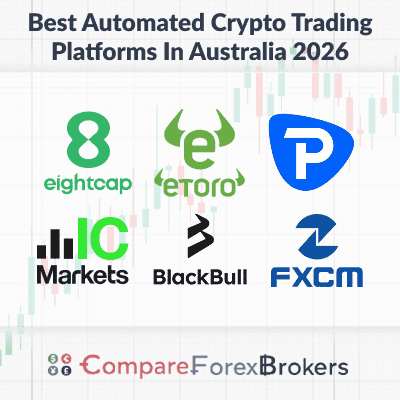

6 Best Automated Crypto Software Platforms in Australia [2026]

In January 2026, I tested 60 brokers to find the best automated crypto trading platform in Australia. I compared the available platforms, trading conditions, range of markets, and trading fees to find the best options for Australian traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

The top automated crypto trading providers in Australia are:

- Eightcap - The Best Automated Crypto Trading Platform

- eToro - Best Cryptocurrency Copy Trading Platform

- Pepperstone - Great Automated Trading Platform For Scalping

- IC Markets - Top Cryptocurrency Social Trading Platform (with ZuluTrade)

- BlackBull Markets - Top Crypto Platform with Fastest Execution Speeds

- FXCM - Best No code Automated Crypto Trading Platform

Who Are The Best Australian Automated Cryptocurrency Brokers?

With the popularity of cryptocurrencies rising, more brokers are offering crypto CFDs, allowing retail traders to profit from these assets. Through my testing, I found 6 forex brokers that offer the best automated crypto trading platforms. I choose this top six according to their execution speeds, low spreads, access to crypto, and customer support.

1. Eightcap - The Best Automated Crypto Trading Platform In Australia

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

In my broker reviews, I awarded Eightcap 96/100 for its low Raw account spreads and access to 95 crypto CFD markets, the largest selection across the 60+ brokers I’ve tested. I found the broker also provides multiple automated crypto trading platforms, including MT4/MT5 and Capitalise.ai.

As well as the large choice of crypto instruments, you can trade other markets like currency pairs, commodities, stocks, and indices. Customer support is also strong, and provided through live chat. Particularly impressive is that support is available 24/5 via human agents.

Pros & Cons

- Best cryptocurrency range

- Great platforms for automation

- Competitive trading fees

- Narrow range of CFDs

- Lacks a proprietary platform

- Educational content limited

Broker Details

Best Crypto Trading Platform With MT5

Eightcap provides two platforms for automated crypto trading – MetaTrader 4 and MT5. Both provide programmable crypto bot tools known as Expert Advisors. These bots follow your instructions precisely, allowing you to automate every aspect of your trading and risk management strategy.

I used MetaTrader 5 in my reviews. This platform has 38+ technical indicators built-in, but you can code custom indicators to suit your own trading strategy.

Using MQL5, you can create your own Expert Advisors (EAs). An EA is an auto-trading bot that can execute and manage your trades for you. I like that MT5 provides an in-built backtesting tool where you can try out your new EAs using historical data. This means you can fine-tune your strategy before deploying it live.

Most Cryptocurrency Markets Available

Another big reason to choose MT5 is that it gives you access to the broker’s full range of 95+ crypto CFDs. In contrast, you’ll only get 79 on MT4. So you’re not only trading on liquid markets like Bitcoin, XRP, and Ethereum, but also altcoins like Polkadot and Solana.

Unlike crypto exchanges, Eightcap is fully regulated by the ASIC. So you can rely on it to provide transparent and secure trading services. This holds true whether you are trading cryptos, or other CFD markets like forex, commodities, and indices.

In other words, you can automate your strategy across multiple assets using one account, and your fund will be protected through ASIC as an Australian trader.

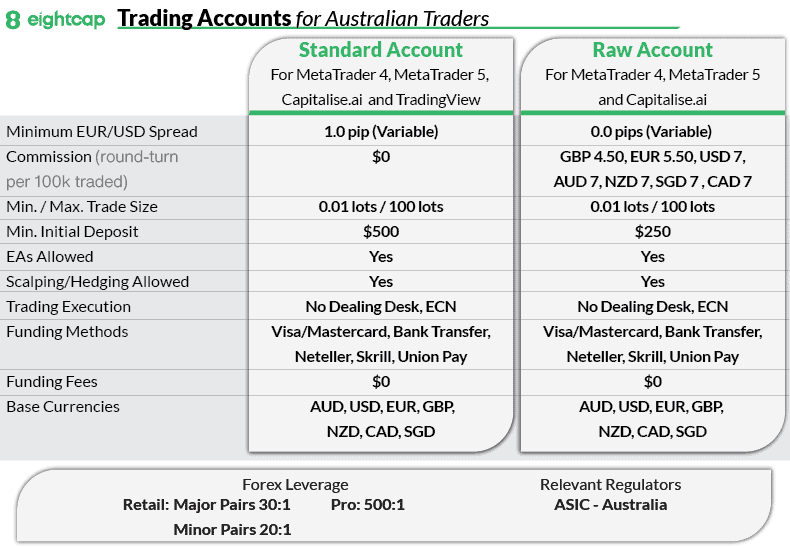

Low–cost Trading Accounts

Eightcap offers two trading accounts, each with its own pricing model. You’ve got spread-only (Standard account) or tighter spreads with commissions (Raw account).

Both are solid options when it comes to crypto trading. However, the Raw account is always going to be the better choice thanks to its tighter average spreads. In our tests, we found spreads as low as 0.20 pips on EUR/USD.

Low spreads equal cheaper trading, so I’m certainly a fan of this from Eightcap.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

2. eToro - Best Cryptocurrency Copy Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro

Minimum Deposit

$50

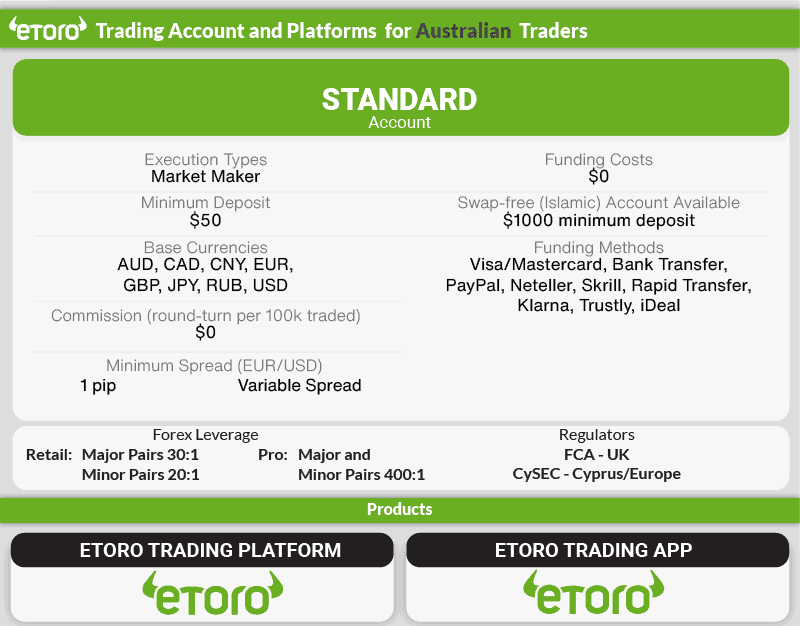

Why We Recommend eToro

I chose eToro as I think they offer the easiest-to-use copy trading platform in the industry. eToro acts as both the broker and the platform provider, so you have complete transparency when copy trading. The broker verifies trading history in real-time, blocking any potential scammers.

Plus, the broker offers access to 100+ crypto CFDs, which is the largest range I found from any brokers in the copy trading category. You’ll also find that the Standard account spreads are decent, starting from 1 pip on EUR/USD. There are no commissions on any of its assets, including stocks, which is a bonus too.

Pros & Cons

- Select traders based on proven performance

- Commission-free trading

- Easy-to-use platform for copy trading

- Higher trading costs

- Lacks MetaTrader 4 support

- Has withdrawal fees

Broker Details

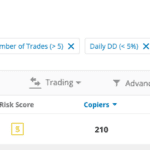

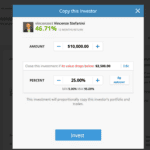

CopyTrader Mirrors Experienced Traders

In my opinion, the easiest way to automate your crypto trading is through eToro’s CopyTrader platform. It’s very easy to search for an experienced trader specialising in cryptocurrencies and copy their market movements.

By mirroring a copy trader’s orders, you’ll profit when they profit – and you’ll lose when they lose. While there is still risk, I think this is a good option for beginners, as you don’t have to do so much manual work researching and executing trades.

I liked that each copy trader has their own profile, with all their statistics clearly laid out. Here, you’ll find their trading history, running PnL (profit-and-loss), and follower history.

I personally think follower history is a great metric for validating trader performance. If the trader’s follower count is growing, this typically translates to better performance. I haven’t seen this metric on other copy trading platforms, so eToro definitely stands out here.

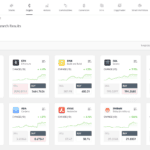

Excellent Range of Crypto Markets For Copy Trading

As a crypto trader, you’re trading with more than 106 cryptocurrencies. This exposes you to a solid variety of markets, from Bitcoin to Solana and basically everything in between.

When I was looking at copy traders, I found that most traders don’t focus on just a single instrument category. So the trader you copy will probably be making moves in other markets too, like forex, stocks, or commodities.

Low Spreads With No Commissions

With eToro, you can only use the Standard account – this means no commissions on any of the assets. I don’t mind this, as it simplifies your trading costs, even though Raw accounts tend to be a bit cheaper.

Spreads on the account are competitive, starting from 1 pip on EUR/USD. This is around 16% cheaper than the industry-tested average.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

3. Pepperstone - Great Automated Trading Platform For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone is my overall top-scoring broker (98/100) as it offers excellent trading conditions. It supports a respectable 33 crypto markets, and all four of the most popular trading platforms – TradingView, MT4, MT5, and cTrader.

The MT5 and cTrader are the standout platforms for me for several reasons, including the one-click trading and Depth-of-Markets features. I advise pairing these platforms with the broker’s Razor account, which offers the second-fastest limit order execution speeds in the industry. The Razor spreads are tight too – as low as 0 pips in some cases.

Pros & Cons

- Solid choice of trading platforms

- 0 pip spreads with the Razor account

- Fast execution speeds

- Demo account is limited to 30 days

- Lacks guaranteed stop-loss orders

- The product range is limited on MT4

Broker Details

Solid choice Of Trading Platforms

Pepperstone has a solid variety of trading platforms, but I like that they offer MT5 and cTrader. These are two of the best platforms for automated crypto trading – especially if you scalp these markets.

I personally prefer MT5 as I have some background in the MQL5 language, and so I can use the platform to develop my own crypto bots. This means I can automate my crypto strategies according to my own needs.

MT5’s infrastructure also allows you to integrate volume-based trading tools with your Expert Advisor automated trading bots, making it easier to leverage volume indicators when trading cryptocurrencies.

This platform also offers Pepperstone’s full range of crypto markets, covering 27 cryptocurrencies like Bitcoin and Ethereum.

Fast Execution Speeds For Crypto Trading

In my testing, I found the advantages of the MT5 platform were boosted even further by the broker’s excellent trading conditions. Pepperstone recorded some of the fastest execution speeds I’ve seen, with its limit order speed of 77ms.

| Broker | Limit Order Rank | Limit Order Speed (ms) |

|---|---|---|

| Blackbull Markets | 1 | 72 |

| Pepperstone | 2 | 77 |

| Fusion Markets | 3 | 79 |

| Octa | 4 | 81 |

| Oanda | 5 | 86 |

| Blueberry Markets | 6 | 88 |

| Global Prime | 7 | 88 |

| Axi | 8 | 90 |

| Tickmill | 9 | 91 |

| Exness | 10 | 92 |

Pairing the fast speed with the broker’s free VPS service gives you 24/7 automated trading on the crypto markets, and you won’t even need to leave your device on.

To get VPS access, you need to trade 10+ lots in any currency/asset over a 60-day period. I think this is pretty generous as most brokers I’ve tested require 10+ lots a month.

Zero Pip Spreads On Razor Account

Pepperstone’s trading costs are some of the lowest I’ve tested with its Razor account. My analyst tested its spreads against 14 other ECN brokers and found Pepperstone offers zero pip spreads on EUR/USD 100% of the time (outside of rollover).

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| Blueberry Markets | 100.00% | 100.00% | 91.30% | 100.00% | 78.26% | 95.65% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% |

4. IC Markets - IC Markets Top Cryptocurrency Social Trading Platform (with ZuluTrade)

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

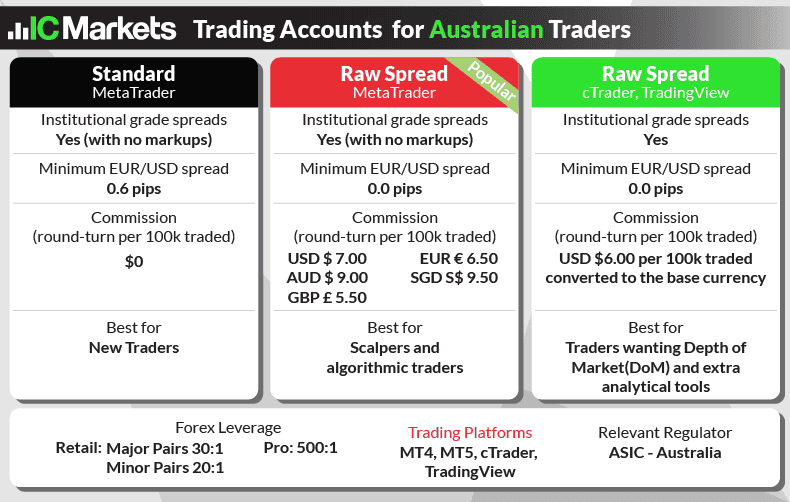

Why We Recommend IC Markets

IC Markets is a solid performer for social trading and has the lowest Standard account spreads. This is why I rated them 93/100 in my reviews. The broker supports ZuluTrade, which uses MetaTrader 4 to provide social trading services. There are 2,500+ financial markets in total, including 23 cryptocurrencies.

Spreads are very good too. The Standard account spreads were the lowest I’ve tested, averaging 0.73 pips on EUR/USD.

Pros & Cons

- Low spreads

- Solid choice of crypto markets

- Access social trading tools with ZulTrade

- Limited market analysis resources

- Live chat can be slow

Broker Details

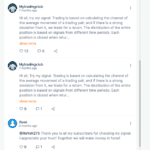

Social Trading With ZuluTrade

Out of the brokers tested, I found IC Markets is the best choice if you want to social trade thanks to its ZuluTrade integration. ZuluTrade is accessible through the MetaTrader 4/MetaTrader 5 platforms and automates your crypto trades when you follow other trades through the ZuluTrade platform.

I like ZuluTrade’s advanced search tool that lets you find traders based on specific criteria – like PnL, trades per month, drawdown metrics, and other filters. I found this helps narrow the available selection, making it easier to analyse potential traders.

Another feature I like is the hashtag system. This curates all the conversations and data around certain topics in one place. So you can search for something like “#Bitcoin”, and find out what everyone is saying about the topic.

You can use this to find like-minded traders and engage with them for collaborative market analysis and potentially find new trading opportunities.

Lowest Standard Account Spreads

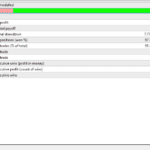

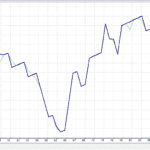

For social trading, IC Markets consistently offers the lowest trading costs according to our tests. CompareForexBrokers analyst Ross Collins tested 15 brokers using the IceFX SpreadMonitor EA on his MT4.

After gathering the average spreads, he found IC Markets averaged 0.73 pips on EUR/USD. This made it 34% cheaper than the tested industry average of 1.11 pips, which is a huge saving.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

5. BlackBull Markets - Top Crypto Platform with Fastest Execution Speeds

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, BlackBull Social, BlackBull Shares, BlakcBull Trade

Minimum Deposit

$0

Why We Recommend BlackBull Markets

BlackBull Markets is the fastest execution broker on my list, beating 36 other top brokers to gain top spot. This contributed to my overall score of 95/100 for the broker. I’d say BlackBull offers some of the best trading conditions for automating your crypto trades, across the MT4, MT5, cTrader, or TradingView platforms.

A unique bonus for BlackBull Markets is that it offers retail traders 1:500 leverage on forex pairs and 1:100 on its 16 cryptocurrencies – the highest out of the brokers I tested.

Pros & Cons

- Highest leverage crypto broker

- Fastest execution speeds tested

- Solid range of trading platforms

- ECN accounts have minimum deposits

- Not the largest range of cryptos

- Not ASIC regulated

Broker Details

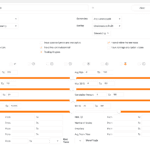

Fastest Execution Speeds For Crypto Platforms Overall

Our head analyst, Ross Collins, tested the execution speeds of 36 brokers. He used the ExTest_ForExpat EA on the MT4 platform to examine limit orders, and used the Broker Latency Tester EA for market order speeds.

In these tests, he found BlackBull Markets has the fastest execution speeds overall. The broker’s limit order averaged 72ms, while the market order averaged 90ms.

| Broker | Overall Speed Ranking | Limit Order Speed (ms) | Limit Order Rank | Market Order Speed (ms) | Market Order Rank |

|---|---|---|---|---|---|

| BlackBull Markets | 1 | 72 | 1 | 90 | 5 |

| Fusion Markets | 2 | 79 | 3 | 77 | 1 |

| Pepperstone | 3 | 77 | 2 | 100 | 10 |

| OANDA | 4 | 86 | 5 | 84 | 2 |

| Octa | 5 | 81 | 4 | 91 | 6 |

| Exness | 6 | 92 | 10 | 88 | 3 |

| Blueberry Markets | 7 | 88 | 6 | 94 | 7 |

| FOREX.com | 8 | 98 | 13 | 88 | 4 |

| Global Prime | 9 | 88 | 7 | 98 | 9 |

| Tickmill | 10 | 91 | 9 | 112 | 11 |

| TMGM | 11 | 94 | 11 | 129 | 13 |

| City Index | 12 | 95 | 12 | 131 | 14 |

For me, these execution speeds make a huge difference in automating your crypto trading strategies. They reduce the likelihood of requotes and negative price slippage, which will impact your trading costs.

Multiple Crypto Platforms With High Leverage

BlackBull Markets offers multiple automated crypto trading platforms, including TradingView, MetaTrader 4, MT5, and cTrader – all of which exhibit fast execution speeds.

A bonus I find with BlackBull Markets is the leverage of 1:500 on forex markets and 1:100 on crypto CFDs. This is 50 times greater than Pepperstone’s leverage of 1:2 on crypto, so you can trade big crypto positions with lower margin requirements.

BlackBull Markets can offer this because it is regulated by the Financial Markets Authority (FMA) in New Zealand. The FMA is more relaxed on leverage than the ASIC (Australian Securities and Investments Commission).

Tight Spreads Using ECN Prime Account

Along with top trading conditions, I found BlackBull’s ECN Prime account offers decent Raw spreads. The published spreads for EUR/USD average 0.14 pips – way ahead of the industry average.

The other majors performed well too, with GBP/USD, AUD/USD, and USD/CAD beating their industry average comfortably. You can see these results in more detail below.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | |

|---|---|---|---|---|---|

| BlackBull Markets | 0.14 | 0.45 | 0.43 | 0.3 | 0.41 |

| Industry Average | 0.27 | 0.42 | 0.53 | 0.44 | 0.60 |

6. FXCM - Best No-code Automated Crypto Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 0.3 GBP/USD = 0.9 AUD/USD = 0.4

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

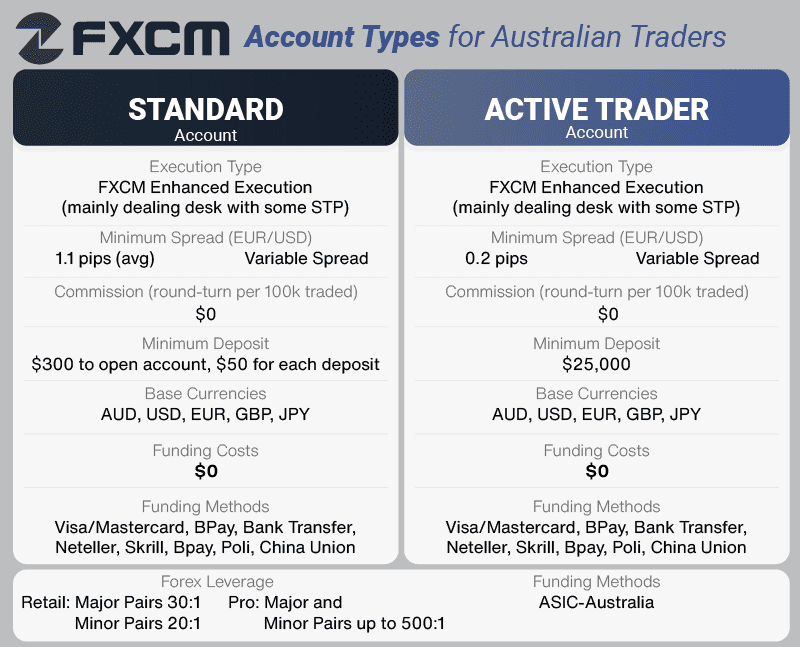

Why We Recommend FXCM

FXCM is my favourite option no-code automated crypto trading, thanks to its Capitalise.ai integration. This platform lets you develop trading strategies in minutes, and you can write AI-based trading bots without knowing how to code.

Although the broker doesn’t offer many crypto markets, you still have access to major markets like Bitcoin and Litecoin. FXCM’s trading costs are competitive, especially if you decide to trade forex pairs. Major forex pairs average 1.24 pips.

Pros & Cons

- Excellent educational tools

- Great execution speeds

- Good support for automation

- Limited range of crypto products to trade

- Bank transfer withdrawal fee is high

- Minimum deposit

Broker Details

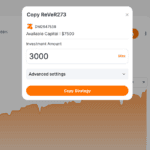

FXCM Has Capitalise.AI

While testing FXCM, I was pleased to find that they offer Capitalise.AI – the best automated crypto trading platform if you lack programming experience. Capitalise.AI lets you develop automated strategies using plain English instead of writing the code, opening up automated trading to everyone.

I like this platform as you can type your trading instructions and risk management rules directly into the app. The AI will then complete the automation instantly. Additionally, you can backtest your strategies, and even automate forward testing, on a demo account. So you can track the performance before deploying your bots live.

Trade A Variety Of Markets

Although the automation side of FXCM is very good, I did find they are a little lacking in their choice of crypto markets. You can only choose from seven cryptocurrencies. The range still includes things like Bitcoin and Ethereum, but lacks the altcoins brokers like Eightcap offer.

Outside of cryptocurrencies, you can even automate other markets through Capitalise.AI. The range covers 42 forex pairs, 219 share CFDs, 11 commodities, and 16 indices.

Competitive Spreads With FXCM’s Standard Account

I found FXCM only offers a Standard account, so all of your costs are priced according to the spread. This keeps trading costs simple, as there are no commissions.

In our spread tests, FXCM’s Standard account achieved an average of 1.24 pips across the 5 major pairs I tested. This is around 19% cheaper than the industry average.

| Top 5 Most Traded Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| IC Markets | 0.93 |

| Fusion Markets | 1.04 |

| Eightcap | 1.16 |

| Go Markets | 1.08 |

| TMGM | 1.20 |

| ThinkMarkets | 1.22 |

| FXCM | 1.24 |

| City Index | 1.24 |

| Pepperstone | 1.26 |

| Blackbull Markets | 1.30 |

| eToro | 1.30 |

| IG | 1.38 |

| Industry Average | 1.53 |

Ask an Expert

Do these bot platforms have like a paper trading or demo thing so I can try out strategies before actually putting in real money?

Yes, the platforms I’ve listed on this page all offer demo accounts for free. This way you can get used to the platform and try them out with virtual money.