Trading Platforms In Singapore

Singapore brokers require the right platform to ensure fast CFD trading across currency pairs, low spreads and costs, and the ability to trade a range of financial instruments, including Cryptocurrency CFDs such as bitcoin.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

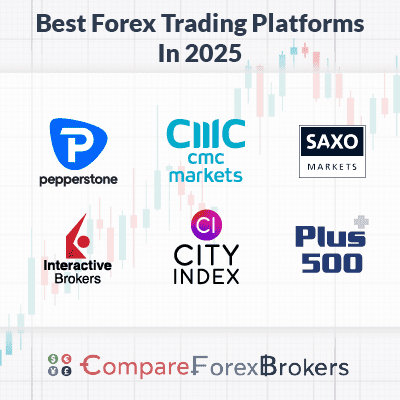

The best platforms for Singaporean Traders are:

- Pepperstone - Best MT5 Forex Trading Platform In Singapore

- CMC Markets - Best MT4 Trading Platform In Singapore

- Saxo Markets - Best Trading Demo Account

- Interactive Brokers - Best Singapore CFD Trading Platform

- City Index - Best Charting Software For Singapore Traders

- Plus500 - Best Mobile Trading Platform

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

1. Pepperstone - Best MT5 Forex Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

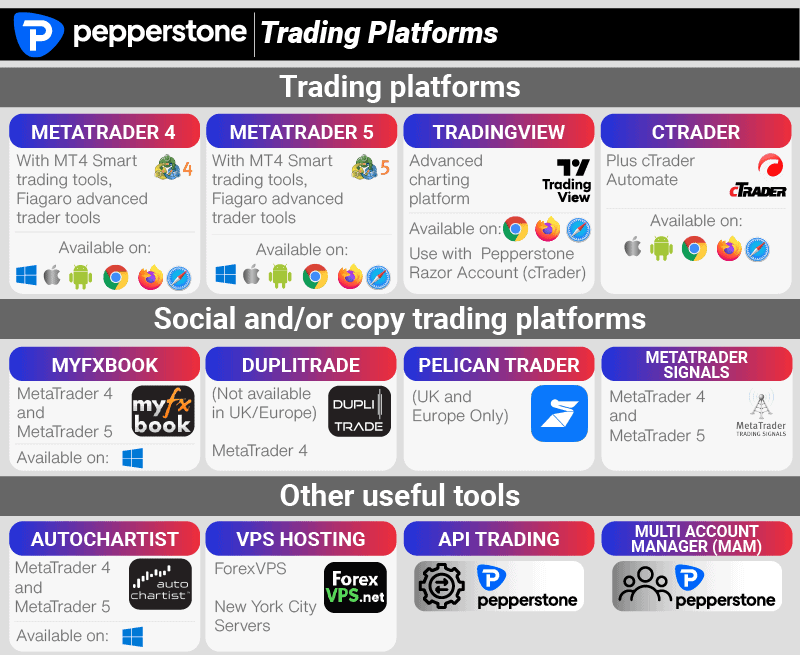

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We liked Pepperstone for several compelling reasons. First, their spread structure is extremely competitive, offering fixed spreads with an included commission for retail accounts or flat-rate commissions with ECN-like spreads. There’s also no need to worry about a minimum deposit, which makes it accessible for traders of all levels. However, their award-winning customer service sets them apart, ensuring that traders have timely support when they need it.

Pros & Cons

- Top MetaTrader 5 offering

- Industry leading forex spreads

- Great range of trading tools

- Lack of MAS regulations

- No Pepperstone in-house platform

- Not many alternative asset classes

Broker Details

We’ve had the opportunity to trade with Pepperstone, which comes with a wide array of regulatory backing from authorities like ASIC (AU), CySEC (Cyprus), CMA (Kenya), DFSA (Dubai), BaFin (Germany), SCB (Global), and the FCA (UK). For those trading from Singapore, regulation is overseen by the Securities Commission of The Bahamas (SCB).

Pepperstone offers a choice of retail investor accounts featuring fixed spreads with built-in commission or a flat rate commission paired with ECN-like spreads. We were particularly impressed with their award-winning customer support and the fact that they require no minimum deposit to start trading forex and CFDs. This broker provides comprehensive access to the international financial markets.

If you want a platform optimised for ECN-like currency trading, you can explore Pepperstone on MetaTrader5 with a demo account.

MetaTrader 5 Trading Platform

MetaTrader is internationally recognised as the best retail currency trading platform. After the success of MetaTrader 4, MetaQuotes released its latest trading platform, MetaTrader 5 (MT5), in 2010.

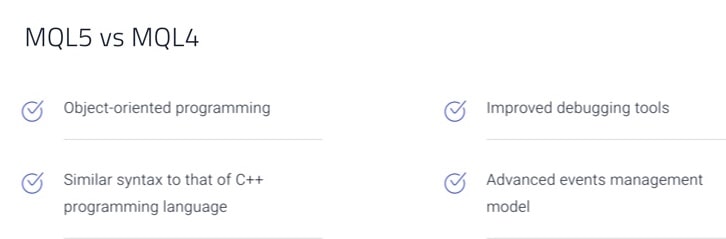

MT5 is a step ahead of its predecessor, boasting quicker processing speeds, a more straightforward programming language, an economic calendar, and a broader range of investment opportunities beyond forex trading. The platform’s automated trading options and advanced features are a great fit for active forex traders. At the same time, its more straightforward programming language makes it accessible for beginners as well.

More about the Best MT5 Brokers in Singapore.

One noteworthy perk of MT5 is the ability to develop unique technical indicators and Expert Advisors through its programming language, MQL5. We found MQL5 to be more efficient than MQL4, cutting down the time we spent writing and updating code. Additional upgrades include more types of order fill policies and pending orders and enhancements to hedging, netting, Strategy Tester, and the marketplace.

You can further customise your risk management and trading strategies on MT5 by downloading additional indicators and add-ons directly from Pepperstone’s website. Whether you’re trading forex, cryptocurrencies, or CFDs, the platform provides a rich set of tools to fine-tune your strategies. Smart Trader Tools include, but are not limited to:

Indicators

- Pivot Point: pivot calculation based on historic prices

- Renko: continuous or separated Renko blocks

- Donchian: high and low values to assess price volatility

- Freehand: Draw directly on charts

- Keltner: a central moving average showing bullish and bearish trends

Add-ons

- Mini Terminal: Place buy and sell orders, create smart lines, and view order ladders

- Trade Terminal: shows all the activity on your account, including an account summary, central trading panel, order list, quick-access trading panel, and list of market categories

- Sentiment Trader: live and historical market sentiment data

- Correlation Matrix: identifies an absent, weak, medium, or strong correlation between different instruments

- Tick Chart Trader: allows extra-fast trading using a keyboard or mouse

- Market Manager: Shows watch lists, open positions, and pending orders, as well as price activity and account summaries.

| Crytocurrency | Pepperstone | Hugosway |

|---|---|---|

| Commission | None | USD$5 per lot |

| Hedging permitted | Yes | Yes |

| Minimum Lots | 0.01 | 0.01 |

| Maximum Lots | 100 | 100 |

| Default Margin Call | 90% | 100% |

| Default Stop-Out | 20% | 70% |

| Cryptocurrencies Available | Bitcoin Bitcoin Cash Litecoin Ethereum Dash | Bitcoin Bitcoin Cash Dash EDO EOS Ethereum Metaverse ETP IOATA Litecoin Neo OmiseGo TRON Monero XRP ZCash Santiment Network Token |

The expansive market access MT5 offers across different asset classes was a definite upgrade for us. Beyond forex, you can also engage with broader capital markets, including indices, cryptocurrencies, commodities, and CFDs. Due to their high-risk nature, Pepperstone offers a reduced leverage of 5:1 for trading cryptocurrency CFDs.

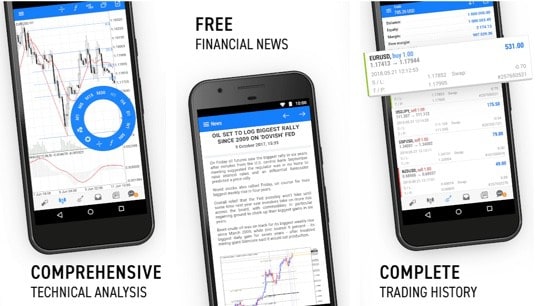

For those keen on exploring further, Pepperstone provides a demo account to get a feel of the forex trading environment and the capabilities of MetaTrader 5. The platform is compatible with MacOS, iOS, Windows, and Android. Aside from MT5, Pepperstone also offers trading on MetaTrader 4 and cTrader platforms.

Other Trading Platforms

You aren’t confined to just the MetaTrader 5 platform with Pepperstone. Options also include MetaTrader 4 and cTrader, each providing excellent conditions for forex trading.

If you’re inclined towards automating your trading strategies, Pepperstone supports various tools that integrate with MetaTrader and cTrader platforms. These include Expert Advisors and social and copy trading software such as MT4 Signals, cTrader Automate, Myfxbook and Duplicated.

2. CMC Markets - Best MT4 Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We’ve found CMC Markets to be an exceptional choice for MetaTrader 4 brokers, especially for Singaporean traders. It’s a trustworthy platform with a capital market license from Singapore’s MAS and additional regulations from reputable agencies like FMA, ASIC, BaFin, and FCA. Their 20:1 leverage and expansive market access, providing more than 9,500 investment opportunities, make it a strong contender in the cross-currency game. The fact that they’re the largest fx broker in Singapore—and globally—only adds to their credibility.

Pros & Cons

- Multi-regulated by global authorities

- Wide investment instrument range

- Premium MT4 addons

- No VPS on Next Generation

- Mac OS requires extra setup

- Lacks Next Gen backtesting

Broker Details

We’ve traded with CMC Markets, a foreign exchange broker with a capital market licence from the Monetary Authority of Singapore (MAS). In addition to its standing in Singapore, the firm is multi-regulated by authorities like the FMA in New Zealand, ASIC in Australia, BaFin in Germany, and the FCA in the UK.

As well as being a licenced broker in Singapore, CMC Markets offers a competitive leverage of 20:1 and market access to over 9,500 investment instruments, including currency trading.

CMC Markets is available on two trading platforms, MetaTrader 4 (MT4) and Next Generation. We found that free demo accounts are available on both platforms, providing access to CMC Markets’ educational resources, comprehensive charting features, customer service, and a real-time news feed.

MetaTrader 4 Trading Platform

MetaTrader 4, a staple in the trading community since its introduction in 2005, is available for desktop and mobile trading. MT4 is particularly renowned for its extensive customisation features and various drawing tools to enhance chart analysis.

The platform is compatible with Microsoft Windows, mobile devices, and tablets. For those utilising Mac OS, Wine and PlayOnMac applications will need to be installed beforehand. Like MetaTrader 5, Smart Trader Tools can be directly downloaded from the CMC Markets website to enhance your trading experience.

Next Generation

As an alternative to MT4, CMC Markets also offers the Next Generation platform. It has extensive charting features compatible across web, mobile, and tablet interfaces. These include price projection tools, pattern recognition capabilities, client sentiment indicators, and chart trading tools. While it offers a sophisticated ordering system, we noted that Next Generation does not support backtesting or offer VPS capacity, features available on MetaTrader 4.

One of the unique aspects of Next Generation is its Chart Forum community. This forum allows traders to engage with other like-minded individuals and CMC Markets’ global market analysis team. It’s a great place to view, copy, and comment on expert analyses, providing a broader perspective on market trends and opportunities.

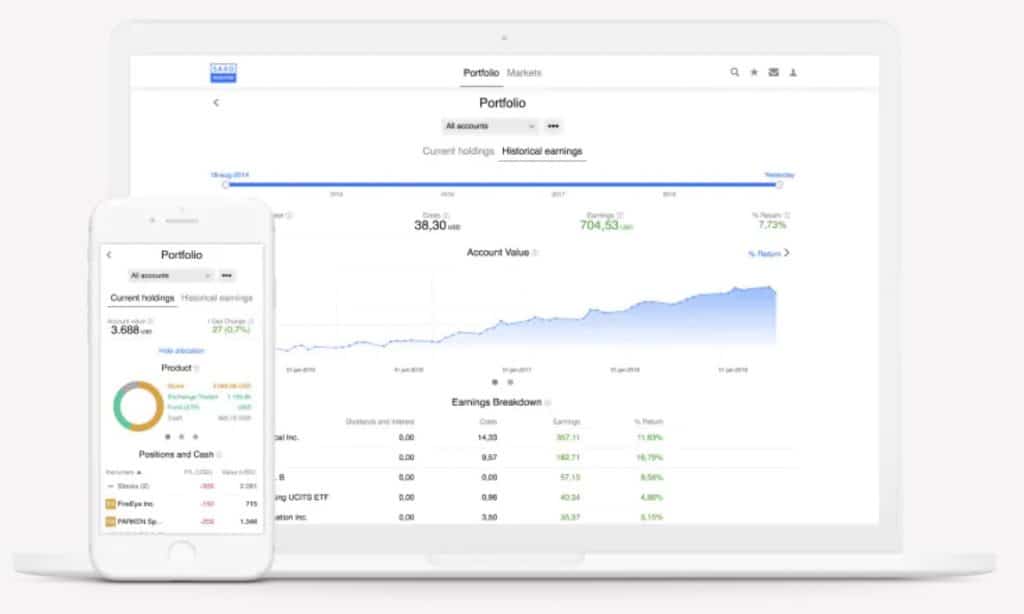

3. Saxo Markets - Best Trading Demo Account

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$10,000

Why We Recommend Saxo Markets

We highly rate Saxo Markets as the go-to broker for the best demo account, particularly for Singaporean traders. They’re not just locally regulated by MAS but also adhere to ASIC and the FCA oversight. Their aggressive spreads and user-friendly platforms make it easy to get a realistic sense of trading before committing to real capital. With offices right in Singapore, their local presence reassures that they understand the specific needs of Singaporean traders. All these factors make their demo account an ideal training ground for traders keen to refine their strategies before going live.

Pros & Cons

- Multiple regulatory oversight

- Demo accounts available

- Solid selection of trading products

- Limited SaxoInvestor assets

- Short SaxoTraderPRO demo period

- High minimum deposit

Broker Details

We’ve had the opportunity to trade with Saxo Markets, a broker regulated by the Monetary Authority of Singapore (MAS), ASIC in Australia, and the FCA in the UK. The broker offers three distinct platforms—SaxoTraderGO, SaxoTraderPRO, and SaxoInvestor—each with its own demo account to help traders get a feel for the tools and features.

SaxoTraderGO

SaxoTraderGO is an incredibly streamlined platform designed for traders who want quick and versatile access to their portfolios. Whether you’re using a Mac, Windows computer, phone, or tablet, this platform grants access to a diverse range of financial instruments through a single multi-currency account.

The platform has charting tools, market research, and technical analysis features. Plus, Saxo Academy is readily accessible for further learning. To top it off, you can demo SaxoTraderGO without any account registration and receive a trial balance to simulate trades and explore a variety of research tools.

SaxoTraderPRO

SaxoTraderPRO offers an advanced multi-screen interface, personalised market information, and sophisticated trading tools for active or professional traders.

To demo the platform, both a software download and account registration are necessary. Once set up, you’re given USD $100,000 in trial cash to simulate trading scenarios. Full access to advanced trading functionalities is provided, aiding in strategy development.

We found SaxoTraderPRO to be fast-loading, intuitive, and fully customisable. You can choose between 1-click and 2-click trading, saving workspaces, setting up alerts, and modifying chart themes. On Mac and Windows, demo software access lasts for 20 days.

SaxoInvestor

Launched in 2018, SaxoInvestor aims to simplify the investment process. The platform, accessible via phones, tablets, and computers, doesn’t require account registration for its demo account. However, it’s worth noting that the platform restricts practice to stocks, mutual funds, ETFs, bonds, and managed portfolios, leaving out CFD trading. SaxoInvestor focuses on emerging investment trends like cybersecurity and electric vehicles. The demo account offers a simple snapshot of mock portfolios and market data but has limited trial access to the platform.

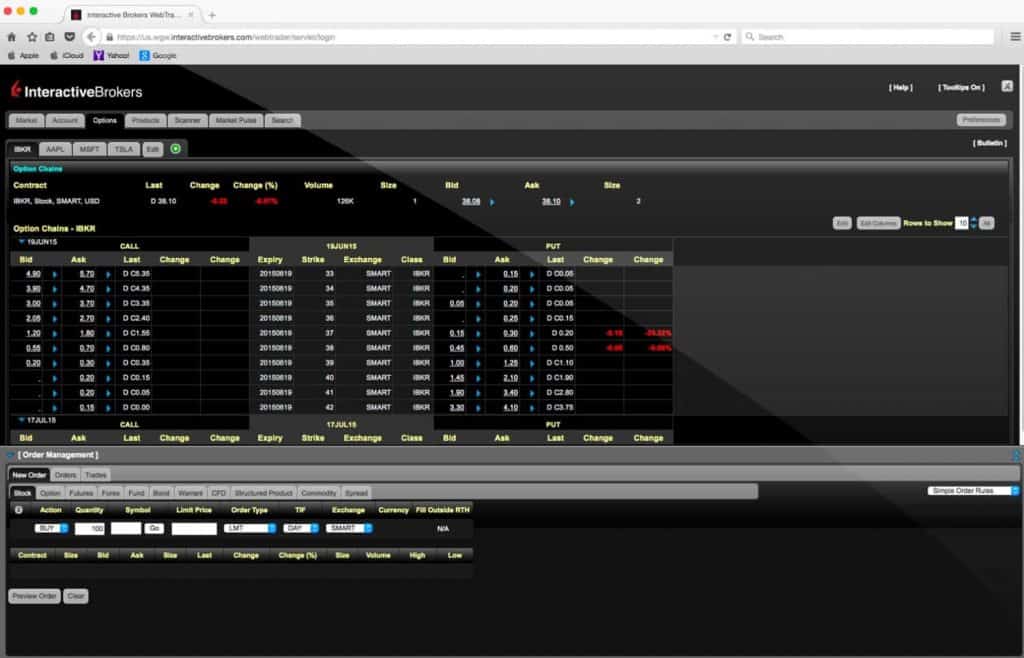

4. Interactive Brokers - Best CFD Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

We found Interactive Brokers delivers on regulatory compliance and platform quality, making them a top pick for CFD trading in Singapore. Being a part of IBKR, a company that has been in business since 1978 and is listed on the New York Stock Exchange, lends considerable credibility. Moreover, they’ve been operating in Singapore since early 2020 and have secured a license from MAS, aligning with local regulatory standards.

Pros & Cons

- Transparent fee structure

- Excellent trading platforms

- Comprehensive range of trading products

- No cryptocurrency CFDs

- Geographic trading restrictions

- Minimum commission is $2 on FX

Broker Details

Interactive Brokers should be on your shortlist if you’re keen on CFD (contract for difference) trading and are eyeing the Singapore market. We’ve found their fee structure to be transparent, with quite competitive commissions. They offer multiple trading platforms to suit varying levels of experience, not to mention a solid range of over 13 stock CFDs and 5900 stock index CFDs.

In terms of trustworthiness, we can vouch for Interactive Brokers’ long-standing reputation. Founded back in 1978, their parent company, IBKR, is NYSE-listed. They’ve recently set up shop in Singapore and have been granted a MAS (Monetary Authority of Singapore) licence, operating in the region since early 2020. Currently, they’re regulated by top-tier financial authorities such as FCA (UK), IIROC (Canada), ASIC (Australia), SILL (Luxemburg), SEBI (India), and SFC (Hong Kong).

Unlike other brokers like Pepperstone and Oanda, it’s worth noting that Interactive Brokers don’t offer complex instruments like cryptocurrency CFDs.

Trading Platforms and Features

For traders of all stripes, Interactive Brokers cater well, whether you’re trading CFDs or foreign currency. For novice investors, trades can be executed on the mobile platform (iOS and Android) or online with the Client Portal or WebTrader. For experienced traders requiring advanced tools, clients can use either WebTrader (online) or Trader Workstation (desktop).

Client Portal

We found Client Portal particularly user-friendly, making it a good stepping stone for those new to CFD trading. It has everything you need to start — easy trade executions, market news analysis, notifications, and a simplified portfolio view.

WebTrader

Interactive Brokers WebTrader is a well-structured platform offering a mix of basic and more advanced tools. Here, we could easily interpret charts, market data and news. The Portfolio News tool even filters market news relevant to your existing portfolio. Basic orders are a single click away, while a more comprehensive Order Management panel is available for intricate trades.

WebTrader Tools and Resources:

- Market Depth: assess the liquidity in different markets

- BookTrader: to evaluate depth of book

- Market Scanners: filter and scan suitable markets for investment opportunities

Trader Workstation

Interactive Brokers desktop platform allows traders to engage in sophisticated trades and technical analysis. Tailored for high-volume traders on a Pro account, it offers a suite of advanced tools in a single workspace. We could trade a wide range of financial products, from CFDs to metals and even bonds.

Trader WorkStation Tools and Resources:

- Technical Analytics

- Risk management tools: Risk Navigator and Model Navigator

- DepthTrader: measure market liquidity

- Basket Trader: replicate or create custom baskets

- FXTrader: over 20 order types

- BookTrader: price ladder

- Rebalance Portfolio

- ComboTrader: custom or pre-set combination strategies

- ChartTrader: real-time charts and advanced technical analysis

- Option Strategy Lab: produce different strategies based on your price and volatility forecasts

- Market Scanners: find the best-performing instruments

- ArbTrader: an arbitrage tool for cash or stock-for-stock mergers

- Customisable Accumulate/Distribute Algos and various trading algorithms

- Portfolio Builder: create and back-test strategies

- Volatility Lab: view industry comparisons, implied volatility, and historical volatility

As well as the advanced tools for research and analysis available on the desktop platform, you gain access to an asset management service where you can follow and implement the strategies of professional portfolio managers.

IBot

Unique to Interactive Brokers’ platforms is the IBot feature, which allows orders via voice or text commands. We tried it on various platforms, including Facebook Messenger and Amazon Alexa, and found it quite convenient.

CFDs

We found that Interactive Brokers offer competitive rates for share CFD trading across all platforms. The commission scales based on the monthly trade volume of share CFDs reward higher-volume traders with lower fees. However, note that if you’re trading less than SGD $50,000,000, the commission tops out at 0.11% per trade. Initial margin requirements on share CFDs stand at 20%.

One limitation we encountered: MAS regulations currently limit Singapore residents from sharing CFDs and bar them from trading CFD products based on underlying trades in Singapore. But this might change, given that Interactive Brokers began their Singapore operations in 2020.

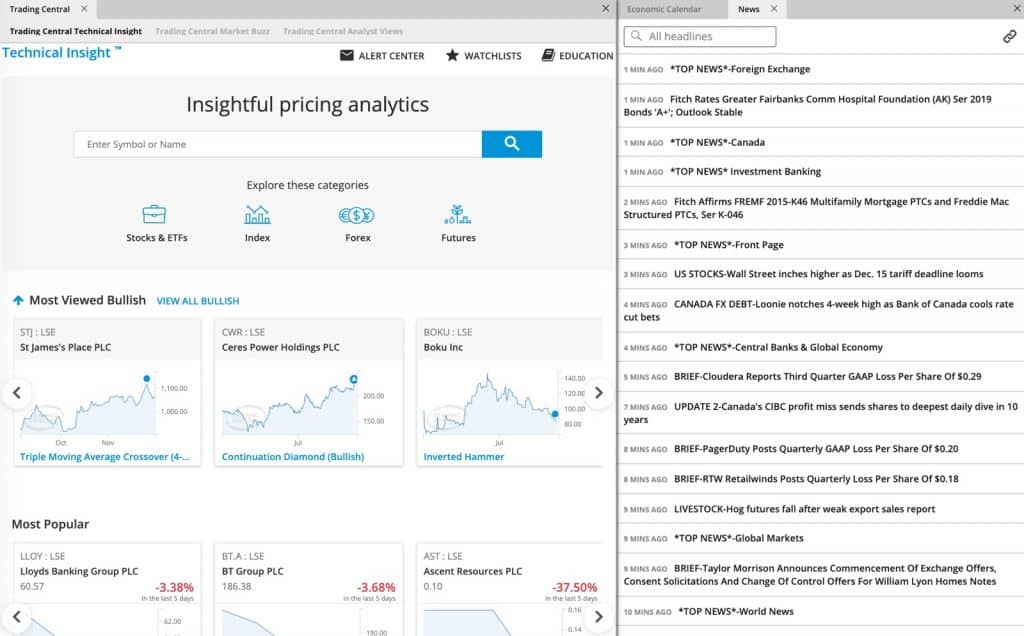

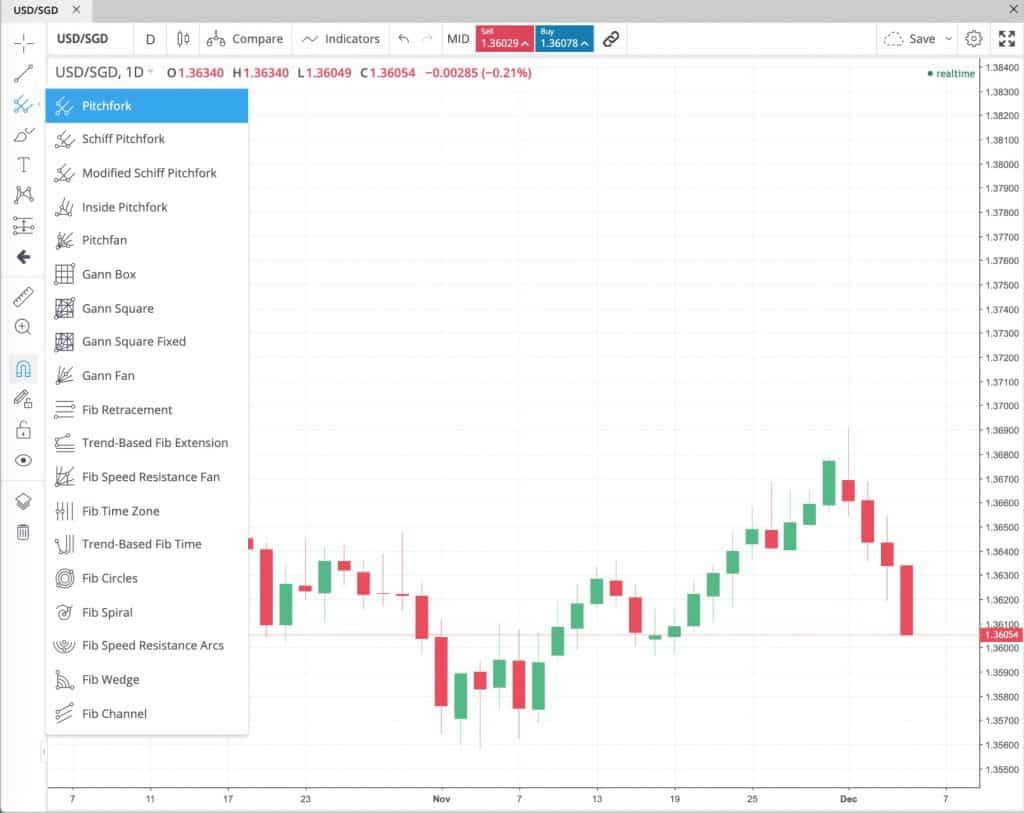

5. City Index - Best Charting Software For Singapore Traders

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$150

Why We Recommend City Index

We liked City Index for many reasons; whether you’re just dipping your toes in or a seasoned trader, the platform’s user-friendly interface makes it a breeze to navigate. What caught our eye were the customisation options on WebTrader, allowing you to fine-tune your trading strategies effectively. Furthermore, the platform provides an invaluable Technical Insight hub that categorises instruments as Most Bullish, Most Bearish, and Popular, offering traders in Singapore an added edge.

Pros & Cons

- Multiple regulated platforms

- Extensive charting tools

- 24/7 customer service

- Complexity for beginners

- Limited product range on MetaTrader 4

- Has a minimum deposit

Broker Details

If you’re considering a broker that ticks the boxes for being well-regulated and versatile in platform offerings, we’d recommend giving City Index a look. We’ve personally utilised their services and found them to be regulated by the MAS (Monetary Authority of Singapore), FCA (UK), and ASIC (AU), providing an additional layer of confidence. With platforms like WebTrader and MT4 available, it suits newcomers and experienced traders.

City Index’s WebTrader, which we’ve had the chance to use, is incredibly user-friendly and fully customisable, catering to traders at all levels of expertise. The platform has a robust research portal and price alerts, keeping you well-informed of market movements and significant economic events. We also delved into their Technical Insight hub, which provides a snapshot of the most bullish, bearish, popular instruments.

As for its charting capabilities, WebTrader offers a strong suite of tools, including 12 different chart types and over 80 indicators for technical analysis. We found it straightforward to trade directly from the charts with a single click, with positions and stop and limit orders displayed. The platform also offers a range of drawing tools, from basic trend lines to Fibonacci retracements, all saveable for future reference.

You might find City Index’s AT Pro platform appealing if you’re a more seasoned trader. We also got our hands on this one and found it quite robust. The platform allows for automated trading strategies and provides extensive charting options with over 100 indicators. AT Pro offers some unique features such as:

- Trade signals on charts showing possible entry and exit points

- Code your own strategies in Visual Basic, .NET, and C#

- Back-testing with historical data

City Index also offers the MetaTrader4 (MT4) platform for those focused on fx trading. Trading on MT4 comes with its own set of perks, such as different spreads, lot sizes, and leverage, compared to AT Pro and WebTrader. We were able to access expert advisors to download or create our own automated trading strategies. Plus, they offer 24/7 customer service. MT4 is fully customisable, from the economic calendar to its charting features. The platform also comes with a variety of order execution tools that we found useful for crafting our trading strategies, including:

- Stop and limit orders

- Trailing stops

- Partial close

- Hedging tools

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

6. Plus500 - Best Mobile Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$0

Why We Recommend Plus500

We found Plus500 the go-to option for those who want a top-notch mobile trading experience. Regulated by multiple authorities, including MAS in Singapore, you can be sure you’re safe. The platform is highly compatible, working smoothly on iOS, Android, Windows Phone, and even smartwatches. Its user-friendly design allows you to sift through data and execute trades without fuss swiftly. Plus, it packs unique features alongside your standard trading functions, making it a comprehensive mobile trading solution for Singaporean traders.

Pros & Cons

- Comprehensive mobile platform

- Extensive alert functions

- Well-regulated broker

- Limited educational resources

- Inactivity fees

- Lacks automated trading tools

Broker Details

If you’re looking for a broker with an expansive mobile trading platform, consider Plus500. In our experience, Plus500 is well-regulated, with oversight from reputable authorities, including MAS (Monetary Authority of Singapore), ASIC (AU), FMA (NZ), CySEC (Cyprus), and the FCA (UK).

We’ve found the mobile app quite comprehensive, compatible with iOS, Android, Windows Phone, and even Smartwatches. The fully functional platform allows for deposits and withdrawals, access to the education centre, and the ability to execute trades. The two-step login adds a layer of security, and the user-friendly interface is designed for efficient trading on the go. Plus500 goes beyond basic trading functionalities and offers unique features like:

- Account Snapshot

- Alert functions

- Charting

- Economic and Corporate Calendar

While using Plus500, the account snapshot gave us a convenient overview of our account balance, leverage, and open positions. The ability to create lists of favourite instruments streamlined our trading process significantly.

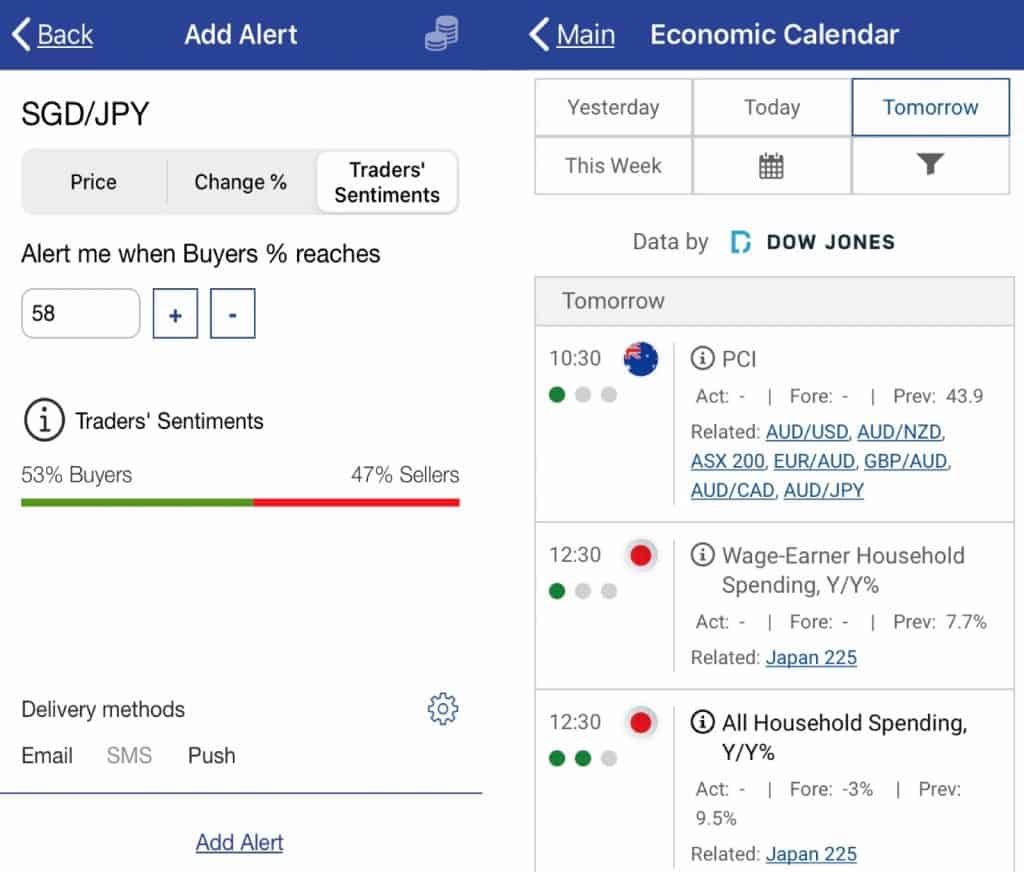

We found the alert function to be more comprehensive than those offered by other CFD brokers. The app enabled us to set up alerts for various asset classes—indices, shares, options, ETFs, and commodities. Moreover, it allowed customisation for specific price movements, either by a certain percentage or a specific amount.

A unique feature offered by Plus500 is the traders’ sentiment alert function. For example, users can set an alert for when buyers of SGD/JPY reach 60%. You can choose whether you want to receive emails, SMS or push notifications for all alerts to keep you updated with market movements.

Plus500’s mobile charting function is excellent. The mobile charting function gave us access to over 115 indicators for building various investment strategies, covering everything from moving averages to linear regressions and stochastics.

We found the Economic Calendar informative, consolidating Dow Jones data to keep you abreast of key economic events. It indicates the timing and details of events and provides an outlook on the expected impact on various trading instruments.

The Corporate Event Calendar further complements the Economic Calendar, supplying information about major financial events like dividend payments or earnings releases. It outlines the time, the company, and the country involved, helping us to stay well-informed.

Finally, for those who’d like to dip their toes before diving in, Plus500 offers a demo account accessible through the app. It’s a handy feature that we use to simulate strategies, examine market conditions, and explore the platform’s functionalities.

Ask an Expert

hi may i know which brokerage companies have same trading stock option put ,call like plus500 option stock. thank, pls help.

Sorry, but we advise on forex. We are not the best source for options