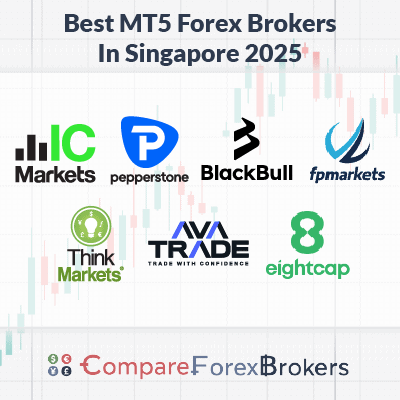

MT5 Brokers In Singapore

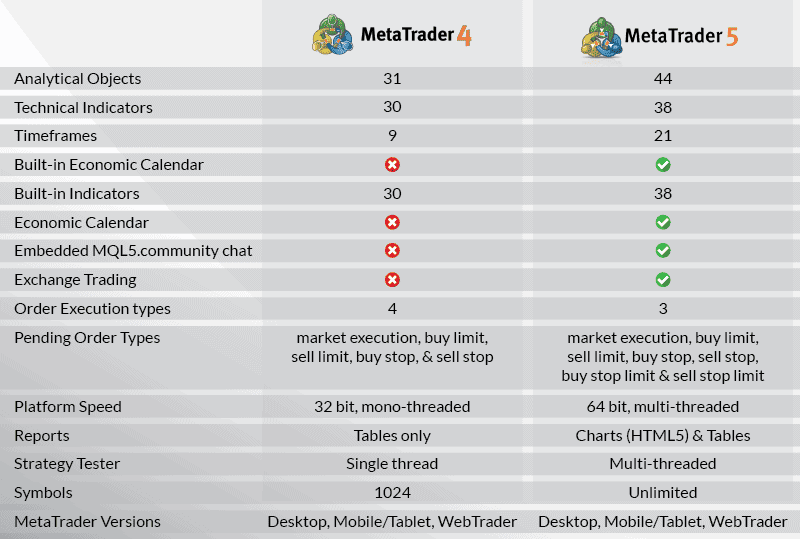

MetaTrader 5 (MT5) is an upgrade on MT4 with 44 analytical objects, 38 technical indicators and 21 timeframes. We review 6 of the best brokers with MT5 for Singapore traders including features such as costs, account types and trading platform.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

- IC Markets - Best MT5 Forex Broker Overall

- Pepperstone - Top MT5 Broker With RAW Spreads

- BlackBull Markets - Good Broker For MT5 Execution Speed

- FP Markets - Best Broker With MT5 For Scalping

- ThinkMarkets - Top Broker With VPS Service For MT5

- AvaTrade - Good Broker With MT5 For Day Trading

- Eightcap - Good Broker For Crypto Trading

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

1. IC Markets - Best MT5 Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We recommend IC Markets as the best MT5 Forex broker overall for its low-cost trading on MetaTrader 5. The broker is great for forex trading, offering an average spread of just 0.16 pips when you combine the major pairs, the joint lowest we’ve tested.

This is highly beneficial if you engage in high-volume or frequent trading, as it reduces transaction costs. Its MT5 platform with level 2 pricing provides complete transparency, showing a full range of prices directly from IC Market’s providers.

Pros & Cons

- Low average spreads

- Good range of markets

- Social trading tools

- Has a minimum deposit

- Different commissions on cTrader

Broker Details

With more than 180,000 clients worldwide, IC Markets is one of the largest Forex CFD providers in terms of Forex volume, with over US $1.2 trillion in trading volume as of March 2023. Where IC Markets stood out from our analysis, however, was its low spreads and advanced MT5 trading tools making it the best MT5 forex broker in Singapore.

Forex Trading With Ultra-Tight Spreads

From our testing, IC Markets has some of the lowest spreads trading with the MT5 trading platform.

Where IC Markets stood out was its Standard account, with lowest spreads against 15 other top brokers we tested. The broker averaged 1.03 pips across the USD major pairs, coming out on top overall. The next nearest broker was CMC Markets averaging 1.11 pips.

For our RAW spread testing, we found IC Markets averaged 0.32 pips across the 6 major currency pairs. This put the broker 3rd overall, just behind Fusion Markets (0.22 pips) and City Index (0.25 pips).

The combination of low spreads across both its account types, ensured IC Markets kept its trading costs low while we traded using MT5.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Advanced MT5 Trading Tools

IC Markets’ MetaTrader 5 platform gives you access to real-time quotes for the broker’s full range of markets on the desktop, Webtrader and mobile app. From our MT5 testing, we found the broker allowed multiple forms of trading including scalping, hedging, automated trading, social trading and copy trading.

In particular, we liked that IC Markets let you integrate popular copy trading and social trading tools like ZuluTrade and Myfxbook with MT5.

Other key highlights we found include real-time trade reporting, better control over risk with the use of micro lots and a built-in Economic Calendar to keep track of major macroeconomic reports and other key volatility-inducing events.

Broker Screenshots

2. Pepperstone - Top MT5 Broker With RAW Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.4

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Based on our tests, we recommend Pepperstone as a top MT5 broker with RAW spreads. The broker offers exceptionally tight spreads, averaging 0.1 pips on EUR/USD with the Razor account, over 50% better than the industry average.

Pepperstone received a 99/100 in our review, making it our highest-rated broker. Its excellence in trading services is evident through its solid variety of platforms, industry-low trading costs, and outstanding customer service.

Pros & Cons

- Low average RAW spreads

- Fast execution speeds

- Weekly educational webinars

- Lacks a guaranteed stop-loss

- Demo account expires

- Limited crypto selection

Broker Details

Pepperstone is a leading Australian CFD and Forex broker regulated in a number of top-tier jurisdictions worldwide. We selected Pepperstone as one of the best forex brokers with MetaTrader 5 based on the broker’s low RAW spreads. We also rate Pepperstone highly for its diverse range of trading platforms and Smart Trader Tools, a MetaTrader enhancement.

Competitive RAW Account Spreads

You can start trading with either Pepperstone’s Standard and Razor account, but it is the broker’s Razor (Raw spread) account where you’ll obtain the lowest spreads. From our spread analysis, Pepperstone achieved average spreads of 0.1 pips for EUR/USD.

As highlighted from our spread module below, Pepperstone’s RAW spreads comes out on top when compared to other top brokers such as IG Group and XTB.

Having consistently low spreads reduces your trading costs, especially during volatile market conditions when spreads can fluctuate wildly.

Fast Execution Speeds

From our execution speed testing, Pepperstone is one of the fastest brokers we’ve seen in Singapore. Testing against 20 other top brokers, Pepperstone was the third fastest broker overall with speeds of 77ms for limit orders and 100ms for market orders.

Only BlackBull Markets (72ms and 90ms) and Fusion Markets (79ms and 77ms) achieved faster speeds from our testing.

We found Pepperstone’s fast execution speeds reduced our latency at the point of trade execution, resulting in a more consistent (and lower) spread.

While we tested on MT4, MT5 is a faster and more powerful platform so will almost certainly achieve the same, if not better, results.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

| FP Markets | 10 | 225 | 20 | 96 | 4 |

| IC Markets | 10 | 134 | 10 | 153 | 14 |

| CMC Markets | 16 | 138 | 11 | 180 | 17 |

| ThinkMarkets | 20 | 161 | 18 | 248 | 20 |

MetaTrader 5 Enhancements

Pepperstone not only offers both MetaTrader platforms, but Smart Trader Tools, an MetaTrader enhancement tool that we think elevates the broker as one of the top MT5 brokers.

When testing the 28 apps included in the Smart Trader Tools add-on, we particularly liked the Trade Terminal and Mini Trade Terminal. The Trade Terminal allowed us to easily set stop loss or take profit levels across all of our open orders by the same pip distance (E.g. 30 pips away).

Similarly, the Mini Terminal allowed us to create an order template for lot sizes, stop loss and take profit levels across all of our new orders.

Both of these tools made it much smoother and quicker to manage the risk profile of trading activities, both open orders and new orders.

Broker Screenshots

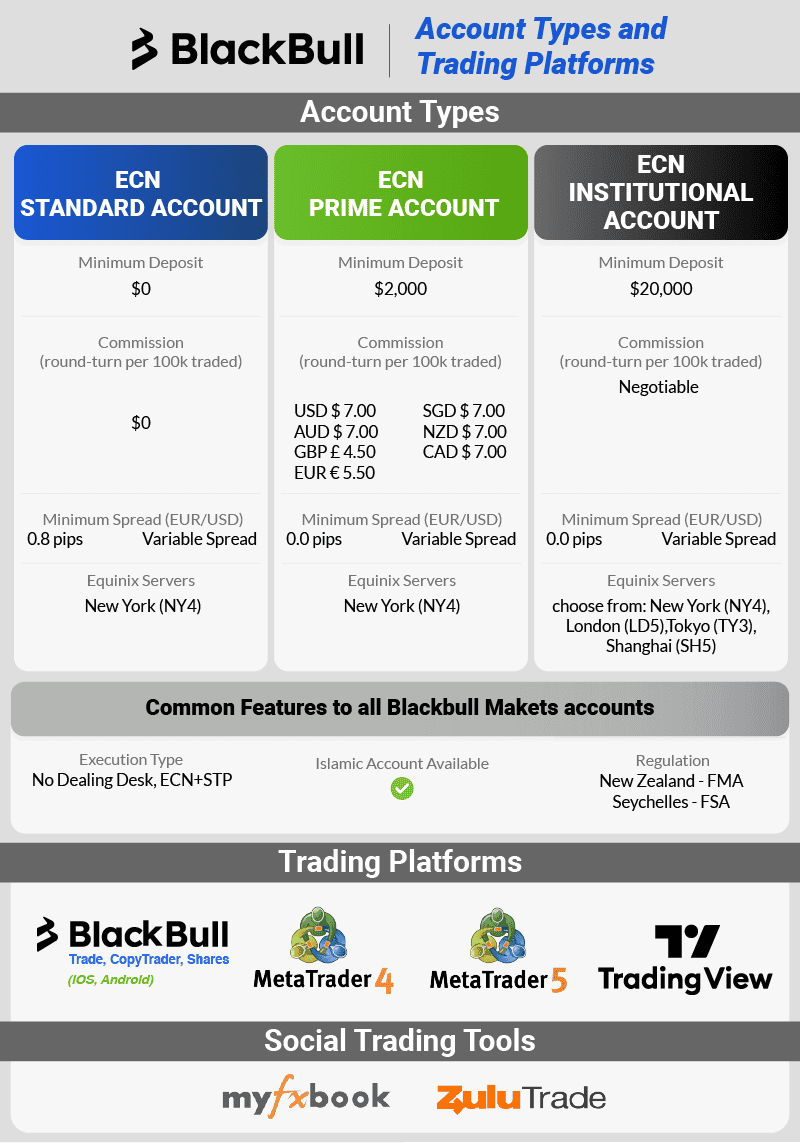

3. BlackBull Markets - Good Broker For MT5 Execution Speed

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We recommend BlackBull Markets as a good broker for MT5 execution speed based on our independent testing. BlackBull Markets has the fastest execution speeds we’ve tested, averaging 77 ms for limit orders and 90 ms for market orders (anything less than a second is excellent).

This fast execution is a major advantage, especially if you trade frequently. It means your trades are executed almost instantaneously, reducing the risk of price slippage and ensuring you get the prices you ask for.

Pros & Cons

- Fast execution speeds

- Decent choice of markets

- MT4, MT5, cTrader, TradingView platforms

- Has a high minimum deposit

- Spreads aren’t the lowest

- Does not have tier-1 regulator

Broker Details

BlackBull Markets earned top marks for execution speeds, being our fastest MT5 broker overall. We also liked the broker’s excellent platform tools, including FIX API trading, which improved our MT5 trading experience overall.

Fastest Execution Speeds

Based on our execution speeds testing, BlackBull Markets is the fastest MT5 broker overall. The broker averaged execution speeds of 72 ms for limit orders and 90 ms for market orders, putting it at the top of our list.

As mentioned above, we found having fast execution speeds lowered our latency in order execution, which greatly reduced our risk of slippage.

Excellent Trading Platform Tools

Other than MT5, BlackBull Markets offers a solid range of platforms, including MT4, cTrader and TradingView.

When trading with MT5, we particularly appreciated utilising the broker’s VPS (Virtual Private Server) and API FIX service, which gave us better trading connectivity, faster execution speeds and lower latency.

The broker also offers a range of the useful add-on trading tools including an MyFxBook integration for MetaTrader 4, as well as ZuluTrade and Hokocloud.

Broker Screenshots

4. FP Markets - Best Broker With MT5 For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets offer incredibly tight RAW spreads, averaging at 0.1 pips, and in our tests, they provided zero spreads on EUR/USD 97.83% of the time. This is a huge benefit if you’re a scalper because the cost of each trade is minimised, maximising your potential profits from small price movements.

Scalping requires fast and frequent trades, and with FP Markets’ almost non-existent spreads, you get an optimal environment for this trading style.

Pros & Cons

- Zero-spreads available

- Fast execution

- Sold selection of markets

- Mobile app lacks most features

- Limited share choice on MT5

- Educational eBooks are basic

Broker Details

With over 15 years of business history and more than 30 Industry Awards, FP Markets is one of the best trusted global CFD and Forex brokers. Where FP Markets stands out to us, however, is for scalping due to the broker’s competitive spreads and fast market execution speeds on the MT5 platform.

Tight Spreads for MT5 Trading

From our spreads analysis, Muslim clients can take advantage of true ECN pricing with very competitive spreads for the broker’s Standard and RAW accounts.

Against the industry average of 0.45 pips, FP Markets achieved RAW account spreads of 0.22 pips for the top 5 most traded currency pairs. For its Standard account, FP Markets’ averaged 1.30 pips against the industry average of 1.52 pips for the top 5 majors.

Commissions CAD $7, which is the industry average, but having such tight spreads keeps your trading costs low, regardless.

The good news is, trading with MT5 will give you access to the majority of the broker’s products.

Fast Market Order Speeds

Our execution order speed testing of 20 top brokers revealed that FP Markets achieved fast market order speeds.

FP Markets had an average market order speed of 96ms which put the broker as the 4th fastest broker for market orders.

As such, when combining the broker’s tight spreads and fast execution speeds, we believe FP Markets is suited for scalpers who want low latency while entering and exiting positions over a short period of time.

5. ThinkMarkets - Top Broker With VPS Service For MT5

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets offers solid spreads on MT5, with average RAW spreads of 0.2 pips across the forex majors, one of the lowest average spreads we’ve recorded.

However, what truly sets ThinkMarkets apart is its VPS service, which ensures that your trading strategies run smoothly and continuously without any internet or power issues.

It’s valuable if you use Expert Advisors to automate your strategies, as it provides stability and constant connectivity to the markets while being able to run across all trading sessions.

Pros & Cons

- Decent spreads

- Offers VPS services

- Low minimum deposits

- RAW spreads unavailable on ThinkTrader

- Trading tools offered are unavailable on MT5

- Customer support is slow out of trading hours

Broker Details

ThinkMarkets is our top pick for the top brokerage with a VPS service for MT5. We also rank ThinkMarkets highlight for its competitive RAW spreads pip spreads, the broker achieving 0-pip spreads 95% of the time.

Top MT5 VPS Service

When we signed up for ThinkMarkets’ ThinkZero account, we were given access to a free VPS service, which made our trading experience very smooth with strong connectivity and low latency.

While a lot of brokers offer VPS services, not all are free and ThinkMarkets provided the additional benefits of 24/7 customer support and an account manager which gave us great customer service coverage and ensured our trading was hassle-free.

Competitive Raw Spreads

When analysing RAW spreads, ThinkMarkets offers ultra competitive average spreads of 0.20 pips for the 5 most traded currency pairs.

This put ThinkMarkets 4th in our list of most competitive RAW spread brokers, just behind Tickmill, IC Markets and Fusion Markets.

From testing ThinkMarkets’ ThinkZero (RAW) trading account, we had access to both MetaTrader 4 and MetaTrader 5 in a demo account. To use the broker’s own platform, ThinkTrader, we had to open a Standard account.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

6. AvaTrade - Good Broker With MT5 For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is a solid pick with the MetaTrader 5 platform for day trading, as the spreads offered are fixed and very competitive. The fixed spreads start from 0.9 pips on EUR/USD, which is impressive compared to the average variable spreads of 1.24 pips offered by other brokers.

Fixed spreads are ideal for day trading as they won’t widen (get expensive) during price spikes or news announcements, allowing you to trade without worrying about the spread.

Pros & Cons

- Tight fixed spreads

- Wide choice of markets

- Solid selection of trading platforms

- No RAW spread pricing

- High inactivity fees

- Options not available on MT5

Broker Details

We awarded AvaTrade as the best broker for day trading in Singapore because it offers the most competitive fixed-spread trading from our testing. We also scored the broker highly for its solid trading platforms and social trading tools.

Competitive Spreads For Day Trading

AvaTrade offers fixed spreads, which are different from the variable spreads that most brokers offer. When testing using MT5, we found AvaTrade offers stable fixed spreads of 0.9 pips while trading EUR/USD.

When we measured against the top 10 fixed spread brokers, AvaTrade came out on top, offering an average of 1.4 pips across the 7 most traded currency pairs. While you can obtain tighter spreads with a RAW/ECN-style account, AvaTrade’s fixed spreads are consistent enough to keep your trading costs low.

As such, this is why AvaTrade is suited for day trading where consistently low spreads are important.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Great Trading Platforms And Social Trading

We scored AvaTrade 8/10 for its trading platforms, with the broker offering a solid range of third-party and proprietary platforms.

In addition to both MetaTrader platforms, AvaTrade offers its own excellent AvaTradeGo platform, as well as speciality platform AvaOptions to trade options, to diversify your trading portfolio.

Lastly, we love AvaTrade’s range of copy trading options, which few brokers can boast, including the popular third-party platforms, DupliTrade and ZuluTrade, as well as its own, AvaSocial where you can copy successful trading strategies.

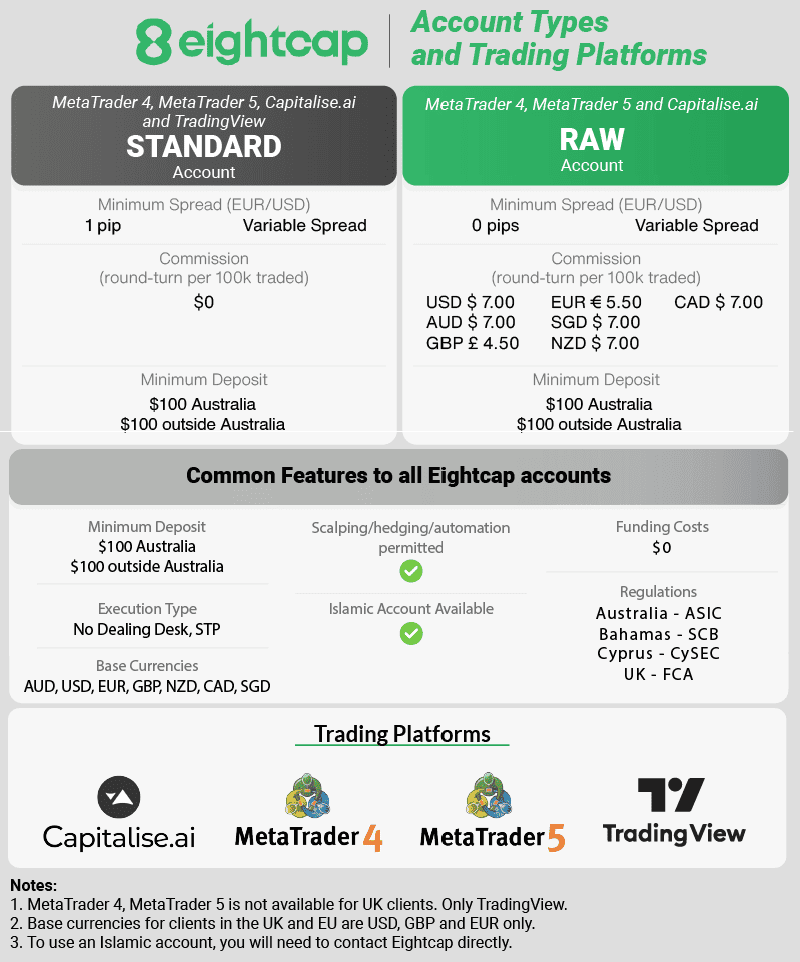

7. Eightcap - Good Broker For Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06

GBP/USD = 0.73

AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We recommend Eigthcap as they have 95 crypto products to trade, far more than any other broker. According to our tests, Eightcap also has 56 Forex pairs to trade with spreads averaging 0.06 pips for EUR/USD. To help your trading, you can you FlashTrader which adds stops and targets for every trade you make automatically.

Pros & Cons

- Largest range of cryptocurrencies

- Decent choice of markets

- MT4, MT5, TradingView

- Useful 3rd party tools

- Need better education

- Limited research and education suite

- 24/5 not 24/7 customer support

Broker Details

Top Crypto Offering for MT5

From our analysis of MT5 brokers, Eightcap is the best cryptocurrency broker with the most products (95), lowest spreads and best MT5 tools to trade them with.

Competitive Crypto Spreads with MT5

When our head of research, Ross Collins, tested average spreads for cryptocurrencies, he found Eightcap had the lowest spreads overall against other MT5 brokers such as eToro, IG Group and IC Markets.

As an example, Eightcap averaged 12 points for Bitcoin compared to the next nearest, IC Markets, at 18.2 pts.

From further analysis, we also found the broker offers the widest selection of cryptocurrencies with 95 cryptocurrencies. Compared to other MT5 brokers, Pepperstone offers 19 cryptos, IC Markets offers 25, and ThinkMarkets offers 27.

Top MT5 Tools

When we tested Eightcap’s platforms to trade its extensive crypto range, we found many helpful trading tools such as Capitalise.ai for code-free automation, and FlashTrader, which helps you manage your risk and trade faster.

To us, FlashTrader is the highlight. We liked that we could target multiple profits, calculate our position size, and place stops and limits in just one click, using our trade ticket. That way, we had more time and freedom to focus on our trading strategy without having to manually calculate our positions.

Ask an Expert

What is the largest market in Singapore?

Forex trading is the worlds largest market in terms of volume and it is no different in Singapore.