Introduction to Online Forex Trading

The foreign exchange market is the most popular market in the world. Forex has the largest daily volume, averaging $7.5 trillion per day, 10 times more than the US stock market. While you may think this is all from retail and institutional trading, the bulk of it is from commercial transactions between businesses.

What I find makes online forex trading appealing is that it is tradable 24-hours a day. You can trade before, during, and even after work so there are always opportunities with trading forex. With Malaysia’s timezone ahead of Europe and US trading sessions, I find the best times to trade are in the evening.

Understanding How Forex Trading Works

Forex trading works by purchasing one currency like the EUR while selling another like the USD to profit from the change in exchange rate. Currency pairs are standardised to make it easier to trade, which is why you see two currencies like EUR/USD when trading.

The whole point of trading forex is to make a profit based on the price moving up or down. To do this you need to predict the market direction, which is easier said than done. Fortunately, there are plenty of different strategies to help you.

Profiting with forex isn’t easy due to all the factors that influence the market, like central banks policies and macroeconomic data. Every day you’ll see new announcements that move the markets, which is also what makes trading forex exciting.

As an example, the Malaysian Ringgit is influenced by the Bank Negara Malaysia’s (BNM) monetary policy. Additionally, like all currencies, it is also impacted by global supply and demand of commodities like crude and palm oil, making it an interesting currency to monitor.

Price of a currency pair is based on pips (percentage in points), and is the smallest value that moves. Pips can be identified as the fourth decimal of each currency price quoted. In the case of MYR/USD priced at 0.2356, the last digit (6) is the pip value.

Struggling to work out your profit? This calculator built by our team does the hard work for you. Enter your trade details below and it will show the profit (or loss).

Your Profit

Profit in pips:

Profit in Pips Calculation

= ( Close Price - Open Price ) / 0.0001 x Trade size

= ( - ) / 0.0001 x Profit in Pips Calculation

= ( Open Price - Close Price ) / 0.0001 x Trade size in lot

= ( - ) / 0.0001 x

Profit/Loss Calculation:

Profit/Loss in Calculation

= Profit in Pips x Pip value

=

Getting Started with Forex Trading For Beginners

Compared to 10 years ago, I don’t think there has ever been an easier time to learn as a beginner. Access to online video courses is abundant, while brokers have cheaper trading costs.

If I had to start again, these are the steps I’d take to start trading forex as a beginner:

Learn to Trade Forex

Honestly, from what I’ve seen on the Internet, you can now get high quality online lessons for free. Websites like BabyPips give you the basics by breaking down the core concepts in a beginner-friendly way.

Develop a Trading Strategy

The exciting part of trading is developing a strategy that consistently makes you money. There are plenty of ways to find trading strategies to suit your trading style and risk, which can be found on YouTube for free.

When you find one, develop your trading strategies by testing them with the best platforms for beginners in Malaysia.

Set Up with A Forex Broker

Everyone needs a live trading account even when you are just starting. Taking the first step from demo to live account is an exciting time, so make sure your strategy has a solid win rate.

The best forex brokers have tight spreads to lower trading costs and fast execution speeds to minimise slippage. You can see our comparison of the lowest spread brokers here.

Start Trading With Small Capital

Most brokers let you get started with $50-$100, which is enough to open several micro-lot trades. With leverage up to 1:500, you can open micro-lots with just $2 margin, letting you start small and scale as you get more experienced.

Choosing a Broker

To trade forex you must have a broker who acts as the intermediary between you and the financial markets. This means the broker executes your trades on your behalf, leveraging the broker’s network and liquidity providers for low cost trading.

Not only do brokers provide market access, they supply live price feeds, and trading platforms so you can analyse and manage your trades. Some brokers offer advanced trading tools and trading signals to help you find trading opportunities daily.

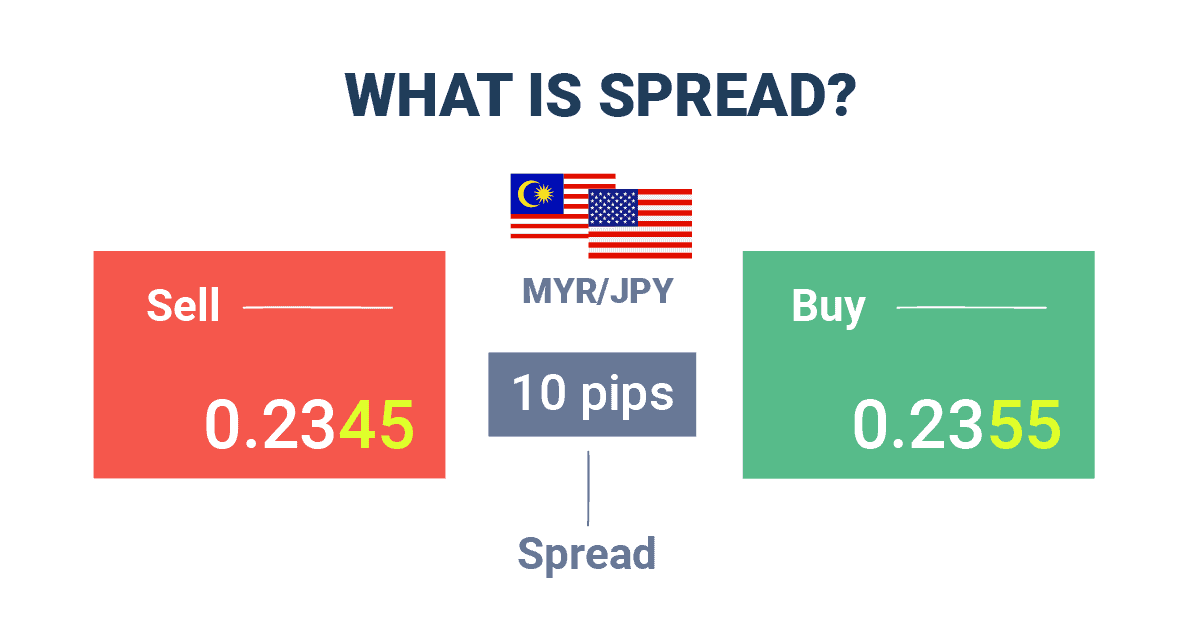

To access all of the broker’s services you pay a spread when you open a trade. The spread is the difference between the buy and sell price, and can be as low as zero to as high as 50 pips for exotic currency pairs.

You won’t have to work out the spread on trading platforms as they are displayed clearly, but it’s good to learn. To illustrate my point, if MYR/USD has a buy price 0.2355 and sell price 0.2345, this shows a difference of 10 pips. Therefore, the cost to open this trade is 10 pips.

What to look for in a forex broker

I find the best forex brokers in Malaysia have excellent trading conditions with low spreads, and a variety of trading platforms. Check out my list of “must-have” features when picking a broker:

Make sure the broker is regulated

Look out if the broker is regulated and accepts Malaysian traders. A solid trust signal for me is if the broker has multiple regulators. Especially from Tier-1 authorities like Australian Securities and Investments Commission (ASIC) or the Financial Conduct Authority (FCA).

Charges low trading fees

Improve your profits by choosing a broker with low spreads. Ideally, you want a broker that delivers spreads from 1 pip or lower.

Provides fast execution speeds

Having quick trading conditions gets you better pricing and less chance of negative slippage. Use a broker with Electronic Communications Network (ECN) or Straight-Through Processing (STP) execution models.

These brokers have the best order speeds as your trades are passed directly to the liquidity provider, lowering execution speeds.

Variety of trading platforms

Get a broker that supplies the trading platform you want to use. Luckily, MetaTrader platforms and TradingView are available with a majority of brokers

Sign up Requirements of A Forex Broker

Signing up with a broker is simple. You need to complete an online application form by filling in your personal and financial details, including your trading experience.

Once the account is set up, the next step is to submit your verification documents such as photo ID and proof of address. After approval, you’ll be able to deposit funds and start trading.

Regulation

There is a regulator in Malaysia called the Securities Commission of Malaysia (SCAM) and oversees the derivative and securities markets. However, SCM does not provide licences to forex brokers directly. That said, they let you sign up to international brokers to trade online.

One of the great features of international brokers is that they are normally regulated across several jurisdictions. Some of the top jurisdictions include the UK’s Financial Conduct Authority and Australian Securities and Investments Commission.

When I find a broker licensed by these authorities, I consider them trustworthy. Getting authorised by the FCA or ASIC is no easy task, so the standards of the firm will be high.

While there are scam brokers out there, they can easily be avoided by choosing a regulated broker. Here are the most common offshore regulators that accept Malaysian traders:

- Seychelles Financial Services Authority (SFSA)

- Monetary Authority of Singapore (MAS)

- Securities Commission of the Bahamas (SCB)

- Vanuatu Financial Services Commission (VFSC)

That said, here are some of the protections that financial authorities implement to promote security and transparency:

- Segregating client funds from its operational accounts.

- Set a minimum capital requirement for the broker to have, ensuring they stay solvent during difficult times.

- Offer negative balance protections, preventing your account from going below zero during volatile periods.

Depending on the regulator, Malaysian traders can access up to 1:1000 leverage. On average though, you’ll find that most brokers offer 1:500, which is still high.

Trading Platforms

Brokers supply a range of trading platforms that consists of MT4, MT5, cTrader, and TradingView. Proprietary platforms are also available, but I don’t really recommend them as they lack the features offered by the above platforms.

| Feature | MetaTrader 4 | MetaTrader 5 | TradingView | cTrader |

|---|---|---|---|---|

| Markets Supported | Forex, Indices, Commodities, Crypto | Forex, Indices, Commodities, Crypto, Stocks, Futures | Forex, Indices, Commodities, Crypto, Stocks, Futures | Forex, Indices, Commodities, Crypto, Stocks, Futures |

| Timeframes | 9 | 21 | Unlimited custom + standard | 26 |

| Indicators | ~30 built-in, custom MQL4 | ~38 built-in, custom MQL5 | 110+ built-in + custom (Pine Script) | ~70 built-in, custom (C#) |

| Automated Trading | Yes | Yes | Limited | Yes |

| Depth of Markets | No | Yes | Yes | Yes |

| Social Trading Features | Yes, through third-party tools | Yes, through third-party tools | Yes, natively | Yes, natively |

MetaTrader 4

The most popular trading platform in Malaysia is MetaTrader 4, which is why MT4 brokers are the top choice in the region. I like how MT4 makes it simple to trade forex as the interface places its charts front and centre, making technical analysis always within eyeshot.

MetaTrader 4 is also packed with advanced features like custom indicators to create bespoke trading strategies. Alternatively, MT4’s Expert Advisors (EAs) can be set up to automate your trades.

One advantage of MT4 being a desktop application is there are no restrictions on how many indicators on your charts. This lets you build out unique strategies like using multiple moving averages to help determine early trend changes.

MetaTrader 5

MetaTrader 5 introduces additional features where MT4 lacks. With MT5, you can now trade share CFDs and ETFs (Exchange Traded Funds), making it a true multi-asset platform.

Part of the upgrade includes more tools for technical analysis including 21 timeframes and 38+ indicators.

MetaTrader 5 offers the same base resources as MT4, such as automated trading, while improving its technical analysis features with more tools. A built-in economic calendar is included, displaying upcoming news events on your charts. I like to use this calendar to find times when a spike in volatility may appear, allowing me to try and scalp the markets.

TradingView

TradingView is my personal favourite. The platform has a modern interface and is easiest to use in my opinion. It also gives you access to the best technical analysis tools and market scanners to automate finding trade ideas.

You can develop virtually any trading strategy with the 110+ built-in indicators, or create custom ones through Pine Script. However, TradingView doesn’t currently support automated trading, which is why MT4 and MT5 are still popular options

Social trading tools are available natively on TradingView. You can engage with over 50 million traders through live chat rooms and social media feeds by posting your chart set ups. I’m a fan of this feature for beginners as you can get feedback on your technical analysis before live trading.

cTrader

cTrader has the looks and feel of the MT5 and TradingView platforms. The modern layout and charting experience is similar to TradingView’s, with MT5’s automated trading and customisation features. cTrader also offers a native copy trading platform, something not available on the other platforms.

One of cTrader’s top features is its Depth of Market tool. This shows you the pricing volume available at different price levels, helping you detect hidden support/resistance levels.

Trading Platform Types

- Desktop Platforms: Runs on your desktop or laptop, and have the most features like automated trading. The main desktop platforms are MetaTrader 4, MT5, and cTrader.

- Web Platforms: These are the platform types I prefer to use. Web-based platforms can be used by any device with no downloading or installing required, as long as there is an internet connection. TradingView is an example of a web platform and still offers the best technical analysis experience in my view.

- Mobile Trading App Platforms: These are platforms developed specifically for the mobile device, making it easier to use through tapping instead of clicking. All platforms have a trading app, which can be downloaded to iOS and Android devices.

You can see detailed platform comparisons with our in-depth trading platform guide for Malaysian traders.

Our team at CompareForexBrokers has created a Trading Platform tool that uses our industry experience to pair you with a platform. It takes less than 60 seconds to complete the questions and receive your results, try it out below:

Market Access

Part of using a broker is to get access to the markets without paying for price feeds. Most traders in Malaysia trade forex, but you can also trade assets like crypto, commodities, indices, and share CFDs.

Forex

Currency trading is the most popular asset and available on all forex brokers. You’ll find most offer 70+ forex pairs, which includes major, minor, and exotic pairs.

Currency pairs with the lowest spreads are listed as majors like EUR/USD with spreads from 0.80 pips. Exotic pairs are the most expensive, which is why most brokers don’t list them and can be as high as 50 pips.

Share CFDs

Some brokers offer share CFDs on major stocks like Tesla and Apple. From experience you can expect to find between 100 to 600 companies across multiple stock exchanges, from the US to Hong Kong. With share CFDs you can profit from the share price rising (or falling), making them a solid asset to trade during company Earnings Seasons.

Commodities

Trading commodities is also a popular asset with forex brokers. You can trade precious metals (like gold and silver), energies (like oil), and soft commodities like wheat. Most brokers don’t offer an extensive list of commodities, but gold and WTI oil are popular markets for scalping.

Indices

Indices offer a way to get exposure to a country’s stock market without buying single stocks. There are options for each major country that houses a stock market, like the UK’s FTSE 100 and the US’ S&P 500.

Cryptocurrencies

Trading CFDs on crypto lets you use leverage to trade markets like Bitcoin and Ethereum without buying the underlying asset. With crypto, you can trade 24/7 allowing you to trade on weekends.

All of these markets are available through international CFD brokers. Compare your options in our best CFD brokers in Malaysia guide.

Trading Account Types

Brokers offer multiple trading account types. These are designed to let you tailor the way to pay for the broker’s services. Whether you want to pay spread-only, or tighter spreads with commission – both accounts offer similar experiences.

Below, I’ll go through the differences for Malaysian traders:

1. Raw Accounts

For the tightest spreads available with a broker, raw accounts are your best bet. They have tight spreads from 0 pips because it’s sourced directly from the broker’s liquidity provider. As there is no broker markup on spreads, brokers charge a small commission per trade.

For example, if the broker charges $3.50 per lot, you pay $3.50 at entry and $3.50 on exiting. So, your total cost per lot is $7.00 plus the spread paid, which is around 0 – 0.2 pips.

Brokers that offer raw accounts I find have better execution speeds as they use ECN or STP execution models. Orders executed this way bypass the broker’s trading desk and are filled directly by the liquidity providers, receiving best available pricing.

Raw account types are used by experienced traders as the execution speeds help lower slippage. These accounts are also slightly cheaper than the Standard account type. High volume traders in particular will notice the lower trading fees due to the amount of trades placed.

At CompareForexBrokers, our team captures the average pricing (spreads) of each broker as a key criteria when determining the best forex broker in Malaysia.

Below is our table showing how competitive spreads are for Malaysian traders:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

2. Standard Accounts

For a commission free trading experience, Standard accounts are available with all forex brokers. The spreads are wider because brokers add a markup that includes the brokers fees automatically – saving you from paying a commission.

In general, Standard accounts are suited for beginners due to the costs being factored into your live profit and loss. I think this makes it easier for you if you’re new to make decisions without accidentally exiting a trade too early.

Let’s say your trade shows a green profit, you’ve covered the spread fee and the figure you see is pure profit. Unlike raw accounts where the P&L doesn’t include the external commissions. If you don’t factor the commissions, you can exit early and turn a winning trade into a loser by mistake.

Our team at CompareForexBrokers monitors over 40 forex brokers with Standard accounts to see who charges the tightest spreads. Below is our results for Standard account brokers that accept Malaysian traders:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

3. Swap-Free Accounts

Swap-free accounts are available for Muslim traders so you can comply with Sharia law when trading forex. Instead of paying interest like traditional accounts, you pay an administration fee.

Most brokers don’t offer swap-accounts during the account opening process. You can request to switch your account to a Sharia compliant one by contacting your broker.

4. Other Account Types

Fixed-spread Account

Fixed-spread accounts have no commissions and have spreads that do not change during the trading session. For example, if a broker offers a fixed spread of 1 pip on EUR/USD, it’ll stay 1 pip unless the markets are abnormally volatile.

One reason you may choose fixed-spreads over variable spreads is that it helps keep your costs consistent. Especially if you automate your trades, where you can’t control the timing of your trades during high-impacting market announcements.

Demo Accounts

You can practise how to trade without risking your money by using demo accounts. These accounts provide live price feeds so you can trade “as-if” it’s the real market, letting you build experience.

Brokers typically offer demo accounts on all of the platforms they offer. This lets you test the platforms to see which suits you best.

Understanding Leverage & Margin

What is Leverage?

Leverage allows you to control a larger position while only requiring a portion of the capital upfront. It’s expressed as a ratio and in Malaysia, depending on the broker, you can get up to 1:1000 in leverage.

The ratio is used to demonstrate that for every $1 you put down as margin, the broker lets you borrow $1,000. This lets traders with small accounts to trade the forex markets without requiring large capital to trade. Without leverage, to make money in forex would require $100,000s to invest.

That said, leverage does magnify your profits and losses by the value of the leverage.

To give you an example, let’s say you had $100 in your account and leverage is 1:50. You take a position of $5,000 on EUR/USD, using your full $100 as margin. Should EUR/USD fall 1% ($50), you’ll have lost 50% of your account. Alternatively, if EUR/USD increased by $50, your new balance would be $150, gaining 50%.

What is Margin?

Before using leverage and opening a position, brokers require a margin in your account. This is the minimum amount the broker requires you to fund your position to open a trade. Fortunately, the broker assists you with this as they will show you how much margin is needed automatically.

Let’s say you wanted to open a 1-lot position (100,000 units) on EUR/USD and have 1:100 leverage. From this example, the margin required is $1,000 to open this position.

Risk Management

Before you start trading, it’s smart to create a solid risk management plan. It helps you protect your losses when trades don’t work in your favour, which will happen.

The most common ways of risk management are:

Stop Loss Orders

A stop loss order is your best tool for protecting your money. By setting one, you’ll tell the broker: “if this trade moves against me to X price, close it.” This way you’ve already set the maximum risk you’re willing to lose and the stop loss will cut your losses automatically.

Take Profit Orders

Similar to stop loss, take profit orders will exit your profitable trades at a predetermined price, helping lock-in profit. This is useful to automatically close in profit if you have positions over night, or away from the keyboard.

Position Management

Position size is something else to consider when developing your risk management plan. I recommend using between 1-2% of your balance, ensuring you have breathing room after a losing streak.

By using percentage based position management, your trade sizes will scale based on your performance. Better the performance, the higher the balance, therefore increasing your trade sizes naturally.

Broker Policies That Protect You

Regulated forex brokers have policies in place to help protect your account against unforeseen circumstances. The main policy is negative balance protection that brokers offer to stop your losses from taking your account below zero.

FAQs

Is forex trading legal in Malaysia?

Yes, forex trading is legal in Malaysia. The derivatives and financial markets are overseen by the Securities Commission Malaysia (SCM) and includes forex trading as a regulated trading activity.

What is the best forex trading platform in Malaysia?

The best forex trading platform in Malaysia is TradingView and is also one of the most popular with 50 million users. The platform is web based, so you can access TradingView with any device while its charts are feature rich for technical analysis.

Is $100 enough to start forex?

$100 is enough to start forex trading, but it is always advisable to start with more if you can afford it. With access to 1:500 leverage, you can use $100 to trade multiple micro-lot positions with just $2 margin. This means you can open roughly 50 positions on majors like EUR/USD.

Do forex traders pay tax in Malaysia?

Malaysian forex traders will pay tax on their foreign exchange trades profits. This tax is collected as personal income, so seek professional advice to ensure you get this correct. To help you out, retail investor accounts keep a list of your transactions, helping you review your potential tax liabilities.

Ask an Expert