Highest Leverage Forex Brokers

Forex trading requires a forex broker offering leverage to trade using automation, copy trading strategies or when making manual trades. Our team in July 2025 found the highest leverage forex broker by each regulated region from 30:1 in Australia to 2000:1 in South Africa.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

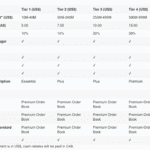

Our list of the highest leverage forex broker by regulator is:

- Pepperstone - The Best Australian High Leverage Broker

- BlackBull Markets - The Best High Leverage NZ Forex Broker

- Plus500 - The Best High Leverage Forex Broker in Singapore

- Axi - The Highest Dubai and UAE Forex Broker

- FXTM - The Highest Leverage Forex Broker Overall

- ThinkMarkets - The Best High Leverage UK Forex Broker

- FP Markets - The Highest Leverage EU Forex Broker

- IG Group - A Good Margin Trading FX Broker in Germany

- OANDA - A Top FX Broker In USA To Trade Leverage Products

- FOREX.com - The Best Forex Brokers In Canada With Gearing

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC,FCA ,DFSA,FMA |

0.2 | 0.5 | 0.5 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72 | 37 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

84 |

FCA, CIRO, NFA/CFTC CySEC, JFSA, CIMA |

0.17 | 0.29 | 0.3 | $6.00 | 1.5 | 1.8 | 1.5 |

|

|

|

30 ms (May 2023) | $100 | 91 | 8 | 30:1 | 400:1 |

|

What Forex Brokers Have The Highest Leverage?

Leverage involves borrowing capital to gain a larger exposure to the Foreign exchange market. With it, comes inherent risk as the more leverage you expose yourself to, the more you risk losing, potentially. Saying all that, we have come up with a list of the best high-leverage forex brokers, based on a series of trading factors.

1. Pepperstone - The Best Australian High Leverage Broker

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone as the best Australian high-leverage forex broker offering the maximum 30:1 leverage for forex trading. This was based on our comprehensive analysis, comparing the top ASIC-regulated brokers and focusing on currency pairs, spreads, commissions, and trading platform features.

While a handful of forex brokers from IC Markets to CMC Markets also offered 30:1 leverage, overall, we determined Pepperstone as the top high-leverage forex broker in Australia due to a combination of these key trading factors.

Pros & Cons

- Retail leverage of up to 400:1

- Powerful trading platforms

- Super competitive spreads

- Only offers third-party platforms

- No trading on physical assets

- U.S. clients not accepted

Broker Details

Leverage With Pepperstone In Australia

Pepperstone is regulated by the Australian Securities and Investment Commission (ASIC), which caps leverage to 1:30 on Forex majors for retail traders. We found that Pepperstone offers different leverages per market, described in the table below:

| Market | Retail Leverage | Professional Leverage |

|---|---|---|

| Major currencies | 1:30 | 1:500 |

| Minor currencies | 1:20 | 1500 |

| Major Indices (FTSE 100, S&P500) | 1:20 | 1:200 |

| Gold | 1:20 | 1:200 |

| Minor indices | 1:10 | 1:100 |

| Other commodities | Up to 1:10 | Up to 1:100 |

| Shares | 1:5 | 1:20 |

| Crypto | 1:2 | 1:10 |

| ETFs | 1:5 | 1:20 |

Spreads With Pepperstone Start From Zero Pips

We think the broker’s spreads are competitive for both account types. The spread-only and no-commission Standard account averages 1.12 pips for EUR/USD, while the RAW pricing account has a commission averaging 0.1 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

With RAW pricing, spreads can go as low as 0.0 pips, so we tasked our analyst Ross Collins to investigate how often Pepperstone offered these spreads using MetaTrader 4 and 20 other top brokers.

Surprisingly, Ross found that Pepperstone offered 0.0 pip spreads on EUR/USD 100% of the time outside rollover for (AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF and USDJPY) and is one of only two brokers on this list to do so. 0 pips spreads reduce your trading costs so this makes Pepperstone a good choice to save on a wide range of currency pairs.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

To take advantage of these low spreads with high leverage, Pepperstone has the largest choice of trading platforms: TradingView, MetaTrader 4 & 5, and cTrader.

We think TradingView is best if you use technical analysis as it has the best choice of indicators (100+) and chart screeners that can help speed up finding new ideas. If you want to automate your trades, MetaTrader 4 & 5 are solid options, allowing you to program your strategies with Expert Advisors that follow your rules and execute trades autonomously.

In our experience, cTrader is a top choice for scalpers. Its one-click trading feature allows you to execute your trades instantly without filling out an order ticket, saving you time.

| Features | cTrader | TradingVew | MetaTrader 4/5 |

|---|---|---|---|

| Developer | Spotware Systems | Stan Bokov | MetaQuotes |

| Programming Languages | C# | Pine Script | MQL4, MQL5 |

| Built In Indicators | 58 | 100+ | 30 (MT4), 38 (MT5) |

| Automation | cAutomate | TradingView Scripts | Expert Advisors (EAs) |

| No. Brokers Offer | 10-20 | 40-50 | 750+ |

| TimeFrames on charts | 26 | 5+ | 9 (MT4), 21 (MT5) |

2. BlackBull Markets - The Best High Leverage NZ Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.23

GBP/USD = 0.72

AUD/USD = 0.65

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

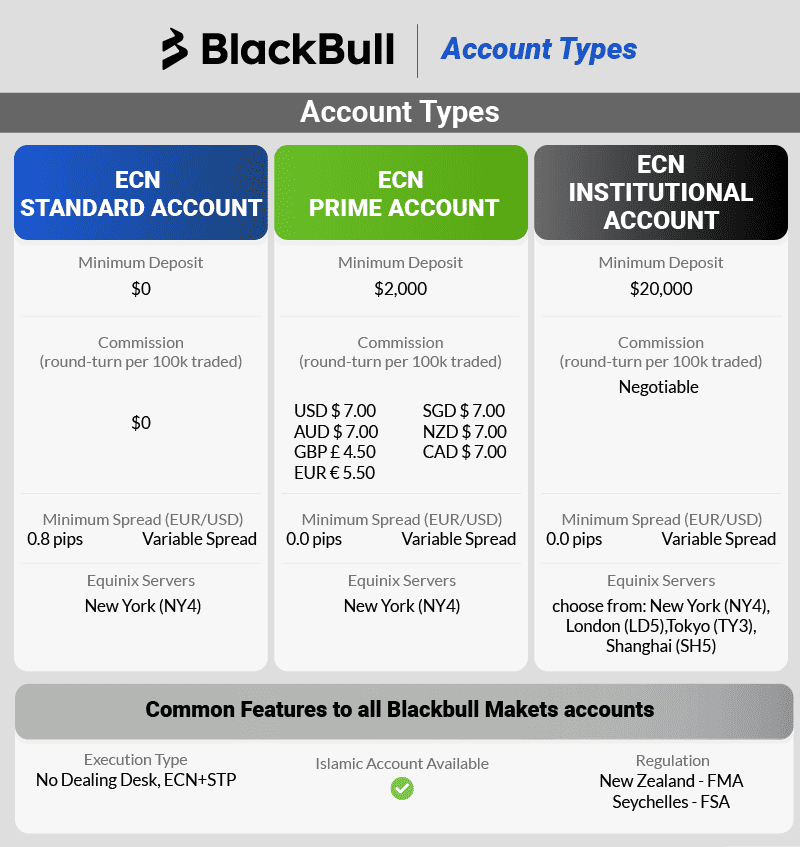

Why We Recommend BlackBull Markets

Blackbull Markets is our top New Zealand broker that offers the highest leverage of 500:1. Unlike countries like Australia (ASIC), Europe (CySEC), and the UK (FCA) where leverage caps of 30:1 are imposed, NZ forex brokers can offer significantly higher leverage to you as a retail trader. This is because, in New Zealand, the Financial Markets Authority (FMA) have a different set of trading rules.

We also like BlackBull Markets’ fast execution speeds (which we tested), diversity of trading platforms and a solid range of trading products.

Pros & Cons

- Highest leverage of 500:1

- Fast execution speeds

- Great range of trading platforms

- Spreads wider than average

- Limited educational resources

- Only regulated in two jurisdictions

Broker Details

Leverage With BlackBull Markets In New Zealand

In our testing, BlackBull Markets had one of the highest leverage offerings of 1:500 for retail traders. This leverage is made available by being regulated by the New Zealand Financial Markets Authority (FMA) and Seychelles Financial Services Authority (FSA). In other jurisdictions like the UK, you’d need to be an elective professional to obtain this high leverage.

| Product With BlackBull Markets | Leverage (up to) |

|---|---|

| Forex | 1:500 |

| Gold | 1:500 |

| Silver | 1:400 |

| Energies | 1:100 |

| Indices | 1:100 |

| Shares | 1:5 |

| Cryptocurrencies | 1:5 |

The broker accepts clients from different jurisdictions. So, if you want to take advantage of the higher leverage but are happy to sacrifice protections from your local jurisdiction, BlackBull Markets is a solid choice.

BlackBull Markets Has Fast Execution

As part of our testing, we like to compare a broker’s execution speed, as fast latency reduces the risk of slippage, which can be costly when prices move negatively. We asked our analyst Ross Collins to compare BlackBull Markets and 15 other brokers to see who had the fastest execution speeds using the MetaTrader 4 platform.

From this test, we found that BlackBull Markets had an impressive advantage, with execution speeds averaging 72ms for its limit order speed and 90 ms for market order execution speed. To put this in perspective, BlackBull Markets beat FxPro’s execution speed of 152ms (still fast) by 55%.

| Broker | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|

| Blackbull Markets | 72 | 90 |

| Fusion Markets | 79 | 77 |

| Pepperstone | 77 | 100 |

| OANDA | 86 | 84 |

| Tickmill | 91 | 112 |

| City Index | 95 | 131 |

| Eightcap | 143 | 139 |

| IC Markets | 134 | 153 |

| FxPro | 151 | 138 |

| Admirals | 132 | 182 |

| IG | 174 | 141 |

| CMC Markets | 138 | 180 |

| FP Markets | 225 | 96 |

| VantageFX | 175 | 154 |

| Avatrade | 235 | 145 |

We found that the broker also offers copy trading tools like Zulu Trade, Myfxbook and BlackBull Social app, which can take advantage of the execution speeds when copy trading. Execution speed is essential when copy trading as lags in order execution can see you get different spreads to the signal provider you copy.

BackBull Market Minimum Deposit

We like that BlackBull Markets doesn’t have a minimum deposit with their standard; this allows you to deposit the funds you are comfortable with and not be shoehorned into depositing too much. However, we feel the USD $2000 minimum deposit with their ECN Prime could be lower.

3. Plus500 - The Best High Leverage Forex Broker in Singapore

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

We picked Plus500 as our best high-leverage forex broker in Singapore. In Singapore, the Monetary Authority of Singapore (MAS) enforces leverage caps, with Plus500 able to offer a maximum of 20:1 when forex trading.

Features with Plus500 we like include its user-friendly Plus500 trading platform, commission-free forex spreads and guaranteed stop-loss orders (GSLOs), which is why we recommend the broker for beginners.

Pros & Cons

- Best high-leverage broker in SG

- Simple Plus500 trading platform

- Good risk management tools

- Doesn’t offer ECN trading

- Limited trading tools available

- Wider-than-average spreads

Broker Details

Leverage With Plus500 In Singapore

In our tests, we found Plus500 to have the highest leverage in Singapore, offering 1:20 while regulated by the Monetary Authority of Singapore (MAS). We were surprised that the max leverage was lower than other regulators like ASIC and FCA, limiting at 1:30. Even more so, we found that you could not increase the leverage as Plus500 does not offer professional accounts. Still, if you use a MAS-regulated broker, this is the best you can get.

Plus500 Trading Platform And Key Features

We found the Plus500 trading platform to be better than its competitors. Plus500 offers 119 indicators, 13 chart types, and a guaranteed stop-loss order, which eliminates slippage risks if applied. However, the broker does lack social trading and automation.

What stood out for us was its +insights tool, which aggregates all Plus500 traders’ data and compiles it into useful information to find new trade ideas. We like that it provides the data into different categories, such as “highest buy ratio”, which you could use as a signal to analyse these markets further for potential trades.

Plus500 also has a decent choice of markets to trade with including 71 currency pairs, 1100+ stocks, 30 indices, 12 commodities and 98 ETFs.

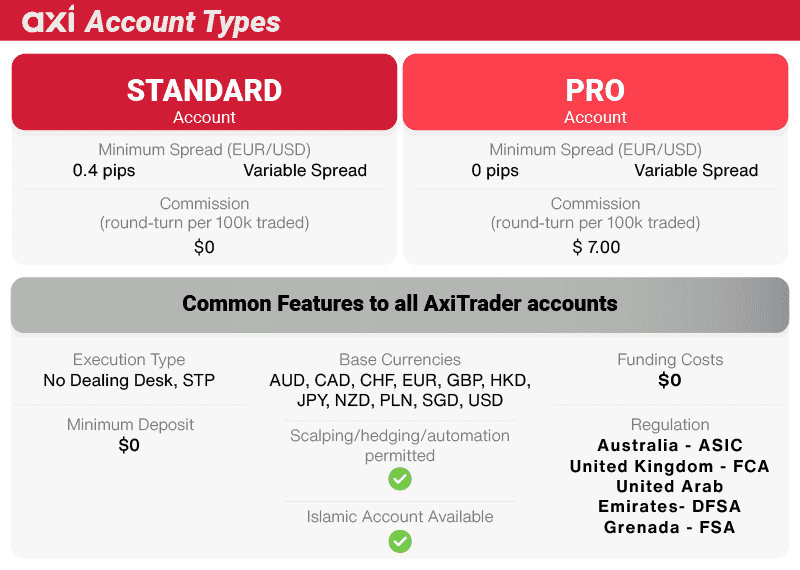

4. Axi - The Highest Dubai and UAE Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.44

GBP/USD = 0.85

AUD/USD = 0.42

Trading Platforms

MT4

Minimum Deposit

$0

Why We Recommend Axi

Among the best Forex brokers under DFSA regulation, our team of industry experts recommends Axi (formerly AxiTrader) for leverage trading in Dubai and the UAE. Under current legislation, the Dubai Financial Services Authority (DFSA), offers a maximum leverage for retail traders of 1:30 on all currency pairs.

Features of Axi that we were impressed with include its fast limit order speeds of 90 ms and its solid range of 72 forex pairs available to trade.

Pros & Cons

- 72 forex pairs to trade

- Fast limit order execution speed

- $0 minimum deposit requirement

- Spreads could be tighter

- Limited range of platforms

- Inactivity fees apply

Broker Details

Leverage With Axi In The UAE

Axi is regulated by the Dubai Financial Services Authority (DFSA), which offers a maximum leverage of 1:30. This leverage cap aligns it with other top regulators like CySEC, ASIC, and FCA.

We Tested The Average Spreads Of DFSA Brokers

We tested Axi’s fees by finding the average spread across the major markets and comparing them with 15 other DFSA-regulated brokers. Our comparison found that Axi came second with an average of 1.24 pips across the major pairs, making it one of the cheapest to trade forex. Our average pairs were EUR/USD, USD/JPY, GBP/USD, AUD/USD, and EUR/GBP.

| Broker | Average Major Pair Spread |

|---|---|

| ThinkMarkets | 1.22 |

| Axi | 1.24 |

| HYCM | 1.24 |

| eToro | 1.30 |

| XTB | 1.36 |

| IG Group | 1.38 |

| Pepperstone | 1.40 |

| Saxo | 1.48 |

| Multibank Group | 1.54 |

| Tickmill | 1.60 |

| FxPro | 1.62 |

| XM | 1.72 |

| HF Markets | 1.76 |

| Plus500 | 1.86 |

| SwissQuote | 1.92 |

Axi can offer its spreads this low as it has a no-dealing desk, meaning the trades are passed directly to the liquidity providers.

Axi Has One Of The Fastest Limit Order Execution Speeds In UAE

Axi’s lack of dealing desk and use of ECN-like trading explain why it can achieve fast execution speeds. Our tests found that Axi achieved 90ms, placing it second for limit order speed behind Pepperstone of the DFSA-regulated brokers we tested.

| Avg Limit Order ms | Avg Market Order ms | |

|---|---|---|

| Pepperstone | 77 | 100 |

| Axi | 90 | 164 |

| FxPro | 151 | 138 |

| Admiral Markets | 132 | 182 |

| IG | 174 | 141 |

| XM | 148 | 184 |

| FP Markets | 225 | 96 |

| HYCM | 241 | 268 |

Axi Is a MetaTrader 4 specialist

Axi only offers MetaTrader 4 as its platform, which comes with 30+ technical indicators, 9 timeframes, 24 analytical objects, 4 Pending order types and allows you to program custom indicators using Expert Advisors.

What stood out for us is that Axi provides 6 additional EAs that can enhance the platform further. Specifically, the trader sentiment tool shows the percentage of Axi’s traders who are long or shorting the asset, which you can use as an indicator to validate a trading bias.

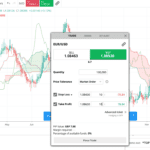

The indicator below shows that 21% of Axi’s traders are long on EUR/USD.

5. FXTM - The Highest Leverage Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 0

GBP/USD = 0

AUD/USD = 0.5

Trading Platforms

MT4, MT5

Minimum Deposit

$10

Why We Recommend FXTM

We recommend FXTM because it offers the highest leverage of any forex broker in the industry. This is because FXTM is regulated by The Financial Sector Conduct Authority (FSCA) in South Africa, which allows brokers to offer leverage of up to 1:2000, four times higher than other tier-1 brokers around the world.

Appealing features with FXTM include MT4 and MT5, its unique social copy platform, FXTM Invest and the broker’s excellent educational resources.

Pros & Cons

- Highest leverage of 1:2000

- Both MT4 and MT5 offered

- Good for copy trading

- Limited funding methods

- Product range could be bigger

- Wide Standard account spreads

Broker Details

FXTM Leverage Up To 1:2000 With The Offshore Entity

We found that FXTM had the highest leverage of all brokers we’ve tested, with a maximum leverage of 1:2000 on forex majors if you open an account under their Mauritius entity. We tested this on its Advantage and Advantage Plus accounts and found that the leverage was scaled based on your trade size, with the lowest trade size having the highest leverage.

| Notional Value (USD) | Leverage |

|---|---|

| 0 - 50,000 | 1:2000 |

| 50,001 - 200,000 | 1:1000 |

| 200,001 - 2,000,000 | 1:500 |

| 2,000,001 - 6,000,000 | 1:200 |

| 6,000,001 - 8,000,000 | 1:100 |

| 8,000,001 + | 1:25 |

This is interesting as we think it allows smaller accounts to benefit from the higher leverage as long as you are happy with the added risk.

FXTM Has Low Spreads And Commissions

While reviewing the live account, we found their spreads low on the RAW account, averaging zero pips on EUR/USD, USD/JPY, and GBP/USD. The commission is also low, with FXTM at just $2.00 per lot traded, which is well below the industry average of $3.48.

| Broker | USD | Broker | USD | Broker | USD |

|---|---|---|---|---|---|

| Tickmill | $2.00 | FIBO Group | $3.00 | EightCap | $3.50 |

| RoboForex | $2.00 | Admirals | $3.00 | Axi | $3.50 |

| FXTM | $2.00 | Blackbull Markets | $3.00 | IC Markets | $3.50 |

| Fusion Markets | $2.25 | FP Markets | $3.00 | ThinkMarkets | $3.50 |

| London Capital Group | $2.25 | HF Markets | $3.00 | Dukascopy | $3.50 |

| CMC Markets | $2.50 | Axiory Nano | $3.00 | Global Prime | $3.50 |

| BD Swiss | $2.50 | MultiBank Group | $3.00 | TMGM | $3.50 |

| AMarkets | $2.50 | Tradersway | $3.00 | Blueberry Markets | $3.50 |

| Fair Markets | $2.50 | ATC Brokers | $3.00 | FxPro | $3.50 |

| Go Markets | $2.50 | FlowBank | $3.25 | LQDFX | $3.50 |

| City Index | $2.50 | Pepperstone | $3.50 | OctaFx | $3.50 |

| VT Markets | $3.00 | FlowBank | $3.25 | XM | $3.50 |

During our testing, we noticed the broker has two platforms to trade from, MetaTrader 4 and MetaTrader 5. MT5 has 38 indicators,44 analytical objects, 3 chart types, and 21+ time frames, but what we like about the MT5 platform is that you have the depth of market access.

We think this is a significant improvement as it gives you access to the liquidity provider’s order book to see where most pending orders are. This can be a helpful tool to improve your technical analysis, like with supply and demand, by using it to see if there is actual buying or selling demand.

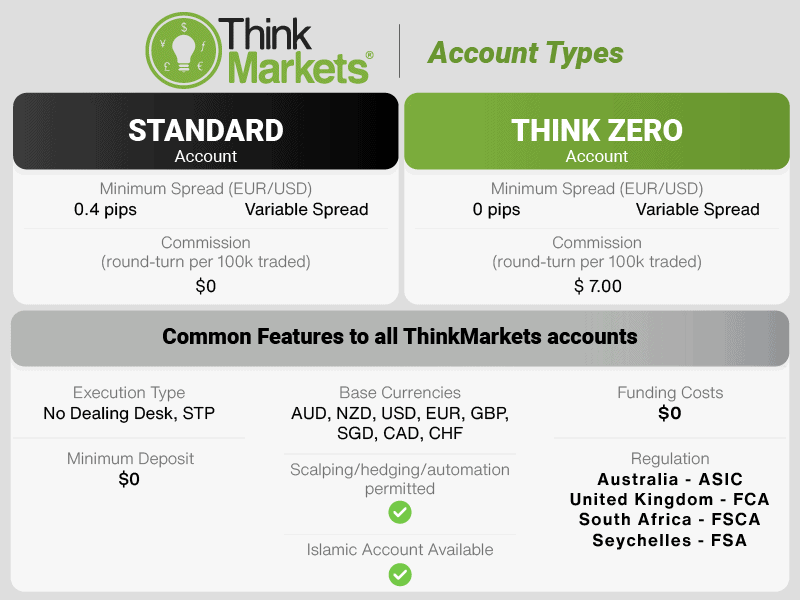

6. ThinkMarkets - The Best High Leverage UK Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

ThinkMarkets is our choice for the best high leverage FCA-regulated forex broker, in the UK. Like a lot of forex brokers, ThinkMarkets limits leverage to a maximum of 1:30 for retail traders. Where the broker stands out for us is its low RAW spreads, which are tight across the board at 0.20 pips for the 5 major currency pairs.

We also like ThinkMarkets’ platform range, which includes MT4 and MT5 and the broker’s excellent platform, Thinkorswim, which is a favourite of ours.

Pros & Cons

- Competitive spreads

- Solid platform range

- Good range of funding methods

- Slow execution speeds

- $500 minimum deposit for RAW

- Only 46 forex pairs to trade

Broker Details

Leverage With ThinkMarkets For Professionals

Our tests found that ThinkMarkets offers retail traders 1:30 leverage on currency majors, the maximum allowed in the UK by the Financial Conduct Authority (FCA). Unless you are a professional trader, you can request a professional trading account with 1:500 leverage, but you must meet specific criteria first. To qualify, you must meet any 2 out of 3 requirements:

- Work or have worked in the industry

- Have £500,000 of liquid assets

- Traded sizeable lots at least 12 times per quarter.

| ThinkMarkets | Professional Leverage |

|---|---|

| Major currencies | 1:500 |

| Minor currencies | 1500 |

| Major Indices (FTSE 100, S&P500) | 1:200 |

| Gold | 1:200 |

| Minor indices | 1:100 |

| Other commodities | Up to 1:100 |

| Shares | 1:20 |

| Crypto | 1:10 |

| ETFs | 1:20 |

ThinkMarkets Has Low Spreads With ThinkZero

We were impressed with ThinkMarkets’s low trading costs, especially with the ThinkZero account. Our analyst Ross Collins ran a test to find the average RAW spreads of the brokers in the UK and found that ThinkMarket’s spreads were competitive.

The broker achieved an average RAW spread of 0.22 pips on EUR/USD, which put ThinkMarkets on the low end, beating CMC Markets, which averaged 0.44 pips. Collectively, the results put ThinkMarkets in second place for the combined average spreads on the majors.

| AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | |

|---|---|---|---|---|---|---|

| Tickmill | 0.37 | 0.15 | 0.59 | 0.5 | 0.52 | 0.67 |

| ThinkMarkets | 0.42 | 0.22 | 0.62 | 0.56 | 0.7 | 0.25 |

| Eightcap | 0.48 | 0.2 | 0.44 | 0.64 | 0.76 | 0.47 |

| City Index | 0.23 | 0.22 | 0.17 | 0.16 | 0.44 | 0.27 |

| Pepperstone | 0.19 | 0.19 | 0.41 | 0.61 | 0.39 | 0.36 |

| Admirals | 0.7 | 0.21 | 0.73 | 1.46 | 1.08 | 0.58 |

| Axi | 0.67 | 0.43 | 0.95 | 0.74 | 0.94 | 0.64 |

| CMC Markets | 0.68 | 0.44 | 0.9 | 0.75 | 0.94 | 0.64 |

We think this provides an excellent opportunity to trade the markets with a low-cost broker with high leverage.

We also like that the broker offers a free VPS service with servers next to the exchange to maximise your execution speed and reduce lag. We think this service is excellent if you automate your trades, as you can set up your MT4 platform on the VPS and run it remotely 24/7 with a 99.9% uptime guarantee.

7. FP Markets - The Highest Leverage EU Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.1 GBP/USD = 1.3 AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

100

Why We Recommend

FP Markets is our best European broker with the highest leverage, offering a maximum of 1:30 on major forex pairs, which CySEC caps for retail traders.

The broker impressed us with its wide selection of 10,000+ financial instruments, covering markets from forex to crypto, giving you plenty of options to find trading opportunities. We also liked their tight RAW account spreads, which average just 0.1 pips on EUR/USD, lower than the industry average of 0.22 pips.

Pros & Cons

- Low trading costs on RAW account

- Free trading tools, including Trading Central and AutoChartist

- Fast market order execution speeds

- Share CFDs unavailable on MetaTrader 4

- TradingView and cTrader unavailable for EU Clients

- Has a minimum deposit requirement

Broker Details

FP Markets’ main regulator is CySEC, which, like the FCA, caps leverage at 1:30 for its forex majors, the highest in the EU. Like other regulators, you can increase your leverage by being classified as a professional, giving you 1:500 leverage.

Using FP Markets live Classic and RAW Spread accounts, we explored the range of financial instruments available, including 70 Forex pairs, 10,000 stocks, 22 indices, 9 commodities, 9 metals, 4 ETFs, 2 bonds, and 11 cryptos. When trading with FP Markets, you can choose between MetaTrader 4, MetaTrader 5, cTrader and TradingView platforms.

FP Market Customer Service

FP Markets has excellent customer service. We tested their live chat and were impressed that humans, not chatbots responded which was a nice point of difference. The live chat team was knowledgeable and explained to us the difference between all of their trading accounts.

8. IG Group - A Good Margin Trading FX Broker in Germany

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

Among high leverage Forex brokers under the BaFin regulation in Germany that we reviewed, IG Group offers the best trading conditions. Offering the same leverage ratios as other EU regulated brokers (by CySEC, FINMA and FCA), IG Group stands out as a highly trusted broker with a huge range of markets, including over 13,000 tradeable instruments. This is why we gave IG Group a perfect score of 10/10 for trust and range or markets.

Pros & Cons

- 110 forex pairs to trade

- Highly trusted broker

- Diverse range of proprietary platforms

- Slow execution speeds

- Average Standard account spreads

- High commission costs

Broker Details

IG Group is regulated by BaFin (The Financial Supervisory Authority) in Germany, offering max leverage at 1:30 for forex majors. Unlike its European counterparts, BaFin caps professional max leverage to 1:100.

What stood out for us while using our IG Group account was its vast range of 17,000+ tradeable instruments, which is the most CFD markets available out of all the brokers we’ve tested. You can trade 100 forex pairs, 12,000+ share CFDs, 130 indices, 41 commodities, 6,000+ ETFs, and 7,000+ options markets.

The fact that IG Group offers options markets across a spectrum of assets is impressive, as they provide an excellent opportunity to take advantage of volatile markets and announcements. Plus, the broker has excellent educational resources to teach you how to trade options with IG Group.

While using our account, we also explored the IG Trading platform, which is their in-house platform that lets you trade all of its markets. We found that the platform had 33 technical indicators, such as the Donchian Channel and Aroon indicators, and 19 drawing tools, including Fibonacci retracement and head and shoulder tools.

We like the IGTV feature within the platform, which has market commentary, breaking news, and technical analysis of market movements throughout the day. This is a nice touch, as you’ll be able to get added information and real-time updates on the markets you may have missed throughout the day.

If you prefer more specialised trading platforms, IG Group offers other platforms such as MetaTrader 4, ProReal Time, and L2 Dealer.

9. OANDA - A Top FX Broker In USA To Trade Leverage Products

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

Among US-regulated brokerages we reviewed, OANDA is the most appropriate choice for forex trading. In the US, the Commodities & Futures Trading Commission (CFTC) imposes a higher-than average maximum leverage of 1:50 on major currency pairs.

With its esteemed reputation and multiple tier-1 regulations, we scored OANDA highly for trust (10/10). We also like OANDA’s user-friendly platforms, which is why we recommend the broker for beginners.

Pros & Cons

- Highly trusted broker

- 1:50 maximum leverage for major pairs

- Good for beginners

- No share CFDs

- Limited online funding methods

- Lacks ECN/RAW account

Broker Details

Leverage With OANDA US

OANDA is one of the few brokers regulated by the NFA/CFTC, which set the max leverage to 1:50 on forex majors. Giving you a higher leverage experience with forex compared to the EU and UK brokers.

Accounts And Spreads With OANDA

While opening our account with OANDA, we found that the broker only offered a Standard account, in which costs are spread only with no commissions. Typically, we like to see a choice of a standard and a RAW pricing account. We feel RAW pricing is more attractive if you are an experienced trader due to the tighter spreads and fixed commission costs.

We tested OANDA’s trading costs and found their spreads competitive. They average 1.4 pips on EUR/USD, 1.4 pips on AUD/USD, and 2 pips on GBP/USD.

OANDA Has A Discount Program For High Volume Traders

We like that OANDA provides a rebate program called “Elite Trader” that allows you to reduce your trading costs further based on the volume of trades you make. The minimum volume requirement is $10M for tier-1, which may appear a lot, but if you scalp or trade daily with one-lot sizes, you’d be surprised how quickly this adds up to $10M.

Although they have an excellent offering of 68 forex pairs, we found that they didn’t offer any share markets, commodities, or indices. However, it has a selection of 8 crypto markets, including Bitcoin, Ethereum, and Litecoin.

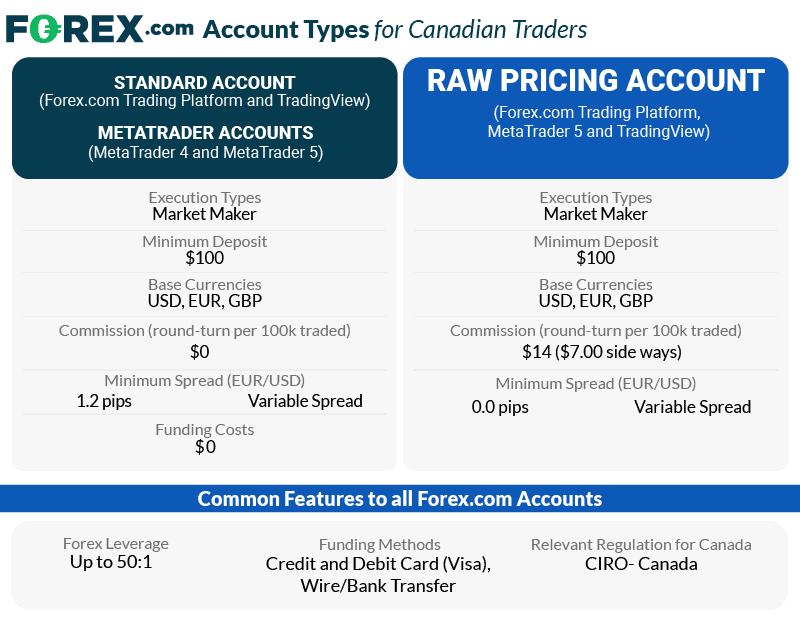

10. FOREX.com - The Best Forex Brokers In Canada With Gearing

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 0.8

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

Among CIRO-regulated brokers we reviewed, FOREX.com is the most appropriate choice to trade Forex pairs with reasonable leverage trading conditions.

Under current legislation by the Canadian Investment Regulatory Organization (CIRO) (formerly IIROC), you can trade with a maximum leverage of 1:50, which is higher than the 1:30 that most brokers offer retail traders.

We particularly like FOREX.com’s user-friendly proprietary platform and integration with TradingView charting, a must for technical analysis traders.

Pros & Cons

- Up to 1:50 forex leverage

- MT4, MT5 and proprietary platform

- Excellent charting via TradingView

- Wider average spreads

- High commissions of $14

- Product range could be better

Broker Details

Leverage With FOREX.com

FOREX.com is regulated by CIRO in Canada, allowing 1:30 leverage on forex pairs. What surprised us was that we found that EUR/USD (1:22) didn’t have the highest leverage available; instead, it was USD/CAD at 1:30.

Testing The FOREX.com Accounts

We opened a Forex.com standard account to test their spreads and found that they averaged 1.2 pips on EUR/USD, which is about average for a Canadian broker. If you want tighter spreads, we found the RAW pricing account had spread from 0.0 pips, but you had to pay $7.00 per lot traded in commission.

The broker offers a solid selection of trading platforms, including the Forex.com Web Trader, MetaTrader 5, and TradingView. We like how Forex.com’s Web Trader uses TradingView’s charts, giving you access to over 80 indicators and 50+ drawing tools that make technical analysis a breeze.

To test the platform, we executed a few trades from within the chart to see how easy it was. All we had to do was click the buy or sell button at the top of the chart, and an order ticket popped up so we could enter our trade. We like that the order buttons are at the top of the chart, out of the way of accidentally clicking on them while doing technical analysis.

Your capital is at risk up to ‘76% of retail CFD accounts lose money with FOREX.com’

Ask an Expert

Is high leverage good?

Leverage in forex trading is the process of using your existing capital to borrow capital so you can trade with higher amounts. It is sometimes called margin trading or financial gearing.

High leverage trading means you borrow a higher ratio to the amount compared to how you deposit in your trading account. Leverage of 1:500 or 500:1 means you borrow $500 for every $1 you deposit.

Since Forex is highly volatile, leverage can be seen as a good and bad thing since favorable forex movements really can increase your profits while unfavorable movements can result in crippling losses.

For this reason high leverage which many financial regulators consider to be leverage greater than 1:30 is only recommended for experienced traders. It is not recommended for new traders or risk averse traders.

A good broker with high leverage is Blackbull markets which offer 1:500

I’m located in Malaysia and noticed that there are no locally regulated CFD brokers. What broker do you recommend for high leverage and where are they regulated?

Hi Huey, that is not exactly correct, the Securities Commission in Malaysia (SCM) and the Labuan Financial Services Authority (LFSA) are recognised regulators of forex brokers in Malaysia. Malaysian traders can use brokers regulated with the SCM or offshore brokers. The Financial Markets Act has a section that recognises “foreign supervisory authority” which means they allow offshore brokers provided they have a local registration and are regulated in other countries.

Who decides on how much leverage the brokers can offer?

The brokers can decide how much leverage they offer for each trading instrument but they cannot exceed the maximum permitted for the country they are regulated in. For example – ASIC is the financial regulator in Australia. This means for the broker to legally offer trading services in Australia, then the country or one of their subsidiaries must be operating in Australia with an ASIC trading licence. ASIC allow up to 30:1 to retails for major currency pair meaning the brokers Australian subsidiary cannot offer more than 30:1 but they could offer less.

which high leverage broker is the cheapest to use?

If you find an account with commissions, that would suggest the broker is using Straight through processing (STP). These accounts have the tightest spreads. Look at brokers like Pepperstone, IC Markets, Eightcap. Go Markets and Fusion Markets however do have lower commissions.