Best Forex Trading App UK Comparison

We compared the best UK trading apps to match the different platforms to distinct types of traders. When finalising our platform recommendations, we focused on the ease of use, and range of tradable instruments and spreads.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The best forex trading platforms for mobile trading are:

- Plus500 - Best Forex Trading App For UK Traders

- Pepperstone - Lowest Spread Trading Platform

- eToro - Top Trading App For Copy Trading

- CMC Markets - Good Trading App For Beginners

- FXCM - Great Range Of App Trading Platforms

- IG Markets - Best App For Large Range Of Markets

- AvaTrade - Best Fixed Spread Broker

- Swissquote - Trusted App With TradingView Charting

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

57 |

FCA CySEC |

- | - | - | - | 1.70 | 2.3 | 1.4 |

|

|

|

140ms | $100 | 71+ | 15+ | 30:1 | 300:1 |

|

Read review ›

Read review ›

|

98 |

FCA CySEC, BaFin |

0.10 | 0.30 | 0.20 | £2.25 | 1.10 | 1.30 | 1.20 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

43 |

FCA CySEC |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 46+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

69 |

FCA BaFin |

0.5 | 0.9 | 0.6 | £2.50 | 1.12 | 1.30 | 1.64 |

|

|

|

138ms | $0 | 338+ | 19+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

70 |

FCA BaFin, CySEC |

0.30 | 0.90 | 0.40 | $3.00 | 1.3 | 1.4 | 1.7 |

|

|

|

150ms | $300 | 42+ | 7+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

71 |

FCA BaFin, CySEC |

0.16 | 0.59 | 0.29 | £3.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $450 | 100+ | 12+ | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

64 |

CySEC CBI, KNF |

- | - | - | - | - | - | - |

|

|

|

160ms | $100 | 55+ | 15+ | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

29 |

FCA CySEC, CSSF |

- | - | - | 2 | 1.7 | 2 | 1.6 |

|

|

|

170ms | $1000 | 76+ | 26+ | 30:1 | 400:1 |

|

What Are The Best Forex Trading Apps For UK Traders?

In 2025, we determined the best forex brokers in UK overall winners based on their desktop trading experience. We understand many traders primarily use mobile, so we tested the trading apps and shortlisted the brokers based on our findings.

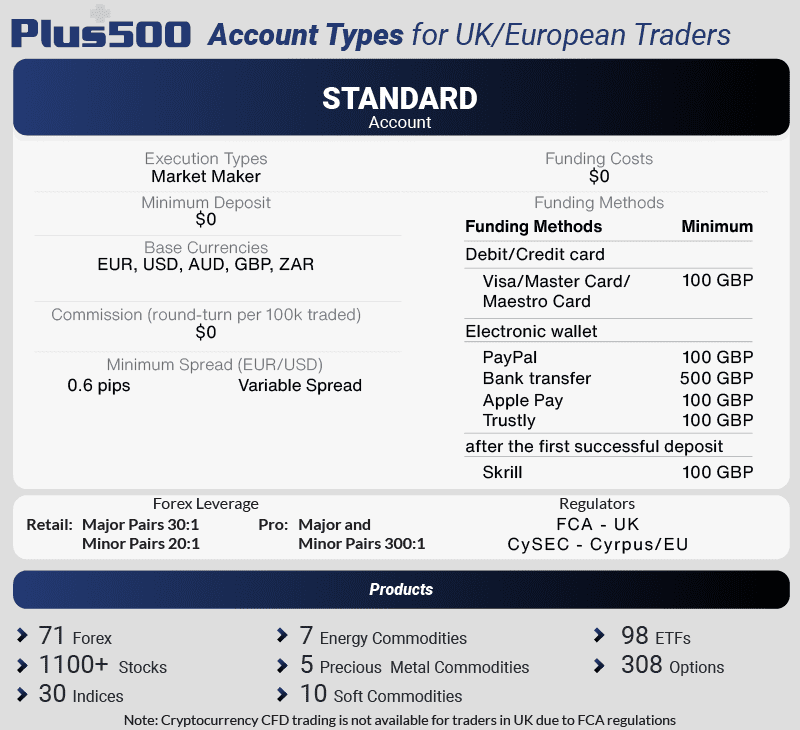

1. Plus500 - Best Forex Trading App For UK Traders

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$0

Why We Recommend Plus500

We liked Plus500 for its standout features and user-friendly mobile experience. While trading on the platform, we noticed it’s particularly well-suited for beginner to intermediate traders who prefer lower-volume trades. The spreads can be a tad wider than some prefer, but the overall ease of use compensates for this minor drawback.

Pros & Cons

- Easy to use forex trading app

- Wide range of currency pairs

- Advanced trading tools

- Higher trading costs

- No copy trading facility

- No spread betting option

Broker Details

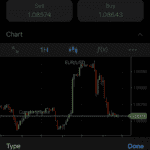

After we opened a Plus500 Standard account, we noticed you could only use their proprietary trading app to execute and analyse the markets. While this lack of platform options is usually a drawback, their trading app surprised us during our tests. The app is user-friendly, and we can navigate to most markets and tools with just one tap, making it quick to access everything we need.

We found the platform offers over 100 technical indicators, 13 chart types, and extra tools like +insights to help identify market trends, which we think could be useful for beginners. It aggregates Plus500 client order data to reveal real-time buying and selling hotspots, giving you a sense of the current market sentiment. This insight can help you judge whether Plus500’s clients favour long or short positions, which can help validate your trade ideas.

As a bonus, we like that Plus500 allows you to use guaranteed stop-loss orders on their platform. This feature ensures your trade will be closed at the specified price level no matter what, preventing potential losses from exceeding your initial risk and protecting you from market slippage.

While exploring the Plus500 platform, we found the broker offered a decent range of markets to trade, including 71 forex pairs, 1100+ share CFDs, 30 indices and 12 commodities. The diverse range enabled us to utilise the +insights tool, revealing markets other Plus500 traders were actively trading. This insight opened up new market opportunities we might have overlooked, expanding our potential for profitable ventures.

View Plus500 ReviewVisit Plus500

*Your capital is at risk ‘80% of retail CFD accounts lose money’

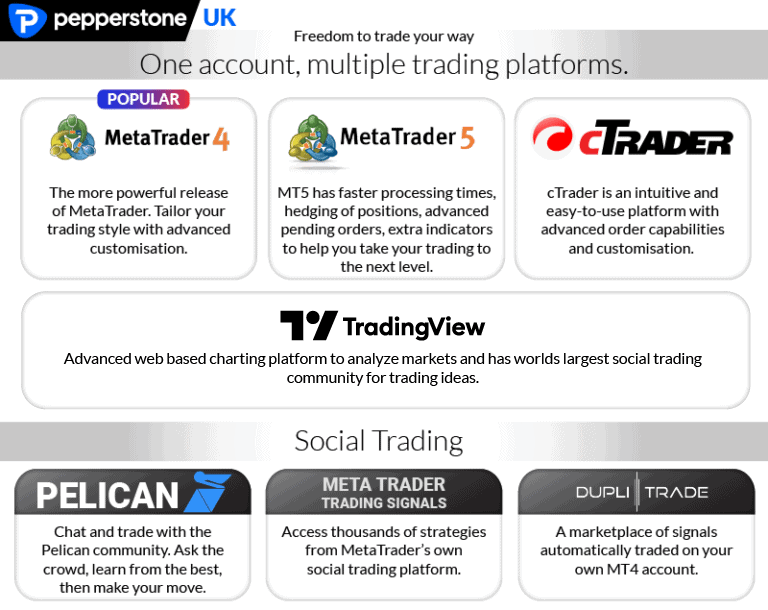

2. Pepperstone - Lowest Spread Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

We recommend Pepperstone because our analysis shows their standard account has the lowest spreads. Unlike Plus500, Pepperstone’s full suite of trading platforms all have their own apps, so it comes down to personal preference, which option you choose.

Pros & Cons

- Low-spread trading accounts

- Fast execution speeds

- Excellent choice of mobile trading apps

- Customer service can be lengthy

- No guaranteed stop-loss orders

- Not all indicators work on the mobile app

Broker Details

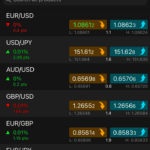

Pepperstone advertises spreads from 0.0 pips on its RAW account, so our analyst Ross Collins tested the spreads to see how frequently the broker offers them this low. Surprisingly, his findings showed that they were offered 100% of the time on the major pairs (EUR/USD, USD/JPY, AUD/USD, etc.).

This makes the RAW account an excellent choice for scalpers, as you’ll only pay the commission (only $3.50 per lot traded). Since the commission is a fixed fee, you’ll have the same trading costs in quiet and volatile markets.

If you’re against commission-based accounts, you should try the Standard account, which is commission-free but has wider spreads, averaging 1.12 pips on EUR/USD (this is still low compared to the industry average).

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.62 |

| eToro | 1 |

| Pepperstone | 1.12 |

| IG | 1.13 |

| FXCM | 1.3 |

| Plus500 | 1.7 |

| Swissquote | 1.7 |

| Industry Average | 1.24 |

We like that the broker offers a range of trading platforms so you can choose the one that best suits your trading style and preferences. These platforms include MetaTrader 4, MT5, cTrader, and TradingView, and we think having multiple platform options is beneficial, allowing you to find the right fit for your needs.

We tried the MetaTrader 4 platform, which offers 30+ indicators, three chart types, nine timeframes, customisable indicators, and automated trading through Expert Advisors. As a mobile app, it naturally has push notifications on your device, which we found helpful when creating trading alerts and ensuring we never miss a potential trading opportunity.

*Your capital is at risk ‘74.8% of retail CFD accounts lose money’

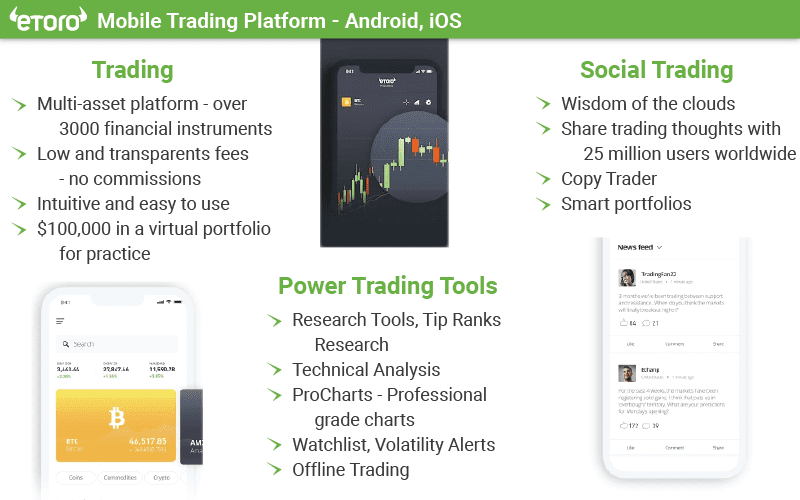

3. eToro - Top Trading App For Copy Trading

Forex Panel Score

Average Spread

EUR/USD = 1.0

GBP/USD = 2.0

AUD/USD = 1.0

Trading Platforms

eToro Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

We recommend eToro as the top trading app for copy trading in the UK. Its platform is tailored for novice traders, making it straightforward to fund and engage with the social trading community. While the fees are higher and there’s a withdrawal charge, it’s an excellent choice for copy traders who only trade sometimes. All in all, eToro offers a solid experience for those keen on mirroring successful traders.

Pros & Cons

- Optimised trading platform for copy trading

- Intuitive filter system to find traders to follow

- No commissions on trading

- Has withdrawal fees

- Slightly higher spreads compared to the industry

- Does not offer ECN/STP

Broker Details

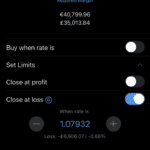

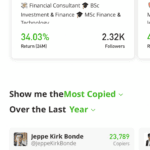

You can use eToro’s CopyTrader to mirror a trader’s positions, leveraging the expertise of experienced traders. This feature is particularly useful for beginners or if you lack the time (or confidence) to manage your trades.

eToro’s CopyTrader platform is the easiest to use among the others we’ve tested. With features that simplify filtering its 30,000,000 traders, we could fine-tune the criteria to find traders who meet our high requirements.

We tried eToro’s filter tool by selecting the metrics we’re interested in. It returned the top traders we can copy who match our essential criteria, allowing us to find highly targeted traders to copy.

One of the filters we liked was the ability to choose which markets your copy trader specialises in. We used this filter to select the best traders for each market and built a “portfolio” of copy traders to leverage their expertise across multiple markets.

Compared to other copy trading platforms we’ve tested, eToro’s trading costs are low – averaging one pip on EUR/USD with no commissions. With this in mind, if you want to copy trade, then with eToro, you’ll get the best of both worlds – low trading fees and a range of experienced traders.

*Your capital is at risk ‘51% of retail CFD accounts lose money’

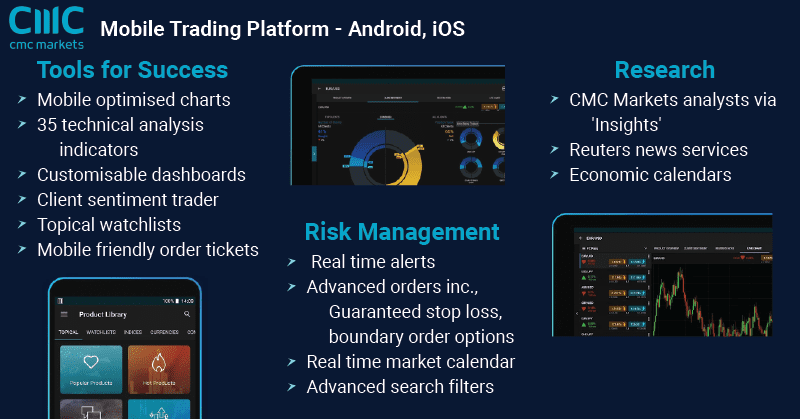

4. CMC Markets - Good Trading App For Beginners

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

We highly recommend CMC Markets for traders just starting. Their trading app is beginner-friendly, boasting competitive spreads and fees. Furthermore, they’ve earned a commendable trust score in the industry. The intuitive platform and top-notch customer service make CMC Markets a solid choice for those new to forex trading in the UK.

Pros & Cons

- Easy-to-use trading app

- Solid selection of trading indicators and tools

- Extensive choice of trading products available

- Customer support is limited via the app

- No copy trading tools

- 300+ FX pairs may confuse beginners

Broker Details

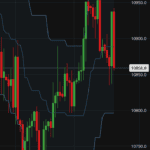

CMC Markets has an extensive range of 13,000+ markets, but what stood out was that it had 330+ currency markets, covering crosses from EUR/USD to USD/TBH. Although this may seem unnecessary, we think experienced traders can benefit from the extra volatility these markets have to find more opportunities unavailable to other brokers.

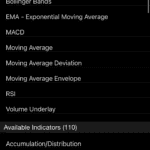

The NGEN platform by CMC Markets is an advanced trading app with excellent features from its Web Trader version, allowing you to access advanced charting and pattern recognition tools. With 75+ indicators and specialised pattern indicators, we find this impressive as more brokers tend to limit features on mobile apps.

Plus, we found the broker had guaranteed stop-loss orders on the NGEN app, which we believe is a valuable tool for beginners that helps to manage risk effectively.

We found that you can benefit from tight spreads if you trade the major forex pairs with its FX Active account. The account offers the tightest spreads (averaging 0.50 pips on EUR/USD) and cheap commission for ten currency pairs (GBP/USD, AUD/USD, CAD/USD, EUR/USD, etc.).

CMC Markets has one of the lowest commissions in the UK, at $2.50 per lot traded on its FX account. Although this is a positive if you trade the major pairs, you’ll have to pay the standard account spreads if you want to trade other assets like shares or indices.

*Your capital is at risk ‘70% of retail CFD accounts lose money’

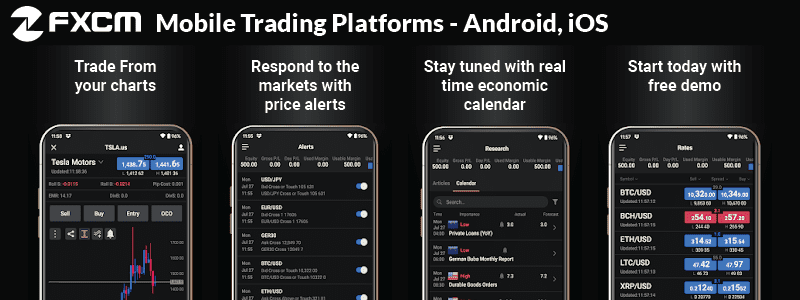

5. FXCM - Great Range Of App Trading Platforms

Forex Panel Score

Average Spread

EUR/USD = 1.3

GBP/USD = 1.4

AUD/USD = 1.7

Trading Platforms

MT4, TradingView, Trading Station

Minimum Deposit

$50

Why We Recommend FXCM

FXCM is a solid broker offering its own propriety platform available on the App Store (Android and Apple). We liked the broker’s offering for CFD trading, but their fees were the main sticking point.

Pros & Cons

- Good selection of trading platforms

- Offers plenty of trading tools

- Mobile app is easy to use

- Trading product range is limited

- Withdrawal fees

- Only offers 24/5 support

Broker Details

What stood out for us when using FXCM’s Trading App was its Research tool, which collated market news articles from 22+ sources, such as Investing.com, Bloomberg, and Reuters, and presented them in one tab. We like this feature as it makes staying on top of market events easy, helping you time your trade ideas better by avoiding markets with recent volatility.

The Technical Analyser tool is also decent. We used the tool, which suggested new trading opportunities with market commentary and a chart showing the analysis. This allowed us to validate the idea and act if we liked it. As this tool is an automated feed of analysis, this allowed us to expand our trading opportunities across multiple markets, increasing our likelihood of finding profitable trades during the day.

Plus, we found that the app leverages TradingView’s SuperCharts package, giving you clean and responsive charts. Although it uses TradingView, the app lacks the same features, with access to TradingView’s 50+ indicators and three chart types, much lower than what TradingView (and other trading apps offer). While the charting capabilities are good, we think the limited number of indicators and chart types may be a drawback for more advanced traders.

We tested FXCM’s standard account, which is commission-free, and you just pay the spreads to open your trade. Based on our tests, we found the broker competitive, offering an average spread of 1.3 pips on EUR/USD. While this is slightly higher than the industry average of 1.24 pips, these spreads are reasonable, especially when combined with the commission-free trading structure.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

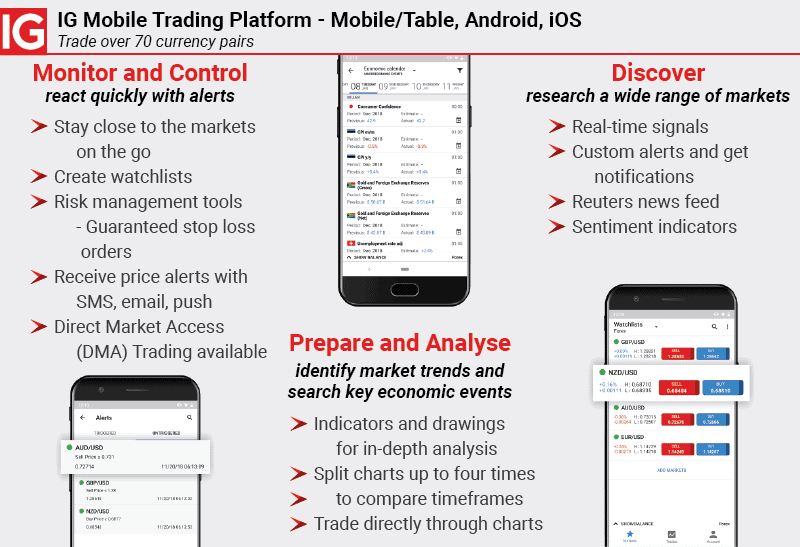

6. IG Group - Best App For Large Range Of Markets

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

We recommend IG Group if you’re looking to trade more exotic CFDs worldwide. Not only does IG, through their desktop software or trading app, allow traders the most markets and currency pair options, but there is sufficient depth to keep spreads lower on these exotic instruments. The platform is clean, has reasonable spreads, and is suited to more intermediate CFD traders.

Pros & Cons

- Largest range of financial markets

- Trading app has excellent trading tools

- Competitive spreads

- High minimum deposit

- No social trading tools

- Limited customer service over the weekend

Broker Details

In our testing, we found IG Group to offer an impressive 17,000+ markets, the most we’ve seen from a CFD broker. These markets included 80+ currency pairs, 12,000+ shares, 130 indices, 41 commodities, and 6,000+ ETFs. With such a varied market choice, you can trade across multiple markets using one account, making capitalising on the day’s volatility easy.

IG Group offers several trading platforms, including MetaTrader 4, IG Group Trading Platform, L2 Dealer, and ProRealTime. We used the IG Trading App, which we enjoyed because of its easy-to-use interface and a decent choice of 40+ indicators, including moving average and MACD. Compared to the other apps on offer, we noticed that the IG Trading app was the only one that allowed you to trade the full range of markets.

IG Group only provides a Standard account, which is spread-only with no commissions, as the price is baked into the spread. We tested the Standard account to see how low IG Group’s spreads were across the forex markets and found that they were low compared to the industry average.

This resulted in the broker averaging 1.13 pips on EUR/USD, putting it in line with other low-spread brokers like Pepperstone and cheaper than the industry average of 1.24 pips.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

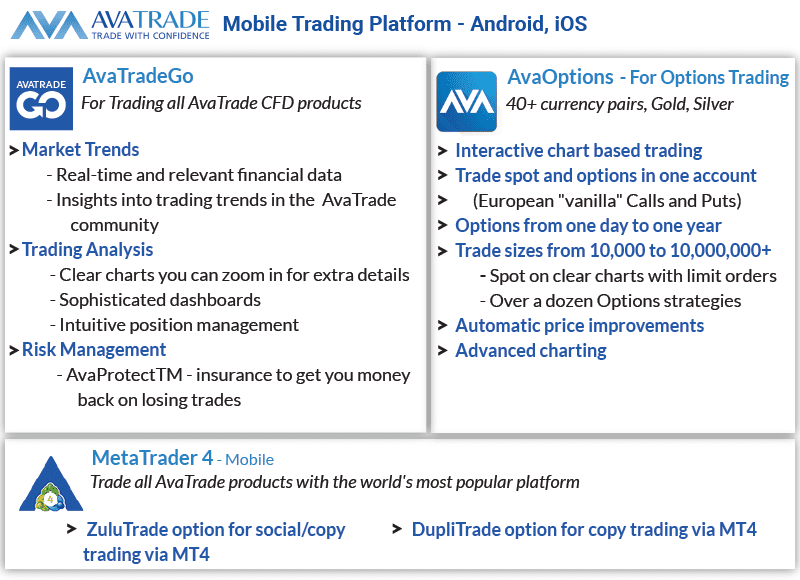

7. AvaTrade - Best Fixed Spread Broker

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

We recommend AvaTrade only to novice traders with a very low-risk appetite. While it’s nice to know the fees of a broker ahead of time and to have a feature allowing a trader to exit a losing trade, the fees are very high. This makes it hard to profit when trading CFDs, raising the question of whether a trade suits this category.

Pros & Cons

- Tight fixed-spreads

- Intuitive trading app with FX options

- Improved risk management with AvaProtect

- AvaProtect only available on AvaTradeGO

- Limited market analysis tools

- High inactivity fees

Broker Details

If you day trade or like to profit from volatile markets, we think AvaTrade is a top choice thanks to its fixed spreads with no commission. Using AvaTrade’s Standard account, we tested their spreads and found they offered 0.9 pips on EUR/USD. The results impressed as they make AvaTrade’s spreads competitive (if not cheaper) than variable spread brokers, as you can see in the table below:

| Broker | Avg. Spread EUR/USD | Variable/Fixed |

|---|---|---|

| eToro | 1.00 | Variable |

| AvaTrade | 0.90 | Fixed |

| Pepperstone | 1.12 | Variable |

| CMC Markets | 1.12 | Variable |

| IG Group | 1.13 | Variable |

| FXCM | 1.30 | Variable |

| Plus500 | 1.70 | Variable |

| Swissquote | 1.70 | Variable |

We think fixed spreads can be a good alternative to variable spreads for day traders as they provide a fixed cost for each trade, regardless of market volatility. This allows you to enter the markets at any time throughout the trading day without fear of entering at the same time as an economic announcement, which may spike the spreads for variable brokers.

With AvaTrade, you can access several platforms, including MT4, MT5, Web Trader, AvaTradeGO, and AvaTrade Options. We liked AvaTradeGO as a mobile app platform with an impressive market sentiment feature built-in and decent charting tools, including 80+ indicators and three chart types.

In particular, we like the app’s sentiment tool, which allows us to see where AvaTrade’s clients think the market will go based on current open and pending orders. For example, we could see that on GBP/USD, 55% of the traders had a long open or pending position, meaning they think it is likely to rise soon.

This is a decent feature for validating your trade ideas against others, but it does not fully represent all market participants.

*Your capital is at risk ‘63% of retail CFD accounts lose money’

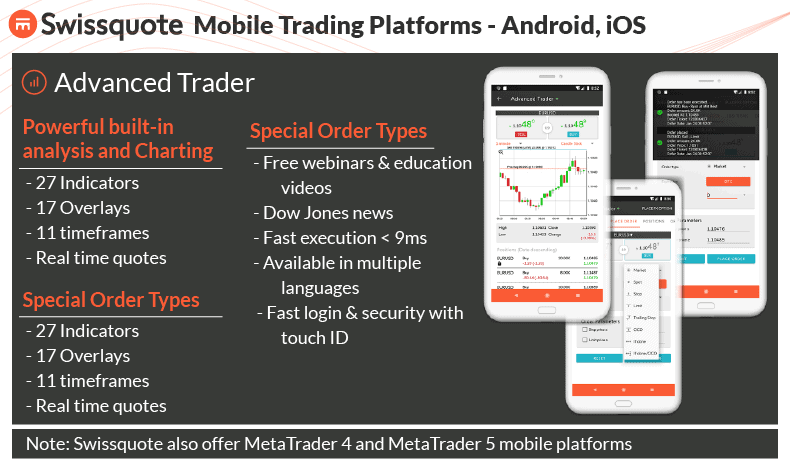

8. Swissquote - Trusted App With TradingView Charting

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.0

AUD/USD = 1.6

Trading Platforms

MT4, MT5, CFXD

Minimum Deposit

$1000

Why We Recommend Swissquote

We liked the trading platform and broker offering, but the broker spreads were high, and we had issues with their customer support. The broker is only recommended if you are an experienced trader and can self-serve using the mobile app.

Pros & Cons

- Well-designed trading app

- An extensive range of indicators on the app

- Tight spreads on the Elite account

- Standard account spreads are high

- Requires a high minimum deposit

- Limited financial markets available

Broker Details

Swissquote has integrated TradingView’s advanced charting functions into its CFXD platform. However, after installing the CFXD mobile app on our phone, we found it lacked the same features expected from TradingView’s charts. In fact, we were surprised that the platform only had six technical indicators available to add to its charting, which is the lowest we’ve seen for a trading app.

With its lacklustre charting features, we found it has other decent features we should mention. Firstly, it has a decent range of 24 educational videos available directly on the mobile app covering the basics of risk management—something we haven’t seen in our testing.

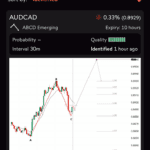

While using the app, we liked that they had a built-in Autochartist feature, a market scanner that automatically monitors markets and identifies trading opportunities based on technical analysis. We tried this tool and found it can help save time by finding new trades across multiple markets. Plus, we thought adding a confidence rating (and other metrics) to help validate a signal was helpful. We could also filter the tool so it only analyses the markets we like to trade.

We opened a “Premium” Standard account to see how the broker’s spreads compared to what they advertised, starting at 1.3 pips for EUR/USD. But, in our tests, we found the average was 1.7 pips, which is more expensive than the typical 1.24 pips. If you choose a Prime account, the spreads get better, starting at 0.6 pips, but you must deposit at least £5,000.

This could be worth it if you’re okay with investing that much and prefer using Swissquote. However, if you’re looking for better deals without a required minimum deposit, a broker like Pepperstone might be a better option.

*Your capital is at risk ‘82.48% of retail CFD accounts lose money’