What Are The Best CFD Gold Trading Brokers?

The best gold CFD trading brokers allow you to trade gold vs USD, EUR, AUD, and CAD. They also offer silver, oil and gas, trading via a good range of forex pairs and trading platforms like MetaTrader 4.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our list of the best trading platforms for gold in 2025 are:

- Eightcap - Best Gold CFD Broker Overall

- Pepperstone - Best Range of Gold Trading Platforms

- IC Markets - Great Broker For Algo Trading

- IG Group - Gold Broker With The Best Range of Metals

- CMC Markets - The Broker That Has A Good Range Of Markets

- AvaTrade - Best Gold Copy Trading Platforms

- eToro - The Broker That Has Good Social Trading

- Plus500 - Best Gold Broker For Beginners

- FP Markets - Good Broker For Gold Scalp Trading

- City Index - Good Trading Tools

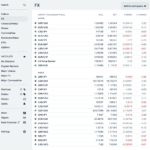

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

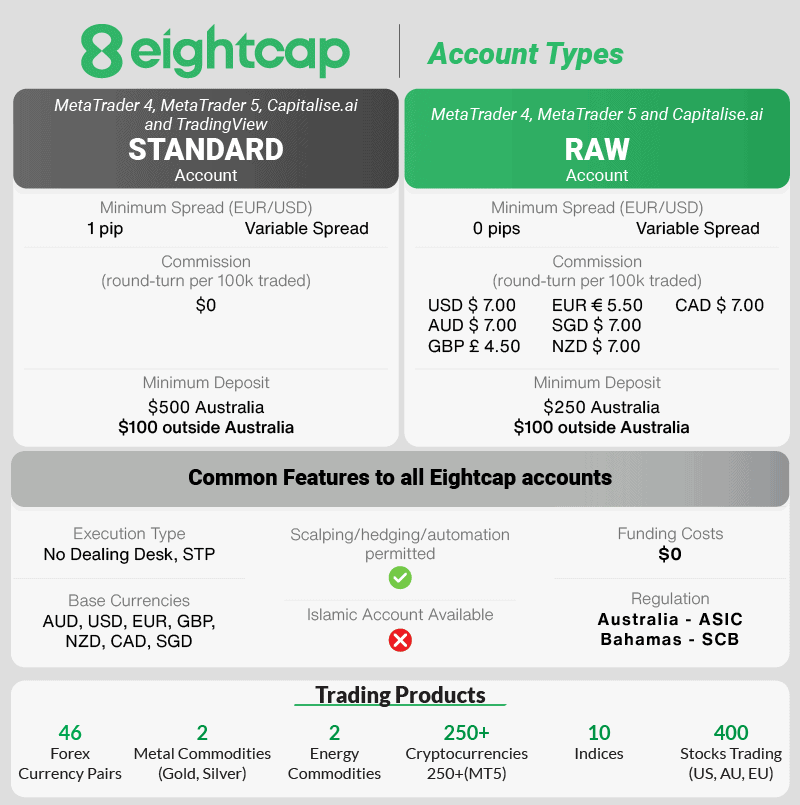

1. Eightcap - Best Gold CFD Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We think Eightcap is one of the best gold CFD brokers because it has tight gold spreads, a great range of accounts, and a good overall product range.

While they don’t have the widest commodity offering compared with other brokers, they combine a lot of other advantages including a solid range of products and platform integrations.

Pros & Cons

- Tight gold spreads

- Exceptional customer support and support materials

- Diverse range of platforms

- Islamic (swap-free) trading unavailable

- Must use MT5 for full product range

- No guaranteed stop loss orders

Broker Details

We found that Eightcap allows you to trade gold against multiple major currencies, such as EUR, JPY, and AUD, which are not typically offered. This allows you to exploit the volatility of different currency movements against gold, offering more ways to profit from the price direction of gold.

In our live fee tests, we found Eightcap’s gold spreads to be competitive, with gold averaging 0.12 USD – one of the lowest we’ve tested. These low spreads were also shared across multiple markets, including EUR/USD which averaged 0.06 pips.

These low spreads contributed to giving Eightcap an impressive 75/100 in our review, along with its decent choice of trading platforms, including MetaTrader 4, MetaTrader 5, and TradingView.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

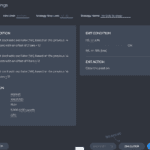

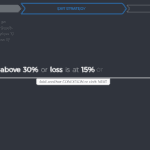

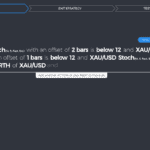

What sets Eightcap apart is its access to the Capitalise.ai feature, which offers code-free automation. This means you can easily program and automate your trading strategies without writing a single line of code. We found this to be true in our tests as we launched our first gold strategy within minutes of launching the platform, thanks to its interactive tutorial.

Our tests also led us to explore Eightcap Labs, a resource that provides a wealth of information on market trends, trading strategies, and comprehensive how-to guides. We like the “Latest Fundamentals” section, which teaches you how to trade the asset based on what is going on in the current markets, essentially providing a real-time market education.

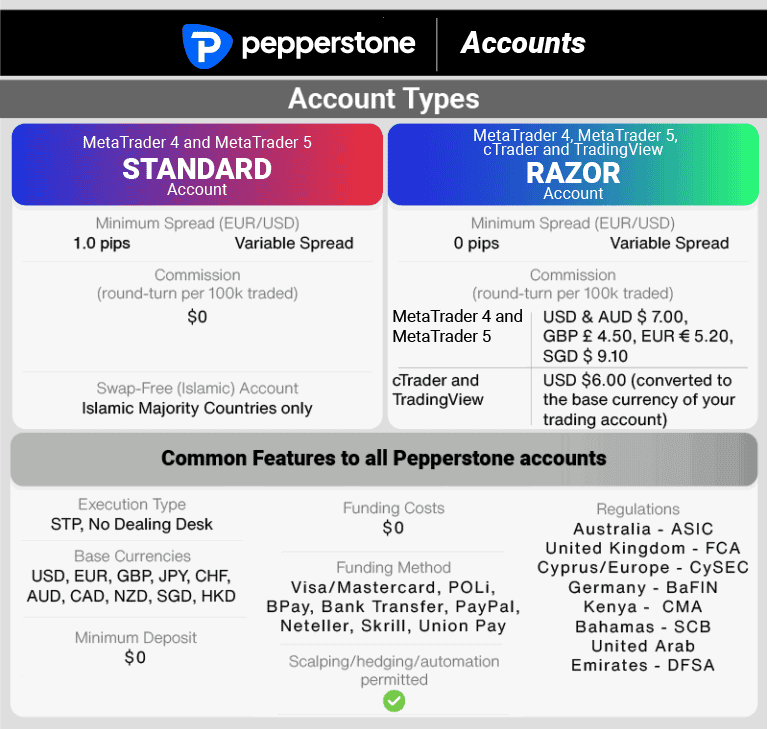

2. Pepperstone - Best Range of Gold Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

From our extensive research, it is clear that Pepperstone offers the best range of gold trading platforms. In addition to being integrated with MT4, MT5, cTrader, and TradingView, Pepperstone also offers a demo account and mobile app functionality.

While the MetaTrader platforms are very popular, cTrader is also great and suited for scalping, while Tradingview is excellent for chart trading.

Across all platforms, you will have access to top-tier liquidity, fast execution speed, and tight spreads for commodity CFD trading.

Risk management is an important consideration, so it’s good that Pepperstone is regulated by multiple tier-1 regulatory institutions, meaning they are undoubtedly a safe and reputable brokerage.

Pros & Cons

- Diverse range of platforms

- Excellent customer support

- Extensive funding options

- Great trading experience

- Limited range of educational materials

- Average spreads and commissions

- No proprietary trading platform

Broker Details

Out of all the brokers we’ve tested, Pepperstone offers the best selection of trading platforms, including TradingView, MetaTrader 4 (MT4), MT5, and cTrader. We like it when brokers offer a variety, allowing you to choose a platform that suits your trading style.

In particular, we like that you can access TradingView as it has the widest choice of trading indicators (110+), making it an ideal platform if you rely on technical analysis. As a bonus, we found that the chart syncs with all the devices you use with TradingView. This allows you to keep and analyse the markets with the same indicators, drawings, and support/resistance lines from desktop to mobile.

In our live trading tests, Pepperstone stood out with its competitive spreads. We found that its RAW account had an average spread of just 0.1 pips, and its Standard account had a spread of one pip (commission-free).

The spreads on gold are decent too, averaging 0.15 USD, putting it slightly higher than Eightcap, but it is still a low spread compared to the rest of the industry.

Through further testing by our analyst, Ross Collins, we discovered that Pepperstone offered zero-pip spreads on the majors 100% of the time with the RAW account. This is impressive as it means the only cost to you is a commission of $3.50, which we think is the ideal environment if you are a scalper. Only Pepperstone and City Index offered zero-pip spreads in our testing 100% of the time.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| City Index | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| Eightcap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| Admiral Markets | 100.00% | 99.5% | 79.13% | 95.22% | 100.00% | 100.00% |

We also found that Pepperstone doesn’t have a minimum deposit to open an account, which is excellent as you are not forced to deposit more than you want.

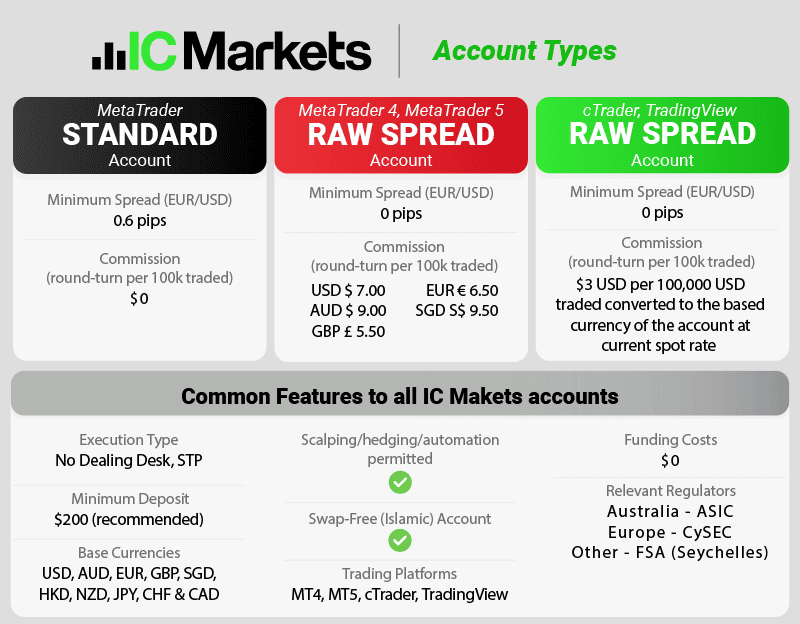

3. IC Markets - Great Broker For Algo Trading

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

From our research, IC Markets is a great broker for algo trading because they offer you very tight spreads, a Virtual Private Server (VPS), and are integrated with a variety of platforms like cAlgo and cTrader Copy.

Additionally, they’re also integrated with MT4, MT5, and you can also connect to Myfxbook and ZuluTrade, two of the more popular third-party social and copy trading platforms.

If you’re an algo trader, it gets even better as IC offers a Virtual Private Server (VPS) which enables rapid trade execution with average market order speeds executing at 168ms and limit orders at 233 ms.

Pros & Cons

- Very tight spreads

- VPS available for use

- Excellent range of markets

- Limited educational materials

- Average trade execution speeds

- Limited regulatory oversight

Broker Details

While exploring MetaTrader 5 on IC Markets, we were particularly impressed by its suite of tools tailored for algo trading. With over 38 readily available indicators, MT5 also allows you to develop and integrate your indicators through Expert Advisors (EAs). You can also choose to program your EA to automate your trades and manage your risk for you.

You can automate any market when using MetaTrader 4, which means you can take advantage of IC Market’s selection of precious metals, including gold, silver, palladium, and platinum.

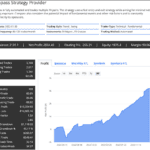

We especially appreciate the upgraded Strategy Tester in MT5, a significant improvement over its predecessor, MT4. In our tests, we used this tool to backtest and optimise our Expert Advisor, finding the process much faster and more efficient than on the MT4. This tool is excellent for refining your trading strategies using historical data before deploying it to your live trading account.

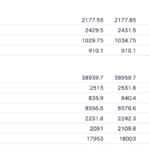

Our live RAW Account testing with IC Markets found low spreads, averaging 0.02 pips on EUR/USD, significantly lower than the industry average.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| City Index | 0.07 |

| FP Markets | 0.1 |

| Pepperstone | 0.1 |

| IG | 0.16 |

| CMC Markets | 0.5 |

| Industry Average | 0.22 |

Alternatively, if you prefer a commission-free option, IC Market’s Standard account presents an attractive alternative, with an average spread of 0.62 pips on EUR/USD – again, surpassing industry benchmarks.

IC Markets offers a complimentary VPS service for live account holders who meet a minimum monthly trading volume of 15 lots. This threshold is relatively low, particularly for traders looking to automate their strategies, ensuring uninterrupted operation and optimal execution speed.

4. IG Group - Gold Broker With The Best Range of Metals

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

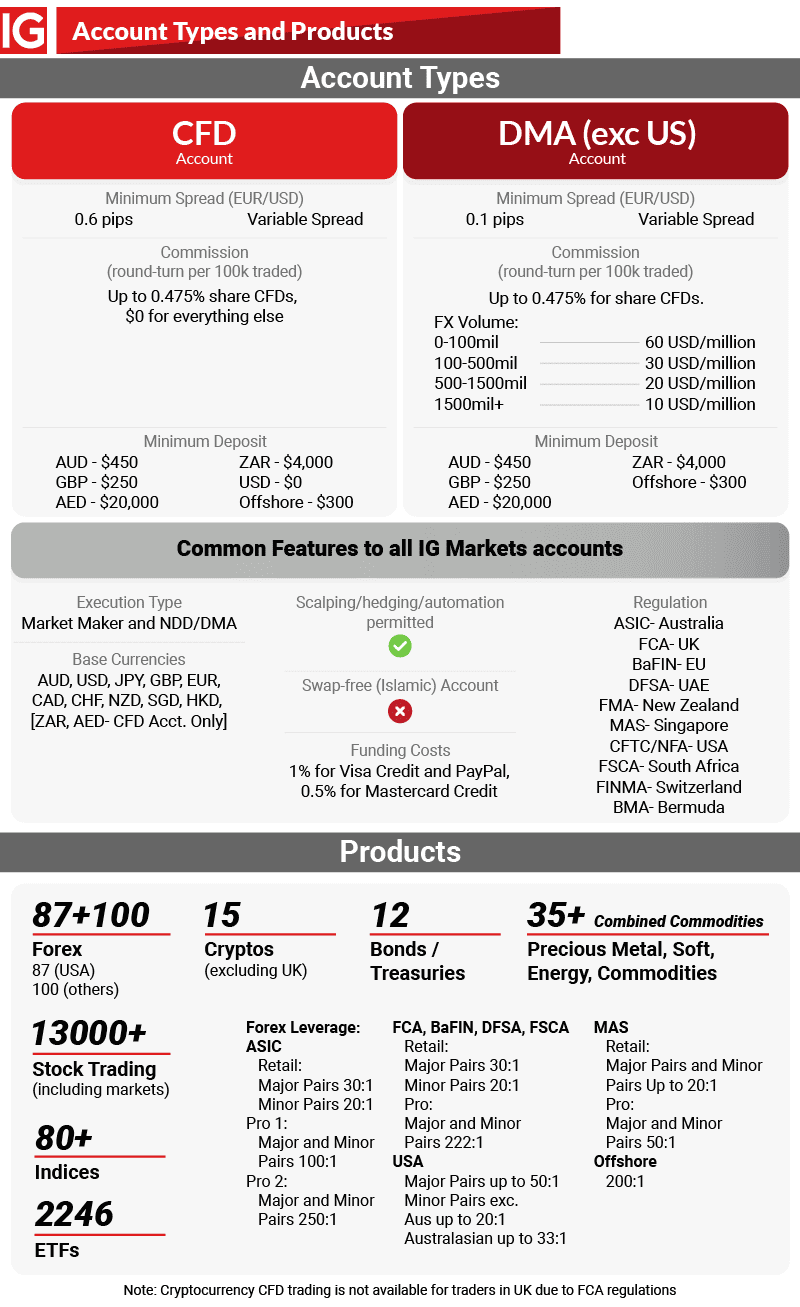

Why We Recommend IG Group

Without a doubt, IG Group has the most extensive range of markets available of any broker we’ve seen.

There are over 15,000 instruments available to trade including over 35 commodities markets which can be traded as CFDs (shares, spot prices, ETFs, futures, or options contracts) or shares (shares or ETFs).

Additionally, there are over 13,000 stocks (Australian, US, and European only), up to 100 Forex pairs outside the U.S., and 2246 ETFs available to trade, the most of any broker we’ve seen.

Pros & Cons

- Massive range of markets

- Great safety and regulation

- Excellent education materials

- Average customer service

- Limited platform integration

- Minimum deposit requirements

Broker Details

In our tests, IG’s trading platform emerged as a top choice for the best range of metal products. IG Group stood out with a solid range of 17,000 markets, including an impressive selection of 11 metal markets, more than the industry average.

| Broker | Precious Metal Markets |

|---|---|

| IG Group | 11 |

| AvaTrade | 8 |

| eToro | 7 |

| Eightcap | 6 |

| Pepperstone | 5 |

| CMC Markets | 5 |

| Plus500 | 5 |

| IC Markets | 4 |

| FP Markets | 4 |

| City Index | 4 |

You can also trade 80 forex pairs, 130 indices, 6,000+ ETFs, 12,000+ shares, and 14 fixed-income markets, which is ideal if you like to trade multiple markets.

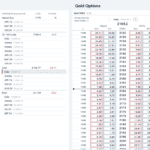

With IG Group’s extensive product range, they are one of the only brokers that allow you to trade gold as a CFD, through exchange-traded funds, futures, or options. This gives you multiple avenues of gaining exposure to the gold markets, especially with options which allow you to benefit from the volatility of gold.

The IG Trading Platform impressed us with its clean design, which is clutter-free from news widgets and watchlists. It ensures that everything you need is available on a single screen. We found it easy to navigate, as the search bar let us find the markets faster, which is needed with so many markets to trade from.

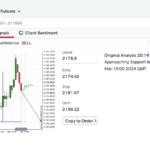

The IG Trading Platform, which has over 40 trading indicators and access to two trading signal services, can enhance your trading experience by providing you with frequent daily trading ideas. We think these signals, complete with chart analysis and comments, are particularly user-friendly, allowing you to copy order details and execute trades directly from the signal window.

Our tests also revealed that IG offers competitive spreads, averaging 0.3 points on gold and 1.13 pips on EUR/USD. These rates are lower than the industry average of 1.24 pips.

| Broker | EURUSD |

|---|---|

| IC Markets | 0.62 |

| Eightcap | 1 |

| City Index | 0.7 |

| eToro | 1 |

| FP Markets | 1.1 |

| CMC Markets | 1.12 |

| Pepperstone | 1.12 |

| IG | 1.13 |

| Plus500 | 1.7 |

| Industry Average | 1.24 |

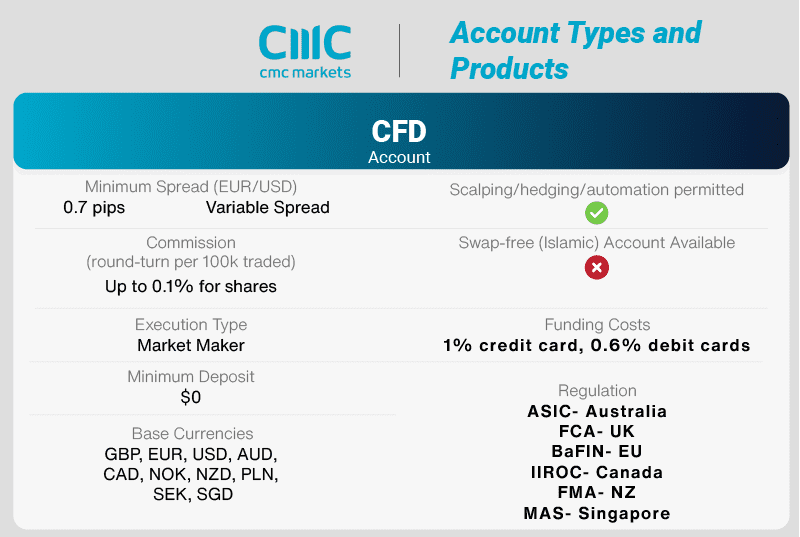

5. CMC Markets - The Broker That Has A Good Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets offers a whopping 12,000 tradable instruments, positioning them as one of the most competitive in the industry.

In addition to gold, you can trade 3 other precious metals (silver, palladium, platinum), copper and 5 energies (crude oil, brent, natural gas, gasoline, and heating oil).

Other standout features for CMC Markets include their high-calibre educational resources and the fact that they’re regulated by numerous tier-1 regulatory bodies.

While their spreads aren’t the best in the market, they have very attractively priced commissions, making them a great choice overall.

Pros & Cons

- Extensive range of markets

- Great educational materials

- Regulated by various tier-1 bodies

- Restrictive account funding options

- Limited platform integrations

- Average customer service

Broker Details

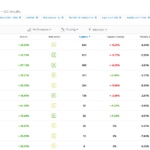

While exploring our CMC Markets account, we found that they had an extensive range of markets that competed with IG Group, offering over 13,000 financial products. These markets include 9,000+ stocks, 82+ indices, 15 commodities (with gold, silver, palladium, and platinum CFDs), and 338 currency pairs (the most we’ve seen a broker offer).

Although the broker offers MetaTrader 4, we tested their NGEN platform, the default platform you start with. It’s an impressive platform that challenges MetaTrader 4 and TradingView, offering 75+ indicators and tools like chart pattern recognition.

What sets this platform apart is its advanced chart pattern recognition tools. These tools are excellent if you rely on price action, as the software does all the heavy lifting by automatically identifying the patterns and giving you target prices for profit.

Our analyst, Ross Collins, conducted live trading tests on CMC Markets’ spreads using a Standard account to see how low their spreads are. His findings confirmed the competitive nature of CMC Markets, with spreads averaging 0.8 pips on EUR/USD.

This was the third-lowest spread in our testing, narrowly trailing behind IC Markets at 0.73 pips. Moreover, CMC Markets demonstrated strong performance across other major pairs, such as AUD/USD (0.77 pips), GBP/USD (1.08 pips), and USD/CHF (1.31 pips).

| BROKER | EUR/USD SPREAD |

|---|---|

| IC Markets | 0.73 |

| Admiral Markets | 0.74 |

| CMC Markets | 0.8 |

| FXCM | 0.93 |

| TMGM | 1 |

| FusionMarkets | 1.01 |

| OandA | 1.06 |

| City Index | 1.16 |

| EightCap | 1.16 |

| FP Markets | 1.19 |

| Pepperstone | 1.21 |

| Blackbull Markets | 1.34 |

| Go Markets | 1.34 |

| Axi | 1.45 |

| FXPro | 1.59 |

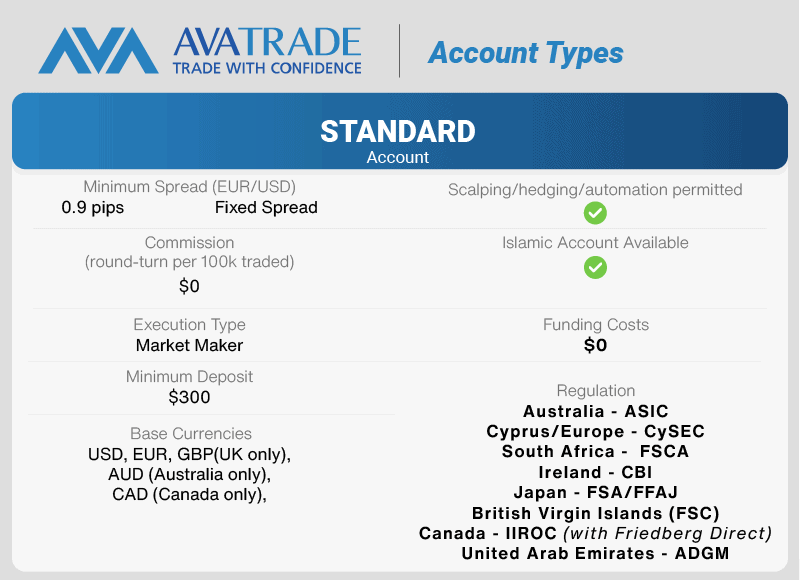

6. AvaTrade - Best Gold Copy Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

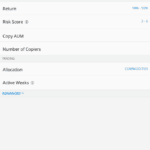

AvaTrade scored very well in our ‘trading platform’ category given it has two proprietary trading platforms (AvaTrade WebTrader and AvaOptions), the full MetaTrader suite, and copy trading platforms, ZuluTrade and DupliTrade.

With regard to markets, AvaTrade has a fairly extensive range beyond gold including other precious metals and 5 energy commodities.

In terms of spreads, we have found them to be competitively priced across the board, with gold starting at 0.29 pips, while all other commodities have similarly tight spreads.

Another key differentiator for AvaTrade is that gold can also be traded as an option in addition to a CFD.

Pros & Cons

- Great range of platforms

- Large range of markets

- Good regulatory oversight

- High commissions and spreads

- Limited educational materials

- Limited account options

Broker Details

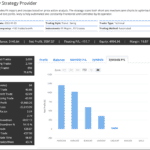

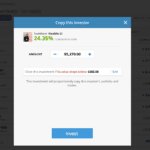

AvaTrade offered the most copy trading options for trading gold in our tests, featuring platforms like DupliTrade and ZuluTrade. DupliTrade caught our attention for its unique approach, allowing you to invest in trading strategies (such as the Compass we tested), like putting your money into a managed fund.

On the other hand, ZuluTrade offers a more traditional copy trading experience, where you can select individuals to mirror based on their trading performance.

Between the two, DupliTrade stood out for its ease of use, broader strategies and longer track records, making it a more appealing choice if you are new to copy trading.

We see AvaTrade as a standout choice for copy trading because of its fixed spreads. This pricing structure ensures consistent trading costs, eliminating widening spreads during volatile markets and price spikes.

We found AvaTrade’s fixed spreads competitive, starting from 0.9 pips on EUR/USD—a rate that rivals even variable spread brokers. We like this because it combines the predictability of fixed spreads with cost efficiency and will help reduce trading costs during volatile markets.

Our comparison with other fixed spread brokers revealed that AvaTrade leads the pack in terms of overall value. Below is a table showcasing how AvaTrade’s fixed spreads compare.

| Fixed Spread | |||||||

|---|---|---|---|---|---|---|---|

| Broker | EUR/USD | AUD/USD | EUR/GBP | EUR/JPY | GBP/USD | USD/JPY | USD/CAD |

| AvaTrade | 0.9 | 1.1 | 1.5 | 1.8 | 1.5 | 1 | 2 |

| easyMarkets (Web/App) | 0.8 | 1.5 | 2 | 2.2 | 1.4 | 1.5 | 2.3 |

| IronFX (standard) | 1.8 | 2.2 | 1.8 | 2.2 | 1.7 | 1.8 | 1.8 |

| HYCM | 1.5 | 1.8 | 2 | 2 | 2 | 1.8 | 2 |

| InstaForex | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| ForexCT | 4 | 4 | 3 | 5 | 5 | 4 | 5 |

| FxPro | 1.96 | 2.34 | 2.19 | 2.1 | 2.14 | 1.82 | 2 |

| IFC Markets | 1.8 | 2 | 1.8 | 2.5 | 3 | 1.8 | 3 |

| FIBO Group | 2 | 3 | 2 | 3 | 3 | 3 | 4 |

| Average Spread | 1.8 | 2.2 | 2 | 2.2 | 2.14 | 1.8 | 2.3 |

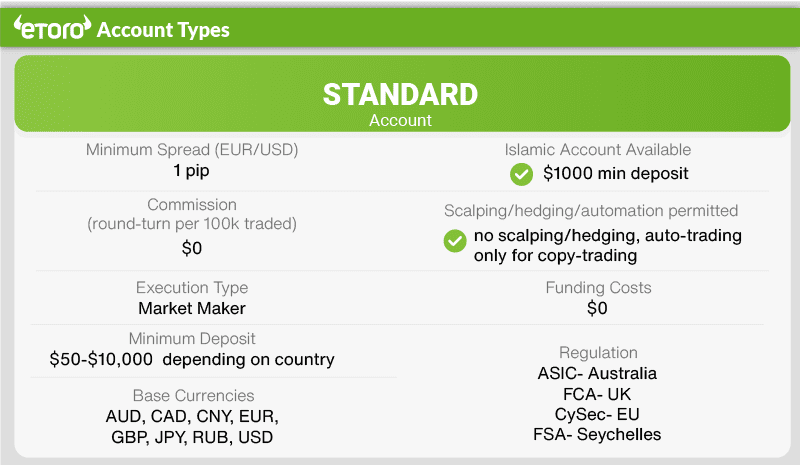

7. eToro - The Broker That Has Good Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

eToro boasts a seamless and intuitive interface which resembles a social media feed. The platform is very easy to navigate and enables you to easily replicate the trades of successful traders, fostering a collaborative and community-driven approach to investing.

The broker also boasts a solid range of financial instruments and you can trade gold either via ETFs if you’re based in the U.S. or as CFDs anywhere else in the world.

eToro also offers a range of useful analytics and trading tools which collectively positions them as the premier choice for those seeking a comprehensive and engaging copy trading experience.

Pros & Cons

- Great social trading

- Decent range of markets

- Numerous funding options

- Trading costs are high

- Trading platform is limited

- Average customer support

Broker Details

eToro’s social trading platform has a large community of over 20,000,000 traders, allowing you to interact with other traders like Facebook or Twitter. We think it fosters an environment where you can share insights, ask questions, and follow the trades of your peers.

We particularly like this level of engagement, as it allows all traders, beginners and experienced, to interact with one another and share tips, which could speed up the learning curve.

The standout feature for us, however, was eToro’s CopyTrader platform. This innovative tool enables you to mirror the trades of other investors automatically. With the ability to filter and choose from 2,000,000 traders based on criteria that align with your trading goals, the CopyTrader platform offers customisation and choice. You can even find traders who focus only on a specific market, such as commodities, so that you can copy trades and profit from gold’s market movements.

This is especially valuable if you do not have extensive market analysis as you can leverage another trader’s and follow their strategy in real-time (while potentially profiting from it).

In our tests trading on eToro, we opened a standard account which featured commission-free spreads. We were pleased that eToro offers competitive spreads, averaging one pip on EUR/USD, positioning them below the industry average while making CopyTrading affordable.

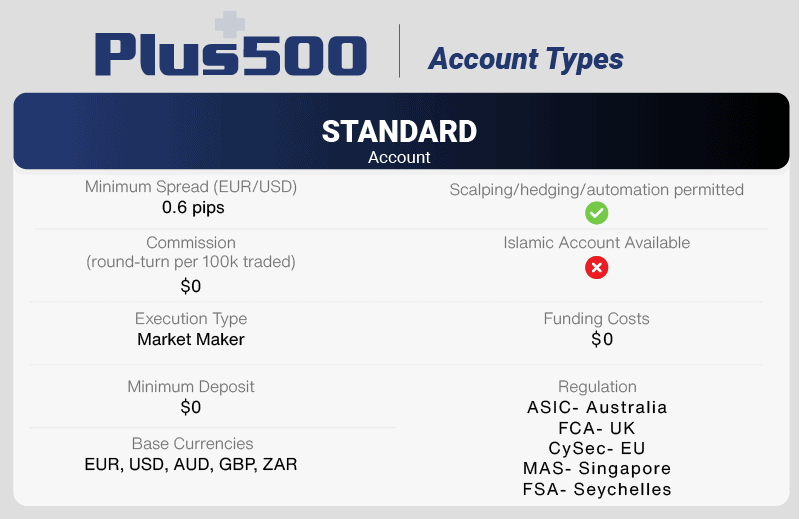

8. Plus500 - Best Gold Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

From our extensive analysis, we think Plus500 is highly suited for novice traders due to its exceptionally user-friendly trading interface.

Additionally, the broker’s regulatory standing in three tier-1 jurisdictions and four tier-2 jurisdictions enhances its reputation for safety, providing a secure environment, especially if you’re a new trader.

Regarding markets, Plus500 has an enticing range with over 22 commodities available including all the major precious metals, other metals, soft commodities, and energy instruments.

Spreads are a little wider for gold than other brokers but there are still plenty of commodity trading options with reasonably tight spreads

Pros & Cons

- Simplistic interface

- Good range of markets

- Great regulatory oversight

- Limited platform functionality

- Average educational materials

- Inactivity fees charged

Broker Details

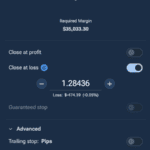

In our tests, we found that Plus500 had decent risk management tools, particularly the guaranteed stop-loss orders, which we think adds extra protection if you are a beginner. Such features are invaluable for managing your trading risks, ensuring you’re not exposed beyond your comfort level – especially when trading gold which can be volatile at a moment’s notice.

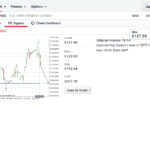

Despite the lack of platform options, which we usually consider a drawback, their proprietary platform surprised us while executing our trades. The platform has 100+ technical indicators, 13 chart patterns, and extra tools like +insights to help you identify market trends.

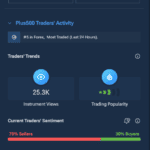

One standout feature is the +insights tool, which aggregates Plus500 client market orders to reveal trends, such as the current buying or selling hotspots. We think this tool is excellent, especially if you are a beginner, offering a real-time market sentiment you can use to judge if the market is currently long or short. As you can see in the image below, you can view the sentiment of gold which shows the percentage of Plus500 currently buying and selling the asset.

Furthermore, we found that Plus500 gives you access to a decent selection of trading products, including 5 precious metals like gold, 71 forex pairs, 30 indices, and 1,100+ stocks.

9. FP Markets - Good Broker For Gold Scalp Trading

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

There are several reasons why we like FP Markets, including their commitment to providing unparalleled customer service, a great range of funding options, and their stellar educational resources.

They have a 24/7 customer support line operated by a responsive and knowledgeable team which is further supported with live chat functionality, operated by real people.

Additionally, FP Markets offers a great range of account funding options including Visa, Mastercard, Volt, Skrill, PayPal and more.

We also like their educational resources which include webinars, podcasts, eBooks, and glossaries.

Pros & Cons

- Exceptional customer service

- Great educational resources

- Diverse range of funding options

- Average spreads and commissions

- Mediocre trading experience

- Limited regulatory oversight

Broker Details

We opened an RAW account with FP Markets and downloaded the MetaTrader 4 platform to test the broker’s spreads and execution speed. We feel that RAW spreads and MT4’s features (e.g.) one-click trading) are the best combination for scalping gold, as the broker offers an average spread of 0.06 USD. This is one of the lowest spreads we’ve tested for gold, allowing you to improve your profit margins when scalping gold.

While using MetaTrader 4, we found 30+ indicators and nine timeframes, including tick charts and one-minute charts, which are ideal for scalping. We found the range of indicators was low, but you can use the MetaQuotes Marketplace to find new and custom-made indicators or program them yourself.

We like that MT4 has a one-click trading feature. This feature allows you to execute your trades at the click of a button, allowing you to get in and out of trades faster than the order ticket feature.

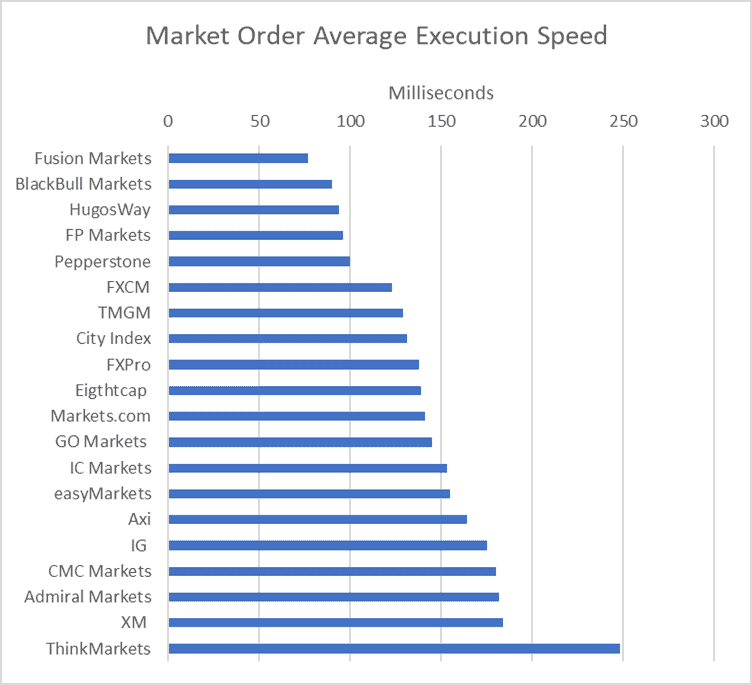

To further test FP Markets’ suitability for scalping, our analyst Ross Collins tested the broker’s execution speeds. Impressively, our tests revealed that FP Markets had an average market execution speed of 96 ms, ranking it the fourth fastest among the brokers we tested. This rapid execution speed is vital for scalpers, ensuring that trades are executed at the desired prices without significant slippage.

10. City Index - Good Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

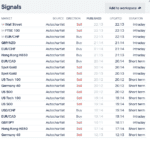

From our analysis, we think City Index is a great forex broker that offers a substantial range of markets, great customer service and support channels, and a decent trading platform.

The City Index trading platform (for web and mobile) comes with useful features like guaranteed stop loss, a trading coach with ‘Performance analytics’ and Smart Signals to help identify when to enter and exit markets.

Pros & Cons

- Great range of markets

- Regulated by various entities

- Comprehensive customer support

- Uncompetitive spreads

- Limited funding options

- High minimum deposits ($150)

Broker Details

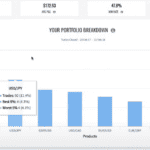

During our testing of City Index, their SMART Signals and Performance Analytics tools stood out, offering unique benefits to live account holders. Both of these tools work across City Index’s range of markets, covering 84 currency pairs, 20 indices, 30+ commodities (including gold and silver), and 4,500+ stocks.

We tested the Performance Analytics tool, which acted like a real-time performance coach, providing detailed statistics about your trading history to pinpoint strengths and weaknesses.

It also offers actionable tips to optimise your trading strategy and risk management. We found this tool beneficial because it encourages a data-driven approach to trade improvement tailored specifically to your trading patterns.

These advanced tools are exclusive to City Index’s Web Trader platform, which integrates TradingView’s advanced charting technology. This collaboration means you can access 80+ indicators and more than 40 drawing tools on a platform popular for its charting software, perfect for those who rely heavily on technical analysis.

Besides Web Trader, City Index provides direct access to TradingView and MetaTrader 4, giving you a choice of platforms, something we like to see from a broker.

To gauge City Index’s cost competitiveness, we had our analyst Ross Collins examine its spreads. Our tests revealed that City Index offers exceptionally low RAW spreads, averaging just 0.22 pips on EUR/USD.

Furthermore, GBP/USD and USD/CAD spreads were even lower, at 0.17 pips and 0.16 pips, respectively.

| EURUSD | Average Spread | GBPUSD | Average Spread | USDCAD | Average Spread |

|---|---|---|---|---|---|

| TMGM | 0.15 | CityIndex | 0.17 | CityIndex | 0.16 |

| Tickmill | 0.15 | Fusion Markets | 0.21 | Fusion Markets | 0.23 |

| Fusion Markets | 0.16 | IC Markets | 0.27 | TMGM | 0.43 |

| IC Markets | 0.19 | FP Markets | 0.31 | IC Markets | 0.45 |

| Pepperstone | 0.19 | TMGM | 0.35 | Go Markets | 0.47 |

| FP Markets | 0.2 | Pepperstone | 0.41 | Blueberry Markets | 0.5 |

| EightCap | 0.2 | EightCap | 0.44 | Tickmill | 0.5 |

| Admiral Markets | 0.21 | Blueberry Markets | 0.44 | FP Markets | 0.51 |

| CityIndex | 0.22 | Go Markets | 0.59 | ThinkMarkets | 0.56 |

| ThinkMarkets | 0.22 | Tickmill | 0.59 | Pepperstone | 0.61 |

| Blueberry Markets | 0.27 | ThinkMarkets | 0.62 | EightCap | 0.64 |

| Go Markets | 0.38 | Admiral Markets | 0.73 | Axi | 0.74 |

| Axi | 0.43 | CMC Markets | 0.9 | CMC Markets | 0.75 |

| CMC Markets | 0.44 | Axi | 0.95 | Blackbull Markets | 1.01 |

| Blackbull Markets | 0.46 | Blackbull Markets | 0.96 | Admiral Markets | 1.46 |

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’