrawal fee, some traders might feel nickel-and-dimed.

OANDA doesn’t require a minimum deposit, charges no withdrawal fee, and boasts a respectable average spread of 1.5 pips. According to Ross, our Head of Analytics, who tested the Standard Account Spreads of over 15 brokers, that translates into an average spread cost of USD 14.23.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

2. Better Trading Platforms – OANDA

Tempting though it might be to focus primarily – even exclusively – on trading costs when choosing a broker, we think new traders should pay close attention to available platforms and tools (more on those later). Why? Because tight spreads and low fees might save you a few pennies, but they won’t generate profits like the right charting tools.

| Trading Platform | eToro | OANDA |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | No |

| cTrader | No | No |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our Better Trading Platform Verdict

If you’re a casual trader looking for straightforward social and copy trading support, eToro will likely meet your needs. For anything more complex, including even basic technical analysis, you’ll want to look elsewhere.

In addition to its proprietary platform, fxTrade, OANDA supports MetaTrader 4, as well as the TradingView charting platform and social network. Numbers don’t lie. With more than double the points, OANDA takes the top spot in this category.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

3. Superior Accounts And Features – OANDA

While we wouldn’t hesitate to recommend both eToro and OANDA to beginner traders, that’s where the similarities end. Designed for casual traders or hobbyists, eToro just doesn’t have the same ‘power under the hood’ as OANDA – and higher trading costs, too.

| eToro | OANDA | |

|---|---|---|

| Market Maker | Yes. eToro acts as a market maker. | Yes. OANDA acts as a market maker. |

| Dealing Desk | No. | Yes. |

| Execution Type | ECN | ECN |

| Demo Account | Yes. The eToro demo account includes $100K of virtual funds and does not expire. | Yes. The OANDA demo account includes $100K of virtual funds and does not expire. |

| Standard Account | Yes. Standard account minimum variable spread: 1.0 pip. | Yes. Standard account minimum variable spread: 1.1 pip. |

| Commission Account | No. | Yes. USD 5 per round-turn trade of a standard lot. |

| Fixed-spread Account | Yes. | No. |

| Swap-free Account | Yes. | No. |

| # of Base Currencies | 1 USD | 5 USD, CAD, EUR, GBP, AUD |

| Maximum Leverage | 1:500 | 1:500 |

| FINAL SCORE | 26 | 46 |

| eToro | OANDA | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | Yes | No |

| Active Traders | No | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

eToro’s published minimum spread of 1.0 pip seems reasonable when compared with other brokers. Our tests told a different story, however. eToro’s average spread for a Standard account is 4.3 pips. Yep, a full 3.3 pips higher than the minimum. OANDA also came in a bit higher than the published minimum – 1.5 pips – but there’s really no competition between 3.3 and .4 pips, is there?

OANDA also scored high marks both for offering a low-spread, commission-based account and for the size of the commission. To trade a standard lot with OANDA will set you back USD 5. eToro, on the other hand, has no commission-free account option, which likely won’t appeal to more experienced traders.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

4. Best Trading Experience – OANDA

When opening an account, you want a smooth, seamless experience. Some brokers have more steps to set up an account than others, and some require you to make a deposit before you can use your account, even if it is a demo account.

| eToro | OANDA | |

|---|---|---|

| Application required? | Yes | Yes |

| Approval time? | 24 hours | 24-36 hours |

| Funding methods | Bank transfer Credit card Debit card PayPal E-wallet | Bank transfer Credit card Debit card |

| Customer Support | Web-based 21 languages No phone support Limited service hours | Live chat 25+ languages Phone and email support Worldwide: 24/5 |

| FINAL SCORE | 52 | 66 |

Our Best Trading Experience and Ease Verdict

While we appreciate that OANDA does its due diligence, the three-day wait to open an account and limited funding methods proved off-putting to some of our team. That said, the dedicated account manager and personalised customer support gave the broker a slight edge over eToro.

Read more about our founder Justin’s attempt at this Account Opening process with every major forex broker and learn which one tops his list for user experience. (20 and counting.)

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

5. Stronger Trust and Regulation – OANDA

OANDA Trust Score

eToro Trust Score

Trading via an online broker carries two types of risk. Putting your money in the market can lead to big wins if you predict movements correctly – but equally significant losses when you don’t. That’s normal and an inevitable possibility when trading CFDs, stocks, or forex.

Fortunately, you can virtually eliminate the other major risk by trading with a broker licensed by a Tier 1 regulator, such as the UK’s Financial Conduct Authority or the Commodities Futures Trading Commission and National Futures Association in the US. These government-run oversight agencies place strict requirements on brokers and other financial service providers designed to protect customer funds and prevent fraud.

| eToro | OANDA | |

|---|---|---|

| Tier 1 regulators* | ASIC (Australia) CYSEC (Cyprus) FCA (UK) | NFA/CFTC (USA) MAS (Singapore) CIRO (CANADA) FCA (UK) ASIC (Australia) |

| Tier 2 regulators | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) | JFSA (Japan) KNF (Poland) MFSA (Europe) |

| Tier 3 regulators | FSA-S (Seychelles) | FSC-BVI |

| Negative Balance Protection | Yes | Yes** |

| Trust Score | 63 | 84 |

* Australian Securities & Investment Commission (ASIC); Financial Markets Authority (FMA); Swiss Financial Market Supervisory Authority (FINMA); Financial Conduct Authority (FCA); Commodity Futures Trading Commission (CFTC); Comisión Nacional del Mercado de Valores (CMNV); Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Investment Industry Regulatory Organization of Canada (IIROC)

** Except US clients

Our Stronger Trust and Regulation Verdict

While we’d definitely rate eToro a safe and trustworthy broker, we’re impressed with the scope of OANDA’s regulatory coverage – virtually every major forex market.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

6. Most Popular Broker – eToro

eToro gets searched on Google more than OANDA. On average, eToro sees around 823,000 branded searches each month, while OANDA gets about 550,000 — that’s 33% fewer.

| Country | eToro | OANDA |

|---|---|---|

| United Kingdom | 135,000 | 33,100 |

| France | 110,000 | 22,200 |

| Italy | 110,000 | 18,100 |

| Germany | 74,000 | 40,500 |

| Spain | 60,500 | 22,200 |

| United States | 33,100 | 49,500 |

| Australia | 27,100 | 6,600 |

| Netherlands | 18,100 | 6,600 |

| Colombia | 14,800 | 9,900 |

| United Arab Emirates | 14,800 | 6,600 |

| Mexico | 12,100 | 6,600 |

| Switzerland | 12,100 | 22,200 |

| India | 9,900 | 33,100 |

| Malaysia | 9,900 | 6,600 |

| Poland | 9,900 | 3,600 |

| Peru | 9,900 | 2,400 |

| Taiwan | 8,100 | 2,900 |

| Philippines | 8,100 | 9,900 |

| Argentina | 8,100 | 4,400 |

| Portugal | 8,100 | 9,900 |

| Austria | 8,100 | 5,400 |

| Ireland | 8,100 | 2,900 |

| Greece | 6,600 | 2,400 |

| Brazil | 5,400 | 6,600 |

| Chile | 5,400 | 1,600 |

| Sweden | 4,400 | 4,400 |

| Canada | 3,600 | 12,100 |

| Morocco | 3,600 | 1,900 |

| Singapore | 3,600 | 9,900 |

| South Africa | 2,900 | 12,100 |

| Thailand | 2,900 | 4,400 |

| Indonesia | 2,900 | 2,900 |

| Pakistan | 2,900 | 2,400 |

| Vietnam | 2,900 | 2,400 |

| Nigeria | 2,900 | 6,600 |

| Ecuador | 2,900 | 1,000 |

| Turkey | 2,400 | 4,400 |

| Bolivia | 2,400 | 720 |

| Cyprus | 1,900 | 4,400 |

| Dominican Republic | 1,900 | 1,300 |

| New Zealand | 1,900 | 1,600 |

| Costa Rica | 1,900 | 1,000 |

| Japan | 1,600 | 12,100 |

| Hong Kong | 1,600 | 4,400 |

| Egypt | 1,600 | 2,900 |

| Venezuela | 1,300 | 880 |

| Saudi Arabia | 1,300 | 2,400 |

| Algeria | 1,300 | 1,600 |

| Kenya | 1,000 | 4,400 |

| Bangladesh | 1,000 | 2,400 |

| Jordan | 1,000 | 1,600 |

| Cambodia | 880 | 590 |

| Ghana | 480 | 2,900 |

| Sri Lanka | 390 | 1,300 |

| Panama | 390 | 1,000 |

| Uganda | 260 | 1,300 |

| Uzbekistan | 260 | 390 |

| Ethiopia | 260 | 880 |

| Mauritius | 260 | 2,400 |

| Tanzania | 210 | 1,600 |

| Botswana | 70 | 480 |

| Mongolia | 70 | 70 |

2024 Monthly Searches For Each Brand

eToro - UK

eToro - UK

|

135,000

1st

|

OANDA - UK

OANDA - UK

|

33,100

2nd

|

eToro - Italy

eToro - Italy

|

110,000

3rd

|

OANDA - Italy

OANDA - Italy

|

18,100

4th

|

eToro - Spain

eToro - Spain

|

60,500

5th

|

OANDA - Spain

OANDA - Spain

|

22,200

6th

|

eToro - US

eToro - US

|

33,100

7th

|

OANDA - US

OANDA - US

|

49,500

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 4,647,000 for OANDA.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

7. CFD Product Range And Financial Markets – eToro

Both OANDA and eToro offer customers a comprehensive selection of financial instruments and markets from which to choose, though each has its own particular niche. eToro tops our best forex brokers for cryptocurrency trading, while OANDA has more to offer when it comes to currency pairs.

| eToro | OANDA | |

|---|---|---|

| Forex trading | 49 currency pairs | 68 currency pairs |

| Cryptocurrency trading | 79 cryptos 14 crosses | 4 cryptos |

| Share CFD trading | Yes | No |

| Commodities CFD trading | 26 | 10 |

| ETF CFD trading | 300 | No |

| Indices CFD trading | 20 | 15 |

| Bonds/Treasuries CFD trading | No | 5 |

| Real Stocks | 17 | No |

| FINAL SCORE | 57 | 62 |

Our Top Product Range and CFD Markets Verdict

Both eToro and OANDA have something for everyone, but eToro consistently outperformed OANDA in terms of the breadth of markets available. Our crypto enthusiasts especially preferred the Israeli broker for its 79 pairs and 14 crosses, but our trading team also appreciated the extensive range of ETF CFDs available.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

8. Superior Educational Resources – OANDA

eToro:

- Offers a comprehensive educational section on their website.

- Provides webinars for real-time learning experiences.

- Features a demo account with $100K of virtual funds for practice.

- Includes articles and tutorials for beginners.

- Social trading feature allows learning from other traders.

- No advanced courses for professional traders.

OANDA:

- Also offers a detailed educational section.

- Provides a demo account with $100K of virtual funds.

- Includes articles, webinars, and video tutorials.

- Features advanced courses for professional traders.

- Offers MetaTrader 4 tutorials.

- Provides risk management tools and educational content.

Our Superior Educational Resources Verdict

Based on the available information, OANDA offers a more comprehensive set of educational resources, including advanced courses and MetaTrader 4 tutorials, making it the better choice for educational support.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

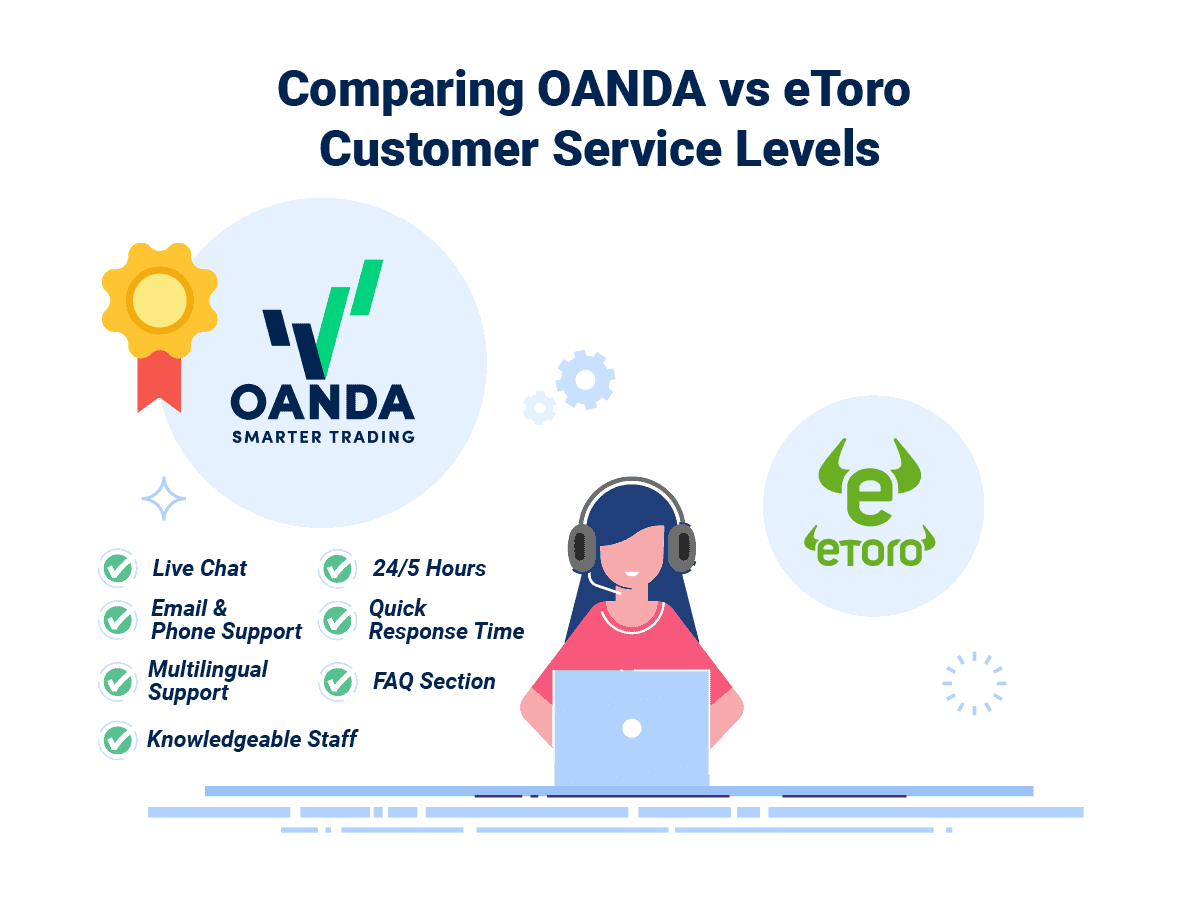

9. Better Customer Service – OANDA

OANDA:

OANDA also provides customer service through live chat, email, and phone. They offer 24/6 support, giving them a slight edge over eToro in terms of availability. OANDA’s customer service is known for its quick response time and knowledgeable staff.

eToro:

eToro offers customer service through multiple channels, including live chat, email, and a comprehensive FAQ section. The support team is available 24/5, which is particularly useful for traders who operate in different time zones.

| Feature | eToro | OANDA |

|---|---|---|

| Support Channels | Live Chat, Email, FAQ | Live Chat, Email, Phone |

| Availability | 24/5 | 24/6 |

| Response Time | Moderate | Quick |

| Knowledgeable Staff | Yes | Yes |

| Multilingual Support | Yes | Yes |

| Customer Reviews | Mixed | Generally Positive |

Our Superior Customer Service Verdict

Based on the available information, OANDA offers superior customer service with 24/6 availability and quicker response times, making it the better choice for customer support.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

10. More Funding Options – OANDA

eToro:

eToro offers a variety of funding options, including credit/debit cards, PayPal, Skrill, and wire transfers. The platform does not charge any deposit fees, but withdrawal fees apply. The minimum deposit requirement varies depending on the region, with $200 being the standard for most countries.

OANDA:

OANDA also provides multiple funding options, such as credit/debit cards, PayPal, and wire transfers. Unlike eToro, OANDA does not charge any fees for both deposits and withdrawals. The platform also has no minimum deposit requirement, making it more accessible for traders with smaller budgets.

| Funding Option | eToro | OANDA |

|---|---|---|

| Credit/Debit Card | ✓ | ✓ |

| PayPal | ✓ | ✓ |

| Skrill | ✓ | ✗ |

| Wire Transfer | ✓ | ✓ |

| No Deposit Fee | ✓ | ✓ |

| No Withdrawal Fee | ✗ | ✓ |

| Neteller | ✓ | ✗ |

| UnionPay | ✗ | ✓ |

| WebMoney | ✗ | ✓ |

| Bitcoin | ✗ | ✗ |

Our Better Funding Options Verdict

Based on the available information, OANDA offers better funding options with no fees for both deposits and withdrawals, as well as a wider range of payment methods.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

11. Lower Minimum Deposit – OANDA

When it comes to trading, the initial investment can be a significant factor for many traders, especially those who are new to the market. eToro and OANDA differ in this aspect, making it crucial to consider their minimum deposit requirements.

- eToro: Requires a minimum deposit of $50 for its Standard account.

- OANDA: Offers a $0 minimum deposit for both its Spread Only and Core Pricing accounts.

This difference can be a game-changer for traders who are cautious about investing a large sum upfront.

| Broker | Minimum Deposit | Recommended Deposit |

|---|---|---|

| eToro | $50 | $200 |

| OANDA | $0 | $25 |

| Trader is a redident in: | Minimum First Deposit (USD) |

| Australia, United Kingdom, Germany, Malaysia, Singapore, Thailand, Ireland, Spain, Sweden | $50 |

| France, Poland, Slovakia, Belgium, Czech Republic | $100 |

| Eligible countries outside of the list | $200 |

| New Zealand | $1,000 |

| Israel | $10,000 |

| Uniited States | $10 |

Our Lower Minimum Deposit Verdict

OANDA takes the lead in this category by offering a $0 minimum deposit for its accounts, making it more accessible for traders who are just starting out or those who prefer to trade with a smaller initial investment.

*Your capital is at risk ‘76.6% of retail CFD accounts lose money’

So is OANDA or eToro the Best Broker?

OANDA is the winner because it outperforms eToro in most of the key categories that matter to traders. The table below summarises the key information leading to this verdict.

| Criteria | eToro | OANDA |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ✅ |

| Better Trading Platform | ❌ | ✅ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ❌ | ✅ |

| Stronger Trust and Regulation | ❌ | ✅ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ❌ | ✅ |

| Lower Minimum Deposit | ❌ | ✅ |

OANDA: Best For Beginner Traders

For those just starting out in trading, OANDA offers a more comprehensive educational platform and lower minimum deposit requirements.

OANDA: Best For Experienced Traders

For seasoned traders, OANDA provides a more robust trading platform and a wider range of account features.

FAQs Comparing eToro Vs OANDA

Does OANDA or eToro Have Lower Costs?

OANDA generally offers lower costs compared to eToro. While eToro has a spread starting from 1 pip for EUR/USD, OANDA offers spreads as low as 0.6 pips for the same pair. For more details on which brokers offer the most competitive rates, you can consult this guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

OANDA is the superior choice for MetaTrader 4 users. eToro does not support MetaTrader 4, limiting its appeal to traders who prefer this platform. For a comprehensive list of top MetaTrader 4 brokers, you can refer to this comparison of the Best MT4 brokers.

Which Broker Offers Social Trading?

eToro is the leading broker for social and copy trading. OANDA does not offer these features, making eToro the preferred choice for traders interested in social trading. For more insights into the best platforms for social trading, you can explore this guide on the best copy trading platforms.

Does Either Broker Offer Spread Betting?

Neither eToro nor OANDA offer spread betting services. If you’re interested in spread betting, you’ll need to look elsewhere. For a list of brokers that do offer this service, you can check out this guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, OANDA is the superior choice for Australian Forex traders. Both OANDA and eToro are ASIC-regulated, but OANDA offers a more comprehensive trading platform and lower fees. If you’re an Australian trader looking for more options, you can explore this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe OANDA is the better option. Both brokers are FCA-regulated, but OANDA’s platform offers more features and lower costs. For more information on the best options available to UK traders, you can refer to this comprehensive guide on the Best Forex Brokers In UK.

Choosing the best forex broker for your trading style can feel like an overwhelming process, even for experienced traders. Our head-to-head broker comparisons are designed to help traders cut through the noise to identify the brokers with the best combination of trading tools, costs and fees. Whether you’re an experienced forex trader or a novice, our unbiased, data-driven assessments give you the information you need to choose the right online broker for you

Our team of expert traders put popular forex brokers OANDA and eToro to the test to help you make an informed decision about the better broker for your trading skills and strategy. We tested everything from trading experience to customer support to charting to commissions to bring you a comprehensive assessment of each broker. Keep reading for the results of our 2025 head-to-head matchup.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does OANDA charge a monthly fee?

No, OANDA does not charge a monthly maintenance fee for accounts. However, the broker does impose a monthly inactivity fee of up to $10 if there has been no trading activity in the account for 12 months.

Does OANDA allow day trading?

Yes, OANDA permits day trading.