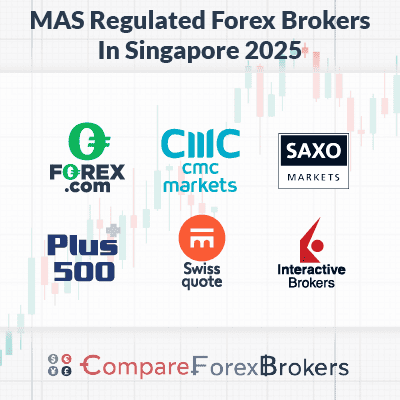

Compare Forex Brokers Regulated By MAS

Top forex brokers are MAS regulated (Monetary Authority of Singapore). We review the best MAS regulated forex brokers based on trading platforms, CFDs, minimum deposits and fees, trading accounts, spreads and demo accounts.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

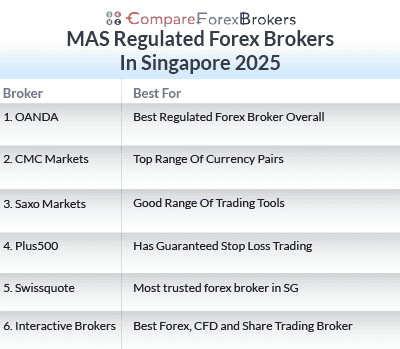

These are our top brokers for traders in Singapore are:

- OANDA - Best Regulated Forex Broker Overall

- CMC Markets - Top Range Of Currency Pairs

- Saxo Markets - Good Range Of Trading Tools

- Plus500 - Has Guaranteed Stop Loss Trading

- Swissquote - Most trusted forex broker in SG

- Interactive Brokers - Best Forex, CFD and Share Trading Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

91 |

MAS, CIRO, ASIC FCA, NFA/CFTC |

- | 0.2 | 0.2 | - | 0.92 | 0.9 | 1.1 |

|

|

|

- | $0 | 68 | 4 |

|

||

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

29 |

FCA, FINMA MAS, DFSA, MFSA |

1.7 | 1.6 | 1.7 | 2 | 1.7 | 2 | 1.6 |

|

|

|

170ms | $1000 | 80 | - | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

Monetary Authority of Singapore Guidelines

MAS regulation is considered the gold standard not just in Singapore but throughout the Asian/Pacific region. For over 40 years (founded in 1971) the regulator is both the financial regulatory body and the Central Bank of Singapore. We strongly recommend that Singaporean traders select a MAS broker to ensure it has a strong reputation and to ensure protections exist set by the regulatory body.

Below is a list of the brokers, their standard account spread and their licence number.

| Broker | Mas Licence Number | EUR/USD Standard Spread |

|---|---|---|

| OANDA | 200704926K | 0.6 |

| CMC Markets Singapore Pte. Ltd. | 200605050E | 1.12 |

| Saxo Capital Markets Pte. Ltd. | 200601141M | 1.2 |

| PLUS500SG PTE. LTD. | 201422211Z | 1.7 |

| Swissquote Pte. Ltd. | 201906194G | 1.7 |

| INTERACTIVE BROKERS SINGAPORE PTE. LTD. | CMS101000 | N/A |

Who Are The Top Forex Brokers That Are MAS Regulated?

The best Monetary Authority of Singapore-regulated brokers depend on the type of trader you are. Based on this we have broken down the list for each segment.

1. OANDA - THE BEST BROKER WITH MAS REGULATION

Forex Panel Score

Average Spread

EUR/USD = 1.4

GBP/USD = 2

AUD/USD = 1.4

Trading Platforms

MT4, TradingView, OANDA Trade (FxTrade)

Minimum Deposit

$0

Why We Recommend OANDA

OANDA is our choice for the best regulated forex broker overall in Singapore. Regulated in 9 different jurisdictions, including tier-1 regulations in Australia (by ASIC) and the UK (the FCA), OANDA earned a high trust score of 8/10 from the CompareForexBrokers team.

We also recommend OANDA for its low forex spreads, having the lowest average spreads for the top 5 traded currency pairs at 0.70 pips compared to the industry average of 1.52 pips for its Standard account.

Pros & Cons

- Top proprietary forex platform

- Great range of 70 forex pairs

- Social trading with TradingView

- No shares CFDs available

- Limited learning resources

- MetaTrader 5 not available

Broker Details

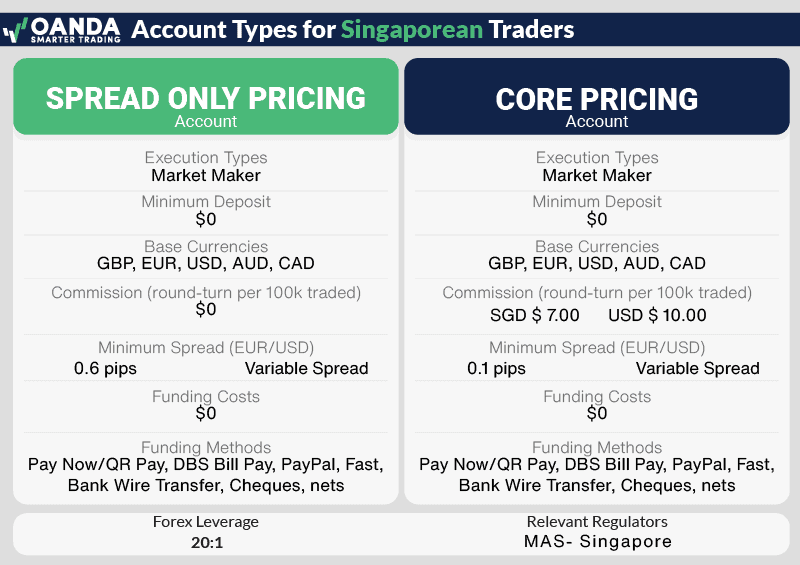

OANDA is a multi-regulated market maker broker that offers Singaporean traders commission-free trading on a range of contracts for difference (CFDs). We think OANDA is the best MAS-regulated broker due to its low spreads, user-friendly trading platform and highly trusted nature.

Solid Proprietary Platform

OANDA offers three trading platform options, a proprietary platform, the popular forex trading platform, MetaTrader 4 (MT4) and the powerful charting platform, TradingView. While we think all platforms are solid choices, we highly recommend OANDA Trade, which is easy to use and well-suited to beginner traders.

While you can obtain 80 technical indicators via TradingView through the web and desktop versions of OANDA Trade, what we particularly appreciate is the mobile app. Not only is the overall layout to be straightforward and easy to use, the app features research from Autochartist and news headlines to help make informed trading decisions.

The highlight for us, however, was the ability to quickly enter our orders from the chart, then adjust their stop-loss and limit order levels with a simple drag and drop function. This meant we could manage our risk seamlessly without worrying about the market getting away from us in volatile conditions.

Lowest Commission-Free Spreads

OANDA offers one trading account type with no choice of pricing structures available. As the broker is a market maker, all CFD trading is commission-free, with OANDA’s compensation for their brokerage services built into the spread.

From our published spreads analysis, OANDA offers the lowest commission-free spreads we’ve see, averaging 0.70 pips for the 5 most traded currency pairs, which includes EUR/USD. Of the 40 other forex trading financial institutions we analysed, this puts OANDA on top of our list.

An important disclaimer we’d like to note is that OANDA operates as a market maker, and does not offer an ECN account (which generally provide lower spreads but charge commissions to compensate).

Avg. spreads are taken from each broker's website and updated monthly. Last update on 06/01/2025

Highly Trusted Broker

With a longstanding reputation dating back to 1996 and regulated in 9 jurisdictions, including 7 tier-1 regulators, OANDA is a highly trusted broker, which is why we scored it a perfect 100 for trust.

Trust is important to us to ensure protection of our funds and peace of mind, as trading is a high risk venture, with lots of less than reputable online brokers out there.

2. CMC Markets - THE LARGEST RANGE OF CFD TRADING PRODUCTS

Forex Panel Score

Average Spread

EUR/USD = 0.5

GBP/USD = 0.9

AUD/USD = 0.6

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets has the top range of currency pairs, offering over 300 tradeable markets. We like CMC Markets so much because the broker quotes its 150 odd currency pairs both ways, meaning you can trade both EUR/USD and the inverse USD/EUR. No other broker that we know offers inverse quotes.

You can trade these forex pairs on one of our favourite trading platforms, CMC Markets’ own Next Generation platform.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Broker Details

Established in 1989, CMC Markets is a public company listed on the London Stock Exchange (LSE). CMC operates all over the globe, with regulated subsidiaries in Singapore, New Zealand, Australia, Germany, the UK, and Canada.

Where CMC Markets stands out is by offering the largest ranges of forex and CFD trading products in the market we’ve seen. We were also impressed by the broker’s low commission-free spreads and impressive Next Generation platform.

Over 12,000 CFDs Available

From our observations, CMC Markets offers the largest selections of CFDs we’ve seen, with a huge range of over 10,000 financial instruments. This includes a whopping 330 currency pairs, which no other broker offers from our analysis.

We discovered the reason CMC Markets can offer 330 currency pairs is because you can trade both the EUR/USD and the inverse of USD/EUR, for example.

Excellent Next Generation Platform

CMC Markets clients’ can place orders via MetaTrader 4 (MT4) or the forex broker’s proprietary platform, Next Generation.

From our observations, the Next Generation platform has numerous advantages over the broker’s MetaTrader 4 offering. For a start, you can stay up to date with market movements thanks to an economic calendar, insights and real-time news.

Along with the wider product range compared to MT4, we liked how highly customizable the platform was, with a layout wizard that lets you choose between floating or fixed windows (or keep the pre-defined ones).

You will also have access to advanced charting tools that includes 80 technical indicators, 40 drawing tools, and 60 easily attachable candlestick patterns.

Competitive No Commission Spreads

While CMC Markets is a market maker, it does offer STP execution through its FX Active account, which is commission-based.

It is the broker’s CFD account, however, that impressed us with some of the lowest spreads we’ve tested. The broker averaged spreads of 1.11 pips for the 6 USD-backed major currency pairs (E.g. EUR/USD, GBP/USD etc), which put it first on our list of Singapore-regulated brokers.

By comparison, the industry average for Standard accounts is 1.50 pips for the same currency pairs, from our testing.

| Standard Account Spreads | Top 5 Average Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|---|

| CMC Markets | 1.35 | 1.12 | 1.38 | 1.3 | 1.64 | 1.32 | 0.857 | 1.55 | 1.8 |

| IC Markets | 0.76 | 0.62 | 0.74 | 0.83 | 0.77 | 0.85 | 1.27 | 1.3 | 1.5 |

| Fusion Markets | 0.99 | 0.93 | 1.02 | 1.08 | 0.92 | 0.98 | 0.98 | 1.31 | 1.4 |

| Thinkmarkets | 1.22 | 1.1 | 1.4 | 1.3 | 1.1 | 1.2 | 1.1 | 1.2 | 1.2 |

| City Index | 1.24 | 0.7 | 0.6 | 1.1 | 2.2 | 1.6 | 1.1 | 1.6 | 2.2 |

| eToro | 1.3 | 1 | 1 | 2 | 1 | 1.5 | 1.5 | 2 | 2 |

| Pepperstone | 1.4 | 1.12 | 1.47 | 1.69 | 1.22 | 1.5 | 1.4 | 2.1 | 1.7 |

| Saxo Markets | 1.48 | 1.2 | 1.8 | 1.8 | 0.9 | 1.7 | 1.5 | 2.2 | 1.8 |

| OANDA | 1.68 | 1.4 | 1.4 | 2.0 | 1.4 | 2.2 | 1.7 | 1.8 | N/A |

| Plus500 | 1.86 | 1.7 | 1.9 | 2.3 | 1.4 | 2 | 1.7 | 2.4 | 3 |

3. Saxo Markets - GREAT BONUS TRADING TOOLS FOR CHARTING

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 0.7

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why We Recommend Saxo Markets

We like Saxo Markets’ range of trading tools, particularly through its excellent platform, SaxoTraderGo. The platform offers complex order types and account protection features, which we regard very highly to help manage risk.

One aspect of SaxoTraderGo we particularly enjoyed, is having a tab for each asset to easily access market information such as news headlines, videos and trading signals.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Broker Details

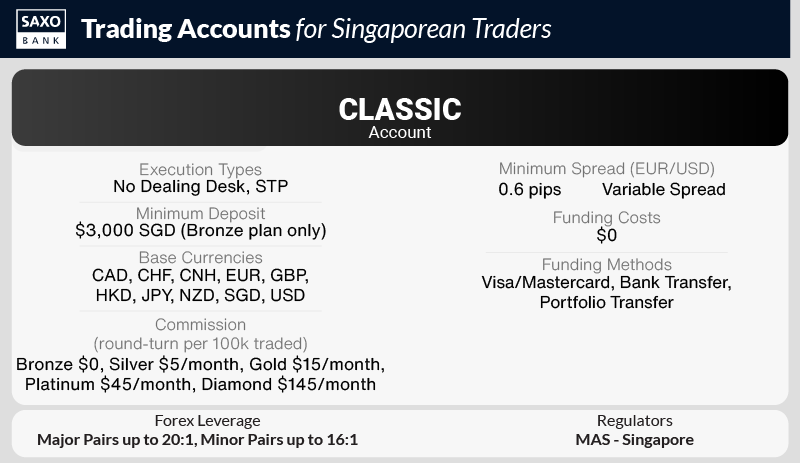

Saxo Markets is one of the most well-known top forex brokers due to its large market access and global reach. We particularly like the forex broker due to its varied selection of proprietary platforms, extensive range of products, and professional-grade trading tools.

Excellent Proprietary Platforms

Saxo Markets offers two trading platforms for clients to choose from, each suited to different levels of forex trading experience. SaxoTraderGO, the broker’s user-friendly, web trading platform is an excellent option for those new to trading foreign exchange. SaxoTraderPRO, on the other hand, is a professional-grade interface available as a desktop platform.

While both platforms are equally impressive, we gravitated towards SaxoTraderGO due to its combination of advanced trading tools and ease of use.

We particularly loved being able to seamlessly switch between forex CFDs, futures, forwards, or forex options using the trade ticket. Another feature we made good use of was the Quick Trade option, which allowed us to set price tolerance for slippage when we needed immediate fills.

Professional-Grade Charting Tools

Whether you use SaxoTraderGO or SaxoTraderPro, you will obtain professional-grade charting tools with either platform.

With SaxoTraderGO, you’ll have access to 62 indicators, 20 drawing tools, and 9 selectable chart types, which sync across devices.

We also found it incredibly easy to swap between instruments too, and there is a nice value-add in the product overview section, which shows related news and trade signals from Autochartist.

SaxoTraderPRO has the same features but adds support for up to six monitors and the ability to stream Level 2 order books.

Level 2 is essentially the order book for stocks that trade on major exchanges. This gives you detailed insight into the price action, giving better indication of what a particular market is doing and whether it is likely to rise, fall or remain flat.

Huge Range of CFDs

Saxo Markets provides an extensive range of over 9000 CFDs to trade, across a diverse range of asset classes. These asset classes include futures, options, bonds, crypto, CFDs, ETFs, stocks, indices and forex, which is a range very few brokers offer to Singaporean traders.

What’s more, we found a unique feature that Saxo Markets offer is its SaxoSelect system. With SaxoSelect, you can own an investment portfolio managed by world-renowned experts that is recommended to you based on your desired risk level.

With the combination of robot trading and portfolio management, this allows you to build confidence and save time while trading without the need to do any market research of your own.

4. Plus500 - TOP PLATFORM WITH RISK MANAGEMENT TOOLS

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$0

Why We Recommend Plus500

We’re big fans of any broker that offers good risk management tools and Plus500 is one of our favourites. The broker offers guaranteed stop-loss orders (GSLOs) to help minimise your risk of slippage while trading.

We also like Plus500’s simple, user-friendly platform which,, when combined with the broker’s risk management tools, is well-suited for beginner traders.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Broker Details

Top Risk Management Tools

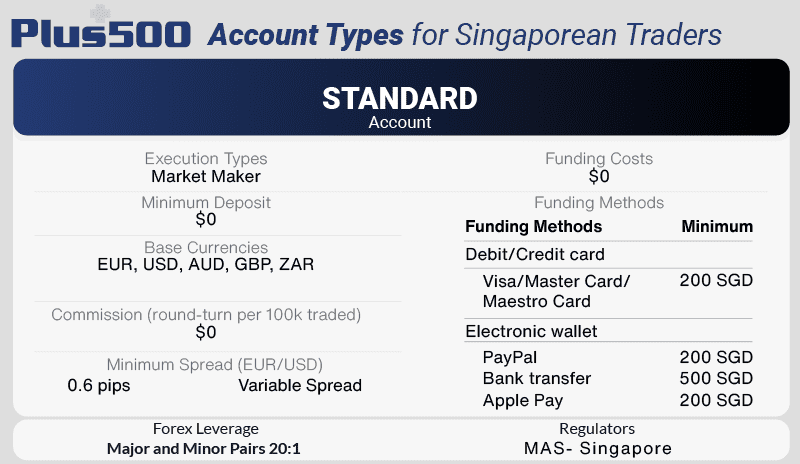

Plus500 is a CFD provider that charges no commissions and offers a specialised trading platform with useful risk management tools, that we think is best suited for beginners.

When testing out the platform, we appreciated the inclusion of guaranteed stop-loss orders (GSLOs) to help reduce our slippage while trading. If we made a loss on a trade, we found our GSLOs were triggered accurately at the price levels we set, prior to putting the order on.

Another useful risk management feature Plus500 offers is Negative Balance Protection, which, as the name suggests, helps protect your account balance from going below 0.

This is available to all retail investor accounts, as well as professional accounts, which offer higher leverage limits (we checked).

User-Friendly Proprietary Platform

Plus500 only offers one user-friendly proprietary platform to trade CFDs with, available as a Webtrader platform and a mobile app.

While the platform lacks advanced tools and functionality like other platforms on this list, you can still trade with 110 technical indicators and 20 drawing tools for diverse charting analysis. For reference, that’s much more than either MetaTrader platform offers.

We also appreciated how seamlessly the platform worked across devices, offering a very similar experience overall. Where we think the platform stands out, however, is the trader sentiment feature, which allowed us to assess the supply and demand of different instruments and buy and sell accordingly.

5. Swissquote - MOST TRUSTED FOREX BROKER IN SG

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 1.6

AUD/USD =

Trading Platforms

MT4, MT5, CFXD

Minimum Deposit

$1,000

Why We Recommend Swissquote

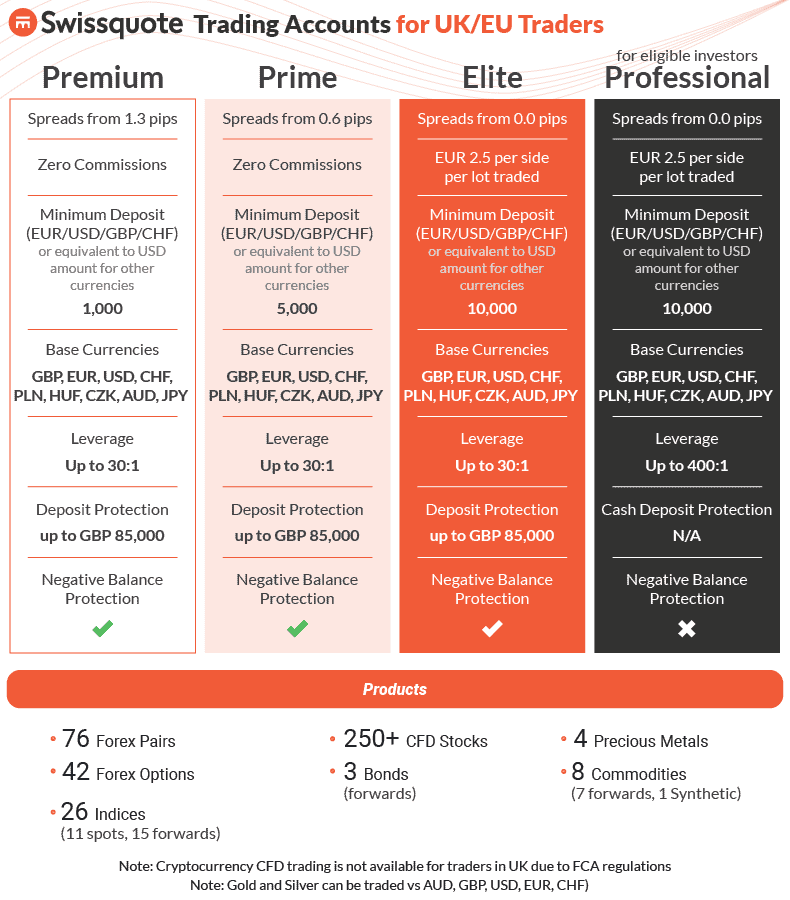

Trust scores highly with us and Swissquote is the most trusted forex broker in Singapore to our eyes. The broker is regulated in five tier-1 jurisdictions, including MAS in Singapore, FCA in the UK and the SFC in Hong Kong.

We also like Swissquote’s Advanced Trader platform, which features TradingView charts, one of our favourite platforms.

As a regulated forex broker that also operates three banks, Swissquote’s reputation in the industry precedes itself.

Pros & Cons

- Most trusted broker in SG

- Excellent trading platforms

- Advanced Trading Tools

- Wide Commission-free Spreads

- High Minimum Deposit

- Limited CFD Range

Broker Details

Most Trusted Broker in Singapore

Founded in 1996, Swissquote is publicly traded (SIX: SQN) and regulated in five Tier-1 jurisdictions, including MAS in Singapore, the FCA in the UK and, of course, FINMA in Switzerland. As such, due to its longstanding reputation and highly regulated nature, this makes Swissquote our most trusted broker in Singapore.

Powerful Platform Experience

Swissquote offers three trading platforms: its own excellent Advanced Trader platform and both MT4 and MT5.

In terms of platform experience, we think Swissquote stands out by offering the MetaTrader Master Edition for additional advanced trading tools as an MT4 and MT5 upgrade.

As keen scalpers, the tool that we found particularly useful was the Stealth Orders, which allowed us to close all our positions at the same time in one click without a tolerance level. At the same time, we could also insert hidden pending orders until they are executed.

Secondly, charting platform, TradingView can be integrated with Advanced Trader, as well as Autochartist for superior charting and algorithmic trading. While this enhances the Advanced Trader platform experience with 49 technical indicators, we think MT4 and MT5 is perhaps a more reliable alternative.

Decent Forex Range

While Swissquote doesn’t offer a huge range of trading products, the broker does offer a decent 76 forex pairs, more than the average broker. You can also trade forwards with Swissquote, which is a unique investment vehicle not many brokers offer.

6. Interactive Brokers - BEST FOREX, CFD AND SHARE TRADING BROKER

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

Interactive Brokers is our top forex, CFD and share trading broker due to the sheer immensity of its product range. As well as a good range of +80 forex pairs, we particularly like that IB offers trading on over 90 global share exchanges.

You can trade this huge range of products on Interactive Brokers’ advanced proprietary platforms, which we enjoy for their sophisticated trading tools.

Pros & Cons

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

- Tight standard account spreads

- Good trading platforms for beginners

- Solid range of CFD products

Broker Details

We think Interactive Brokers stands out as the top platform for forex trading, CFD and share trading broker for two main reasons: its highly sophisticated CFD trading platforms and diverse range of products on offer across 150 markets.

Wide Range of Trading Products

As a Singapore trader with Interactive Brokers, you have direct market access (DMA) to 80 major, minor, and exotic currency pairs, consisting of 23 trading currencies, making it one of the most extensive ranges available.

In terms of physical stocks, we found you could trade a whopping 11,918 products across 90 market centres. And as for CFDs, you can trade over 8500 share, index, forex and commodity CFDs.

But Interactive Brokers goes beyond this to also offer such complex instruments as Mutual Funds, options and ETFs to its product mix, ensuring great opportunities for diversification in your portfolio.

Sophisticated Trading Platforms

To trade its immense product range, Interactive Brokers offers several highly sophisticated trading platforms.

Among these proprietary platforms, Interactive Brokers’ Trader Workstation (TWS) stood out, particularly the FXTrader terminal within TWS designed for forex trading.

FXTrader offers advanced trading tools developed by the broker and supports over 20 order types, including trailing stop limits, brackets, one cancels all, and limit if touched.

One of the key features of FXTrader that we found was its easily customisable layout, with each currency pair’s “trading cell” displaying position, average cost, and profit and loss data, providing traders with comprehensive trading information at a glance.

Ask an Expert