Forex market hours run 24 hours a day across 4 major forex trading sessions. This forex trading hours guide will teach you the times forex markets open for trading. Trading in busy times means more liquidity and this can impact your trading strategies.

What Are The Forex Trading Hours For Currency Traders?

Forex markets are open 24 hours a day, five days a week. For Australians, forex trading kicks off at 7:00 am on Monday, and runs continuously until 7:00 am on Saturday. This extended trading window provides a distinct advantage over the stock market, which operates on a much more limited schedule.

Are Forex Markets Open 24 Hours a Day?

Yes, foreign exchange markets are open 24 hours during weekdays.

One of the unique aspects of forex trading is that there’s always a major market open somewhere in the world, allowing for continuous trading opportunities during the week.

What are the Four Forex Trading Sessions and Times?

The forex market operates through four major trading sessions, being Sydney, Tokyo, London, and New York. Each market opens at a different time, with overlapping periods leading to the greatest liquidity and volatility in the markets, making them prime times for trading forex.

Australian traders will mostly be trading during the Sydney session hours.

Forex Market Time Zone Converter

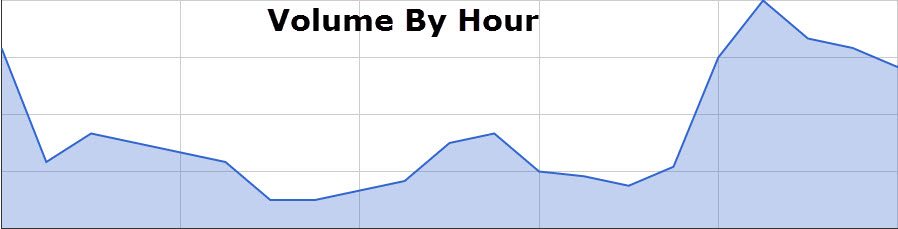

The Forex Market Time Zone Converter below serves as a valuable tool for traders. It shows the four major trading sessions, as well as the current trading volume. By adjusting the Draggable clock to your chosen time, you can immediately view the equivalent times and trading sessions in other time zones.

Forex Market Time Zone Converter

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 0

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

Sydney

(UTC +10)

Tokyo

(UTC +9)

London

(UTC +1)

New York

(UTC -4)

Trading Volume is usually

at this time of day.

What is the Most Popular Time to Trade Forex?

The most popular trading times are when sessions overlap on global currency markets

This demonstrates how markets around the world are interlinked.

- Sydney: 7:00 to 16:00 with 8:00 to 11:00 being the busiest time

- Tokyo: 9:00 to 16:00

- London: 17:00 to 1:00

- New York: 22:00 to 7:00

Sydney Session – Australia (AEST)

|

Sydney Session |

Local Time: Australia (AEST) | Time in Japan (JST) | Time in the UK (GMT) | Time in the US (EST) |

|

Open |

8:00 | 10:00 | 18:00 |

17:00 |

| Close | 16:00 | 18:00 | 2:00 |

1:00 |

Tokyo Session – Japan (JST)

|

Tokyo Session |

Local Time: Japan (JST) | Time in Australia (AEST) | Time in the UK (GMT) | Time in the US (EST) |

|

Open |

9:00 | 10:00 | 1:00 |

19:00 |

| Close | 18:00 | 19:00 | 10:00 |

4:00 |

London Session – UK (GMT)

|

London Session |

Local Time: UK (GMT) | Time in Australia (AEST) | Time in Japan (JST) |

Time in the US (EST) |

|

Open |

8:00 | 18:00 | 16:00 | 3:00 |

| Close | 16:00 | 2:00 | 0:00 |

11:00 |

If you’re located in the UK, view our UK forex trading hours page which has all the time zone shifts for British Standard Time.

New York Session – US (EST)

|

New York Session |

Local Time: US (EST) | Time in Australia (AEST) | Time in Japan (JST) | Time in the UK (GMT) |

|

Open |

8:00 | 23:00 | 21:00 |

13:00 |

| Close | 17:00 | 8:00 | 6:00 |

22:00 |

Alternatively, if you’re located in the United States, then view our Forex Trading Hours page, which has all the time zone shifts for Eastern Standard Time.

Best Time To Trade Forex In Australia

Based on Australian Eastern Standard Time (EST), forex market hours are Sydney, 7:00 am – 4:00 pm AEST; at 9:00 am the Tokyo (Japan) forex market opens and then before it closes, the London market comes online at 5:00 pm; New York opens at 10:00 pm and closes at 7:00 am when the Sydney (and New Zealand) forex market opens again.

Most trading occurs when both the American, European & UK forex market hours are open from 10:00 pm to 2:00 am AEST during winter. In summer these hours shift from 12:00 am to 4:00 am due to daylight saving all in local time.

Generally, the opening and closing times of a market are the most important periods, as it often sets the tone for the trading session and can have very high liquidity (especially in the first/last few minutes).

Forex Trading Holidays (Bank and Public Holidays)

During selected key national bank holidays (known as public holidays by Australians) a country’s currency market may close, limiting the overall forex trading sessions. Worldwide, major public holidays such as Easter and Christmas lead to all currency markets closing, including Australia.

Whether trading seizes due to a public holiday depends on the country and trading session. For instance in the US, if there is a public holiday that is not globally recognised such as Thanksgiving, US financial markets close and the worldwide currency markets that are trading do so at lower levels, and are less volatile and liquid.

In Australia, national public holidays do not halt trading or close the Sydney session, but trading volumes are significantly lower.

Holding Forex Positions Over the Weekend and Major Holidays

While forex brokers allow you to hold forex positions over the weekend and during major holidays, it comes with additional risks. In Australia, the forex market is closed from 7am Saturday until 7am Monday AEST (5pm Friday – Sunday 5pm EST). During this time, there is no trading activity and liquidity is incredibly low.

Holding a position during this time exposes you to the potential of significant gaps in market prices triggered by factors such as economic events and political news. The same goes for major public holidays that are globally recognised. Holding a position over these periods where forex markets are closed may result in increased spreads and unexpected price movements when the market reopens.

Another consideration are swap or rollover fees. Such fees may be higher for positions held over the weekend or holiday periods, increasing the costs of your trade.

Therefore, while it is possible to keep positions open over weekends and public holiday, its vital to factor in all costs and ensure you are employing risk management tools such as stop loss orders to minimise losses.

Forex Trading Hours and Daylight Savings

Although forex markets are open 24 hours, it’s vital to keep in mind the start and end times of each key areas session are impacted by daylight savings.

In Australia, the Sydney forex trading session usually operates from 7am to 4pm (AEST). But, during daylight savings, the Sydney sessions runs an hour later from 8am to 5pm (AEDT).

For Australian traders, the Sydney session will start operating from 8am to 5pm from the first Sunday in October until the first Sunday in April.

| Sydney Session Trading Hours | Forex Market Hours | Month Starts | Month Ends |

| Australian Eastern Standard Time (AEST) | 7am – 4pm | First Sunday in April | First Sunday in October |

| Australian Eastern Daylight Time (AEDT) | 8am – 5pm | First Sunday in October | First Sunday in April |

Specific Sessions and High-Volume Hours

While foreign exchange trading is divided into four key sessions (Sydney, Tokyo, London and New York), periods of high volatility occur when the New York and London sessions overlap from 12pm to 4pm GMT. When trading from Australia, this equates to the following time periods depending on daylight savings:

- During non daylight savings time (AEST) the London-NY overlap occurs between 10pm to 2am

- During daylight savings time (AEDT) the London-NY overlap occurs between 11pm to 3am

During this window, both liquidity and volatility are at their peak, providing traders the greatest opportunities for significant price movements.

Forex Hours Q&A

What are the Most Popular Currency Pairs to Trade?

While there are over 170 major, minor, and exotic currency pairs to trade, just seven major pairs account for 85% of forex transactions. The six most popular currency pairs are:

- USD/EUR

- USD/JPY

- USD/GBP

- USD/CNY

- USD/CAD

- USD/AUD

The EUR/USD currency pair dominates the forex market, accounting for 22.7% of daily trading volume. As two of the world’s major currencies, the Euro and the U.S. Dollar contribute to high liquidity in this pair.

Next in line are the USD/JPY and GBP/USD pairs, with daily trading volumes of 13.5% and 9.5%, respectively. The next most popular forex pairs are the USD/CNY and USD/CAD.

The AUD/USD pair constitutes 5.1% of daily trading volume. The Australian Dollar is closely tied to commodity prices, such as iron ore and coal. This provides an edge for Aussie traders who have a good grasp on the commodities market.

Forex Market Cap: How Big is the Forex Market?

With an increase from USD 1.93 quadrillion in 2019 to USD 2.73 quadrillion in 2022, forex markets have grown by 41.45% in just three years.

What is the Daily Turnover of Forex Markets?

The forex markets daily turnover increased 13.6% in the space of three years from 6.6 trillion in 2019 to USD 7.5 trillion in 2022.

Click here to find out more about the most up to date Forex Trading Statistics.

Do I Need Multiple Forex Brokers To Trade All Hours?

The simple answer is no. Almost any Australian forex broker has the ability to access any currency market when open and trade multiple currencies across a trading day. Just because Asian markets (i.e. Japanese) are the only ones open doesn’t mean you couldn’t trade currency pairings such as AUD/USD to EUR/USD.

An interesting fact is that AUD/USD is actually traded the most when the Australian market is closed, highlighting the opportunities that exist for currency traders all the time. It is possible that volatility for these currency pairings will be lower during different periods of the day. But with currency markets volume being multiples of worldwide share markets, there is always an opportunity to trade.

All Australian Forex Trading brokers are open at least 24/5. If the broker is a market maker or uses a No Dealing Desk Brokers, then you will be restricted to trading only from when the Australian markets open on Monday morning till the end of US trading on Friday (or for Australians early Saturday). Not only can you trade through their forex trading platforms, but the currency brokers also keep customer service open during all of these forex trading hours. This is critical if you require assistance even during the early hours of the morning.

On the other hand, if you are using an ECN broker for trading, then trading may be done 24/7. ECN technology allows for trading to be done during all hours because it uses technology to automatically match your order to the best prices on offer in the market. It does not require brokers and liquidity providers to be active in executing and accepting trades.

This is especially handy for those who are not able to trade during conventional market session hours or are using automated trading. If you are using an ECN account, you will need to check with your broker if they allow trading when the market closes.

At What Trading Hours Do Currency Pairings Fluctuate The Most?

There are no set Forex trading hours when currency paring historically fluctuates the most. While volume/liquidity is the highest when multiple markets are open (e.g. when the London and New York markets are open) this doesn’t necessarily mean the currency will fluctuate more. There are though a few general events that can lead to currency pairings having large changes including:

When markets open:

When a new country’s currency exchange market often opens, the first few minutes will see some larger price fluctuation as traders enter the market factoring in movements that have occurred in previous markets. This also impacts the currencies traded from the AUD, JPY, EUR, and GBP to the USD.

When rate decisions are made:

Countries’ central banks such as the RBA make rate announcements on the same day of the month and at a set time. These announcements directly impact relevant currency pairs and increase currency trading. Knowing the key reserve bank dates and times is critical for any trader.

When economic data is released:

Like the reserve bank announcements, government departments regularly release economic performance figures from terms of trade to warehouse orders and production. Like rate announcements, these directly impact currency pairings and can see large fluctuations. In 2015, the Chinese announcements led to the largest fluctuations worldwide’

When multiple market sessions are active:

There are times when multiple markets around the world are open at the same time and those correlating times make the market especially volatile. For example, when the North American New York session starts the US Dollar is particularly volatile. The same goes for the London session and the pound (especially seen in the forex pair GBP/USD), and the Tokyo session with the Japanese yen. This effect is compounded when multiple sessions are open at the same time, for example, the crossover of the New York session and the London session.

There is a similar effect with some smaller markets around the world, for example, Germany’s Frankfurt session has an effect on the Euro price, and the Hong Kong & Singapore sessions have an effect on the Asian markets.

What Forex Broker Features Should Australian Traders Look For?

Australia has the Top Forex Trading Countries, 7th highest interest in forex trading worldwide. To cater to this demand there is a plethora of forex brokers regulated by ASIC which differ by a few different factors:

Leverage Levels

Without leverage, making sizeable profits or losses would be near impossible. While leverage is a great benefit when foreign exchange trading, it also increases your risk profile. Only those with experienced trading activity and a high level of risk appetite should accept a broker’s maximum leverage.

Spreads

There are two ways CFD brokers make money. One way is through spreads which is the difference between the buy and sell rates. The second way is to set commissions based on trading volume. It’s important to work out the volume you plan to trade and then work out which broker will provide you with the best value for money. This can be based on average spreads/commissions. Generally, ECN brokers which allow you to make trades directly without liquidity providers, offer lower spreads than market makers.

Execution Speeds

With currency markets existing often overseas, having fast connections to these markets is critical when individuals trade forex. Making sure that your Fx broker not only has fast connections to overseas markets (e.g. through optic fibre cables) combined with fast servers will help give you the edge when trading outside of Australian market hours. It also reduces slippages. This happens when your order is filled lower/higher than when you placed the order due to the delays in execution speeds. Some brokers have one-click trading, which allows you to execute your trades with one click, thus saving time. Pepperstone offers some of the fastest execution speeds in the industry.

Fail-safes

While all forex brokers offer stop/loss features when trading, it is possible to exceed loss levels set due to slippage. Because of the high levels of risk, traders may select a broker that offers guaranteed stop-loss orders. This means they can’t lose more than a set amount for a trade. Another fail-safe broker’s offer is Negative Balance Protection. This is where brokers automatically exit CFDs traders from the market when their deposit level reaches a $0 balance. Even if slippage does occur, the broker pays the difference. Reading the risk warnings of brokers is important before trading currency.

Regulation

It is also important to understand what country regulates the broker. Australian regulation is considered one of the premium regulators requiring brokers to have training requirements and to segregate clients’ funds into separate accounts. As with any investment product, if it’s too good to be true, it normally is. Play it safe by ensuring the broker has an Australian Financial Services Licence with a good reputation and market share. All brokers trading in Australia such as IC Markets and Pepperstone are regulated by ASIC (Australian Securities Investment Commission). These brokers hold an AFSL licence.

Account Types

Most brokers will offer a range of day trading accounts to suit your needs. These will typically include standard accounts, which will have a fee for each trade executed instead of a commission. These accounts tend to be best if you wish to keep your trade costs simple. Brokers will often have a second type of account, which will base commissions on transactions. These accounts are best suited for high-volume forex traders, as there can be substantial savings when trading using a commission.

Minimum Deposits

When you open a new trading account, the broker will require a minimum deposit. Some brokers do not require any deposit to simply open an account while others have a minimum of $200. You will need to add some funds if you do want to execute actual trades.

Education Resources

Good brokers offer resources such as forex training materials, forex markets reviews, and forex news to help you learn about forex trading and happenings in the forex world. A comprehensive video tutorial series is offered by IC Markets to help you get started with your trading education. There is also a range of technical analysis resources.

You can view our Best Forex Brokers In Australia page to compare low-spread brokers regulated by ASIC.

Ask an Expert

I’m based in Manchester UK need advice if I should select a CFD account or a spread betting account?

You can choose either but realise that CFD trading and Spread Betting are not the same thing. Contracts for difference, or CFDs, are leveraged derivative contracts that track the value of underlying financial instruments such as forex, stocks, indices and commodities such as precious metals energies and soft. If the underlying instrument moves up, then you profit. Spread betting on the other hand is speculatively betting on the price movements of an underlying instrument without actually owning it. This means you can bet the movement will go up or down. Both have pros and cons but spread betting does have tax advantages when you win.

Im looking for clubs or mentors in Australia to learn trading off do you know of any such persons or groups cheers.

No idea sorry but try meetup.com or similar

What to trade on weekends?

Forex Markets are generally closed over weekends so maybe look at other insturments

What is the best timeframe to trade forex for beginners?

Every individual is different for how long they need before they start trading. Sign up for a demo account and practice and test your trading strategies and teach yourself as much about Forex trading as you can. Only start trading when you are confident you can make a profit and only risk as much as you can afford to lose.

What happens after trading hours?

While no individual exchange is open 24 hours a day, the 4 exchange markets overlap meaning you can trade 24 hours a day through the work week. All Forex exchanges are closed over the weekend, when this happens you will not be able to trade Forex. All open position will remain open however you will incur swap fees for keeping your position open.

What time does the gold market open in Australia?

The gold market (like Forex) is oopen from 01:01 – 23:59 Monday to Friday but closed on weekends