Best CFD Trading Platforms

Trading software is one key consideration when you choose a broker with the best CFD trading platforms allowing forex, cryptocurrencies and stock CFDs to be traded. Our CFD broker comparison factored in the best platforms, trading fees and the top features that traders may require.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

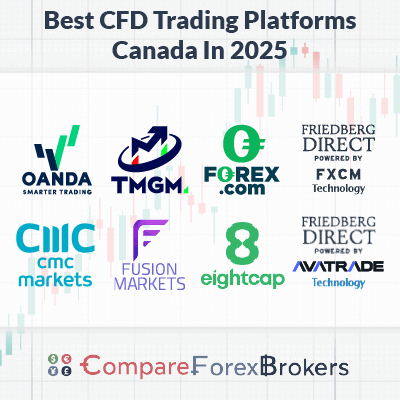

The best CFD brokers based on critical trading considerations:

- OANDA - Best CFD Trading Platforms Canada Overall

- TMGM - Top Broker with High Leverage on MetaTrader 4

- FOREX.com - Top Analysis Tools Like TradingView Charts

- Friedberg Powered By FXCM - Good Automation With Trading Station

- CMC Markets - NGEN Platform IS Great For Risk Management

- Fusion Markets - Low Commission And Spreads With MT4 And MT5

- Eightcap - Great Platform Options for Crypto Trading

- Friedberg Powered By Avatrade - Fixed Spreads WIth Metatrader

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

71 |

FMA, VFSC ASIC |

0.20 | 0.30 | 0.10 | $3.50 | 1.20 | 1.20 | 1.0 |

|

|

|

94ms | $100 | 61 | 12 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

84 | CIRO, FCA, NFA, CFTC, MAS, JFSA, CIMA | - | - | - | $7.00 | 1.2 | 1.5 | 1.4 |

|

|

|

30 ms (May 2023) | $100 | 80+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

70 |

ASIC, FCA FSCA, CIRO |

0.22 | 0.80 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 39+ | - | 30:1 |

|

|

Read review ›

Read review ›

|

69 |

ASIC, FCA MAS, CIRO |

0.5 | 0.9 | 0.6 | $2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 339+ | - | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

64 |

CIRO, FSCA ADGM, CBI |

- | - | - | - | 0.90 | 1.5 | 1.1 |

|

|

|

160ms | $100 | 37+ | - | 33:1 | 33:1 |

|

Read review ›

Read review ›

|

96 |

FCA, ASIC CySEC, SCB |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

What Are The Best CFD Brokers For Canadian Traders?

In this comparison of the best CFD Trading Platforms for Canadian traders, we look at the best forex brokers and the trading platforms they offer. There are many other factors to consider too, such as the accounts each broker offers, along with the CFD products available. These are all listed at the bottom of the page.

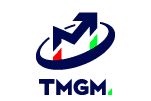

1. OANDA - Best CFD Trading Platforms Canada Overall

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

We recommend OANDA and its OANDA Trade platform as the best CFD trading platform overall, with good charting tools and a simple interface that is easy to use.

One top feature we liked is that the platform allows you to trade smaller lot sizes than other brokers (below micro-lots), giving you complete control of your position sizes.

We gave OANDA, our highest CIRO-regulated broker, a score of 91/100 for its low trading costs and beginner-friendly services.

Pros & Cons

- Tight spreads with no commission

- Solid choice of CFD trading platforms

- Good position management tools

- Educational resources are basic

- No share CFDs

- It does not offer a RAW trading accoun

Broker Details

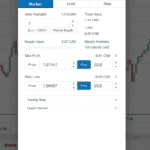

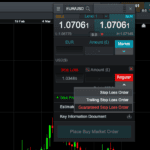

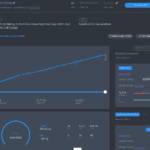

OANDA provides a decent choice of trading platforms, but we felt the OANDA Trade platform (their proprietary platform) provided the best overall performance. You can access the platform via the web, so there is nothing to download like MT4 or MT5. This is also good as it means you can access it from any device.

Even though the OANDA Trade platform is web-based, it doesn’t lack features. The platform’s charting is powered by TradingView, which lets you use over 100+ indicators and drawing tools to provide thorough technical analysis. If you are stuck with trading ideas, the platform also has Autochartist, which provides you with daily trading signals for free.

While trying the OANDA Trade platform, we were struck by its default trade setting options and low unit sizes, which we think make it appealing for beginners. We found that the low unit sizes were customisable, allowing you to trade as low as one unit (vs. the 1,000 units most brokers impose).

Accessing lower unit sizes makes the transition from demo account to live account less risky, as we found you could open one unit position on EUR/USD with just 0.07 CAD as margin.

Another highlight was setting up a pre-configured trade size and risk management for each trade. Surprisingly, this feature isn’t common with other platforms, and we feel that it can help limit basic mistakes like entering the wrong trade size—especially if you are in a hurry to enter the markets.

OANDA also stood out for its low trading costs on the Standard account. Our testing found the broker average of 0.60 pips on EUR/USD, the lowest among the CIRO-regulated brokers.

| Broker | EUR/USD |

|---|---|

| OANDA | 0.6 |

| Fusion Markets | 0.93 |

| Eightcap | 1 |

| TMGM | 1 |

| CMC Markets | 1.12 |

| FXCM | 1.3 |

| Forex.com | 1.2 |

| Industry Average | 1.24 |

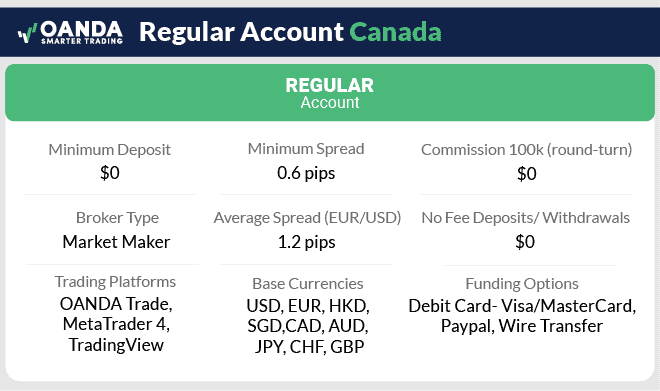

2. TMGM - Top Broker with High Leverage on MetaTrader 4

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.42 AUD/USD = 0.21

Trading Platforms

MT4, MT5, TMGM App

Minimum Deposit

$100

Why We Recommend TMGM

TMGM is our top pick if you want access to higher leverage with up to 1:500 leverage on majors.

We think TMGM pairs nicely with MetaTrader 4. In our tests, the broker had one of the lowest average RAW spreads, 0.32 pips, placing it in the top three.

You’ll also find that TMGM has an impressive selection of 12,000+ markets you can take advantage of with higher leverage.

Pros & Cons

- High leverage available

- Fast execution times

- Tight spreads

- Limited range of forex pairs

- Not CIRO regulated

- Limited educational resources

Broker Details

With TMGM, you can access up to 1:1000 leverage, more than any other CIRO-regulated broker. This high leverage is available thanks to TMGM’s offshore regulator, the Vanuatu Financial Services Commission (VFSC), which also accepts Canadian clients. This regulator gives you access to larger leverage at the expense of not being protected by CIRO.

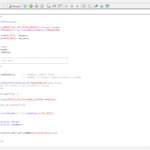

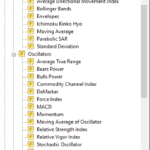

MetaTrader 4 is a versatile trading platform with excellent tools for technical analysis and for developing automated trading strategies with its Expert Advisors. The platform has 30+ technical indicators built in, but you can download more from the MetaQuotes Marketplace or customise your own using MQL4 to code it.

When you combine TMGM’s high leverage with the core features of MetaTrader 4, you end up with a solid platform for scalping the markets. This is because TMGM requires a lower margin to trade, allowing your scalps to take on more risk and more potential rewards for the same price movements.

We found this in our testing as you can utilise the One-click Trading feature that allows you to set your trade sizes, and it will execute your trades instantly. This saves you time from opening a trade ticket, inputting your lot size and clicking the buy or sell button, as a scalper, this would take too long.

In our testing, analyst Ross Collins found that TMGM had the lowest average spread of 0.15 pips on EUR/USD with the Raw account, almost 50% cheaper than the tested industry average of 0.27 pips. Low spreads will reduce your trading costs on TMGM, allowing you to take advantage of the high leverage on the MT4 platform.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

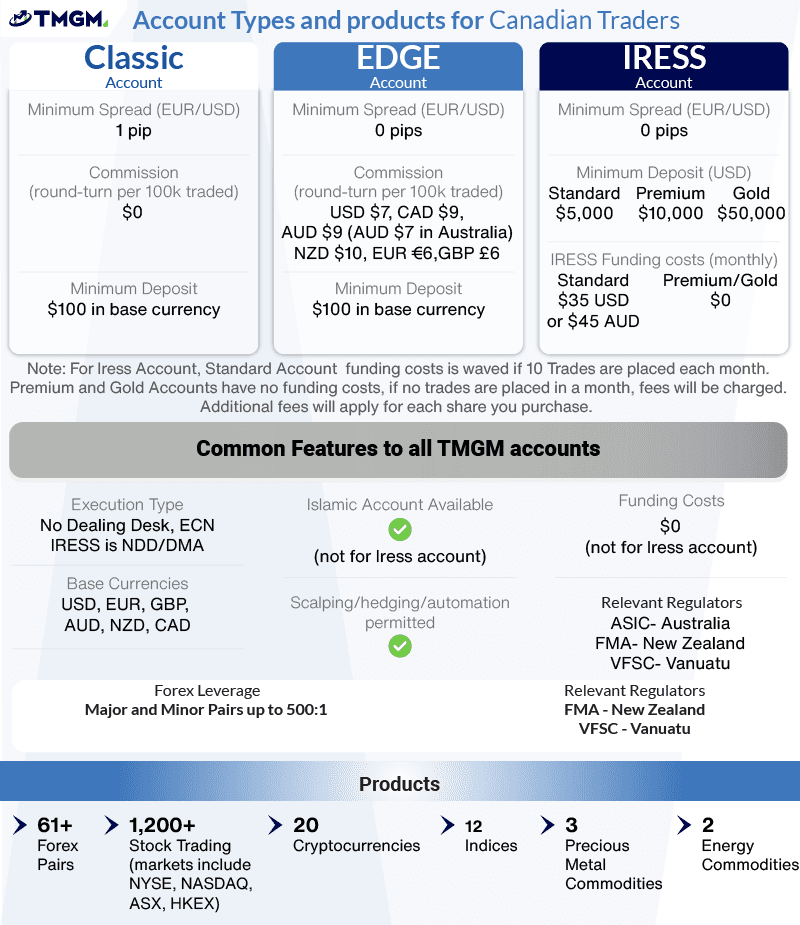

3. FOREX.com - Top Analysis Tools Like TradingView Charts

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 0.8 AUD/USD = 1.7

Trading Platforms

MT4, MT5, TradingView, Forex.com Trading Platform

Minimum Deposit

$100

Why We Recommend FOREX.com

We recommend Forex.com for its excellent trading tools and platform choices, which include top technical chart platforms like TradingView.

Also, we think the TradingView platform works nicely with Forex.com’s 80+ currency pairs, as you’ll benefit from advanced charting tools to monitor each market automatically with its built-in scanner.

What we like most is its low spreads that averaged 0.1 pips on EUR/USD for its RAW account, which means you save money on each trade.

Pros & Cons

- Works with TradingView

- Low RAW spreads

- Solid range of currency markets

- Client support isn’t 24/7

- Not all tools available to Canadian traders

- Requires a minimum deposit

Broker Details

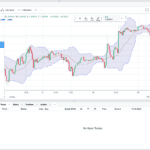

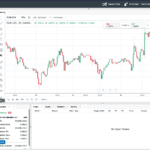

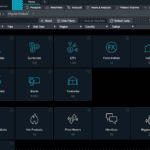

To trade on FOREX.com, you can choose MetaTrader 5, the proprietary Web Trader platform, or TradingView, our top pick. TradingView is packed with features to make analysing the markets easy without downloading the platform, making it one of the most advanced and accessible platforms on the market.

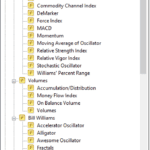

TradingView’s charts are the best in the industry. They offer over 110 technical indicators, including basic and advanced indicators you’d normally have to pay extra for with other platforms. Additionally, the drawing tools are excellent, offering Fibonacci retracement tools, Elliott Wave tools, and now Volume Profile tools that can help pinpoint the market’s flow.

A huge quality-of-life feature of TradingView is that the charts sync across each platform. That means you won’t have to remember the nearest support or resistance level. Every drawing is placed from desktop to mobile (and vice versa), keeping your analysis up to date, even when you’re on the move.

TradingView gives you access to FOREX.com’s full suite of markets, consisting of 84 forex pairs, 17 indices, 2500 share CFDs, and 11+ commodities. You can compile your favourite markets from Forex.com into a watchlist, making navigating between them on TradingView easy.

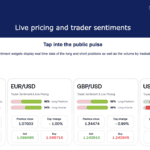

Other trading analysis tools we liked include the Trader Sentiment feature, which allows you to see how other Forex.com traders place their short and long positions. Tools like these give you a snapshot of how others think and can be useful for validating your trading ideas.

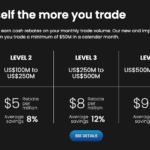

During our testing, we found that the broker offered an Active Trader program where you can receive cash rebates based on your trading activity. Programs like these can reduce your trading costs if you execute large volumes, making it worth signing up for.

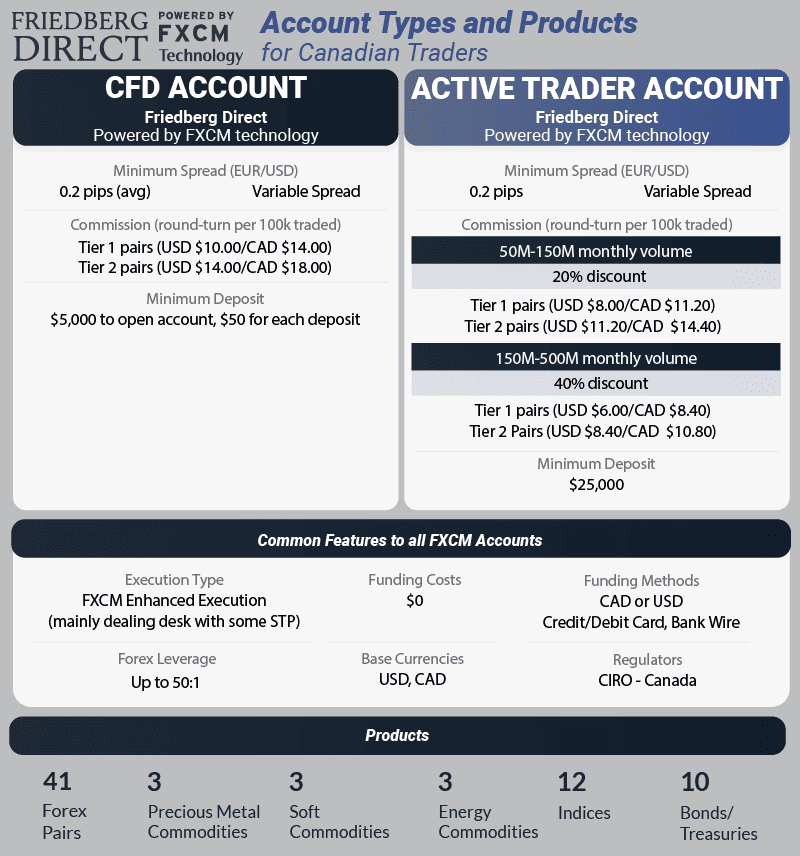

4. Friedberg Powered By FXCM - Good Automation With Trading Station

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

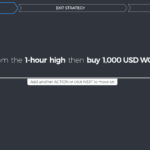

FXCM is a top choice if you want to automate your trades, offering a range of platforms that can get the job done for you. We’re impressed with its TradingStation platform, which includes a built-in optimization tool that lets you test and refine your strategies using historical data.

We like that FXCM offers competitive spreads averaging 0.2 pips for EUR/USD, so you won’t have wide spreads while automating your trades.

Pros & Cons

- Top platform for automating trades

- Competitive RAW average spreads

- Good variety of trading tools

- Lacks TradingView/MT5 support

- Has a minimum deposit requirement

- It has a large minimum deposit

- Limited customer support hours

- No MetaTrader 5/TradingView platforms

Broker Details

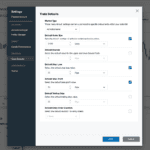

Trading Station by FXCM is one of the only platforms built in-house by a broker to offer automated trading. Unlike MT4, Trading Station uses a popular programming language, C++, to develop its strategies, which has a broader appeal than MQL4.

The trading platform also has 60+ indicators, which you can copy the code from to use in your strategies, making it easier to program.

A limitation we found on Trading Station is that only the platform’s desktop version allows you to automate your trades, and you have to keep your computer on to run the strategies. This limitation isn’t unique to Trading Station; MetaTrader 4 & 5 and cTrader also have this limit.

If you don’t want to program your strategy, you can use Capitalise AI, an add-on service for Trading Station. We liked Capitalise AI as it is a no-code, beginner-friendly solution to automating your strategies.

Giving it your entry and exit rules for the strategy will instantly generate automation. Then, you just make the strategy live, and your Trading Station account will automatically execute the strategy trades without writing one code line.

While testing the broker, we used a Standard account and found the spreads to average 1.30 pips on EUR/USD, which is slightly more expensive than the industry average of 1.24 pips.

We also noticed that the broker offers an Active Trader program, a decent incentive if you trade high volumes with your automation. The main benefit of using the Active Trader program is that you get tighter spreads by paying a $7.00 per lot trade commission, which is average for CIRO-regulated brokers.

Even though you are paying a commission, we found you can receive deep discounts, saving you up to 40% and potentially reducing your commission costs to $3.00 per lot traded.

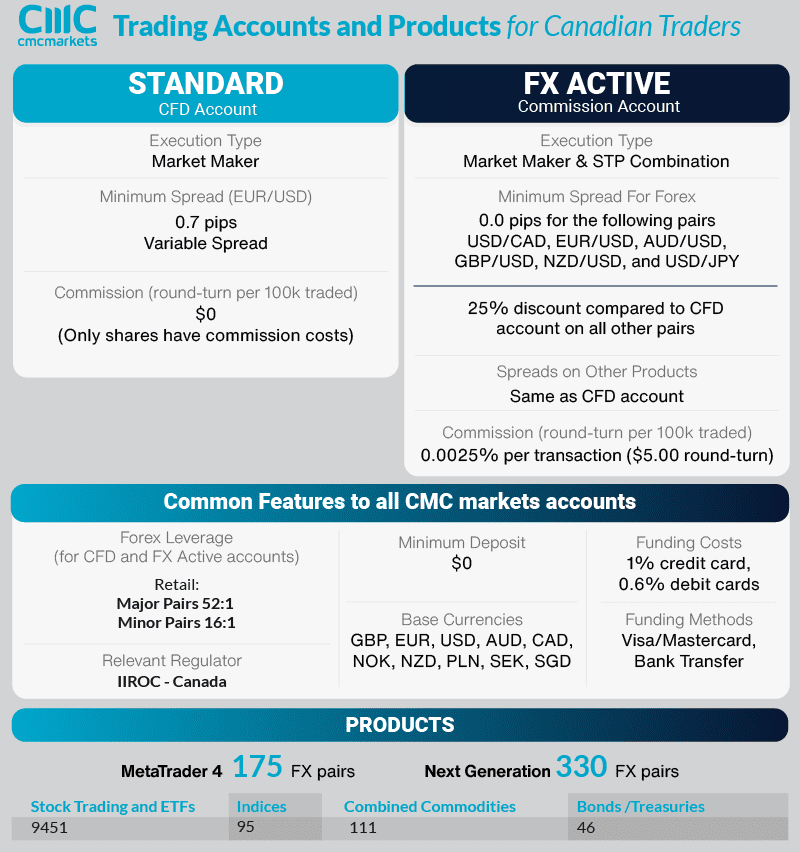

5. CMC Markets - NGEN Platform Is Great For Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.9 AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets trading platform is one of the best broker platforms we’ve tested, making it an easy recommendation. As a bonus, the broker has tight spreads from 0.5 pips with no commission.

The NGEN platform has a range of tools to help you get more out of your trading day, but in particular, the platform has guaranteed stop-loss orders. We like seeing brokers offer these as they can help you limit your losses during volatile times.

Pros & Cons

- Decent spreads with Standard and RAW accounts

- No minimum deposit

- NGEN is an excellent trading platform

- No automated trading with the NGEN platform

- Only offers support during trading hours

- Lacks social trading tools

Broker Details

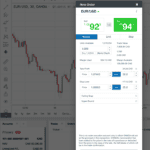

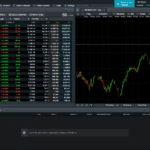

We think CMC Markets has one of the best proprietary trading platforms, packed with features like performance analytics and chart pattern recognition tools. The NGEN platform also provides excellent risk management tools, allowing you to manage your capital actively.

The NGEN platform lets you use Guaranteed Stop-Loss orders, which help protect your positions from price slippage should you get stopped out.

While testing the platform, we found adding a GLSO to our trade straightforward, as adding the Guaranteed Stop-Loss was conveniently placed within the order ticket. You pay a slight premium for it, but it’s worth it as you have no idea how much the market could slip.

The NGEN platform was impressive with its excellent charting tools, which offer 70+ technical indicators and drawing tools, including popular indicators like Ichimoku and Relative Strength Index.

Unique to the NGEN platform, we found it had chart pattern indicators, which scanned the assets for candlestick and chart patterns. You could add these indicators to the charts directly or, as we found out, use the Chart Pattern Recognition tool, which scans multiple markets automatically to find the patterns. We also liked that each pattern shows you a confidence rating and an expected price movement directly on the chart, so you can see these patterns unfold in real time.

While using the NGEN platform, we found that CMC Market offered over 330+ currency pairs, the most we’ve reviewed. Access to these markets allows you to trade different forex markets you won’t find on other platforms.

In addition to the large currency markets, the broker has 13,000+ markets in total, covering a variety of indices, stock CFDs, commodities, and ETFs – making it an excellent broker if you like to trade multiple markets.

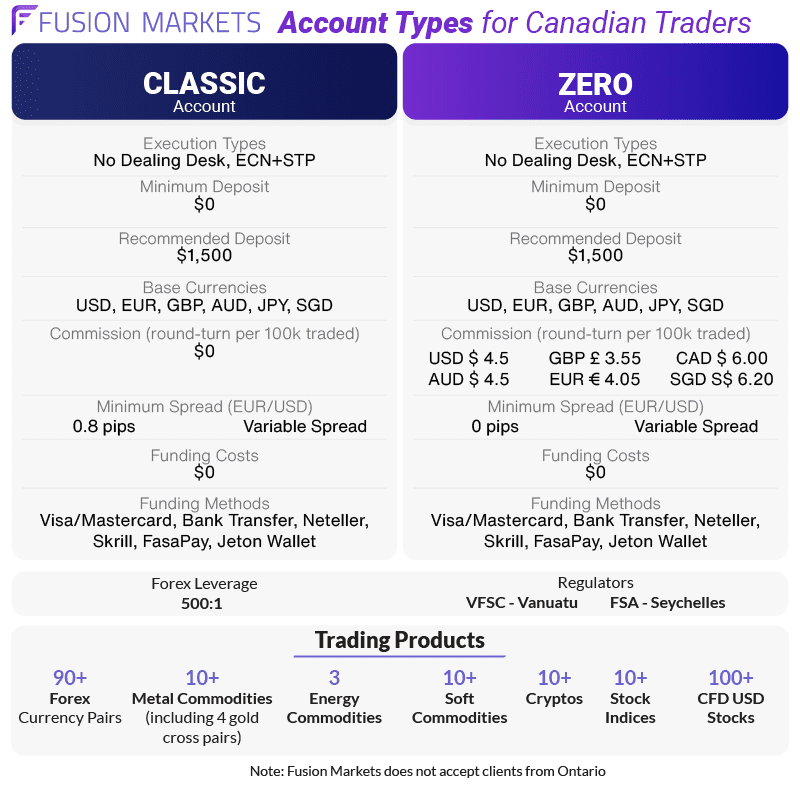

6. Fusion Markets - Low Commission And Spreads With MT4 And MT5

Forex Panel Score

Average Spread

EUR/USD = 0.13 GBP/USD = 0.21 AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Fusion Markets is a broker we highly rated (giving it 92/100) for its tight average RAW spreads, lowest commissions, and fastest execution speed tested – an excellent combination.

In our testing, Fusion Markets charged the lowest commission of $2.25 per lot traded, which is $4.75 lower than FXCM’s ($7.00). We think Fusion Markets is a top choice if you are a scalper, as the lower fees will boost your bottom line.

Pros & Cons

- Cheapest commissions available

- Fast execution times

- Good range of trading tools for free

- Limited range of markets

- A minimum deposit is needed

- Has an inactivity fee

Broker Details

From our testing, Fusion Markets repeatedly stood out for its low trading costs while trying the MT4 and MT5 platforms. The broker offers two accounts: the Classic account, which is spread only (no commissions) and has wider spreads (averaging 0.93 pips on EUR/USD). It’s the Zero account that stuck out for us.

Although commission-based, our analyst Ross Collins mentioned that the spreads were the lowest tested, averaging 0.16 pips on EUR/USD and 0.09 pips on AUD/USD.

| AUDUSD | Average Spread | EURUSD | Average Spread | GBPUSD |

|---|---|---|---|---|

| Fusion Markets | 0.09 | TMGM | 0.15 | CityIndex |

| TMGM | 0.15 | Tickmill | 0.15 | Fusion Markets |

| Pepperstone | 0.19 | Fusion Markets | 0.16 | IC Markets |

| CityIndex | 0.23 | IC Markets | 0.19 | FP Markets |

| IC Markets | 0.23 | Pepperstone | 0.19 | TMGM |

| FP Markets | 0.31 | FP Markets | 0.2 | Pepperstone |

| Blueberry Markets | 0.32 | EightCap | 0.2 | EightCap |

| Go Markets | 0.37 | Admiral Markets | 0.21 | Blueberry Markets |

| Tickmill | 0.37 | CityIndex | 0.22 | Go Markets |

| ThinkMarkets | 0.42 | ThinkMarkets | 0.22 | Tickmill |

| EightCap | 0.48 | Blueberry Markets | 0.27 | ThinkMarkets |

| Axi | 0.67 | Go Markets | 0.38 | Admiral Markets |

| CMC Markets | 0.68 | Axi | 0.43 | CMC Markets |

| Admiral Markets | 0.7 | CMC Markets | 0.44 | Axi |

| Blackbull Markets | 0.85 | Blackbull Markets | 0.46 | Blackbull Markets |

| Tested Industry Average | 0.42 | 0.27 |

Ross also mentioned that Fusion Markets’ Zero account has the lowest commissions for Canadian traders at just $2.25 per lot traded. This commission is $4.75 cheaper than CIRO-regulated broker FXCM offers, placing Fusion Markets as a true low-cost broker.

| Broker | USD |

|---|---|

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| TMGM | $3.50 |

The broker isn’t just cheap. Our analyst also shared that Fusion Markets had the lowest execution speeds for Canadian traders. Ross found that the broker had a limit order speed of 79 ms and a market order speed of 77 ms (the fastest), both important for instant execution and stop loss/take profit orders.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Market Order Speed (ms) |

|---|---|---|---|

| Fusion Markets | 2 | 79 | 77 |

| OANDA | 5 | 86 | 84 |

| FOREX.com | 8 | 98 | 88 |

| TMGM | 11 | 94 | 129 |

| CMC Markets | 24 | 138 | 180 |

| Eightcap | 16 | 143 | 139 |

| FP Markets | 25 | 225 | 96 |

| FXCM | 28 | 188 | 189 |

| AvaTrade | 29 | 235 | 145 |

When you combine the execution speed, lowest commission, and tight spreads on the Zero account, we have to say that it shapes up to be a solid broker for scalping.

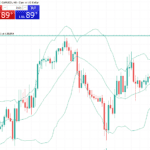

Fusion Markets has MT5, which means you can use tick charts and one-click trading to find scalping opportunities and execute trades quickly. As Fusion Markets is an ECN-style broker, you also get the Depth of Market tool on MT5. This tool lets you find where most of the buy/sell orders are with the liquidity provider, helping you time your scalps better.

You can combine the 38+ technical indicators to help you find scalping opportunities using popular indicators such as MACD, RSI, and Bollinger Bands.

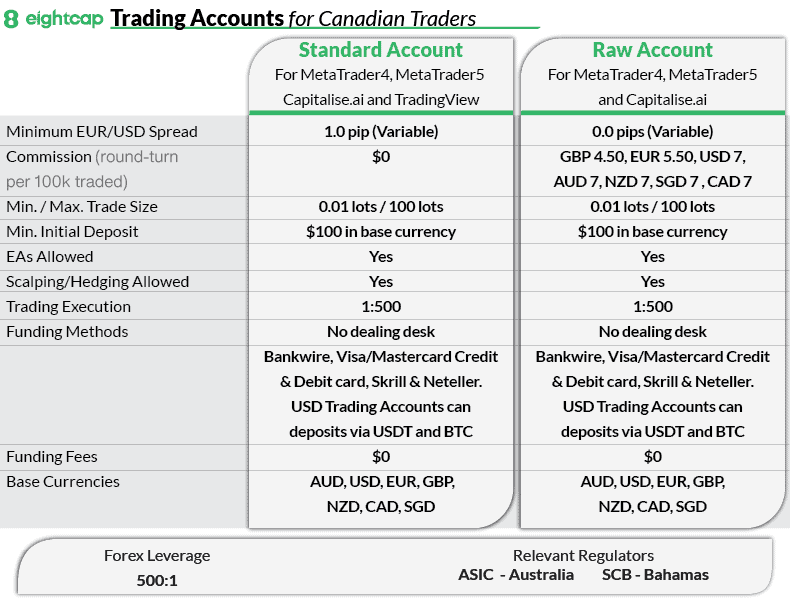

7. Eightcap - Great Platform Options for Crypto Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.73 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

We recommend Eightcap as our top pick for crypto trading because it offers a wide range of 95 cryptocurrencies to trade, from Bitcoin to XRP.

Alongside crypto markets, Eightcap offers commodities, indices, shares, and forex CFDs with low spreads, averaging 0.06 pips on EUR/USD.

Pros & Cons

- Top choice of crypto markets

- Decent RAW spreads on FX

- Solid choice of trading platforms

- The choice of markets is low

- Customer support isn’t available over weekends

- Need a minimum deposit to open an account

Broker Details

We found that Eightcap offered 95 crypto markets, including Bitcoin, Ethereum, and Ripple, plus less liquid coins like DASH and ATOM. Interestingly, compared to the rest of the CIRO-regulated brokers on this list, Eightcap has almost five times the amount available, giving you the best choice for crypto markets.

| Broker | Crypto Markets |

|---|---|

| Eightcap | 95 |

| TMGM | 20 |

| AvaTrade | 17 |

| CMC Markets | 14 |

| Fusion Markets | 10 |

| Forex.com | 8 |

| FXCM | 7 |

The broker offers traditional financial instruments, including forex, indices, stock CFDs, and commodities. Compared to the rest of the industry, Eightcap’s 800 markets fall short, focusing only on major markets and limiting your trading opportunities with the broker.

As for trading platforms, Eightcap offers TradingView, MetaTrader 4 and MT5, allowing you to choose the way to trade with the broker. You can trade cryptocurrencies on each platform, our favourite being TradingView, thanks to its excellent advanced charting tools, including 110+ indicators with popular indicators like Bollinger Bands and Stochastic.

Plus, we like the drawing tools as they snap onto the price points, making technical analysis faster.

If you want to automate your crypto trades, you can choose between the MetaTrader platforms with Expert Advisors (EA). A drawback of using EAs is that you must program the strategy using MQL4/5, which requires coding knowledge that most traders don’t have.

With Eightcap, you can use Capitalise AI to automate your strategy without learning and programming your own Expert Advisor. During our testing, we typed the trading rules for entering and closing a position, and the tool generated an automated strategy.

We liked this as Capitalise AI helps bridge the gap for those without experience programming EAs and building an automated trading strategy.

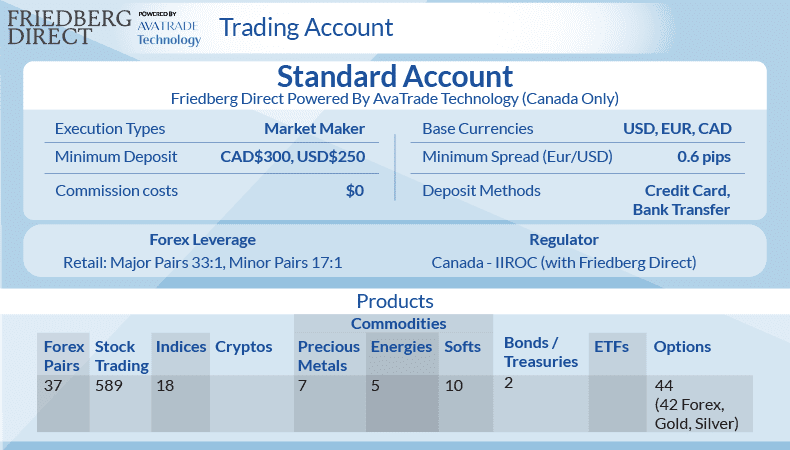

8. Friedberg Powered By Avatrade - Fixed Spreads With Metatrader

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.5 AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade because it really stands out with its fixed spreads starting from just 0.6 pips on EUR/USD. These spreads are surprisingly low compared to other brokers, which often have variable spreads averaging around one pip or more.

AvaTrade earned a respectable score of 64/100 in our review, impressing us with its range of markets and trading platforms, like the popular MetaTrader 4.

Pros & Cons

- Competitive low-fixed spreads

- Good variety of market

- Has MT4 and MT5 platforms

- Charges inactivity fees

- AvaTradeGO is unavailable in Canada

- Customer support could be available for more hours

Broker Details

Through AvaTrade’s fixed spreads, you can maintain the average trading costs even during news announcements and during high volatility price spikes. Because of this, it can be appealing to day traders to ensure they get a decent price, no matter the time of day they trade, and not have to worry about market announcements.

| Broker | EUR/USD (Average Spread) | Fixed/Variable |

|---|---|---|

| OANDA | 0.60 | Variable |

| AvaTrade | 0.90 | Fixed |

| Fusion Markets | 0.93 | Variable |

| TMGM | 1.00 | Variable |

| Eightcap | 1.00 | Variable |

| CMC Markets | 1.12 | Variable |

| Forex.com | 1.20 | Variable |

| FXCM | 1.30 | Variable |

Typically, fixed spreads are more expensive than variable spreads due to the increasing risk of market volatility; however, we found AvaTrade to be very competitive. From our testing, the broker surprised us with fixed spreads of 0.90 pips on EUR/USD, below the industry average of variable spread brokers at 1.24 pips.

You can enjoy these fixed spreads on MetaTrader 4 or MetaTrader 5. Both have similar features, but traders stick with MT4 because their custom indicators and EAs are not yet compatible with MT5.

While MT5 offers all the features MT4 has, it also offers faster software performance speeds through the 64-bit architecture, which can help reduce input lag on EAs and trades.

Plus, MT5 has more indicators, timeframes, a depth of markets tool, and a native economic calendar that labels upcoming events directly on the chart to keep you in the know.

Ask an Expert

What is a CFD Trading Platform?

CFD stands for contracts for difference. It is a form of trading where you buy a contract for an asset that is based on the price of the underlying instrument. So instead of buying physical shares, you buy a contract of that share and this contract is based on the price of the actual share. Since this is a contract, you don’t own the share itself.

CFDs can be applied to all kinds of financial instruments – forex, shares, indices, bonds, treasures, ETFs, metals such as gold and silver, energies like oil, cryptocurrencies and soft commodities like rice and corn.

A CFD trading platform is the software that allows you yo buy and sell these CFDs. Popular platforms include MetaTrader 4 and 5, eToro, Plus500, cTrader

what platform is best for me to copy trade on

This really comes down to personal preference. The eToro trading platform is built for social and copy trading and their social network is large. Spreads however tend to me higher. Most brokers offer Myfxbook as an add on so this could be a good options, alternatively, consider MetaTrader signals which uses the MetaTrader network.

What is a cod trading platform

Cash on delivery (COD) is a type of transaction where the recipient pays for a good at the time of delivery rather than using credit. The terms and accepted forms of payment vary according to the payment provisions of the purchase agreement.

will canada ever allow cfd trading of cryptocurencies

I would love to give you an answer but I’m afraid I have no idea.

hello can I trust exc500.pro platform

No