Best Australian Trading Platforms: Share, Forex, CFDs, Crypto

The most crucial step for Australian traders is selecting the appropriate trading software. We’ve matched each trading platform with the best broker suited for specific trading needs based on trading fees, service quality, speed, and features.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Great Trading Software With The Most Charting Tools

Great Trading Software With The Most Charting Tools Ideal Trading Platform For Day Traders And High-Volume Traders

Ideal Trading Platform For Day Traders And High-Volume Traders

Ask an Expert

I’m looking for a fixed spread trading platform. What do your recommend?

Most brokers offer variable spreads, so it is important to choose the right broker for fixed spreads. Brokers that offer Fixed spreads include AvaTrade, easyMarkets, FxPro and OctaFX. You can find out more about these brokers our best Fixed Spread Brokers page.

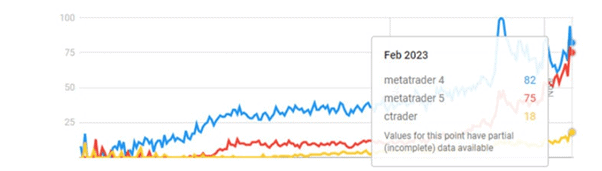

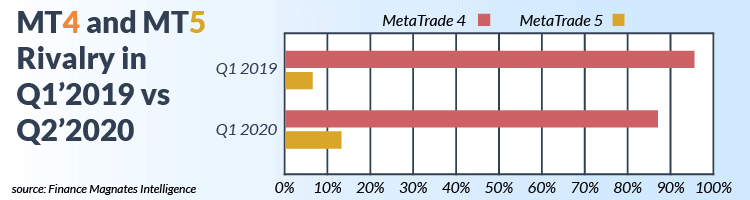

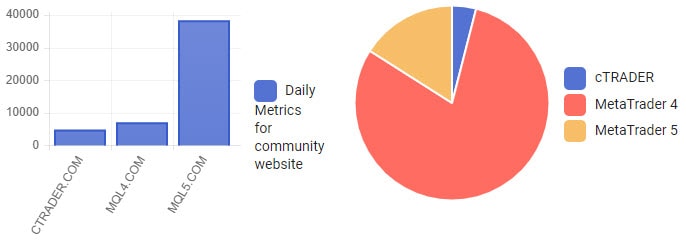

In Australia what is the most popular trading software used for forex?

MetaTrader 4 is the most popular software for currency trading but MetaTrader 5 is quickly gaining market share due to its additional CFD functionality. This makes it easier to trade gold, indices, shares and even crypto.

Are prop firms the same as a broker?

While both roles involve researching investments and trading securities, the nature of the work is different. Stockbrokers primarily serve as intermediaries, executing trades on behalf of retail clients, whereas traders also execute trades for institutional clients but also invest their firm’s capital.

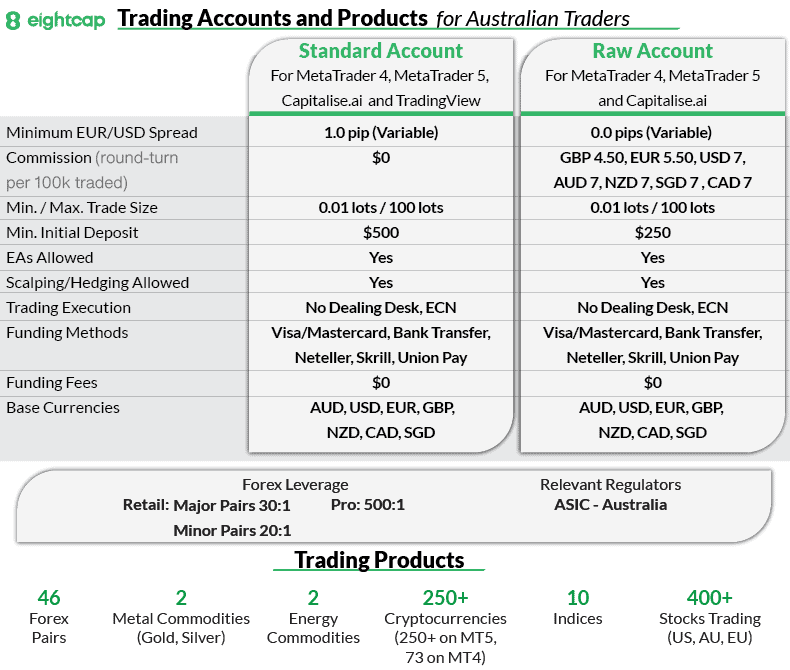

Which country is Eightcap based in?

Hey Logan, Eightcap is based here in Australia.