Best Forex Demo Accounts

Singapore traders can choose between a Monetary Authority of Singapore (MAS) regulated forex brokers or a tier-1 regulated broker. The best brokers in Singapore offer low spreads and the best forex trading platforms.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

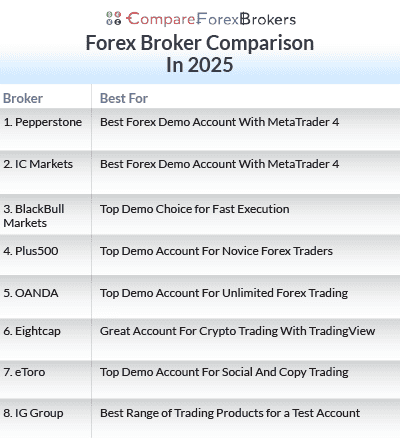

My best MAS regulated forex demo account list is:

- Pepperstone - Best Forex Demo Account With MetaTrader 4

- IC Markets - Top CFD Demo Account With MetaTrader 5

- BlackBull Markets - Top Demo Choice for Fast Execution

- Plus500 - Top Demo Account For Novice Forex Traders

- OANDA - Top Demo Account For Unlimited Forex Trading

- Eightcap - Great Account For Crypto Trading With TradingView

- eToro - Top Demo Account For Social And Copy Trading

- IG Group - Best Range of Trading Products for a Test Account

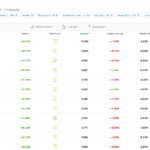

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

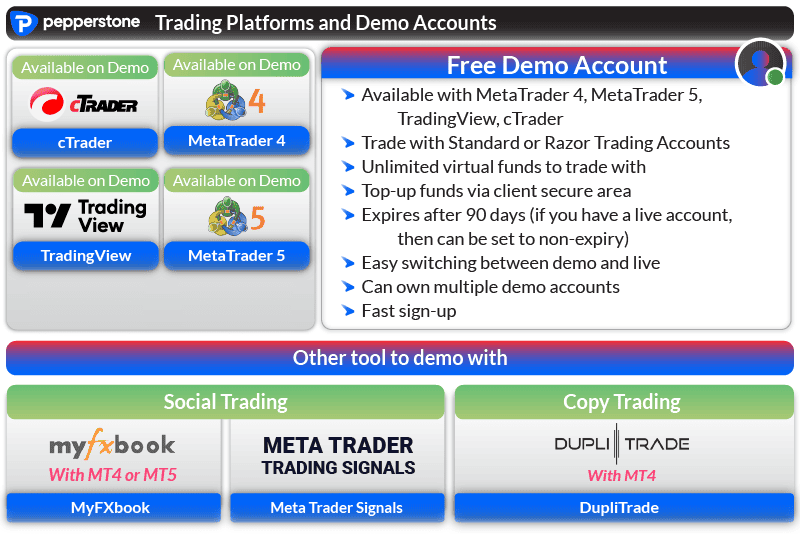

1. Pepperstone - Best Forex Demo Account With MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Pepperstone won me over by having the best Forex demo account with MetaTrader 4. There are several reasons for that but chief among them are combining a transparent fee structure, ECN-like spreads, and fast execution speeds, especially while using MT4.

When testing out Pepperstone’s demo account on MT4, I found the trading experience extremely smooth, from the broker’s account opening to trading itself. From new traders to experienced traders, everyone will enjoy the experience. In fact, I scored Pepperstone a perfect 15/15 for account opening experience, which no other broker could match.

Pros & Cons

- Lowest EUR/USD spreads

- Top-tier liquidity and fast execution

- Industry-leading platform range

- SGD base currency trading accounts

- No deposit or withdrawal fees

- Non-MAS regulated broker

- Doesn’t offer spot trading

- Demo account only for 30 days

- No local office in Singapore

Broker Details

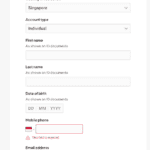

Straightforward Account Opening

I set up a MetaTrader 4 forex trading demo account at Pepperstone to explore the Australian broker’s features and services. Opening the free demo account was simple, the only requirement is entering basic personal details like name and email address for retail investor accounts.

Unlike other brokers that often require financial information and extensive questionnaires, Pepperstone’s process was quick and hassle-free, which is why I gave them a perfect 15/15 for account opening.

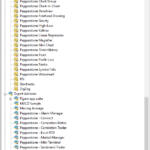

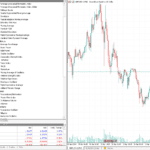

Smart Trading Tools on MT4

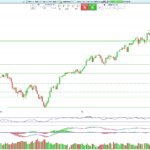

With Pepperstone’s demo account, you get access to 4 major trading platforms, MT4, MT5, cTrader and TradingView, but it is in MetaTrader 4 that the broker stood out from my testing. In addition to being a reliable forex trading platform with great trading tools such as 30 built-in indicators, I particularly liked the broker’s Smart Trader Tools add-on of 28 smart tools to expand the platform’s functionality.

One standout feature I liked is the sentiment indicator, which gives insights into how Pepperstone’s clients are positioned in the markets. I found this tool valuable especially during times of volatility, as it allows you to leverage the collective wisdom of the crowd to make informed decisions on whether to go long or short in the market.

Fast Execution Speeds

From my MT4 testing on a variety of demo accounts, Pepperstone had some of the fastest execution speeds out there, averaging 77ms for limit orders and 100ms for market orders. These speeds placed the broker third overall, just behind BlackBull Markets and Fusion Markets.

Having fast execution speeds reduced the latency on my trade execution and thus, my overall slippage when trading on the broker’s demo account, ensuring a smooth trading experience.

Competitive Spreads

When testing the spreads on Pepperstone’s live MT4 accounts, I found the broker has competitive RAW spreads of 0.1 pips for EUR/USD. Meanwhile, you’ll get slightly wider spreads of 1.12 pips on the Standard account since you will not be paying for commission.

Both account types (Standard and Razor) offer spreads lower than industry averages for their respective categories. Meaning you’ll get lower trading costs which is necessary when trading in high volume.

100% Zero pip Spreads

From my experience, most brokers advertise spreads as low as 0 pips on their RAW accounts. To test this theory, our analyst Ross Collins investigated how frequently Pepperstone offers these zero-pip spreads.

He found Pepperstone offers zero pip spreads 100% of the time on the major pairs, meaning you would only pay the $3.50 commission per lot traded. This can lead to significant savings, especially for frequent traders of major currency pairs.

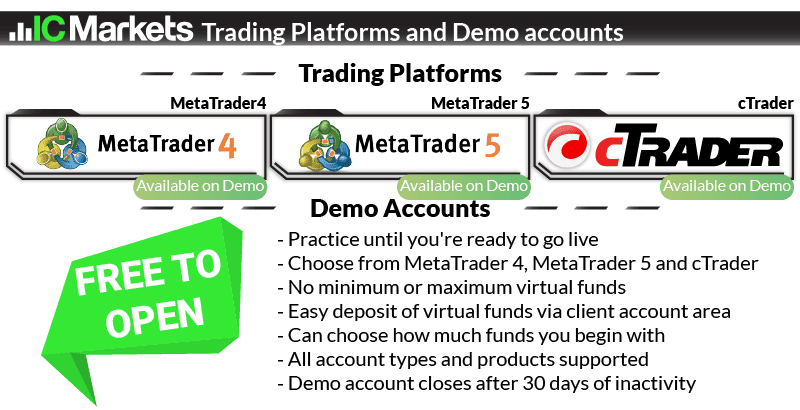

2. IC Markets - Top CFD Demo Account With MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why I Recommend IC Markets

I like IC Markets for two key reasons: low trading costs and great MT5 trading experience. In fact, I even awarded IC Markets as my best MT5 broker overall.

This is for combining tight spreads, low commissions, and excellent MT5 integrations, which puts the broker above the rest of the competition.

My testing of IC Markets’ CFD Demo account using MT5 proved that fact in spades.

Pros & Cons

- Lowest trading costs

- Top MT5 integrations

- No withdrawal or deposit fees

- Average execution speeds

- Education could be better

Boker Details

From my testing of IC Markets’ demo account, I found that it’s possible to trade with unlimited virtual funds and as long as you place a trade every twenty days, it never expired. Be mindful though, the demo account will expire after 30 days of inactivity.

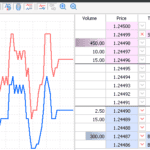

Superior MT5 Trading Experience

While MT4, MT5, and cTrader can be traded on the broker’s demo account, I decided to primarily focus on the MetaTrader 5 demo account, as the platform offered a more comprehensive set of tools for technical analysis, including over 38 indicators, more than 15 drawing tools, and three chart types.

One feature that stood out is the inclusion of the depth of market (DoM) tool, which allows you to view the order books of liquidity providers and observe where other traders are placing their orders. This feature intrigued me because it provided insight into the relative strength of both the buy and sell sides real-time.

Lowest Standard Account Spreads

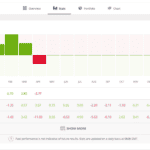

While using the demo account, our analyst Ross tested IC Markets’ Standard account spreads for major forex pairs and compared them to those of 14 other brokers I’ve evaluated in order to assess the competitiveness of IC Markets’ pricing.

Ross found that IC Markets had the lowest average spread of 1.03 pips across major pairs. Additionally, my personal observation proved that the broker offered the lowest spreads for EUR/USD and USD/JPY, averaging 0.73 and 1.09 pips, respectively.

If you are a user of a commission-free account, note that these spreads are much lower than the tested industry average of 1.52 pips across the 5 most traded currency pairs.

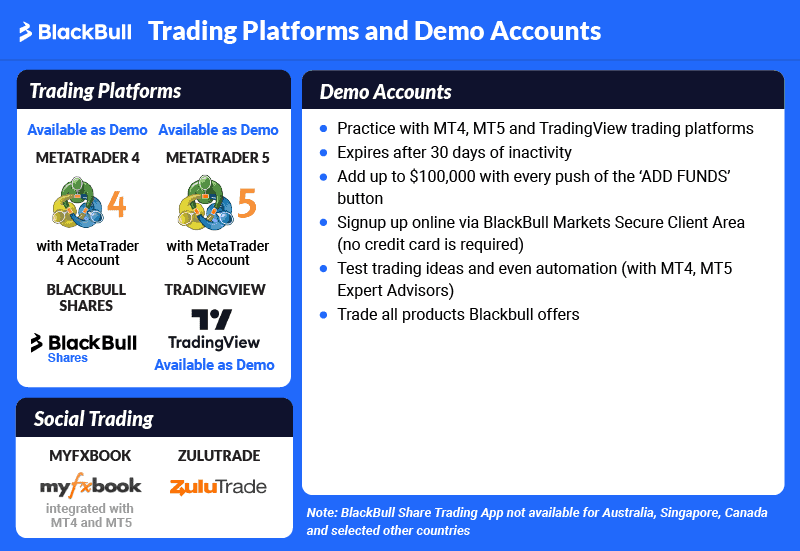

3. BlackBull Markets - Top Demo Choice for Fast Execution

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, TradingView, Blackbull Trade

Minimum Deposit

$0

Why I Recommend BlackBull Markets

It’s no competition, BlackBull Markets has the fastest execution speeds I’ve ever seen. The broker ranked 1st and 2nd for limit and market orders respectively, putting them at number 1 overall when I tested using its MT4 demo account.

A fast execution speed is extremely important to me, since this plays a crucial role not only in avoiding slippage (I.E. reducing your trading costs) but also in having a reliable platform trading experience.

BlackBull Markets ticks this box in spades, as one of only two brokers in my tests to have execution speeds under 100ms (0.1 seconds) for limit and market orders.

Pros & Cons

- Fastest execution speeds

- High forex leverage of 1:500

- Competitive spreads

- Limited in-house market analysis

- Withdrawal fees

- High minimum deposit for ECN Prime

Broker Details

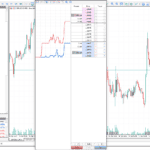

BlackBull Markets offers demo accounts for the TradingView, MT4 and MT5 trading platforms. Where the broker stood out, however, is in having lightening fast execution speeds.

FASTEST EXECUTION SPEEDS ON DEMO ACCOUNT

Based on my tests conducted on the broker’s demo account, BlackBull Markets had the fastest execution speeds among all brokers I evaluated. I was particularly impressed to find that BlackBull Markets achieved execution speeds of 72ms for limit orders and 90ms for market orders. This outstanding performance placed them at the top, surpassing 20 other brokers on my list.

One huge advantage of fast execution speeds is reducing the latency at the point of trade execution. You can expect to keep your slippage to a minimum when trading with BlackBull, ensuring a smoother trading experience.

TIERED ACCOUNT TYPES AND SPREADS

BlackBull Markets sits just above the industry average spreads with spreads of 1.2 pips for 0.23 pips across its Standard and Prime accounts for the EUR/USD. For the lowest spreads, I recommend the ECN Prime account, although you’ll need a $2000 minimum deposit to start trading.

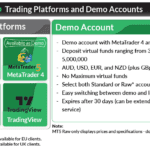

Great Range of Demo Platforms

The ability to practice trading using MT4, MT5 and TradingView pitched BlackBull Markets right to my list, each with unique advantages.

I found that BlackBull Markets offers a free subscription to TradingView Pro. This gives access to great benefits like additional trading indicators on charts and more price alerts. Overall, this is helpful for better strategy implementation and risk management.

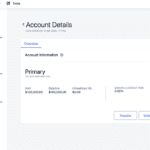

4. Plus500 - Top Demo Account For Novice Forex Traders

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why I Recommend Plus500

While we’re an experienced team at CompareForexBrokers, I understand novice forex traders require low trading costs, a simple, reliable trading platform and risk management tools.

When I tested Plus500’s demo account, the broker ticked all of these boxes, offering commission-free trading, a user-friendly proprietary platform and a guaranteed stop loss order (GSLO) to minimise your risk.

In my opinion, this gives Plus500 the best combination of features that beginners will appreciate.

Pros & Cons

- Offers swap-free Islamic account

- Decent trading costs with no withdrawal fee

- Won several awards for customer service

- Minimum deposit of only $100

- No MetaTrader 5, cTrader, or Trading View

- Dedicated account manager only for professional accounts

- No commission-based account

- Plus500 proprietary trading platform users may find it hard to switch to another trading platform.

Broker Details

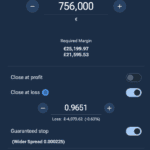

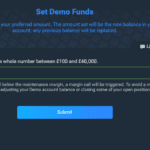

Plus500 stood out to me for having an unlimited time demo account, risk management features and platform ease-of-use, which makes it most suited for novice traders.

Best Demo Account for Novices

The broker’s demo account allows users to “deposit” new funds using an internal transfer system. In my opinion, this significantly enhances the realism of the trading experience and serves as a practical tutorial on managing real funds. I found this to be a clever and subtle educational tool.

If you are concerned about user-friendliness, I can attest that the platform is beginner-friendly. It provides essential features for starting trading without overwhelming users, with its clean design and easy-to-access charting tools.

I was also impressed to find that you could trade a decent range of markets: 71 currency pairs, over 1,100 shares, 30 indicators, 15 crypto markets, and 12 commodities.

Risk Management Features

One standout feature of Plus500 for novice forex traders is the availability of guaranteed stop-loss orders which I found in every order ticket I opened. As someone valuing brokers that offer this option, with its ability to protect your positions against losses during volatile markets and prevent slippage, I see this as an important advantage in the competition.

Additionally, while the Plus500 trading platform lacks advanced analytical tools, I still found the broker’s 100 technical indicators to be sufficient. There is also a ‘traders sentiment’ feature that shows the ratio of buyers/sellers for a particular instrument, and this can be beneficial when looking for more in-depth market research.

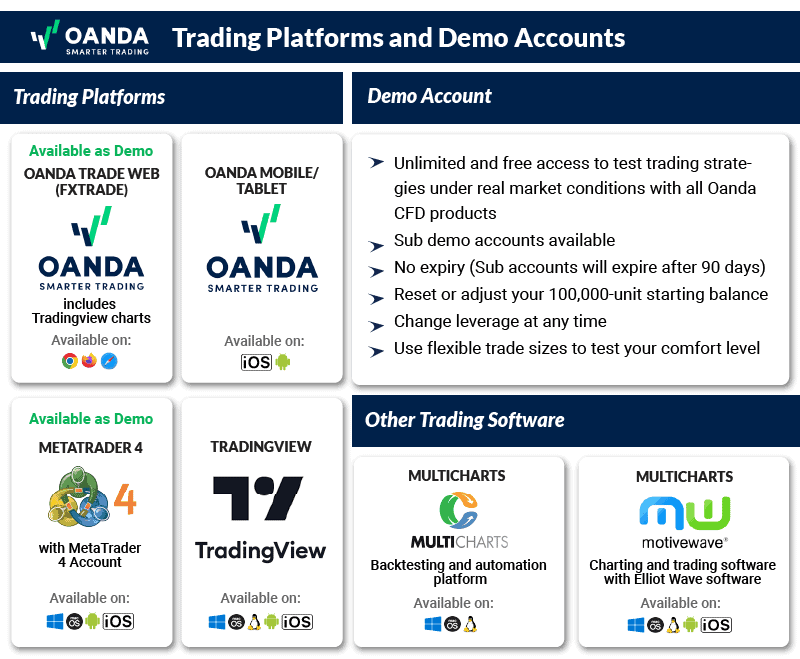

5. OANDA - Top Demo Account For Unlimited Forex Trading

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

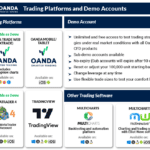

Trading Platforms

MT4, TradingView, OANDA Trade (fx Trade)

Minimum Deposit

$0

Why I Recommend OANDA

I enjoyed using OANDA for one main reason: the broker gives free and unlimited access to trade forex and test trading strategies under real market conditions. After thoroughly testing the demo account, I can say that if you are into automated trading, OANDA stands out as an excellent choice.

OANDA provided me with the tools like Multicharts, excellent for backtesting and automation, and an environment I needed to refine my trading approach before committing real capital.

Pros & Cons

- Highly trusted broker

- Over 70 forex pairs

- No requotes or rejections

- Customer support is not 24/7

- Doesn’t offer share CFDs

- No ECN/STP trading

Broker Details

In my assessment, I was very impressed by the unrestricted access to OANDA’s demo account. It comes preloaded with $100,000 in virtual funds on the OANDA Trade platform or MT4, allowing me to test different strategies and take large positions without having to worry about limited funds.

Unlimited Trading on Demo Account

After running a test on the OANDA Trade platform, I found the default trade ticket feature as noteworthy. This has significantly streamlined my trading process by allowing to pre-set trade size, stop loss, and take profit levels. The best aspect is that all future trade tickets automatically reflect these settings, and this will be helpful if you want to save time while trading. Not only that, it can also minimize your risk of making costly errors due to manual input mistakes.

While the broker also offers MT4 as a demo account with benefits such as EAs for algorithmic trading, I highly recommend OANDA Trade, particularly for beginners looking to streamline the overall trading experience.

Competitive Commission-Free Spreads

OANDA performed very well during my live spread test. Using the Standard account, the average spreads for the EUR/USD pair came at 0.6 pips, significantly lower than the industry average of 1.24 pips.

I’ve observed this level of performance to be consistent across the 5 most traded currency pairs, with an average spread of 0.7 pips. This positions OANDA as the lowest-cost broker in the forex market for commission-free accounts.

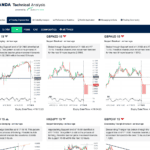

Top Educational Resources

Lastly, OANDA has a wide range of training and research tools you can utilise while testing its demo account. I appreciated the ability to develop my trading strategies using OANDA’s newsfeed, currency heat maps, webinars, as well as economic and technical analysis tools.

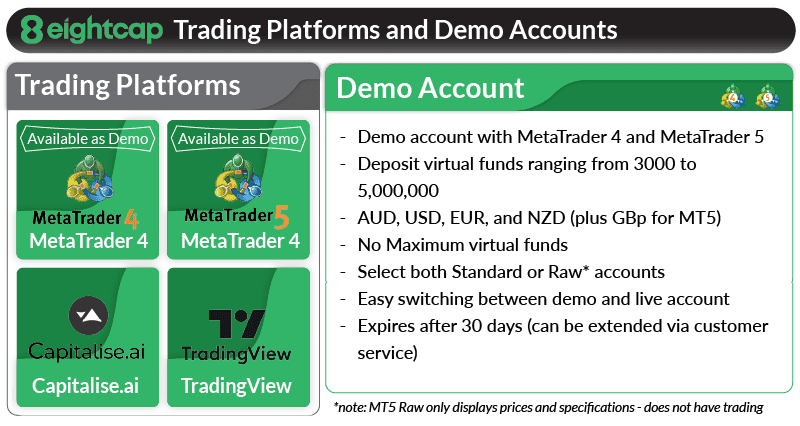

6. Eightcap - Great Account For Crypto Trading With TradingView

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why I Recommend Eightcap

When I tested Eightcap’s live account, the broker stood out with a great account for crypto trading using the TradingView platform.

While you can’t use TradingView in a demo account, you can practice trading using both MT4 and MT5, coming with charting features you can use to spot trends and create decent strategies.

I also noticed that Eightcap offers a large range of cryptocurrencies on the demo account, coming with unlimited virtual funds you can use while practice trading.

Pros & Cons

- Wide range of cryptocurrencies and stocks.

- Commission-free trading.

- Free deposits and withdrawals.

- 24-hour customer service Tues-Fri

- Not regulated by the MAS

- No demo account with TradingView

- Low commodities selection

- No proprietary trading platform

Broker Details

After setting up a demo account with Eightcap, I was introduced to the broker’s wide range of markets, including 95 cryptocurrency markets on offer. This selection includes major players like Bitcoin, Ethereum, and Litecoin, as well as other options like Ripple and Cardano. This is one of the most comprehensive cryptocurrency offerings I’ve seen from a forex broker.

Top Crypto Trading with TradingView

While Eightcap only offers MT4 and MT5 demo accounts, I liked the inclusion of everyone’s favorite charting platform, TradingView, with its intuitive user interface and over 100 technical indicators. To use TradingView, you’ll have to sign up for a live account but Eightcap makes it easy switch between a demo and live account.

If you are interested in automating cryptocurrency trading strategies without the need for complex programming, Eightcap has Capitalise.ai. Within minutes of starting the beginner tutorial, I was able to create an automated strategy without any coding.

I find this feature particularly attractive if you’re looking to take advantage of the volatile crypto market with automated strategies. Capitalise.ai allows you to apply these strategies to its strong line-up of cryptocurrencies.

Competitive Spreads

Based on my testing, Eightcap showed competitive spreads, averaging 0.2 pips on EUR/USD, comfortably within the industry standard bandwidth of 0.22 pips. For cryptocurrencies, spreads were similarly competitive against top brokers, with Bitcoin spreads starting from 12 USD, whilst the next nearest competitor was IC Markets at 18.2 USD.

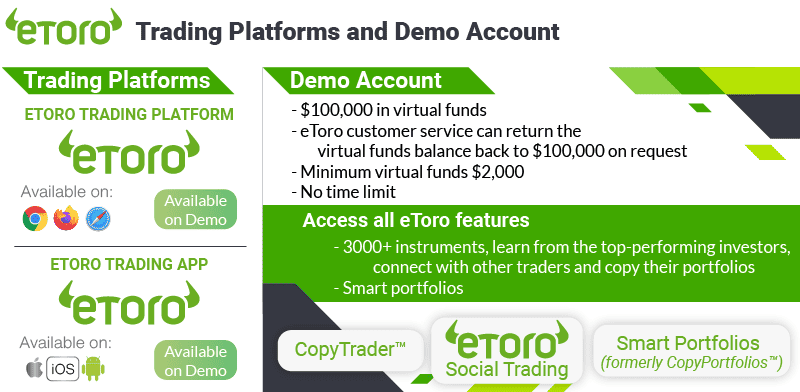

7. eToro - Top Demo Account For Social And Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why I Recommend eToro

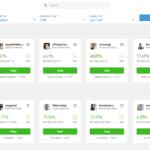

eToro’s reputation for social trading is well-deserved, and my testing confirmed that the broker truly lives up to its name. I was particularly impressed by the simple and intuitive user interface, which makes eToro an excellent choice for those interested in copying other traders’ strategies within a dynamic community setting.

I would also like to mention that the platform is not only user-friendly but also makes it easy to follow and replicate the strategies of seasoned traders. Beginner traders and experienced traders will appreciate having this straightforward experience. Overall, I recommend eToro if you are looking to bypass the complexities of individual analysis and trade placements.

Pros & Cons

- Large community of 20 million users

- No management fees or hidden costs

- Singapore traders can copy 100 traders

- Offers a popular investor program

- High minimum deposit of USD 500

- Does not offer algorithmic trading

- The trader you copy may not be skilled

Broker Details

eToro is a globally renowned broker for social and copy trading, and my testing with a demo account confirmed this excellent reputation. The eToro trading platform comes with a generous $100,000 in virtual funds, combining manual trading and social trading.

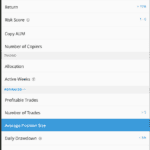

Copy Traders Risk-Free

I particularly appreciate the inclusion of the CopyTrader feature in the demo environment (with the same functionality as the live account), allowing me to pick traders to copy without risking real money.

Where the platform truly excels, however, is in its filtering capabilities. With over 2 million trader profiles to sift through, I found the 14 different settings incredibly useful for narrowing down my options. This singlehandedly demonstrated how precise and efficient the filter is in aligning the choices with my specific preferences and goals.

Commission-Free Spreads

Given eToro is a market maker, the broker only offers a commission-free Standard account, with spreads averaging 1 pip for the EUR/USD, which is the industry average. If you prefer having low spreads in a RAW account in exchange for a commission, then this could be a downside.

Another thing to note is that hedging and scalping is not permitted on eToro’s account, but you do have the option of algorithmic trading via copy trading.

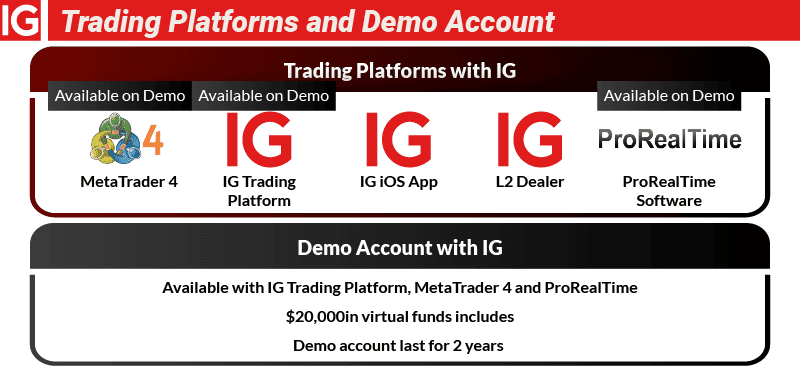

8. IG Group - Best Range of Trading Products for a Test Account

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why I Recommend IG Group

Like the majority of forex traders, I’m impressed by IG Group’s extensive range of trading instruments. In my opinion, this broker won in terms of having the best range of products, and if you seek to diversify trading portfolio, this will be a solid option.

I particularly like that I can trade with the IG trading platform, MT4 and L2 Dealer in IG Group’s demo account. The broker has allowed me to test multiple platforms before opening a live account.

What’s more is that demo accounts are good for 2 years, which is longer than any other broker I’ve tested. This can give you the right amount of time to master trading skills without time pressure.

Pros & Cons

- Biggest range of tradable markets

- Two-year demo account

- L2 Dealer, MT4 and IG platforms

- Platform-based trading differences

- Limited Customer service

- Slow execution speeds

Broker Details

While trading using IG Group’s demo account, one factor that stood out to me was the vast range of financial markets. The broker has 17,000 products, the most of any broker I’ve tested. This includes a diverse selection of asset classes including 80+ forex pairs, over 12,000 shares, 130 indices, 41 commodities, 15 cryptocurrencies, and more than 6,000 ETFs.

The demo account is also valid for 2 years, which is the longest out there, although $20,000 in virtual funds is relatively low compared to other top brokers. Nevertheless, IG Group offers multiple trading platforms you can test with on a demo account, including MT4, IG’s proprietary platform and ProRealTime, a technical analysis software.

While testing, I focussed on the broker’s flagship trading platform which opened access to the broker’s full range of products. I found the platform user-friendly whilst boasting an impressive charting package with over 28 indicators and trading signals from PIA First and AutoChartist, helpful in finding new trading ideas throughout the day.

For more complex technical analysts, I personally recommend that you use the ProRealTime feature. This stands out for the ProRealTrend tools that automate the drawing of support/resistance levels and trend lines.

Ask an Expert

How much does a forex trader earn in Singapore?

A professional trader can earn about $83,000 SGD per annum on average in Singapore however experienced traders can earn a lot more. Keep in mind that forex trading is risky so don’t trade more than you are prepared to lose.

What is the best demo account to try as a beginner?

Most brokers offer a free demo account to test their platform and most are much the same. The main feature that differentiates demo account is the trial period. OANDA for example does not have an expiry period, while Pepperstone has a generous 90 day trial period which can be extended if you sign up for a live account.