Forex Brokers With Negative Balance Protection

Negative balance protection protects your trading account from debt when forex trading. We look at the best negative protection forex brokers with ThinkMarkets our best forex trading platforms with negative balance protection.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

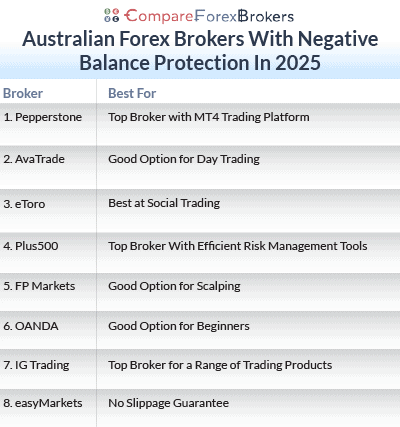

The best negative balance protection regulated Forex brokers are:

- Pepperstone - Top Broker with MT4 Trading Platform

- AvaTrade - Good Option for Day Trading

- eToro - Best at Social Trading

- Plus500 - Top Broker With Efficient Risk Management Tools

- FP Markets - Good Option for Scalping

- OANDA - Good Option for Beginners

- IG Trading - Top Broker for a Range of Trading Products

- easyMarkets - No Slippage Guarantee

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 | ASIC, FCA, DFSA | 0.10 | 0.30 | 0.20 | $3.50 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.10 | 0.50 | 0.30 | $3.00 | 1.20 | 1.50 | 1.40 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.90 | 1.78 | 1.54 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

52 |

ASIC, CySEC FSA-S, FSC-BVI |

- | - | - | - | 0.70 | 0.90 | 0.90 |

|

|

|

155ms |

$200 (Standard) $3,000 (Premium) $10,000 (VIP) |

62+ | 17+ | 30:1 | 500:1 |

|

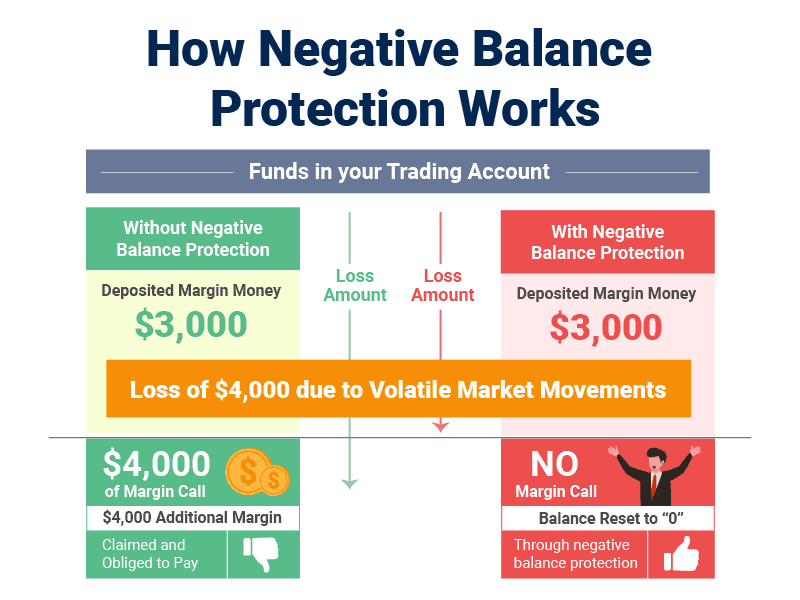

Negative Balance Protection is a great feature that protects your trading balance from going into negative territory. Not all brokers offer it, so the team at Compare Forex Brokers have picked the top forex brokers with negative protection. We have chosen brokers based on a feature that sets them apart from the rest.

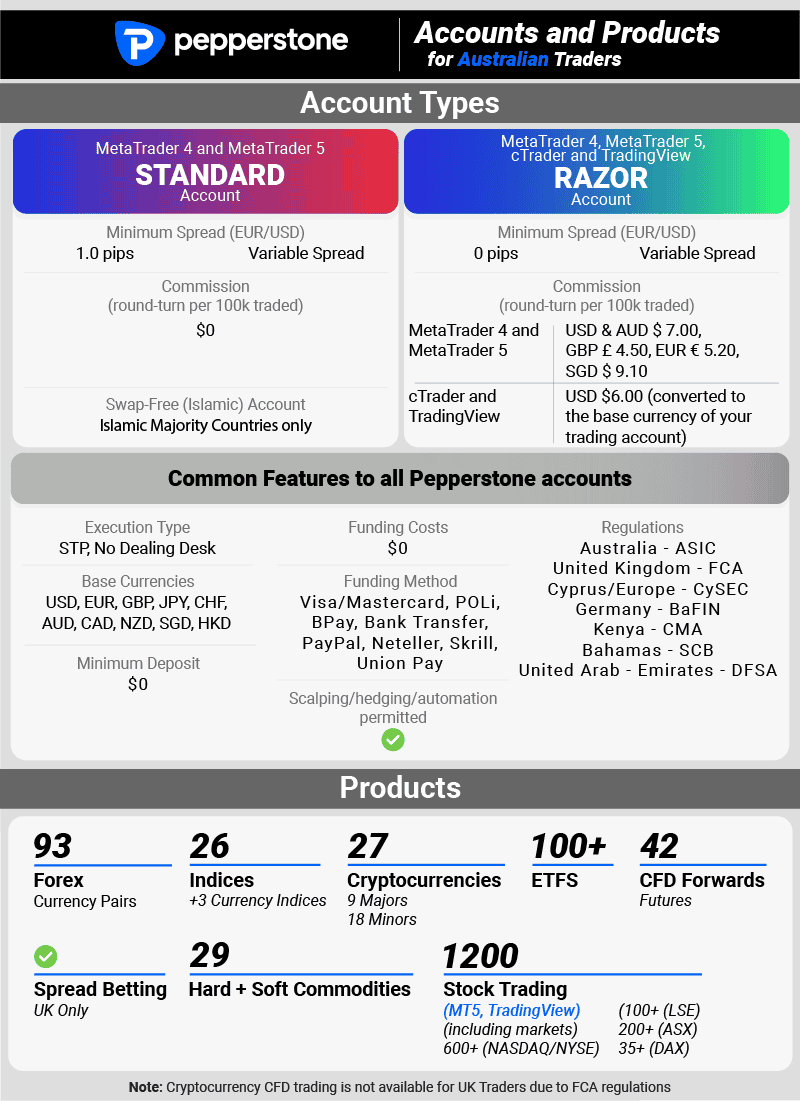

1. Pepperstone - Top Broker with MT4 Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We gave Pepperstone an overall score of 98 out of 100. Key features we like Pepperstone include the choice of TradingView, MT4, MT5 and cTrader platforms, a large range of CFDs including 92 Forex pairs, zero deposit fees and no minimum deposits.

Our tests found the brokers have an average spread of just 0.1 pips for EUR/USD with their razor account and fast execution with 77 ms for limit orders. All these add further reasons why we like Pepperstone.

Pros & Cons

- User-friendly trading interface

- Zero Deposit

- Limited options on MT5

- Undynamic swap fee

Broker Details

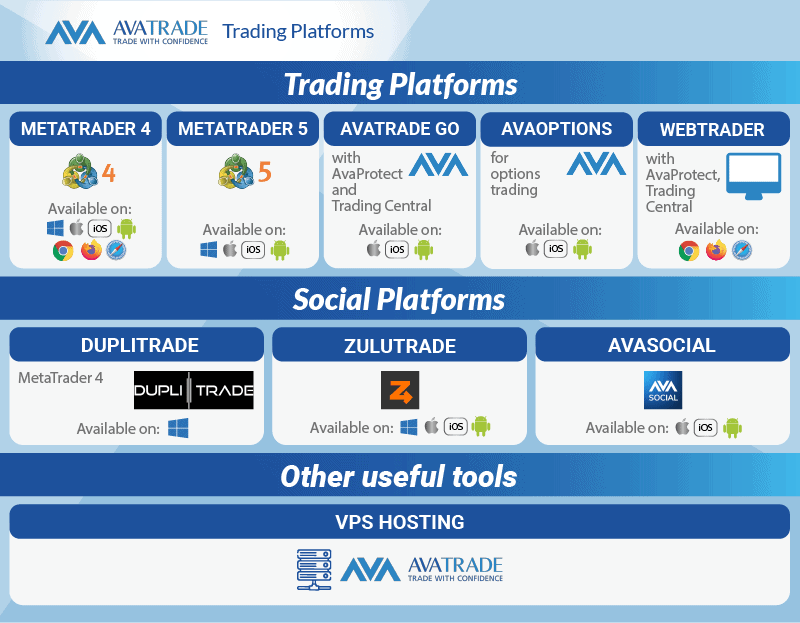

2. AvaTrade - Good Option for Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.5 AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

Based on our findings, we recommend AvaTrade as a good option for day trading because of its intuitive trading platforms (MT4 and MT5), trade automation functionality and tighter fixed spread.

AvaTrade is highly ranked among other forex brokers that offer fixed spreads. Its 0.9 pips fixed spread on EUR/USD is among the lowest, considering that other brokers offer an average of 1.8 pips on the same currency pair in our tests done by Ross Collins.

Pros & Cons

- Tight fixed spread

- Mobile trading app

- Trade automation

- Average customer support

- No RAW spread pricing

Broker Details

A Broker Good For Social Trading With Account Protection

AvaTrade is a regulated forex broker and an ECN broker that provides negative balance protection and a great selection of copy trading tools.

Whether you are a beginner lacking confidence or an expert wanting to save time researching financial markets, the account mirroring services offered by AvaTrade allow you to fully automate trading while sharing knowledge and strategies with a large forex community.

AvaTrade’s risk management policies make them an ideal choice for social trading, not only does one get negative balance protection but AvaTrade uses a 100% margin call and 30% stop out for their MT4 and MT5 trade accounts (standard accounts) and 50% margin call for their MT4 and MT5 Zero accounts. These provide extra protection should one have the misfortune to have poor-performing traders signals.

Three of the best social-copy trading systems are offered by the broker to automate Forex and CFD trading. You can choose between MetaTrader Signals, ZuluTrade or DupliTrade, depending on the trading platform you want to use and whether you prefer direct or indirect copy trading tools.

MetaTrader Signals

MetaQuotes proprietary copy trading service available on MT4 and MT5. The automated trading tool allows you to copy the trades made by successful investors known as signal providers. The MetaTrader Signals community consists of millions of users, with both free and paid trading signals available to copy.

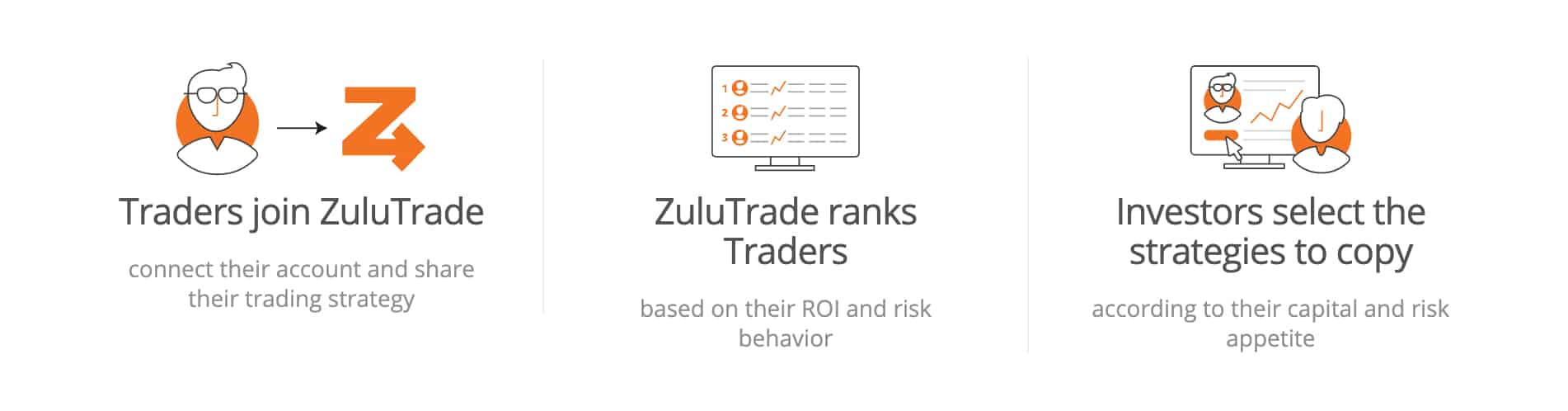

ZuluTrade

ZuluTrade is a social-copy trading provider for MT4 that provides account mirroring services plus a large social network of forex traders. Users can simplify trading by copying the strategies of experienced investors, saving time placing orders and conducting lengthy technical and fundamental analysis.

The social trading service also provides useful risk management tools such as ZuluGuard. ZuluGuard, an account monitoring feature, will close positions if it detects changes to a trader’s performance of which you are copying.

The social trading service also provides useful risk management tools such as ZuluGuard. ZuluGuard, an account monitoring feature, will close positions if it detects changes to a trader’s performance of which you are copying.

To open a ZuluTrade social-copy trading account with AvaTrade, an initial minimum deposit of $500 is required. Alternatively, traders can explore the third party provider using a demo account funded with a virtual account balance of $100,000.

DupliTrade

Compared to ZuluTrade a significantly higher minimum deposit of $2,000 is required to sign up to DupliTrade. The MT4 add-on allows you to search and copy expert strategy providers that match your preferred asset classes, timeframes, and risk levels.

To see if DupliTrade is the right account mirroring service for you, MT4 traders can sign up for a 30-day demo account.

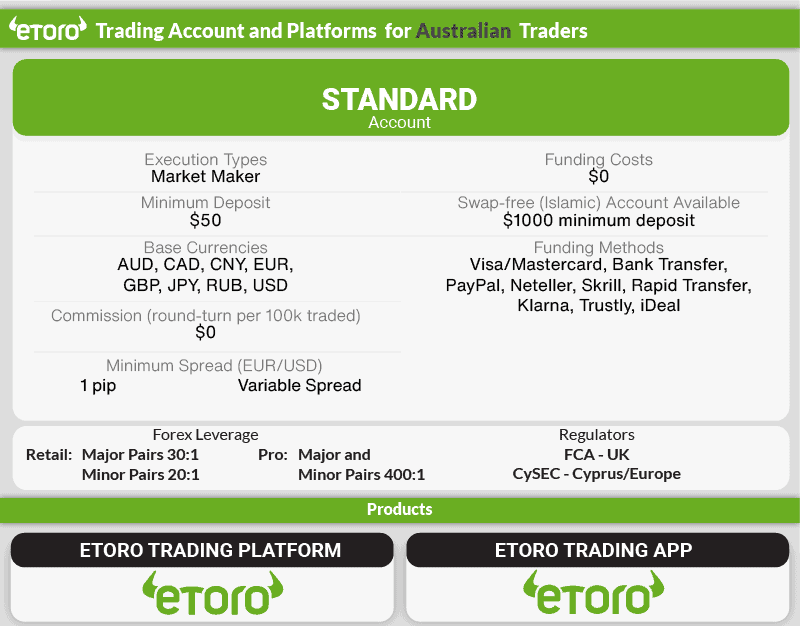

3. eToro - Best at Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0 GBP/USD = 2.0 AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

Why We Recommend eToro

eToro is arguably the best broker platform for copy trading and community-level support. This is helpful for beginner traders as they can copy successful experts and find help from platforms. It has a major pair average spread of 1.30, competitive charges, and strong alignment with trading stocks and ETFs.

Drawbacks for eToro include $5 withdrawal fees and a base currency limitation that accepts only the USD. However, its numerous tradable asset options and friendly interface make it a great choice.

Pros & Cons

- Social trading feature

- Cost-effectiveness

- Wide range of tradable assets

- Demo account

- $5 withdrawal charge

- Uses only one base currency – USD

- Inadequate customer support and research resources

Broker Details

4. Plus500 - Top Broker With Efficient Risk Management Tools

Forex Panel Score

Average Spread

EUR/USD = 1.7 GBP/USD = 2.3 AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

Plus500 is a multi-asset platform recommended because of its extensive order types. Based on our findings, Plus500 has a vast range of tradable products like 71 Forex pairs, 98 ETFs and 300+ Options. to trade on its in-house developed trading platform.

We like the inclusion of a guaranteed stop loss which adds another layer of protection in addition to the negative balance protection.

Pros & Cons

- Wide range of order types

- Extensive market choice

- Efficient risk management tools

- Has trading app

- Limited customer service options

- Inadequate educational content.

- No MT5

Broker Details

The Top CFD Provider With Negative Balance Protection

Plus500 is an established CFD provider with an excellent range of financial instruments to trade. As well as access to thousands of financial markets, Plus500 offers premium order types and negative balance protection to mitigate the high risk of trading CFDs.

The broker is ASIC-regulated in Australia as well as regulated by Seychelles. The broker is also regulated by Cyprus’ CySEC for European traders in Europe and the Financial Conduct Authority in the UK. For its high trust and STP-style trading, it is the preferred choice of many professional traders.

Commission-Free Forex Trading

Plus500 offers a simple pricing structure that does not require traders to calculate account and exchange commission fees. Plus500 is a market maker broker that matches traders’ orders internally (rather than externally as with NDD brokers), and therefore only offers retail clients one account type. When trading forex, spreads are commission-free with the CFD provider charging no account management fees for deposits or rolling open positions on forex or other derivatives.

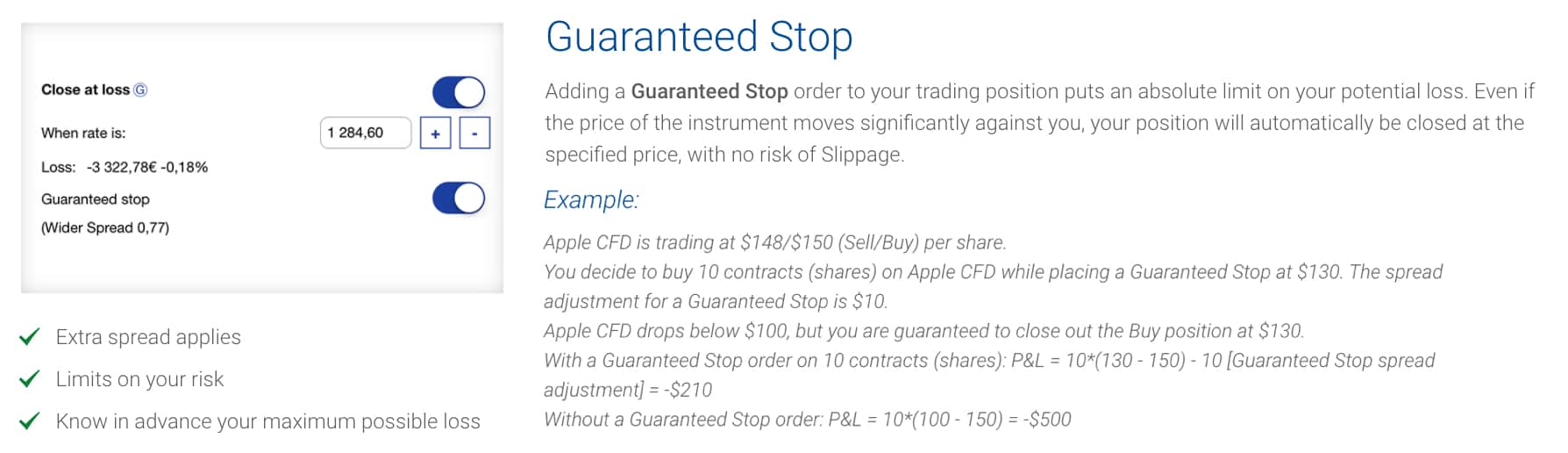

Risk Management Tools: Order Types

On top of basic order types such as stop limits, stop losses and trailing stop losses, Plus500 allows customers to place guaranteed stop-loss orders (GSLOs) for a fee. When using a free stop-loss order, traders can protect profits by specifying a price to automatically close a position. As a risk of basic stop-loss orders is the trade not being closed at the price set by the customer, the premium paid for the order guarantees trades will be closed at the specified price, regardless of gapping.

Negative Balance Protection And Margin Calls

Similarly to ThinkMarkets, the Plus500 provides negative balance protection (NBP) and enforces margin calls to ensure retail clients do not end up with negative trading account balances when markets are volatile. If a trader does not meet a margin call within the required time period, all positions will be closed at the current market price. When trading forex with Plus500 an initial margin between 33-50% is required.

Similarly to ThinkMarkets, the Plus500 provides negative balance protection (NBP) and enforces margin calls to ensure retail clients do not end up with negative trading account balances when markets are volatile. If a trader does not meet a margin call within the required time period, all positions will be closed at the current market price. When trading forex with Plus500 an initial margin between 33-50% is required.

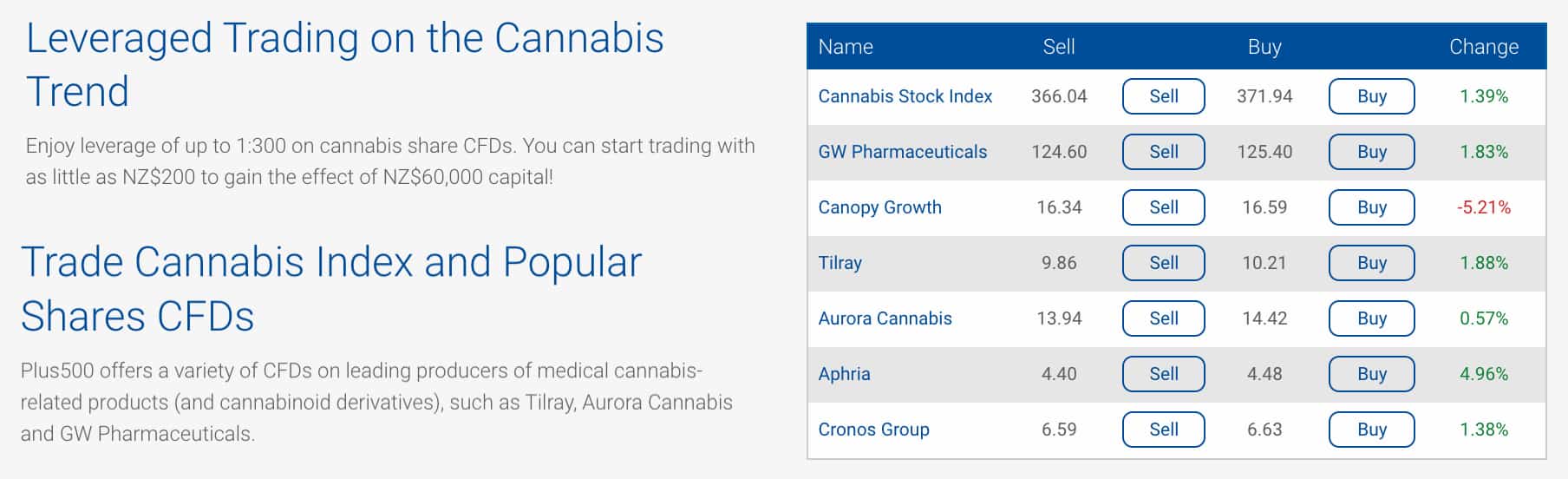

CFD Trading Product Range

Plus500 offers a vast range of CFDs to trade derived from seven asset classes. With over 2,000 financial instruments in total, customers can easily develop trading strategies using the following CFDs:

- 70+ Forex pairs

- 1,800 Shares

- 30 Stock indices

- 98 Exchange-Traded Funds (ETFs)

- 22 Commodities

- 15 Cryptocurrencies

- 308+ Options

As well as commonly traded CFDs, Plus500 offers market access to emerging industries such as Cannabis in addition to share markets throughout 23 countries.

To start trading with Plus500, prospective retail clients can sign up for a demo account with no time limits or restrictions on virtual funds. To access Plus500’s wide product offering traders are limited to the CFD provider’s proprietary trading platform, available as a desktop, WebTrader, Android, Windows or iOS trading app.

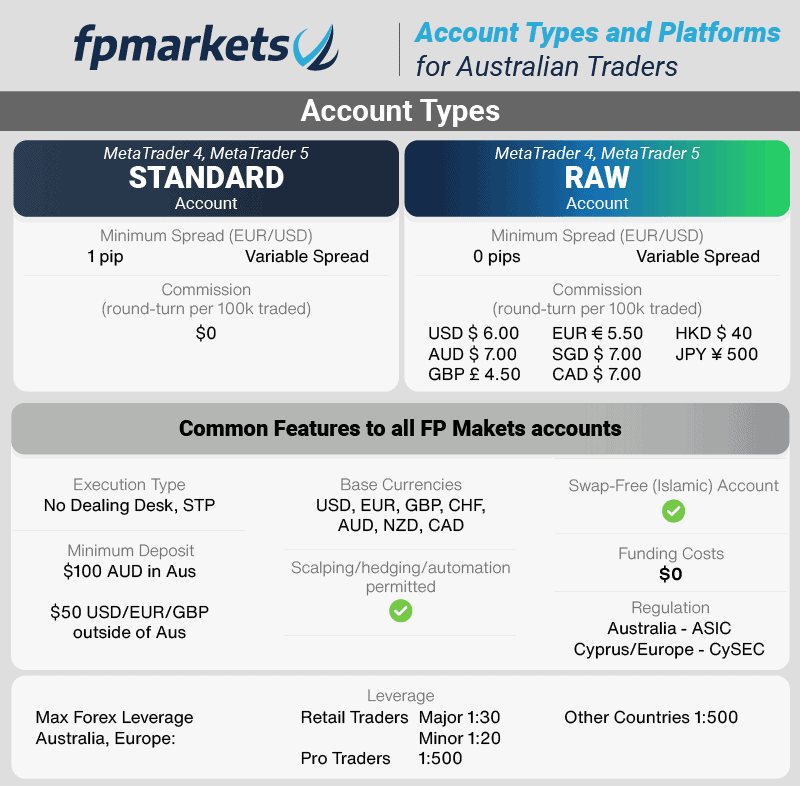

5. FP Markets - Good Option for Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.2 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

FP Markets is recommended for scalping because of its tight RAW spread, averaging 0.1 pips on the EUR/USD currency pair and an overall major pair average spread of 0.22 pips based on our summation. These offerings provide scalpers with lower fees and smaller entry and exit points, translating to larger profits on every trade. Another unique feature of FP Markets is zero-cost VPS, which provides optimal trading platform performance.

Pros & Cons

- Tighter spread

- Zero-cost VPS service

- Fast order execution

- Basic educational content

Broker Details

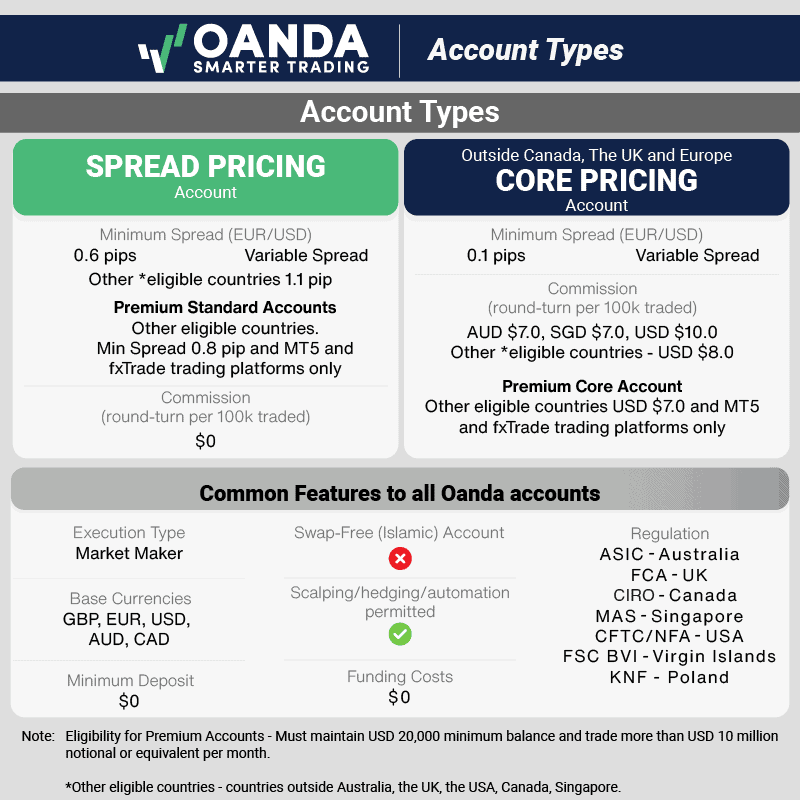

6. OANDA - Good Option for Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.4 GBP/USD = 2 AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA’s extremely tight standards spread illustrates why we recommend them for most beginner traders. With an average of 0.6 pips for EUR/USD, OANDA offers the lowest spreads compared to the industry average spread of 1.24 pips provided by other brokers.

Other features we like include zero minimum deposit to create an account, exceptional customer support, and incredible educational resources.

Pros & Cons

- Tight spread

- Great educational resources

- Zero minimum deposit

- No MT5

- Average proprietary software

Broker Details

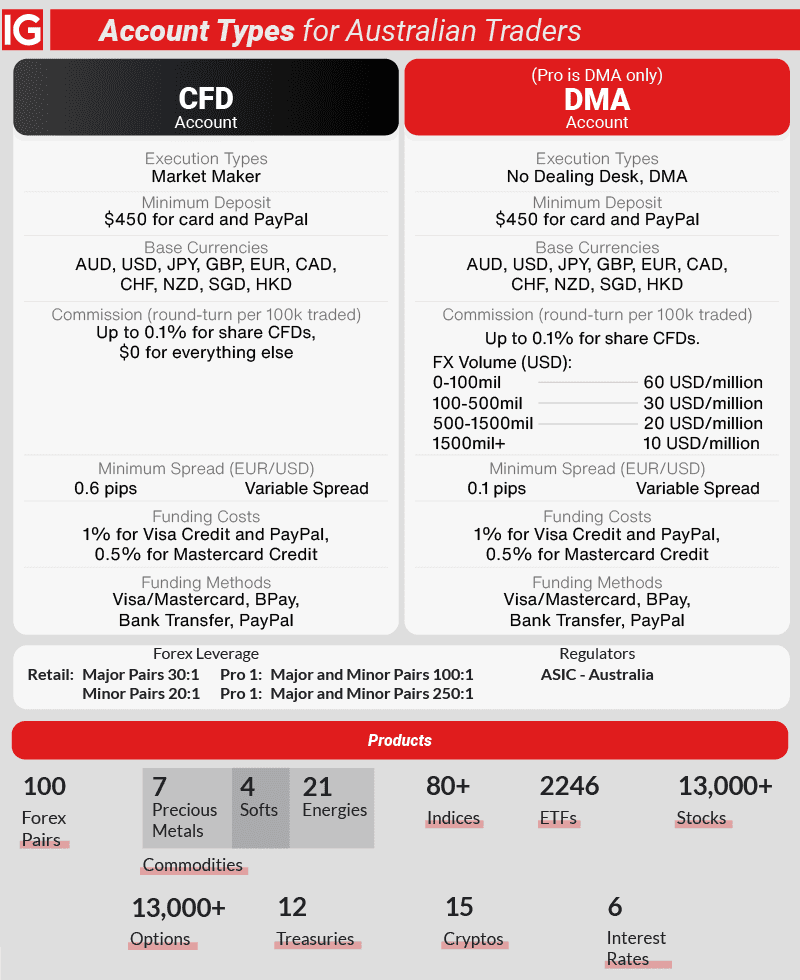

7. IG Trading - No MT5 Average proprietary software

Forex Panel Score

Average Spread

EUR/USD = 1.13 GBP/USD = 1.66 AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Trading

IG arrays of trading products “10/10 in the market range category” have substantiated the reason for its recommendation. IG offers a tight RAW spread of 0.1 pips for EUR/USD currency pairs, indicating a 0.32 significant pair average spread. IG VPS service ensures traders can trade their extensive range of products on its MetaTrader 4 trading platform without glitches.

Pros & Cons

- Tight Standard spreads

- Offers VPS service

- Extensive range of trading product

- High minimum deposit

- MT5 is not available

Broker Details

8. easyMarkets - No Slippage Guarantee

Forex Panel Score

Average Spread

EUR/USD = 0.8

GBP/USD = 1.4

AUD/USD = 1.5

Trading Platforms

MT4, MT5, TradingView, easyMarkets Trading

Minimum Deposit

$200

Why We Recommend easyMarkets

easyMarkets offers extensive base currencies and tight fixed spread, averaging 0.8 pips for EUR/USD currency pairs on its easy Markets and MT4 platform. All orders include a guaranteed stop loss, this plus fixed spreads means easyMarkets can guarantee no slippage. This is the basis upon which we recommend easyMarkets as the best broker on our list.

Pros & Cons

- Tighter fixed spread

- Extensive base currencies

- Zero slippage

- 24/5 customer support

- High minimum deposit

Broker Details

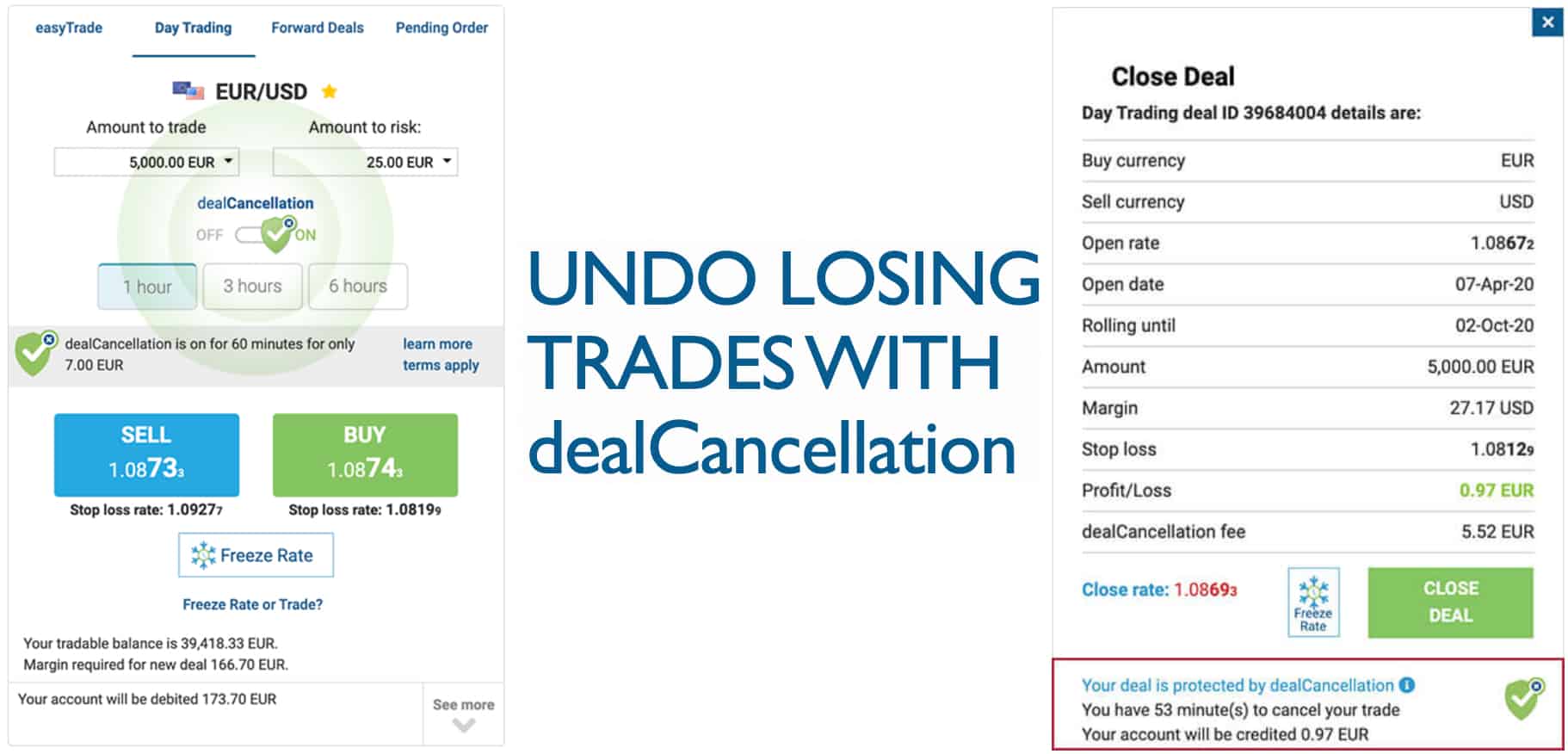

The Best Forex Broker With Risk Management Tools

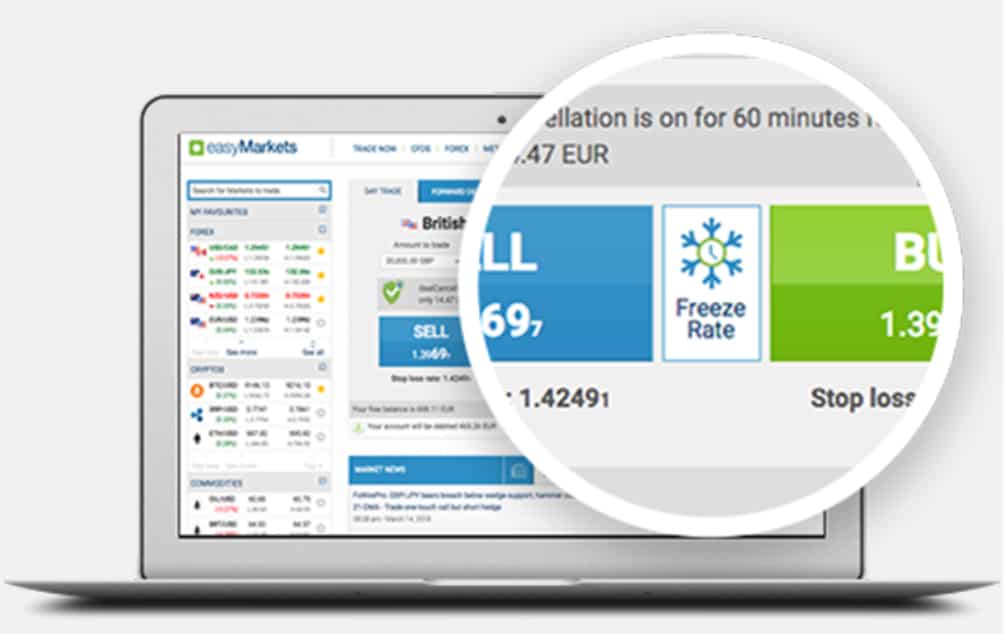

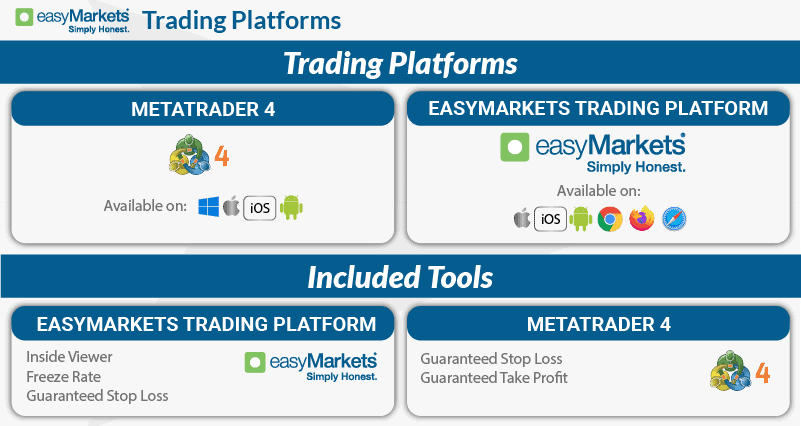

Compared to other brokers, easyMarkets offers a wealth of risk management tools. On top of negative balance protection, the ASIC regulated broker offers free guaranteed stop-loss orders, dealCancellation and Freeze Rates through their proprietary web trading platform and mobile trading apps and MetaTrader 4 (MT4).

- Guaranteed Stop Loss Orders: MT4 and the easyMarkets proprietary trading platform

- dealCancellation: easyMarkets platform

- Freeze Rates: easyMarkets platform only

Spreads

easyMarkets fixed spreads can be wider than other top forex brokers. For instance, Pepperstone offers standard account holders average spreads of 1.0 pip on the EUR/USD forex pair, and Razor account holders 0.0 pips. easyMarkets on the other hand offer minimum spreads starting from 1.2 pips on their proprietary platform and 0.9 pips when using MT4.

Free Guaranteed Stop-Loss Orders (GSLOs)

When trading with easyMarkets it is free to place a Guaranteed Stop Loss Order (GSLO). Many competing brokers such as Plus500 offer these GSLO order types but charge significant fees. The risk management feature ensures orders are executed at the exact price set by the trader with no chance of slippage.

When trading with easyMarkets it is free to place a Guaranteed Stop Loss Order (GSLO). Many competing brokers such as Plus500 offer these GSLO order types but charge significant fees. The risk management feature ensures orders are executed at the exact price set by the trader with no chance of slippage.

dealCancellation

dealCancellation is a unique risk management tool offered by easyMarkets allowing traders to cancel orders after they have been executed. For a small fee, customers can reverse trades within a one, three or six-hour window, significantly reducing the high risk of forex trading. The premium feature allows clients to take advantage of volatile markets, as the order can be cancelled within the time limit chosen.

Fees are based on recent market volatility and whether you have chosen a 1, 3 or 6 expiration period. Please note, you are not able to add dealCancellation to open trades, you must select the feature when first placing an order. dealCancellation is only available on day trading products such as oil, silver, gold and forex pairs.

Freeze Rate

As well as cancelling orders, easyMarkets offers a Freeze Rate feature to customers. As CFD and forex markets are highly volatile, the Freeze Rate tool allows you to lock in the current market price you see, while providing a few seconds to press buy or sell.

As well as cancelling orders, easyMarkets offers a Freeze Rate feature to customers. As CFD and forex markets are highly volatile, the Freeze Rate tool allows you to lock in the current market price you see, while providing a few seconds to press buy or sell.

Education

To learn about different risk management techniques, trading strategies and technical analysis, traders can utilise easyMarkets range of educational tools. Whether you are just learning how to trade forex and wanting to figure out how CFDs work or requiring advanced resources, there are plenty of resources freely available on the broker’s website, including webinars, a glossary and articles on how to start trading as well as outlining technical and fundamental analysis techniques.

Trading Platforms

Opening a forex trading account with easyMarkets provides you access to their proprietary trading platform as well as MetaTrader 4 (MT4). While the easyMarkets platform offers extensive risk management tools explained above, MT4 allows users to perform sophisticated technical analysis plus develop automated trading strategies using Expert Advisors. Another key difference between the two platforms is market access. MT4 offers forex pairs, commodities, indices, metals and cryptocurrency trading, while those using the proprietary platform can also trade options.

Both the easyMarkets and MT4 platforms are offered as a web trader, mobile or tablet app, with a PC desktop option also available with MT4.

Ask an Expert

Don’t all brokers in Australia have to offer negative balance protection with the new ASIC policies?

In March 2020, ASIC who are the Australian financial regulator issued a product intervention order requiring all brokers to have negative balance protection for their retail clients. This follows policies set in UK and Europe by ESMA which required regulators such as FCA, CySEC and BaFIN must ensure the brokers they regulate to offer negative balance protection. The exception to this rule is for Elective Professional Traders. These trader can trader with higher leverage but may lose negative balance protection but you need to check with the broker as some will still have it.