ASIC Regulated Forex Brokers

Forex brokers in Australia must be regulated by the Australian Securities and Investment Commission or ASIC, the prime regulator of financial markets in the country. Here are the best ASIC Regulated Forex Brokers based on spread, forex trading platforms, and trading account types.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

The 2025 top ASIC-regulated forex broker list:

- Pepperstone - Best ASIC Forex Broker Overall

- FP Markets - Top Broker For Scalping

- AvaTrade - Great Broker For Day Trading

- GO Markets - Best Broker With Educational Resources

- ThinkMarkets - Good Broker With VPS Services

- IC Markets - Great Broker With Tightest RAW Spreads

- eToro - Best For Social Trading

- Fusion Markets - Best Low Commission Broker

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

86 |

ASIC,CySEC, FSA-S FSCA,FSC-M, CMA |

0.2 | 0.29 | 0.21 | $3.00 | 1.2 | 1.4 | 1.3 |

|

|

|

225ms | $100 | 63 | 11 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

68 |

ASIC, FSCA CBI, KNF, CIRO ADGM, FSC-BVI |

Cross | Cross | Cross | Cross | 0.9 | 1.3 | 1.1 |

|

|

|

160ms | $100 | 55 | 27 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

FCA, FSCA ASIC, FSA-S, CySEC |

0.11 | 0.23 | 0.24 | $3.50 | 1.1 | 1.3 | 1.1 |

|

|

|

161ms | $0 | 46 | 27 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

93 |

ASIC, FSA-S CySEC |

0.02 | 0.23 | 0.03 | $3.50 | 0.82 | 1.03 | 0.83 |

|

|

|

134ms | $200 | 61 | 23 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

48 |

ASIC, CySEC, MFSA FCA, FSA, FINRA |

- | - | - | - | 1.0 | 2.0 | 1.0 |

|

|

|

130ms | $200 (Australia), $50-$100 (EU) | 49+ | 93 | 30:1 | 400:1 |

|

Read review ›

Read review ›

|

92 | ASIC, VFSA, FSA-S | 0.11 | 0.24 | 0.12 | $2.25 | 0.83 | 1.42 | 1.12 |

|

|

|

79ms | $0 | 84 | 14 | 500:1 | 500:1 |

|

Who Are The Best ASIC Forex Brokers In Australia?

As an Australian venturing into retail Forex trading, selecting the best currency trading platform leads to higher chances of success. By this, I mean selecting a broker holding an AFSL license by the Australian Securities and Investments Commission (ASIC) should be a top priority.

In this guide, I will walk you through the best ASIC-regulated online brokers and rate them according to Australian traders’ needs.

1. Pepperstone - Best ASIC Forex Broker Overall

Forex Panel Score

Average Spread

EUR/USD = 1.10

GBP/USD = 1.3

AUD/USD = 1.20

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why I Recommend Pepperstone

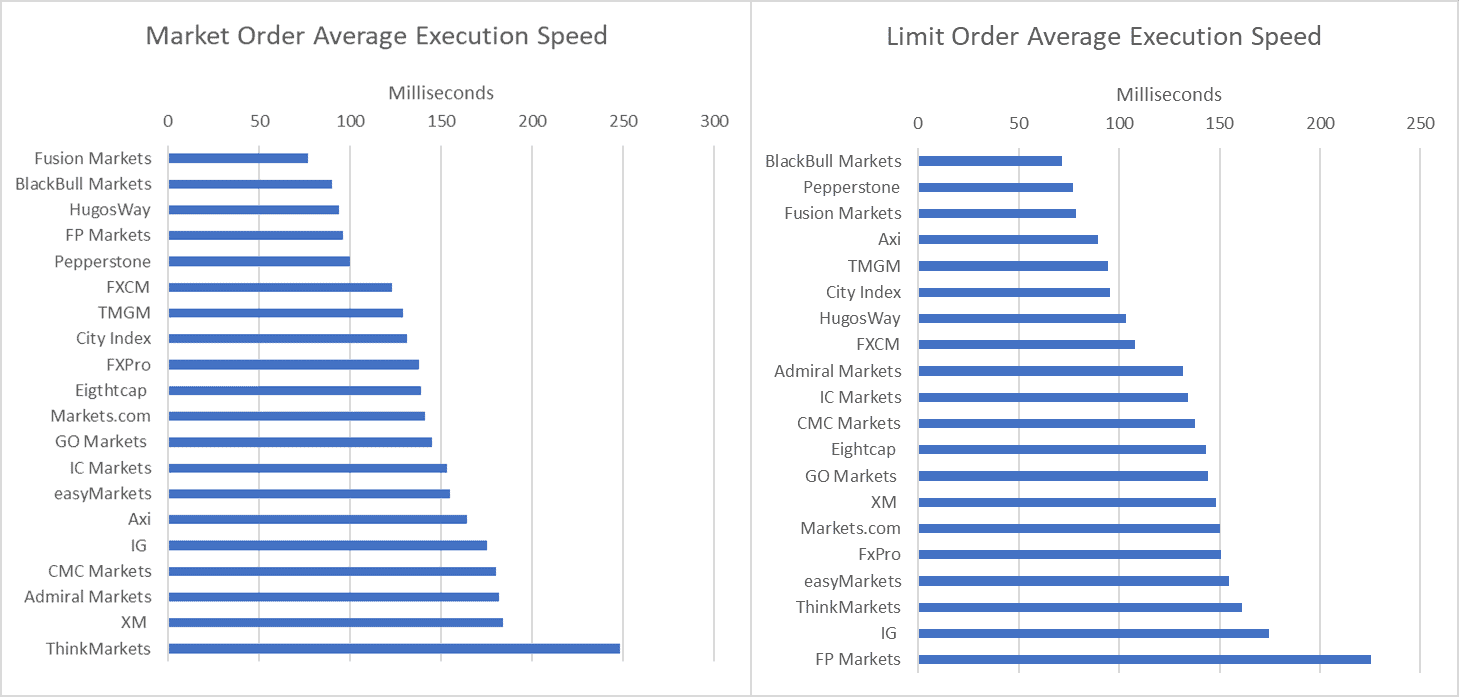

I have Pepperstone a score of 98/100 for their low trading costs, fast execution speed, and wide-range of trading platforms. When I tested the broker, I was impressed to get a 77ms execution speed for limit order — one of the fastest I’ve seen. Such a speed reduces risks brought by volatile price movements.

Another feature I liked is the availability of MetaTrader 4, MT5, cTrader, and TradingView Trading platforms. This variety ensures access to the best tools and features tailored to your trading style and preference.

Pros & Cons

- Offers a wide range of platforms

- Fast execution broker

- Tight average spreads

- It doesn’t provide guaranteed stop-loss orders

- The demo account is limited to 30 days

- Crypto markets are limited

Broker Details

Founded in 2010, Melbourne-based Pepperstone has claimed the top spot for my ranking on the best ASIC-regulated broker. During my testing, the broker has shown stellar performances all across the board, having fast execution speeds, competitive spreads, and a wide range of trading platforms and tools. With all of these factors, I am convinced that Pepperstone suits forex traders of all levels, from beginners to professionals.

Founded in 2010, Melbourne-based Pepperstone has claimed the top spot for my ranking on the best ASIC-regulated broker. During my testing, the broker has shown stellar performances all across the board, having fast execution speeds, competitive spreads, and a wide range of trading platforms and tools. With all of these factors, I am convinced that Pepperstone suits forex traders of all levels, from beginners to professionals.

Fast Execution Speeds

The mark of a good regulated broker is the trading conditions you’ll receive, which includes execution speeds of trades you make. Based on my test results, Pepperstone has some of the fastest execution speeds I’ve seen.

When I tested 20 top brokers of my choosing, Pepperstone came as the third fastest broker overall with execution speeds of 77ms for limit orders and 100ms for market orders.

From my experience, it is rare for brokers to achieve execution speeds under 100ms, which indicates just how fast Pepperstone’s execution speeds are. Having this reduced my trade latency, resulting in less slippage at the point of trade execution.

Competitive Standard Account Spreads

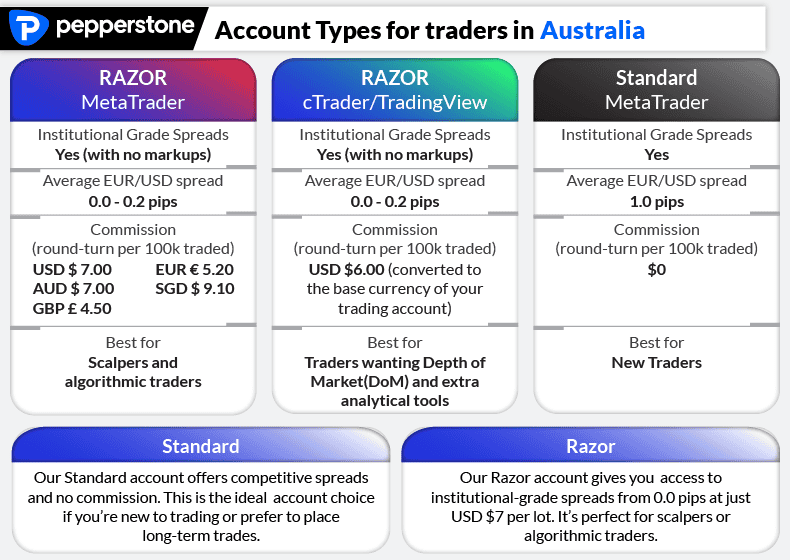

Pepperstone offers two main retail investor accounts: the Standard account, which has no commissions, and the Razor account, which is commission-based. Both accounts feature competitive spreads, but my monthly spread analysis reveals that the Standard account consistently provides the most competitive spreads.

As you can see from the module below, Pepperstone compares favourably to brokers such as IG Group, Saxo Markets and FOREX.com for popular forex pairs such as EUR/USD, AUD/USD and EUR/GBP.

This information is using published data from each of the brokers’ websites and is updated each month.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Minimum Deposit and Funding Methods

Pepperstone doesn’t require a minimum deposit to open an account. However, I personally recommend at least $200 to get started. Since you will be trading with leverage, you will need enough equity in your account to meet margin requirements when opening a position.

I also discovered that the broker offers a wide range of funding methods for Australians, which include Visa and MasterCard Debit and Credit, PayPal, bank transfers, and digital wallets like Skrill and Neteller.

While an international transfer using a bank transfer will have a small fee and may have fees from the provider’s end, Pepperstone doesn’t have any other transfer costs.

Wide Range of Platforms and Tools

Pepperstone offers a wide range of trading platforms and stands out for its extensive array of trading tools that enhance the overall platform experience.

You can either choose the popular forex and stock trading platforms, MetaTrader 4 and MetaTrader 5, the advanced trading capabilities of cTrader or the powerful charting features of TradingView.

In addition to useful algorithmic trading tools including cTrader Automate and Autochartist, my personal favourite is the Smart Trader Tools add-on for MT4 and MT5. In detail, Smart Trader Tools, comprising 28 apps, significantly enhanced my MT4/MT5 platform experience. Its Mini Terminal allows the creation of an order template for all new orders, while there’s also a Trade Terminal that will allow you to uniformly set stop loss or take profit levels for all open orders.

Overall, I found the Smart Trader Tools added to a smoother, more efficient trading experience, improving my decision making as a result.

2. FP Markets - Top Broker For Scalping

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.2

AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why I Recommend FP Markets

I recommend FP Markets as the best broker for scalping, offering great spreads when I tested its Zero-spread RAW accounts. My results showed that the broker offers EUR/USD at 0.0 spreads 97.83% of the time, meaning you only pay a commission.

This will be ideal when you’re scalping as low spreads can significantly impact your trading success. Additionally, you get access to MetaTrader 4, which offers excellent tools like one-click trading.

Pros & Cons

- Offers zero spreads

- Has MT4, MT5, cTrader and TradingView available

- A large variety of markets

- IRESS platform may be complicated for beginners

- The higher minimum deposit for the IRESS platform

- Limited features with the mobile trading app

Broker Details

A real all-rounder, FP Markets snaps a top spot on my list due to its fast execution speeds and competitive spreads. This gives the broker an edge when it comes to scalping where making a fast profit off small price changes is crucial.

A real all-rounder, FP Markets snaps a top spot on my list due to its fast execution speeds and competitive spreads. This gives the broker an edge when it comes to scalping where making a fast profit off small price changes is crucial.

I also liked FP Markets’ huge range of 10,000 shares to trade via the IRESS trading platform, uniquely offered to Australian traders, alongside other financial instruments.

Competitive Spreads

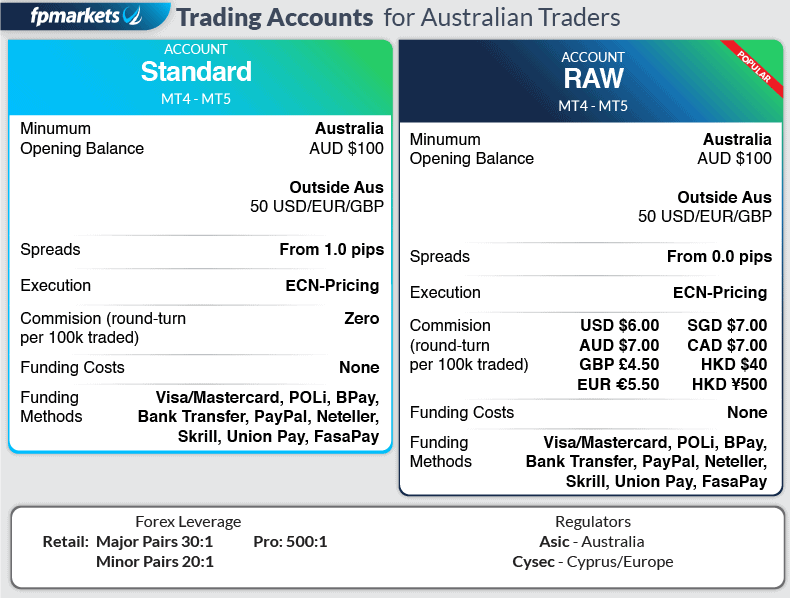

My analysis shows that as an Australian trader, you can benefit from highly competitive spreads on both FP Markets’ Standard and RAW accounts. Compared to the industry average of 0.45 pips, the broker offers RAW account spreads of 0.22 pips for my benchmark currency pairs, which includes EUR/USD, AUD/USD, and GBP/USD.

For the Standard account, FP Markets averages spreads of 1.30 pips, lower than the industry average of 1.52 pips for the top 5 major USD-backed currency pairs. While you’ll pay commissions of AUD $7, which, to be fair, aligns with the industry average, funding your account in USD will save you $1 per round-turn trade (at $6 per trade) further keeping your trading costs low.

Rapid Market Order Speeds

In my tests of execution order speeds across 20 top brokers, FP Markets demonstrated impressively fast market order speeds. With an average market order speed of 96ms, this broker ranks as the 4th fastest for market orders.

Combining these tight spreads with fast execution speeds makes FP Markets an excellent choice if you’re seeking low latency for quick entry and exit of positions.

Huge Range of Shares

While FP Markets has a solid range of forex and CFDs, it is the broker’s over 10,000 shares available to trade that stood out to me. As an Australian trader, you can trade these shares through the IRESS suite of trading platforms, including IRESS Trader and IRESS Mobile, using Direct Market Access (DMA) execution.

What I like about DMA trading is being able to execute trades by directly interacting with an electronic order book. As an added bonus, FP Markets recently added Mottai to trade DMA CFDs on the ASX only, although the broker is looking to introduce FX and Index price feeds, from our discussions.

I also appreciate that FP Markets offers four of the most popular third-party platforms in MT4, MT5, cTrader and TradingView.

3. AvaTrade - Great Broker For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.9

GBP/USD = 1.5

AUD/USD = 1.1

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why I Recommend AvaTrade

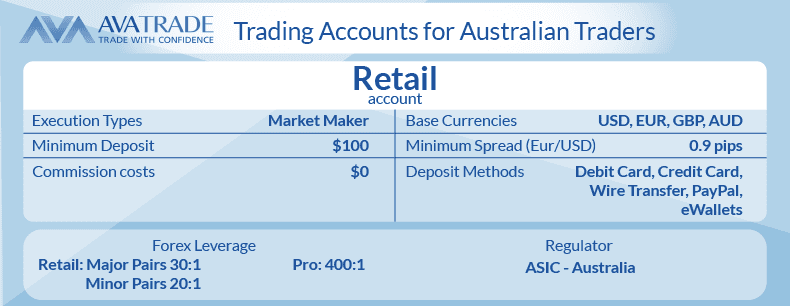

If you day trade, AvaTrade is my top recommendation. The broker’s fixed spread is a key advantage when trading in volatile markets or during unpredictable news announcements.

AvaTrades fixed spreads start at just 0.9 pips on EUR/USD, which is competitive, especially compared to the average variable spreads of 1.24 pips offered by other fixed spread brokers.

The broker also offers a decent selection of trading platforms, including AvaTradeGO, MetaTrader 4, and MetaTrader 5.

Pros & Cons

- Tight fixed spreads

- Solid choice of platforms

- Provides social trading tools

- Limited market research tools

- No RAW spread accounts

- Has an inactivity fee

Broker Details

I awarded AvaTrade as the best ASIC-regulated broker for day trading for having competitive fixed-spread trading and robust trading platforms.

The broker also excels in social trading tools offering both DupliTrade, a popular third-party platform, and its proprietary AvaSocial platform.

Competitive Spreads for Day Trading

AvaTrade stands out with its fixed spreads, unlike the variable spreads most brokers offer. My published spreads analysis found that the broker provides stable fixed spreads of 0.9 pips for EUR/USD. Compared to the top 10 fixed spread brokers, AvaTrade leads with an average of 1.4 pips across 7 popular currency pairs, from AUD/USD to EUR/USD.

Although RAW/ECN-style accounts can offer tighter spreads, I found AvaTrade’s consistent fixed spreads help keep trading costs low. This makes it an ideal provider if you’re day trading where low, predictable spreads are crucial.

Great Trading Platforms and Social Trading

For my overall trading platform experience, I gave AvaTrade a solid score of 8/10, offering a strong selection of third-party and proprietary options. In addition to MetaTrader, AvaTrade features the excellent AvaTradeGO platform and the specialized AvaOptions for trading options. Both platforms are helpful if you want to diversify your trading portfolio.

Moreover, AvaTrade excels in copy trading, providing several options that few brokers match. These include popular third-party platforms like DupliTrade and ZuluTrade, as well as AvaTrade’s own AvaSocial, where you can replicate successful trading strategies.

AvaProtect for risk management

AvaTrade’s innovative risk management also stood out to me, which I think will appeal greatly to beginners. The broker offers a proprietary tool through the AvaTradeGO mobile app, available in both iOS and Android, that allows you to effectively insure specific trades for up to AUD $1 million during a given period.

For example, if you apply ‘AvaProtect’ to an open position for a week and the market moves against you, causing you to close the position at a loss after three days, AvaTrade will reimburse you directly into your trading account.

4. GO Markets - Best Broker With Educational Resources

Forex Panel Score

Average Spread

EUR/USD = 0.2

GBP/USD = 0.5

AUD/USD = 0.2

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

Why I Recommend GO Markets

I recommend GO Markets as the best broker with educational resources, a perfect choice if you’re still learning to trade. They offer the usual basics of trading articles and video resources, but what really impressed me are the weekly webinars on various topics, which are free to attend.

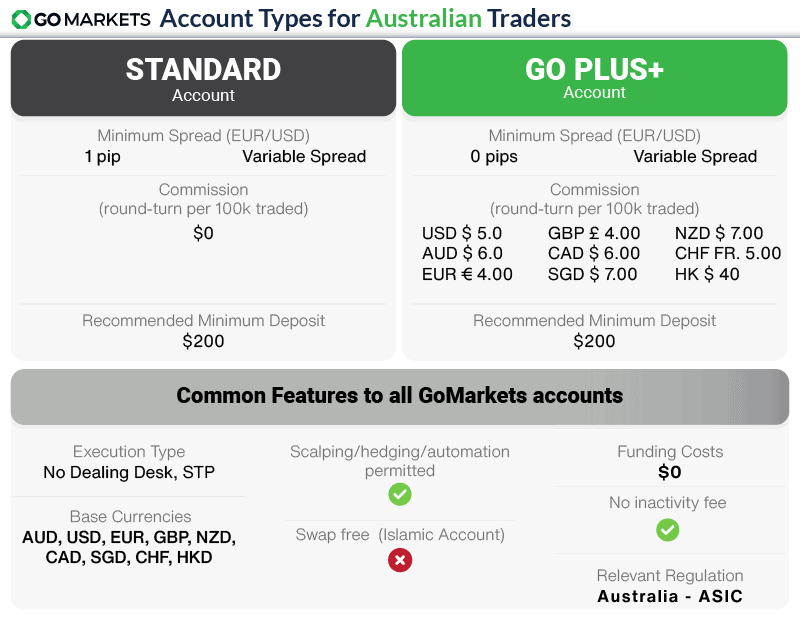

GO Markets offers solid average spreads of one pip on EUR/USD without commission. This makes them an excellent alternative if you want to distance away from paying commission.

Pros & Cons

- Low commissions

- Solid choice of trading platforms

- Impressive market analysis videos

- Limited market selection

- Customer support isn’t 24/7

- Minimum deposit required

Broker Details

GO Markets, a self-proclaimed, “first MT4 broker in Australia,” has consistently delivered a high-quality trading experience to Australian account holders, particularly those interested in trading stocks.

However, I found that the broker stands out with extensive, high-quality educational resources for beginner and experienced traders alike.

Excellent Educational Resources

Regardless of your account type, trading style or strategy, you’ll benefit from an extensive library of free educational resources, ranging from introductory how-to guides to detailed trading tutorials. Podcasts and webinars help you stay current on market analysis, along with live Q&As with experienced traders.

Rated #1 for educational materials by Investment Trends in 2021, GO Markets is clear with its commitment of making retail investing accessible.

Solid MetaTrader Trading Environment

In addition to low commissions and competitive RAW spreads, GO Markets offers a wide range of trading platforms, including MT4, MT5, cTrader, and its own GO WebTrader.

I particularly enjoyed the Genesis upgrade to the MetaTrader platforms, which includes a series of Expert Advisors (EAs) that can be easily applied to live MetaTrader trading accounts with just a few clicks.

Competitive RAW Spreads + Low Commissions

Testing GO Markets’ ECN Account (GO+), I recorded average spreads of 0.28 pips for the five most traded currency pairs — this is significantly below the tested average of 0.44 pips. Such combination of low spreads and $3 per lot commissions helps keep trading costs low.

In my opinion, the broker’s commission-free pricing model and more predictable spreads of the Standard Account are a good choice if you’re new to trading or just prefers to hold assets for a longer period.

For more experienced traders, or those who rely on micro-movements in the market to generate profits, the GO Plus+ account’s tight spreads better align with your trading needs.

5. ThinkMarkets - Good Broker With VPS Services

Forex Panel Score

Average Spread

EUR/USD = 0.1

GBP/USD = 0.3

AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why I Recommend ThinkMarkets

ThinkMarkets offers a robust VPS service, perfect if you want to automate your trades, as it allows you to trade even while you sleep. With the broker’s RAW account, I found that you can benefit from low average spreads starting from just 0.1 pips, which is ideal for automated trading.

Alternatively, if you prefer trading without commission, the Standard account offers spreads averaging 1.1 pips on EUR/USD — better than the industry average.

Pros & Cons

- Top broker for VPS service

- Offers low average spreads

- No minimum deposits for the standard account

- No RAW spreads on the ThinkTrader platform

- Not all tools are available for MT4/5 platforms

- Customer support is slow

Broker Details

I liked ThinkMarkets for its VPS services and competitive RAW spreads. The broker achieved 0-pip spreads 95% of the time based on my testing.

Top VPS Service

Top VPS Service

Upon signing up for ThinkMarkets’ ThinkZero account, I received access to a free VPS service, ensuring a smooth trading experience with strong connectivity and low latency. While many brokers offer VPS services, not all do so for free.

ThinkMarkets also stands out by providing additional benefits such as 24/7 customer support and a dedicated account manager, enhancing my trading experience overall.

Competitive RAW Spreads

In my analysis of RAW spreads, ThinkMarkets offers ultra-competitive average spreads of 0.20 pips. With the industry average at 0.44 pips, I am surprised to see that my result is highly competitive.

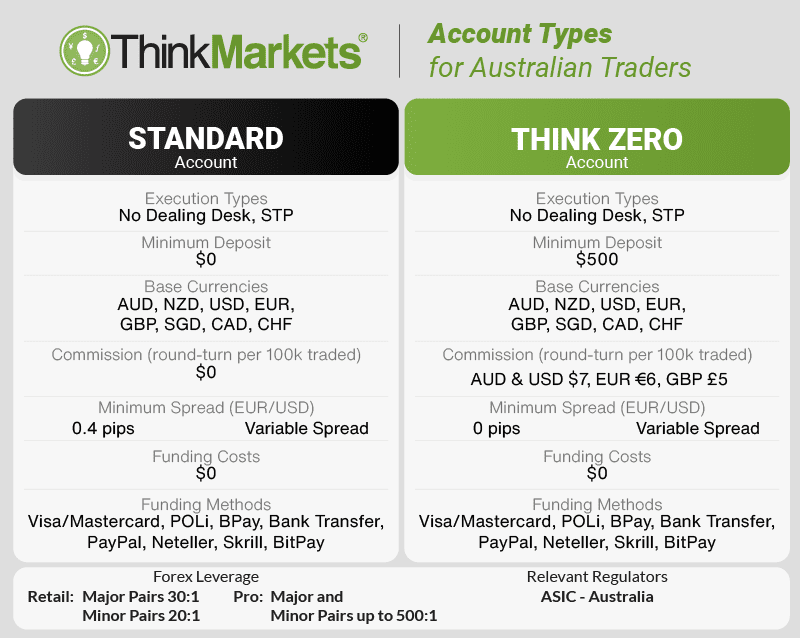

While testing ThinkMarkets’ ThinkZero (RAW) trading account, I had access to both MetaTrader 4 and MetaTrader 5 in a demo account. However, to use ThinkMarkets’ proprietary platform, ThinkTrader, I needed to open a Standard account.

If you decide to open a demo account, then here’s something you should take note: while ThinkMarkets has neither a recommended nor a required minimum deposit to open a Standard account, ThinkZero accounts need AUD $500 to cover margin costs.

Likewise, I found that the broker allows you to fund accounts via credit card, bank transfer, PayPal if you’re trading forex, ETFs, derivatives, and other financial instruments. Meanwhile, enthusiasts of cryptocurrencies can also use BitPay, charging no internal fees for deposits and withdrawals.

Solid Proprietary Trading Platform

ThinkMarkets account holders have the option to trade via the well-known MetaTrader 4 and MetaTrader 5 platforms. However, in my opinion, the broker’s proprietary platform, ThinkTrader, provides a unique combination of features and tools that may win over novices and committed traders alike.

In addition to 125 technical indicators, 20 charts and 50 drawing tools, ThinkTrader doubled down by offering a trading app with significantly more tools than either MetaQuotes option, including DoM, Time and Sales, automatic funds transfers and partial order filling.

6. IC Markets - Great Broker With Tightest RAW Spreads

Forex Panel Score

Average Spread

EUR/USD = 0.02

GBP/USD = 0.23

AUD/USD = 0.17

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why I Recommend IC Markets

IC Markets impressed me with the tightest spreads I’ve seen, averaging just 0.02 pips on EUR/USD. This makes them a top choice, especially if you want to minimise trading costs.

Along with low spreads, the broker’s execution speeds and a wide choice of markets further enhances trading experience. This is why I gave IC Markets an 84/100 in my review, ranking them as one of the best brokers I’ve tested.

Pros & Cons

- Has tight spreads

- Good range of trading products

- Has MT4 and cTrader platforms

- A minimum deposit is needed

- Different commissions for MT4 and cTrader

Broker Details

Sydney-based IC Markets has expanded since its launch in 2007 to become one of the largest and best-known forex brokers in the world. Access to deep liquidity sourced from over 25 providers around the world allows this leading broker to stand out with the lowest RAW spreads of any broker I’ve tested.

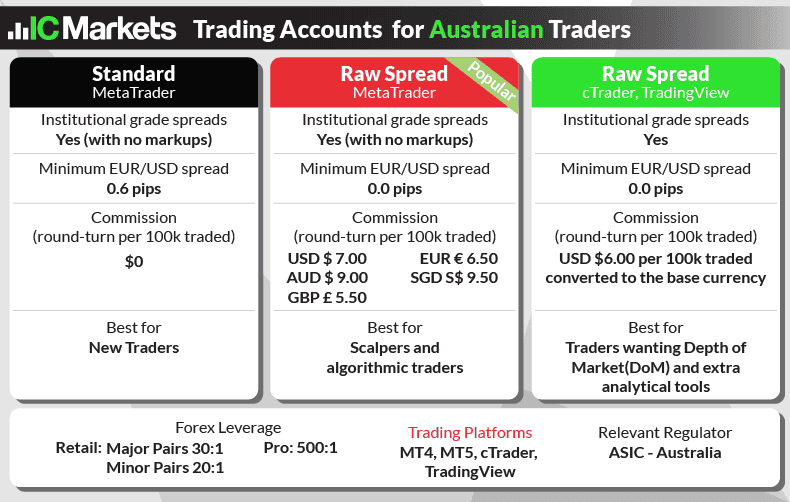

IC MARKETS ACCOUNT TYPES

Note that, as with other top forex brokers, your choice of account type with IC Markets should consider your preferred trading platform. Standard account holders are locked into MetaTrader 4 and MetaTrader 5, while those opting for Raw Spread also have the option trade on cTrader.

For me, the simple pricing structure and more limited range of trading tools make the Standard account a better option for new traders, while those with more experience will find the Raw Spread accounts offer more bang for the proverbial buck.

Meanwhile, algorithmic traders using expert advisors (EAs) and scalpers can benefit from the Raw Spread with MetaTrader configuration, while cTrader may hold more appeal for those who need greater Depth of Market (DOM) visibility.

If you’re not yet familiar with IC Markets, I suggest that you first get acquainted with the Australian forex broker by opening a demo account. To convert to a live account, IC Markets recommends a minimum deposit equivalent to USD $200 to cover margin costs.

IC MARKETS COMMISSION-BASED SPREADS VS OTHER BROKERS

Because IC Markets makes use of such a large pool of liquidity providers, the broker is able to offer some of the best spreads in the industry with their RAW Spread account.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Average spreads for this account are below 0.10 pips which is the benchmark when it comes to the EUR/USD currency pair. This compares well with other notable no dealing desk competitors such as Pepperstone, FP Markets and ThinkMarkets.

Tightest RAW Spreads

My testing reveals that IC Markets offers some of the lowest spreads in the market. The Standard account particularly impressed me, achieving the lowest spreads among 15 top brokers I’ve tested, averaging 1.03 pips across USD major pairs. The next nearest competitor, CMC Markets, averaged 1.11 pips.

For RAW spreads, IC Markets averaged 0.32 pips across 6 USD-backed major currency pairs, placing 3rd overall, just behind Fusion Markets (0.22 pips) and City Index (0.25 pips).

This combination of low spreads across both account types ensures IC Markets maintains low trading costs overall.

Advanced MT4 Trading Tools

IC Markets’ offers access to an enhanced MT4 trading through its MT4 Advanced Trading Tools suite of apps.

In addition to the Advanced Trading tools suite of solutions, which includes expert advisors (EAs), you’ll have access to MT5, cTrader and TradingView, along with a whole host of social trading and algorithmic tools from ZuluTrade to cTrader Automate.

7. eToro - Best For Social Trading

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro

Minimum Deposit

$50

Why I Recommend eToro

I recommend eToro as the best broker for social trading, especially if you’re new to copy trading. My favourite feature is the CopyTrader platform as it gives you the ability to filter and select experienced traders based on their performance and the markets they trade.

Based on my experience, having such a strong filtering power gives greater control over who you copy, making it easier to find traders that match your investment style and goals.

Pros & Cons

- Excellent platform for copy trading

- Solid choice of markets

- Commission-free trading

- Lacks MetaTrader 4 and TradingView platforms

- Not an ECN/STP broker

- Charges fees to withdraw

Broker Details

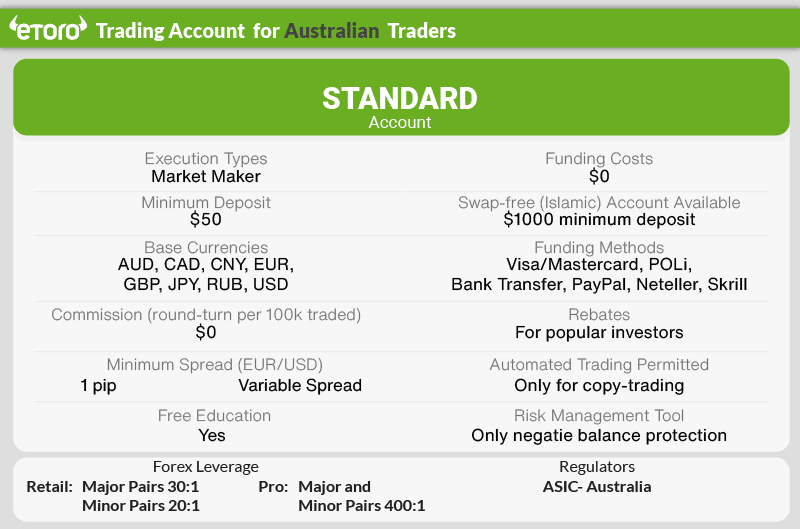

eToro may not have the breadth of tradable products available with other top-tier brokerages, but they are undoubtedly a leader in social and copy trading technology, making trading more accessible to all types of trader.

Top Social Trading Platform

Unlike other Australian forex brokers, eToro offers only its home-grown trading platforms to account holders. Whether you’re a social or copy trader, something you’ll notice is that the broker offers cutting edge tools designed to make these trading styles accessible to even the most casual traders.

The platform’s standout features include the CopyTrader and Smart Portfolio solutions. As an expert, I found the CopyTrader feature particularly impressive, especially the Popular Investors option. This highlights top traders to follow and emulate based on their past performance.

On the other hand, if you’re a new investor, the Smart Portfolios offer ready-made investment strategies organized around specific themes like IT, cannabis, and electric vehicles. This makes it easier to dive into diversified investments.

Commission-Free Spreads

Similar to AvaTrade which I reviewed above, eToro aims to simplify trading by reducing the available account types to a single account structured with retail investors in mind.

Australians trading with eToro will pay no commissions on trades, however the broker acts as a market maker, sitting on the opposite side of some trades. While this ensures that your order gets filled, the certainty comes with a cost. Traders must cover spread fees starting from 1.0 pips.

Curious traders interested in learning more about eToro can open a free demo account funded with virtual currency. To open a live account requires only $50 to open an account, but does charge an AUD $5 withdrawal fee, which lowered its standing in my rating.

8. Fusion Markets - Best Low Commission Broker

Forex Panel Score

Average Spread

EUR/USD = 0.13

GBP/USD = 0.21

AUD/USD = 0.12

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why I Recommend Fusion Markets

After testing the broker, Fusion Markets led the pack with low commissions, just $2.25 per lot traded — the lowest among the brokers I’ve tested. Additionally, Fusion Markets offers tight spreads, averaging only 0.22 pips on EUR/USD in my independent testing – again, the lowest I’ve found.

This combination of low commissions and tight spreads means you can trade cost-effectively, a key reason I gave them a 79/100 in my review, reflecting their exceptional value.

Pros & Cons

- Lowest spreads and commissions

- Fastest execution speeds

- Good choice of trading tools

- No TradingView

- Educational resources are lacking

- Limited choice of markets compared to its peers

Broker Details

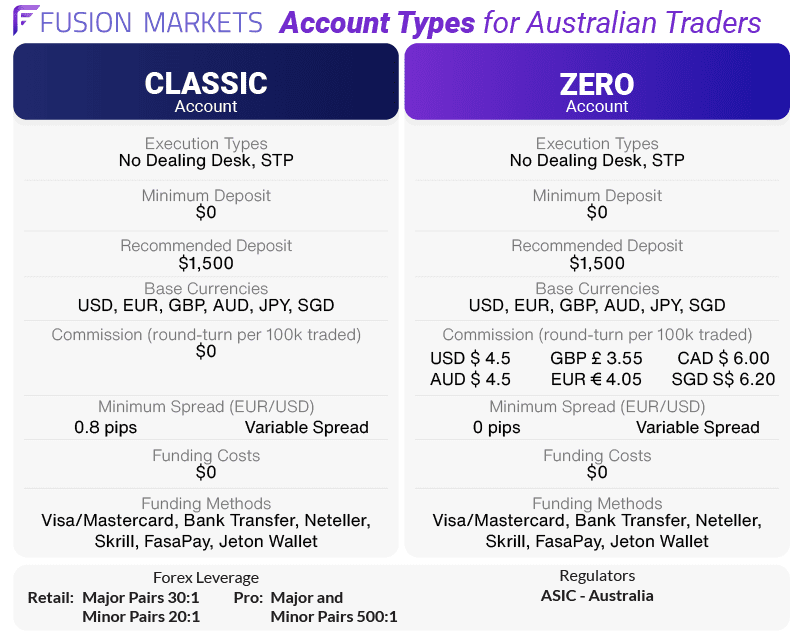

Fusion Markets stands out with the lowest commissions I’ve encountered, coupled with competitive spreads, some of the fastest execution speeds, and a broad selection of 90 forex pairs to trade.

Lowest Commissions and RAW Spreads

Fusion Markets offers the lowest forex commissions based on my analysis. The broker charges $2.25 (AUD) per side, translating to $4.50 per trade round-turn. In comparison, the industry standard is around $3.50 per side.

In addition to low commissions, Fusion Markets also keeps spreads low. The results of my tests found that broker has the lowest RAW/ECN-style spreads for AUD/USD and USD/JPY, the second lowest for GBP/USD, USD/CAD, and USD/CHF, and the third lowest for EUR/USD.

Averaging these results, Fusion Markets offers the lowest overall average spread of 0.22 pips. You can trade a wide range of 90 forex pairs with these low spreads, which is the largest of any ASIC-regulated online brokerage I’ve encountered.

Fast Execution Speeds

In addition to competitive spreads and low commissions, Fusion Markets boasts the second-fastest execution speeds, with 79ms for limit orders and 77ms for market orders. From my experience, anything under 100ms is extremely fast, minimizing latency (time the trade is initiated and executed) and reducing slippage (cost of trade execution), which adds to the broker’s low-cost appeal.

Ask an Expert

I want to know about decfx, are they regulated in Australia and are they permitted to carry out offshore retail trading

Hi Martins

DECFX is not regulated by the ASIC which is the Australian Securities Investment Commission. DECFX is an offshore broker, we always recommend ASIC regulated brokers for Australian traders as per ASIC guidelines.

What are Fusion Markets good at other than low commission costs?

Fusion Markets is a no dealing desk broker that uses STP style trading execution. For this reason you can expect the same low spreads you typically find with non market makers.

Is copy trading allowed in Australia?

Yes it is. Good choices are eToro, MyfxBook, NinjaTrader, DupliTrade and MetaTrader Signals.

does etoro have any tools to help me copy trade?

eToro offers Smart Portfolios which are themeatic baskets that aggregates groups of traders by machine learning so you can copy them. It also has Top Trader Smart Portfolions that groups successful traders together in different portfolios using algorithms based on particular trading attributes