Forex trading involves exchanging two currencies with the goal of profiting from the changing exchange rates. This page looks at what forex trading is, its benefits, legality, and regulation in the UK.

With 6.6. trillion Forex transactions each day, Forex trading is by far the most actively traded financial market in the world. This trading activity results in the volatility of prices between different currencies and, therefore, opportunities to make a profit. In this guide, we cover Forex trading, its benefits and risks, and some strategies to help you capitalise on global currency market opportunities. We also cover aspects relevant to trading Forex in the UK, such as its legality and how it is regulated.

A Few Basic Facts About Forex Trading In The UK

- Forex trading allows you to trade currencies 24 hours daily, with low transaction costs and easy-to-obtain leverage.

- With $6.6 trillion traded daily, the foreign exchange market is the world’s largest and most liquid financial market.

- The Forex market is 2.33 times the size of the UK’s annual GPB (2.827 trillion).

- More Forex is traded each day than the cryptocurrency market at its peak capitalisation ($835 billion).

- Careful research is essential to select the right forex broker. Some are much better than others.

- Risk management is key when it comes to trading forex. All traders will make losing trades sometimes, so it’s important not to destroy your capital with inevitable losses.

- To offer Forex trading services to UK residents, forex brokers must be regulated by the Financial Conduct Authority (FCA).

What Is Forex Trading

Foreign Exchange Trading (or Forex trading and even FX trading for short) is the simultaneous exchange of hands from one currency to another.

Each currency has a value that is constantly changing against another currency (known as a currency pair). Thus, opportunities are available to profit from differences in value when buying and selling each currency.

Why Trade Forex?

You’ve probably heard of people trading the stock market or cryptocurrencies; these are great asset classes. But, for an individual trader with a small amount of capital, the foreign exchange markets may be the very best asset class to trade. Forex markets across the globe have over $6.6 trillion in forex transactions each day, making it the most liquid financial market you can trade. And there is a Forex market open somewhere in the world 24 hours per day, five days per week, so it’s possible to find trading opportunities around the clock.

Opening a Forex broker account and depositing capital is often very simple. Most brokerages offer easy-to-use trading platforms where a beginner can be comfortable placing their first trade within minutes of loading the platform.

Forex also allows traders to make large profits and losses on a small amount of capital through leverage. Leverage is where you have a small amount of capital in your account to use as a margin, and the broker will lend you the rest to hold a large currency position.

Another benefit for small and beginner traders is that you can trade with as small or as large sizes as you like. This makes it easy for a trader to start out in the markets trading small size. They can gradually increase their position sizes as their skill level grows.

These are some advantages when trading forex, but you also need to be aware of the risks of trading forex.

Risks in Forex Trading

The reality of trading any asset class, especially forex, is that you’ll make losing trades. Even the very best traders and hedge fund managers regularly make losing trades. To succeed in forex trading, managing your risk is important so that a string of bad trades won’t destroy your trading capital.

Most traders will do this by risking only a small percentage of their capital on any one trade. For example, a trader with £10,000 in their trading account may only risk 1%, or £100, on a single trade.

The use of leverage is another risk factor in FX trading. Leverage can be great if you’re making profitable trades, as it can magnify your profits with your trading capital. On the flip side, using leverage when making losing trades will magnify the amount of capital you can lose. As a rule of thumb, it’s a good idea to be conservative with the level of leverage you use.

Another danger in forex trading is what’s known as event risk. Sometimes a central bank will announce a sudden interest rate cut, which can send currencies flying or plummeting. The best way to protect yourself from these sudden events is by keeping your eye on expected economic releases.

Strategies For Trading Forex

There are almost infinite possibilities, tools, and techniques for analysing forex markets.

It’s important to develop trading strategies that are well suited to your own personal risk tolerance, personality, interest, and lifestyle.

Here are some of the broad types of ways to analyse currencies:

Technical Analysis

Technical analysis is a form of analysing markets by interpreting the price and volume data, often found on the chart of a currency price. Price action on a chart represents the collective psychology of all market participants. We can see how markets reacted at certain price levels and specific points in time.

There are many types of technical analysis, with some people electing to mark key price levels on their charts. Others use complicated mathematical indicators to try and predict the likely future action of a currency pair.

Most forex brokers offer free charting with their trading platforms. If you’re just getting started, it’s a good idea to play around with all the indicators and see if something clicks with you. One rule of advice for using technical analysis is to keep it simple. Many of the best traders in the world use straightforward charts.

Fundamental Analysis

Fundamental analysis is the process of analysing markets using economic data and news, such as interest rates and employment figures. Currency prices will often ebb and flow along with the underlying country’s economic condition, so you can find trading opportunities by having insight into economic conditions.

If fundamental analysis interests you, it’s a good idea to be well-versed in economics and general financial matters. You can do this by reading books on economics and financial news, or even studying these topics at university.

Spread Betting

A unique option spread betting in the UK. This is similar to currency trading but has tax benefits compared to conventional CFD trading. It’s worth considering which strategy is right for you. Factor in how this impacts the way you trade vs the tax you will need to pay on any profits made. Not all Forex brokers offer spread betting, but those that do allow you to bet with the same CFD product they offer.

Getting Started with Forex Trading

Compared to other capital markets, the forex market is probably the easiest for new traders to set up and start placing trades.

1. Choose A Forex Broker

When choosing a forex broker in the UK, there are many important factors to consider. Many brokers accept retail investor accounts, with some offering unique features suited to different trading experience levels, styles, and strategies.

Some of the most important considerations include:

- The type of broker and the spreads they offer

- The trading platforms and available tools

- The risk management features available through the broker

- Whether the broker offers additional products such as spread bets or CFD trading

Our Best Forex Brokers In UK page provides extensive write-ups on most of the major brokers, where you can quickly compare each firm’s fees and features. We’ve analysed many of the biggest and most well-known brokers, such as CMC markets, Saxo Bank and Interactive Brokers.

Types Of Brokers

Forex brokers can be split into two main groups in how they offer prices of currencies for you to trade.

- Dealing Desk Brokers

- No Dealing Desk Brokers

Dealing Desk Brokers

Dealing desk brokers, also known as market makers, use company funds to trade with customers.

For example, if you buy some AUDUSD through a dealing desk broker, that broker will often sell it to you from its own company inventory instead of the broader FX market.

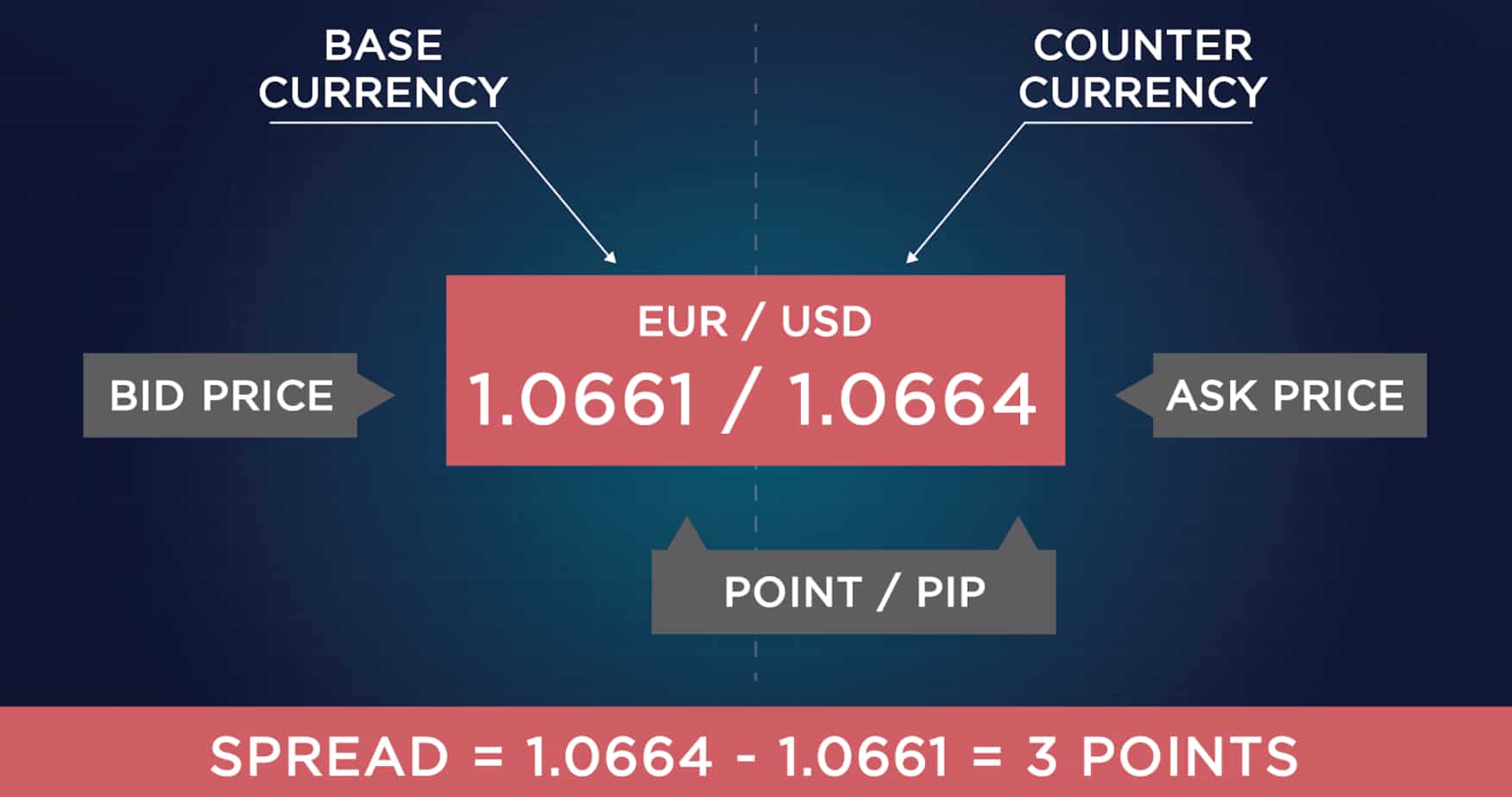

A thing to watch out for with dealing desk brokers is how the firm manages its bid-ask spread.

The bid-ask spread is the quoted numbers that the firm will allow you to buy or sell a currency. Sometimes dealing desk brokers can lack transparency with their spreads and suddenly widen them, which may cause sudden losses for your account.

Make sure you understand how spread work and what they are.

No Dealing Desk Brokers

Conversely, No Dealing Desk Brokers (NDD) brokers use external liquidity sources to determine bid-ask prices and fill orders.

When you place an order with an NDD broker, it is directly passed onto liquidity providers with no dealing desk interference. As prices are sourced from multiple providers, bid-ask prices react to current market conditions, such as volatility and liquidity. Plus, you’re getting a true view of the forex market.

A major benefit to NDD brokers is that they often offer faster execution and tighter spreads than market makers. They are purely acting as a bridge between forex traders and multiple top-tier liquidity providers.

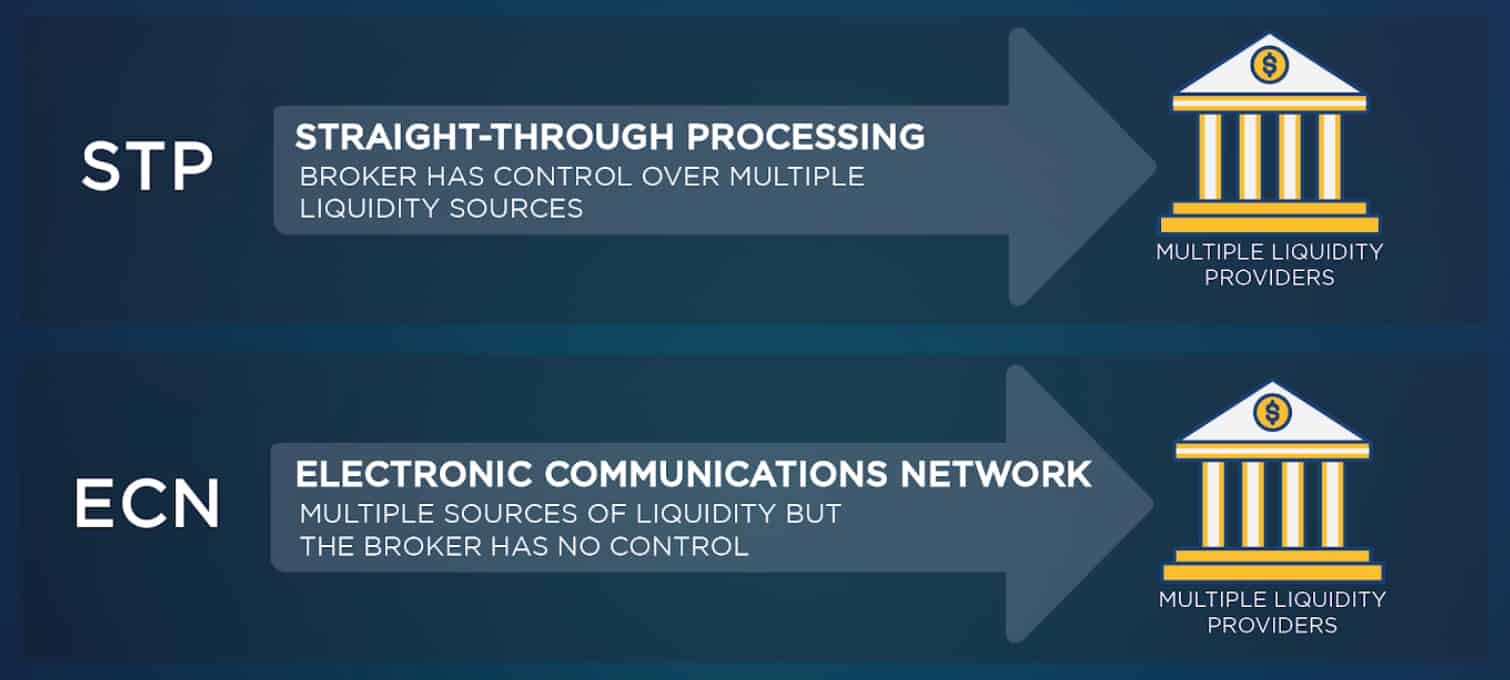

NDD brokers use straight-through processing (STP) or electronic communications network (ECN) execution methods, or in some cases, a combination of the two:

- STP: Has an internal pool of liquidity sourced from multiple providers. Broker retains some control over liquidity.

- ECN: Routes orders onto an interconnected hub with different banks and other major market players. Broker has no control over liquidity providers.

2. Choose The Forex Trading Account

Most forex brokers offer several trading account options that primarily impact fees.

A standard account is when the primary brokerage is baked into the spread. This is why there will be a difference between the ‘Ask’ and ‘Sell’ prices of any currency pair.

A Raw/ECN trading account will have lower spreads that are set by the market and, in addition, will charge a commission based on trading volume. Standard accounts are more popular with UK traders, but our spread research shows they attract higher Forex Fees.

There are also retail vs professional trading accounts. The latter requires you to qualify and prove you are a sophisticated trader based on your past trading patterns, personal wealth, or level of knowledge.

The advantage of a professional account is primarily the ability to receive higher leverage. For example, the FCA sets the maximum leverage when trading major currency pairings at 30:1, while a broker like Pepperstone will give a professional trader up to 500:1 leverage.

3. Selecting A Forex Trading Platform

Most brokers will give several options when it comes to forex trading platforms. Some are easier to use than others or have more advanced features. It’s important to find a platform that you’re comfortable with.

The most popular trading platform for currency trading is MetaTrader 4. The more recent MetaTrader 5 is also popular but also provides access to a wider array of markets such as CFDs and shares. The Best MT4 Brokers in the UK often provide excellent trading conditions, competitive spreads, and reliable customer support to complement the robust capabilities of the MetaTrader platform.

Two more forex platforms to note are cTrader known for being popular with scalpers due to Depth of Market tools, and TradingView, known for its extensive list of features, trading products, and data feeds.

Some platforms have copy trading capability like eToro, ZuluTrade and MQL5 while others have automation and AI capability such as Capitalise.ai and Expert Advisors (with MT4 and MT5).

4. Practising with a Live or Demo Account

For new forex traders, a demo account is an invaluable tool that enables you to experiment with different tactics and techniques without putting real money on the line.

Signing up for this type of trading account only requires submitting your basic information such as name, address, and email address. It’s quite straightforward. The ‘fake’ or virtual funds allow users to simulate transactions in actual market conditions, which helps them sharpen their strategies risk-free.

It’s recommended that they spend at least half a year practising through the demo platform before transitioning into active investing. In this way, they can thoroughly understand currency trading and how it works and perfect their methods accordingly.

Forex Instruments When Trading

When engaging in Forex trading, it is important to be familiar with the different instruments available. These range from spot transactions and forward contracts to futures and options trading – each of which brings its own advantages and risks that need evaluation depending on your style and risk appetite.

The most popular currency pairs are EUR/USD, GBP/USD, etc., while minor or exotic currency combinations provide less liquid markets but also different levels of market activity.

Spot Transactions

Spot transactions in foreign exchange are a quick way to buy or sell one currency for another at the existing market rate. Through the spot market, traders are basically exchanging one currency for another at the agreed market rate.

This is the simplest way to speculate on currencies and potentially earn a profit if the exchange rate moves.

Forward Contracts and Futures

Forward contracts and futures derivatives provide traders with a way to protect against changes in the exchange rate. They secure an agreed-upon price for the currency at some point in the future.

These instruments help manage foreign exchange risk, allowing you to lock in your desired rate now before market rates fluctuate. The primary distinction between forward agreements and futures is that while forwards are transacted privately OTC, future transactions occur on exchanges.

Other than this difference, they are similar in that they are beneficial tools in situations involving potential currency fluctuations. Retail traders will often skip over forward and futures contracts, as spot trading is often all that is needed for short-term speculating on FX prices.

Options Trading

Options trading is a form of derivative trading that gives traders the option, but not an obligation, to buy or sell a currency at an arranged price for later.

Forex options offer flexibility and potential profit as well as provide ways to minimise losses. Traders can apply various strategies such as straddles, butterflies, condors, and vertical spreads, which all come with their own advantages and disadvantages.

Understanding the risks associated with this kind of trading activity is essential before forming your own plan to maximise gains. Key point: Options are not for beginners.

Currency Pairs and Liquidity

When you trade a currency, you’re always buying one currency while selling another. For example, if you purchase GBPUSD, you are buying GBP and selling USD. These six-letter quotes are known as currency pairs, and there are a few factors you should know about them before you start trading.

Currency pairs are often quoted against the USD. Currency pairs are broken down into three types: major, minors and exotics.

Major Currency Pairs

These are the currencies attached to the world’s largest and most advanced economies. Major Forex Pairs include the EURUSD, GBPUSD, USDJPY, CADUSD, AUDUSD and USD/CHF.

These currencies make up the bulk of trading volume and often offer huge trading liquidity and tight spreads.

Minor and Exotic Currency Pairs

Aside from the major currency pairs, there are minor and exotic categories. Minor currency pairs, also known as cross-currency pairs, involve two major world currencies but not the US dollar.

The EUR/GBP, EUR/JPY, and GBP/JPY are examples of minor forex pairs. Such combinations tend to have lower liquidity than majors. They also come with wider spreads and greater volatility.

On the other hand, we have the exotics that combine one main currency versus a less widely used version, such as the USD against Turkish Lira or South African Rand – these offer unique prospects as they often deliver unpredictable movements in price due to their low liquidity accompanied by larger bid-ask gaps.

Charting Tools For Trading Currencies

Most retail traders will use charting tools when trading forex, allowing them to observe and study changes in price over time. Traders will often use bar charts or candlestick charts to look at the previous few hours, to a few weeks of price action, depending on the trader’s desired timeframe.

Bar and candlestick charts reveal the opening, maximum, minimum, and closing prices for an allocated interval in time. Traders often overlay key support and resistance levels, prior swing highs and lows, and possibly even technical indicators.

By spending the time to learn to read the charts, you can gain insight into the underlying psychology of the market. Knowing how traders will react at certain levels or situations can help you predict the likely next move of a currency.

Charting tools will vary by trading platform and device, depending on your chosen trading app. It’s worth trying out a few to see which one you’re most comfortable with.

Regulatory Landscape and Legal Aspects

In the UK, financial oversight for forex trading is provided by the Financial Conduct Authority (FCA).

The FCA ensures compliance with rules and regulations that help safeguard investors from potential risks in this industry. It is tasked to monitor all forex-related activities by UK brokers.

It is advised that any individual based in the United Kingdom should only choose FCA Regulated Brokers for their own protection and security purposes.

The FCA ensures compliance with relevant rules and regulations so that consumers can confidently enjoy foreign exchange trading without worrying about exploitation or manipulation from unscrupulous actors.

Global Regulatory Bodies

Different jurisdictions worldwide provide regulatory oversight of forex trading.

In the United States, for example, it is supervised by the Commodity Futures Trading Commission (CFTC). The Australian Securities and Investments Commission (ASIC) is responsible for all financial services within Australia that involve forex brokers.

These global regulating bodies aim to protect traders through comprehensive frameworks and restrictions on forex trading activities as well as guarantee market stability. We compare forex brokers primarily that are FCA regulated but for features traders may want (eg higher leverage) we may add some international brokers but these are clearly flagged.

Summary

The forex market is very well suited for traders just getting started due to the ease of opening an account, the ability to trade small size, and the ability to trade at any hour of the day. The above information will get the ball rolling for you, but it’s important to continue learning and developing your skills when it comes to forex trading.

Most importantly, remember to manage your risk, develop an intelligent trading strategy and never trade with funds you aren’t comfortable losing.

Frequently Asked Questions

Is £100 enough to start forex?

Yes, £100 is enough to start forex with most forex brokers like Pepperstone having a £0 minimum deposit. The advantage of depositing a small amount is you can’t lose more than that since the FCA enforces negative account protection. It’s advisable that rather than trade with a small amount you open a forex demo account.

Is forex trading legal in the UK?

Yes, the Financial Conduct Authority (FCA) is responsible for overseeing the legality of forex trading in the U.K., making sure all brokers involved are authorised and licensed to offer their services. The FCA has established a regulatory framework that serves as an assurance that investors will be able to safely engage with this market through secure means.

Forex brokers must hold an FCA licence, have at least two years of operation under their belt and adhere to necessary standards for financial soundness put forth by the authority itself. Traders dealing with FCA-accredited brokers can be confident knowing their investments are secure.

Can forex trading be profitable?

Forex trading has the potential to generate significant rewards if you have the right skill set. In fact, many of the world’s largest hedge funds and traders have made exorbitant amounts of money from trading forex. Every single trader in the world has started out as a confused beginner, so if that sounds like you, don’t be scared but understand the risks. We have more on the subject on our risk management guide.

Is forex trading good for beginners?

Compared to other asset classes, such as the stock market and cryptocurrencies, forex trading is perhaps the best suited for beginner traders. With the ease of setting up an account, the simplicity of forex trading platforms, and the ability to trade small sizes, a beginner trader can be set up and trading within minutes.

It’s best to start out on a demo account, where you won’t have to risk any money. Check out our Forex Trading Platforms For Beginners guide, which will help you decide which forex broker is best for you.