Best Trading Platform: Stock, Forex, Options and CFDs

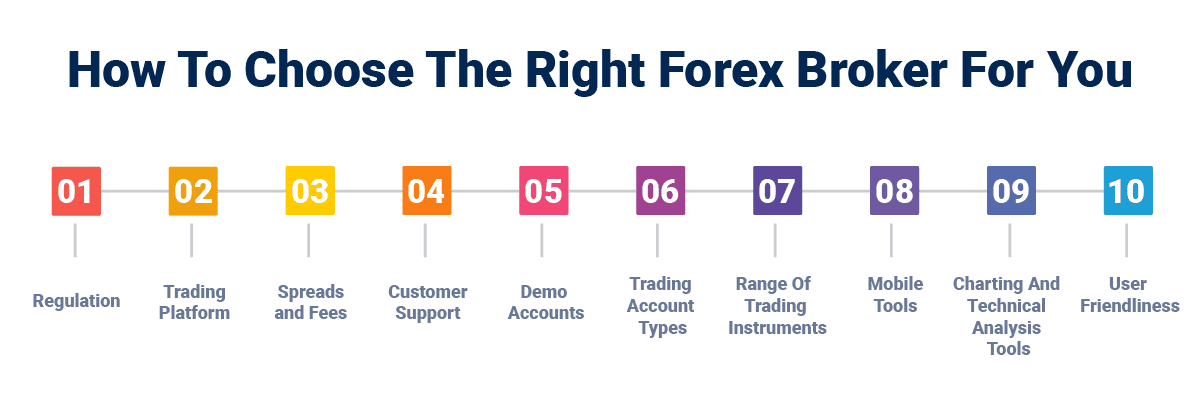

The best UK brokers were determined by the brokerage, trading software, customer support and overall trading experience. We compared top trading platforms and found the best broker for each type of trading, from shares to CFDs.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

These awards were based on each broker’s spreads, commissions, customer service and features. For a broker to be eligible for the shortlist, they must be FCA regulated with an entity based within the United Kingdom. Below is a summary of the key strengths and why we felt they were the best in the category.

The best UK brokers based on the different types of trading are:

- Pepperstone - Best Forex and CFD Trading Platform

- Interactive Brokers - Leading Stock Trading Platform

- IG Markets - Widest Range of Trading Platforms

- Plus500 - Top CFD Platform for New Traders

- CMC Markets - Great Options Trading Platform

- eToro - Top Social Trading Platform

- FXCM - Advanced Charting with Trading Station

- FxPro - Leading cTrader Broker

What is the best trading platform for UK traders?

Pepperstone offers UK traders five platform options including MT4, MT5, cTrader, TradingView and their proprietary platform, all with spreads from 0.0 pips and 77ms execution speeds. We compared and reviewed platforms on charting sophistication, automation capabilities, mobile functionality and execution reliability during UK trading hours to match different skill levels and trading styles with appropriate software.

1. Pepperstone - Best Forex and CFD Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

By opening several accounts and field testing using EAs, we were able to determine that again Pepperstone was the clear winner when it came to the best forex broker in 2026. Key areas that Pepperstone won include the lowest spreads (RAW account), fast execution speeds, easiest joining process and the longest periods of 0 spreads on major currency pairs.

The broker also won Investment Trends for best customer service and most satisfied customers. All of these reasons are why we gave Pepperstone a score of 98/100 and why we list them as number 1 for the UK.

You can view the best forex trading platforms UK page for our full comparison.

Pros & Cons

- Low standard account spreads

- Best trading platform range

- Fast execution speeds

- Can’t trade spot equities

- No high-volume discounts

- Limited Risk Management tools

Broker Details

With 5 distinct types of trading platforms, social and algorithmic trading tools, 2 types of trading accounts, and a large range of products, Pepperstone has something for every kind of trader.

Key Features Of Pepperstone:

- Great range of trading platforms

- Competitive spreads

- Fast execution speeds

- Two account types, both with tight spreads

Pepperstone has Fast Execution Speeds

When testing execution speeds against 20 top brokers, Pepperstone was our 3rd fastest broker overall. Chief of technology research, Ross Collins, tested execution speeds using limit and market orders on an MT4 demo account. His results showed Pepperstone had an execution speed of 77ms for limit orders (2nd) and 100ms (5th) for market orders.

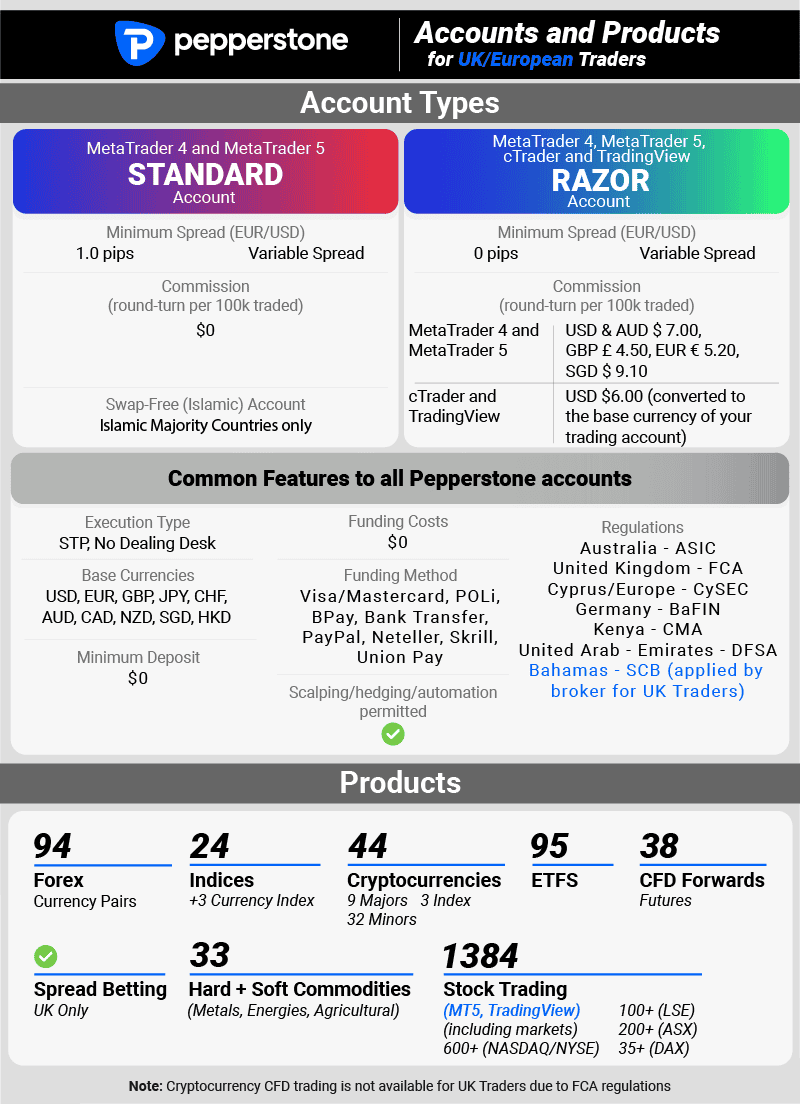

Trading Accounts

Pepperstone’s two accounts are the spread-only, Standard Account and commission-based Razor Account. The Razor account uses Straight-Through-Processing (STP) trading execution for ECN-like pricing. With this type of execution, quotes are provided directly from liquidity providers, meaning no dealing desk is involved in the trading process. Pepperstone charges a brokerage commission of GBP 2.25 per side instead of a wider spread to keep spreads as organic as possible.

While the Razor account has the lowest spreads, starting from 0.0 pips, the Standard account has no commissions with spreads from 1.0 pips. This is why we recommend the Razor account for more experienced traders with more costs to consider but potentially more profit margin.

One key advantage of Pepperstone’s Razor account, is you can reduce your commission costs if you trade with cTrader or TradingView. Please note, this only applies if you have a USD-base currency account.

Pepperstone is a top FX broker with low spreads, whether you trade with commissions or no commissions. Regarding no commission spreads, spreads start from 1.0 pips for the EUR/USD and GBP/USD pair. The chart below compares the average spread for the standard account of different brokers, such as City Index, CMC Markets, and Forex.com, using information published on each broker’s website.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Lowest Spread UK Forex Brokers

Looking at this comparison, it is clear that Pepperstone is one of the best choices you can make for tight spreads.

In terms of products, Pepperstone provides you with a wide range of financial instruments for trading, allowing you to diversify your portfolio. Pepperstone offers over 92 currency pairs with maximum leverage of up to 30:1.

As a UK trader, you also have the unique ability to spread bet as an alternative to trading CFDs. The good news is, Pepperstone’s entire product range is available to spread bet with. To place spread bets, you must use one of the MetaTrader platforms or cTrader.

Previously, Pepperstone provided access to cryptocurrency markets as well as the above asset classes. However, changes to FCA regulations in the UK now mean retail traders cannot trade cryptos such as Bitcoin.

Pepperstone has the Easiest Account Opening Process

When opening an account with Pepperstone, we found the broker had the easiest Account Opening process of any broker we tested. Using 15 key criteria against 20 other brokers, Pepperstone was the only broker to score a perfect 15/15. As well as being a simple and easy process, Pepperstone offered a very helpful account manager, who smoothly guided us through the process.

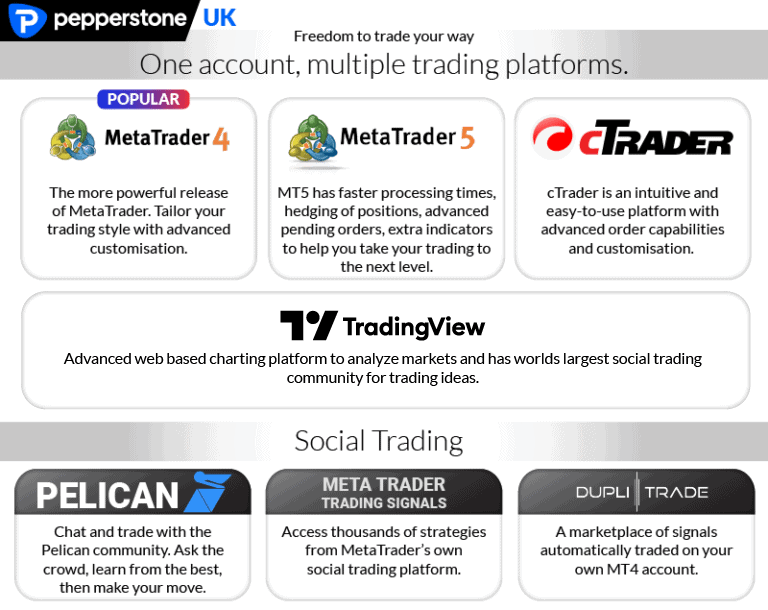

Trading Platforms

Pepperstone offers a choice of 5 diverse trading platforms. These are MetaTrader 4, MetaTrader 5, cTrader and TradingView. Each platform has features that will appeal to different traders. Below we cover each platform to help you understand which platform best meets your trading needs.

We ranked Pepperstone as one of the best MT4 forex brokers in the UK due to its low spreads, fast execution speeds and its MT4 trading tools. Pepperstone offers a free add-on package called, which comprises of 28 additional technical indicators and Expert Advisors. Smart Trader Tools enhances your trading environment with different order and risk management tools and market data and analysis features.

Pepperstone also allows scalping and hedging, which you can take full advantage of with the use of Expert Advisors and Smart Trader Tools.

Because of Pepperstone’s diverse platform range, you can automate your trading, use world-renowned charting tools via Autochartist (with useful AI features), TradingView and social copy with DupliTrade, Pelican and MetaTrader Signals.

All platforms are great choices for trading with Pepperstone range of 93 Forex pairs, commodities like gold and silver, 37 cryptocurrencies, 27 indices and over 100 ETFs.

Pepperstone Is An Award Winning Broker

Pepperstone is a multi-award-winning broker. To highlight the quality of its services, Pepperstone won not 1 but 5 awards at the prestigious Investment Trends Awards in 2026. Awards won include best for client satisfaction and value for money.

Our Pepperstone Broker Verdict

Our comparison of the best forex brokers in UK found that Pepperstone stands out with super-fast MT4 execution speeds and ultra-competitive spreads across the board. Additionally, the broker offers a great range of trading platforms, excellent algorithmic tools, including a range of EAs, and responsive 24/5 customer support.

Pepperstone ReviewVisit Pepperstone

Your capital is at risk ‘71.9% of retail CFD accounts lose money with Pepperstone’

2. Interactive Brokers - Best Stock Trading Platform

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

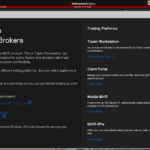

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Globally-regulated, Interactive Brokers was our pick for the best stock trading platform. Beyond excellent stock market access, IBKR grants users various popular and niche financial products, ranging from futures and forex to ETFs and hedge funds. IBKR’s comprehensive platform caters to diverse trading needs. The broker’s Traders’ Academy offers novices extensive educational content, including webinars and platform tutorials.

Pros & Cons

- Wide range of financial instruments

- $0 minimum deposit requirement

- Advanced trading tools on IBKR trading platform

- Low leverage levels

- Overwhelming product list for some

- Platforms too complex for beginners

Broker Details

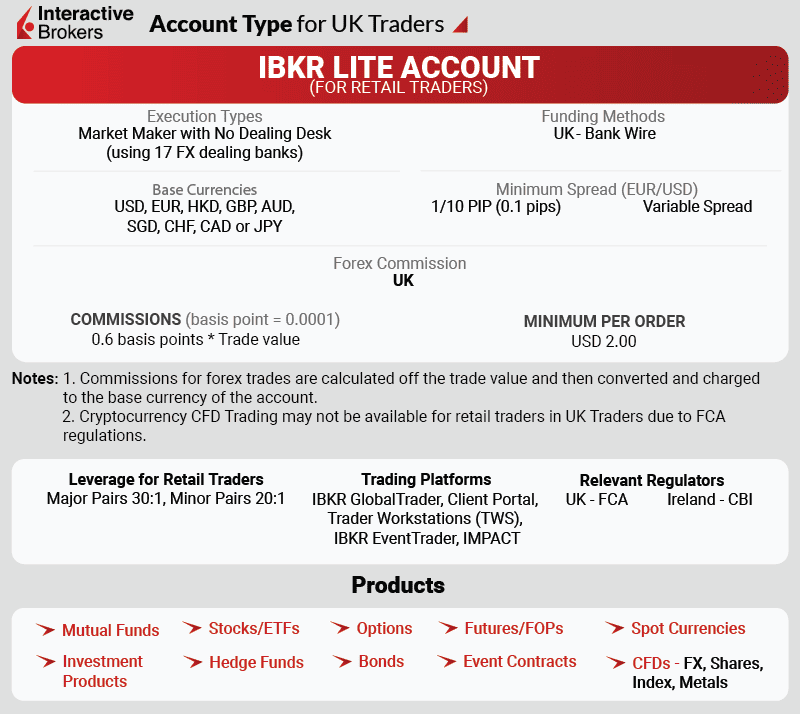

Interactive Brokers offers ECN broker spreads (market-based spreads) and the lowest commissions for high-volume traders. If you predict future trade value and are looking for a low-cost broker, IBKR ticks the boxes.

Those looking to trade more than just currency across the globe across multiple markets with a single interface are ideally suited toward IBKR. From our analysis, IBKR is more suited for active (high volume traders) and professional traders.

Beginners may feel overwhelmed with IBKR’s product list, and the learning curve too steep for its proprietary platforms.

IBKR Retail Investor Account

Interactive Broker’s trading accounts have no minimum deposit requirements, as shown below. This is across both trading accounts for individuals. However, inactivity charges are partially set on the trading account balance.

This is across both trading accounts for individuals. However, inactivity charges are partially set on the trading account balance.

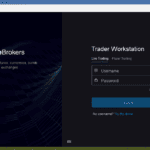

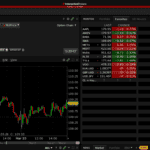

Interactive Brokers’ Trading Platforms

Interactive Brokers only offers its own trading platforms, with customised platforms for mobile, web and desktop. Where IBKR stands out is in its advanced trading tools, with highly sophisticated order type configurations and plenty of charting tools. Coupled with IBKR’s huge range of share CFDs and stocks, with access to over 80 stock exchanges, we rated IBKR as having the best stock trading platform.

One thing to point out is that IBKR doesn’t offer MT4 or MT5, which are two very popular platforms. There is also a steep learning curve for the IBKR platforms, which may be a bridge too far for beginner traders.

Our Interactive Brokers Verdict

Interactive Brokers will suit those traders who like to deeply analyse the markets with advanced and sophisticated trading platforms and tools. Along with the broker’s extensive product range, which includes everything from currency to mutual funds, we recommend IBKR for more experienced traders who like having a wide range of markets to trade.

3. IG - Largest Range of Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.16

GBP/USD = 0.59

AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

£250

Why We Recommend IG Group

We recommend IG Group to UK traders as it delivers its standout, bespoke platform with prime trading and research tools. Catering to a broad audience, the broker offers options from its superb proprietary platform, DMA trading via L2 Dealer, the advanced ProRealTime for charting and the reliable MT4. Additionally, IG provides an impressive array of tradeable products, with discounts for high-volume FX trading.

Pros & Cons

- Wide range of markets

- Negative balance protection

- Provides AutoChartist on MT4

- Customer support only on weekdays

- No social trading tools

- Limited product range with MT4

Broker Details

IG Group is one of the oldest brokers, founded in London in 1974. Not only does IG have the best range of trading platforms, but the broker also has one of the best proprietary trading platforms in the industry, with excellent trading and research tools. A big plus with the IG platforms is the inclusion of a guaranteed stop loss for risk management, which not every broker offers.

The broker offers many advantages, including:

- Industry beating proprietary platform

- A vast range of markets

- Competitive pricing

- Advanced trading tools

Trading Accounts

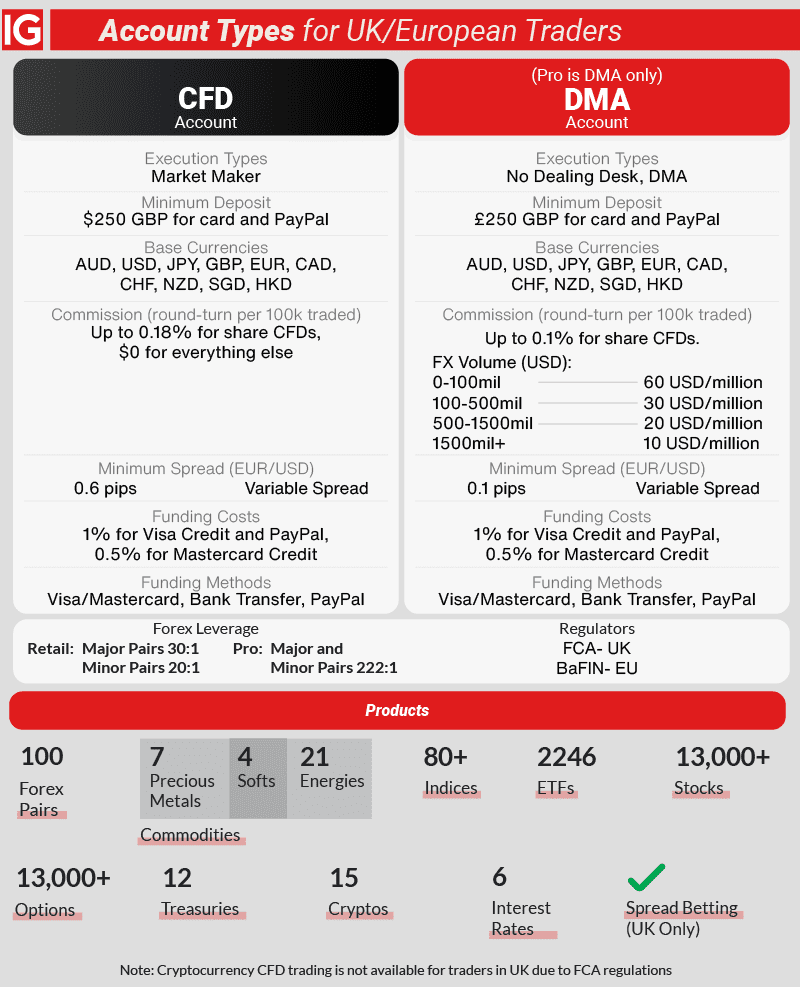

IG offers two vastly different retail investor accounts: a CFD and a DMA account.

Their CFD account is aimed at beginners, with no commissions (other than share CFDs at 0.18%) and spreads starting at 0.6 pips, which is competitive for similar account types.

IG’s DMA account, on the other hand, offers discounts for active traders, depending on your monthly traded FX volume. The currency market spreads you will obtain are very competitive, starting as low as 0.1 pips. This, in addition to low commissions for share CFD trading at 0.1%, gives the DMA account a great incentive for high-volume traders with years of experience.

Both accounts have funding costs, which vary depending on whether you use Visa/Mastercard or PayPal. Bank Transfer incurs no such fees. To open either account, you will need an initial deposit of GBP 250 (using a card or PayPal).

IG’s product range is extensive and diverse, offering 100 Forex pairs and a huge range of over 13,000 stocks to trade. You can even trade some rare types of CFD products, such as options, treasuries, and interest rates. International stocks are also available as CFDs and as spot products.

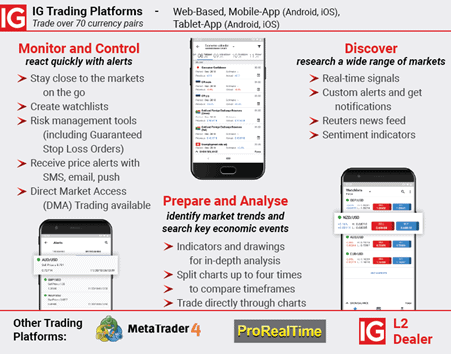

Trading Platforms

IG Markets offers 4 distinctly different trading platforms, thus allowing you to find the platform that fits your needs. IG Trading Platform is IG’s flagship platform, but you can also choose from MetaTrader 4, ProRealTime, and L2 Dealer.

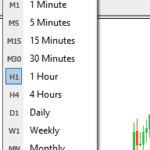

IG’s award-winning proprietary trading platform comes in 3 versions. From our testing, the most powerful version is browser-based and includes all of IG’s best trading features. This consists of the full range of trading products: 28 indicators, 17 drawing tools, and 4 timeframes in a single chart.

Other features we liked include five order types, such as guaranteed stop loss orders (GSLOs) to protect yourself against higher losses than you can accept, monitoring tools such as watchlist, price alerts, Autochartist, and ProRealTime integration.

If you prefer to trade via mobile, you can download the Android or iOS app or the progressive web app. The mobile app has many critical features as the web version but does not offer Autochartist or ProRealTime. DMA trading is also possible but with iOS only. The progressive web app is a browser-based tool with mobile shortcuts.

L2 Dealer is a purpose-built trading platform for traders who wish to have direct market access (DMA) pricing. You will need a Forex Direct account to trade fx or a Share DMA account for Share trading to access DMA. While the platform is free, additional costs exist to access shares data and live level 2 pricing.

When trading direct market access (DMA), understanding the market’s overall sentiment can be a significant advantage. This is a key feature of IG’s L2 Dealer platform through their live pricing feed, which lets you view the order books at the exchange.

If you rely on charting for advanced technical analysis when trading, ProRealTime offers over 100 powerful decision-support tools to help with this. ProRealTime is a charting package that can function as a standalone trading platform or an add-on to the IG web-based trading platform.

ProRealTime is free to use in the first month and will remain free if you make four monthly trades. For algorithmic traders, the platform also has automation capability.

IG Markets Broker Verdict

Overall, IG has a platform for everyone, whether it be the broker’s excellent proprietary platform, DMA trading with L2 Dealer, ProRealTime for advanced charting tools, or the popular MT4. The broker also offers competitive pricing and a huge range and diversity of tradeable products.

Your capital is at risk ‘69% of retail CFD accounts lose money with IG Group’

4. Plus500 - Best Broker for Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.6

AUD/USD = 1.0

Updated 06/02/2026

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 80% of retail CFD accounts lose money

Why We Recommend Plus500

Plus500 is my pick as the best CFD broker if you require risk management. When using the Plus500 trading platform, you will see it has competitive variable spreads, a guaranteed stop loss order which protects you from slippage, plus good education resources and a demo account to practice your trading.

Pros & Cons

- No CFD commissions + low spreads

- Provides sentiment-based trading tools

- Provides a GSLO for trading

- No social trading tools

- No direct phone line

- Lacks choice of trading platforms

Broker Details

Plus500 is the largest online CFD broker in the world that comes with its own in-house proprietary trading platform. Plus500 has a rich history in the online trading business since 2008 when it started serving clients around the world.

Our team of experts considers Plus500 to be one of the best brokers in the market, thanks to its demo account and Trading Academy, which let beginners practice safely before using real capital, for the following reasons:

- Intuitive proprietary trading platform

- Great selection of markets

- Competitive spreads

- Robust charting features

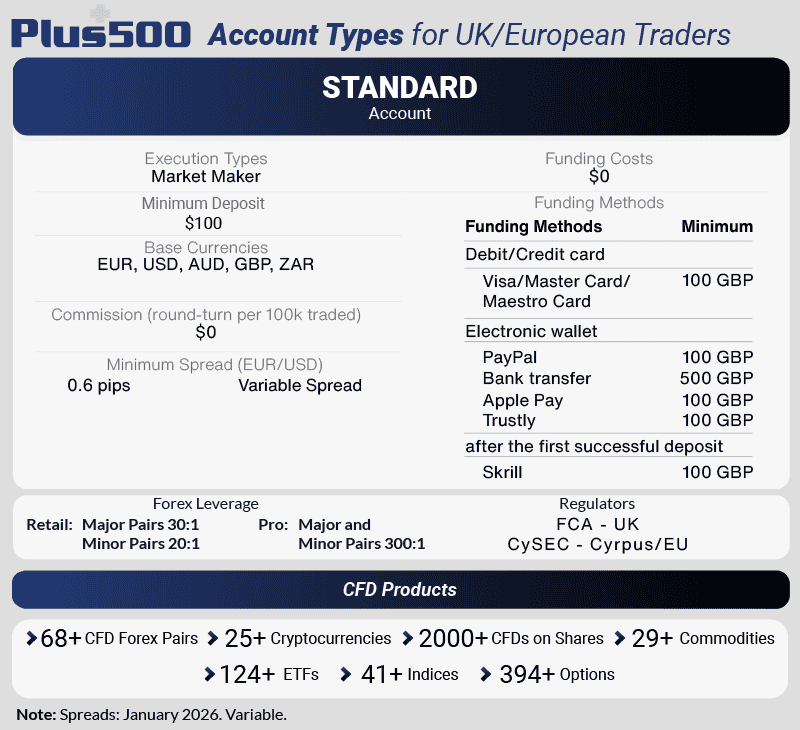

Trading Accounts

Plus500 only offers a Standard account, which makes it suitable for traders wanting to trade with no commissions (other fees apply) and a competitive minimum spread of 0.6 pips.

To fund an account, you must deposit 100 GBP through most funding methods other than a bank transfer, in which case you’ll need to transfer 500 GBP. There are no additional funding costs, though.

Plus500 offers a wide range of markets with over 2000 CFD financial instruments tradeable through the Plus500 trading platform.

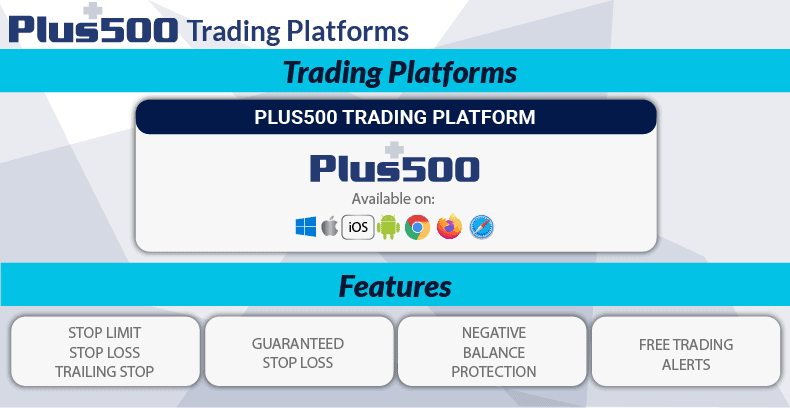

Trading Platforms

Plus500 only offers one trading platform, but its proprietary platform comes with a guaranteed stop loss which can be a handy risk management tool for new traders. In addition to a GSLO, Plus500 includes an unlimited demo account to practise with is a feature all beginner traders should use to practice with before using their own funds.

You can trade via the web-based trading platform and trading apps on both iOS and Android. Mobile trading has integrated the same features of the Plus500 web-based trading platform.

Plus 500 Broker Verdict

Overall, we recommend Plus500 for UK traders wanting to learn about and practice CFD trading before using their own capital for trading.

*Plus500 disclaimer: CFD service. Your capital is at risk. 80% of retail CFD accounts lose money.’

5. CMC Markets - Best Options Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We’ve put CMC Markets to the test and found its appeal lies in the potent combination of high leverage, a robust trading platform, and guaranteed stop-loss orders. While some brokers might edge out with slightly lower spreads, the consistency and reliability of CMC Markets remain unmatched, especially for traders valuing stability and a proven track record.

Pros & Cons

- Low spreads

- Charts sync across the cloud

- Automated pattern recognition tools

- No social trading tools

- Limited customer support on the mobile app

- 300+ FX pair may overwhelm beginners

Broker Details

As one of the largest brokers in the world, CMC Markets is a trusted, world-renowned broker, offering CFD trading in over 10,500 markets, including spread betting.

As a CMC Markets client, you can choose between MetaTrader 4 and the next CFD Next Generation platform.

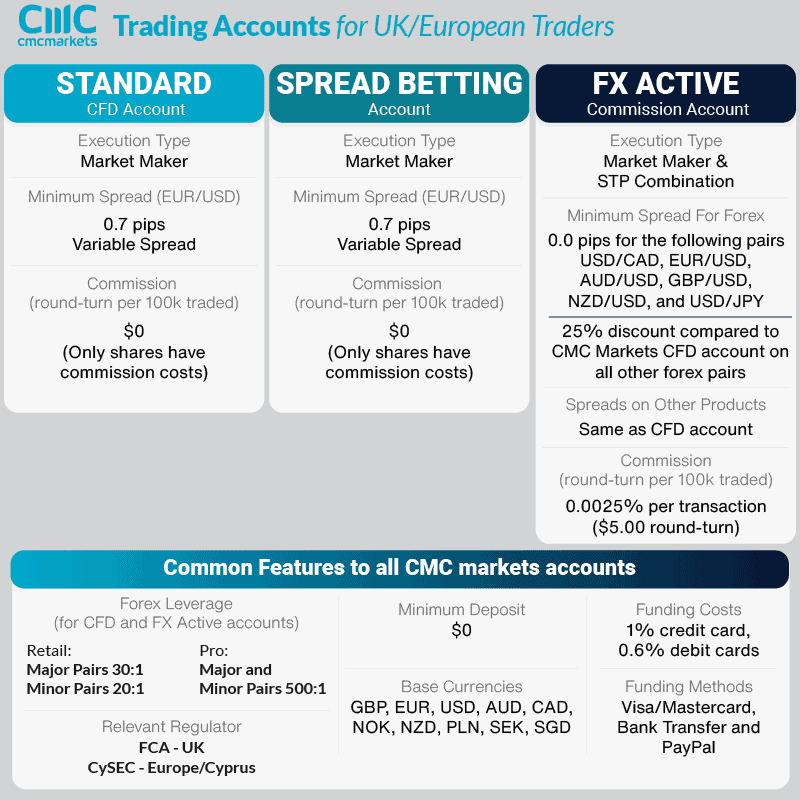

CMC Markets Trading Accounts

CMC Clients in the UK can choose from 3 types of accounts: the CFD Account for retail traders, FX Active for experienced traders, and a spread betting account. While CMC Markets can’t compete with the lowest spread CFD brokers (based on our testing), you can lower your costs if you use the FX Active account. This account offers competitive commission costs of USD $5 round-turn per trade, which is lower than the industry average of USD $7.

CMC Markets Trading Platforms

CMC Markets offers two main trading platforms: MT4 and the broker’s own, Next Generation platform. We were particularly impressed with Next Generation’s speed and reliability as a platform. It’s also excellent as a mobile app or on desktop. While you can’t automate your trading on the platform, you can use GSLOs to protect you from unexpected slippage. It’s also important to note, you can only trade CMC Markets’ full product range on Next Generation, not MT4.

CMC Markets Verdict

Overall, CMC Markets offers a superior platform experience with its Next Generation platform as well as a huge range of markets to trade.

Your capital is at risk ‘69% of retail CFD accounts lose money’

6. eToro - Best Social Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We’ve engaged with eToro and can confidently vouch for it as the premier social trading platform for UK traders. As the world’s leading social trading broker, eToro empowers traders to mirror successful counterparts or delve into manual trades using their advanced social trading tech. If social trading piques your interest, eToro is a good fit for you.

Pros & Cons

- Intuitive platform for copy trading

- Good selection of trading products

- Interact and trade with 30M+ traders

- $5 withdrawal fee

- Lacks support for other platforms

- Limited advanced tools

Broker Details

eToro is the world’s leading social trading broker that allows millions of investors to copy trade in real-time. eToro’s innovative social trading technology will enable traders worldwide to copy other successful traders or open manual trades in the financial markets.

We awarded eToro the prize of the best social trading platforms due to its top social trading network and world-class copy trading platforms.

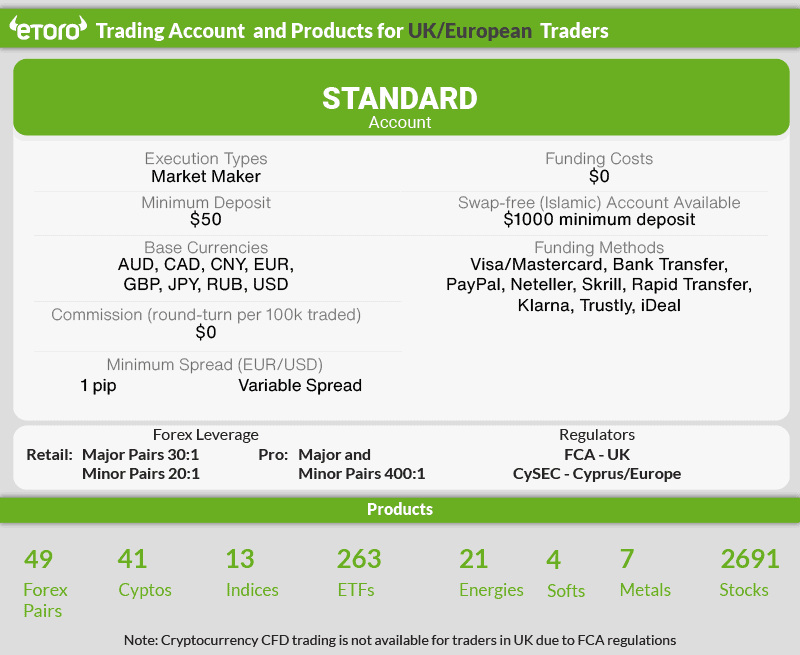

Trading Accounts

As a market maker, eToro only offers one account: a Standard account. This account has no commissions and average minimum spreads of 1 pip for major currency pairs. This is in line with the industry average for similar accounts, though wider than other market makers such as Plus500.

When we opened a demo account with eToro, we were gifted $100,000 in a virtual account to trade with, which is unique to eToro. Having such a large virtual account will suit beginners who want to practice trading and develop a trading strategy before signing up.

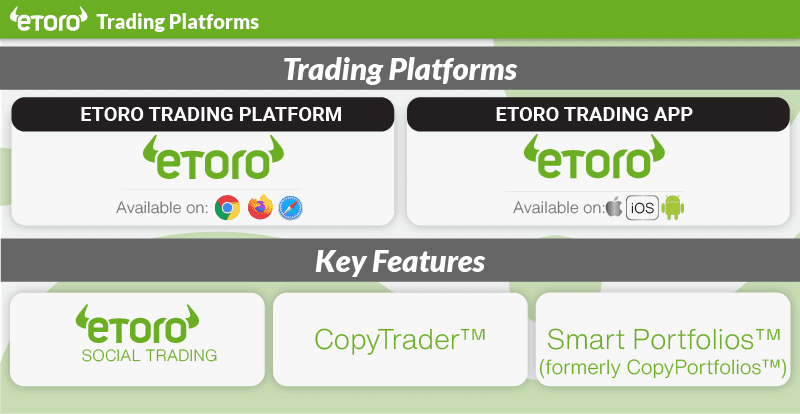

Trading Platforms

eToro’s social network platform connects traders from over 140 countries and lets them mimic the trading activity of the most talented traders. eToro’s proprietary trading platform is recognised around the world for its advantageous social ecosystem. The platform is intuitive, user-friendly and combines the benefits of social trading and self-directed trading.

CopyTrader helps you copy an individual trade, while SmartPortfolios helps you copy an entire portfolio of instruments or traders in real time. Of the three types of new investment opportunities SmartPortfolios offers, we particularly like the Top Trader Portfolio, which features eToro’s most successful and profitable traders to copy from.

eToro Broker Verdict

Overall, no UK broker comes close to eToro regarding its social trading features. eToro’s platforms are also intuitive and user-friendly, though lacks advanced tools, which will particularly suit beginners.

*Your capital is at risk ‘61% of retail CFD accounts lose money’

7. FXCM - Best Charting Software Trading Station

Forex Panel Score

Average Spread

EUR/USD = 0.3

GBP/USD = 0.9

AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

We’ve delved deep into FXCM and can confidently put it forward as our top pick for its proprietary Trading Station, brimming with advanced tools that set it apart from the competition. FXCM’s suite of platform options boasts cutting-edge charting tools tailored for automated trading strategies, ensuring traders have the resources they need to excel.

Pros & Cons

- Top automated trading solutions

- Trading Station platform

- No withdrawal fee

- Limited CFD markets

- No MT5

- Higher spreads than industry average

Broker Details

Trading Station is the platform FXCM developed for the exclusive use of its clients of all skill levels. With this platform, you will find some of the best analytical tools of any platform on the market.

The broker also offers great algorithmic trading platforms, advanced trading tools and low commissions for active traders.

Trading Accounts

FXCM’s standard account features zero commissions with average minimum spreads of 1.1 pips, slightly wider than the industry average. You will obtain the most value with FXCM’s active trader account, featuring commissions as low as $5 (round-turn) if you trade between 150M and 500M monthly. The account does require a steep minimum deposit of $25,000, so it is only suited for serious traders with considerable financial resources.

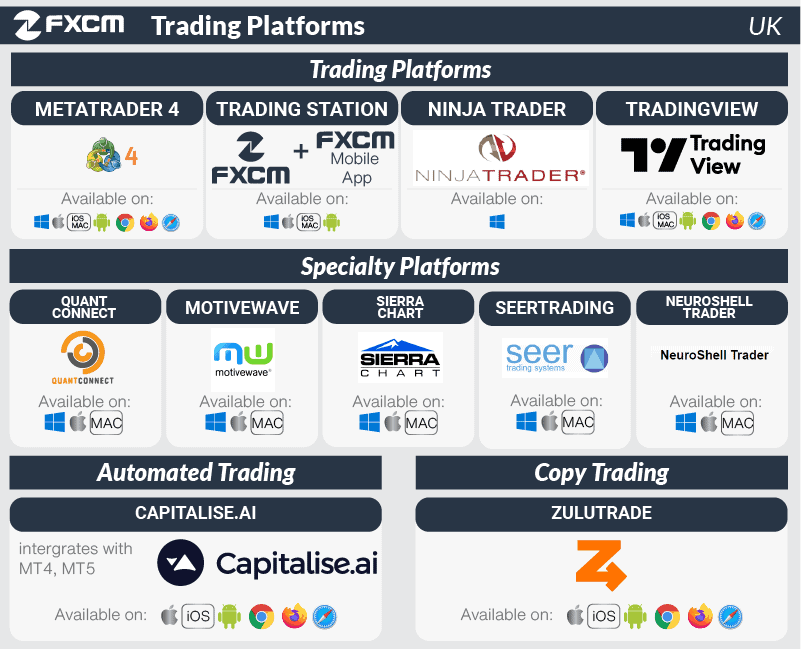

Trading Platforms

FXCM offers a diverse range of trading platforms, particularly the popular MetaTrader 4 and the broker’s excellent proprietary platform, Trading Station.

Trading Station is our recommended trading platform with FXCM. The platform is available as a mobile app for Android and iOS and was recently upgraded to HTML5, allowing optimal functionality with all web browsers.

However, the desktop version is FXCM’s flagship trading platform and was built from the ground up based on client feedback. This platform offers all the major features FXCM offers, including Marketscope 2.0. Marketscope 2.0 is a powerful professional charting package that allows you to access critical market data in real time, trade directly through the charts, and easily edit your orders.

FXCM’s Trading Station also permits trade automation, a feature usually only found on mainstream platforms such as MetaTrader 4 and 5.

The broker also offers a solid range of specialty and algorithmic platforms, including Quant Connect, Motivewave, and Sierra Chart. Each has its own unique advantages to enhance your trading experience.

FXCM Broker Verdict

Overall, FXCM is an excellent choice for algorithmic traders, giving users a superior charting experience with automation capability. The broker’s biggest selling point is its proprietary Trading Station, which has advanced trading tools. FXCM also offers a wide array of related platform options with advanced charting tools and automated trading strategies.

*Your capital is at risk ‘65% of retail CFD accounts lose money’

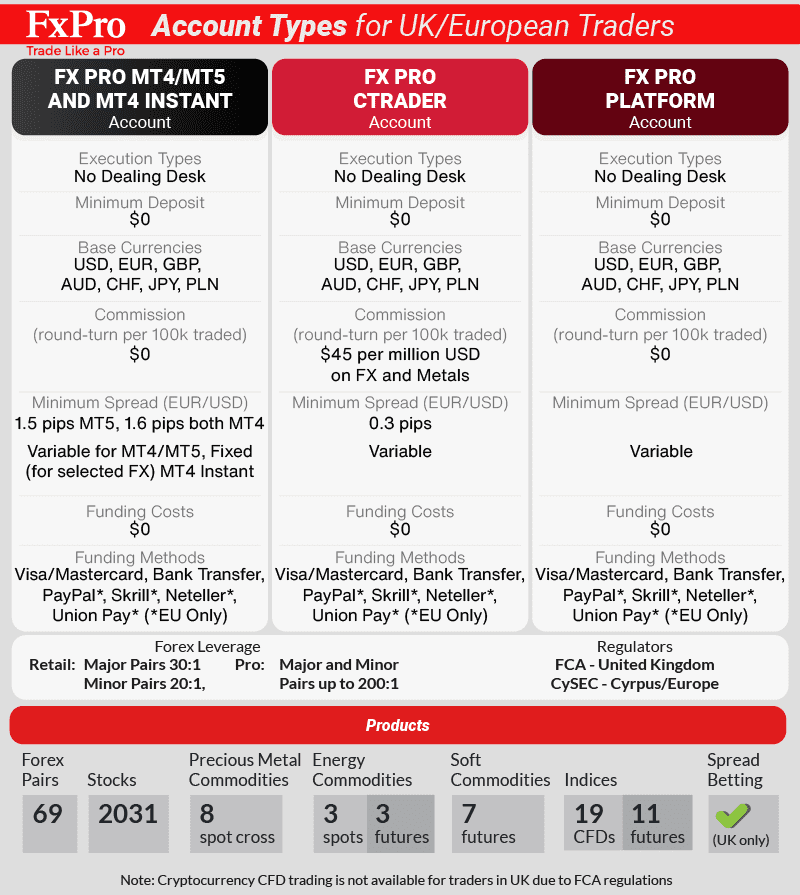

8. FxPro - Best Broker with cTrader

Forex Panel Score

Average Spread

EUR/USD = 0.15 GBP/USD = 0.58 AUD/USD = 0.55

Trading Platforms

MT4, MT5, cTrader, FxPro Trading Platform

Minimum Deposit

$0

Why We Recommend FxPro

We’ve rigorously tested FxPro and are convinced it’s the premier choice for UK traders seeking a broker with cTrader. Notably, FxPro stands out from other cTrader-equipped brokers with its advanced trading features. Among the early UK CFD platforms, FxPro led the pack by offering cTrader Automated, complete with integrated algo trading capabilities. Opting for FxPro ensures you have a suite of potent trading platforms tailored to meet any trader’s requirements.

Pros & Cons

- Multiple trading platforms

- Robust regulatory framework

- No dealing desk execution

- Customer service variability

- Complex account structure

- Wider standard account spreads

Broker Details

FxPro has been awarded the best cTrader broker with the best UK spread betting platform by our team of expert analysts. This is because many advanced trading tools help FxPro to stand out from the other cTrader brokers. The broker also has a variety of account options, the full MetaTrader suite and its own, proprietary trading platform.

Trading Accounts

FxPro has various account types, separated by your choice of trading platform: MT4/MT5, cTrader, or FXPro’s own in-house platform. Each account also uses either instant or market execution. Instant execution is subject to requotes but no slippage, while market execution may have some slippage, but there are no requotes.

As our top cTrader broker, we think FxPro’s cTrader account offers the best value, with commissions from $45 per million USD traded with spread costs as low as 0.3 pips for major pairs.

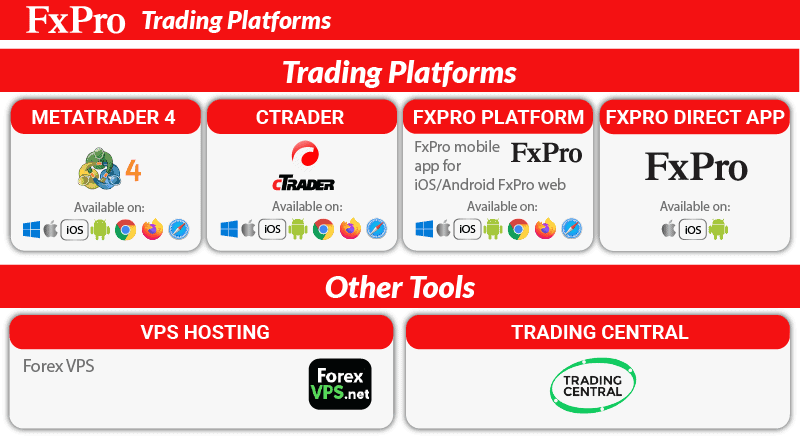

Trading Platforms

FxPro offers a great range of trading platforms, including:

- MetaTrader 4 and 5

- cTrader

- FxPro Platform and Direct App

FXPro is one of the few brokers that offers the full MetaTrader suite, which are available both as desktop or web trader options. The broker also offers Trading Central, a useful charting plugin that can be integrated with MT4 and MT5.

Where FXPro really shines, however, is in its cTrader trading platform, which is an award-winning platform with the following capabilities:

- Ultra-fast order execution capabilities

- Full live market depth (including VWAP, Standard, and Price DOM)

- cTrader Automate (for algorithmic trading)

- Robust charting (including 73 indicators and dozens of drawing tools)

FxPro’s proprietary trading platform is also available on mobile or as a web trader, which features slick charting and an intuitive design.

FxPro Broker Verdict

FxPro was among the first of the best CFD trading platforms to offer cTrader Automated, including all the integrated algo trading tools that come with it. This is in addition to FXPro’s variety of account types, execution methods, and transparent pricing.

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Ask an Expert