When I have traded with both demo and live accounts I have found EA traders one of the best tools in the automated trading toolkit. EAs can assess more financial markets than is possible for me to do myself and can do this 24/7. EAs also remove emotions that can affect my trading decisions.

I created this forex EA guide to cover in-depth these areas:

- How forex EA trader works

- How you can run an EA on particular trading software (MT4)

- What advantages does EA trading offer

- What you should take into account before using EAs

An Introduction to Forex EAs Trader

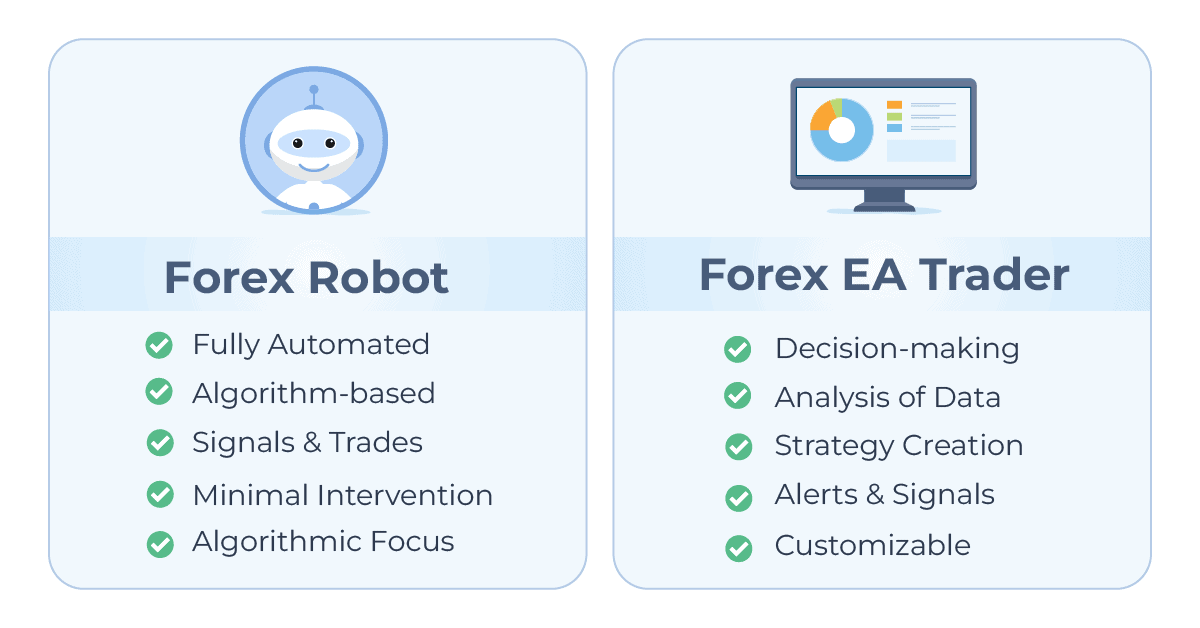

A Forex Expert Advisor is software that analyzes market conditions and utilizes algorithms and technical indicators to notify Forex traders of potential market opportunities. I’ve seen firsthand how this type of algorithmic trading software helps find the best entry points for trade by indicating the lowest price level to buy and the highest price level to sell.

These indicators use a set of yes/no rules and sophisticated mathematical models to help traders implement their strategies. In my trading, I’ve found this particularly useful for maintaining consistency in my approach.

EAs can be utilised across various forex exchange platforms. Many of these platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), offer the flexibility to fully customize trading systems. I’ve found this flexibility particularly useful for applying personalized systems to my trading accounts.

EAs are usually built using MetaQuotes Language (MQL). Specifically, MetaQuote language (MQL4) can be used to develop 4 different types of automated programs:

- Expert Advisors

- Custom Indicators

- Scripts

- Library

I’ve observed that developers constantly backtest the best strategies, or in other words, they assess their viability by discovering how well those strategies would perform when historical data is used.

What makes a Forex EAs crucial?

In my years of trading, I’ve realized that the Forex market’s 24/5 operation makes it impossible for even the most experienced traders to monitor, analyze, and make trading decisions on market developments around the clock.

This is where an EA comes in. I’ve found that this forex trading robot can trade continuously without ever needing a break. It processes market data quickly and accurately, helping me make better decisions with my financial instruments.

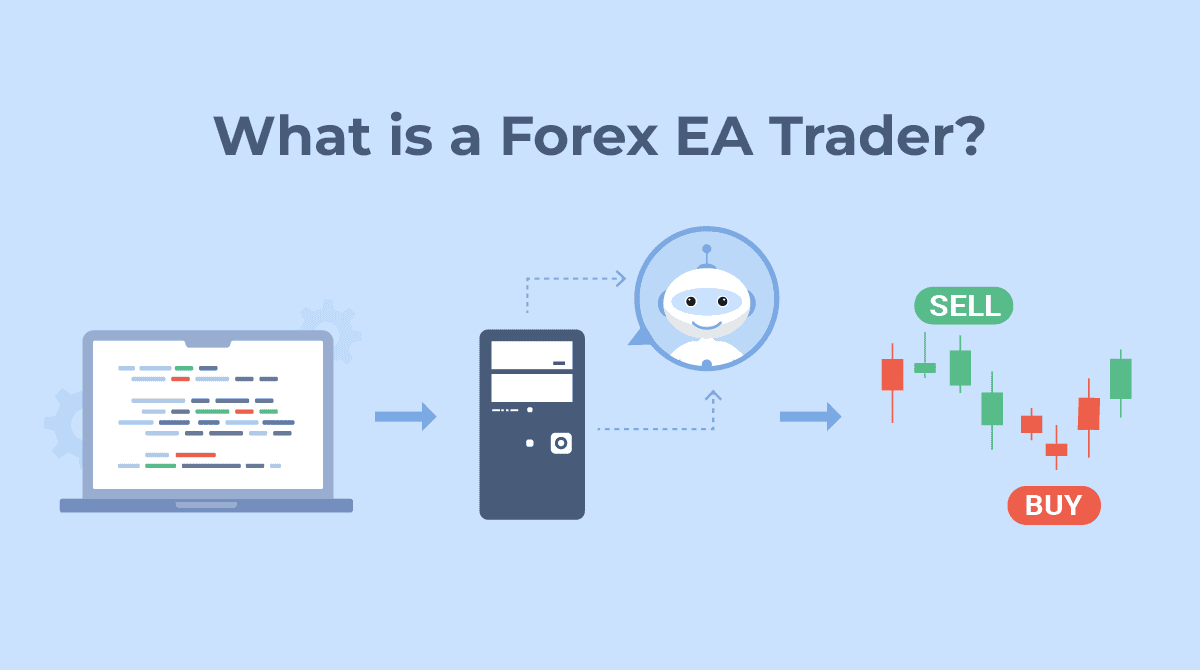

How Does a Forex EAs Trader Work?

In my experience, Forex expert advisors use various pieces of information, such as price data and market trends, to decide what action to take next. By analyzing this data, the EA can create strategies and take trades automatically. I’ve found this process can lead to effective and successful trading strategies.

To start trading with an EA, you first need to set it up with your trading platform. I’ve seen EAs programmed to automatically generate Forex signals and alert traders to market opportunities.

On the other hand, a Forex robot, or another type of automated trading system, uses algorithms to identify market patterns, generate trading signals, and execute trades automatically on a trader’s behalf to take profits and manage stop-loss controls.

That being said, some Forex EAs are designed to take full control of one’s trading account. Such an EA will analyze a trader’s current account balance and then decide what portion of it to put at risk. In my trading, I always adhere to the golden rule of risking no more than 1% to 2% of the total account balance on each trade.

Types Of Forex Expert Advisors

In my trading career, I’ve encountered several types of Forex EAs. Here’s a summary of the main types I’ve worked with:

| Forex EA Type | Purpose | Key Features |

|---|---|---|

| Forex News EA | Trades based on major news and market volatility. | Responds to central bank decisions, GDP, and inflation. |

| Forex Hedge EA | Uses opposing positions to hedge against losses. | Cancels hedge if profitable. |

| Forex Breakout EA | Trades on breaks of key levels (support, resistance, moving averages). | Constantly analyzes for breakouts. |

| Forex Scalper EA | Trades frequently to profit from small price movements. | Uses technical indicators, optimal with narrow spreads. |

| Forex Adaptive EA | Adapts to market conditions using machine learning. | Preferred by advanced traders for dynamic strategies. |

Here are more detailed descriptions of each Forex EA type:

1. Forex News EA

It will usually keep track of major news announcements and buy and sell currencies based on the market volatility around news events. The EA reacts to events such as central bank policy decisions, GDP, employment growth, inflation, and other macroeconomic reports and alerts traders of potential opportunities to open a position.

2. Forex Hedge EA

The hedge expert advisor is a strategy that places two opposing positions (buy and sell) in the same currency pair, to protect against adverse price movements. In case the original position closes at a loss, the hedge positions (which are in the opposite market direction) will generate profits. In case the original position closes at a profit, the hedge positions may not even be triggered and will instead be cancelled. Since “perfect risk management” does not exist, this EA will simply help traders minimize drawdown.

3. Forex Breakout EA

The breakout EA is designed to take advantage of those situations where the price breaks a significant level. The significant level can be an important support and resistance level, a moving average, a previous swing high and low, etc.

This expert advisor type will conduct constant technical analysis of market conditions to determine when a breakout occurs in a given currency pair. A breakout often leads to quick and sharp price movement. In this regard, retail traders are better off using an EA who can react more quickly to changes in price trends.

4. Forex Scalper EA

The scalping expert advisors is an automated trading system that will buy and sell multiple times a day in an attempt to capture a profit from very small price movements. Scalping in the foreign exchange market involves buying and selling currencies based on technical indicators (RSI, MACD, stochastic, moving averages, etc.).

This EA works best when currency pairs’ spreads are narrower and the trading platform’s execution speed is faster. A true low-latency forex broker may be the best choice for Forex traders who employ scalping strategies. While a Market Maker is not suitable.

5. Forex Adaptive EA

The adaptive expert advisor is a trading system that as the name suggests adapts to the constant market changes. Adaptive quantitative trading relies on a machine-learning algorithm to come up with the most profitable trades.

EAs On MetaTrader 4

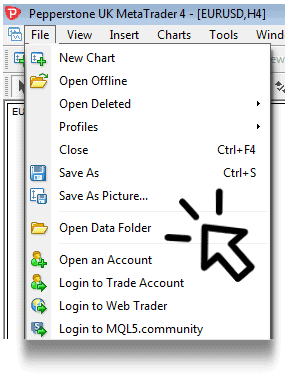

Once you have found an EA to use on the MT4 platform, you will have to copy it into the “Experts” folder where the trading platform is installed on your PC. That folder should be located on the “C:” drive. The fastest way to locate the installation folder on your PC is to go directly to your MT4 platform –> File –> Open Data Folder (see figure below).

Each EA is comprised of two files:

- .ex4 – used to launch the EA in the MT4 terminal.

- .mq4 – used to adjust the code of the EA.

I’ve noticed that more complex EAs may contain extra files to operate correctly. All files needed for the working process of the EA can be found in the Data Folder of the MT4 Terminal. Once the platform is launched, you need to click on “File” in the navigation menu and then select “Open Data Folder”. Inside it, you need to go to the “MQL4” and then the “Experts” folder. After that, you need to copy and paste the two files (.ex4 and .mq4) into that folder.

In case the EA is based on custom indicators, they should be placed in another folder – MQL4 –> “Indicators”. .dll files should be placed in MQL4 –> “Libraries” folder. Once all the files are copied into the respective folders, you need to open the “Navigator” section of the MT4, right-click on the “Expert Advisors” and then click on “Refresh”. Your own EA will now be successfully installed in the MT4 Terminal and can be found in the “Navigator” section.

Allow Automated Trading On MT4

Before launching your EA, follow these steps:

1. Check Settings: Go to “Tools” > “Options” > “Expert Advisors” and ensure “Allow automated trading” and “Allow DLL imports” are enabled. Verify that “AutoTrading” is green on the MT4 terminal.

2. Launch EA: Open a chart for the desired instrument and timeframe. In the “Navigator” section, drag your own EA onto the chart or double-click it. Confirm settings in the EA’s window: “Allow live trading,” “Enable alerts,” “Allow DLL imports,” and “Allow import of external experts” should be enabled. Adjust parameters in the “Inputs” tab.

3. Verify Operation: Look for a smiley face in the top right corner of the chart to ensure the EA is active. Check “Experts” and “Journal” for any error messages.

VPS Hosting For Forex EAs

I’ve found that in order to allow an EA to operate even when the PC is turned off, Forex traders may use a virtual private server (VPS). What the latter does is host the MT4 on an external server, which operates all the time, allowing the EA to function >How To Run An EA On MetaTrader 4 (MT4)

From my experience, you can either build an EA for MT4 by using the MQL4 programming language or for the MT5 using MQL5. Alternatively, I’ve seen traders build less sophisticated EAs with the help of the platform’s inbuilt wizard. For example, you can build an EA to detect mean reversion opportunities on a given currency pair (say GBP/USD) with the use of the 20-day Exponential Moving Average indicator.

I’ve used such EAs to constantly monitor that Forex pair and alert me when GBP/USD breaks out of the 20-day EMA. You can also use a pre-built expert advisor on the MT4 software.

Advantages of EA trading

Throughout my trading experience, I’ve noticed several benefits to using Expert Advisors (EAs) in trading:

1. Easy To Use

First, an EAs can easily be accessed and used. A trader doesn’t need to be that well-versed in MQL coding to make changes to an expert advisor’s code.

Meanwhile, people who feel confident that coding is their strength will always be able to create an EA exactly according to their preferences.

2. Flexibility

Second, even though a Forex robot is usually meant for use in Forex trading, it offers sufficient flexibility to be applied in trading other CFDs (on Commodities, Stock Indices, Cryptocurrencies, and so on).

The expert advisor can be programmed to react to price moves, indicators, or news announcements across a variety of tradable instruments.

3. Saves Time

Third, using an expert advisor can save traders time. The software will constantly monitor market developments and will do so in a much more precise manner than most human traders would. The EA will run every day without interruption, while traders will be able to focus on other daily activities (work engagements, hobbies, spending time with family, etc.) without missing a single trading opportunity.

4. Trading Robots Are Emotionless

Fourth, emotions such as greed or fear can always affect manual trading. Emotions can prompt you to continue holding a losing position for longer than you should, simply because you do not want to take that loss. The EA’s algorithm simply views trading in the financial markets in black and white, which is a series of instructions that must be followed.

5. You Can Know The EA’s Past Performance Ahead Of Time

Last but not least, you can know ahead of time the EA’s past performance. Traders can backtest their expert advisor on the MetaTrader 4 platform before allowing it to operate through a live account. Backtesting is the process through which we can test the potential profitability of a trading system.

Things To Consider Before Using an EA

Before using an EA, I always recommend traders pay attention to the following considerations:

EA needs constant optimization

Regardless of that emotions are completely taken out of the decision-making process, and the lack of human interaction makes an EA incapable of reacting quickly to changing market conditions and incapable of “thinking” in a creative way. Therefore, the performance of an EA needs to be constantly checked, so that a trader can determine whether it is in unison with his/her trading goals.

Be aware of the EA scams

The Forex space has been flooded with EAs that are nothing more than a scam. In case a trader comes across an EA product that promises greater returns at a very affordable price compared to those of some of the most successful fund managers, then perhaps it is an offer too good to be true!

Carefully researching a particular EA or trading robot before buying it is imperative. Be aware of martingale EA systems, which increase the USD value of your position after a loss.

You need a VPS to run the EA 24/5

EAs can only be accessed from the device where it has been installed, and can only operate when that device is turned on and when the platform is connected to the Internet. Note that the EA service can experience interruptions due to power outages or Wi-Fi connectivity problems. Therefore, the solution is a virtual private server (VPS), which allows the EA to operate around the clock.

Final Thoughts

In my years of trading, I’ve found many benefits to using Expert Advisors (EAs). They provide automated execution, ensuring consistent trading decisions without emotional interference. I’ve particularly appreciated their ability to operate 24/7 and the fact that they can be backtested with historical data to refine strategies.

If you are considering a free pre-built EA, I always stress the importance of conducting thorough research and reading reviews from other traders. I recommend starting by understanding what a forex EA trader is and testing the EA on a demo account to assess its performance and suitability for your trading needs, before investing with real money.

This approach has allowed me to evaluate EAs’ effectiveness without risking real capital, and I believe it’s a crucial step for any trader considering the use of EAs.

FAQ

What is EA Trading in Forex?

EA trading involves using Expert Advisors (EAs), which are automated programs on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. EAs use algorithms to monitor the forex market and execute trades based on your settings, either notifying you of opportunities or automatically opening positions.

Do Forex EAs work?

Yes, forex Expert Advisors (EAs) can be effective and profitable, but their success depends on the EA’s strategy and market conditions. It’s important to ensure the EA is compatible with your broker and to backtest its results for better performance.

Why use EA for trading?

Using an EA helps you manage your time by monitoring the market all day and executing trades quickly. It maximizes opportunities, removes emotional trading, and lets you either use it for alerts or automate trades while you monitor the results.

How do I set up EA trading?

- Open MT4 and go to File → Open Data Folder.

- Navigate to MQL4 → Experts and copy your .ex4 and .mq4 files into this folder.

- If the EA uses custom indicators, place them in MQL4 → Indicators. Place .dll files in MQL4 → Libraries.

- Refresh MT4 by opening the Navigator section, right-clicking on Expert Advisors, and selecting Refresh. Your EA will now be available in MT4.

Are Forex EAs legal?

Yes, Forex EAs are legal in most countries. However, check local regulations as some nations restrict automated trading or have specific rules for EA use.

Disclaimer

Forex trading is extremely risky and you should practice effective risk management and never trade with money you cannot afford to lose. Forex education provided in this forum is for general information purposes only and does not consider your circumstances or suitability.

Ask an Expert