Top ECN Brokers For Singapore Traders

By choosing an ECN forex broker, you can get lower spreads as there is no dealing desk. Below, lists the ECN forex accounts from the best forex brokers varied by criteria such as minimum deposit requirements, trading platforms and CFDs offered.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Here is our list of the best ECN forex Brokers for Singapore Traders:

- Pepperstone - Fast Execution and Competitive Commissions

- IC Markets - Low Minimum Deposit And Spreads

- Interactive Brokers - Volume Traders

- Axi - Low Spread Broker Specialising In Metatrader 4

- IG - Largest Forex Broker Offering A Direct Market Access Account

- FXTM - Specialist ECN Broker Account (Not Singapore Regulated)

- FxPro - No Dealing Desk Account But Higher Spreads

- Saxo Markets - Regulated ECN Broker with High Minimum Deposit

Who are the best ECN brokers in Singapore?

Pepperstone ranks first for Singapore with true ECN execution, RAW spreads from 0.10 pips and direct market access through multiple liquidity providers with 77ms order processing. We compared ECN brokers on their depth of market visibility, price improvement frequency and execution quality during volatile Asian trading sessions to separate genuine ECN models from market maker brokers.

Pepperstone: The Best ECN Forex Broker For Singapore Traders

After a thorough analysis of brokerage services, I chose Pepperstone as the top ECN Forex broker for Singaporean traders. This is for having fast execution speeds, low commissions (using cTrader), and diverse range of ECN platforms.

Admittedly, Pepperstone not being a MAS-regulated broker might initially seem off-putting. However, you will be onboarded by the CySEC authority in Cyprus which is a prime regulatory body in Europe. Additionally, the broker is one of the best-regulated forex brokers outside Singapore, overseen by top-tier authorities such as ASIC and FCA.

- Great tight currency spreads

- Fast execution and top liquidity

- Algorithmic and social trading tools

- No spot trading, only CFDs

- Not a huge diversity of markets

- Not regulated by MAS in Singapore

Fastest Execution Speeds

I rigorously tested Pepperstone to compare its order execution speeds with other ECN forex brokers. Among the 20 MT4 brokers I tested, Pepperstone ranked among the fastest, living to its reputation as one of the best Forex brokers in Singapore.

Based on my tests, the broker achieved impressive execution speeds of 77ms for limit order and 100ms for market order. With this outstanding performance, Pepperstone placed third in my evaluation overall, while taking the top spot for Singapore traders.

I consider speeds under 100ms to be exceptionally fast for ECN brokers. Having low latency (time delay between placing an order and its execution) significantly reduced my slippage (trade losses), and resulted in seamless trade executions with Pepperstone.

Low Commissions and Good ECN Trading Conditions

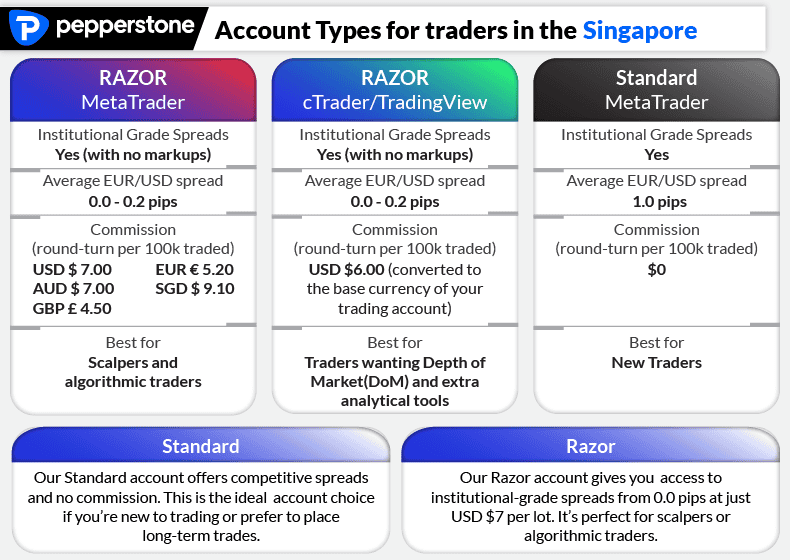

Although Pepperstone offers two account types — a commission-free Standard account and a low-spread Razor account — I found the broker’s Razor Account to provide the best ECN-like trading conditions. It features competitive spreads, fast execution speeds, and low commissions.

Walking you through my trading experience, the broker has low commissions, particularly if you use the cTrader platform at USD $6 per trade, round turn. If you choose any other platform (MT4, MT5 or TradingView), commissions will be the industry standard of $7 per trade, round turn.

Pepperstone also offers highly competitive RAW/ECN-like spreads, averaging at 0.10 pips for EUR/USD. This is notably lower than the industry average of 0.22 pips, and fared exceptionally well on our team’s published spreads analysis of the Top 40 ECN brokers.

I discovered one key reason for Pepperstone’s excellent low trading costs and excellent ECN trading conditions: the broker has access to 20 liquidity providers operating in global markets.

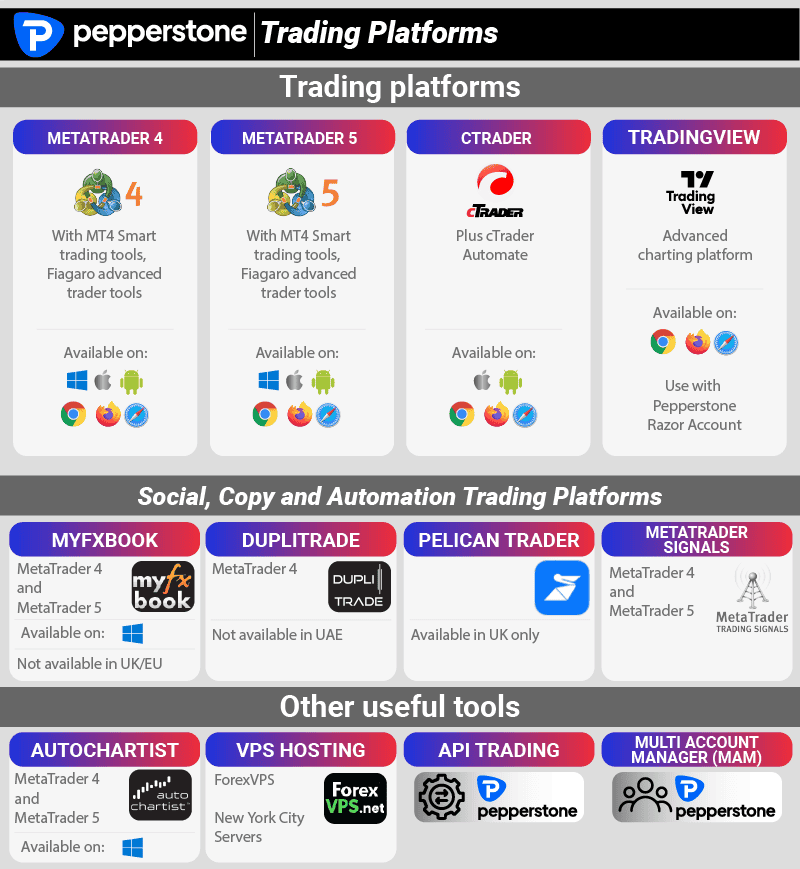

Diverse Range of Platforms for ECN Trading

You can trade with ECN-like trading conditions on four different forex trading platforms: MetaTrader 4, MetaTrader 5, cTrader and TradingView. From my test, all these platforms offer tools to develop your trading strategies, including customisable charting, strategy backtesting, Expert Advisors (MT4) and copy trading.

Where Pepperstone stands out for me, however, is in having an array of add-ons and advanced trading tools specifically for the MetaTrader platforms. The Smart Trader Tools add-on, in particular, consists of 13 Expert Advisors and 15 indicators to develop sophisticated trading strategies.

Pepperstone ReviewVisit Pepperstone

The overall rating is based on review by our experts

IC Markets: Lowest ECN Spreads Account

I find IC Markets’ Raw Spread Account to be very similar to an ECN account, offering some of the lowest spreads I’ve seen thanks to its 25 top-tier liquidity providers. The broker also provides an excellent range of third-party trading platforms and advanced trading tools, allowing traders to fully leverage its ECN-like trading conditions.

Lowest ECN Spreads Account

As an ECN broker, IC Markets offers two retail investor accounts, both featuring low spreads.

IC Markets’ standard commission-free account stood out for having the lowest spreads when I tested it real-time, averaging 1.03 pips across major USD currency pairs like EUR/USD and USD/JPY. This is highly competitive compared to the tested average of 1.50 pips and its nearest competitor, CMC Markets, with 1.11 pips.

For the RAW Spread account, IC Markets had an average spread of 0.32 pips, placing third overall on my list. The broker’s result is also significantly lower than my tested average of 0.50 pips, showcasing the competitiveness of the broker’s spreads against other financial institutions.

While IC Markets charges the industry standard $3.50 commission per side, I found that it is possible to open a RAW Spread account with as little as a $200 minimum deposit, and there will be no deposit or withdrawal fees.

For traders of Islamic faith, IC Markets offers a swap-free account where a flat overnight commission is charged for holding leveraged positions, instead of the standard percentage-based financing fees offered by other trading brokers.

| Tested Raw Spread | |

|---|---|

| Broker | Combined for major pairs we tested |

| Fusion Markets | 0.22 |

| City Index | 0.25 |

| IC Markets | 0.32 |

| TMGM | 0.32 |

| Pepperstone | 0.36 |

| FP Markets | 0.41 |

| Blueberry Markets | 0.43 |

| GO Markets | 0.46 |

| ThinkMarkets | 0.46 |

| Tickmill | 0.47 |

| Eightcap | 0.5 |

| Axi | 0.73 |

| CMC Markets | 0.73 |

| Admirals | 0.79 |

| BlackBull Markets | 0.94 |

Advanced MT4 Trading Tools

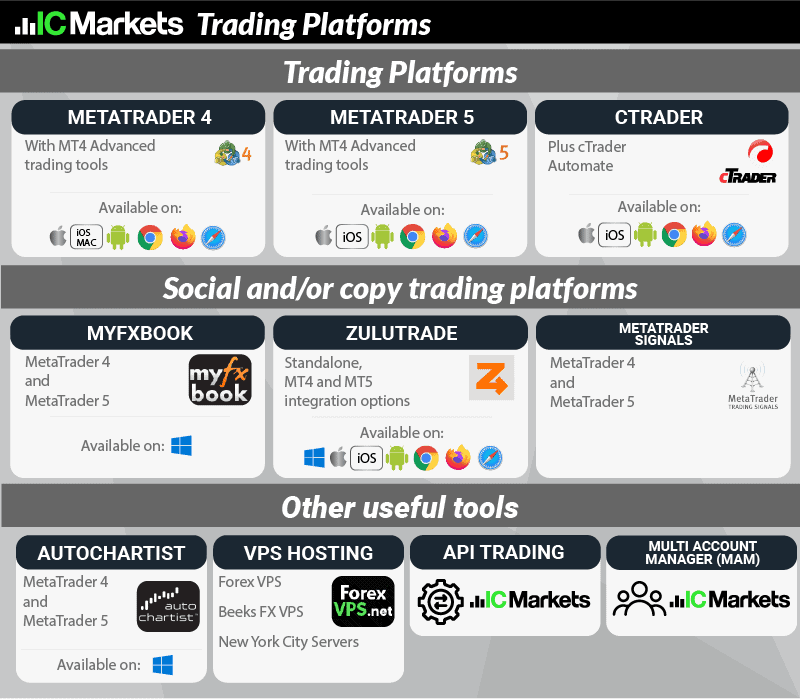

IC Markets gives you a choice of four reliable third-party trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView. Each platform comes with different trading tools and functionality for better decision-making and risk management.

While I enjoy MT5’s robust range of trading tools, the cTrader Copy feature for copy trading, and TradingView’s powerful charting experience, it is the broker’s MT4 Advanced Trading tools that stood out to me the most. Here, you get a user-friendly forex trading platform while taking advantage of an additional 20 trading tools to enhance your overall experience. The line-up includes an alarm manager, correlation matrix, and my personal favorite, stealth orders, which lets you hide entry and exit levels from the market when placing orders.

This gave me a great advantage at getting ahead of the market and earning more positive slippage at times. Though, disclaimer, it also meant I could lose more slippage than a normal order.

Interactive Brokers: Top MAS Regulated ECN Broker

After my extensive research, I found Interactive Brokers to be one of the top MAS-regulated brokers in Singapore, offering the lowest ECN spreads for high-volume traders. With the broker’s complex trading platforms and fee structure, I recommend IBKR for experienced, active traders.

Discounts for High Volume Traders

Given that Interactive Brokers derives its market prices from 16 global exchange dealers, there are no markup or fees built into the spreads, with ECN-like spreads as low as 0.1 pips for EUR/USD.

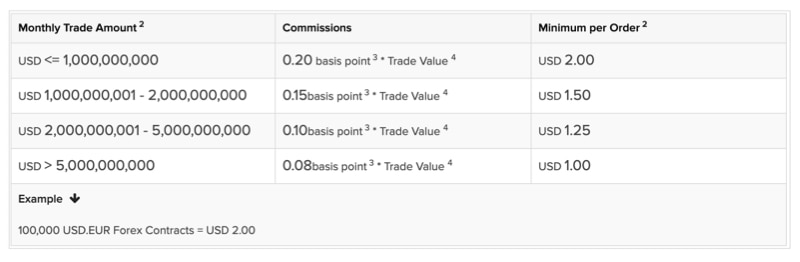

From my testing, I am convinced that the greatest benefit of being an Interactive Brokers client is the broker’s tiered volume-based commission structure, where fees depend on your monthly trading volume.

High-volume traders are rewarded with lower commission fees ranging from 0.08-0.2%. Additionally, if you are an IBKR Pro Account client, you will earn interest on idle cash balances over $10,000.

One minor downside to Interactive Brokers is the imposition of inactivity fee, amounting up to $20 a month. This is charged if you do not generate at least $20 in commissions or maintain a balance of $100,000. Likewise, a $10 inactivity fee is observed if commission fees are less than $10 per month, or your balance drops below $2,000.

One slight downside to Interactive Brokers is that a high inactivity fee of up to $20 a month is imposed if you do not generate at least $20 in commissions or maintain a balance of $100,000. Likewise, a $10 inactivity fee is imposed if commission fees are less than $10 per month, or your balance drops below $2,000.

Sophisticated Platforms and Product Range

Given that Interactive Brokers derives its market prices from 16 global exchange dealers, there are no markup or fees built into the spreads, with ECN-like spreads as low as 0.1 pips for EUR/USD.

From my testing, I am convinced that the greatest benefit of being an Interactive Brokers client is the broker’s tiered volume-based commission structure, where fees depend on your monthly trading volume.

High-volume traders are rewarded with lower commission fees ranging from 0.08-0.2%. Additionally, if you are an IBKR Pro Account client, you will earn interest on idle cash balances over $10,000.

One minor downside to Interactive Brokers is the imposition of inactivity fee, amounting up to $20 a month. This is charged if you do not generate at least $20 in commissions or maintain a balance of $100,000. Likewise, a $10 inactivity fee is observed if commission fees are less than $10 per month, or your balance drops below $2,000.

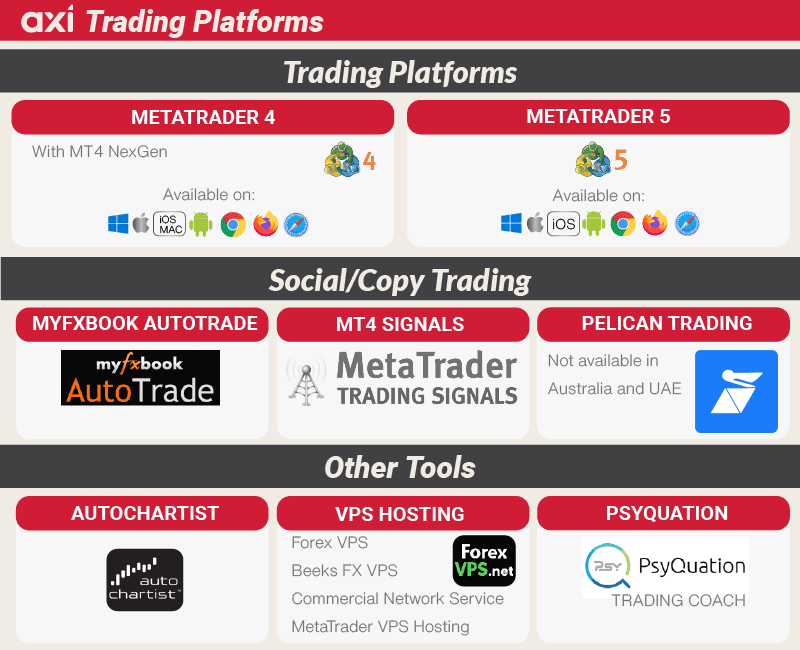

Axi: Best MetaTrader 4 ECN Account

Axi (formally AxiTrader) has the best MetaTrader ECN Account, designed for experienced traders wanting access to ECN-like spreads and fast execution speeds. Similar to an ECN trading environment, my tests found that the MT4 Pro account provides traders spreads as low as 0.0 pips, with Axi working with top-tier international liquidity providers.

MT4 Pro Account Spreads

While Axi offers a Standard account for beginners and an Elite account for experienced traders, I particularly like the MT4 Pro Account due to competitive spreads and $0 minimum deposit.

While there are commissions of USD 3.50 per side, the MT4 Pro account offers competitive spreads averaging 0.2 pips for USD/JPY, 0.3 pips for EUR/JPY and 0.4 pips for EUR/GBP. These all placed under the tested industry average of 0.38 pips, 0.74 pips, and 0.57 pips respectively.

Fast MT4 Execution Speeds

When I traded forex markets on Axi’s MT4 demo account, I took note of the broker’s fast execution speeds, particularly for limit orders. Axi’s average speed came at of 90ms for limit orders, which, being under 100ms, is very fast and placed among the top 4 brokers I tested.

In my opinion, the fast execution speeds offered by this broker demonstrate its superior ECN trading conditions, resulting in lower latency and reduced slippage (losses from trading) overall.

Superior MT4 ECN Trading Experience

Overall, Axi’s MT4 user experience was up there with the best I’ve ever tested, at par with Pepperstone. When testing this broker’s MT4 NextGen enhancement tool, I particularly loved utilizing the Alarm Manager, which alerted me when my stop loss and take profit orders approach. Though, it’s worth noting that downloading MetaTrader’s latest MT4 NextGen software for free requires a minimum deposit of $1,000.

Other useful tools I managed to utilize with the MT4 NextGen platform are: correlation trader, sentiment indicator, economic calendar, forex news, session map, as well as an automated trade journal.

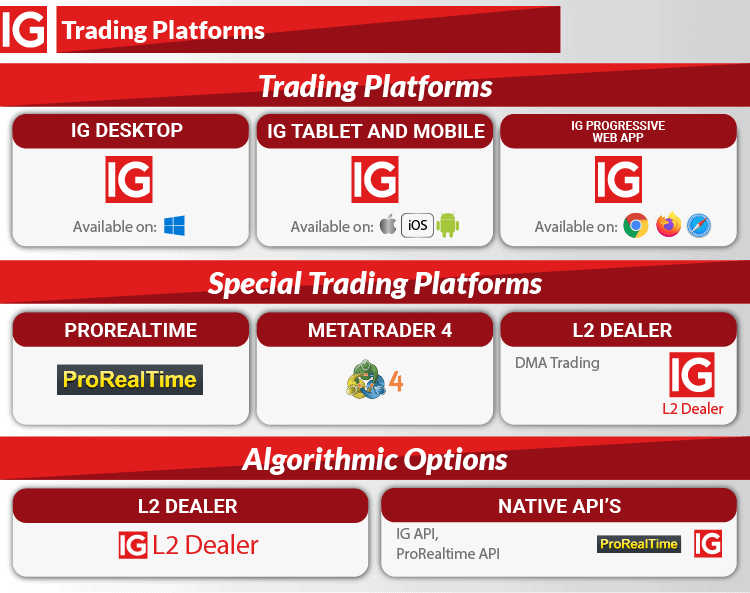

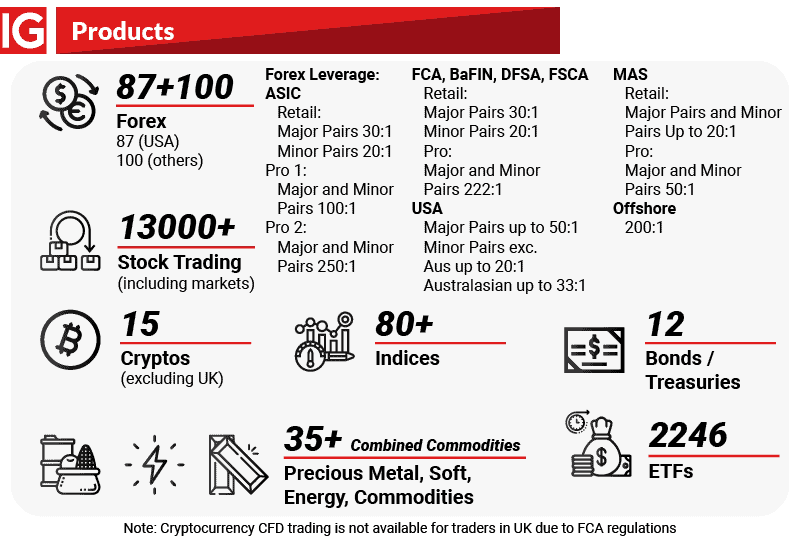

IG Markets: Huge Product Range With DMA Account

IG Markets is a Monetary Authority of Singapore (MAS)-regulated broker that accepts clients from Singapore and internationally. In addition to having access to over 12,000 financial instruments, which is one of the widest ranges I’ve encountered, this forex broker offers Direct Market Access (DMA) to ECN-type marketplaces and liquidity providers.

Direct Market Access (DMA) Trading

Aside from a CFD trading account which features no commissions, IG Markets offers a DMA (Direct Market Access) account. This is a method of electronic trading where you can execute trades by directly interacting with an electronic order book (much like ECN trading).

I find offering DMA trading unique, providing significant benefits for those seeking deep liquidity, full market visibility, and advanced execution. From my testing, I had access to level 1 and 2 pricing streamed directly from the exchange order books for forex and shares.

This provided valuable market insights and enabled me to predict market trends based on volume-based data at various price levels. IG Markets offers DMA trading through its mobile apps, FIX API or the broker’s own, L2 Dealer platform.

Huge Range of Products

IG Markets has one of the largest product ranges I’ve seen, offering multiple asset classes from CFDs to ETFs.

You can trade over 80 forex pairs and a substantial 12,000 CFDs across shares, indices, commodities, bonds, and cryptocurrencies. If you prefer complex derivatives, you’ll have access to 6,000 ETFs and 7,000 options that’s great for diversifying your portfolio, while taking advantage of the broker’s ECN trading conditions.

FXTM: High Leverage ECN Account With STP

FXTM is a Cyprus-based broker offering an ECN-like Advantage account with straight-through processing (STP) and no dealing desk (NDD) technology. After conducting a comprehensive test on the broker, I found that it provides access to highly competitive spreads, complemented by leverage levels of up to 1:2000, which no other broker offers to traders in Singapore.

Competitive Spreads and High Leverage

Using either of FXTM’s accounts (Advantage and Advantage Plus), I discovered that you can access ECN-like trading conditions with huge leverage limits of 1:2000. However, my spread analysis found that the commission-based Advantage account offers the lowest spreads.

Based on my benchmarks for currency pairs such as EUR/USD, USD/JPY, and GBP/USD, FXTM’s spreads averaged at 0.22 pips, placing among the top 5 out of 40 ECN brokers I tested. The industry average is 0.44 pips, highlighting just how competitive FXTM’s spreads are.

While the broker requires a high minimum deposit of USD 500, this already grants you access to a great leverage of up to 1:2000, which is well above the market average of 1:30 for forex traders. You’ll also be charged USD 3.50 per side in commissions, which is within industry standard.

I appreciate FXTM’s competitive spreads and high leverage options. To take advantage of these, I found that you have access to both MT4 and MT5 platforms. In my experience, these platforms offer everything you’ll need for forex trading, combining powerful tools with user-friendly interfaces.

FxPro: Global ECN Broker With MetaTrader 5

FxPro offers instant, market, or fixed spread order execution, differentiating its offers against other brokers. What I like most about FxPro is that the broker markets itself as a true no-dealing desk (NDD) broker with STP and ECN-like trading conditions.

Diverse Execution Methods

FxPro offers a diverse range of execution methods: market, instant, and fixed spreads. Market execution provides the best available price, instant execution means the price may change between the time of order and execution, and fixed spreads remain constant, as the name suggests.

While there are pros and cons to each execution method, I appreciate that FxPro offers three different types. This flexibility has allowed me to test and determine what works best for my strategy, depending on market volatility and prevailing ECN trading conditions.

Solid Range of Platforms

When I opened an account with FxPro, I discovered a solid range of platforms to choose from including MT4, MT5, cTrader and the FxPro platform itself.

For the best ECN-like trading conditions and features, I recommend the broker’s MT5 RAW account. It offers the lowest spreads (starting from 0.2 pips for EUR/USD) and includes added features such as EA trading, DoM (depth of market) liquidity, and superior charting tools with 35 indicators and 21 timeframes.

Having said that, there are still many benefits to MT4 with the availability of instant and fixed spread execution methods, while cTrader offers a larger range of modern features, particularly for algorithmic trading.

*Your capital is at risk ‘84.69% of retail CFD accounts lose money’

Saxo Bank: Top VIP Account For High Volume ECN Traders

Saxo Bank is a MAS-regulated broker in Southeast Asia, connecting traders with international capital markets. I like this forex broker for having a wide range of offers: 182 forex pairs and over 9,000 CFDs, including ETFs, futures, commodities, stocks, and bonds.

For me, where Saxo Bank stands out the most is the broker’s VIP account which I highly suggest if you are an active trader looking for ECN-like spreads and high-volume discounts.

Top VIP Account for High Volume ECN Traders

If you’re an active trader, I found that you can upgrade your retail investor account to VIP status with Saxo Bank and enjoy tighter spreads and other benefits. Although the broker doesn’t publish spreads for the VIP account, its promotional materials indicate that spreads are 30% lower for Platinum accounts and higher.

Given that Saxo Bank averages a 1.2 pip spread for EUR/USD on its Standard account, my calculations indicate that the VIP account would offer spreads of 0.84 pips or lower. This makes the VIP account ideal for high-volume traders, especially considering the high minimum deposit requirement of SGD 1 million.

Although this is a high initial minimum deposit, Saxo Bank doesn’t charge commissions, so as long as you can maintain the trading account limits, there are no extra forex trading fees.

Exclusive VIP Account Features

In addition to lower spreads, the major benefit of a VIP account then lies in the extra account features. These VIP features include around-the-clock, priority client support (in your chosen language), from a dedicated sales trader to a personal relationship manager.

One of the highlights is having the opportunity to speak directly, one-on-one, with the broker’s top-tier strategists in SaxoStrat to discuss macro outlook and market trends. Additionally, you will receive invitations to exclusive VIP events from market-focussed flagship events to entertainment and sporting events.

Trading Forex in Singapore

Residents of Singapore can legally trade forex in Singapore. Domestic brokers based in Singapore are regulated by the Monetary Authority of Singapore (MAS), while other international forex brokers are regulated by top-tier authorities such as ASIC and FCA. MAS promotes efficient and competitive financial markets, with Singapore residents who participate in financial markets in addition to their regular occupation enjoying tax-free capital gains on forex trades.

The Monetary Authority of Singapore acts as the country’s central bank and regulator of financial markets. Singapore is the fifth largest forex trading centre in the world and the largest in Southeast Asia. MAS ensures Singapore’s financial markets are upheld to the high standards seen in global markets such as the United Kingdom and Australia. As with ASIC (AU) and FCA (UK) regulations, MAS-regulated brokers are required to hold traders’ funds in segregated accounts where the money is prohibited from being used as operational capital.

As cryptocurrency is a highly volatile asset, trading Bitcoin etc is considered high risk. It is worth noting that MAS does not offer any legislative protection or risk warning regarding cryptocurrency trading. This is due to cryptocurrency assets not being classed as legal tender, yet MAS recently announced the authority is initiating steps to begin regulating instruments such as Bitcoin. View more on our MAS CFD broker page. View our top ECN global brokers list if you’re considering choosing a broker regulated with another leading regulatory body from ASIC to the FCA.

You can view each category by navigating back to the compare forex brokers SG homepage which lists the other lists of brokers by attribute.

You can view each category by navigating back to the Compare Forex Brokers which lists the other lists of brokers by attribute.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert