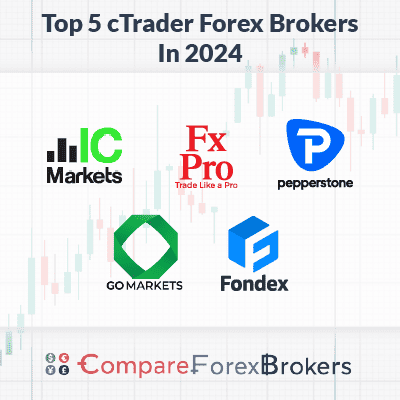

What Are The Best cTrader Brokers?

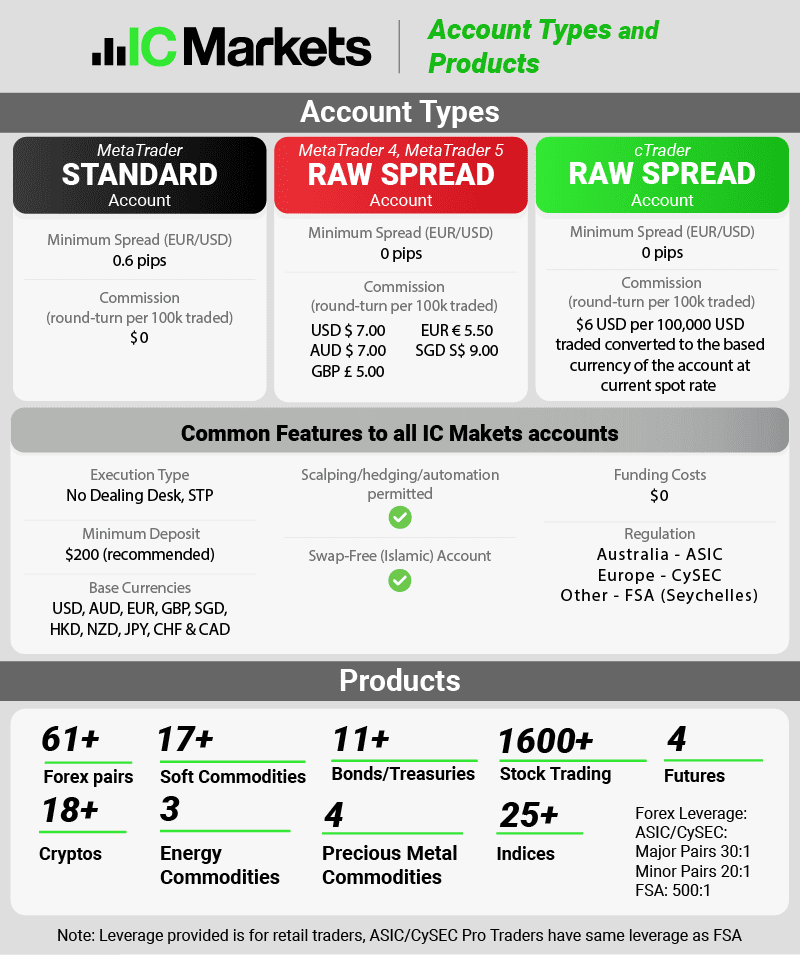

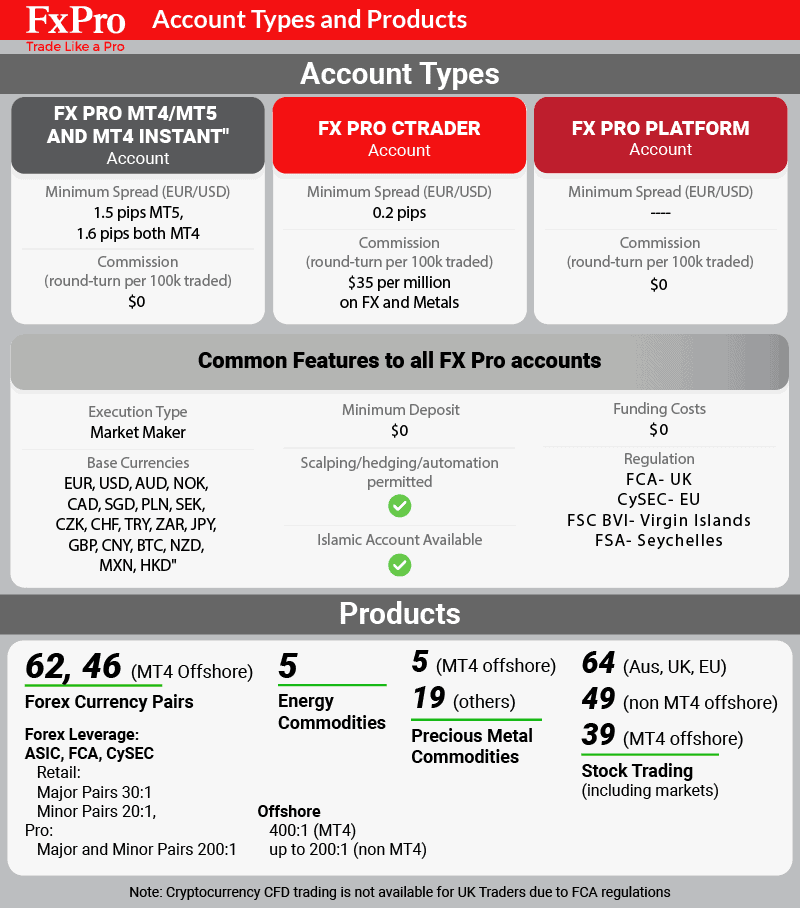

With Level II Pricing, cTrader by Spotware is one of the leading forex trading platforms. We look at the top cTrader forex brokers offering the platform by country – Fx brokers include FxPro, IC Markets and Pepperstone.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert

I’m in the US, can I use Pepperstone?

Unfortunately, you can’t. Pepperstone does not accept traders in the US (very few CFD broker will).