To begin online forex trading in the UAE, you’ll need a defined strategy and a good broker with reliable trading platforms and competitive trading conditions. In this guide, I give you all the information you need as you take your first steps into forex and CFD trading.

Introduction to Online Forex Trading

Forex (also known as foreign exchange) involves buying one currency while selling another at the same time. These price movements provide opportunities for Forex traders to profit provided you are smart with your trades.

As a trader based in the UAE you will first need to choose a reliable broker and trading platform. This platform should give live prices quickly, useful economic data, and tools to manage risk, and most of all have a license to operate in the UAE. This means choosing a broker regulated by one of the Securities and Commodities Authority (SCA), the Dubai Financial Services Authority (DFSA), or the Abu Dhabi Global Market (ADGM).

In this guide, I will walk you through the fundamentals of forex and CFD trading with a strong focus on the UAE market. You will learn how to select a reliable broker, understand how leverage works, comply with local regulations, and apply effective risk management techniques.

Understanding How Forex Trading Works

In Forex trading, currencies are traded in pairs, like EUR/USD or GBP/JPY, and the goal is to profit from changes in their relative values.

So if you believe the Euro will rise against the US Dollar, you buy EUR/USD. If the price goes up, you can close the trade at a higher rate and pocket the difference. If it moves the other way, you take a loss. That’s forex in a nutshell, a constant tug-of-war between global currencies, driven by interest rates, economic data, and market sentiment.

Currency pairs are categorised into majors, minors and exotics. Majors involve the US Dollar paired with other major currencies, such as EUR/USD. Minors don’t include the US Dollar but involve other major currencies, like EUR/GBP. Exotics consist of a major currency paired with the currency of a developing or emerging economy.

Most UAE traders focus on major pairs, but some also look at minors and regional pairs depending on their strategy. I’ve come across the USD/AED pair with a few brokers but because of the currency peg, I’d say it’s a dead zone for speculative trading. You’re better off putting your money where the market actually moves.

Before you place a trade, you also have to set the lot size as it directly impacts your potential profits and losses. A standard lot represents 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot is 1,000 units.

We’ve created a handy forex profit calculator to give you a quick glimpse into how forex trading works. Give it a try below:

Your Profit

Profit in pips:

Profit in Pips Calculation

= ( Close Price - Open Price ) / 0.0001 x Trade size

= ( - ) / 0.0001 x

Profit in Pips Calculation

= ( Open Price - Close Price ) / 0.0001 x Trade size in lot

= ( - ) / 0.0001 x

Profit/Loss Calculation:

Profit/Loss in Calculation

= Profit in Pips x Pip value

=

Choosing a Broker

Choosing the right broker is one of the most important decisions you will make as a trader. It affects everything from your trading costs to the tools you use and the level of protection you receive. While traders everywhere need to consider things like platform quality and fees, if you are based in the UAE, you must observe these local requirements, especially around regulation.

In the sections below, we break down the key factors to look for to find the best broker, starting with the regulatory bodies that oversee forex trading in the UAE.

Regulation (SCA, DFSA, ADGM, CBUAE)

It is important to look for an appropriately regulated broker as this means the broker is licensed to offer trading services in your country. In the UAE this means choosing a broker regulated by one of the SCA, DFSA or ADGM. I also recommend you only trade with regulated brokers, as working with a broker without the right license is too risky.

The Securities and Commodities Authority (SCA) is the federal regulator responsible for overseeing the UAE’s capital markets. This includes the regulation of financial markets, securities, and forex products such as spot trading and CFDs across the UAE mainland. Brokers licensed by the SCA can accept clients from anywhere within the Emirates.

There are however circumstances where you can choose brokers regulated by two other regulators in the UAE. If you are in the DIFC or Financial Services Regulatory Authority (FSRA) free zones found in Dubai and Abu Dhabi respectively then you may prefer to choose brokers regulated by the DFSA or ADGM. DFSA stands for Dubai Financial Services Authority and ADGM stands for Abu Dhabi Global Markets.

The last regulator is the Central Bank of the UAE (CBUAE) which oversees banks and monetary policy but doesn’t license retail trading platforms. However, some brokers may have a licence which allows them to direct their clients to other subsidiaries owned by the broker outside the UAE.

Trading with a broker licensed by the SCA, FSRA or DFSA means the broker can legally operate within the UAE and/or the UAE free zones. It also means you’re getting a stronger layer of investor protection than you’d find with offshore brokers. In the UAE, local oversight tends to come with tighter rules like segregated client accounts, formal dispute resolution channels, and access to compensation schemes if things go sideways.

Here’s a quick overview of brokers currently licensed by each UAE authority so you can compare them before opening an account.

Trading Platforms

A good broker always offers a range of trading platforms that suit both beginners and experienced traders as well as different trading styles. For traders in the UAE, this comes down to choosing between MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView.

Platform Description

MetaTrader 4 & 5 MT4 and MT5 are favourites across the region for their Arabic language support,

flexible charting, and support for automation through Expert Advisors (EAs).

TradingView A strong platform for technical analysis and advanced charting.

cTrader An advanced platform with solid cTrader Copy and cTrader Algo tools.

Brokers may offer their own proprietary platform, which is exclusive to the brokerage. Such platforms may have features not found on mainstream platforms such as a guaranteed stop loss. Just keep in mind that they might lack the flexibility or the community support you’d find on third-party platforms.

Whatever you choose, make sure the platform supports your preferred trading account type and favourite instruments. It should also offer the right tools for technical and fundamental analysis, from advanced indicators to real-time news and price alerts. If you can’t break down a chart quickly or test a strategy properly, the platform’s not doing its job.

For most platform options, you’ll have another choice to make too – the desktop, web software, or mobile app version of the platform.

Desktop Platforms

The desktop platform is software you download to your laptop or personal computer. You may feel that downloaded software is more stable and reliable than browser-based web apps, but you will be limited when it comes to trading on the move. This is because you’ll only be able to trade from the device that hosts the software.

Web Platforms

Web platforms offer more flexibility than desktop platforms. You can trade from anywhere with an internet connection, as the software just opens in your web browser. Despite perceptions, these platforms should be just as stable as the desktop version, and include all the same features.

Mobile App Platforms

Mobile apps are useful for monitoring your trades on the move. Most brokers offer mobile apps with full trading functionality for both iOS and Android devices.

I don’t like executing trades on mobile devices – the process tends to be too fiddly, and the app may lack some desktop or web app features. Still, keeping an eye on my trades while I’m out and about is something I find helpful.

Market Access

The broker serves as your connection to the markets, they provide the infrastructure so you can trade CFD products with liquidity providers. In the UAE, most traders start with forex and then diversify their trading portfolios across various markets such as stocks over time.

All the brokers we feature on CompareForexBrokers offer a good range of currency pairs, but the number and types can vary. Some focus on major pairs like EUR/USD and USD/JPY, which are the most liquid and typically come with lower spreads. Others include minor and exotic pairs, which are worth exploring if you’re trading more regionally or using specific strategies.

While there are a number of ways you can trade Forex, including spot, futures and options at CompareForexBrokers we focus on Forex CFD products. CFDs (Contracts for Difference) are derivative instruments that allow you to speculate on the price movements of various financial assets without owning the asset itself. They include:

| Tradable Instrument | Description |

|---|---|

| Equities and Stocks | Stocks listed on the New York Stock Exchange, Dubai Financial Market, or other global markets. |

| Exchange-traded funds (ETFs) | Complex financial instruments with several different assets that are traded on stock exchanges. Some brokers offer halal-compliant ETFs for Islamic account holders. |

| Cryptocurrencies | Highly volatile digital assets like Bitcoin, Ethereum, or XRP. Not always available on Islamic accounts, so check first. |

| Commodities | Includes precious metals, energies like crude oil and natural gas, and soft commodities like wheat and corn. Gold and oil (Brent and WTI) are particularly popular in the region due to the UAE’s energy ties and history of gold trading. |

| Indices | Performance yardsticks that track with specific market sectors such as the S&P 500, FTSE 100, or regional benchmarks like the DFMGI. |

| Bonds | Speculating on the price movements of bond securities, such as government bonds. Bonds may not be permitted on Islamic accounts due to their interest-based structure. |

Trading Account Types

When you sign up with a broker, you will need an account. There are a few types of accounts but the two most common are Standard and RAW accounts. Other types of accounts can include Swap-Free (also called Islamic accounts, Cent Accounts, Fixed Spread, Pro and Instant accounts.

Raw Accounts

A Raw account gives you access to the tightest spreads. These accounts are offered on a No Dealing Desk (NDD) model, using Electronic Communication Network (ECN), Straight Through Processing (STP), or a combination of the two.

With ECN, you connect directly with liquidity providers in the market. The broker doesn’t control these liquidity providers. With STP, you connect with the broker’s own liquidity pool, so the broker has some control, but you’re still accessing interbank rates.

In both cases, the spreads should represent competitive pricing. You’ll pay a commission to access this, as the broker isn’t making anything from the spread. This commission is usually between USD $2.00 and $3.50 for each standard lot when you buy and again when you sell.

Raw accounts are ideal for high-volume traders, scalpers, or day traders looking for the most precise market pricing.

At CompareForexBrokers, we ran our own independent tests to compare Raw account spreads across major brokers serving UAE traders. We gathered live pricing data over a set period, covering popular forex pairs like EUR/USD, GBP/USD, and USD/JPY, to see which brokers consistently delivered the tightest spreads.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Standard Accounts

With a Standard account there is no commission or more accurately, the broker includes their costs in the spread. For this reason, spreads are wider than RAW accounts and generally slightly more costly. They are however less complicated to understand which is why new traders prefer them.

While nearly all brokers offer this type of account, they are most associated with market makers. These brokers act as the intermediaries between the interbank market and you as a trader and in some cases might be your direct counter-party. In this instance, the broker is taking the other side of your trade, which is why they are sometimes called B-Book brokers.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Swap-Free Accounts

For Muslim traders selecting a broker that offers swap-free (Islamic) accounts ensures compliance with Sharia law. Since Forex CFD have swap fees when you hold your position after 6pm New York time, it is not Sharia compliant since you are earning or paying interest.

A Swap-Free account removes overnight interest charges so is usually suitable for traders of Islamic faith. Nevertheless check with your broker if the account is Sharia compliant, as some brokers replace the swap with admin fees or widen the spread.

For the UAE – SCA-regulated brokers should offer an Islamic account however I have noticed some DFSA brokers may not.

Other Account Type

- Pro Accounts are for Professional Traders, you will need to meet certain criteria to qualify and with this you can trade with higher leverage.

- A cent account means you can trade using micro lots.

- A fixed spread account means spreads are fixed rather than variable.

- An Instant account is the opposite of a market account. While a market account will automatically give you the next best order price if slippage occurs, an instant account will give you a requote for you to accept or reject.

Understanding Leverage & Margin

Whenever you trade forex or another CFD, you will be trading with leverage and margin. Leverage simply means adding to your traded funds by borrowing capital directly from the broker. Margin is the amount of your own capital you will use to trade.

The UAE regulatory authorities I mentioned earlier are responsible for setting leverage limits in their specific regions.

The DFSA’s forex leverage limits for retail clients are 30:1 for major pairs and 20:1 for minor/exotic pairs. This leverage aligns with top regulators like ASIC (Australia) and the FCA (UK). Major and minor indices are capped at 20:1 and 10:1 respectively. Gold is set at 20: 1 and other commodities 10:1. As for shares, leverage is capped at 5:1 and crypto is at 2:1

Professional clients who meet certain criteria can access higher leverage, usually 1:500 but sometimes 1:1000 for Forex.

Like the DFSA, the ADGM limits leverage to 30:1 for major forex pairs. Qualified professionals may access up to 50:1 leverage subject to the FSRA’s approval and the broker’s policies.

The SCA has generally capped leverage at 50:1 for retail clients. Pro traders can access higher leverage but this is at the discretion of the SCA and the individual broker.

So let’s say I open a trade and access leverage of 30:1. For every dollar of margin I put up from my own account, the broker will put up 30 dollars of leverage. So my purchasing power is basically 30 times what it would be without leverage.

My market exposure has increased too, by the same magnitude. The potential profits are multiplied by 30, and my potential losses are also. Therefore, use leverage judiciously and ensure you have a solid risk management strategy in place.

Risk Management

Risk management is the foundation of survival in forex trading. Without it, even the best strategy will fail over time. Successful trading is all about balancing risk and reward, and taking steps to tip this balance in your favour.

Broker Policies That Protect You

The protection your broker offers should stretch beyond just regulation. You want to look at specific policies that keep you safe.

Fund segregation, for example, keeps your capital separate from the broker’s operating capital, so you’re protected if the broker gets into financial trouble.

Negative balance protection is another valuable policy in my view. This means you can only lose the capital you put into your account. You won’t end up owing anything to the broker, even if your account balance falls to zero.

Broker Tools

Brokers will also provide you with tools you can use to manage risk – and I certainly recommend you use these tools. Stop-loss orders will close out your trade once losses reach a pre-defined level, while take-profit orders will do the same thing once your profits hit a certain point. These are essentially guardrails for your trades, helping you keep to your strategy.

Some brokers may provide Guaranteed Stop-Loss Orders (GSLOs). This makes your stop-loss a hard limit. If market volatility causes your trade to fall below the stop loss level, you won’t lose any further money – it’ll still be closed out at the chosen stop-loss point.

Good Trading Habits

I also advise you to practice safe and responsible trading. By this, I mean being conservative with leverage and position sizes, and adhering to your strategy. Automated trading bots can help you here – these bots remove the emotion and stress from trading, so your positions are executed according to your rules.

Practising with a free demo account is also a good idea. While successful demo trading doesn’t always translate to the live environment, it at least allows you to get used to market forces before you risk your money for real.

Selecting Your Forex Trading Strategy

There are different methods you can use for trading, and all of these methods have the potential for success. The strategy you choose will depend on your own trading preferences.

Position Durations

Many strategy options are defined by the time you hold the position. The main strategies are as follows:

- Scalping Strategies – Opening and closing positions quickly, responding to real-time market data to make multiple small trades across the day.

- Day Trading Strategies – Opening and closing positions within the same trading day, aiming to profit on relatively small price movements.

- Swing Trading Strategies – Keeping positions open for longer than a single trading day, in search of medium-term price reversals.

- Trend Trading Strategies – Keeping positions open for a longer duration, following overall trends and ignoring relatively small price movements.

You can keep positions open for as long as you like. However, CFD trading is usually focused on shorter-term positions. This is because you’ll pay overnight fees for any positions you keep open at the close of trading. These charges are known as swap fees, and they can eat into your profits.

Copy and Social Trading

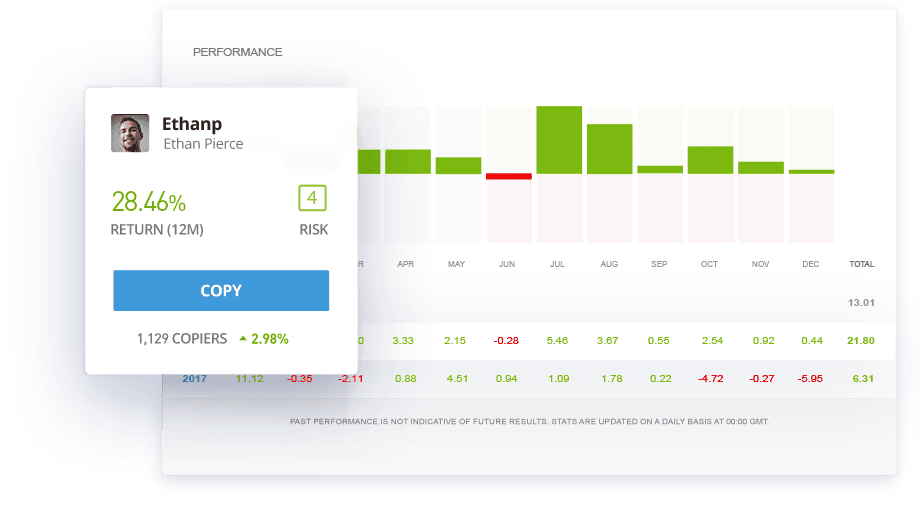

Copy trading and social trading are two possible strategies you can use. I see many traders using these terms interchangeably, but they are quite different.

Social trading is a broad term. You will be connecting with other traders, taking inspiration from their actions and discussing trading options. It basically means adding a social element to your trading. This type of trading can include copy trading.

Copy trading is more specific. You are using a trading tool built into an online platform. This tool automatically copies the movements of other traders, so your profits and losses mirror their own.

I find this especially appealing for new traders in the UAE as several brokers now support copy trading features that are available in Arabic and compatible with Islamic (swap-free) accounts. Pepperstone, for example, supports DupliTrade, cTrader Copy, and Myfxbook AutoTrade.

If you’re still learning, copy trading allows you to gain exposure while relying on the experience of more skilled traders. However, it’s not entirely hands-off. You still need to choose who to follow, how much capital to allocate, and manage risk by setting performance limits.

I recommend doing a background check on a trader before copying their trades. Look at how long they’ve been trading, how much they’ve drawn down during losing periods, and whether their trading style matches your goals.

Automated Trading

An automated trading strategy uses software tools to monitor the markets and execute trades based on predefined rules. While some advanced systems use artificial intelligence to adapt to changing conditions, most automated strategies rely on fixed logic rather than true AI. For example, you might use automation to trigger price alerts or to open and close positions automatically, even when you’re away from your screen.

One of the most common tools for automation is the Expert Advisor (EA), which I briefly mentioned earlier. EAs are programs designed to follow specific trading rules, such as opening a buy position when two moving averages cross and closing it when the RSI reaches a certain threshold. These tools can help remove emotion from trading and ensure consistent execution based on your chosen strategy.

If you want to add automation to your trading, marketplaces like the MetaTrader CodeBase are the best place to start. You’ll find free and paid EAs to play around with. If you know how to code, you can even build your own using the MetaEditor in MT4 or MT5.

I like automated trading because it removes emotions and impulses from the equation, helping me stay within my planned strategy.

FAQs

Is forex trading legal in the UAE?

Yes, forex trading is legal in the UAE as long as you deal with a broker that adheres to local law.

Can UAE traders open accounts with offshore brokers?

UAE traders can open accounts with offshore brokers. Many actually do especially when they’re looking for higher leverage or a wider range of trading instruments.

Disclaimer: Seek Independent Investment Advice

The information on this page is not intended as financial or investment advice. You are advised to seek advice from a licensed financial advisor before you invest or trade in the forex market. Forex and CFD trading is always high risk, and investors and traders are in danger of losing money rapidly.

Ask an Expert