Best MT5 Brokers

Forex traders looking to trade with the MetaTrader 5 should select the best MT5 broker for their circumstances based on 2025 spreads, range of CFDs, regulation and customer service levels.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

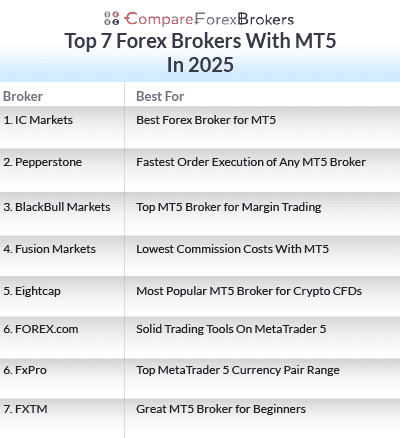

My list of the best brokers offering MT5 brokers in 2025 are:

- IC Markets - Best Forex Broker for MT5

- Pepperstone - Fastest Order Execution of Any MT5 Broker

- BlackBull Markets - Top MT5 Broker for Margin Trading

- Fusion Markets - Lowest Commission Costs With MT5

- Eightcap - Most Popular MT5 Broker for Crypto CFDs

- FOREX.com - Solid Trading Tools On MetaTrader 5

- FxPro - Top MetaTrader 5 Currency Pair Range

- FXTM - Great MT5 Broker for Beginners

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

84 |

FCA, CIRO, NFA/CFTC CySEC, JFSA, CIMA |

0.17 | 0.29 | 0.3 | $6.00 | 1.5 | 1.8 | 1.5 |

|

|

|

30 ms (May 2023) | $100 | 91 | 8 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

59 |

FCA, FSCA CySEC, SCB, FSCM |

0.45 | 0.52 | 0.57 | $3.50 | 1.46 | 1.76 | 2.06 |

|

|

|

151ms | $100 | 69 | 28 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

62 |

FCA, FSCA, CySEC FSCM, CMA |

0.1 | 2 | 0.5 | $4.00 | 2.1 | 2.5 | 2.1 |

|

|

|

160ms | $10 | 58 | - | 30:1 | 300:1 |

|

What Are The Best MetaTrader 5 Brokers?

Choose the right MT5 broker for your forex trading needs. We’ve ranked the best MetaTrader 5 brokers of 2025 based on critical metrics such as trading costs, execution speeds, range of tradable products, and customer service.

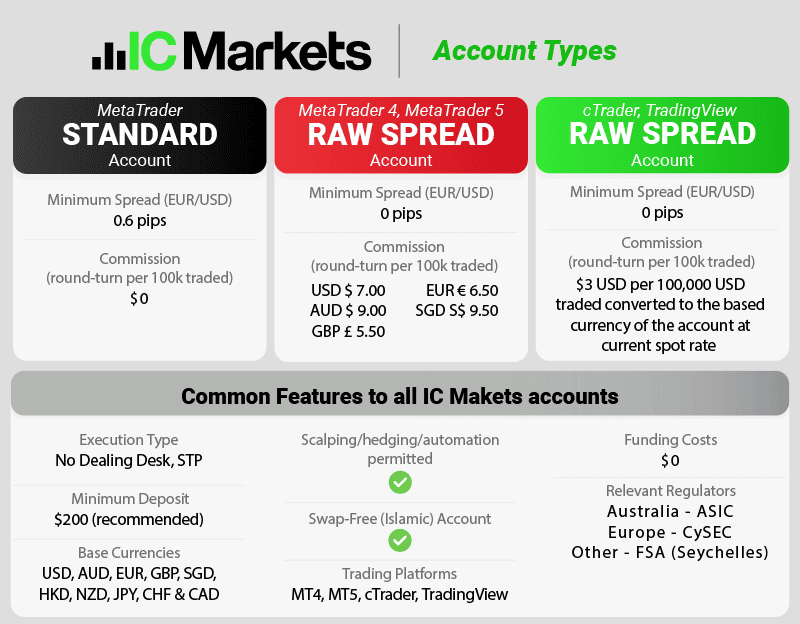

1. IC Markets - Best Forex Broker for MT5

Forex Panel Score

Average Spread

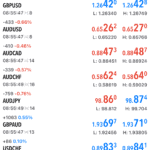

EUR/USD = 0.62

GBP/USD = 0.83

AUD/USD = 0.77

Trading Platforms

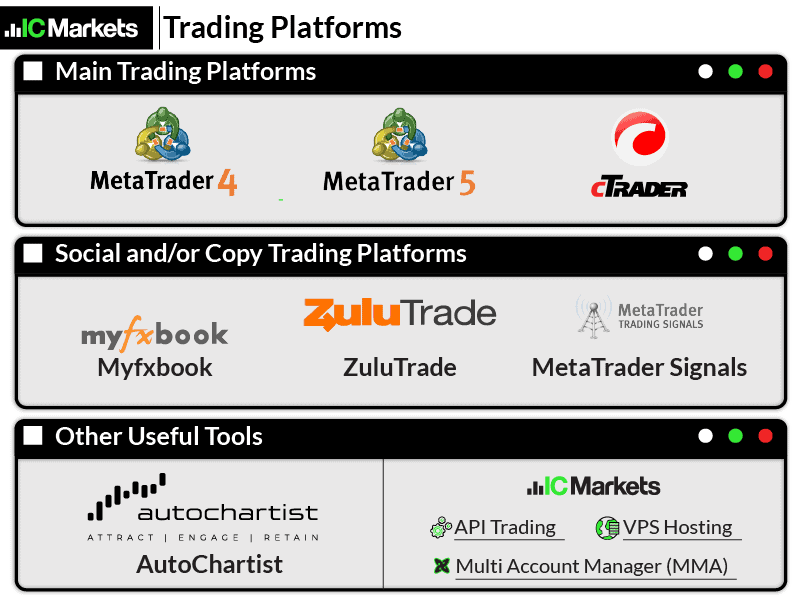

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

I liked that IC Markets has a blend of tight spreads, low commissions, and excellent MT5 integrations. The broker has earned its place as my top choice for the best Forex broker on MT5.

Based on my experience, IC Markets consistently delivers top-notch service in a field where every pip and millisecond counts, and this is the main reason why it is ahead of the competition.

While the broker may not sweep the board in every category, IC Markets has given me a consistent high-level performance, making them a standout choice.

Pros & Cons

- Low spreads

- Fast execution speed

- No withdrawal or deposit fees

- $200 minimum deposit

- Limited educational resources

Broker Details

As well as being the best MT5 forex broker, IC Markets stood out from our testing for the following reasons:

- Tight average spreads – 1.03 pips

- Good range of trading platforms

- Excellent MT5 integrations

Tightest MT5 Commission-Free Spreads

When looking at spreads, Ross Collins, our Head of Research, tested the average spreads you can expect if you trade on a Standard account with our website’s top brokers. Based on his findings, IC Markets offers the tightest spreads of any Tier-1 FX broker at 1.03 pips for the major currency pairs.

To break it down for you, a spread of 1.03 pips means each lot costs USD 9.63, so you’ll pay USD 9.63 for every USD 100,000 you trade. Compare that to our worst-performing broker, FXPro, which posted average spreads of 2.22 pips. Under these trading conditions, a single lot costs USD 20.83 – almost twice as much as IC Markets.

| Broker | Spread | Spread Cost |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

Low RAW Spreads on MT5

Along with the lowest Standard account spreads, I also found that IC Markets offers ultra competitive RAW/ECN account spreads. Referencing my observation to the tests conducted by Ross, the broker has affordable trading fees — third lowest RAW spreads of 0.32 pips across the USD-backed majors. Only Fusion Markets (0.22 pips) and City Index (0.25 pips) had lower spreads.

While both of the spread tests were done using MT4, I suppose that MT5 will almost certainly produce lower spreads being a more powerful and faster platform. As such, IC Markets can back up my claim as one of the lowest spread, MT5 forex brokers.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

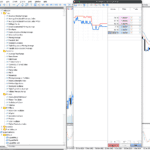

Excellent MT5 Integrations to Enhance Your Trading

While IC Markets offers a range of third-party platforms (including MT4, MT5, and cTrader), if you opt to trade with MT5, you’ll find the broker supports most trading strategies and styles. This includes scalping, hedging, automated trading, social trading, and copy trading.

However, in addition to MetaQuotes’ tool, MetaTrader Signals, IC Markets account holders can integrate copy trading and social trading tools like ZuluTrade and Myfxbook with MT5.

If I am being completely transparent, I don’t love that this requires opening two accounts. In fact, my colleague, Dave, found it time-consuming and tedious to manage both interfaces. Nevertheless, we reached consensus that both of us do like that the broker provides tools for these strategies.

If you’re a more traditional trader like myself, you’ll appreciate the option to supercharge your analysis with an Autochartist integration. Combined with MT5’s 38 technical indicators, Autochartist’s scanning and pattern recognition tools can give you a remarkable depth of insight into market movements and refine your overall strategy.

2. Pepperstone - Fastest Order Execution of Any MT5 Broker

Forex Panel Score

Average Spread

EUR/USD = 0.10

GBP/USD = 0.40

AUD/USD = 0.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

I liked how Pepperstone has the fastest order execution of any MT5 broker, which means your orders will be filled with minimum slippage. Pepperstone makes it dead easy to get started, especially if you’re keen on checking out the broker’s MetaTrader 5 capabilities.

Pros & Cons

- Fast execution speeds on MT5

- Competitive no-commission spreads

- Solid range of markets to trade

- Education resources are limited

- Lacks guaranteed-stop loss orders

- Demo account expires after 90 days

Broker Details

From my testing of Pepperstone, I discovered that the Australian broker offers some of the fastest speeds an MT5 broker offers, along with competitive spreads, easy account opening process, and top MT5 trading experience.

Fast Execution Speeds

While testing execution speeds of 20 top brokers, Pepperstone has offered me the third fastest execution speeds overall for an MT5 broker. Using limit and market orders, the broker recorded average limit orders speeds of 77ms and market order speeds of 100ms.

Only BlackBull Markets (72 and 90 ms) and Fusion Markets (79 and 77 ms) gave me faster execution speed results overall, when averaged out.

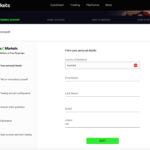

15/15 Account Opening Experience

To give you a comprehensive review, I tested Pepperstone’s signup process and found the first thing you need to do is choose between a demo account and a live account. A demo account with Pepperstone is free for MT5, and what surprised me is that you don’t need to provide any documentation such as a passport or driver’s license or funding details such as your credit card. All you need to do is provide some basic personal details and verify your email or phone number, and you can test the MT5 trading platform and practice trading in just minutes.

I also tested the live account opening process and found it very easy. The main challenge was the 7 questions for the appropriateness test to show I know what forex trading is and the risk involved, but if you do get one wrong, you can reset the test.

Once you pass, you need to upload documentation proof of who you are and your funding details. However, you don’t actually need to fund the account until you start trading, which I thought was a big plus. I couldn’t fault the signup experience with Pepperstone, so scored them 15/15.

Top MT5 Trading Experience

As you might’ve guessed from our name, the team at Compare Forex Brokers focuses our trading on forex. Me and my colleagues use MT4 by default because it is the most common and popular, but I have to admit that we’re big fans of the Pepperstone MetaTrader 5 trading experience.

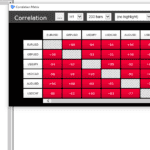

Dave and Sean, our testers, found the Trade Terminal and Market Manager tools especially useful for developing a big-picture, at-a-glance view of their trading activity. Sean also told me that he used the Correlation Matrix to identify a pattern he hadn’t previously noticed and opened a profitable position.

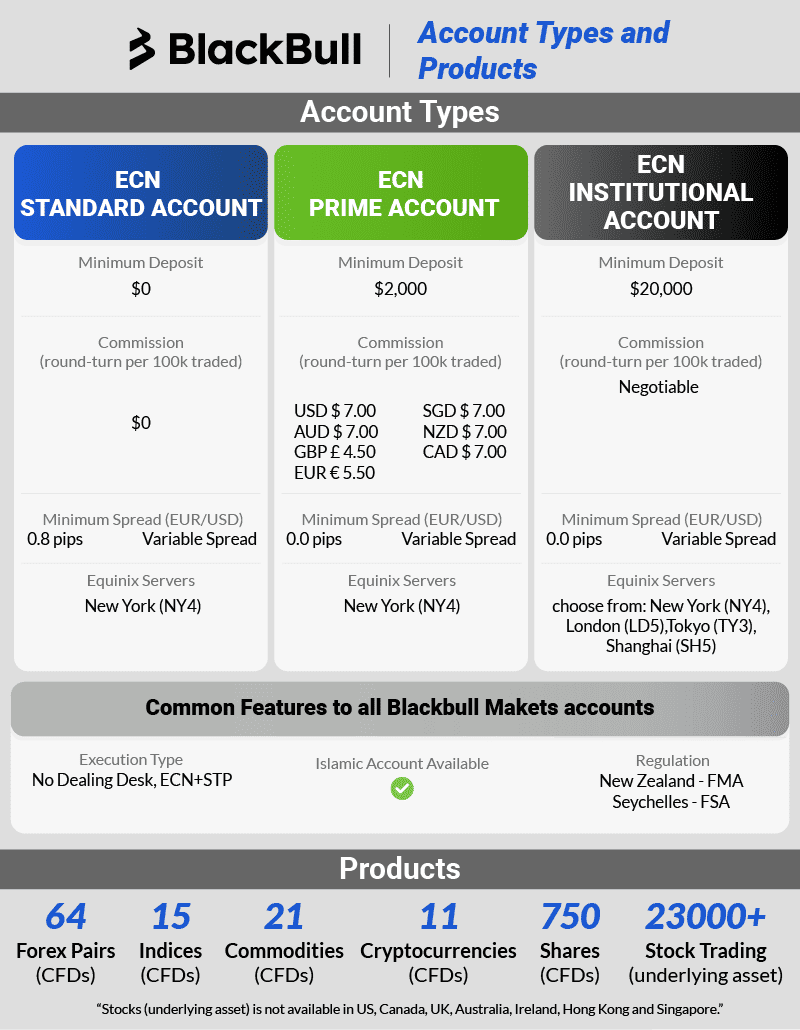

3. BlackBull Markets - Top MT5 Broker for Margin Trading

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlackBull Trade

Minimum Deposit

$0

Why I Recommend BlackBull Markets

For me, BlackBull Markets nailed it in terms of execution speed, but what truly sets the broker apart is the generous leverage of up to 1:500, available to traders globally. Sometimes referred to as ‘trading on margin,’ leverage allows you to amplify the size of your position exponentially by borrowing money from your broker.

This high leverage is possible because the broker operates out of New Zealand, where the regulations are less restrictive than ASIC-supervised brokers. If you’re keen on maximising your exposure while using MT5, then BlackBull Markets is my top recommendation.

Pros & Cons

- Leverage up to 1:500 on forex

- Good range of trading products

- Low spreads

- Withdrawal fees

- Limited in-house analysis of the markets

- A high minimum deposit is required for ECN Prime

Broker Details

While BlackBull Markets has earned top marks for fast execution speeds, for me this broker stood out more for having 1:500 leverage on MetaTrader5. I would also like to mention their excellent platform tools which improved my overall trading experience on MT5.

Fastest Execution Speeds

Based on my execution speeds testing, BlackBull Markets is the fastest MT5 broker overall. The broker averaged execution speeds of 72 ms for limit orders and 90 ms for market orders, putting it at the top of my list.

In my opinion, having fast execution speeds is crucial when trading with BlackBull Market’s high leverage of 1:500. Lower latency can greatly reduce your risk of slippage, which high leveraged trading can amplify.

High 1:500 Margin on MT5

Sometimes referred to as trading on margin, leverage allows you to amplify the size of your position exponentially by, in essence, borrowing money from your broker. While this can lead to significantly larger profit margins if you’ve read the market correctly, it can also mean considerable losses if you fall victim to slippage or requotes.

Most regulators cap the amount of leverage a broker can offer non-professional traders at 1:20 or 1:30. BlackBull Markets, on the other hand, gives you access to leverage of up to 1:500 no matter where in the world you’re trading from. They can can offer high leverage because they are based in New Zealand, which has more relaxed leverage rules than ASIC-regulated Forex brokers.

Excellent Trading Platform Tools

Other with MT5, it was delightful to find that BlackBull Markets offers a decent range of platforms, including MT4, cTrader and TradingView. I’d also like to highlight the useful trading tool add-ons BlackBull Markets offers. If you’re a social trader, then you’ll have access to a MyFxBook integration for MetaTrader 4, as well as ZuluTrade and Hokocloud.

What stood out to me, however, was the broker’s offering of both a VPS (Virtual Private Server) and API FIX service, which gave me better trading connectivity, faster execution speeds and lower latency.

4. Fusion Markets - Lowest Commission Costs With MT5

Forex Panel Score

Average Spread

EUR/USD = 0.93

GBP/USD = 1.08

AUD/USD = 0.92

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why I Recommend Fusion Markets

I liked Fusion Markets specifically for the unbeatable low commissions when using MetaTrader 5. This broker stands out as my top option for cost-conscious traders in a trading landscape where fees can quickly eat into profits.

Based on my experience, this isn’t just a promotional gimmick; Fusion Markets genuinely offers some of the most competitive rates in the industry.

Pros & Cons

- Lowest commissions

- Good choice of trading tools

- Fast execution speeds

- A high deposit fee for wire transfers

- Lacks TradingView platform

- Limited Range of trading products

Broker Details

After analysing trading costs, including spreads and commissions, Fusion Markets stood out as having some of the lowest spreads and cheapest commissions for an MT5 broker. Here is a summary of my test findings.

- 3rd for Standard Accounts spreads (avg 1.19 pips for major pairs, 1.01 pips for EUR/USD)

- 1st for RAW Account Spreads (0.22 pips for major pairs, 0.26 pips for EUR/USD)

- 2nd for order execution speeds (79 ms limit orders, 77 ms market orders)

Ultra Competitive Spreads and Fast Execution Speeds

To interpret the spread results above, the industry average for Standard accounts is 1.52 pips, while it is 0.44 pips for RAW accounts across the 5 most traded currency pairs. As such, Fusion Markets is well below the average for both — only IC Markets (1.03 pips) and CMC Markets (1.11 pips) had tighter spreads for Standard accounts. This means you’ll get solidly affordable rates in both account types with Fusion Markets.

For execution speeds, the broker ranked second for the fastest overall speeds — only BlackBull Markets had faster limit order speeds of 77 ms.

Lowest MT5 Commissions

When comparing commission costs, I found that Fusion Markets has the cheapest commissions of any MT5 broker I tested. Of all the ASIC-regulated brokers, the broker came out on top with a commission of AUD $4.50 round turn per standard lot, which is $2.50 less than the industry standard of $7.

And while the commission cost is definitely a cost to consider, it is only good if the spreads remain competitive, which I had proven in my tests.

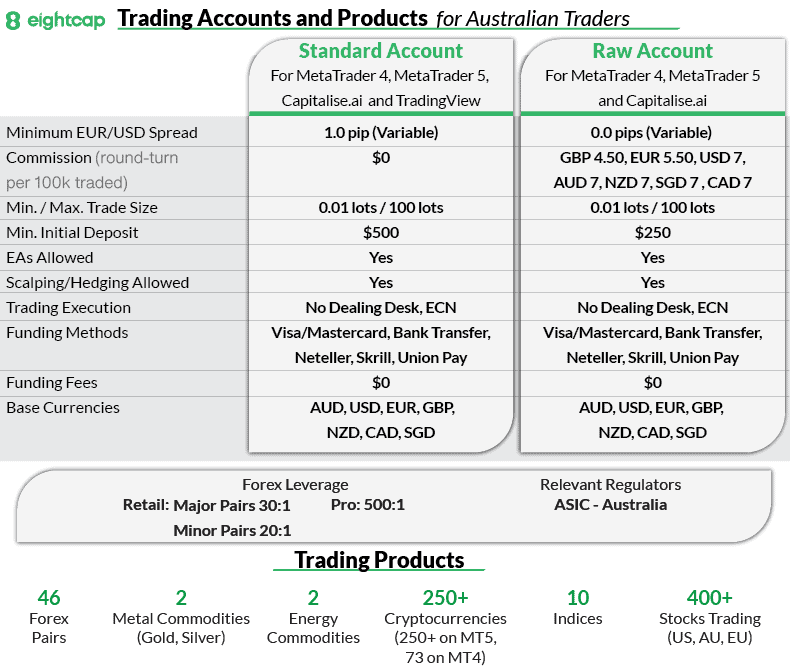

5. Eightcap - Most Popular MT5 Broker for Crypto CFDs

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 1.0

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why I Recommend Eightcap

I liked Eightcap for the extensive range of cryptocurrencies and crypto CFDs. If I am being honest, this broker left competitors in the dust when it comes to crypto trading.

For context, Pepperstone offers 19 cryptos while IC Markets has 25, and Eightcap outperformed both with a broader selection of 95 cryptocurrencies on MetaTrader5.

With this, I advise traders looking to capitalize on the volatile crypto market to check into Eightcap. This broker is the most popular MT5 broker for crypto CFDs.

Pros & Cons

- Tight spreads on crypto markets

- Has automated tools for MT5

- Provides good MT5 market analysis

- Limited range of trading products

- Lacks copy trading tools

- Customer support is not 24/7

Broker Details

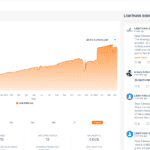

Top Crypto Offering for MT5

Compared to the other brokers I reviewed for this roundup, Eightcap had the widest selection of 95 cryptocurrencies using MetaTrader5. By way of example, other MT5 brokers include Pepperstone offering 19 cryptos, IC Markets with 25, and ThinkMarkets with 27.

From my extensive analysis, the table below highlights that Eightcap offers the largest crypto range against other brokers by some margin.

Competitive Crypto Spreads with MT5

When looking at spreads, I tasked Ross with testing the average spreads for cryptocurrencies for other MT5 brokers including eToro, IG Group, and IC Markets. He found that Eightcap’s spreads compared favourably overall.

The broker averaged 12 points for Bitcoin compared to IC Markets of 18.2 pts, 0.45 pts for Ethereum compared to IG Group’s 1.2 pts and 0.004 pts Cardano compared to eToro’s 0.0085 pts.

Top MT5 Tools

Eightcap will provide you with some helpful trading tools for crypto trading, such as Capitalise.ai, and FlashTrader. This is a pretty solid line-up, although you will need to use MT4 to take advantage of them.

As someone who has been in this market for a while, I personally grew fond of FlashTrader, which is an execution tool that lets you target multiple profits, calculate position size, and place stops and limits in just one click, using your trade ticket.

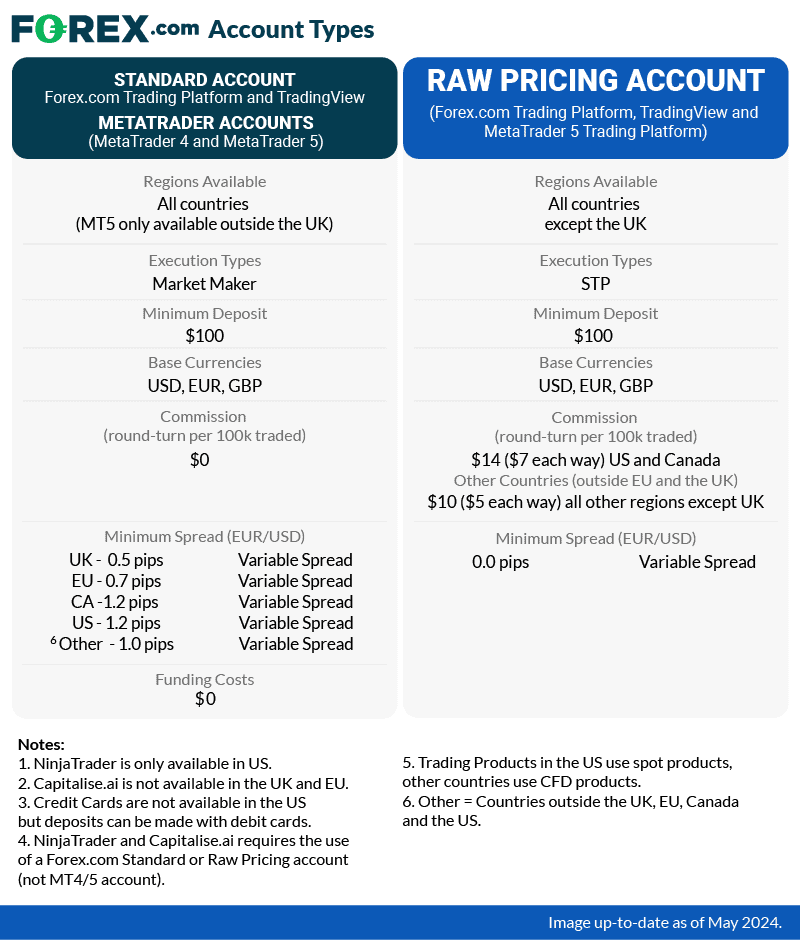

6. FOREX.com - Solid Trading Tools On MetaTrader 5

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why I Recommend FOREX.com

We liked the range of features that Forex.com provides that can help you manage and execute your trades better on the MetaTrader 5 platform. These EAs fill in the gaps that the original MT5 platform skips.

The broker stood out for its solid all-around service, especially with its low trading costs through its Raw account (spreads from 0.0 pips).

Pros & Cons

- Raw spreads from 0.0 pips

- Free MT5 trading tools

- Solid range of forex pairs

- Not available in Australia/Singapore (Use City Index)

- Lacks social trading tools

- The commission is slightly above average

Broker Details

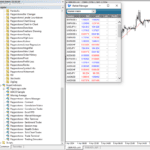

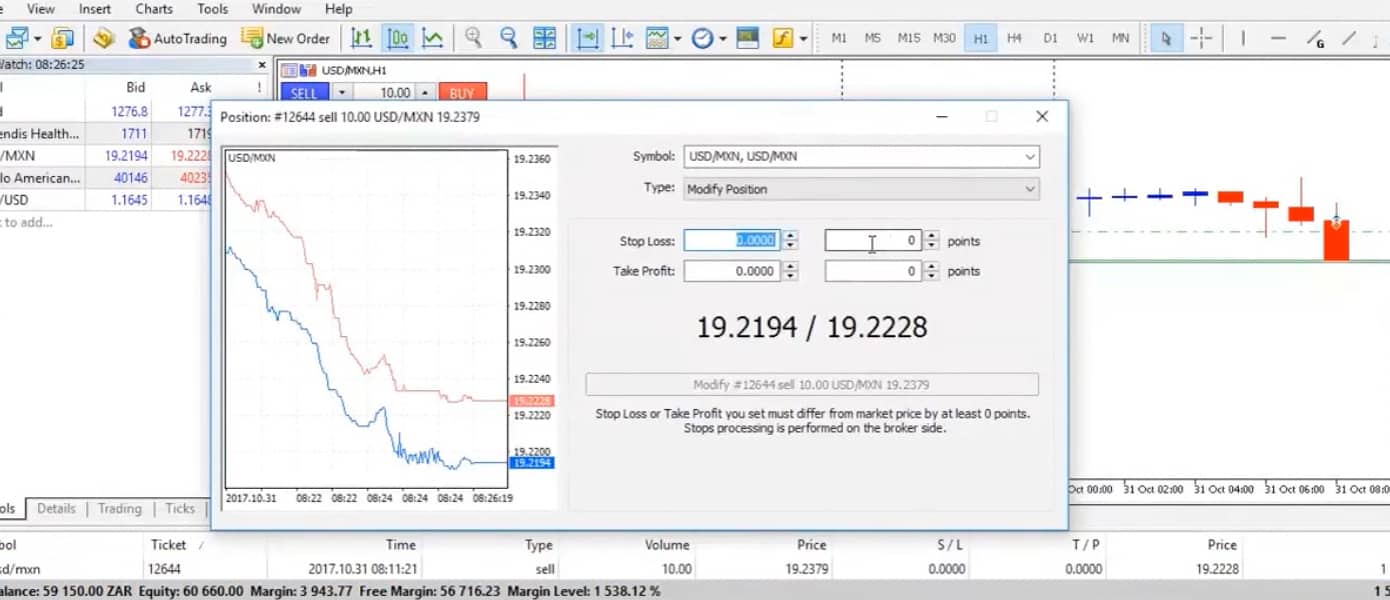

During our MetaTrader 5 tests, we found that Forex.com’s desktop version of MT5 has a few standout tools to enhance the trading platform. One such tool is the FX Blue Expert Advisors, a collection of nine indicators similar to Pepperstone’s Smart Trader Tools that adds improved trade and account management within MT5.

The included Mini-terminal EA extends MT5’s built-in one-click trading tool by adding stop-loss and take-profit orders to your market orders. This tool allowed us to ensure we didn’t forget to add our risk management, making trade management much faster.

We also noticed that Forex.com includes a Reuters news integration for MT5, providing actual market updates in real-time, not just headlines from aggregated news sources that other brokers offer.

Interestingly, Forex.com uses a straight-through process (STP) to execute your trades when you use the Raw pricing account (the broker uses a different process for its Standard account).

Using an STP broker is beneficial as it means the broker passes your orders directly to the market, so your trades are matched with other traders almost instantly. This makes it an ideal choice if you are algo trading or scalping on the MetaTrader 5 platform.

If you trade large volumes or frequently, the Active Trader program is a free opt-in that reduces your spreads and issues you with cash rebates based on your trading activity. The higher the activity, the better the rewards, earning up to $10 rebate per million traded.

*Note: MT5 or Raw Spread accounts are not available in the UK.

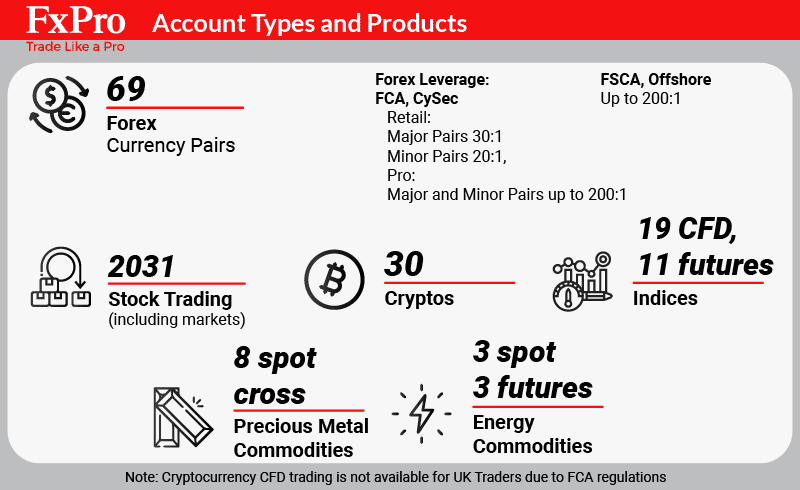

7. FxPro - Top MetaTrader 5 Currency Pair Range

Forex Panel Score

Average Spread

EUR/USD = 1.32

GBP/USD = 1.7

AUD/USD = 1.95

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$100

Why I Recommend FxPro

I liked FxPro for the unmatched variety of currency pairs when using MetaTrader 5. With more than 69 currency pairings, including majors, minors, and exotics, this broker offers the most options in the FX market.

On top of that, FxPro provides an array of asset classes like equities, indices, and commodities for CFD trading. They also offer up to 30 cryptocurrencies and crypto CFDs for international traders.

Pros & Cons

- Over 65+ currency pairs

- Excellent choice of trading tools

- No minimum stop loss

- Has inactivity fees

- Requires a minimum deposit

- Spreads are not competitive enough

Broker Details

Large Range of FX Pairs on MT5

First up, I found it astounding that FxPro gives you access to a large range of 69 currency pairs on MT5, including majors, minors, and exotics. If you think that the path to riches is in pairing the Norwegian Krone, Russian Ruble, Polish Zloty, and Turkish Lira with the US dollar and Euro, then you’ll find lots to like about FxPro.

In addition to forex, you can trade CFDs across a wide range of asset classes, including +2000 shares, indices and commodities and cryptocurrencies.

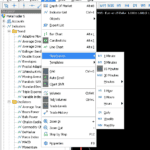

Best Account Features with MT5

When you open an account with FxPro, you can choose MT4, MT5, cTrader or the FxPro platform.

For the best features and lowest spreads, I highly recommend the MT5 RAW account. The added benefit of MT5 compared to the other platforms is that you have access to EA trading, DoM (depth of market) liquidity, over 35 indicators, 21 timeframes and an integrated economic calendar. By comparison, FxPro and MT4 don’t have DoM trading, a less powerful programming language and fewer charting tools.

By comparison, FxPro and MT4 don’t have DoM trading, a less powerful programming language and fewer charting tools.

In terms of minimum spreads, FxPro claims average spreads for its RAW account are 0.2 pips for EUR/USD but my testing has them at 0.32 pips, which is higher than the industry average of 0.24 pips.

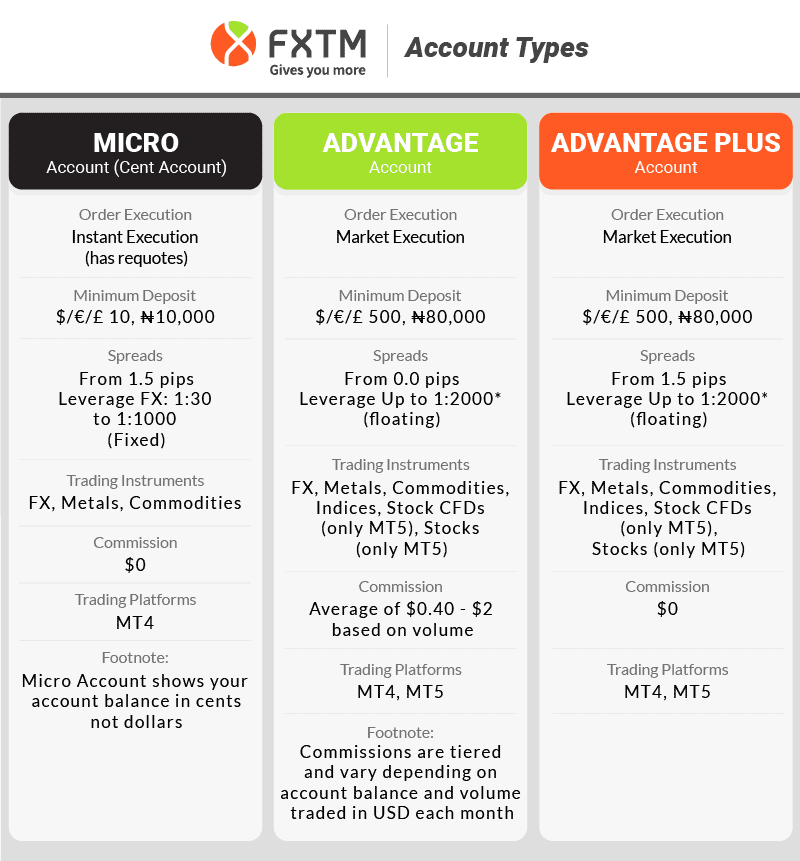

8. FXTM - Great MT5 Broker for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.9

GBP/USD = 2.0

AUD/USD = 2.0

Trading Platforms

MT4, MT5

Minimum Deposit

$10 - $500

Why I Recommend FXTM

FXTM is my top pick if you are just dipping their toes into the MT5 trading waters. With the broker’s straightforward cost structure and narrow spreads, especially in its ECN accounts for retail traders, FXTM makes it easy for beginners to navigate the complexities of forex trading.

Unlike with a Standard account, you can sidestep the added costs and risks of slippage. Essentially, it’s a no-nonsense approach that lets you focus on what matters most: your trades.

Pros & Cons

- Excellent range of educational resources

- Solid selection of trading tools

- Good choice of CFDs to trade

- Withdrawal fees

- Lacks a choice for trading platforms

- 24/5 customer service

Broker Details

Top MT5 Broker for Beginners

While most new traders of the forex markets are naturally drawn to Standard accounts due to their no-commission fee structures, my experience says otherwise. You’ll save more money on a RAW spread or ECN-like account.

As such, I highly recommend FXTM’s Advantage (RAW) account for beginners, due to its straightforward cost structure. From my spreads analysis, I found the broker averaged 0.22 pips across the 5 most traded currency pairs, putting it well below the industry average of 0.44 spreads.

In addition to low spreads, FXTM offers cheap commissions (USD $2.50 per side) which is just amongst the lowest I’ve tested, just behind Fusion Markets at $2.25.

This is why I like FXTM’s Advantage account for new traders using MT5. You lose the extra expense and potential for slippage that come with a Standard account’s higher spreads without the overwhelm of a complex set of commissions.

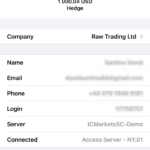

MT5 Interface

MT5 Interface

Ask an Expert

Can you trade stocks with MT5?

Yes. Unlike MetaTrader 4 which is designed for forex trading which is decentralised, MetaTrader 5 is designed for centralised and decentralised trading. Centralised trading means financial instruments that are traded through a central exchange.

Does MT5 still trade Bitcoin?

Yes..The brokers we recommend only have it with CFDs

Hi Justin, Great work indeed. Well explained.Could you please comment about ‘YorkerFx’ in Forex trading. Thanks in advance.

I’ve never heard of YorkerFX, I must admit. A quick look and I can see they specialise in the MT5 trading platform with RAW spreads from 0.o pips with their ECN account but you will need a hefty $5000 minimum deposit to use it. My main concern is that they are not regulated by any notable Financial regulator, instead using an obscure one I have not heard of from Comoros. Personally, I prefer to use a broker with licenced by a notable financial regulator.