10 Best ASIC-Regulated Australian Forex Brokers

I compared 39 ASIC-regulated trading accounts to determine the best Australian forex broker with pricing updates in July 2025. My process included opening accounts, running tests and comparing average spreads of the most traded forex pairs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Our best forex trading platform list is:

- Pepperstone - The Best Forex Broker In Australia

- IC Markets - Lowest Spread No Commission Account

- Eightcap - Best Range For Cryptocurrencies

- IG Markets - Most Popular Retail CFD Broker In Australia

- OANDA - Most Trusted Broker And Best For Beginners

- CMC Markets - Great Range Of Currency Pairs For Trade

- AvaTrade - Top Forex Broker For Day Trading

- FP Markets - Good Choice For Scalp Trading

- Saxo Markets - Great Range of CFDs And Forex Pairs

- eToro - Best Social and Copy Trading Broker

- BlackBull Markets - Highest Leverage Forex Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (AUD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 | ASIC, CySEC | 0.10 | 0.70 | 0.30 | $4.50 | 0.62 | 0.83 | 0.77 |

|

|

|

134ms | $0 | 61+ | 18+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 | ASIC, FCA, CIRO | - | - | - | - | 0.6 | 0.9 | 0.7 |

|

|

|

- | $0 | 70+ | 4+ |

|

||

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

69 | ASIC, FMA, FCA | 0.5 | 0.9 | 0.6 | $3.67 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 338+ | 19+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 | ASIC, CIRO | - | - | - | - | 0.90 | 1.30 | 1.10 |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

80 | ASIC, CySEC | 0.10 | 0.50 | 0.30 | $3.50 | 1.10 | 1.30 | 1.30 |

|

|

|

225ms | $100 | 70+ | 10+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

54 | ASIC, FCA, MAS | - | - | - | - | 1.20 | 1.8 | 0.9 |

|

|

|

135ms | $2000 | 209+ | 9+ | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

43 | ASIC, CySEC, FCA | - | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Who Are The Top 10 Best Forex Brokers In Australia For 2025?

Out of the 39 brokers tested, I narrowed the list to my top 10 ASIC-regulated brokers. The criteria I used to qualify these brokers were based on trading costs, trading platforms, trading conditions, trust factors, range of markets, and customer service levels. I then paired specific trader needs with the broker that best suited them.

1. Pepperstone - The Best Forex Broker In Australia

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

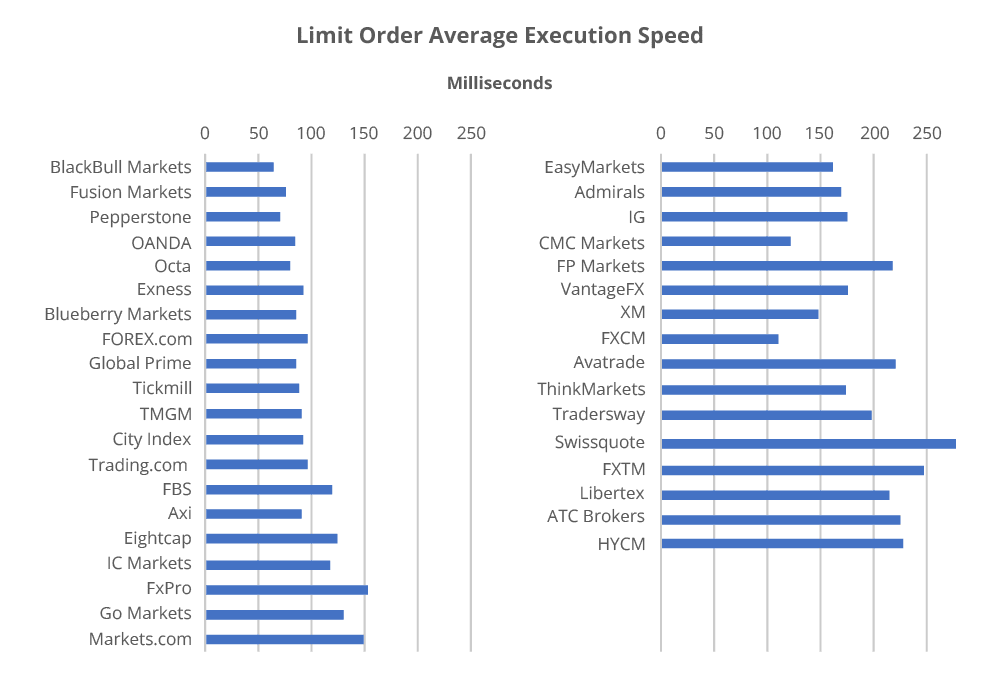

Why We Recommend Pepperstone

With my overall score of 98/100, Pepperstone is my top-rated broker. Their Razor account has zero pip spreads (more often than any other broker) and commissions of $3.50 per lot, making them one of the best choices for low trading costs.

What gives Pepperstone top value in my review is its range of 93 currency pairs which you can trade using MT4, MT5, cTrader and TradingView. Tests by my colleague also found Pepperstone has some of the fastest execution speeds in the industry.

Pros & Cons

- Fastest execution speeds

- Best raw account (ECN) spreads

- Top range of trading platforms

- No Stockbroking Services

- Higher standard account spreads

- Modest In Size Vs IG/CMC

Broker Details

In my tests, Pepperstone strongly performed in my trading cost category, achieving a solid 8.50/10 with its Razor account being my top option. The Razor account is the broker’s tight spread with low commissions ECN style account. This account has spreads from 0 pips and for some of these 93 currency pairs Pepperstone offers, the spreads are consistently at this low amount.

These zero pip spreads were backed up in tests by our CompareForexBrokers analyst, Ross Collins. To test the average spreads of 15 brokers over 24 hours, Ross used SpreadMonitor EA and found Pepperstone kept some of their spreads (like EUR/USD) 0 pips 100% of the time (outside rollover).

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| Blueberry Markets | 100.00% | 100.00% | 91.30% | 100.00% | 78.26% | 95.65% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% |

| CMC Markets | 100.00% | 95.65% | 65.22% | 86.96% | 65.22% | 78.26% |

These spreads on the Razor account make Pepperstone one of the lowest-spread broker options in Australia. Combined with $3.50 per lot traded commissions, I think the Razor account provides great value if you’re looking to lower costs.

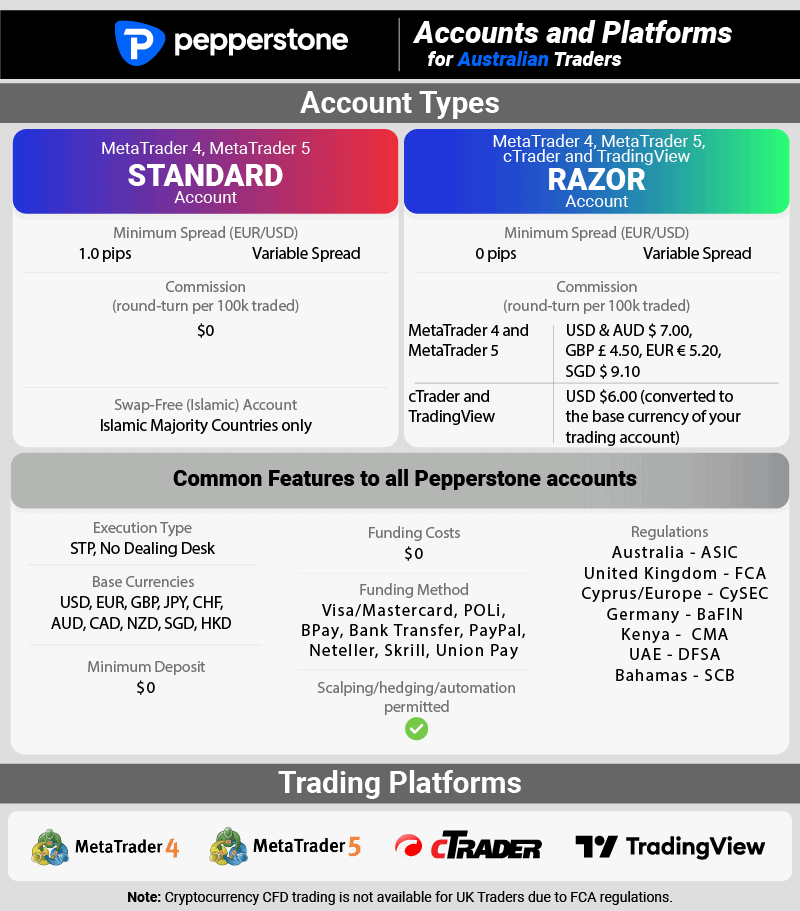

Pepperstone Has Fast Execution Speeds

Spead costs aside, Ross also found Pepperstone ranked third overall for execution speeds with an impressive 77ms limit order speed. This shows that Pepperstone can execute your stop loss and take profit orders fast, which is essential for limiting your losses during volatile periods, helping you avoid slippage.

These fast execution speeds combined with a top pool of liquidity providers also explain why Pepperstone has a 99.60% fill rate.

93 Currency Pairs With Top Trading Platforms

Another category Pepperstone stands out is for its range of trading platforms. Platforms available include Pepperstone Trading App, MetaTrader 4, MT5, cTrader, and TradingView.

While all platforms have their own strengths, I prefer TradingView as it provides the best charting experience. Features include 110+ smart drawing tools. 400+ built-in indicators and over 100,000 public indicators. I find TradingView automated trendlines really help with my technical analysis.

Just note that if you prefer algo trading, then your best options are with MT4, MetaTrader 5, or cTrader. While TradingView does have Pine Script, you will need a bridge to make this work.

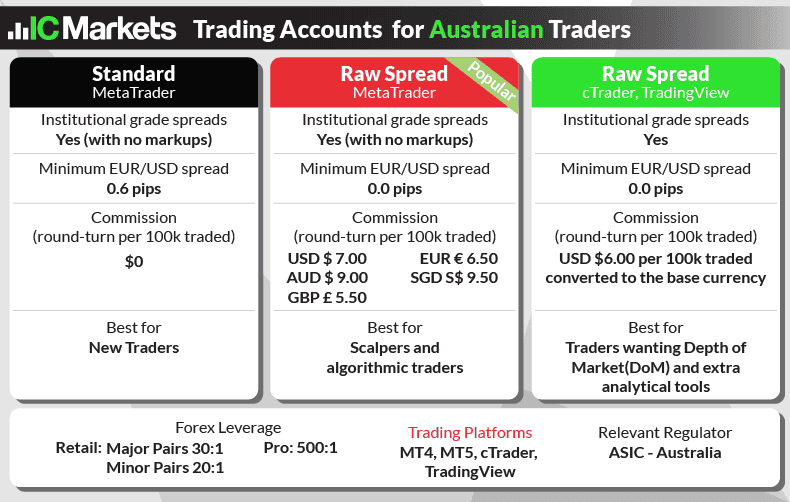

2. IC Markets - Lowest Spread No Commission Account

Forex Panel Score

Average Spread

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

I picked IC Markets as the best broker for low spreads after testing showed they average 0.73 pips for EUR/USD (the best in the industry). Other notable features include top trading platforms like MetaTrader 4 and 5, cTrader and TradingView, 2250+ trading instruments, and 24/7 customer services.

IC Markets is one of the largest brokers in the world with 500,000 trades per day of which 60% are done using algorithms. This achievement shows the broker’s popularity with experienced traders and scalpers who choose brokers with low spreads.

Pros & Cons

- Lowest no-commission spreads

- Solid range of products

- Fast account opening

- Live chat is slow

- No cTrader Copy

Broker Details

IC Markets Has The Best Spreads For Commission-Free Trading

IC Markets Has The Best Spreads For Commission-Free Trading

Ross Collins opened and tested Standard account types from 40+ forex brokers to find the lowest no-commission trading account. He found that the IC Markets Standard account produced the tightest spreads, with EUR/USD averaging 0.73 pips, which is 35% cheaper than the industry average (1.11 pips).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

These spreads are impressive as they compete well with some Raw accounts (which are typically cheaper than Standard accounts).

For example, ThinkMarkets’ Raw account combined spread (0.22) and commission ($3.50) gives it an effective spread of 0.92 pips for EUR/USD. Saving you 20% without having to pay commission making the account an appealing choice if you’re a beginner thanks to its simplicity.

You can see how IC Markets compares to other brokers for its Standard no-commission account by using my Trading Cost calculator tool below.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Similar to Pepperstone, IC Markets offers a solid selection of trading platforms. These platforms include TradingView, MetaTrader 5, cTrader, and MT5, which allow you to benefit from the broker’s standard account spreads on the most popular trading platforms.

I like that IC Markets supplements its MT4 and MT5 platforms with 20 premium trading tools that improve trading management on the platforms.

For example, I’m a fan of the Mini-terminal EA that provides an improved one-click trading feature allowing you to deploy your stop-loss and take profit orders with your order instantly.

I found this helpful when scalping as it allowed me to add my risk management immediately, rather than appending the orders with the open position which risks unnecessary losses.

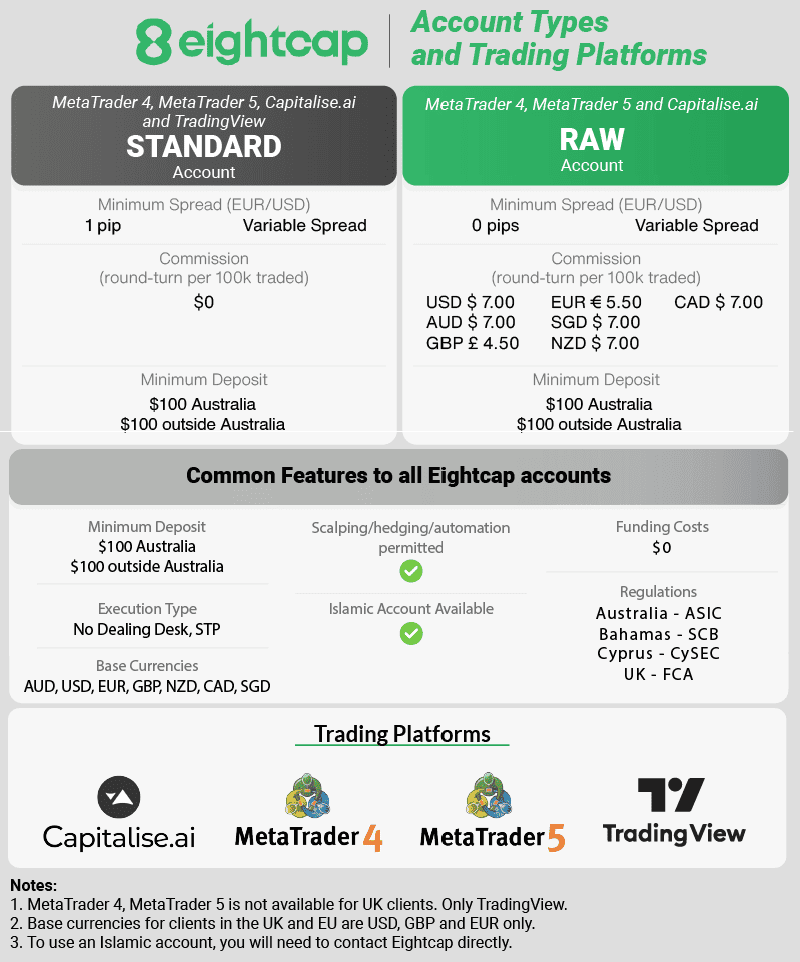

3. Eightcap - Widest Range of Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why We Recommend Eightcap

I chose Eightcap for its excellent range of markets, including 56 Forex pairs and 95+ cryptocurrencies (the largest on this list). Other key features include a choice of standard and RAW trading accounts with spreads from 0 pips and TradingView, MT4, and MT5 Forex platforms.

Eightcap also offers helpful extra tools like Capitalise.ai so you can automate your strategies with zero programming knowledge and FlashTrader.

Pros & Cons

- 95 crypto with MT5, Tradingview, 79 with MT4

- Automation with EAs, Capitalise.ai

- Good social trading options

- Good customer support

- Research tools lack depth

- Education videos could be more detailed

- Execution speed could be faster

Broker Details

Eightcap Leads The Way For CryptoCurrencies

While testing Eightcap with my Standard account, I found the broker to offer a solid selection of markets from 150 share CFDs to 56 currency pairs. However, it was the broker’s impressive 95 crypto markets that stood out for me in 2025.

Eigthcap also has one of the largest range of CFD crypto choices in the market with 95 (with MT5 and TradingView and 79 with MT4). You can find the popular cryptos like Bitcoin and Ripple but also higher-risk Altcoins like DOGE and SHIB.

| Broker | Crypto Markets Available |

|---|---|

| Eightcap | 95 |

| Plus500 | 23 |

| AvaTrade | 17 |

| IC Markets | 21 |

| Pepperstone | 26 |

| CMC Markets | 19 |

| IG Markets | 13 |

| FP Markets | 12 |

| Saxo Markets | 9 |

| BlackBull Markets | 16 |

| OANDA | 4 |

I think through Eightcap, you have an excellent opportunity to trade cryptocurrencies with the protection of an ASIC-regulated forex broker, ensuring your funds are secure and that the conditions are transparent.

Eightcap supplied decent trading costs on its Standard while testing with spreads on EUR/USD averaging 1.16 pips, while cryptocurrencies had a 17 pip spread on Bitcoin. If you choose to predominantly trade forex, the Raw account has tighter spreads from 0 pips and a commission of $3.50 per lot traded, which is the cheaper option.

During my testing, I found that Eightcap offers a decent suite of trading platforms such as TradingView, MT4, and MT5.

During my testing, I found that Eightcap offers a decent suite of trading platforms such as TradingView, MT4, and MT5.

In my opinion, TradingView is the best platform for trading crypto thanks to its charting tools with 110+ indicators, including Ichimoku and MACD, making developing trading strategies easy.

Alternatively, if you want to automate your strategies, I found that Capitalise.AI is a no-code tool that allows you to convert your strategy to an automation for MT4 or MT5.

You can use my trading platform finder tool, which pairs your trading style with a trading platform that will provide the best features to maximise your trading experience.

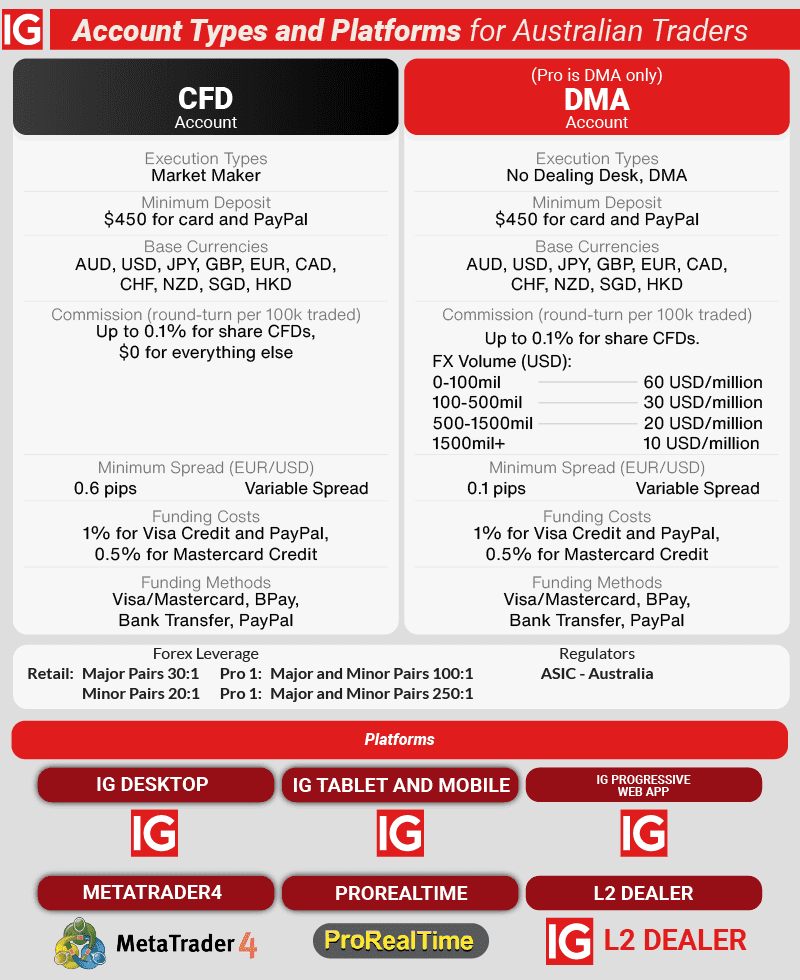

4. IG Markets - Most Popular Retail CFD Broker In Australia

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why We Recommend IG Markets

Established in 1973, IG Markets is one of the oldest brokers in the industry and also one of the most trusted being regulated in 11 jurisdictions. As a trader, the main appeal to me is the availability of 17,000 CFD markets to trade which is more than other brokers I have tested. These include 10+ Forex pairs and 13,000+ global shares.

These CFD products are available via IG trading platform, ProRealTime for chart trading, L2 Dealer and MT4. If you choose the IG trading platform you will be able to manage your risk using a guaranteed stop-loss order.

Pros & Cons

- Huge range of markets

- Highly trusted broker

- 4 Trading platforms

- Guaranteed stop-loss with the IG platform

- Wider spreads than average

- Lacks MetaTrader 5

- No social trading tools

- DMA account only for professional traders

Broker Details

One of the reasons IG Markets is popular is due to its extensive range of markets, consisting of 17,000, which is the most of any CFD broker tested. Here’s the breakdown of the markets I found while testing the Standard account:

- 110 forex pairs covering forex majors, minors, and exotics

- 13,000+ share CFDs from US, AUS, Asia, EU, and UK markets

- 14 cryptocurrencies, including a Crypto 10 Index that tracks the top 10 cryptocurrencies

- 7 energy markets for oil and gas

- 11 metal markets with gold, silver, and palladium

- 23 soft commodity markets such as coffee, wheat, and soybeans

- 2,000+ exchange-traded funds

- 130 indices, including S&P 500 and NASDAQ

- 14 bond and treasury products

- Options trading across forex, indices, and commodity markets

- Share dealing services

Most of these CFD products are commission free with the exception of shares and DMA trading using L2 Dealer.

IG Trading Has Top Trading Platforms

IG Markets has multiple platforms, including MetaTrader 4 and ProRealTime, but neither platform covers all 17,000 markets, which is why I think the IG Trading platform is the best choice.

The IG Trading platform is much better than I first anticipated, considering it’s a proprietary platform. I found the charting software to be excellent, with 30+ indicators like Bollinger Bands. You have access to a decent range of tools for most trading strategies.

If you’re new to trading or need more trading ideas while day trading, then I found the Signal Centre helpful with its real-time signals for forex, indices, and commodities. I like that you can copy the order details (including stop-loss and take profit) to the order ticket, saving you from mistyping and entering the trade quicker.

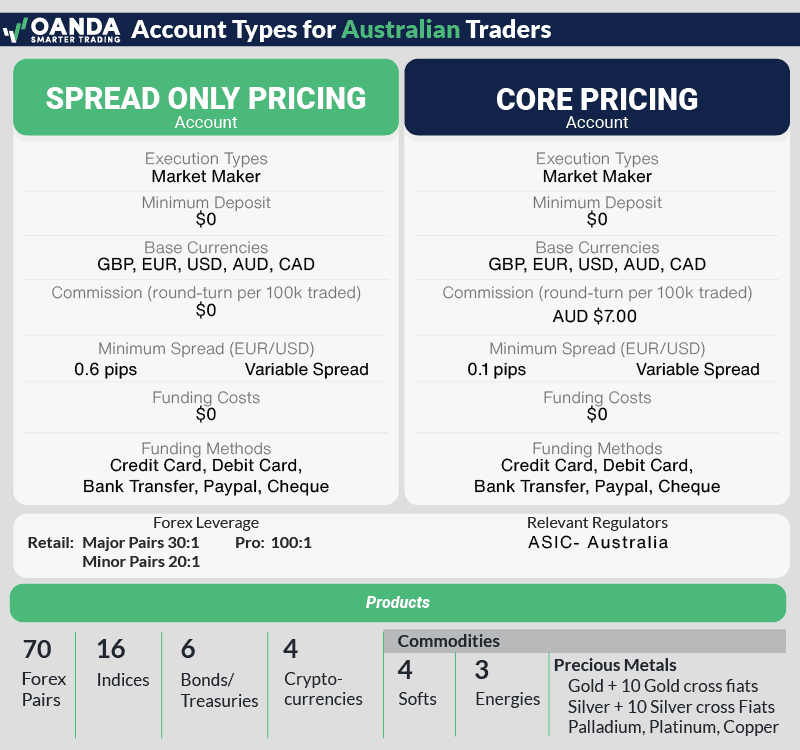

5. OANDA - Most Trusted Broker And Best For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.6

GBP/USD = 0.9

AUD/USD = 0.7

Trading Platforms

MT4, TradingView, OANDA Trade

Minimum Deposit

$0

Why We Recommend OANDA

I awarded OANDA 91/100 in my review, with the broker impressing me as being the most trusted and best for beginners. Trusted because of the life of the broker having been operating since 1996 and for acquiring 10 regulatory licenses from major financial regulators across the globe.

As for beginners, I liked the OANDA Trade platform, which allows complete control of trade sizes (i.e., you are not limited to lots) and Advanced charts with TradingView. OANDA Trade also has a guaranteed stop-loss order for risk management. I also like that spreads are commission-free from 0.60 pips with their standard account and 0.0 pips with the Core account.

Pros & Cons

- 3 Top trading platforms

- Lowest trade sizes from 1 unit

- Top trust, regulation and reputation

- No CFD shares

- Limited leverage with pro account

- Average research tools

Broker Details

Of the brokers tested, I found OANDA to be a truly multi-regulated and secure broker as they have 6 Tier-1 regulators, providing transparent services globally. These Tier-1 regulators include:

Being multi-regulated means the broker must follow multiple strict regulatory frameworks to ensure the services provided are transparent and that your money is secure. With 6 of the most trusted regulators supporting OANDA, this reassures that your trading conditions and account are protected.

During my tests, the broker offers MT4 and TradingView as third-party options, but I found the OANDA Trade platform had interesting features for beginners.

One of the most important is that it provides guaranteed stop-loss orders that protect you from slippage should market volatility pick up and take out your stop loss. This is an important risk management as you can accidentally open trades before high-impact news events like Non-farm payrolls, which can instantly wipe your position out if you are unaware.

Another unique feature to OANDA Trade is that you can trade the smallest trade sizes on the platform from 1 unit, allowing you to trade with smaller trading accounts. I find this makes transitioning from a demo account to live trading lower the financial risk for mistakes while helping you build confidence.

The OANDA Trade platform also leverages TradingView’s charts, giving you access to the best drawing tools like Fibonacci retracements and 110+ indicators to produce decent technical analysis with.

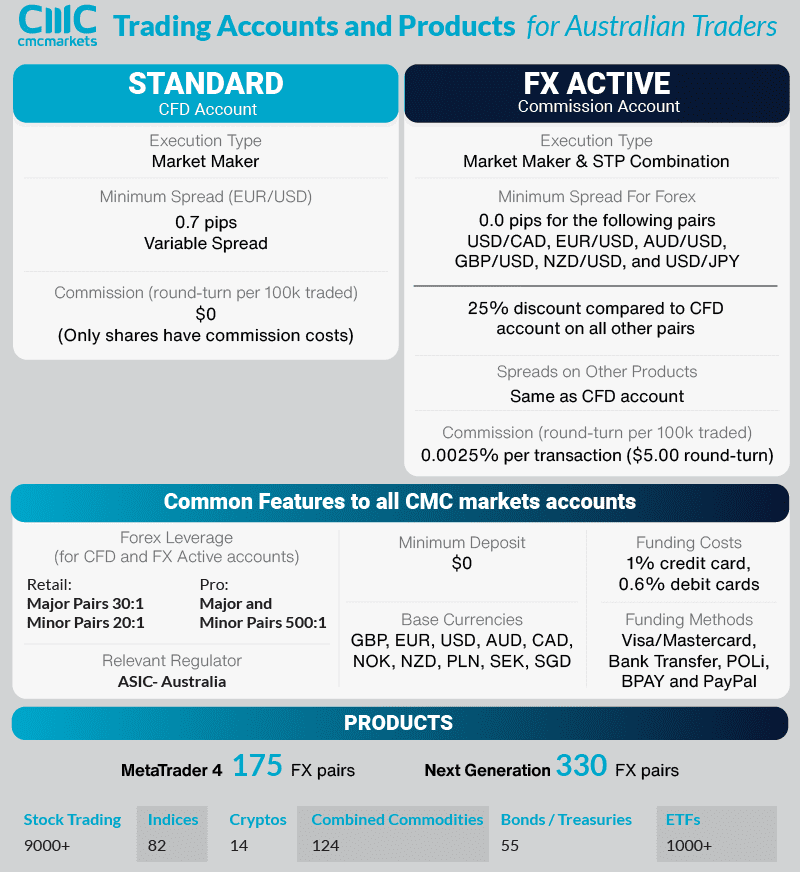

6. CMC Markets - Great Range Of Currency Pairs For Trading

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets scored 73/100 based on its excellent range of 12,000 markets, including 330+ forex pairs, which is the most currency pairs on any platform. I highly rated the broker’s tight spreads from 0 pips and $2.50 commission on its FX Active account, also contributing to the score, providing the lowest commissions in Australia.

I also found CMC Markets’ Next Generation platform a valuable asset for CMC Markets, providing a solid trading experience with advanced charting tools like the automated pattern recognition tools.

Pros & Cons

- Over 330 forex pairs

- Next Generation platform

- Highly trusted broker

- MT4 offers less products

- Account opening not easy

- Limited funding methods

Broker Details

I tested CMC Markets and found they provided the largest range of 330+ forex pairs on their Next Generation trading platform, 3 times larger than IG Markets (110 pairs). This range lets you trade every forex major, minor, and exotic pair so you can truly trade the forex markets, while most brokers offer less than 70 pairs.

Outside of the forex markets, CMC Markets has 12,000+ financial products available including shares, cryptocurrencies, commodities, ETFs, indices, and bonds giving you a solid multi-asset trading experience.

I found the FX Active to be the best trading account on CMC Markets, saving you money if you focus on forex trading. You get spreads from 0.0 pips on six major currency pairs and a 25% discount on spreads compared to the Standard account, which averages 1.13 pips on EUR/USD.

You do pay a $2.50 per lot traded commission for the privilege, but I found it saves about 55% in trading costs compared to the Standard account for EUR/USD. This is because after adding the commission ($5.00) and the zero pip spread, it gives you an effective spread of 0.5 pips vs. 1.13 pips (Standard account).

If you choose the FX Active account, the $2.50 per lot traded commissions are the lowest you’ll find from any of the brokers on this list.

| Broker | Commission Per Lot Traded (In AUD) |

|---|---|

| CMC Markets | $2.50 |

| City Index (Web Trader) | $3.00 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| ThinkMarkets | $3.50 |

| TMGM | $3.50 |

| Blueberry Markets | $3.50 |

| FP Markets | $3.50 |

| Admirals | $4.00 |

| IC Markets | $4.50 |

| Blackbull Markets | $4.50 |

The best platform for forex trading was CMC Markets’ Next Generation web platform, which provides 80+ indicators and access to all of the broker’s markets. Technical analysis on the platform is easy through its free chart pattern recognition tools that automatically find patterns like wedges or triangles, providing intraday trading opportunities.

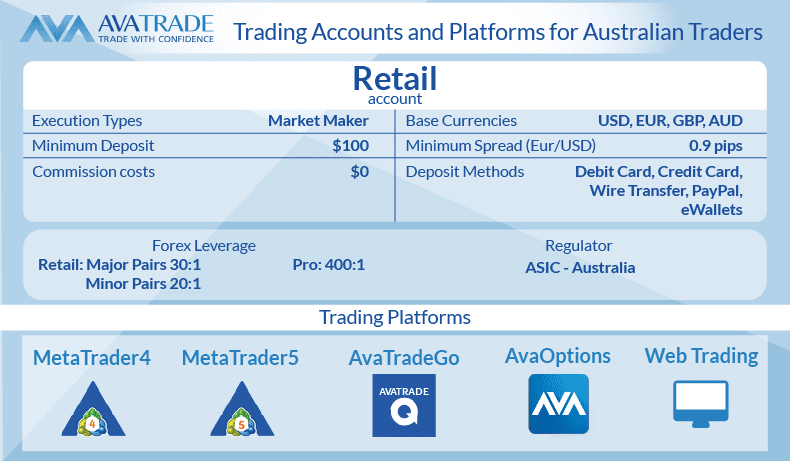

7. AvaTrade - Top Forex Broker For Day-Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.3

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

I awarded AvaTrade the best broker for day trading as it provides favourable trading conditions like fixed spreads from 0.90 pips on EUR/USD. This means you can day trade without worrying about the spread widening during news announcements.

The AvaTradeGO platform also stands out for day trading, providing 90+ indicators, trading signals, and a market sentiment indicator to help gauge intraday market direction.

Overall, I gave AvaTrade 68/100 on my testing. The reason I didn’t score them higher was that they only offer Standard accounts and a limited range of markets compared to its competitors.

Pros & Cons

- No limits on scalping

- Competitive fixed spreads from 0.9 pips

- AvaProtect risk management feature

- Wider market maker spreads

- Limited educational resources

- Customer service doesn’t know its own offerings

Broker Details

After opening my AvaTrade Standard account, I found the broker’s spreads are fixed, which I think provides excellent conditions for day trading. I like fixed spreads as they do not widen when the market volatility rises, such as macroeconomic news announcements like quarterly GDP.

This means you don’t get punished for opening (or closing) trades during these price spikes, while with variable spread brokers, your spread will widen significantly to offset the volatility.

When I find a broker offering fixed spreads, they are typically more expensive compared to variable spreads to make up for the cheaper pricing during volatile prices. However, with AvaTrade, I was impressed to see EUR/USD fixed at 0.90 pips, which is cheaper than the forex trading industry average of 1.24 pips.

| Broker | Spread | Variable/Fixed |

|---|---|---|

| OANDA | 0.60 | Variable |

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| Eightcap | 1.00 | Variable |

| FP Markets | 1.10 | Variable |

| Pepperstone | 1.12 | Variable |

| CMC Markets | 1.12 | Variable |

| IG Trading | 1.13 | Variable |

| Saxo Markets | 1.20 | Variable |

| BlackBull Markets | 1.20 | Variable |

In my tests, I used the AvaTradeGO platform, which has 90+ indicators from simple moving averages to RSI indicators, but what stands out for me was the sentiment indicator.

The sentiment indicator shows where other traders place their trades, giving you a unique perspective that traditional indicators can’t offer. I like this for day trading as it shows you how many traders are long or short an asset, suggesting where the intraday momentum is based on AvaTrade’s clients.

Another factor I considered was that AvaTrade also provides MT4/MT5 for its automated trading features. Accessing this platform allows algorithmic traders to benefit from the fixed spreads to keep your trading costs average throughout the day, even when your EAs open during news announcements.

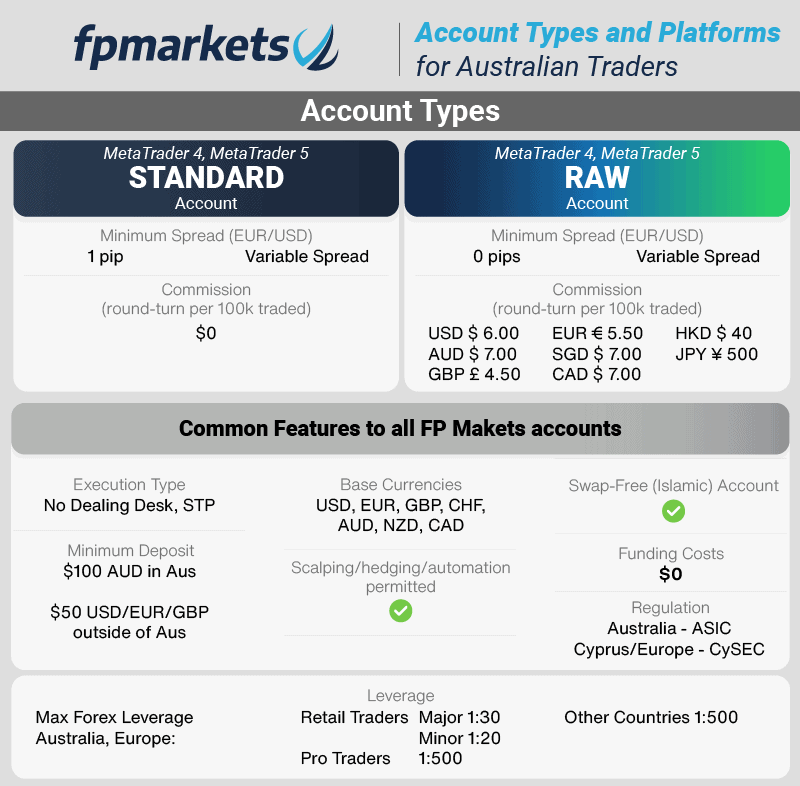

8. FP Markets - Good Choice For Scalp Trading

Forex Panel Score

Average Spread

EUR/USD = 1.1

GBP/USD = 1.3

AUD/USD = 1.3

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$100

Why We Recommend FP Markets

I chose FP Markets as the best choice for scalping with its fast market order execution speeds averaging 96ms and tight spreads from 0.10 pips on its Raw account. I believe this provides top conditions for scalping, which can be enhanced by using the ForexVPS for lower latency.

The factors above helped FP Markets score 86/100 in my tests as well as offering MT4, MT5, cTrader, and TradingView, which are ideal for scalping. These platforms have one-click trading, faster processing of your orders, and access to Depth of Markets tools for advanced order flow analysis for scalping.

Pros & Cons

- Good for scalping

- Low trading costs on Raw account

- Fast market order execution speed

- Social trading limited

- Slower limit order speed

- Lack of advanced tools

Broker Details

I asked analyst Ross Collins to find the execution speeds of brokers to find which ones had the fastest execution times, which is vital for scalping the markets. To do this, Ross tested 36 brokers and used the Broker Latency Tester EA for MT4 to gather the average market order speeds for each broker.

Ross found FP Markets achieved 96ms on its market order speeds, placing the broker in 8th place on the recent test. These speeds remain highly competitive and ensure your scalp trades are filled efficiently, which can still make the difference between hitting or missing an opportunity.

| Broker | Market Order Rank | Market Order Speed |

|---|---|---|

| Fusion Markets | 1 | 77 |

| OANDA | 2 | 84 |

| Exness | 3 | 88 |

| FOREX.com | 4 | 88 |

| Blackbull Markets | 5 | 90 |

| Octa | 6 | 91 |

| Blueberry Markets | 7 | 94 |

| FP Markets | 8 | 96 |

| Global Prime | 9 | 98 |

| Pepperstone | 10 | 100 |

After using FP Markets’ RAW account, I think it offers low costs for scalping with spreads averaging 0.10 pips and AUD $3.50 per lot traded commission. Compared to IC Markets ($4.50), FP Markets’ commissions are about 22% cheaper, which is a significant saving if you are making 20 to 30+ trades per day.

As FP Markets is an ECN broker, you can choose MetaTrader 5 or cTrader to utilise the Depth of Markets tools for analysing the liquidity providers’ order flow. I prefer MT5 for scalping as I found the one-click trading and custom indicators provided a better experience for scalping.

I also liked that FP Markets provides ForexVPS which lets you install MT4/MT5 so you can improve your latency to the broker’s data centres for fast executions. To subscribe, you have to place 20 lots on a Raw account (10 lots on standard) monthly, which I think is an easy target for scalpers.

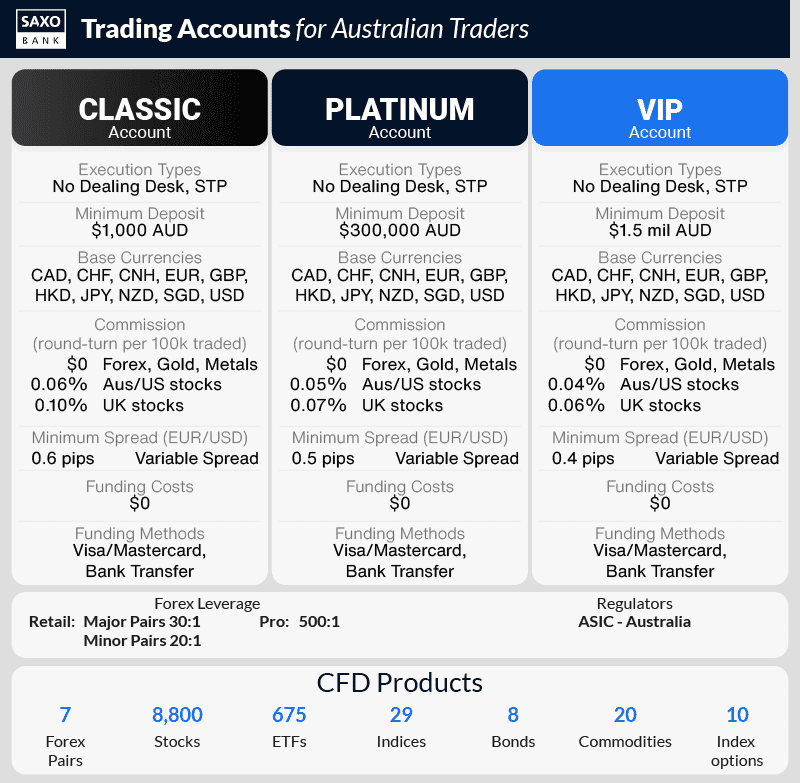

9. Saxo Markets - Great Range of CFDs And Forex Pairs

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTrader Pro

Minimum Deposit

$0

Why We Recommend Saxo Markets

I found the Saxo Markets set-up is ideal for experienced and professional traders as it provides sophisticated in-house analysis with professional market commentary. Its SaxoTraderGo platform is decent, with advanced technical analysis features and 40+ indicators, allowing most trading strategies to be set up on the platform.

The score I gave for Saxo Markets was 55/100 as I felt the SaxoTraderGO platform, spreads, and analysis were decent. However, I found the broker lacked forex CFD pairs, making it a poor choice if you trade forex CFDs.

Pros & Cons

- Huge range of markets

- SaxoTraderGo platform

- Highly trusted

- Only seven forex pair CFDs available

- High minimum deposit requirements

- Not advised for beginners

Broker Details

My experience with Saxo Markets felt like the broker tailored its services to professional traders by providing a decent range of CFDs and professional in-house analysis.

I found the broker offers a decent range of 8,000+ markets which includes:

- 100+ forex pairs (7 CFD pairs)

- 9,000+ shares

- 9 cryptocurrencies

- 20 commodities

- 1,200 Exchange Traded Products

- 29 indices

- 8 bonds

This selection makes Saxo Markets a solid option as a multi-asset broker if you need access to less popular financial instruments, as Saxo Bank covers everything in my opinion. However, if you want access to more markets, then CMC Markets and IG Markets have almost 2 times what Saxo offers, making them good alternatives.

To support Saxo Markets’ range of CFDs, I like that the broker offers professional in-house market analysis covering fundamental and technical aspects of the markets from their Saxo Bank analysts. Unlike other brokers, I can tell Saxo deep dives into their analysis as it provides excellent commentary and graphs to illustrate their ideas, which covers all markets.

These insights are conveniently accessed on the SaxoTraderGO platform and sometimes supported with videos, making them much easier to digest in my opinion. That platform is excellent too, with a user-friendly interface and advanced charting with 40+ indicators; it was easy to apply my technical analysis.

If you trade share CFDs, I found you have access to TipRanks, which provides investment bank analyst consensus with price targets, giving you professional snapshots of a share’s predicted performance.

10. eToro - Best Social and Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

I picked eToro for the best social and copy trading broker as no other copy trading provider comes close to the broker’s CopyTrader platform in my opinion. The platform is beginner-friendly and comes with a tool to make choosing a copy trader straightforward while keeping you in complete control of your capital.

The broker scored 48/100 in my tests, which is reflective of the limited nature of the trading platform for manual trading. Apart from that, you have no commission trading on all 6,000 assets, making eToro the cheapest option for copy trading in my books.

Pros & Cons

- 6,000+ trading instruments

- Beginner-Friendly Platform

- Zero Commission Account

- No Third-Party Platforms

- Does not offer ECN/STP services

- $5 withdrawal fees

Broker Details

I’ve tested multiple copy trading tools from CopyTrading by Pepperstone to ZuluTrade, and nothing competes with eToro’s CopyTrader in my opinion. eToro provides a platform that lets anyone open an account and find a trader to mirror, regardless of your trading experience, and still benefit from leveraged products like forex.

The CopyTrader platform makes it easy to find traders to copy with its filter with 14 metrics to find brokers based on risk score, profitability, and markets traded. A filter I use is the amount of followers a trader has gained, as this gives you an indicator of the trader’s current performance.

I appreciate the effort eToro has taken to make the copy trading process simple. After finding a copy trader, you simply tell the platform how much you want to invest and your maximum drawdown (how much you risk before you stop following the trader).

Social trading is available if you prefer to trade manually, and you can engage with the 30,000,000 eToro traders across 6,000+ financial markets.

In my opinion, TradingView has better social trading features than Pepperstone, where you can comment and interact directly on charts, which is much more engaging and helpful.

Another factor that made me choose eToro as the best copy trading broker is due to the commission-free trading on all assets, including share CFDs, which is rare. This means all of your trading costs are spread-only, so you won’t receive any surprising charges when you mirror trade and simplify your trading costs.

11. BlackBull Markets - Highest Leverage Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, cTrader, Blackbull Trade, BlackBull Social

Minimum Deposit

$1

Why We Recommend BlackBull Markets

I included BlackBull Markets as it accepts Australian traders and offers 1:500 leverage for retail traders through its Financial Markets Authority (FMA) license in New Zealand.

The broker is a top performer, achieving 95/100 in my broker analysis tests with a standout performance for its execution speeds, placing it first place overall.

BlackBull Markets is a solid pick if you use TradingView because they offer free (trading volume requirements) Premium subscriptions to the platform, giving you more advanced features like volume profiles.

Pros & Cons

- Up to 500:1 leverage

- The fastest execution speed globally

- Choice of MT4, MT5 or TradingView

- Not ASIC-regulated

- Lack of tier-1 regulators

- Educational content limited

Broker Details

Although not regulated by ASIC, BlackBull Markets gives you access to 1:500 leverage, which is 16 times more than ASIC, which is capped to 1:30 for retail traders. The higher leverage is because BlackBull Markets is regulated by the New Zealand Financial Markets Authority (FMA), which is more lenient compared to ASIC on leverage.

I think the high leverage is an appealing option for experienced traders who are looking to scale their profitable trading strategies. The increased leverage allows you to benefit from market movements with smaller margin requirements, allowing you to potentially earn 16x more profit compared to the 1:30 leverage ASIC offers.

I think the high leverage is an appealing option for experienced traders who are looking to scale their profitable trading strategies. The increased leverage allows you to benefit from market movements with smaller margin requirements, allowing you to potentially earn 16x more profit compared to the 1:30 leverage ASIC offers.

During my analysts’ tests, Ross found BlackBull Markets to be the overall fastest forex broker for limit order and market order execution speed. He found BlackBull Markets achieved an average limit order execution speed of 72ms (fastest overall), which makes sure your stop-loss and take-profit orders are filled fast, reducing slippage.

During my analysts’ tests, Ross found BlackBull Markets to be the overall fastest forex broker for limit order and market order execution speed. He found BlackBull Markets achieved an average limit order execution speed of 72ms (fastest overall), which makes sure your stop-loss and take-profit orders are filled fast, reducing slippage.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

Ask an Expert

Is forex legal in Australia?

Hi Josh.

Forex trading is very legal in Australia. The most important thing is to choose a broker that i regulated by the Australia Securities and Investment Commission, also known as ASIC.

Using an ASIC regulated broker means the broker complies with the requirements of companies in Australia that manage financial services.

Good brokers ASIC regulated brokers include Pepperstone, IC Markets, FP Markets, Markets.com, IG Markets, Eightcap, BlueBerry Markets,

Should I choose MetaTrader 4 or MetaTrader 5 when opening a demo account?

It is best to demo the platform you plan to use when trading. There are and cons of both trading platforms but generally, MetaTrader 5 has all the features MT4 has and more.

The main reason to choose MT4 is if you have a low powered computer since MT5 uses higher processing power, you want access to the largest possible range of expert advisors since MT4 has a larger marketplace, a larger trading community since more people use MT4 and if you plan to use Myfxbook or Duplitrade which integrates with MT4 but not MT5. If you plan to trade stocks then you must use MT5 since MT4 is not built for this.

I’m looking for a high margin Australian broker but they all seem to have the same leverage. Why is this and how do I get more?

Brokers in Australia must be licenced and regulated by the Australia Securities Investment Commission (ASIC), as a condition of their licence they cannot offer leverage higher than 30:1 for major forex pairs and 20:1 for minor forex pairs. If you want higher leverage, some brokers do offer up 500:1 provided you meet the qualification criteria as a professional trader. To do this you must pass the brokers Sophisticated Investor Test or Wealth test.

I would like to know about decfx, I know they are an Australian broker but I want to know how good they are

Can a broker in Australia with an ASIC license expand their business reach

Yes as long as you abide by ASIC regulatory conditions

What happens with my money sitting in brokers account? Do I get interest?

Your broker will arrange for your funds to be kept in a segregated bank account. This allows you to access the funds for trading quickly and easily without the broker ever being able to access these funds. Since the funds are kept in a bank account, your funds will earn your interest how much this is will depend on the type of account and interest the bank is offering.

When trading you can also earn interests through swaps or overnight fees. If you have an open position and hold this over closing hours (new york time in the case of forex) then you will either pay or earn swaps fees. You can also earn through commissions if you are trading shares.

I’m looking to open a share trading account and a forex account. If I join IG or CMC can I have a centralised account or would it mean opening up two different ones?

What is Australia’s largest broker?

Depends how you define largest Largest by size or by trading volumne? Our research suggest IF with 320,000 clients worldwide is the largest by revenue. In terms of trading volume IC Markets is the largest with $22.68 billion in daily turnover.

How is Exness rating on trust pilot

Exness has a rating of 4.8 or 5 starts from 10593 reviews. Which suggest the broker has good feedback from the community in general.

Is fusion market recommendable for best broker?

Fusion Markets is an excellent broker, known for their lows spreads and low commissions.