CFD vs Stock Trading Guide

This guide looks at trading CFDs vs Invest (in stocks). CFDs are a derivative where prices are matched to the underlying instrument. Stocks are a security where you own a stake in the company. We look at CFDs vs Invest in stocks in this guide.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

As a retail investor, it is important to be knowledgeable about your options when investing in the financial markets. Understanding your investments can help you:

- to develop a better investment portfolio,

- choose financial products that better match your interests and objectives, and

- improve your risk management.

Two popular financial instruments for investment are equities, commonly referred to as stocks, and CFDs which can be derived from a range of financial instruments such as forex, cryptocurrencies, equities, and indices.

In this article, we explain what equities and CFDs are, along with their benefits and drawbacks.

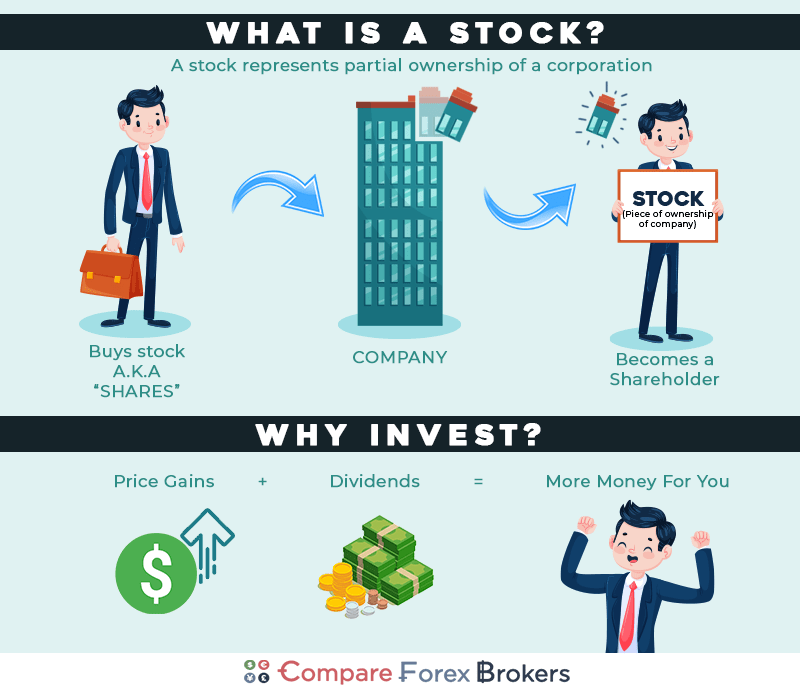

What Is A Stock?

To begin, let’s examine the differences between stocks and CFDs.

A stock, which is also known as a share or as equity, represents partial ownership of a company. The security will give you the rights to the residual claims of the company that you invest in. So, what does this mean?

How Stocks Tie Into The Corporate Financial Structure

For a company to finance its operations, whether it be to purchase new property, plant, and equipment, or to fund the research and development of a new product, the firm must raise capital.

Large credit-worthy companies, such as those listed on stock exchanges, can do this in three primary ways: by issuing debt (bonds, debentures, etc.), issuing preference stock, or issuing common stock.

We must understand all three of these instruments to properly know what a common stock represents.

Debt (Bonds)

A corporate bond is a type of debt. Most corporate bondholders are institutional investors who lend money to companies in a lump sum. They will then receive interest repayments, called coupons, periodically, and a lump sum of the lent amount at the end (maturity date).

Bondholders have the first right to the company’s resources if the company were to enter bankruptcy. This means if a company entered bankruptcy with $100 of assets, and the bond holders’ debt totals $100, they would be paid first. Preferred and common shareholders wouldn’t receive anything.

Preferred Shares

If, however, the company’s assets were $150, and the outstanding preferred stock equals $50, the preferred shareholders would get paid next. Preferred shareholders receive a fixed dividend, just like bondholders receive a fixed interest repayment.

Common Shares

Common shareholders have the right to the residual claims on a business. Thus, they would have the right to anything over and above the $150, should the board of directors choose to pay a dividend. They may also choose to retain the earnings and reinvest them in the company.

Also, note that common and preferred stock is perpetual. This means that there is no maturity or end date like bonds have. Additionally, common shareholders have voting rights on the executive team of the company.

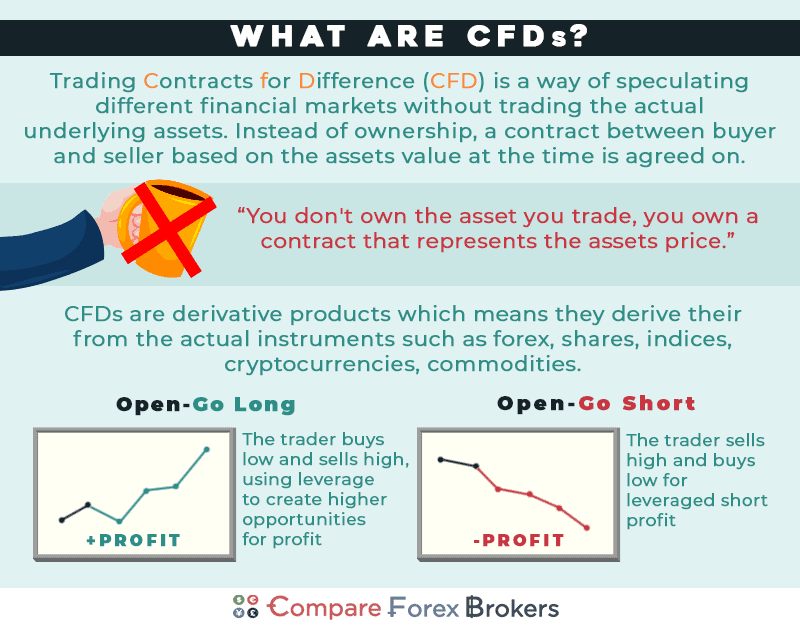

What Are CFDs?

Now that we have a decent understanding of common stock, we can start to understand what a CFD is.

CFD stands for “Contract For Difference”.

Given in the name, a CFD is a contract, an agreement, between two parties, to pay the difference between the current price and the future price at a predetermined future date.

The instrument to which the CFD is subject does not have to be common stock. The CFD can be a contract on equity, fixed income (bonds), indices, ETFs, forex (foreign exchange), cryptocurrency, commodities, energy, carbon emissions trading, or even inflation.

In short, a CFD can be based on any financial instrument.

It is important to note that CFDs are derivative instruments. A derivative “derives” its value from that of another instrument.

A common attraction to CFD trading is the opportunity to profit from the price movement of the underlying asset without actually owning the underlying asset. This means that you do not have voting rights as you don’t actually own a part of the company.

Another attraction to CFDs is that you can buy into long or short positions. A long position is where you bet that the price of the underlying asset will rise. A short position is when you would bet that the price of the underlying asset will fall.

Short Selling

Shorting stocks isn’t typically available to retail stock investors and is only utilised largely by bigger Wall Street hedge funds.

This is because when you buy a stock (take a long position), your risk is limited. Meaning that the most you can lose is the amount you paid for the stock. However, if you short a stock, the price can theoretically rise perpetually, and your losses could be unlimited.

The risk associated with leverage is called market risk.

How Long Does It Take To Receive My Cash Settlement?

When trading stocks, a broker must match buy and sell orders, and generally, it can take one to two days to receive cash in your account once the broker matches orders. This can be an issue for reinvestment if you have an active investment strategy.

When investing in a derivative like contracts for difference, you can typically trade CFDs in two ways.

You can buy a CFD through an over-the-counter (OTC) transaction, or through the Forex Brokers In Australia and trading platforms. The exchange and settlement of CFDs are facilitated by a third party (intermediary) called a clearinghouse.

For this reason, investors can expect their cash settlements from CFDs to be promptly in their trading account within minutes.

Risks With Trading Stocks vs Trading CFDs?

Market Risks

As with any investment, there are risks involved in trading Stocks and CFDs.

CFDs utilise the concept of leverage. Leverage, essentially, makes returns better, and losses worse. It magnifies the effect of returns, whether they be positive or negative.

To understand leverage, and the associated risk, let’s look at a worked example.

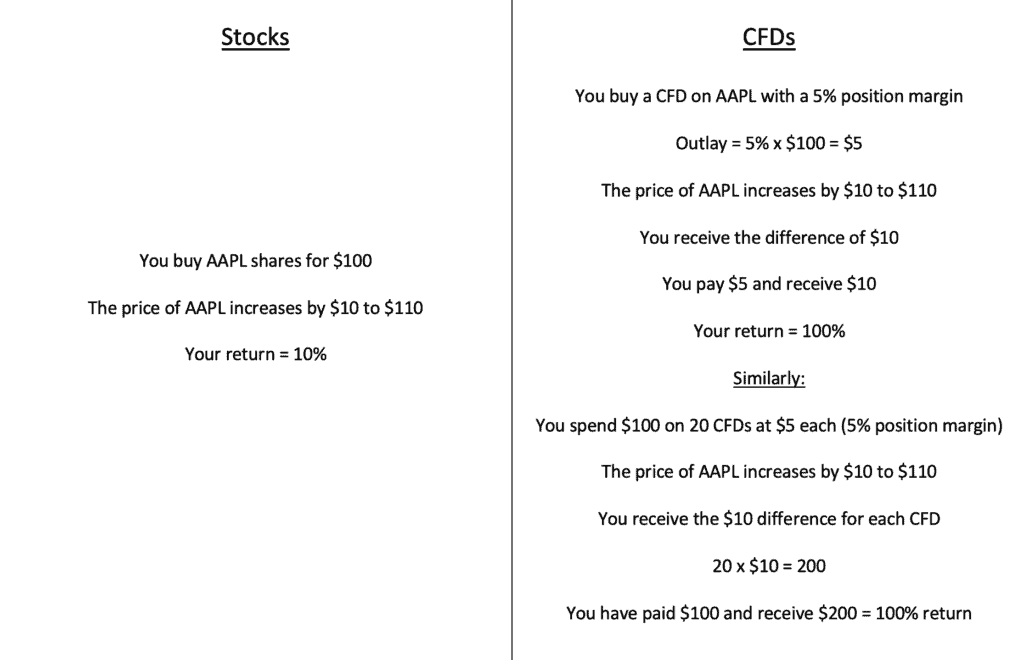

Say we are looking at Apple’s shares which are listed on the NASDAQ. Apple’s ticker symbol is AAPL.

Say AAPL is trading at $100 today and we have two investment options. We can buy the stock for $100, or we can buy a CFD.

The amount you pay for a CFD contract is called the Position Margin and is represented as a percentage of the share price. Sometimes this is also called an initial margin requirement – it is essentially the outlay of cash in the investment.

For example, if the price of the stock is $100, and we want to buy (go long) in a CFD that requires a 5% position margin, we pay $5.

As you have probably realised, we can buy 20 CFDs for the price of one stock.

So, what does this mean for our returns when there is a change in price?

Should the price of AAPL increase from $100 to $110, we receive a 10% return (if we bought a share).

If we have bought into a CFD position, we also receive the $10 difference, but we have only paid $5 for the CFD. This means that we have made 100% (Gain – Cost of the CFD = $10 – $5)

If we were to invest the same amount of money in CFDs as in AAPL stock we would return a $100 profit from $100, as opposed to a $10 profit.

However, while this may sound attractive, we must be very aware of our downside risk.

Conversely to the example above, if the price drops by 10%, you will lose double what you paid for the CFD. You will lose more than you actually paid for the CFD, unlike stocks where the most you can lose is the amount you paid for the stock.

Liquidation Risk

Liquidation risk refers to the risk of your position being liquidated.

How may this happen?

When the price moves unfavourably against the CFD, the broker may become worried that one party may not be able to cover their position. Because CFDs are leveraged and you can lose more than your initial investment, the broker needs to make sure the position can be covered.

For this reason, CFDs require a Maintenance Margin. A maintenance margin (sometimes called a variable margin) is a price, usually expressed as a percentage of the amount the CFD contract is for.

When the price of the underlying asset reaches the maintenance margin, a Margin Call (sometimes called a risk warning) is issued by the broker to the losing party of the CFD.

A margin call requires this party to add new cash to their position to bring the margin to an acceptable level.

If a party cannot cover their margin to bring it back to an acceptable level, then the broker may close (liquidate) the position at a loss to prevent further loss.

Regulators And Tax

Regulation regarding the sale and trade of CFDs, and the tax treatment for them, changes from country to country. In the United Kingdom, the Financial Conduct Authority (FCA) is the authoritative body that regulates the financial services industry and financial markets.

Stocks are considered a financial asset, and thus HMRC taxes them with a capital gains tax (CGT), stamp duty, and potentially dividend tax.

As mentioned, this varies from country to country. In New Zealand, there is no capital gains tax, but there is a tax on dividends called resident withholding tax (RWT). CFDs are not subject to stamp duty but are still subject to any capital gains taxes if applicable in your country. Likewise, with dividend tax if appropriate.

To understand the interest by region, you can view the Top Forex Trading Countries analysis done in 2026.

When Can I Trade Stocks And CFDs?

Generally, you will be restricted to stock trading while markets are open.

Stock exchanges have opening and closing hours that are more or less consistent with that of the working day and for five days a week – Monday to Friday. Usually, they aren’t open on public holidays.

For retail investors who may not necessarily work in the financial services industry, share trading can be a challenge as they must do their research and place orders outside the open hours of the market.

Many instruments, such as forex, commodities, and carbon emissions are traded 24 hours a day, 7 days a week. As with the underlying asset, CFDs that are for these instruments are also traded 24/7.

This makes monitoring short-term positions a lot easier.

There are many CFD providers that offer demo accounts that you can practice with before investing real money.

Summary of Stocks vs CFDs

The following points are some key takeaways from trading CFDs vs stocks:

- When investing in stocks, you are investing in a security that gives you partial ownership of a company.

- The ownership of a stock is perpetual (infinite for as long as the company operates). The ownership of a CFD has a predetermined maturity date.

- CFD stands for “Contract For Difference”.

- A CFD is an agreement between two parties to pay the difference in the value of an underlying security from and to a specified date.

- Investors can make money off changes in stock price without speculating in the stock market.

- A CFD does not have to be a contract for the difference in the price of a stock; it can be for any financial instrument.

- CFDs utilise the concept of leverage. Your gains are magnified, but so are your losses.

- CFDs require a maintenance margin, and you will get a margin call when it reaches that margin.

- Cash settlements for CFDs are prompt which is good for prompt reinvestment.

- CFDs are, in many cases, traded 24/7 which makes it easier for retail investors who don’t work in the financial services industry to allocate time for research and trading.

Getting Started With CFD and Investment

Most Forex brokers specialise in either CFD trading or Investments. However, some brokers do offer both which does give you the benefit of switching between different types of asset classes should you wish.

Brokers that offer derivates trading and stock investments include IG Markets, ThinkMarkets (in Australia and South Africa), CMC Markets, Trading 212, and BlackBull Markets. Just be careful not to confuse investing in stocks equities as opposed to trading stocks as CFDs.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Can I hold CFD for long term?

CFDs do not expire so you can hold the long term as long as you have adequate margin in your account. Keep in mind, holding open position over the rollover period may involve you needing to pay swap-fees.