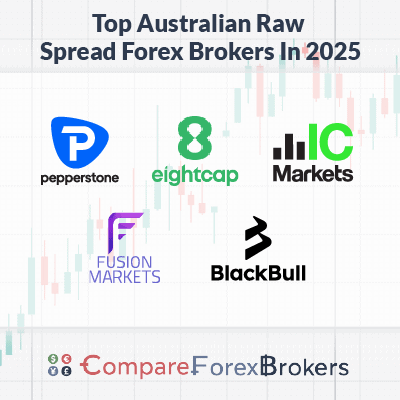

Raw Spread Trading Accounts In Australia

RAW Accounts (aka ECN accounts) have the tightest spreads even with added commissions (typically $6.00 per lot). Here are the Forex brokers we think have the best RAW Spread Forex trading accounts.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

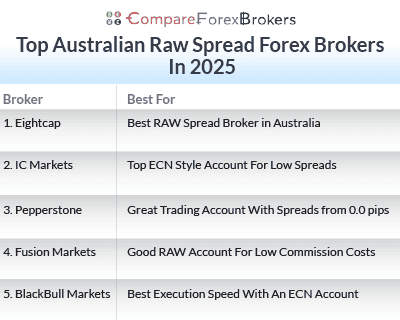

Our list of the best Raw Spread Trading Accounts is:

- Eightcap - Best RAW Spread Broker in Australia

- IC Markets - Top ECN Style Account For Low Spreads

- Pepperstone - Great Trading Account With Spreads from 0.0 pips

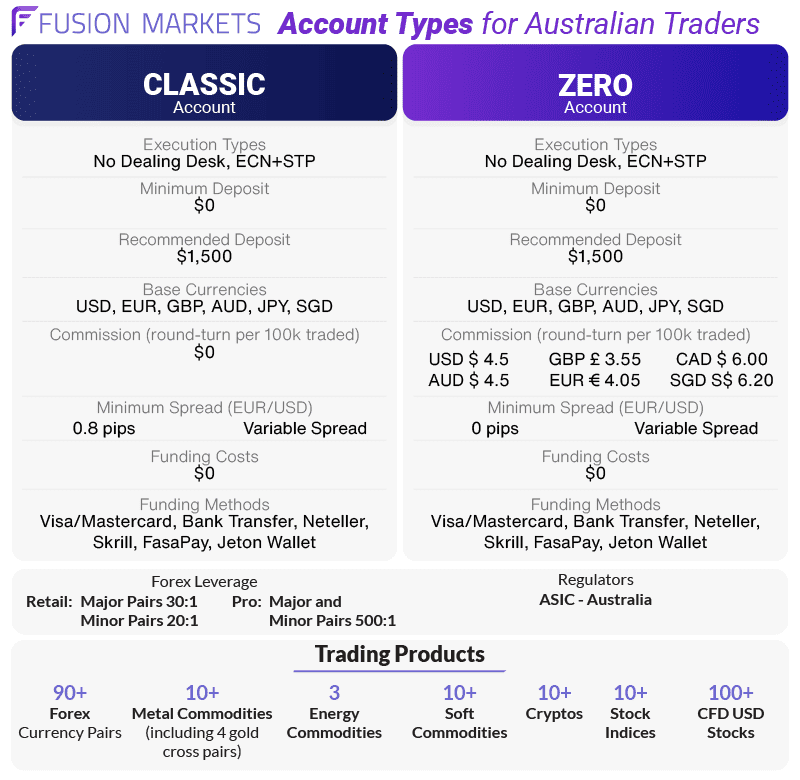

- Fusion Markets - Good RAW Account For Low Commission Costs

- BlackBull Markets - Best Execution Speed With An ECN Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.09 | 0.28 | 0.14 | $2.25 | 0.89 | 1.11 | 0.95 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

95 | FMA, FSA-S | 0.14 | 0.43 | 0.30 | $3.00 | 1.10 | 1.40 | 1.20 |

|

|

|

72ms | $0 | 72 | 9 | 500:1 | 500:1 |

|

Who Are The Best Raw Spread Forex Brokers?

We analysed all the published spreads of forex brokers available to Australian traders and then did our own testing using EAs to determine which are the best Raw spread forex brokers. To do this, we only considered forex brokers that offer ECN-like or ‘Raw’ pricing (I.E. commission-based accounts). Our results have been broken down into specific categories as each broker had a unique competitive advantage.

1. Eightcap - Best RAW Spread Broker in Australia

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why We Recommend Eightcap

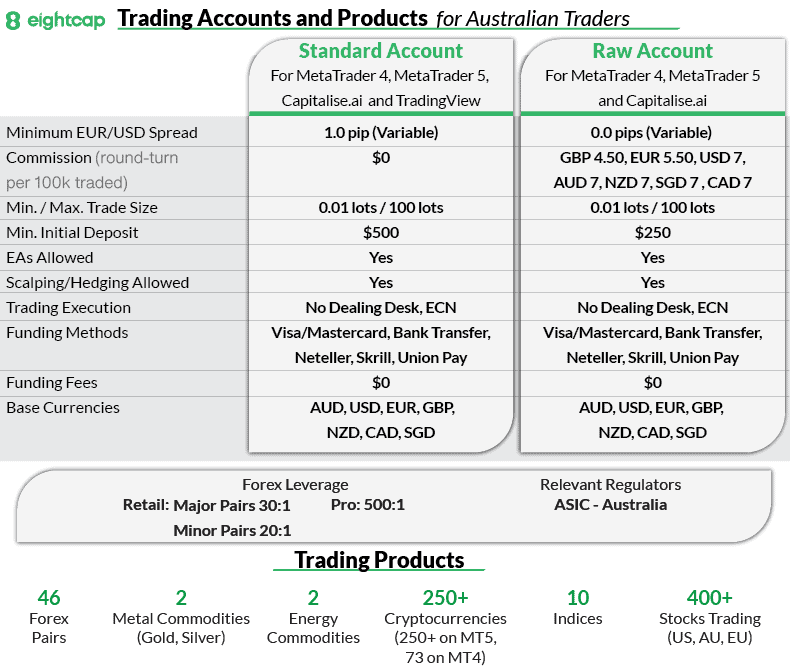

We recommend Eightcap as Australia’s best RAW Spread Broker, with an average of just 0.06 pips on EUR/USD. Plus, Eightcap offers you a diverse range of markets, which includes forex, commodities, indices, and some popular share CFDs.

However, what stood out for us was that Eightcap also has a large range of crypto markets to trade with over 90+ coins, more than the competitors we’ve reviewed.

Pros & Cons

- Top choice for crypto markets

- Tight average spreads

- Offers a range of trading tools

- Client support is limited over the weekend

- Requires a minimum deposit

- The range of trading products is on the low end

Broker Details

We tried out a RAW Account with Eightcap and found their spreads to average 0.06 pips on EUR/USD, matching some of the best in the industry. Having a broker with low spreads will lower your trading costs and increase your profit margins by paying lower fees.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| City Index | 0.07 |

| XTB | 0.09 |

| Tickmill | 0.1 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| LQDFX | 0.1 |

| HF Markets | 0.1 |

| MultiBank Group | 0.1 |

| Pepperstone | 0.1 |

| RoboForex | 0.1 |

| Admirals | 0.1 |

| Fusion Markets | 0.13 |

| IG | 0.16 |

| Global Prime | 0.18 |

| GO Markets | 0.2 |

| London Capital Group | 0.2 |

| Blueberry Markets | 0.2 |

| BlackBull Markets | 0.23 |

| Dukascopy | 0.28 |

| ATC Brokers | 0.3 |

| BD Swiss | 0.3 |

| Axiory Nano | 0.3 |

| Fair Markets | 0.3 |

| FXCM | 0.3 |

| Fibo Group | 0.3 |

| FxPro | 0.32 |

| Blackwell Global | 0.4 |

| Axi | 0.44 |

| Tradersway | 0.5 |

| AMarkets | 0.5 |

| CMC Markets | 0.5 |

| FlowBank | 0.6 |

| OctaFx | 0.9 |

| Industry Average | 0.24 |

Eightcap charges a $3.50 commission per lot traded due to these low spreads. Though it might look like an extra cost, it’s actually a good deal considering the benefits of those tight spreads. Plus, the commission costs are clear and easy to plan for, helping you manage your trading costs better.

Opening a RAW spread trading account with Eightcap gave us access to different trading platforms like MetaTrader 4, MT5, and TradingView. This variety is excellent because it meets various trading needs and preferences. Whether you prefer the well-known MetaTrader or the advanced charting of TradingView, there’s something for everyone.

We’re fans of TradingView, as we think it has the best charting package compared to MetaTrader 4 and MT5. The platform offers more than 110 indicators, is constantly adding new ones for free, and has a large community of traders releasing custom indicators you can try.

A big plus with TradingView is how it syncs charts across all devices. So, if you switch from mobile to desktop, your analysis (such as Fibonacci levels) follows you, unlike MetaTrader 4, where you’d need to redo your analysis on each device. This feature makes trading more streamlined and less hassle when you need to review the markets on the go.

We found that Eightcap offers various markets, including 56 currency pairs, 586 shares, 16 indices, eight commodities, and 95 crypto markets during our testing. Eightcap stands out for its extensive crypto market selection, making it a top pick for traders looking to capitalise on the volatility and new opportunities cryptocurrency trading brings.

2. IC Markets - Top ECN Style Account For Low Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingVIew

Minimum Deposit

$200

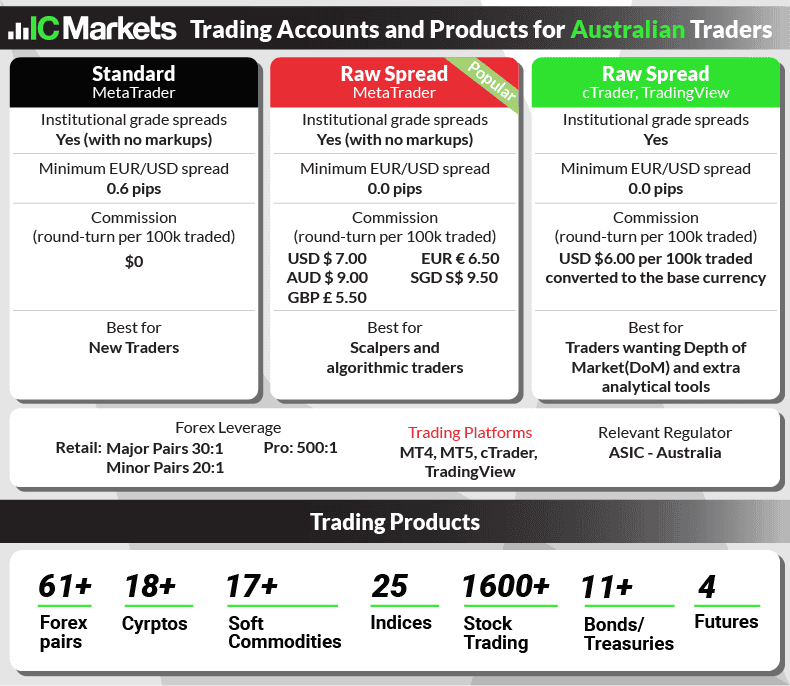

Why We Recommend IC Markets

IC Markets is our top choice for forex trading, especially if you’re into the major currency pairs. What really stands out is its impressive low spreads, averaging just 0.16 pips across the top five most traded forex pairs, making it a top broker if you trade the major forex pairs.

IC Markets impressed us with their low spreads, but also for its range of markets and trading platforms – which is why we gave IC Markets an 85/100 score in our review.

Pros & Cons

- Has low average spreads

- Offers multiple trading platforms

- Social trading tools available

- Has a minimum deposit

- Not the most extensive range of markets

Broker Details

IC Markets is an ECN-style broker, which we think traders should look for when choosing a broker. We believe ECN brokers are better because they provide direct access to interbank liquidity, resulting in tighter spreads and faster execution speeds. Typically, ECN brokers offer lower trading costs and more transparent pricing, which can benefit traders.

While exploring the IC Markets RAW account, we found the spreads to be impressively low, averaging 0.02 pips on the EUR/USD – the lowest we tested. These tight spreads are crucial for high-volume traders, as they directly impact profitability.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| City Index | 0.07 |

| XTB | 0.09 |

| Tickmill | 0.1 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| LQDFX | 0.1 |

| HF Markets | 0.1 |

| MultiBank Group | 0.1 |

| Pepperstone | 0.1 |

| RoboForex | 0.1 |

| Admirals | 0.1 |

| Fusion Markets | 0.13 |

| IG | 0.16 |

| Global Prime | 0.18 |

| GO Markets | 0.2 |

| London Capital Group | 0.2 |

| Blueberry Markets | 0.2 |

| BlackBull Markets | 0.23 |

| Dukascopy | 0.28 |

| ATC Brokers | 0.3 |

| BD Swiss | 0.3 |

| Axiory Nano | 0.3 |

| Fair Markets | 0.3 |

| FXCM | 0.3 |

| Fibo Group | 0.3 |

| FxPro | 0.32 |

| Blackwell Global | 0.4 |

| Axi | 0.44 |

| Tradersway | 0.5 |

| AMarkets | 0.5 |

| CMC Markets | 0.5 |

| FlowBank | 0.6 |

| OctaFX | 0.9 |

| Industry Average | 0.24 |

Furthermore, the broker also had excellent spreads across other major pairs, averaging 0.16 pips, the lowest major average spread we tested. So, if you trade the forex markets, you’ll have the lowest average spreads across the majors. We believe this is excellent as some brokers offer tight EUR/USD spreads but significantly wider spreads on other majors like CAD/USD, skewing the cost of trading forex.

| Top 5 (EUR/USD. USD/JPY, GBP/USD, AUD/USD, USD/CAD) Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| Tickmill | 0.16 |

| IC Markets | 0.16 |

| Fusion Markets | 0.17 |

| ThinkMarkets | 0.20 |

| FP Markets | 0.22 |

| FXTM | 0.22 |

| TMGM | 0.26 |

| HYCM | 0.26 |

| XM | 0.26 |

| GO Markets | 0.28 |

| Eightcap | 0.30 |

| LQDFX | 0.30 |

| HF Markets | 0.32 |

| IG | 0.32 |

| City Index | 0.35 |

| Global Prime | 0.33 |

| MultiBank Group | 0.34 |

| Blackwell Global | 0.36 |

| XTB | 0.14 |

| ATC Brokers | 0.40 |

| VT Markets | 0.40 |

| Pepperstone | 0.44 |

| London Capital Group | 0.44 |

| Blueberry Markets | 0.46 |

| FxPro | 0.47 |

| RoboForex | 0.48 |

| BD Swiss | 0.50 |

| Admirals | 0.52 |

| Axiory Nano | 0.54 |

| Fair Markets | 0.54 |

| Axi | 0.55 |

| FXCM | 0.56 |

| BlackBull Markets | 0.57 |

| Tradersway | 0.60 |

| AMarkets | 0.68 |

| Fibo Group | 0.78 |

| CMC Markets | 0.80 |

| Dukascopy | 0.81 |

| OctaFX | 1.10 |

| FlowBank | 1.12 |

| Tested Average | 0.44 |

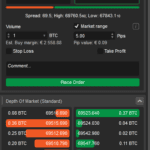

We think the MetaTrader 5 platform pairs nicely with IC Markets, as the broker allows you to use all of MT5’s features, such as depth of market tools. The depth of market tool provides traders valuable insights into the order book, showing the pending buy and sell orders at different price levels. This is golden information, as you can see raw data of where other traders place their orders, giving you an idea of where others think the market will move.

MetaTrader 5 offers several other benefits for traders, including advanced charting capabilities, 50+ technical indicators and drawing tools, and support for automated trading strategies. While using the MT5 platform, we found that it now includes a native economic calendar, allowing you to see upcoming announcements on your charts.

We think this is an excellent addition as it will make it easier to avoid trading during market announcements (to avoid volatility) and stay on the look with fundamental analysis.

IC Markets offers MT5 and MT4 for those who prefer the classic platform, cTrader, and TradingView, which is popular among traders who focus on technical analysis. This selection of platform options ensures you can choose the one that best suits your trading style and preferences.

3. Pepperstone - Great Trading Account With Spreads from 0.0 pips

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.4 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Pepperstone

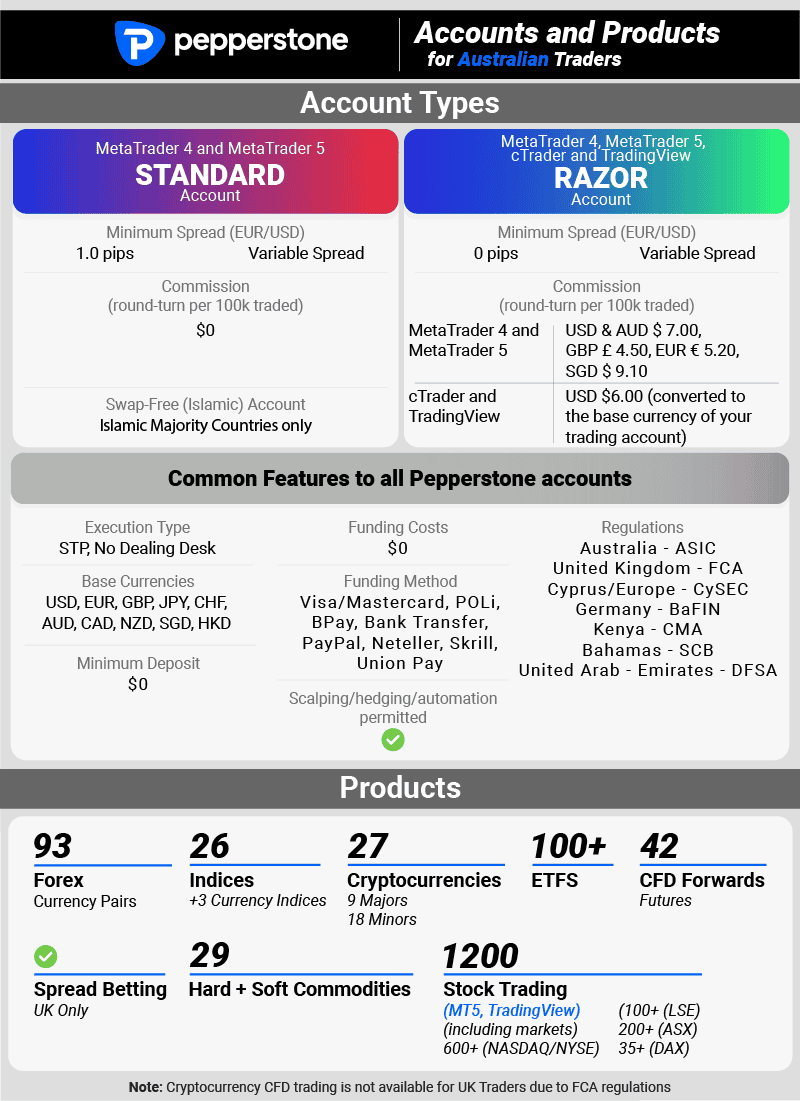

We like Pepperstone as it’s one of the few brokers that maintained zero spreads on EUR/USD in our testing, offering 0.0 pips 100% of the time. With spreads non-existent for EUR/USD, all you have to worry about is the commission which is decent at $3.50 per lot traded.

The low trading costs are one of the main reasons why we scored Pepperstone 98/100 in our review, making it our best forex broker.

Pros & Cons

- Zero spreads on EUR/USD

- Offers MT4, MT5, cTrader, and TradingView

- Solid range of trading products

- The demo account is limited to 30 days

- No guaranteed stop-loss orders

- Crypto markets are limited

Broker Details

While testing Pepperstone, a standout feature that immediately caught our attention was advertising zero-pip spreads on its Razor accounts. Our analyst, Ross Collins, conducted a thorough analysis to verify these claims, discovering that Pepperstone consistently delivered 0.0 pip spreads across major currency pairs 100% of the time.

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| TMGM | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| Blueberry Markets | 94.20% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

| Axi | 82.61% |

| CMC Markets | 81.88% |

Zero-pip spreads eliminate the entry fee and reduce your overall trading costs, as you get the prices without a markup from the broker. However, you pay a commission with the Razor account ($3.50 per lot traded).

We think this works out to be cheaper compared to variable spread accounts. Plus, your costs remain fixed even during volatile times, which is a hidden bonus.

Pepperstone also excels in offering a variety of trading platforms, which are MetaTrader 4,cTrader, MetaTrader 5, and TradingView. This range of platforms ensures you can find the environment that best suits your trading style, whether you prioritise technical analysis, ease of use, or automated trading features.

After opening our Razor account and downloading MT4, we found that the platform offered 30+ technical indicators, including MACD, RSI, and Bollinger Bands, plus three chart types and nine timeframes. Although this is a solid starting platform for most beginner traders, we like that you can download custom indicators or program new ones to enhance the MetaTrader 4 experience further.

In fact, Pepperstone offers a selection of 13+ Expert Advisors and 18 indicators we could install to improve the default MT4 platform. These EAs help improve administrative tasks, like tracking your account on the chart, or provide useful tools like the Mini-Terminal EA.

We tried the Mini-Terminal EA, which enhanced the one-click trading feature by allowing you to add a default stop loss and take profit level. This is a nice quality-of-life upgrade because if you are a scalper, it allows you to set your risk metrics pre-execution, and it’ll execute the orders automatically.

No more having to add stop loss orders and take profit levels manually after entering the position.

4. Fusion Markets - Good RAW Account For Low Commission Costs

Forex Panel Score

Average Spread

EUR/USD = 0.13 GBP/USD = 0.21 AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader

Minimum Deposit

$0

Why We Recommend Fusion Markets

We recommend Fusion Markets because they have the lowest commissions we’ve seen, just $2.25 per lot traded, which pairs well with their tight spreads. In fact, their average spread on EUR/USD is 0.22 pips, the lowest we’ve seen among all the brokers we’ve tested.

This combination of low commissions and tight spreads makes Fusion Markets an excellent choice if you’re looking for a low-cost broker.

Pros & Cons

- The lowest commissions

- Fast execution speed

- Offers a range of free trading tools

- Limited range of trading products

- A minimum deposit is needed

- Has an inactivity fee

Broker Details

We found Fusion Markets to have the lowest commissions, charging $2.25 per lot traded, much lower than the industry average. In fact, compared to an average commission of $3.48, Fusion Markets’ commissions are 35.3% cheaper. This lower commission cost is excellent as it directly reduces your trading expenses and can save you a fortune over time if you trade frequently.

| Broker | AUD |

|---|---|

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Fair Markets | $2.50 |

| Go Markets | $3.00 |

| City Index (Web Trader) | $3.00 |

| VT Markets | $3.00 |

| FIBO Group | $3.00 |

| FlowBank | $3.25 |

| City Index (MT4) | $3.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| Axi | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

| Global Prime | $3.50 |

| TMGM | $3.50 |

| Blueberry Markets | $3.50 |

| Admirals | $4.00 |

| Blackbull Markets | $4.50 |

To test Fusion Markets’ spreads, we opened a Zero account, which is their commission-based trading account with tight spreads. Our analyst, Ross Collins, used this account to get Fusion Markets’ average spreads and found they provide competitive RAW spreads, averaging 0.16 pips on the EUR/USD pair.

These results placed Fusion Markets lower than the industry average of 0.26 pips on EUR/USD and in first place across the ASIC-regulated brokers tested.

| EURUSD | Average Spread |

|---|---|

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| EightCap | 0.2 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blackbull Markets | 0.46 |

| Average | 0.26 |

Tighter spreads mean lower trading costs when entering a trader, allowing you to improve your profit margin with each trade.

In addition to the low trading costs, we were impressed with Fusion Markets’ selection of markets and platforms, including MetaTrader 4, MT5, TradingView, and cTrader. With Fusion Markets covering all the major platforms, you are spoiled for choice.

We tried cTrader because it offers a depth of market access and lets you see liquidity providers’ pending order books. This raw data can help you identify an asset’s current buying and selling pressure, giving you important intel on the market’s potential trend.

cTrader also offers one-click trading on its platform, allowing you to execute your trades instantly. We found this feature was already activated by default at the top of the chart, allowing us to use it immediately.

When you combine the use of cTrader with the low trading costs offered by Fusion Markets, we think the broker positions itself as a top choice for scalpers. The combination of low commissions, tight spreads, and fast order execution provides an excellent trading environment for scalpers to help capture small price movements quickly and efficiently.

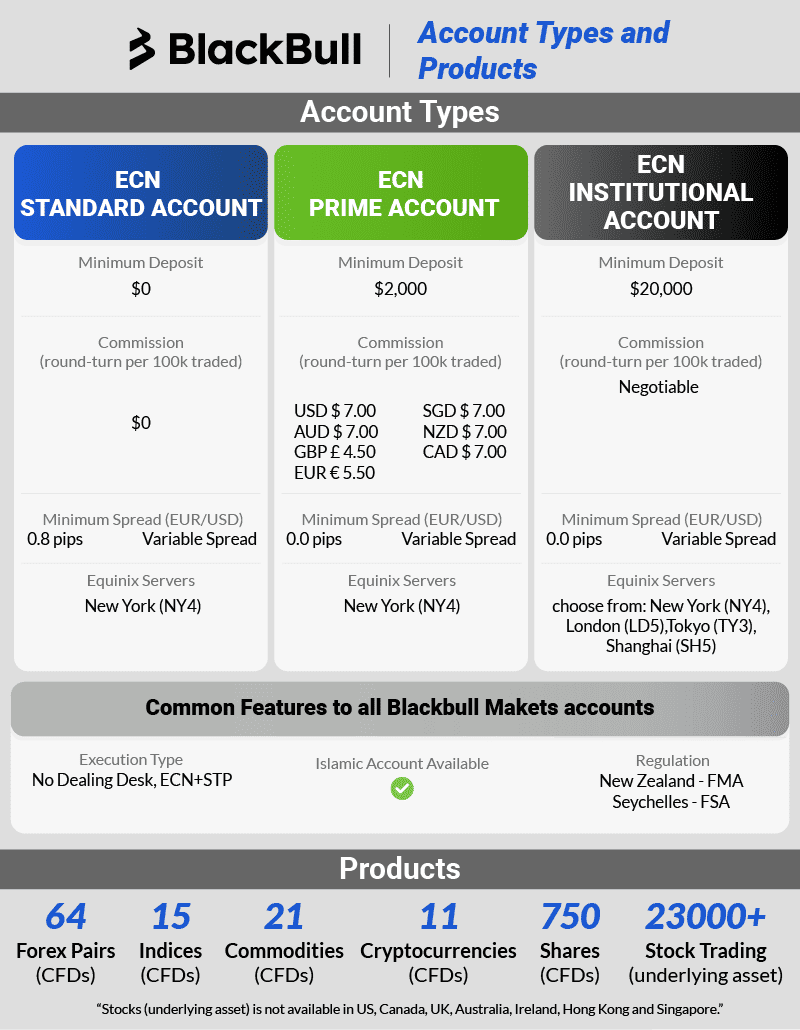

5. BlackBull Markets - Best Execution Speed With An ECN Account

Forex Panel Score

Average Spread

EUR/USD = 1.2 GBP/USD = 1.4 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, BlackBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

We like BlackBull Markets for its fast execution speed and high leverage. With an average execution speed of just 72ms, they stand out as one of the fastest we’ve tested.

Although not regulated by ASIC, we included BlackBull Markets as the broker accepts Australian customers. Letting you take advantage of the 1:500 leverage available with BlackBull Markets – something ASIC brokers cannot offer unless you are a professional.

Pros & Cons

- Has the fastest execution times

- Offers 1:500 leverage on major pairs

- Supports TradingView, MetaTrader4/5, and cTrader

- Charges a small withdrawal fee

- Has a minimum deposit

- Not regulated by ASIC

Broker Details

Execution speed remains critical when evaluating trading platforms, particularly those employing algorithmic or high-frequency strategies to capitalise on market opportunities.

BlackBull Markets is an ECN-style broker. Our analyst, Ross Collins, used BlackBull’s ECN Prime account to test the broker’s execution speed on MetaTrader 4 and compared the results against 14 other brokers.

Among the 15 brokers we tested, they delivered the fastest execution times for limit orders (72 ms) and market orders (90 ms). Fast execution ensures your orders are filled promptly and minimises slippage, protecting you from unexpected costs.

| Broker | Overall | Limit Order Speed | Limit Order Rank | Market Order Speed | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 2 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 5 |

| HugosWay | 4 | 104 | 7 | 94 | 3 |

| TMGM | 5 | 94 | 5 | 129 | 7 |

| FXCM | 6 | 108 | 8 | 123 | 6 |

| City Index | 6 | 95 | 6 | 131 | 8 |

| Axi | 8 | 90 | 4 | 164 | 16 |

| Eightcap | 9 | 143 | 12 | 139 | 10 |

| FP Markets | 10 | 225 | 20 | 96 | 4 |

| IC Markets | 10 | 134 | 10 | 153 | 14 |

| FxPro | 12 | 151 | 16 | 138 | 9 |

| Markets.com | 13 | 150 | 15 | 141 | 11 |

| GO Markets | 13 | 144 | 13 | 145 | 13 |

| Admiral Markets | 15 | 132 | 9 | 182 | 18 |

| CMC Markets | 16 | 138 | 11 | 180 | 17 |

| IG | 17 | 174 | 19 | 141 | 11 |

| easyMarkets | 18 | 155 | 17 | 155 | 15 |

| XM | 19 | 148 | 14 | 184 | 19 |

| ThinkMarkets | 20 | 161 | 18 | 248 | 20 |

We found BlackBull Markets’ spreads competitive, averaging 0.23 pips on the EUR/USD pair, matching the industry average of 0.22 pips. Tight spreads translate to lower trading costs, allowing you to retain more of your profits, especially for scalpers and day traders who execute multiple trades daily, as the savings can accumulate significantly over time.

| BROKER | EUR/USD |

|---|---|

| Tickmill | 0.1 |

| IC Markets | 0.02 |

| Fusion Markets | 0.13 |

| ThinkMarkets | 0.1 |

| FP Markets | 0.1 |

| FXTM | 0 |

| TMGM | 0.1 |

| HYCM | 0.1 |

| XM | 0.1 |

| GO Markets | 0.2 |

| Eightcap | 0.06 |

| LQDFX | 0.1 |

| HF Markets | 0.1 |

| IG | 0.16 |

| City Index | 0.07 |

| Global Prime | 0.18 |

| MultiBank Group | 0.1 |

| Blackwell Global | 0.4 |

| XTB | 0.09 |

| ATC Brokers | 0.3 |

| VT Markets | 0 |

| Pepperstone | 0.1 |

| London Capital Group | 0.2 |

| Blueberry Markets | 0.2 |

| FxPro | 0.32 |

| RoboForex | 0.1 |

| BD Swiss | 0.3 |

| Admirals | 0.1 |

| Axiory Nano | 0.3 |

| Fair Markets | 0.3 |

| Axi | 0.44 |

| FXCM | 0.3 |

| BlackBull Markets | 0.23 |

| Tradersway | 0.5 |

| AMarkets | 0.5 |

| Fibo Group | 0.3 |

| CMC Markets | 0.5 |

| Dukascopy | 0.28 |

| OctaFx | 0.9 |

| FlowBank | 0.6 |

| Industry Average | 0.22 |

The broker’s low trading costs extend across an impressive selection of tradable products, encompassing 64 currency pairs, 23,000+ shares, 15 indices, 23 commodities, and 11 cryptocurrencies. We think this extensive selection is particularly beneficial for day traders, who rely on the ability to pivot between different markets based on volatility and trading opportunities.

BlackBull Markets offers a suite of trading platforms that can benefit from its execution speeds; these include:

- MetaTrader 4 offers automated trading through its Expert Advisor feature, allowing you to program and automate your strategies 24/7.

- MetaTrader 5 is an improved version of MetaTrader 4 that lets you trade stocks on the platform. It also has new features like Depth of Markets and a native economic calendar.

- cTrader is designed for experienced traders and scalpers who will benefit from its Level II pricing, direct market access, and integrated VWAP trading.

- TradingView is best for technical analysts who want access to a versatile charting package with customisable indicators and powerful market screeners.

One standout feature that caught our attention was BlackBull Markets’ offer to subsidise your TradingView paid subscription. We believe this support is invaluable as TradingView is a powerful platform for technical analysis, but its restriction to just two indicators in the free version can be limiting.