Automated Trading Platforms In Singapore

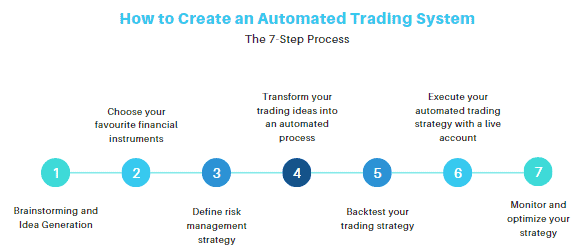

Automating your trading can save you time and improve the efficiency of your trading. There are different ways to automate your trading such as by trading algorithms, social trading, and forex robots, so it is important to select automation software that can do what you require.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The top Automated trading software for Singapore traders are:

- MetaTrader 4 - The Best Forex Algorithmic

- MetaTrader 5 - Best CFD Share Trading

- cTrader - The Top Robot Trading Software

- ProRealTime - Best Auto Trading

- eToro - Great Copy Trading Platform

- MT4 Signals - Top Social Trading

- Capitalise.ai - No Code Automation

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

1. MetaTrader 4 with Pepperstone - The Best Forex Algorithmic

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend MetaTrader 4

We recommend MetaTrader 4 because of its flexible order execution modes (3 modes and 3 order types), trading tools such as alerts, financial news and trading signals, interactive and customizable technical analysis package, as well as user-friendly mobile trading apps for Android and iOS devices.

It’s not just us, MetaTrader 4, already a standard for forex trading, is the most popular and the most commonly offered trading platform by forex brokerages.

That is why the MetaTrader 4 comes with a large online community where you can get help with any issues in programming in MetaQuotes Language 4, with developing automated trading systems, or with testing a particular strategy.

Pros & Cons

- Large online store of EAs

- Huge online community

- Backtesting capabilities

- Historical price data

- The quality of EAs may not always be as expected.

- Researching and backtesting of EAs are required before use.

- Only capable of handling 32-bit-memory automated trading software

Broker Details

MetaTrader 4, already a standard for Forex trading, is the most popular and the most commonly offered trading platform by forex brokerages. Along with its flexible order execution modes (3 modes and 3 order types), trading tools such as alerts, financial news and trading signals, interactive and customizable technical analysis package, as well as user-friendly mobile trading apps for Android and iOS devices, MetaTrader 4 is still regarded as offering the best support functionalities for Forex algorithmic trading.

| Copy Trading | Algorithmic Trading | Trading Robots | Forex Trading | CFDs Trading | Programming Language | |

|---|---|---|---|---|---|---|

| MT4 Expert Advisors | ✔ | ✔ | ✔ | ✔ | ✔ | MQL4 |

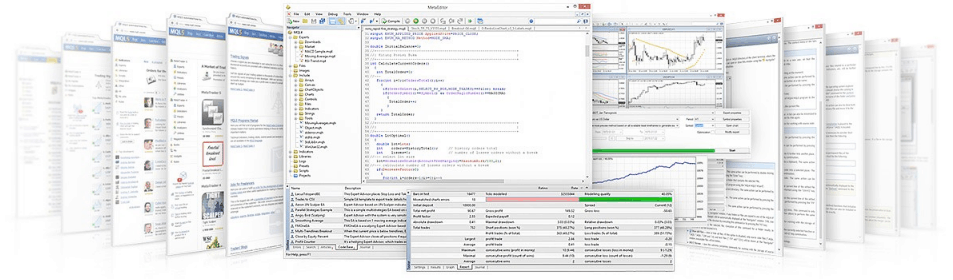

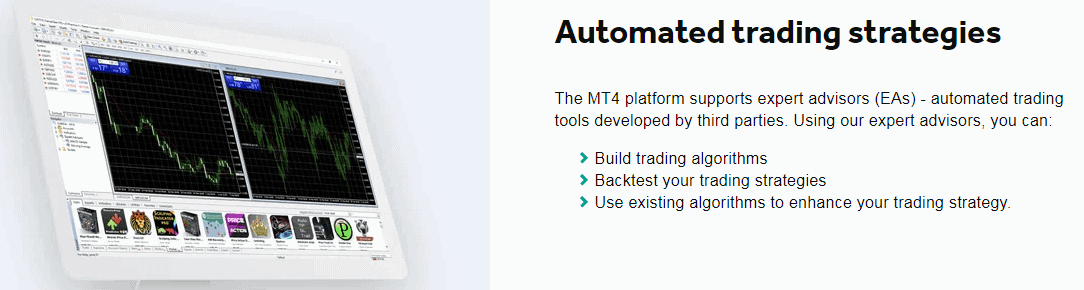

Algorithmic Trading With MetaTrader 4 Forex Trading Platform

One of the most notable strengths of MetaTrader 4 is the MQL4 Integrated Development Environment (IDE), which allows for the development, testing and use of expert advisors and technical indicators for algorithmic trading. The core of the IDE is the MQL4 programming language, with the help of which users can build algorithms for expert advisors focused on buying/selling particular financial instruments, monitoring financial markets and exploring potential trading opportunities.

Other key components of MetaTrader 4’s IDE include:

- The MetaEditor,

- And the Strategy Tester.

Trading strategies developed in the MetaEditor are automatically moved to the MT4 trading platform so that users can further test and optimize them in the Strategy Tester. Once a trading strategy has been compiled and tested, users will be able to run it into the MT4 platform.

MetaTrader 4 Advantages And Features For Automated Trading

5 advantages of using MetaTrader 4’s Forex expert advisors:

- Large online store of EAs

- Huge online community

- Backtesting capabilities

- Historical price data

- Notifications and alerts

Algorithmic trading (automated trading) is one of the strongest features of MetaTrader 4 allowing you to develop, test and apply Expert Advisors and technical indicators.

MetaTrader 4 is not solely about trading strategy development. It also grants users access to the world’s largest marketplace of trading applications, containing more than 1,700 expert advisors and more than 2,100 technical indicators.

MT4 also has a huge online community, where Singapore-based traders can easily find assistance if they have experienced issues with programming in MetaQuotes Language 4, with developing automated trading systems, or with testing a particular strategy.

Disadvantages Of Automated Forex Trading Via MT4

Yet, there are also certain disadvantages we should point out. First, the quality of expert advisors may not always be as expected. Singapore-based traders can acquire an expert advisor on MT4’s marketplace at a relatively low cost, but they need to research and backtest that EA before running it on a live trading account.

Second, backtesting an EA means running a particular strategy against real historical data in order to optimize its performance. However, backtesting performance may be affected by memory capacity, because MetaTrader 4 is capable of handling only 32-bit-memory automated trading software. Programs requiring more in terms of memory capacity may cause issues. Additionally, only one financial instrument at a time (a Forex pair such as EUR/USD, or a Stock Index CFD such as SPX 500) can be tested in MT4’s Strategy Tester.

Expert Advisors For CFD Trading

Third, the trading platform grants access to Forex products and CFDs on multiple asset classes (cryptocurrencies such as Bitcoin or Litecoin, commodities and stock indices), with the exception of real Stocks. Since the Stock market is centralized by nature (trading is conducted through centralized exchanges), Shares are not accessible on MT4 while expert advisors are not suitable for stock trading.

And finally, MetaTrader 4 has no customer support. If traders require any assistance or advice, they can either contact the Forex broker’s support team or look for a solution within the vast MetaTrader 4 online community.

If you are looking for a broker that offers MetaTrader 4, along with an excellent range of features to take full advantage of the trading platform then we recommend Pepperstone. You can read more about this broker in our Pepperstone review

2. MetaTrader 5 with IC Markets - Best CFD Share Trading

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend MetaTrader 5

We recommend MT5 because it offers 38 technical indicators, 46 analytical objects, 4 execution modes, 6 pending order types, 21 timeframes and access to Level II pricing (market depth).

We like it almost as much as its predecessor MT4 because the MT5 platform is designed to be used for trading derivatives requiring access to centralized exchanges like the New York Stock Exchange (NYSE). So, you can trade asset classes such as equities, mutual funds and futures on MetaTrader 5.

Pros & Cons

- Algo trading can be applied to a wider range of assets such as shares and futures CFDs.

- Allows for multithreaded backtesting.

- It can communicate with 4 servers at a time (a trading server, an access server, a history server and a backup server.)

- 64-bit memory capacity.

- The online community is not as vast as MT4.

- The marketplace is more limited compared to MT4.

- You cannot run expert advisors developed in MQL4 for MT4 on the MT5 platform.

Broker Details

MetaTrader 5 is a multi-asset trading platform based on a simpler programming language and features enhanced backtesting capabilities. What MT5 offers are 38 technical indicators, 46 analytical objects, 4 execution modes, 6 pending order types, 21-time frames and access to Level II pricing (market depth).

Unlike its predecessor MT4, the MT5 platform is designed to be used for trading derivatives requiring access to centralized exchanges like the New York Stock Exchange (NYSE). So, users can trade asset classes such as stocks, mutual funds and futures on MetaTrader 5.

| Copy Trading | Algorithmic Trading | Trading Robots | Forex Trading | CFDs Trading | Programming Language | |

|---|---|---|---|---|---|---|

| MT5 Expert Advisors | ✔ | ✔ | ✔ | ✔ | ✔ | MQL5 |

Algorithmic Trading With MetaTrader 5 CFD Trading Platform

Algorithmic Trading With MetaTrader 5 CFD Trading Platform

MetaTrader 5 utilises MetaQuotes Language 5 coding language, based on C++. Because of this, traders cannot run expert advisors developed in MQL4 for MT4 on the MT5 platform. MT5 EAs need to be built by using the MQL5 programming language.

The MT5 is the best platform for creating 4 types of applications:

Trading robots – are computer programs with a defined set of instructions that automates all your trading decisions.

Trading robots – are computer programs with a defined set of instructions that automates all your trading decisions. Custom indicators – are chart analysis tools independently developed by MT5 users that generate signals based on the historical price and volume data of a financial instrument.

Custom indicators – are chart analysis tools independently developed by MT5 users that generate signals based on the historical price and volume data of a financial instrument.

- Scrip – are a little piece of programs designed to perform analytical or trading functions that are meant to be executed only one time.

- Libraries – are files that can’t be executed by themselves, they are merely templates that store custom functions that are easily accessible to be used as part of other automated strategies.

Multi-Asset Trading Software

With MT5, algorithmic trading can be applied to a wider range of assets, including Shares and Futures CFDs. But what is even more, the platform allows for multithreaded backtesting, or users are able to test numerous financial instruments simultaneously, unlike the case with MetaTrader 4. This can be very useful if users intend to backtest a particular EA against a number of instruments (EUR/USD, Gold, Bitcoin, etc.).

Additionally, MetaTrader 5 is designed to communicate with 4 servers at one time – a trading server, an access server, a history server and a backup server, thus, the platform has better backtesting capabilities compared to MT4.

MetaTrader 5 Faster Server

Another advantage of MT5 over MT4 includes MetaTrader 5’s 64-bit memory capacity. This means that the platform is capable of handling both 32-bit and 64-bit EAs. If users can create quality expert advisors that utilize higher memory capacity, this can result in faster algorithmic trading. Because of its 64-bit memory and 4 servers, MT5 also enables traders to avoid potential slippage, as the workload is high.

Cons Of MT5 Expert Advisors

As for disadvantages in using EAs on MetaTrader 5, perhaps the most notable one lies in the fact that the MT5 online community is not that vast compared to the MT4 community. As a result, the MT5 marketplace is also more limited compared to that of MT4.

However, with support for older versions of MetaTrader 4 now discontinued, it is very likely that the MetaTrader 5 platform will continue to gain popularity, including among Singapore-based traders, and its marketplace will probably expand further.

MetaTrader 5 can also be accessed by non-MetaTrader forex brokers like Interactive Brokers through the oneZero Hub Gateway so that IBKR account holders can access the MT5 platform.

See our IC Markets Review, to find out why it is one of the Best MT5 Brokers in Singapore.

3. cTrader with FxPro - The Top Robot Trading Software

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.2

AUD/USD = 0.5

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$0

Why We Recommend cTrader

We like cTrader because of its rich chart and watchlist customization options, cTrader also features the ChartShot tool that allows traders to share trading examples or technical strategies with others.

The platform offers 70 built-in technical indicators, 33 analytical objects, 9 chart types, 54 timeframes and 6 zoom levels per time frame.

cTrader is specifically designed for use with ECN Forex brokers such as IC Markets, Pepperstone, FxPro and so on.

Pros & Cons

- Suitable for forex trading with margin.

- Allows you to place as much detail as possible in your trading strategy.

- Easy-to-use built-in code editor.

- Allows traders to share trading examples and strategies.

- The online community is relatively small

- Smaller marketplace of tools.

- Limited broker availability.

Broker Details

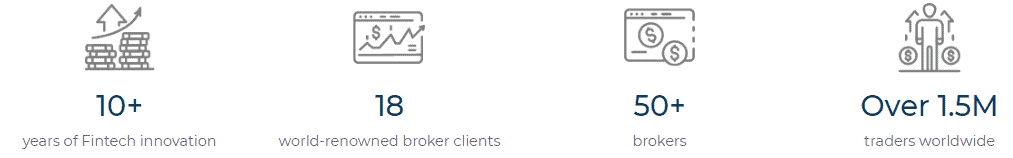

Developed by Spotware Systems Ltd, cTrader is a trading platform specifically designed for use with ECN Forex brokers such as IC Markets, Pepperstone, FxPro and so on.

The platform offers 70 built-in technical indicators, 33 analytical objects, 9 chart types, 54-time frames and 6 zoom levels per time frame. Along with its rich chart and watchlist customization options, cTrader also features the ChartShot tool that allows traders to share trading examples or technical strategies with others.

| Copy Trading | Algorithmic Trading | Trading Robots | Forex Trading | CFDs Trading | Programming Language | |

|---|---|---|---|---|---|---|

| cTrader - cTrader Automated | ✔ | ✔ | ✔ | ✔ | ✔ | C# |

Taking Advantage Of Market Volatility Through Automated Trading With cTrader’s cAlgo

cTrader Automate, or cAlgo, is cTrader’s natively integrated algorithmic trading solution, which enables traders to build trading robots and custom indicators based on the C# programming language and a proprietary cTrader API.

Millions of developers are already coding in C#, so traders can access a large and thriving community without having to learn a new programming language for a single platform.

The API itself is designed to suit the needs of Forex trading on margin and includes all order types, all order modification options, market data and trading history, pre-built indicators, financial instruments and connectivity, all of which with the purpose to incorporate as much detail as possible into a trading strategy.

Visual Studio is cAlgo’s built-in code editor, which makes code writing for trading robots or custom indicators as straightforward as possible for users.

cAlgo also features the “plug and play” functionality, with which traders can load a trading robot or a custom indicator and click “play” to begin trading instantly, which saves them the prolonged installation procedures. The “plug and play” feature makes it possible for cBots to be installed and run within seconds.

cAlgo has a set of valuable features such as visual backtesting, advanced optimization, backtesting history, deal map among others.

| Feature | Visual Backtesting | Optimization | Historical Data | Trade Statistics | Backtesting History | Deal Map |

|---|---|---|---|---|---|---|

| Description | Allows you to visualize your performance | Allows to fine-tune your strategy | Historical price data for a wide range of instruments | Net Profit, Max Balance Drawdown, Max Equity Drawdown, Winning Trades, etc | Full history of your backtesting results | Visualize the trading results on the price chart |

In addition, Singapore-based institutional, professional and high-frequency retail traders can access cTrader’s FIX API trading interface free of charge. The API, which is based on the FIX protocol, communicates directly with the cTrader server through FIX messages (electronic messages with financial data commonly used in electronic trading). cTrader’s FIX API has certain advantages, including:

Last but not least, we should note that, while smaller if compared to MetaTrader 4, cTrader has a constantly growing online community of traders and financial experts.

If you wish to trade with cTrader, we suggest FxPro. You can read more about them in our FxPro Review

4. ProRealTime with IG Group - Best Auto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend ProRealTime

We recommend ProRealTime for experienced traders who use advanced technical analysis and want market access to a variety of asset classes (currency pairs, Stock CFDs, Commodity CFDs, Stock Index CFDs, Cryptocurrencies, ETFs etc.).

This trading software offers more than 100 technical indicators, 8 order types, a wide range of time frames, as well as cutting-edge market scanning tools.

Pros & Cons

- Doesn’t require VPS hosting.

- Backtest trading strategies against 30 years of data or live data.

- Import strategies from third parties.

- Supports advanced technical analysis.

- Not suitable for beginners.

- Smaller online community.

- May be hard to find online resources for assistance.

Broker Details

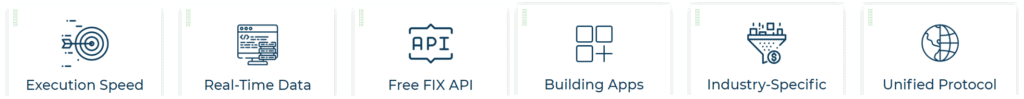

ProRealTime is a leading web-based charting package, designed for experienced traders who use advanced technical analysis, prefer to automate their trades and want market access to a variety of asset classes (currency pairs, Stock CFDs, Commodity CFDs, Stock Index CFDs, Cryptocurrencies, ETFs etc.). This trading software offers more than 100 technical indicators, 8 order types, a wide range of time frames as well as cutting-edge market scanning tools.

| Copy Trading | Algorithmic Trading | Trading Robots | Forex Trading | CFDs Trading | Programming Language | |

|---|---|---|---|---|---|---|

| ProRealTime | ✘ | ✔ | ✔ | ✔ | ✔ | Visual Basic |

ProRealTime Delivers The Best Automated Trading Experience

ProRealTime allows users to build their trading algorithms either with:

- Assisted creation tools,

- Or via coding.

The software’s wizard allows users to create and specify their own trading requirements without writing any code. By using accessible drop-down menus, traders can specify trading conditions, price objectives and Stop Loss levels. Once all desired conditions and parameters have been defined, the code will be compiled by a code generator.

ProBuilder Coding Language

Another option for users to build a trading algorithm includes the ProBuilder coding language, which has some similarities with Visual Basic. However, we should note that the ProRealTime online community is not that vast, especially if compared to that of MetaTrader 4, and it may not be a surprise if a user encounters difficulties to find the proper resources for his/her automation needs.

Note* If you use quantitative analysis then software like ProRealTime is a good start to begin algorithmic trading.

ProRealTime Backtesting Capabilities

On the other hand, ProRealTime allows traders to backtest their trading strategies against 30 years of historical data across a range of time frames. Strategy backtesting is also possible by using live market data.

The platform also allows traders to import strategies, including ones developed by third parties.

ProRealTime Doesn’t Require VPS Hosting

When it comes to running automation tools, we should note that ProReal Time runs through a server of its own. In other words, the automated strategies will continue running even if a trader is offline. That is a notable difference from running expert advisors or trading robots on MetaTrader and cTrader platforms, which require a running PC or a VPS.

Easily create automatic trading systems and execute them even when your computer is off.

Among the best global brokerages, which Singapore-based traders can access the ProRealTime charting software, is IG Markets or Interactive Brokers. ProRealTime’s main competitors are thinkorswim, eSignal, and NinjaTrader.

IG Markets is one of the few major forex brokers that offer ProRealTime. You can read more about this broker in our IG Markets review.

5. eToro - Best Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

In our view, eToro is the best platform for copy trading in Singapore. This is a leading online trading brokerage and one of the originators and innovators of the copy trading field.

Over the past decade, the company’s social trading network has seen tremendous growth and, at present, over 20 million users from 140 countries share their trading ideas and expertise by using eToro’s platform.

There are no management fees or other hidden costs.

Pros & Cons

- A large community of over 20 million users.

- No management fees or hidden costs.

- Singapore-based traders can copy up to 100 traders simultaneously.

- Offers a popular investor program for those who want to sell their expertise.

- High minimum deposit of USD 500.

- Is suitable for automated copy trading but does not offer algorithmic trading.

- The trader you copy may not be skilled enough.

Broker Details

eToro is the best platform for copy trading in Singapore. This is a leading online trading brokerage, and one of the originators and innovators of the copy trading field. Over the past decade, the company’s social trading network has seen tremendous growth and, at present, over 20 million users from 140 countries share their trading ideas and expertise by using eToro’s platform.

| Copy Trading | Algorithmic Trading | Trading Robots | Forex Trading | CFDs Trading | Programming Language | |

|---|---|---|---|---|---|---|

| eToro | ✘ | ✔ | ✔ | ✔ | ✔ | N/A |

Automated Trading With eToro’s CopyTrader

CopyTrader is eToro’s automated trading solution, which brings benefits for both inexperienced traders and people who lack the time to closely monitor developments in the global markets. The feature allows them to automatically replicate the trading activity of other users on the network directly into their own eToro trading account.

Note* There are no management fees or other hidden costs.

The minimum deposit at eToro is USD 500. Singapore-based eToro clients will be able to copy up to 100 traders simultaneously and will have control over the copy, as they can pause or stop it, add or remove funds at any time and set a Stop Loss for the copy. We should also note that the value of every copied trade needs to be at least $2.

The Popular Investor Program

eToro also offers benefits to traders with a proven trading system. They can earn a second income, paid by the broker monthly, by being copied by other eToro clients, if they join the broker’s Popular Investor program. To do so, traders need to satisfy a set of requirements concerning minimum equity, maximum risk score, min. AUM, leverage restrictions (if applicable) and so on.

The Popular Investor program includes 4 different tiers – Cadet, Champion, Elite and Elite Pro, each with its minimum requirements and particular benefits.

| Cadet | Champion | Elite | Elite Pro | |

|---|---|---|---|---|

| Minimum copiers | 1 | 10 | 10 | 10 |

| Minimum time on level | 2 Months | 4 Months | 2 Months | N/A |

| Profile Photo | ✔ | ✔ | ✔ | ✔ |

| Trading bio | ✔ | ✔ | ✔ | ✔ |

| Maximum Risk Score | 6 | 6 | 6 | 6 |

| Leverage restrictions | ✔ | ✔ | ✔ | ✔ |

eToro’s Copy Portfolios

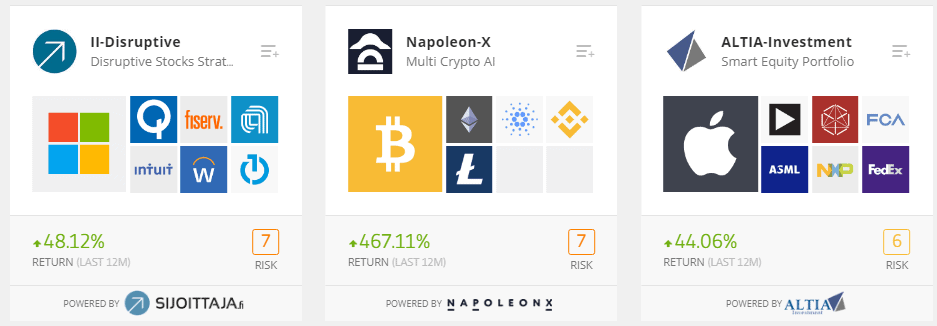

eToro brings copy trading on an even higher level with another unique feature, known as CopyPortfolios. It is an investment product that bundles together a collection of financial assets and requires a minimum investment amount of $5,000.

CopyPortfolios may include either a selection of top-performing traders on the broker’s network (Top Trader Portfolio) or a selection of financial instruments such as Stock CFDs, ETFs or Commodities (Market Portfolio).

To find out more about this broker, have a read of our eToro review.

6. MT4 Signals - Top Social Trading

Forex Panel Score

Average Spread

N/A

Trading Platforms

N/A

Minimum Deposit

N/A

Why We Recommend MT4 Signals

What we love about MT4 Signals is that it can be tested on a free demo account with almost any brokerage that offers MetaTrader 4.

When it comes to social trading options, Singapore-based retail traders may find the MetaTrader 4 trading signals tool as one of the better choices because it allows them to replicate the trading activity of experienced traders without effort in real-time directly into their live brokerage account. Besides, traders will not need to leave the trading platform.

Pros & Cons

- Choose from more than 3,200 free and paid-for trading signals.

- Seasoned traders with a proven approach to financial markets can earn extra income by becoming signal providers.

- Access a multitude of trading systems from within the huge MT4 trading community.

- The cost of social signals can be high.

- It’s important to be careful since not all signal providers are trustworthy.

- Can be higher risk.

Broker Details

When it comes to social trading options, Singapore-based retail traders may find the MetaTrader 4 trading signals tool as one of the better choices because it allows them to replicate the trading activity of experienced traders without effort in real-time directly into their live brokerage account. Besides, traders will not need to leave the trading platform. It is also worth noting that the MT4 signal service can be tested on a free demo account with almost any brokerage that offers MetaTrader 4.

MT4 Signals Advantages

MT4 Signals has certain benefits for both beginners and experienced traders:

- Beginners are able to choose from more than 3,200 free and paid-for trading signals and access a multitude of trading systems from within the huge MT4 trading community.

- Seasoned traders with a proven approach to financial markets are able to earn extra income by becoming signal providers. As they share their trading system with millions of other users, they can earn trading fees from their subscribers.

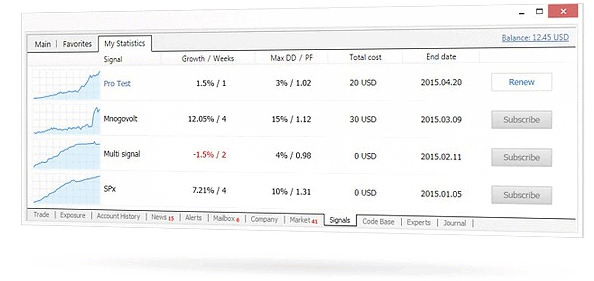

Selecting Trading Signals

Singapore-based traders can access the list of signal providers in the “Signals” tab of MetaTrader 4’s terminal window. All providers are presented by their trading results, with the most successful ones being shown at the top. Traders can select signal providers based on parameters such as the number of subscribers, trading history, funds under management, percentage of growth, max drawdown and so on. Once a provider has been selected, traders can subscribe to his/her signals.

In case Singaporean traders opt to use MT4 Signals with true ECN brokerages such as IC Markets, Pepperstone or FP Markets, they will be able to enjoy fast and reliable order execution with minimum slippage and no re-quotes as well as low-cost Forex and CFD trading. They will also be able to take advantage of various trading styles – from scalping and day trading to swing trading copy trades.

| Brokers with MT4 Signals | Pepperstone | IC Markets | FP Markets | Markets.com | FxPro |

|---|

At the same time, if Singapore-based clients opt to use MT4 Signals with brokers such as Markets.com and FP Markets, they will be able to access more than 2,000 financial instruments and copy various trading strategies across multiple asset classes.

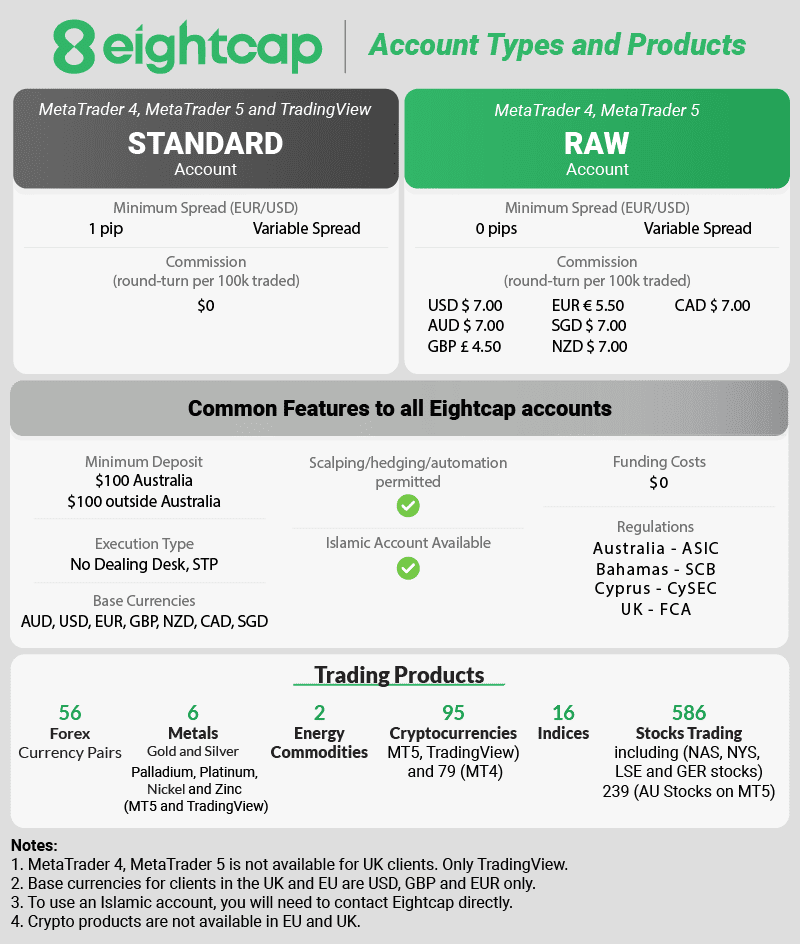

7. Capitalise.ai with Eightcap - No Code Automation

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$250

Why We Recommend Capitalise.ai

We love Capitalise because it’s one of the few no-code automation solutions out there for forex and CFD trading. We tried the platform and it is possible to build full-fledged automated trading strategies by providing plain English instructions to the tool. Some of the types of instructions that you can provide include timing your trades, dynamic entry pricing, trailing stop losses, and so on.

Pros & Cons

- No-code automation by providing instructions in plain English.

- Use macroeconomic events to trigger activity.

- Offers backtesting.

- Lacks the sophistication possible with code-based automation.

- No pre-built strategies.

- Limited range of partner brokers.

Broker Details

We liked the fact that the platform is completely free, at least for now. It’s a new concept so that means that it comes with its own risks. It’s advisable to use the platform and get familiar with it by using paper money before investing real money through the platform.

There will be a bit of a learning curve when building strategies using the platform, but we find that much easier than code-based automation. However, the level of detail that traders can reach with their trading strategies using code-based automation is absent.

We find that the tool works best when your instructions are kept simple. For example, buy USD/EUR when price hits 1.10.

We like the decently extensive resource library that they have created to help you get started on the platform. However, we noticed that they don’t offer any pre-built strategy examples that you can use as a basis for formulating your own strategies.

Since they require a partner broker, we recommend using them through Eightcap.

Ask an Expert