Best ECN Brokers In Australia

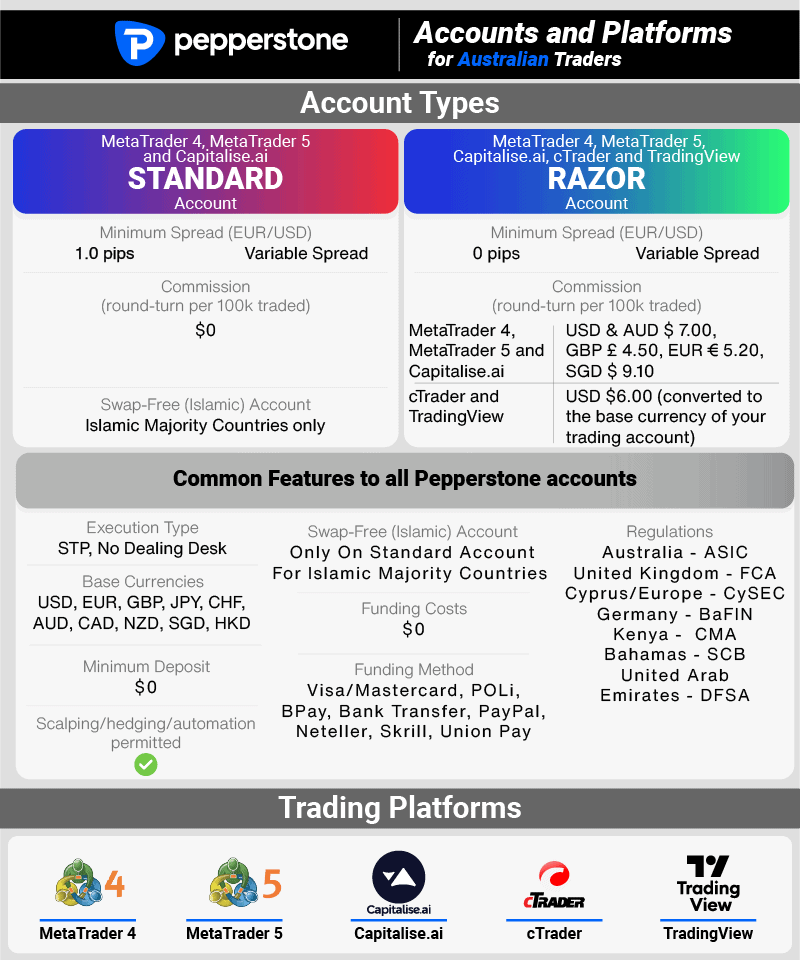

Australian ECN providers allow traders to directly access liquidity pools with no-dealing desks. Through forex trading platforms such as MT4, ECN/STP brokers achieve the lowest spreads and fastest speeds of any Australian broker.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Low spreads from

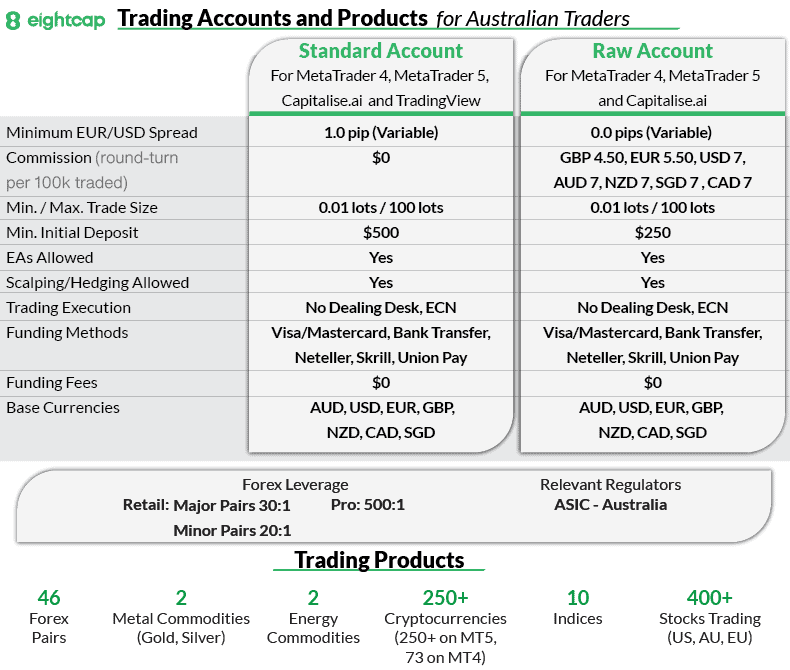

Low spreads from

Ask an Expert

are all of these brokers safely regulated in Australia?

Yes, all the brokers on this list are regulated by ASIC.

What are the disadvantages of ECN?

Disadvantages of using an ECN include the need to pay commission in addition to the spread however since spreads are lower than with a standard account, the overall cost will be lower. You are also reliant on the broker using competitive liquidity providers ECN Brokers often also require a higher minimum deposit requirement as they want to attract serious traders and in some cases will not accept small lot sizes.

Is ECN better than a standard account?

Firstly, standard account can use ECN execution but is often understood to refer to a RAW spread account. RAW spread accounts tends to have lower costs than a Standard account and are often but not always necessarily better.