Best ECN Brokers In Australia

Australian ECN providers allow traders to directly access liquidity pools with no-dealing desks. Through forex trading platforms such as MT4, ECN/STP brokers achieve the lowest spreads and fastest speeds of any Australian broker.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

My best ECN broker Australia list is the following:

- Pepperstone - Best Australian ECN Forex Broker

- Eightcap - Best ECN Platform Broker

- IC Markets - Best ECN Broker With Lowest RAW Spread

- FP Markets - Best ECN Broker For Scalping

- GO Markets - Top ECN Liquidity Providers

- Axi Trader - Good $0 Minimum Deposit ECN Broker

- IG Trading - Top Forex Broker With Largest Range Of Trading Products

- ThinkMarkets - Best ECN Broker For Beginners

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC,FCA ,DFSA,FMA |

0.2 | 0.5 | 0.5 | $3.50 | 1.2 | 1.3 | 1.3 |

|

|

|

90ms | $0 | 72 | 37 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Who are the best ECN brokers?

ECN providers offer the fastest execution speeds and tightest spreads due to their access to top-tier liquidity pools. This list contains my picks for the best Australian ECN forex brokers, based on a number of trading factors. Each broker also has one identifying feature that gives it an edge against others.

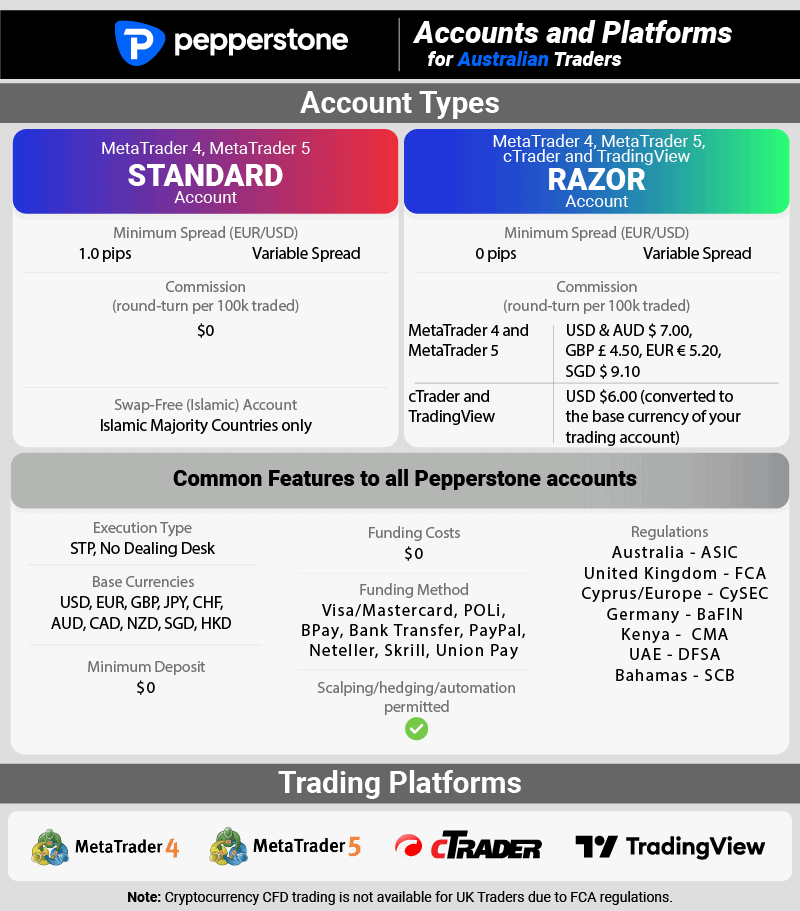

1. Pepperstone - Best Australian ECN Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.4 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

Pepperstone has earned my vote as the best ECN broker due to its no dealing desk setup, ensuring low spreads and rapid order execution.

My tests found that the broker’s Razor account has an average spread of 0.1 pips on the EUR/USD pair, commissions of $3.50 pairs, and a limit order execution speed of 77ms. Moreover, forex traders can trade using MT4, MT5, cTrader and TradingView, and scalping is permitted. All these factors make Pepperstone a good option for low cost trading.

Pros & Cons

- One of the fastest execution speed

- Supports 4 major trading platforms

- Supports 10 base currencies

- 90-day limit on the demo account

- Lacks an in-house trading platform

Broker Details

Pepperstone Is The Fastest Best Low Free Broker

When the team thought about what Australian ECN traders want, I personally put the highest weight on execution speed, spreads, and customer service. Pepperstone excelled in all these areas primarily on their MetaTrader 4 platform which I tested the broker with.

FIVE REASONS WHY I RATED PEPPERSTONE THE BEST

- Fastest-tested execution speed

- Advanced MetaTrader 4 setup

- Melbourne-based customer service

- Low trading spreads and commissions

- Over +1200 trading products

Pepperstone has some of the lowest ECN spreads of any Australian broker as you can compare using our spread calculator.

Pepperstone ReviewVisit Pepperstone

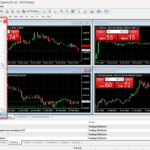

HOW I PROVED PEPPERSTONE HAS THE FASTEST EXECUTION SPEEDS

Ross Collins, our Chief Technology Researcher at CompareForexBrokers, tested the execution speed of 20 forex brokers. When Ross ran MetaTrader 4 EAs over two 24-hour periods, he found that Pepperstone had the fastest Limit Order Execution Speed at just 77ms[1]. You can view the full execution speed test results page with the summary shown below.

Execution speeds matter as they avoid slippage. ECN traders make a large number of trades usually when there is high market volatility. If the broker is too slow the price quoted won’t be what the trader actually received. Slippage can be significant during periods such as interest rate announcements etc. which is why you really want a fast broker.

- Tight standard account spreads

- Multi-platform offering

- Great for social trading

- Limited trading in some markets

- Only third-party platforms available

- Web platform functionality lacking

PEPPERSTONE OFFERS THE BEST TRADING PLATFORMS

While I tested Pepperstone on their MT4 trading platform, the broker offered the full software suite. This includes MT5, cTrader, and TradingView. Once more, these platforms have enhanced ECN features to improve charting, the use of Expert Advisors, and other algorithmic trading features.

Pepperstone’s key trading platform is MetaTrader4. Honestly, MT4 is one of our favourite platforms at CompareForexBrokers due to its spectacular performance. What I found is that Pepperstone allows you to seamlessly access your ECN Razor Account directly within MT4. Here are some of of the many advantages of using MetaTrader4:

- Customisable charts

- Indicators and EAs (Expert Advisors)

- One-click trading

- Multiple markets

It is undeniable that MT4 is one of the most popular forex platforms among traders, and Pepperstone stands out as the best proponent of this platform.

Pepperstone Account Opening Is Very Straight-Forward

When signing up with a broker, you want to be able to do this quickly and with minimum fuss. As the Strategic Head Of Research at CompareForexBrokers, one of my top goals is to see which brokers offer the best account opening experience. I then opened accounts with 20 different brokers to find out the answer to my question.

From my experience, I found that it took less than 10 minutes to open an account with Pepperstone — this is immediate and almost real-time. Surprisingly, I did not need to provide a credit card or funding details as part of the opening process. Only an address, a salary number, and a photocopy of his passport were required. Also, an account manager gave me a phone call the very next day to check if I needed any assistance. I appreciated this proactive customer care.

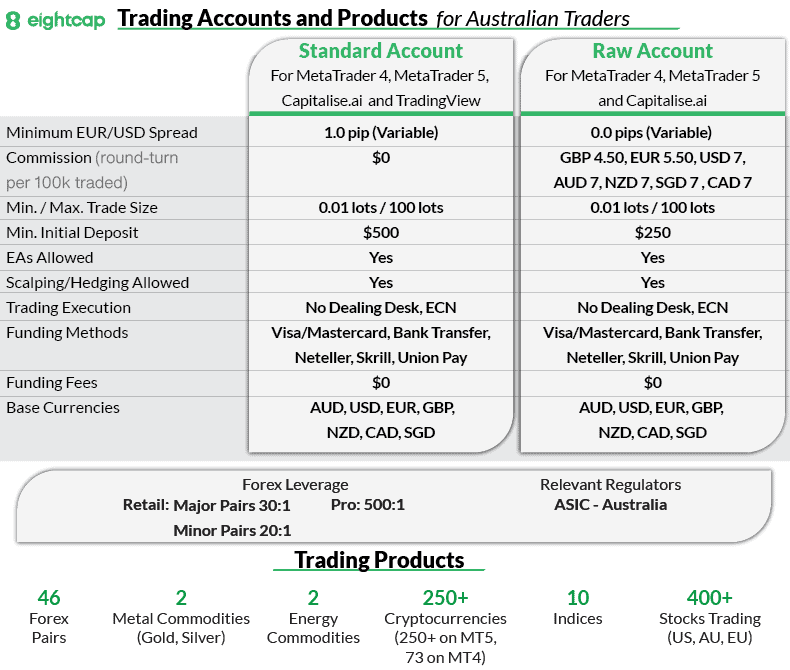

2. Eightcap - Best ECN Platform Broker

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why I Recommend Eightcap

I am impressed with Eightcap’s ECN account. Their RAW spread account features low average spread of just 0.06 pips for the EUR/USD currency pair — this is 0.16 pips below the industry average.

I also took note of the 95 cryptocurrencies offered by Eightcap, as this is by far the largest selection of any broker I have reviewed. Other products available for trading include indices, shares, and gold.

When using MT4, I like that you can use Capitalise.ai, an advanced automation tool that allows you to automate your trading without the need for coding knowledge.

Pros & Cons

- No deposit or withdrawal fees

- Supports 95 cryptocurrencies

- Low RAW spreads

- $500 minimum deposit for standard account

- No Islamic account

- Very few educational resources

- Doesn’t support PayPal

Broker Details

Eightcap Has MetaTrader 4, 5 and TradingView

Eightcap is my top broker for having wide range of platforms as well as the tight ECN ‘like’ spreads. I scored Eightcap’s platform a solid 75/100, with key strengths being their extensive trading platforms and good range of funding methods.

Major highlights of Eightcap include:

- Low ECN spreads

- Top MetaTrader broker

- Diverse range of platforms

- Top cryptocurrency range

I love Eightcap’s Raw account spreads

Eightcap offers a Standard (commission-free) or RAW (commission-based trading) account. If you are looking for the tightest spreads, the RAW account is the way to go. You will pay commissions of AUD $7 per round turn with the RAW account but I found that the Standard account has marked-up spreads, leading to overall higher fees.

I compiled a list of average spreads from major brokers and Eightcap comes out on top for ECN spreads. As you can see, Eightcap has some of the tightest spreads across most of the major currency pairs. These spreads are compiled and updated on a monthly basis.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Eightcap’s Diverse Range of ECN Platforms

Not only does Eightcap have tight spreads, the broker also has a diverse and powerful range of ECN trading platforms which are:

- MT4

- MT5

- TradingView

- Capitalise.ai

- CryptoCrusher

- The Amazing Trader

MT4 and MT5 are two of the most popular forex and CFD trading platforms, while TradingView and Capitalise.ai are strong alternatives. TradingView also offers great charting features while Capitalise.ai specialises in algorithmic trading.

FX Blue Labs, CryptoCrusher, and The Amazing Trader are all specialist platforms. Of all these platforms, CryptoCrusher is the most unique platform to trade with and analyse Eightcap’s immense cryptocurrency range.

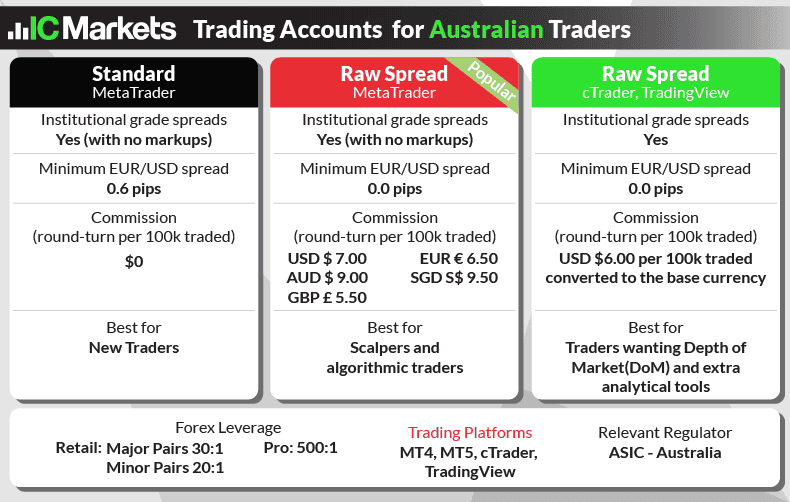

3. IC Markets - Best ECN Broker With Lowest RAW Spread

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why I Recommend IC Markets

IC Markets found a way to top my list because of its extremely low RAW spreads for ECN accounts. The broker claims having an average spread of just 0.02 pips for EUR/USD. The test results done by Ross Collins confirmed that IC Markets is indeed the best broker for low spreads, finishing in the top 2 of the 20 brokers tested.

IC Markets offers trading with MetaTrader 4, MetaTrader 5, and cTrader, which is impressive. However, I did notice that their live chat is a bit slow to respond, and that’s a point for improvement.

Pros & Cons

- Lowest RAW spreads

- Supports 61+ forex trading pairs

- Commission of just AU$3.50

- Limited in-house research data

- Below average execution speed

- No mobile forex trading app

Broker Details

IC Markets Finished First In Our Spreads Testing

After my extensive analysis, I rated IC Markets as my best low-spread ECN broker, offering some of the tightest spreads in Australia. I gave them a score of 85/100 for giving me a stellar trading experience, with a total score of 831/1000 overall.

As one of the best ECN forex brokers in Australia, it is worth noting that IC Markets also provides traders with the following benefits:

- Fast execution speeds

- Superior trading platforms

- Advanced trading tools

- Unrivaled customer service

When it comes to ECN liquidity providers, I discovered that the broker has the most comprehensive partner lists of all forex brokers. I see these partnerships as the shining reason for IC Markets’ low spreads on its RAW ECN account.

Tests confirmed IC Markets has the tightest spreads

Based on the findings of his Standard Account Spreads testing, our analyst Ross Collins, found that IC Markets had the lowest forex market spreads compared to the average spreads published by each broker. You can obtain spreads as low as zero with an average EUR/USD spread of 0.1 pips (AUD/USD at 0.3).

My review also concluded that IC Markets offers deep liquidity pools and fast execution speeds, suited for day traders. By aggregating prices from up to 25 of IC Markets’ partner liquidity providers, the tightest spreads possible are always ensured.

| Broker | Average Spread | Average Spread Cost (USD) |

|---|---|---|

| IC Markets | 1.03 | $9.63 |

| CMC Markets | 1.11 | $10.10 |

| Fusion Markets | 1.19 | $11.07 |

| TMGM | 1.21 | $11.18 |

| Admiral Markets | 1.31 | $11.96 |

| FXCM | 1.47 | $13.49 |

| Pepperstone | 1.46 | $13.52 |

| FP Markets | 1.47 | $13.60 |

| Go Markets | 1.49 | $13.87 |

| EightCap | 1.51 | $13.97 |

| OANDA | 1.54 | $14.23 |

| Axi | 1.71 | $15.99 |

| City Index | 1.79 | $16.52 |

| Blackbull Markets | 1.82 | $16.95 |

| FXPro | 2.22 | $20.83 |

Trader tip

If you’re looking to keep your spreads as close to zero as possible, then trade during periods of high liquidity such as during the London open.

Stable And Fast ECN Trading Servers

Thanks to a global network of strategically placed trading servers, all IC Markets clients benefit from stable, yet lightning-fast ECN trading conditions. Trading conditions go hand in hand with low spreads and we have highlighted why IC Markets can deliver both.

MT4 bridge – A next-generation price aggregator used to connect clients’ trading platforms with deep liquidity pools of partner liquidity providers.

Server locations – Located in the Equinix NY4 data centre in New York, the servers are located close to the MT4 bridge. This ensures latency is minimised, reducing slippage and ensuring accurate fills.

IC Markets’ RAW Spread Account is a Low-Spread ECN Account

Based on my analysis, IC Markets Raw Spread Account, its ECN account, is where you will obtain the lowest spreads.

Key features of the IC Markets Raw Spread Account include:

- Low spreads from 0 pips in peak times

- Ultra-fast order execution

- Deep interbank liquidity from partners

- MetaTrader 4 & 5 trading platforms

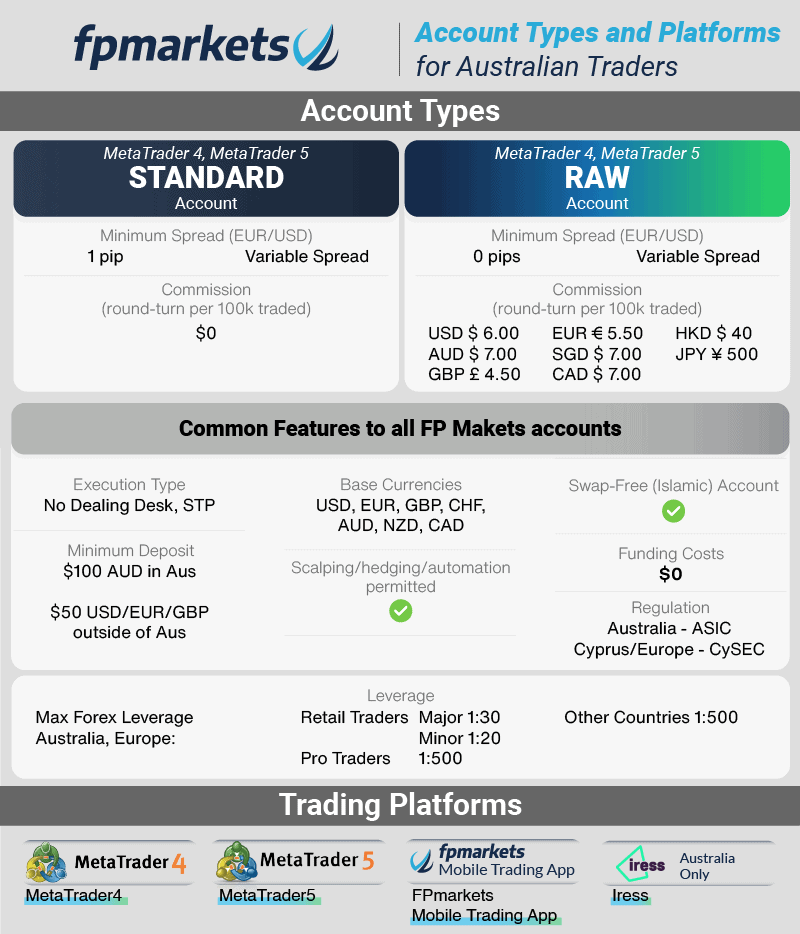

4. FP Markets - Best ECN Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$100

Why I Recommend FP Markets

Australian-based FP Markets is a true ECN broker, with no dealing desk (NDD) execution model that offers the best trading services for scalping. After conducting a zero-spread testing, our analyst Ross Collins found that FP Markets’ spread for EUR/USD is 0 pips 97.83% of the time outside the rollover period, which is true to their claims. This makes the broker a great choice for scalping.

To trade with FP Markets, you can choose between MT4 and MT5 trading platforms and use expert advisors (EAs) for automation as you wish.

Pros & Cons

- Low commission of $3.50

- Good educational resources

- MT4, MT5, cTrader and TradingView Trading platform

- $100 minimum deposit

- Slow limit order execution speed

Broker Details

FP Market’s MT4-MT5 Raw Account Spreads are Tight

Australia-based FP Markets is a true ECN broker, with no dealing desk (NDD) execution model that offers the best trading services for scalping. Upon further analysis, I found their best features to be:

- Access to +10,000 CFDs

- IRESS proprietary web-based platform

- True Electronic Communication Network (ECN) technology

- Full MetaTrader suite (MT4 + MT5)

FP Markets MT4 Traders Toolbox

FP Markets enhances the standard MT4 platform with a set of 12 unique trading tools. Along with the default indicators, I found that you can access features like tick charts and a Mini Terminal that facilitates scalping. The Stealth Order feature is also there, facilitating automatic buying and selling of orders, which is a crucial tool if you are a scalper.

Other advanced functionalities which I liked in the MT4 Trader Toolbox include the ability to set up alerts. I also like the Sentiment Trader feature and the Trader Toolbox Connect tool for quality market research.

FP Markets ECN Account – Raw Account

In my opinion, FP Markets’ ECN account has been specifically designed for active traders with its high-volume discounts. The RAW account provides scalpers with all the features necessary for profitable scalping.

Key features of the FP Markets RAW Account:

- Interbank spreads starting from 0 pips

- Forex quotes streamed from multiple tier-one LPs

- Average EUR/USD spread of 0.0 pips 35.89% of the time

- A low minimum deposit of AUD $100

- Low commission of USD 3 per side for 100,000 units traded

Fast ECN Order Execution and Low Spreads

To give scalpers and day traders a wholesome trading experience, FP Markets has complemented its trading tools with fast execution, no requotes, and low latency. Additionally, the broker’s spreads are consistently low. While not at the top of my list, FP Markets competes with big names like Pepperstone and IC Markets which have the lowest spreads in the FX industry.

When trading, the average EUR/USD spread is 0.1 pips and 0.2 pips for AUD/USD as published on the FP Markets website. I discovered that the broker can obtain spreads as low as 0 pips for each of the major currency pairs.

Moreover, FP Markets servers are located inside the Equinix NY4 data server, which ensures fast execution, ultra-low latency, and minimal slippage from my trading experience.

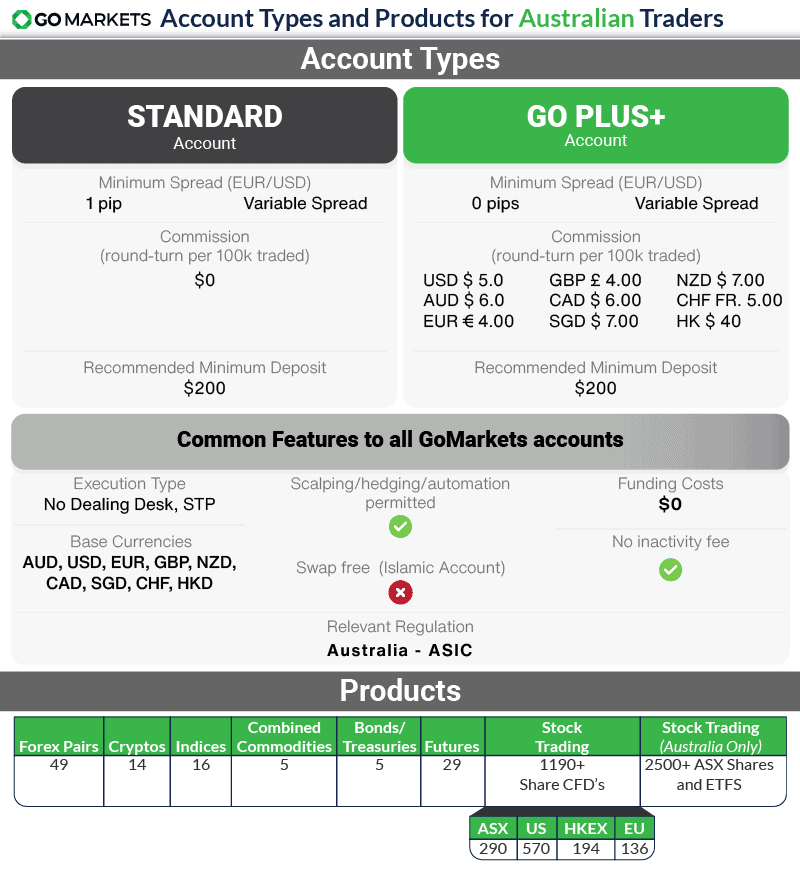

5. GO Markets - Top ECN Liquidity Providers

Forex Panel Score

Average Spread

EUR/USD = 0.2 GBP/USD = 0.5 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, GO Markets App

Minimum Deposit

$200

Why I Recommend GO Markets

With commissions at $2.50, GO Markets has one of the lowest rates in the industry. What caught my attention is the broker’s extensive support for trading platforms including MT4, MT5, cTrader, TradingView, and the in-house Go Markets Web platform.

This impressive platform support is the main reason why GO Markets is the only broker that received a perfect 10/10 score in my testing.

Pros & Cons

- Regulated by ASIC in Australia

- Excellent trading platform support

- Fairly responsive customer support

- No support for PayPal payments

- Customer support is unavailable on weekends

- No Islamic account

Broker Details

Go Markets Go Plus+ Account Commission Costs are the Best in the Market

As Australia’s original MetaTrader forex broker, GO Markets has taken the lead in helping clients upgrade to the MetaTrader 5 trading platform. MT5 is a powerful upgrade from the popular MT4, which is one of my favorites to use.

For platform experience, GO Markets scored a mighty 90/100. In addition to this, here are some of the broker’s best features:

Low spreads from 0.0 pips

Low spreads from 0.0 pips- Australian ASIC regulation

- Fast trade executions

- Segregated client funds in NAB and Commonwealth Bank

- No deposit fees

GO Markets is a Specialist MetaTrader 5 (MT5) Broker

As a specialist MetaTrader 5 forex broker, GO Markets is trusted by both beginners and professional traders so caters to a wide range of trading styles.

Based on trading experience, the MT5 platform is a multi-functional, modern, and user-friendly trading platform with the following advantages:

- Over 350 tradeable instruments across forex, indices, commodities, and crypto

- Full EA (Expert Advisor) functionality

- 6 order types supported

- Up to 80+ technical analysis objects

- Hedging allowed

- Trading signals and copy trading tools

- Algorithmic trading tools

GO Markets ECN Account is GO Plus+

As one of the best Australian ECN brokers, GO Markets has a specialist ECN account called GO Plus+, and here is a brief roundup of its features:

- Raw spreads from 0.0 pips

- Low commissions of $6.00 per round turn

- An low minimum deposit of $500

- Dedicated account manager

You can view my analysis of raw spread forex brokers. See how the commission rates and spreads compare, leading to our GO Markets recommendation.

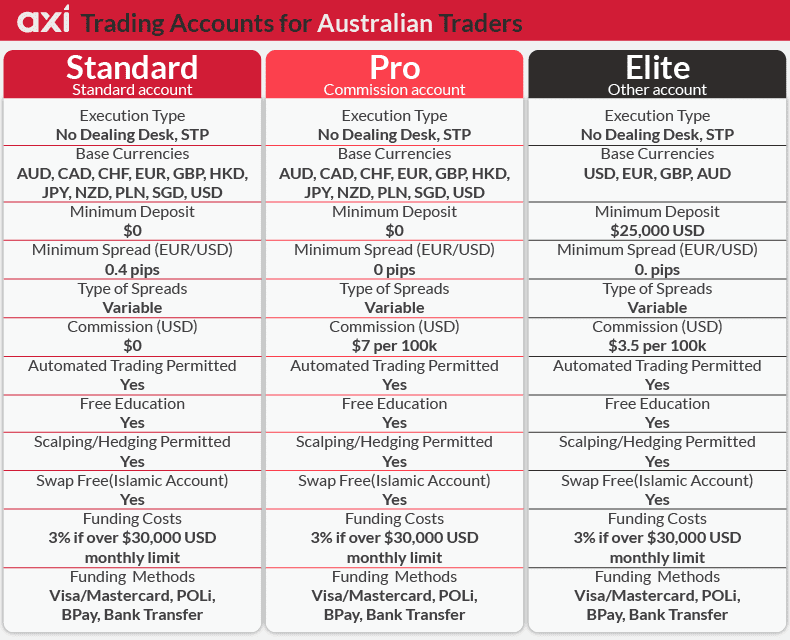

6. Axi - Good $0 Minimum Deposit ECN Broker

Forex Panel Score

Average Spread

EUR/USD = 0.44 GBP/USD = 0.85 AUD/USD = 0.42

Trading Platforms

MT4

Minimum Deposit

$0

Why I Recommend Axi

Axi, formerly known as AxiTrader, brands itself as a MetaTrader 4 specialist — they don’t offer any other trading platforms than MT4. While having multiple platform options could be advantageous, I believe it’s more crucial to have the right platform for your needs. MetaTrader 4 is an excellent choice, offering robust features and tools for traders.

With MT4, you get access to Autochartist and Trading Central for comprehensive technical analysis. Additionally, I found that Axi provides 72 Forex pairs for trading, ensuring a broad range of opportunities when you trade with them.

When signing up, the broker does not have a minimum deposit requirement and uses 20 liquidity providers to offer low spreads. The spreads average 1.2 pips for the EUR/USD on the Standard account and 0.44 pips on the Pro Account.

Pros & Cons

- Offers zero-interest Islamic account

- Good limited order execution speed

- Regulated by ASIC

- Customer support is absent on weekends

- Does not support PayPal payments

- Doesn’t support MetaTrader 5

Broker Details

Axi Requires No Minimum Deposit When You Use Their Demo Account

Axi is part of our big three Australian ECN Brokers. If the most important aspects of a forex broker for you is having a low minimum deposit and the ability to trade micro-lots, then you’ll find no better option than Axi.

Axi’s best features are:

- MetaTrader 4 specialist

- No minimum deposit on ECN accounts

- Over 72 forex currency pairs

- Ideal automated trading conditions (EAs)

Known as a specialist MetaTrader broker because of the broker’s MT4 and MT5 trading platforms, Axi offers a free suite of add-ons for all traders with a live trading account – MT4 NexGen.

Many ECN Account Funding Methods

Being one of the top-rated Australian ECN brokers for having low minimum deposit, you can choose one of several ways to fund your Axi account:

Debit and credit cards (Visa, Mastercard, Maestro, JCB) – Instant, max 15 minutes.

NETELLER – Instant, max 15 minutes.

Skrill/Moneybookers – 3-5 business days.

Global Collect (only for Australian clients) – Same or the next day.

BPAY (only for Australian Clients) – 1-3 business days.

Bank Transfer – Same day for deposits coming from Australian bank accounts, next day for overseas accounts.

Broker to Broker Transfer – 3-5 business days.

Each funding type has its delays and charges, so I highly advise you to check with each provider before making a deposit or withdrawal from your Axi account.

I Love Axi’s NexGen Add-ons

Based on my extensive research, Axi sets itself apart with its free NexGen suite of add-ons aside from offering both MT4 and MT5 trading platforms. Key features of NexGen that I love include:

- Sentiment indicator

- Correlation trader

- Alarm manager

- Economic calendar

- New terminal window

- Automated trade journal

- Session map

- Mini manager

- Forex news

Axi’s ECN Account is the Pro Account

Axi’s ECN account is called the ‘Pro Account,’ and based on my experience, this is where you can obtain the lowest spreads. Along with having no minimum deposit, the account has the following features:

- Raw spreads as low as zero

- Low commissions, from $3.50 per side

- No requotes and instant execution

- Multiple funding methods (PayPal included)

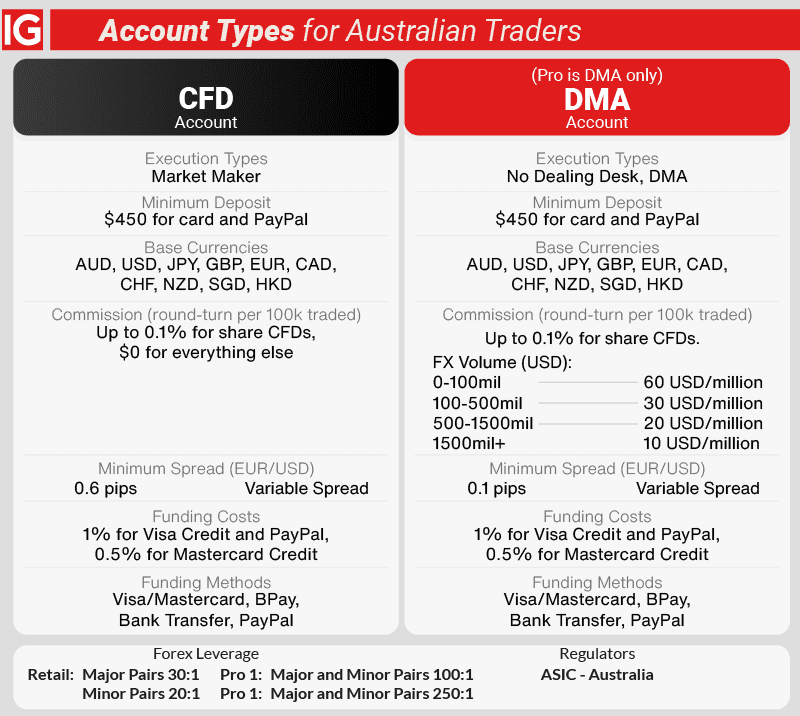

7. IG Trading - Top Forex Broker With Largest Range Of Trading Products

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, IG Trading Platform, L2 Dealer, ProRealTime, TradingView

Minimum Deposit

$0

Why I Recommend IG Trading

IG Trading is a market maker, not a ECN broker. However, they made this list as they have DMA or L2 trading which is similar to ECN. To qualify for the IG DMA account, you need to be a professional trader and use either the L2 trading platform or IG WebTrader.

DMA trading is only with Forex and shares and has an average spread of 0.16 pips for EUR/USD. Retail trader will need to use their CFD account which has average spreads of 1.13 pips EUR/USD.

Pros & Cons

- Responsive 24/7 customer support

- Large variety of trading options

- Regulated by ASIC

- Has a high commission of $6.00

- Minimum deposit of $450 for RAW account

- Doesn’t support cTrader or MetaTrader 5

Broker Details

IG Trading Offers DMA Trading with its L2 Dealer Platform

With over 239,000 retail clients worldwide and 47 years of experience in the FX space, IG Trading is the largest ECN broker in Australia. Currently, IG Trading is processing on average USD 6.8 billion of daily transactions and 7 million orders per month, offering 93 different currency pairs.

I noted the following top features for IG Trading:

- Over 17,000 financial instruments

- Proprietary trading platform – L2 Dealer

- Good selection of trading platforms and tools

- Guaranteed stop-loss order (GSLO) for 0 slippage execution

IG Trading DMA Trading Account

After my personal experience with the broker, I took note of a variety of advantages of IG Trading’s Forex direct account, which mimics the ECN/STP execution models. Here are some of them:

- Fast order execution of 0.014 seconds

- Average EUR/USD spread of 0.16

- Volume-based commission from USD 60 per million traded

- 38% of limit orders received positive slippage

- Low order rejection rate below 2%

- Professional order control and integrated market alerts

- Historical price data on all currency pairs

IG Trading’s Top Pricing Execution and Liquidity Providers

IG Trading uses a DMA (Direct Market Access) model to execute a client’s transactions. This means orders are submitted directly to the Interbank market. I personally prefer this model as it gives you the best available prices and execution without any interference.

IG Trading’s liquidity provider (LP) network is impressive, comprising 12 tier-1 banks and tier-2 banks along with leading market makers and Multilateral Trading Facilities (‘MTFs’). I also appreciate IG Trading’s transparency, with the broker’s execution venues openly published within its Order Execution Policy.

IG Trading prices are aggregated from the following top-tier financial institutions: Bank of America, Barclays, Citadel, Citibank, EBS, Goldman Sachs, Hotspot, HSBC, JP Morgan, Morgan Stanley, UBS, and XTX.

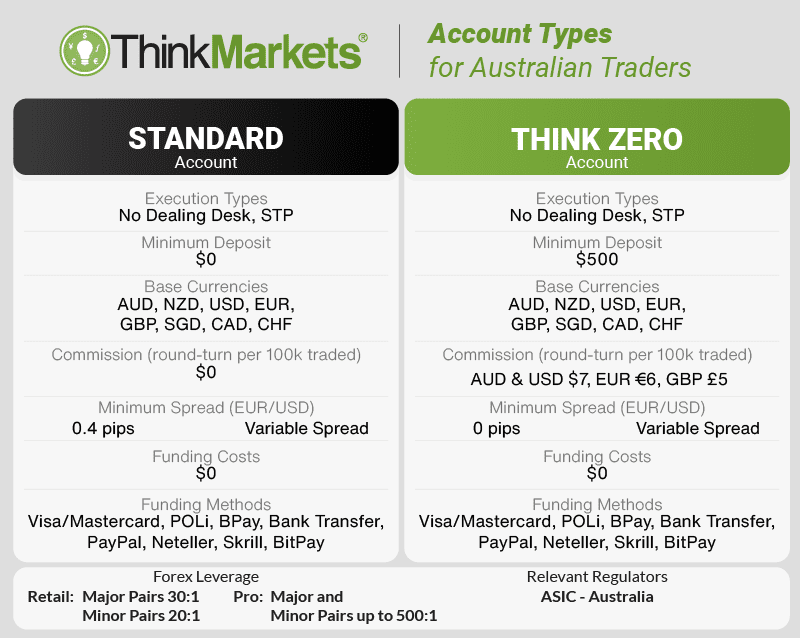

8. ThinkMarkets - Best ECN Broker For Beginners

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.2

Trading Platforms

MT4, MT5, ThinkTrader

Minimum Deposit

$0

Why I Recommend ThinkMarkets

I especially appreciate ThinkMarkets for its affordability, with a low commission of just AU$3.50 and RAW spreads starting from only 0.1 pips for EUR/USD. This combination makes it an excellent platform, particularly if you are a beginner.

ThinkMarkets supports both MetaTrader 4 and the newer MetaTrader 5. This allows you to choose the platform you’re most comfortable with, providing excellent flexibility.

Additionally, I found that you can opt for the in-house ThinkTrader platform, available on both web and mobile. Using this platform, you can buy ASX shares and own the underlying instruments.

Pros & Cons

- Supports large variety of payment options

- Good 24/7 customer support

- Supports both MT4 and MT5

- Shares trading on ASX

- Doesn’t offer an Islamic account

- Below average order execution speed

- $500 minimum deposit for RAW account

Broker Details

ThinkMarkets is a Great Choice for Beginner Traders

If you’re a beginner trader, one of the best forex brokers I highly recommend is ThinkMarkets. ThinkMarkets provides an outstanding selection of quality educational resources and market research. Some of the standout features of ThinkMarkets are:

- Superior MetaTrader package (MT4 and next-gen MT5)

- Access to over 2,300 ASX-listed shares

- Award-winning trading App

- Negative Balance Protection

Top Market Research and Trading Academy

Not all forex brokers are beginner friendly, since traders in this level require special trading features. However, it’s great to find that ThinkMarkets accommodates the needs of even the most demanding FX traders.

This broker provides industry-leading education through its “Learn to Trade” section, which is available for beginner, intermediate, and advanced traders. Additional educational resources include a well-organised trading glossary library with a search function, trading guides on the most popular technical indicators and chart patterns, and free, downloadable eBooks.

If you are a new trader, ThinkMarkets comes with solid research and related resources. The broker also has in-house analysts who cover all the latest market risk events both in writing and interactive live webinars.

ThinkMarkets ECN Account – ThinkZero Account

In my opinion, the ThinkZero Account is the ECN-like account type best suited for beginners. Along with having rich educational resources, I discovered additional key features of this account:

- Spreads as low as 0.0 pips

- Market-leading technologies (MT4, MT5, and API)

- A low commission rate of USD 3.5 per side

- ThinkMarkets News service

- Helpful advanced trading tools (Autochartist and Trading Central)

Ask an Expert

are all of these brokers safely regulated in Australia?

Yes, all the brokers on this list are regulated by ASIC.

What are the disadvantages of ECN?

Disadvantages of using an ECN include the need to pay commission in addition to the spread however since spreads are lower than with a standard account, the overall cost will be lower. You are also reliant on the broker using competitive liquidity providers ECN Brokers often also require a higher minimum deposit requirement as they want to attract serious traders and in some cases will not accept small lot sizes.

Is ECN better than a standard account?

Firstly, standard account can use ECN execution but is often understood to refer to a RAW spread account. RAW spread accounts tends to have lower costs than a Standard account and are often but not always necessarily better.