Interactive Brokers Review Of 2026

Interactive Brokers is a comprehensive broker suitable for traders who want more than just forex trading, with stockbroking, mutual funds, and a hedge fund marketplace. IBKR is a great option for investors seeking low fees across various products.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Interactive Brokers Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA, MAS, CIRO, NFA, CFTC |

| 🗺️ Tier 2 Regulation | CBI, SFC, JFSA |

| 🗺️ Tier 3 Regulation | SEBI |

| 💰 Trading Fees | Variable Spread with no commission |

| 📊 Trading Platforms | Desktop TWS, Mobile, Client Portal, WebTrader |

| 💰 Minimum Deposit | $0 |

| 🛍️ Instruments | Stocks, Futures, Options Trading, Currency, Metals, ETFs |

| 💳 Credit Card Deposit | Yes |

Our Verdict on Interactive Brokers

While we don’t think Interactive Brokers (IB) is the best choice for trading Forex CFDs, they do have a compelling range of investment products like shares, options and futures. What really makes IB stand out are its in-house developed trading platforms, especially Trader Workstation, which has some of the most advanced features for experienced traders to take advantage of.

Interactive Brokers Pros and Cons

- Largest range of financial products including CFDs and stockbroking

- Most regulation in most key locations across the world

- $0 Minimum Deposit requirement

- Relatively low leverage that varies based on the CFDs traded

- Not user-friendly

- Lackluster customer service

Open A Demo AccountOpen Live Account

The overall rating is based on review by our experts

Fees

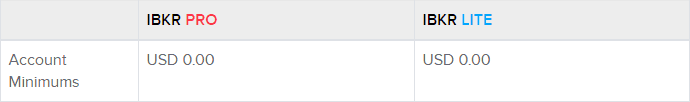

Interactive Brokers offers two pricing options with their Standard Accounts: a commission-free IBKR Lite account and fixed/tiered pricing with IBKR Pro.

- IBKR Lite is suitable for both retail investors and financial advisors who trade on behalf of their clients

- IBKR Pro is designed for more experienced traders and features the lowest margin rates and premier trading tools (IBot, SmartRouting, robo-advisor, traders’ insight, etc.)

Spreads

We rated IBKR’s spreads as an ‘ECN broker’ as they quote prices based on the sixteen largest exchange dealers. This results in over 60% market share of the interbank market, leading to EUR/USD spreads as low as 0.1 pips. To clarify, spreads are not marked up, and the foreign exchange broker makes money from commissions.

While the online broker doesn’t publish their average spreads (for comparison to other brokers), you can see their real-time quotes on their website that are set by the market.

Commissions

IBKR Lite offers commission-free trading for stocks and ETFs listed in the US exchanges. IBKR Lite accounts are subject to fixed pricing for non-exchange-listed US stocks, ETFs, warrants, and other non-qualifying products.

Below, we show the commissions for US markets.

| Monthly Volume (shares) | IBKR Pro - Tiered | IBKR Pro - Fixed | IBKR Lite |

|---|---|---|---|

| ≤ 300,000 | USD 0.0035 | USD 0.005 | USD 0.002 |

| 300,001 - 3,000,000 | USD 0.0020 | ||

| 3,000,001 - 20,000,000 | USD 0.0015 | ||

| 20,000,001 - 100,000,000 | USD 0.0010 | ||

| > 100,000,000 | USD 0.0005 |

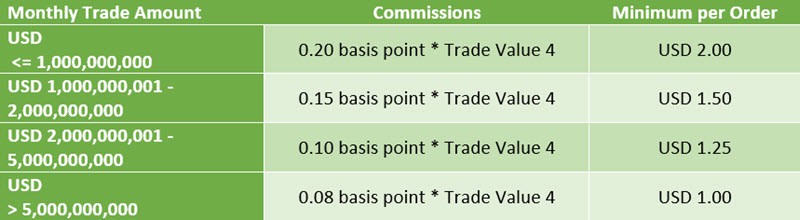

IBKR offers low commissions that decrease with higher trading volume, providing excellent value for frequent traders. The table below shows how a high-volume forex trader can achieve a low commission multiple of just 0.08 basis points.

Low Commission Example

Low Commission Example

To provide an example scenario of the highest traded tier (USD >$5b), if $1,000,000 units of EUR/USD were traded, the total calculation would be $1,000,000 EUR * 0.00001 = $10 EUR. This Euro amount would then be converted to USD at the real-time value set by IBKR. At lighter monthly trading volumes, a broker like Pepperstone or IC Markets may have lower commissions, but for active traders, IBKR has low costs.

Verdict on Interactive Brokers Spreads

Since IBKR offers ECN broker spreads (market-based spreads) and the lowest commissions for high-volume traders, experienced traders are more suitable for their accounts.

Trading Platforms

| Trading Plaform | Available With Interactive Brokers |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

As one of the largest forex brokers in the world, IBKR has created its own forex trading platform, the IBKR Global Trader. Trader Workstation is available as well.

IBKR Global Trader

The biggest advantage of the IBKR trading platform is you can trade more than just forex and CFDs. This means you don’t need a separate platform to trade futures or bonds. Features include:

- A clear price display (currency pairs have their own cell with market/order data).

- Price data with the best available bid and ask prices is displayed.

- The ability to insert any forex quote to cross-trade with Globex forex futures.

- Review functionality prior to making trades or one-click fast trading.

- The ability to make 20+ trades from trailing stop limits to one cancels all.

- Functionality to show average cost, positions and even profile & loss data.

- Extensively customisable charting from trading cell displays, layout to colour schemes used.

- Watchlist that can be synchronised across all your trading platforms.

- TWS API for automated trading strategies.

Trader Workstation

Desktop TWS is designed for active traders with the most advanced forex trading tools and algos. The Trader Workstation (TWS) includes news, risk analysis tools and technical analysis. Trading can occur across all markets using the TWS trading platform.

Client Portal and WebTrader offer non-download versions of the trading platform that have reduced functionality but still have the ability to trade and monitor existing trades.

Mobile Trading Apps

IBKR Mobile is available on Android mobile devices and iPhone/iPad devices to monitor and make foreign exchange trades while on the go.

The table below shows the range of markets, including Stocks, Options, Futures and Bonds available per medium.

| Client Portal/Web | Mobile Apps | Desktop TWS | |

|---|---|---|---|

| Stocks | ✓ | ✓ | ✓ |

| Options | ✓ | ✓ | ✓ |

| Futures | ✓ | ✓ | ✓ |

| Forex | ✓ | ✓ | ✓ |

| CFDs | ✓ | ✓ | ✓ |

| Warrants | ✓ | ✓ | ✓ |

| Bonds | ✓ | ✓ | ✓ |

| Combinations | ✘ | ✓ | ✓ |

| Inter-Commodity Spreads | ✘ | ✘ | ✓ |

Trade Experience

Interactive Brokers has recently joined forces with Blue Ocean, a leading financial data provider, to offer real-time streaming quotes during both regular and extended US trading hours. IBKR Overnight allows Interactive Brokers clients to trade over 10,000 US stocks and ETFs between 8 PM and 3:50 AM ET, Sunday through Friday.

When it comes to trading US stocks, eligible clients can place limit orders on TWS, Client Portal, and Mobile TWS. However, to enable overnight trading, they must access the Client Portal and make the necessary adjustments to their trading permissions.

Verdict on Interactive Brokers Trading Platforms

If you want to trade shares, CFDs and foreign exchange without switching platforms while having powerful features, IBKR is right for you. The only disadvantage of the IBKR platform is that existing forex traders will need to learn the unique platform.

Is Interactive Brokers Safe?

Yes, Interactive Brokers is a safe broker with a trust score of 10 out of 10.

1. Regulation

IBKR is regulated by six tier-1 financial authorities, three tier-2 regulators, and one tier-3 regulator.

| Interactive Brokers Safety | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission FCA (United Kingdom) - Financial Conduct Authority MAS (Singapore) - Monetary Authority of Singapore CIRO (Canada) - Canadian Investment Regulatory Organization NFA (USA) - National Futures Association CFTC (USA) - Commodities Future Trading Commission |

| Tier-2 | CBI (Ireland) - Central Bank of Ireland SFC (Hong Kong) - Securities Futures Commission JFSA (Japan) - Japanese Financial Services Authority |

| Tier-3 | SEBI (India) - Securities and Exchange Board of India |

Headquartered in Greenwich, Connecticut, IB is a financial technology company listed on the NASDAQ, ticker symbol IBKR. Interactive Brokers holds licences from regulators in the UK, Singapore, USA, Canada, Australia, India, Japan, Hong Kong, Europe, Ireland, and Central Europe.

2. Reputation

Interactive Brokers was founded in Connecticut, USA, in 1978. That’s almost 50 years of presence in the industry.

With those years on their backs, the broker receives approximately 673,000 Google searches each month, ranking it as the 5th most popular forex broker globally, with over 1.89m trades daily and 2.09m client accounts.

According to Similarweb data from February 2024, it was the 8th most visited broker, with 7,340,000 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| United States | 110,000 |

| Spain | 40,500 |

| Canada | 33,100 |

| France | 27,100 |

| United Kingdom | 27,100 |

| Germany | 22,200 |

| Hong Kong | 18,100 |

| Italy | 18,100 |

| Mexico | 18,100 |

| India | 14,800 |

| Australia | 14,800 |

| Brazil | 14,800 |

| Colombia | 14,800 |

| Switzerland | 14,800 |

| Singapore | 12,100 |

| Netherlands | 9,900 |

| Poland | 9,900 |

| Peru | 9,900 |

| United Arab Emirates | 8,100 |

| Argentina | 8,100 |

| Portugal | 8,100 |

| Greece | 6,600 |

| Bolivia | 6,600 |

| Venezuela | 5,400 |

| Ecuador | 5,400 |

| Japan | 4,400 |

| Turkey | 4,400 |

| Malaysia | 4,400 |

| Indonesia | 4,400 |

| Chile | 4,400 |

| Panama | 4,400 |

| South Africa | 3,600 |

| Taiwan | 3,600 |

| Thailand | 3,600 |

| Saudi Arabia | 3,600 |

| Austria | 3,600 |

| Ireland | 3,600 |

| Costa Rica | 3,600 |

| Pakistan | 2,900 |

| Philippines | 2,900 |

| Dominican Republic | 2,400 |

| Uzbekistan | 2,400 |

| New Zealand | 2,400 |

| Uruguay | 2400 |

| Egypt | 1,900 |

| Morocco | 1,900 |

| Cyprus | 1,900 |

| Sweden | 1,900 |

| Vietnam | 1,600 |

| Kenya | 1,600 |

| Cambodia | 1,000 |

| Algeria | 880 |

| Nigeria | 880 |

| Mongolia | 880 |

| Bangladesh | 720 |

| Mauritius | 720 |

| Jordan | 590 |

| Sri Lanka | 590 |

| Ghana | 480 |

| Uganda | 390 |

| Tanzania | 210 |

| Ethiopia | 210 |

| Botswana | 140 |

110,000 1st | |

40,500 2nd | |

33,100 3rd | |

27,100 4th | |

27,100 5th | |

22,200 6th | |

18,100 7th | |

18,100 8th | |

18,100 9th | |

14,800 10th |

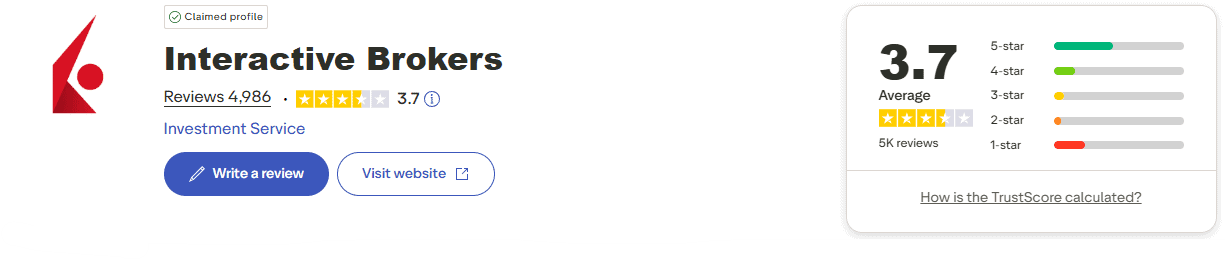

3. Reviews

IB has a TrustPilot score of 3.7/5 from 4,986 reviews, which can still be considered a high score given the volume of trades they do each day.

Verdict on Interactive Brokers’ Trustworthiness

Interactive Brokers has positioned itself as a reliable broker with their high trust score, regulation from several tier-1 authorities, and years of experience in the industry.

Deposit And Withdrawal

Interactive Brokers does not charge annual, account, transfer or closing fees, which is a rare feature among brokers.

What is the minimum deposit at Interactive Brokers?

Interactive Brokers has no minimum deposit requirements across both trading accounts.

Account Base Currencies

Base currencies are available in HKD, EUR, SEK, MXN, HUF, CHF, CZK, NOK, DKK, CAD, AUD, JPY, GBP, NZD, SGD, and USD.

Deposit Options And Fees

IBKR offers various funding options depending on your region. In general, here are the types of deposits available:

- Bank wire

- Check

- Online bill payment

- Canadian bill payment

- Trustee-to-Trustee (IRA)

- Direct Rollover (IRA)

- Automated Clearing House (ACH) transfer initiated at your bank

- ACH transfer initiated by IBKR

- Canadian EFT transfer prompted by IBKR

Withdrawal Options And Fees

IBKR facilitates the following types of withdrawal requests:

- Bank wire

- Check

- Canadian EFT transfer

- Single Euro Payments Area (SEPA) initiated at IB

- Automated Clearing House (ACH) transfer initiated at IB

Ease To Open An Account

Opening an account with IB seemed a little complicated and it took some time to verify our account. It’s not the most user-friendly among all the other trading apps we’ve tried, yet the GlobalTrader app offers a better experience. The upside is there is no minimum deposit required.

Verdict on Interactive Brokers Funding

IB provides several funding options, with no minimum deposit and charges, which makes this broker a winner in our book.

Product Range

Interactive Brokers offers over 48,000 mutual funds, with nearly 19,000 available with no transaction fees, making it the broker with the largest selection of asset classes.

CFDs

- FX Trading is available across 24 currencies from USD, EUR, and AUD to JPY, on over 100 trading pairs.

- Stockbroking services across 135 markets with unique order types and trading tools. Gain access to the largest stock exchanges worldwide (NASDAQ, NYSE, LSE, etc.)

- Options trading with a fixed flat rate or tiered active trader model for high-volume rebates

- Futures trading across 30 financial markets with the ability to hedge positions

- IB Spot Gold/Silver trading for pairs such as XAU/USD (not available for residents in Australia, Canada, Hong Kong, Japan or the U.S.)

- ETFs (Exchange-Traded Funds) across both bond and equity indices on 28 exchanges across 14 countries

Verdict on Interactive Brokers Trading Products

IBKR is the ideal choice for active traders and professionals who want to trade multiple markets worldwide with a single interface.

Customer Service

Interactive Brokers customer support is available 24/5 via live chat, email, and messenger. Customers can find answers throughout the website and trading platforms with IBot, which operates by responding in plain English.

IBKR Customer service includes the following:

- Online chat with a human agent

- Secure messaging

- Toll-free phone support

In addition, you can find their FAQ page to be valuable as it contains several topics and issues that most traders encounter.

Verdict on Interactive Brokers Customer Support

IBKR’s IBot feature proved helpful in answering concerns and chat correspondence was fast. Overall, this broker’s customer service is top-notch.

Research and Education

Interactive Brokers (IBKR) offers a diverse range of investor education programs and research tool that cater to both its customers and the general public.

Tutorials

The brief videos are perfect for learning about TWS and the Client Portal in small, easily digestible pieces. The platform offers multi-language tutorials to assist international investors in understanding how to use it effectively.

Traders Academy

Traders Academy is an online resource designed for financial professionals, investors, educators, and students who want to learn about asset classes, markets, currencies, and functionality available on IBKR’s trading platforms. It offers a structured and rigorous curriculum, available on demand. Their courses cover asset classes such as options, futures, forex, international trading, and bonds, as well as margin use.

Webinars

IBKR provides daily webinars in collaboration with industry experts. These events cover a variety of topics, including how-to guides for platforms and tools, educational resources for options trading, and international product trading.

Research

Fundamentals Explorer

Fundamentals Explorer is a service that offers extensive and global fundamental data to all IBKR clients, completely free of charge. Explore hundreds of data points, including historical trends, industry comparisons, key ratios, forecasts, ratings, and ownership. Get trade ideas, evaluate your portfolio and gauge short sentiment using daily short sale data on thousands of global securities.

Fundamental Analytics on Interactive Brokers

Fundamental Analytics is an interactive website where commodity traders can research price behaviour and the essential data that affect prices. Subscribers can easily analyse price data and related supply/demand information with graphs and tables.

Final Verdict on Interactive Brokers

Interactive Brokers has garnered a rating of 88/100 in our review. Although they performed well in most areas, their unique trading platform was a drawback.

With regulation across the globe, Interactive Brokers can offer most individuals the trading solution to meet their needs overall. Even beginner traders can learn about trading through Interactive Brokers Traders’ Academy, which provides webinars and educational videos on a range of topics, including trading concepts, IBKR’s financial offerings, platform tutorials, and so much more.

Interactive Brokers FAQs

Can I trade forex with Interactive Brokers?

Yes, Interactive Brokers clients can trade forex on the spot market or via CFDs (Contract for Difference). IBKR offers 105 currency pairs with extremely margin rate and low spreads.

Is Interactive Brokers safe?

Yes, Interactive Brokers is considered to be a safe multi-asset brokerage trading firm. The broker complies with the requirements imposed by the world’s biggest financial regulator, the US Securities and Exchange Commission (SEC).

What Demo Account Does Interactive Brokers Offer?

IBKR demo account gives you access to the IBKR Mobile platform and Trader Workstation (TWS). Market conditions, including commissions and fees, determine prices and account values without any risk.

Converting your free trial to a live IBKR account is an easy process. After approval and funding, your custom account settings will be transferred to your live account.

What Leverage Does Interactive Brokers Offer?

Interactive Brokers provides forex trading leverage at lower market rates. Leverage is also determined by the regulations that apply to an individual, with a maximum leverage of 30:1 for forex in the UK (FCA’s maximum leverage for retail traders).

Is Interactive Brokers good for beginners?

No, Interactive Brokers is not recommended for beginner traders. Our careful view toward leverage and our industry-low CFD loss ratio might be better-suited to new traders. TWS Trader Workstation requires a steep learning curve, and the platform interface is difficult to navigate. For beginner traders, we recommend Pepperstone or IC Markets, which are better suited to accommodate the needs of the inexperienced traders.

Justin Grossbard

Having traded since 1998, Justin is the CEO & Co-Founder of CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Go to Interactive Brokers Website

Visit Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

How much leverage can I get in the us and what is the minimal account balance to get it?

Margin Trading For US clients when trading forex is not available for retail traders. Leveraged products available for US clients with IB include Stocks, Options, Futures, Fixed Income and Mutual Funds.