Top ECN Brokers For Singapore Traders

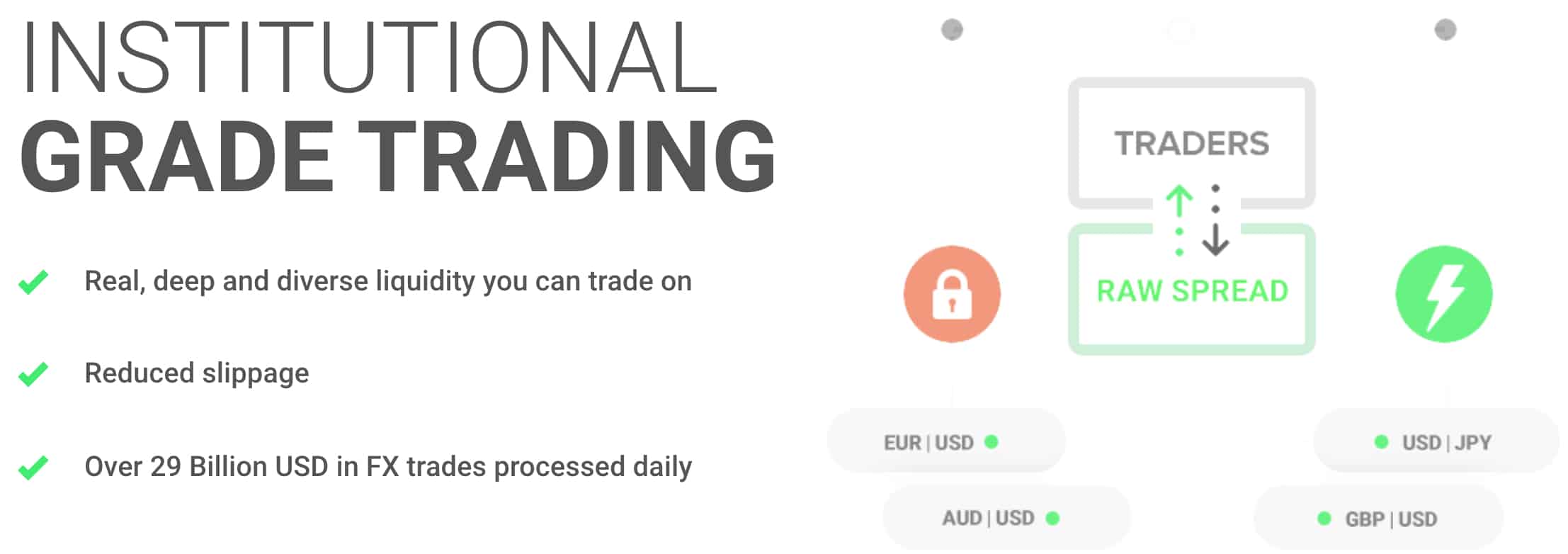

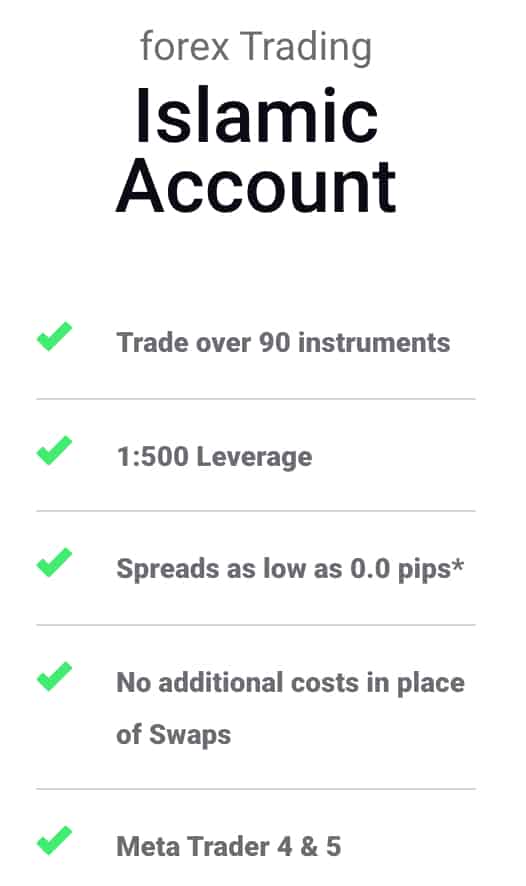

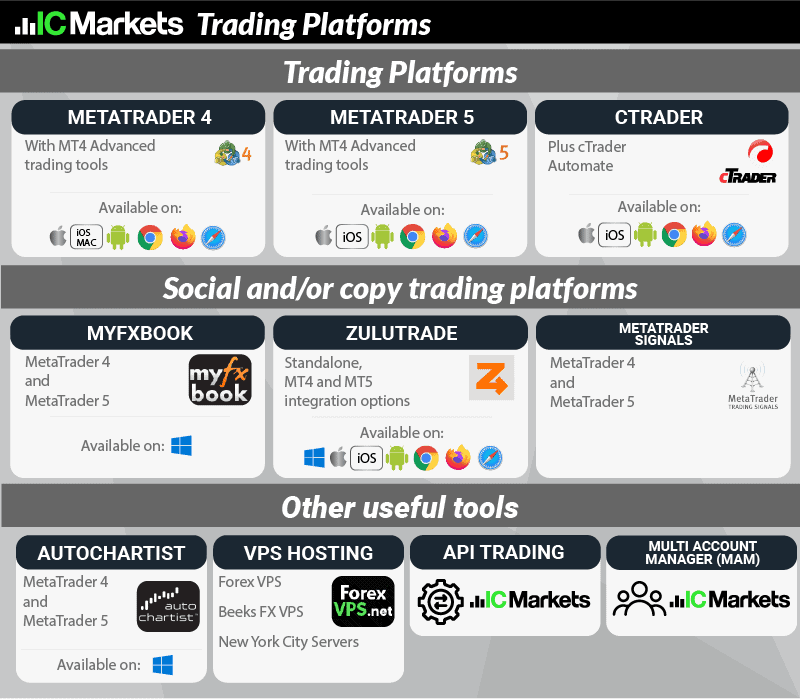

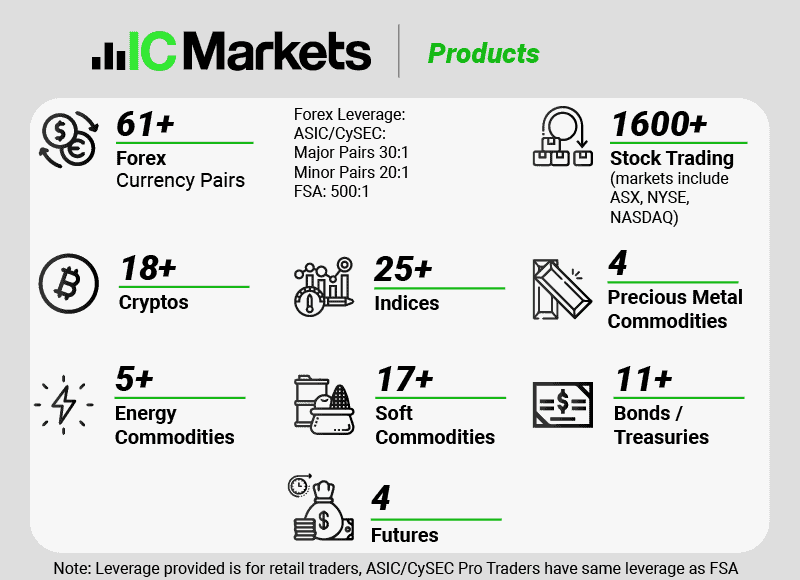

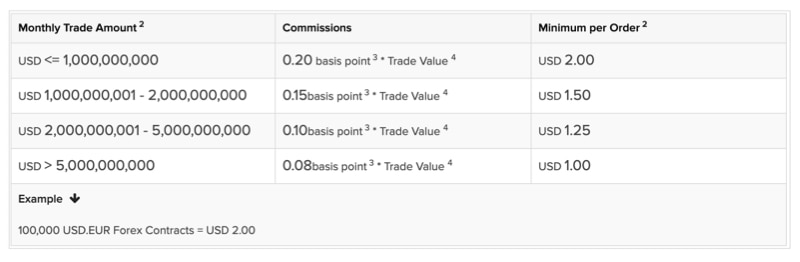

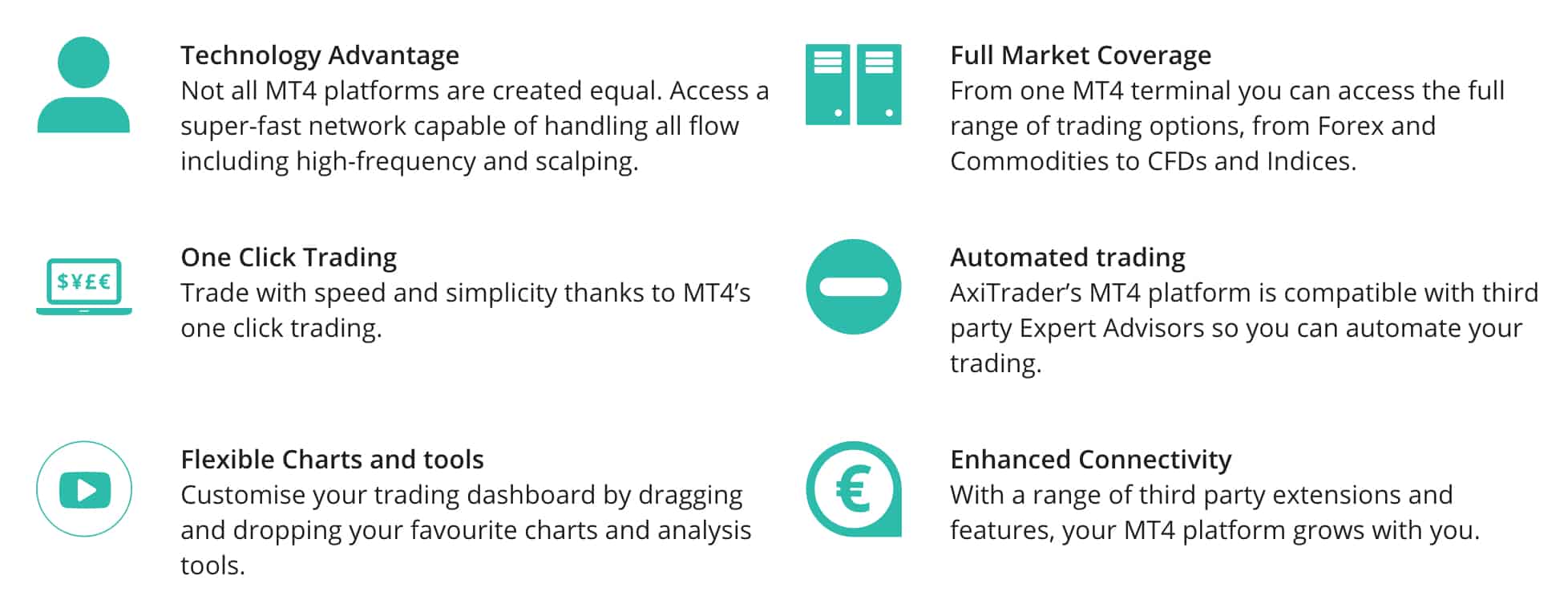

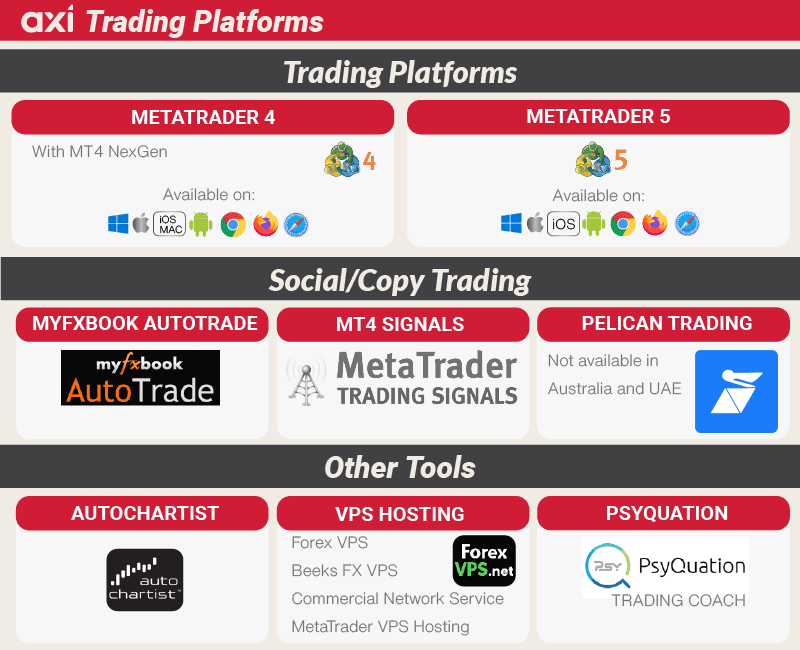

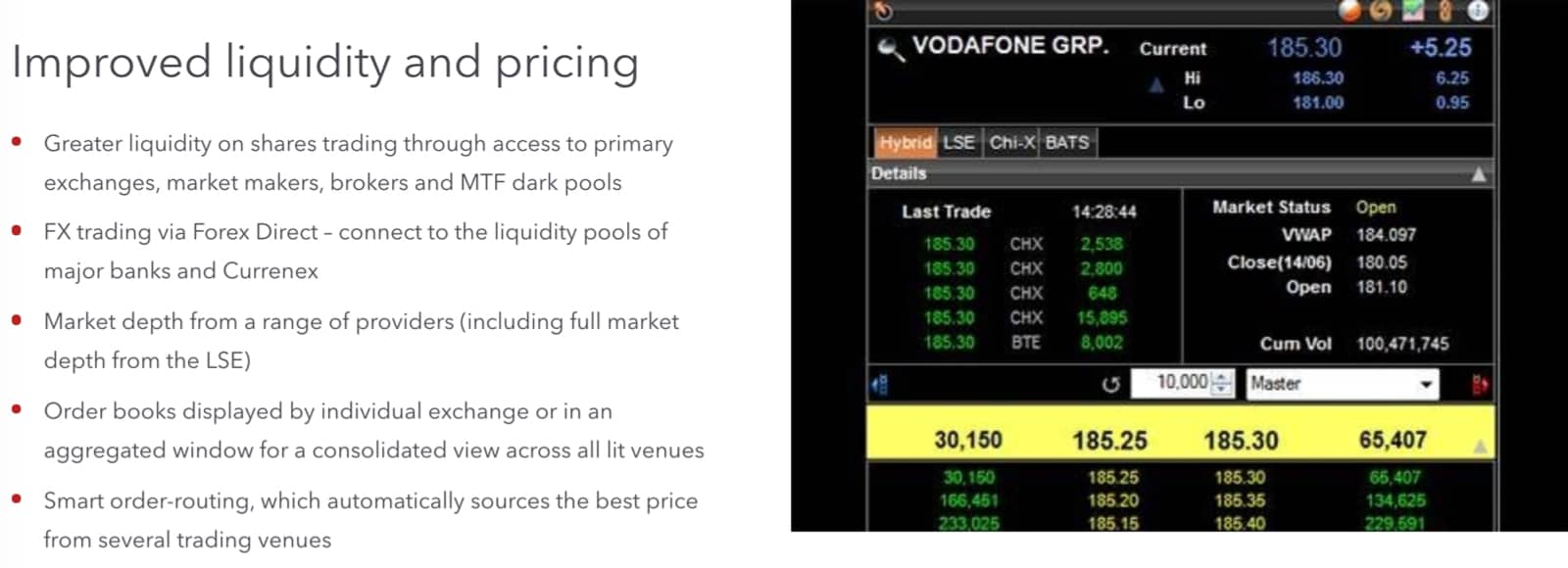

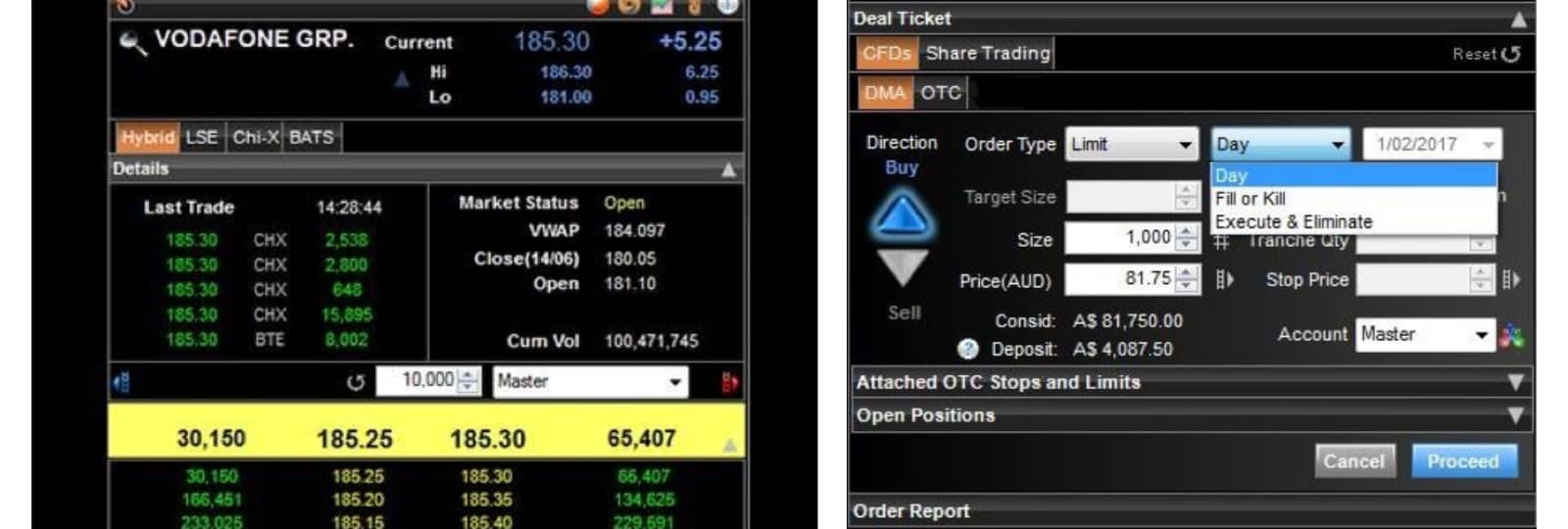

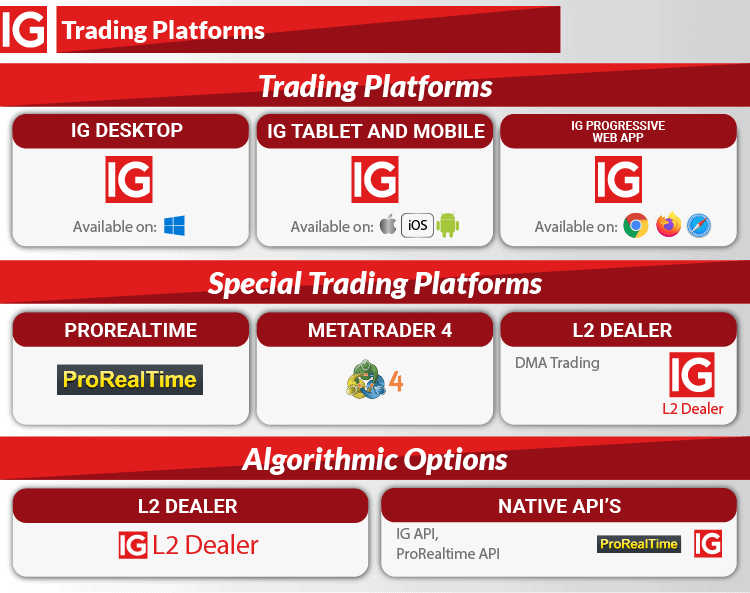

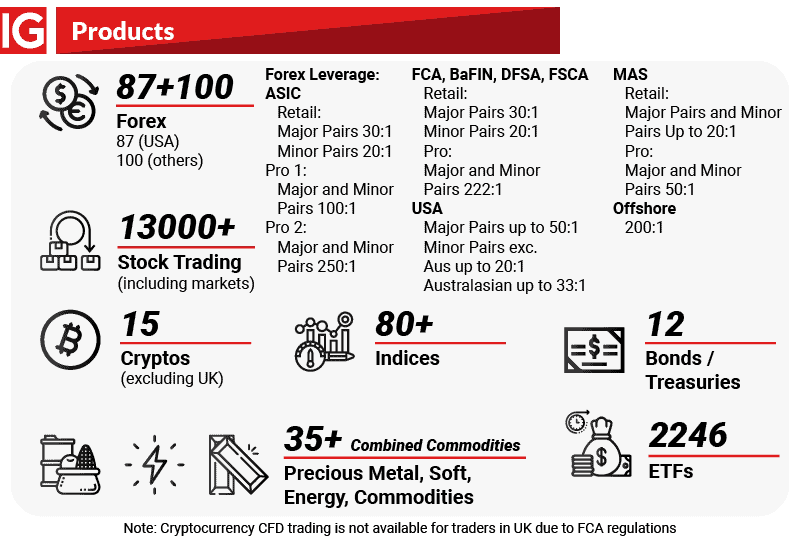

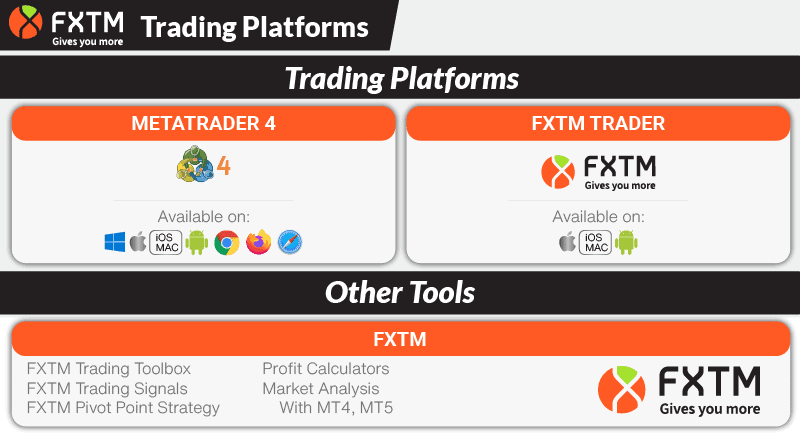

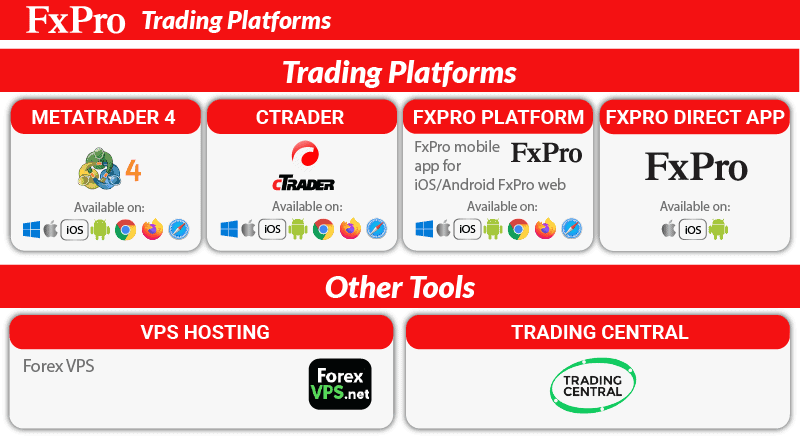

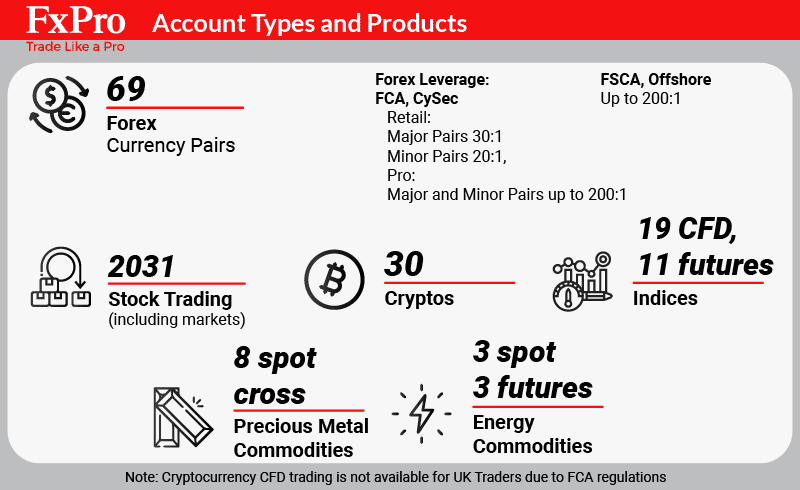

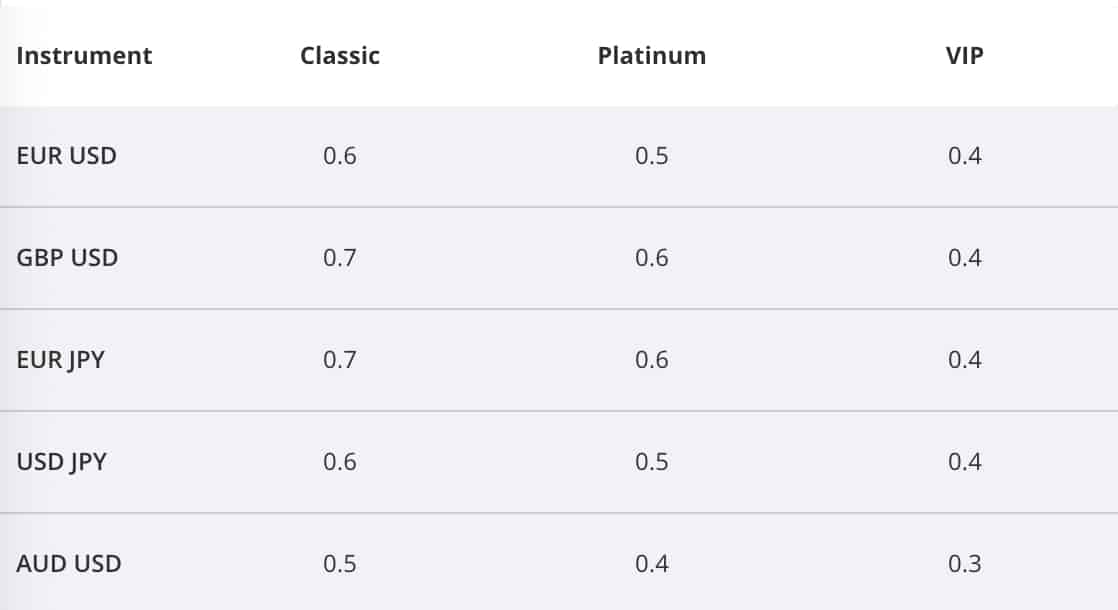

By choosing an ECN forex broker, you can get lower spreads as there is no dealing desk. Below, lists the ECN forex accounts from the best forex brokers varied by criteria such as minimum deposit requirements, trading platforms and CFDs offered.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert