ThinkMarkets Review Of 2026

If you’re looking for an STP forex broker with a reputation for tight spreads, then ThinkMarkets is a great option. ThinkMarkets offers 4 currency pairs for forex trading, choice of MetaTrader 4, 5 and ThinkTrader trading platforms.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

ThinkMarkets Summary

| 🗺️ Tier 1 Regulation | ASIC, FCA, CySEC |

| 🗺️ Tier 2 Regulation | FMA, JFSA, DFSA |

| 🗺️ Tier 3 Regulation | FSCA, CIMA, FSA-S, FSC-M |

| 📊 Trading Platforms | MT4, MT5, ThinkTrader |

| 💰 Minimum Deposit | $0 |

| 💰 Withdrawal Fees | $0 |

| 🛍️ Instruments | Forex, Crypto, Indices, Metals, Futures, Shares, ETFs |

| 💳 Credit Card Deposit | Yes |

Our Verdict on ThinkMarkets

We found ThinkMarkets’ (formerly called ThinkForex) most appealing feature is their award-winning ThinkTrader trading app. This mobile app includes appealing features TradingView charts and Trader’s Gym for backtesting. Other features include top regulation and low spreads with their ThinkZero account.

If you’re into scalping, day trading, or creating automated trading strategies, the ThinkZero account offers ECN-style pric+-ing and trading conditions. On the other hand, newcomers might find ThinkMarkets’ standard account appealing because of its straightforward setup and no extra commission charges.

ThinkMarkets Pros and Cons

- Low spreads

- No minimum deposit

- Social trading available

- Slow trading terminals

- No cent accounts

Open Demo AccountOpen Live Account

The overall rating is based on review by our experts

Trading Fees

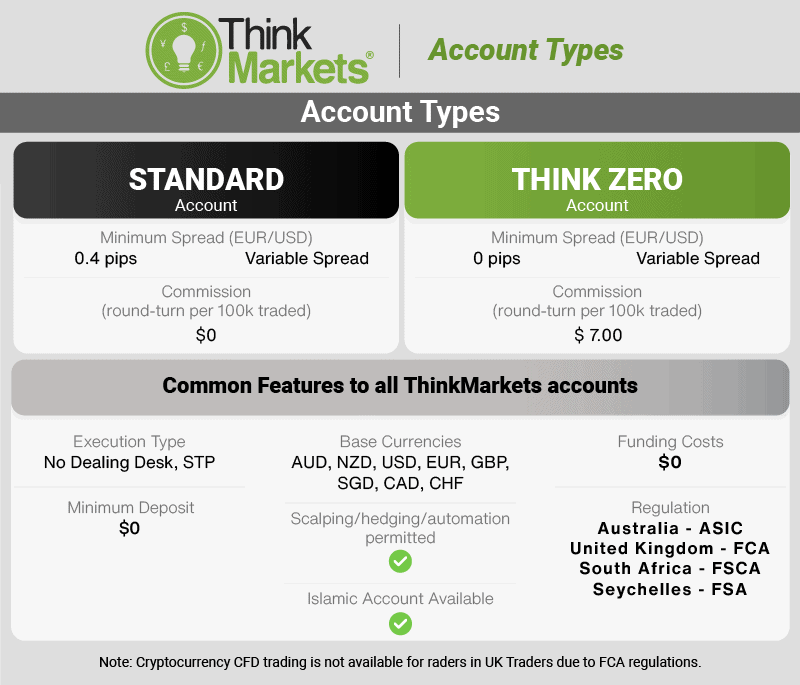

ThinkMarkets offers competitive spreads for both its Standard Account and ThinkZero Account types. Standard account spreads are wider, as there are no commission costs. ThinkZero spreads, on the other hand, have ECN pricing and can be as low as 0.0 pips.

1. Raw Account Spreads

The ECN-like account type provides an institutional trading environment with ultra-tight spreads and low commission fees. As spreads are tight and commissions are low, the ThinkZero account is suitable for day trading, scalping and for traders using Expert Advisors.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-03

0.11 0.30 0.47 0.40 0.44

0.14 0.31 0.62 0.39 0.75

0.06 0.20 0.10 0.10 0.20

0.10 0.10 0.90 0.30 1.30

0.10 0.20 0.60 0.30 1.00

0.90 0.13 0.17 0.14 0.14

0.30 0.40 0.50 0.50 0.50

0.10 0.20 0.50 0.30 0.20

0.16 0.29 1.50 0.54 0.68

0.20 0.40 0.60 0.50 0.70

0.80 0.40 1.30 0.50 0.90

0.10 0.50 0.70 0.60 0.40

0.51 1.15 0.99 0.94 1.28

While forex spreads can be as low as 0.0 pips during times of market volatility, average spreads are 0.1 pips for many major currency pairs.

| Raw Account Spreads | ThinkMarkets | Average Spread |

|---|---|---|

| Overall | 0.53 | 0.74 |

| EUR/USD | 0.11 | 0.21 |

| USD/JPY | 0.29 | 0.39 |

| GBP/USD | 0.4 | 0.48 |

| AUD/USD | 0.3 | 0.39 |

| USD/CAD | 0.5 | 0.53 |

| EUR/GBP | 0.4 | 0.55 |

| EUR/JPY | 0.44 | 0.74 |

| AUD/JPY | 0.47 | 1.07 |

| USD/SGD | 1.9 | 2.34 |

While there is no difference between account types regarding CFD trading, ThinkZero account holders gain access to discounted pricing on metals.

2. Raw Account Commission Rate

Commissions on FX and Metals with ThinkZero accounts are:

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| ThinkMarkets Commission Rate | $3.5 | $3.5 | £2.50 | €3.00 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

- In Australia and South Africa: $3.50 per standard lot each side of the trade or $7.00 round turn

- In the UK: £2.5 per standard lot each side of the trade or £5 round turn

Note: CFD trading on indices, energies, cryptocurrencies, shares, and futures are commission-free

Use the calculator below to compare ThinkMarkets’ trading costs with competitors such as Pepperstone, Eightcap and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

Spreads on standard accounts that charge no commission fees are competitive when trading forex with ThinkMarkets. Forex spreads can be as tight as 0.4 pips, while average spreads are 1.2 pips. When trading metals, pricing starts from 25 cents and CFDs 0.4 points.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| ThinkMarkets Average Spread | 1.1 | 1.4 | 1.3 | 1.1 | 1.2 | 1.1 | 1.2 | 1.2 |

| Industry Average Spread | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

4. Swap-Free Account Fees

Forex traders following Sharia law can sign up to ThinkMarkets Islamic Account. Islamic trading accounts do not pay and receive swap rates derived from interest rates and instead pay a flat rate fee for open positions. In place of swaps (also called overnight fees or rolling fees), ThinkMarkets charges a flat rate weekly administrative fee for positions held 7 days or longer. Islamic account holders trading major forex pairs incur $5 financing fees, while a $10 fee is charged when trading minor forex pair.

5. Other Fees

There are no deposit fees, but there is a charge for withdrawals for international transfers at $25. There are no inactivity fees as well.

Verdict on ThinkMarkets Fees

Although spreads are wider than a ThinkZero trading account, Standard Accounts are an excellent option for beginner traders wanting to avoid complex commission fee calculations.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

ThinkMarkets – Trading Conditions For Clients In United Kingdom

To meet ESMA requirements, FCA has some regulations that online brokers in the UK must follow. While ThinkMarkets offers the same Standard account and ThinkZero account with the same basic trading conditions to all clients, leverage and risk management vary.

Retails vs Professional Account

As professional traders have a greater understanding of leveraged trading and access to greater capital, trading conditions set by the regulator are more relaxed for traders who qualify.

To qualify as an Elective Professional trader for a professional account, traders will need to meet 2 of the following 3 criteria:

- Have done 40 trades of a significant size over last year

- Manage a portfolio that exceeds 500,000

- Have relevant work experience of substantial note in the financial sector

The following leverage is the maximum available for Professional traders.

| Leverage | Retail | Pro |

|---|---|---|

| Forex - Major | 30:1 | 500:1 |

| Forex - Minor | 20:1 | 500:1 |

| Indices | 20:1 | 200:1 (South Africa Zar40 is 100:1) |

| Energy | 10:1 | 200:1 |

| Metals | 10:1 - 20:1 | 400:1 |

| Shares CFD | Mostly 5:1 | 10:1 to 20:1 |

| Futures | 10:1 | 33:1 to 200:1 |

Professional traders will lose negative balance protection and automotive close you when trading account equity falls below 50%.

Spread Betting

Spread Betting is an alternative form of derivatives trading to CFDs. Popular in the UK because of its capital gains saving, spread betting allows you to speculate on price movements in a range of markets. Spread betting differs from CFD trading as traders do not own contracts of the underlying assets.

ThinkTrader allows spread betting with all its instruments except for cryptocurrency. Spreads for EURUSD starts from 0.8 pip, and leverage is the same as for CFDs.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

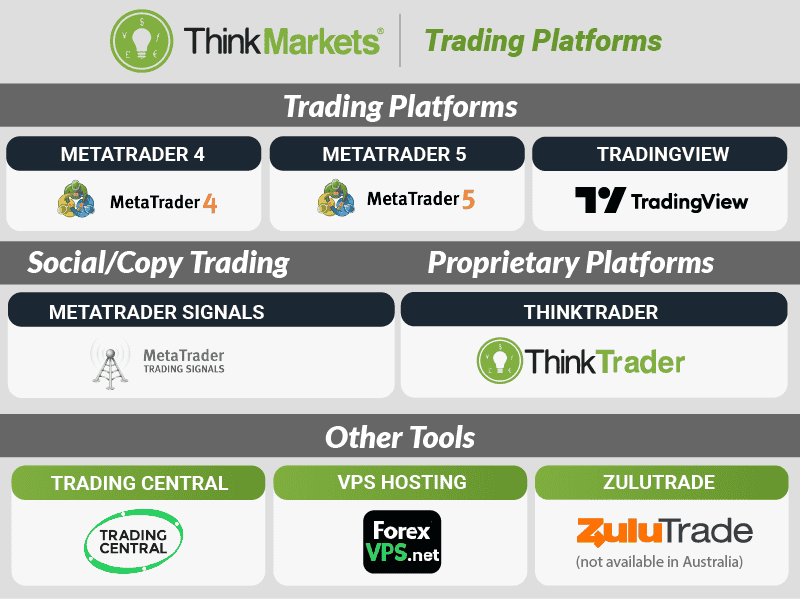

Trading Platforms

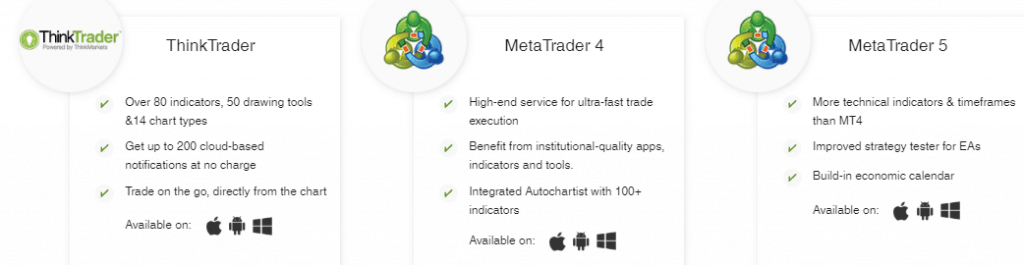

ThinkMarkets customers have a choice of three trading platforms. They include the broker’s proprietary trading platform, ThinkTrader, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). All three platforms offer Web, Desktop, and Mobile/Tablet App versions so that clients have access to their Thinkmarkets account from anywhere, at anytime.

| Trading Plaform | Available With ThinkMarkets |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

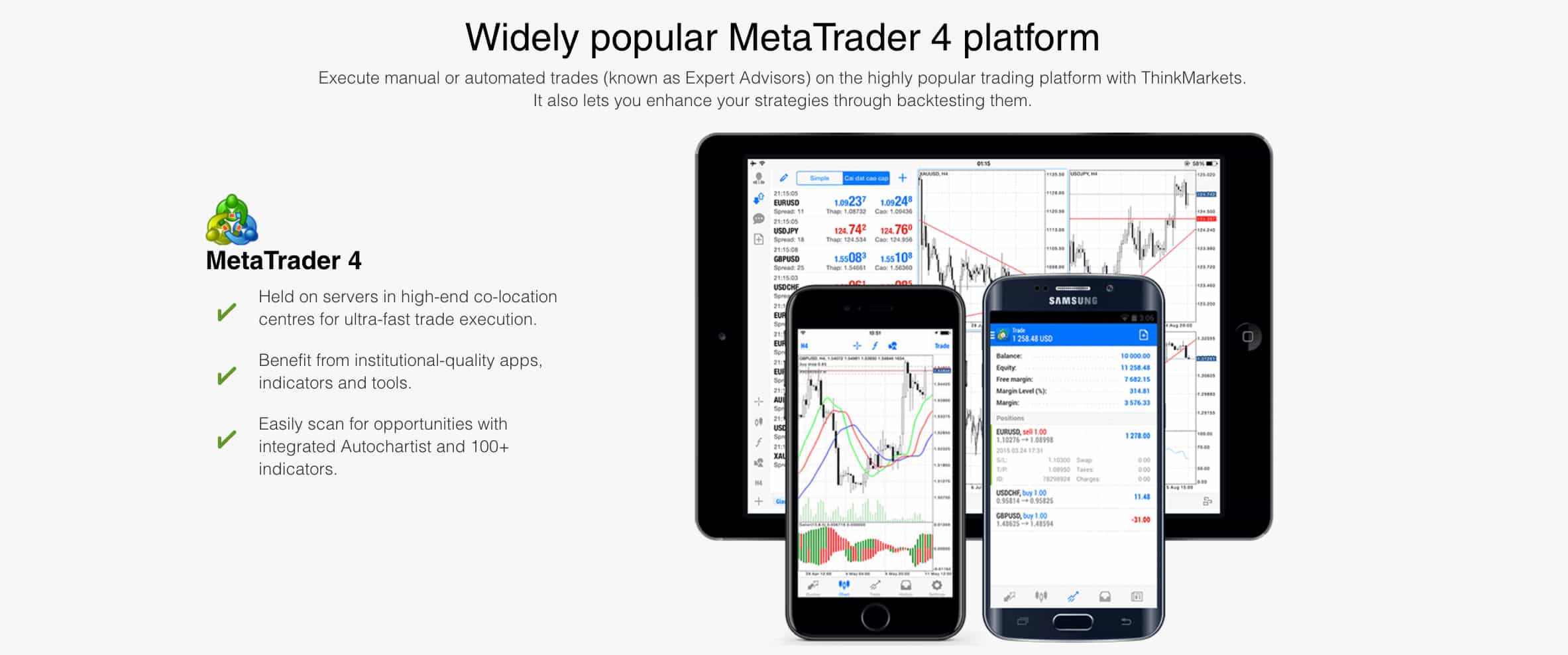

MetaTrader 4

Using the MetaTrader 4 platform, ThinkMarkets customers gain access to advanced charting tools and automated trading features that can be used to develop complex trading strategies. The easy-to-use interface suits all levels of experience, hence its reputation as one of the best trading platforms available to retail investor accounts.

MT4 Features include:

Advanced charting tools

- 9 Timeframes

- 30 Technical Indicators

- 23 Graphical Objects

- 3 Chart Types

Other features

- 4 Pending order types

- Hedging and netting options

- Trading Central Free access

- Social-copy trading with MetaQuotes Trading Signals

- Algorithmic trading with Expert Advisors and MQL4 programming language

- 32-bit single-thread strategy testing for expert advisors (EAs)

- A large trading community and marketplace

- Fast trade execution with minimal slippage

MetaTrader 5

Although MT4 retains a strong following, MetaTrader 5 offers improvements from its predecessor including more charting tools, greater market access and improved backtesting features.

Features of MT5 include:

- 21 Timeframes

- 38 Technical Indicators

- 44 Graphical Objects

- 6 Pending order types

- Trading Central free access

- Trading signals

- Hedging and netting

- Expert Advisors (MQL5 programming language)

- 64-bit multi-thread strategy testing for EAs

- Depth of Market (DOM)

- Partial order filling

- Economic calendar

- Low slippage due to fast order execution

Another advantage of using MT5 over MT4 includes the trading platforms for customer support. With MT4’s customer service being phased out, less help is available for those with trading platform issues or queries.

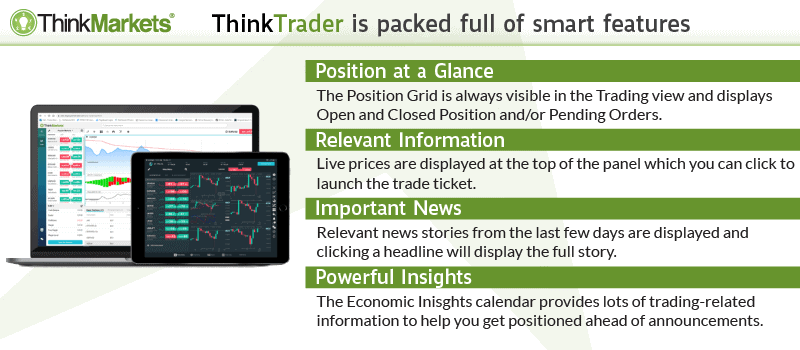

ThinkTrader

The broker offers a proprietary web version, a trading software platform for Mac and Windows computers and iOS and Android devices. The mobile trading app is well-reviewed and offers a user-friendly trading environment, a wide range of technical analysis tools and risk management features.

Trading tools include:

- Over 125 indicators, 50 drawing tools and various chart types

- TrendRisk Scanner: helps traders find the best trading opportunities using different timeframes

- Ability to close multiple orders with one-click

- Log in to multiple devices at one time

- Trading analysis toolkits

- 200 cloud-based alerts than can be sent to mobile, tablets and PCs even when you are offline

- Real-time CFD and forex market news

Social Trading with ZuluTrade

If you are looking to get your skin in the trading game but don’t know much about forex or other CFD product, then social trading can be a solution. With this type of trading, you can copy the trades of other successful traders.

ThinkMarkets offers ZuluTrade, a copy trading tool that you can integrate with MT4. With this platform, you pick and follow a trader in the ZuluTrade community and then set your strategy filters such as lot size and risk management. Once done, ZuluTrade will automatically copy the trades of who you follow.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

Is ThinkMarkets Safe?

ThinkMarkets has a trust score of 80, based on the broker’s regulation, reputation, and reviews.

1. Regulation

ThinkMarkets are regulated by multiple top-tier financial authorities around the world. In the United Kingdom, TF Global Markets (UK) Limited is overseen by the Financial Conduct Authority (FCA) and is required to segregate client funds, provide Negative Balance Protection, and enforce close-out margins.

ThinkMarkets Australian brokerage services are located in Melbourne and regulated by the Australian Securities and Investments Commission (ASIC). As an ASIC-regulated broker, TF Global Markets (Aust) Limited has to ensure clients’ funds are held in segregated accounts, yet investor balance protection or closeout margins are not a legal requirement.

In addition to FCA and ASIC oversight, ThinkMarkets subsidiaries operating in South Africa and Seychelles, these subsidiaries are regulated by The Financial Sector Conduct Authority (FSCA) and Financial Services Authority Seychelles (FSA).

ThinkMarkets is regulated in the UAE by the Dubai Financial Services Authority (DFSA) in Dubai.

Finally, the broker’s branch in Europe is overseen by the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, while the Japanese division is being regulated by Japan’s Services Agency (JFSA)

| ThinkMarkets Safety | Regulator |

|---|---|

| Tier-1 | ASIC (Australia) - Australian Securities and Investments Commission FCA (United Kingdom) - Financial Conduct Authority CySEC (Cyprus) - Cyprus Securities and Exchange Commission |

| Tier-2 | FMA (New Zealand) - Financial Markets Authority JFSA (Japan) - Japanese Financial Services Authority DFSA (UAE) - Dubai Financial Services Authority |

| Tier-3 | FSCA (South Africa) - Financial Sector Conduct Authority CIMA (Cayman Islands) - Cayman Islands Monetary Authority FSA (Seychelles) - Financial Services Authority FSC (Mauritius) - Financial Services Commission |

2. Reputation

Established back in 2010, ThinkMarkets is an award-winning broker with headquarters in London and Melbourne. In 2020, ThinkMarkets won ‘Best Value Broker in Asia’ at the 2020 Global Forex Awards and ‘Best CFD Provider at the City of London Wealth Management Awards (COLWMA) in 2021.

ThinkMarkets also shows moderate popularity in the global online trading space. It receives approximately 18,100 Google searches per month, ranking it as the 41st most popular forex broker based on 2024 data. Web traffic trends are consistent with this, with Similarweb reporting 283,000 global visits in February 2024, placing ThinkMarkets as the 41st most visited broker.

| Country | 2025 Monthly Searches |

|---|---|

| Egypt | 880 |

| United States | 590 |

| South Africa | 590 |

| France | 480 |

| United Kingdom | 480 |

| India | 390 |

| Taiwan | 390 |

| Vietnam | 390 |

| Japan | 320 |

| Germany | 260 |

| Australia | 260 |

| Algeria | 260 |

| Morocco | 260 |

| Netherlands | 170 |

| Brazil | 170 |

| United Arab Emirates | 170 |

| Thailand | 170 |

| Pakistan | 170 |

| Spain | 140 |

| Turkey | 140 |

| Malaysia | 140 |

| Indonesia | 140 |

| Saudi Arabia | 140 |

| Nigeria | 140 |

| Colombia | 110 |

| Hong Kong | 110 |

| Canada | 110 |

| Kenya | 110 |

| Italy | 90 |

| Singapore | 90 |

| Venezuela | 70 |

| Poland | 50 |

| Mexico | 50 |

| Philippines | 50 |

| Cyprus | 50 |

| Bangladesh | 50 |

| Switzerland | 40 |

| Greece | 40 |

| Argentina | 40 |

| Portugal | 40 |

| Sweden | 40 |

| Ghana | 40 |

| Peru | 30 |

| Austria | 30 |

| Dominican Republic | 30 |

| Cambodia | 30 |

| Chile | 20 |

| Ecuador | 20 |

| Ireland | 20 |

| Uzbekistan | 20 |

| New Zealand | 20 |

| Jordan | 20 |

| Uganda | 20 |

| Botswana | 20 |

| Tanzania | 20 |

| Bolivia | 10 |

| Uruguay | 10 |

| Mauritius | 10 |

| Costa Rica | 10 |

| Sri Lanka | 10 |

| Ethiopia | 10 |

| Panama | 10 |

| Mongolia | 10 |

880 1st | |

590 2nd | |

590 3rd | |

480 4th | |

480 5th | |

390 6th | |

390 7th | |

390 8th | |

320 9th | |

260 10th |

3. Reviews

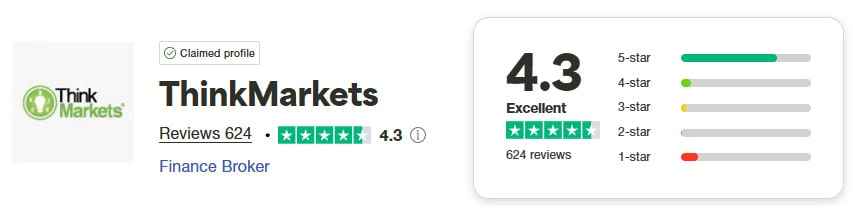

ThinkMarkets has a TrustPilot score of 4.3 out of 5 from 624 reviews.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

Deposit and Withdrawal

ThinkMarkets do not charge customers any fees when making deposits and withdrawals from their trading accounts.

What is the minimum deposit at ThinkMarkets?

To trade with ThinkMarkets, there is no minimum deposit requirement to open an account however clients will need to make a deposit of £/$500 to trade.

Account Base Currencies

When establishing a trading account, customers can deposit funds in base currencies including USD, CHF, EUR, AUD and GBP. Additional base currencies and deposit methods may be available depending on the client’s country / ThinkMarkets entity.

Deposit/Withdrawal Options and Fees

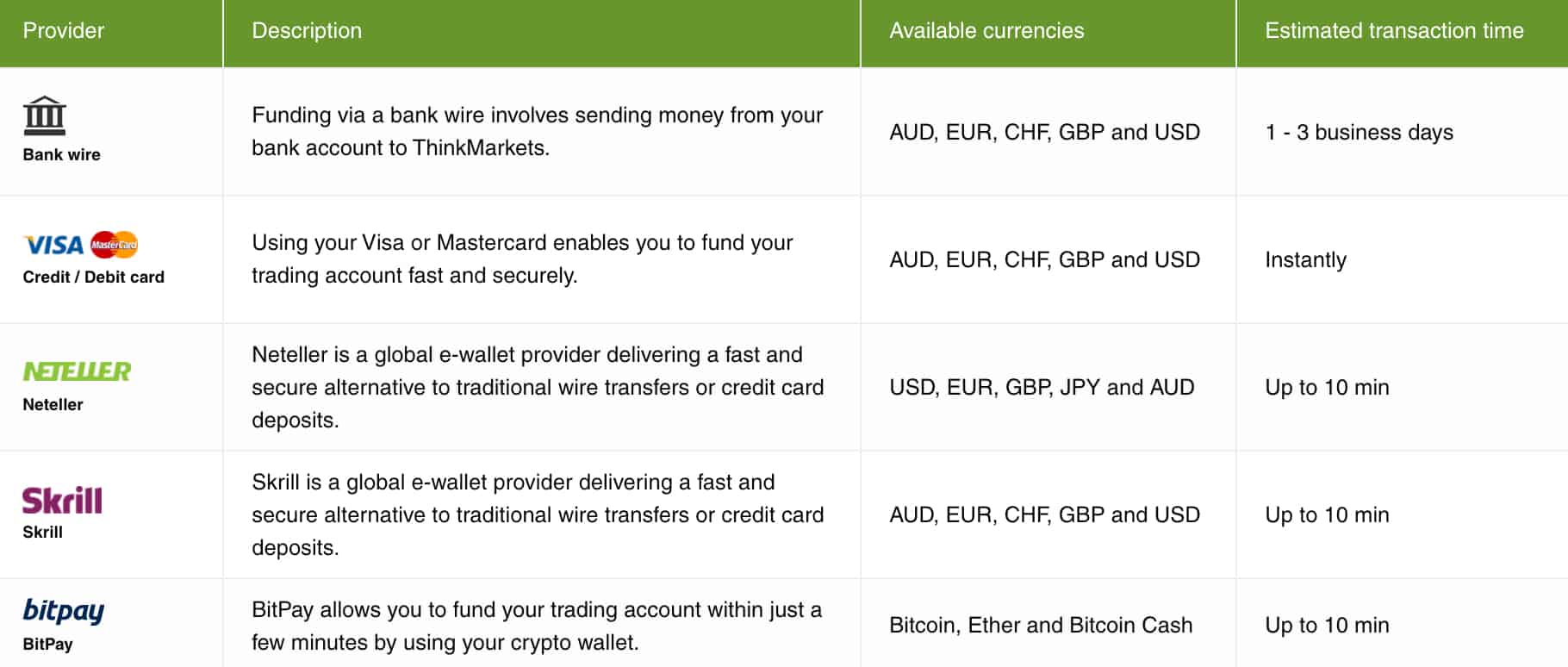

Below is a list of deposit and withdrawal methods available with ThinkMarkets. It is also worth noting that certain payment methods are not available in all countries.

| Provider | Available currencies | Estimated transaction time |

|---|---|---|

| Debit Card | AUD, EUR, CHF, GBP, USD | Instant |

| Debit Card (EU) | EUR | 1 business day |

| Skrill | AUD, EUR, CHF, GBP, USD | Instant |

| Neteller | USD, EUR, GBP, JPY, AUD | Instant |

| Skrill | AUD, EUR, CHF, GBP, USD | Instant |

| Cryptocurrency | BTC, ETH, USDT, ERC-20, TRC-20, BCH, XLM, LTC, EOS, DASH, USDC, XRP, TRX, BUSD | Instant |

| Perfect Money | USD, EUR, BTC | Instant |

| Apple Pay | AUD, EUR, CHF, GBP, USD | Instant |

| Google Pay | AUD, EUR, CHF, GBP, USD | Instant |

| UPI | INR | Instant |

| Netbanking | INR | Instant |

| MPesa | KES | Instant |

| Mobile Money Ghana | GHS | Instan |

- Bank Wire

- Bank Transfer

- Credit Card / debit card(Visa/MasterCard)

- Neteller

- Skrill

- BitPay

- UnionPay

- BPay

- PayPal (Australia only)

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

Product Range

Customers of ThinkMarkets can choose between generous amounts of CFD instruments spread across 8 asset classes. CFD trading can be done on over 3,500 financial instruments including forex currency pairs, cryptocurrencies (outside UK), indices and futures to metals, commodities and shares & ETFs.

CFDs

The list of available CFD products can be traded across ThinkMarkets’ suite of powerful trading platforms (MT4, MT5 and proprietary platform ThinkTrader). However, the FX broker offers a more diverse list of tradable shares CFDs on its MT5 and ThinkTrader as compared to the MetaTrader 4.

![]()

| NBR of Instruments | Spreads | Commission | Platform | |

|---|---|---|---|---|

| FX Pairs | 43 | 0.4 pips (EUR/USD) | $3.5 per side (ThinkZero) | MT4, MT5 & ThinkTrader |

| Cryptocurrencies | 19 | $16 (Bitcoin) | ✘ | MT4, MT5 & ThinkTrader |

| Indices | 23 | 0.4 points (SPX500) | ✘ | MT4, MT5 & ThinkTrader |

| Metals | 4 + 2 Gold and + 2 Silver combos | $0.30 (Gold) | $3.5 per side (ThinkZero) | MT4, MT5 & ThinkTrader |

| Commodities (Energy) | 3 | 0.03 (US Oil) | ✘ | MT4, MT5 & ThinkTrader |

| Futures | 11 | From 0.2 points | ✘ | MT4, MT5 & ThinkTrader |

| Shares | 3500+ (Most on MT5, Selected on MT4) | Variable | ✘ | MT4,MT5 & ThinkTrader |

| ETFs | 352 (Most on MT5, Selected on MT4) | Variable | ✘ | MT4,MT5 & ThinkTrader |

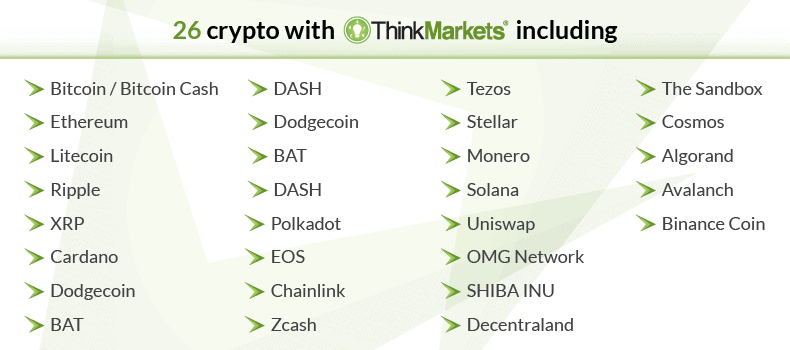

Forex and Crypto Trading

ThinkMarkets offers 43 currency pairs and 19 cryptocurrencies. The FX offerings include all the:

- Major FX pairs (EUR/USD, GBP/USD, AUD/USD, USD/JPY, etc.)

- Minor FX pairs (EUR/GBP, EUR/JPY, GBP/JPY, EUR/AUD, etc.)

- Exotic FX pairs (USD/TRY, EUR/ZAR, EUR/PLN, etc.)

Additionally, traders can speculate on the price movement of the following cryptos without the need for an external wallet or a crypto exchange:

While no additional trading cost is charged by ThinkMarkets, except the spread.

Important Note: In 2020, the UK’s regulatory body (the FCA) banned retail traders from trading cryptocurrency CFDs. Those wanting to trade crypto will need to sign up to ThinkMarkets subsidiaries outside of the UK, such as the Aust ASIC regulated branch.

Indices and Futures

ThinkMarkets’ indices offerings give you access to the major world stock market indices from 5 continents. ThinkMarkets indices include 17 global indices like ASX 200, S&P 500 or Nikkei 225; the US dollar currency index and 6 additional AUD-denominated indices (GER30aud, UK100aud, JPN225aud, NAS100aud, SPX500aud and US30aud)

At ThinkMarkets, you can also gain access to 11 futures contracts that cover several underlying instruments like commodities, stock indices or VIX volatility.

Metals and Energies

ThinkMarkets offers you the opportunity to diversify your trading portfolio and trade on a range of 8 metal pairs and 3 energies. Additionally, to the standard Gold spot contract, ThinkMarkets expanded on its tradable product list by including 2 mini contracts (XAU/USD Mini and XAG/USD Mini) which allow you to trade in smaller position sizes. They also offer prices on 3 energy contracts (US Crude Oil, Brent Crude Oil and Natural Gas).

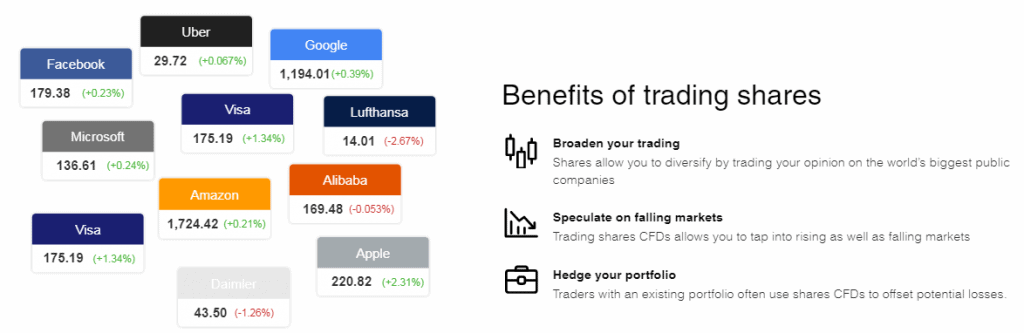

Share Trading

The broker also provides access to more than 3,500 CFD shares and 352 ETFs to speculate on. You can start trading on the world’s biggest companies with a margin starting from 5% and the ability to go both long and short without actually owning the underlying physical stock. Using MetaTrader 5 gives you access to the full range of stocks, you can still use MT4 but only the major stocks for each market is available.

Start trading today on a wide range of companies such as Google, Facebook, Apple, Amazon and so much more.

Price is indicative and does not represent real stock movement

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

Customer Service

Traders can use live chat, phone or email to get in touch with the ThinkMarkets multilingual customer support team. Customer service is available 24 hours a day, 7 days a week. A support ticket can also be submitted for immediate assistance.

![]()

Education

ThinkMarkets offer a solid suite of educational resources designed for beginner, intermediate and experienced traders. Education tools include:

- Weekly webinars

- Trading guides

- Glossary

- Online articles

Resources aimed towards beginner traders offer a soft introduction to forex trading, with how-to guides and glossaries available. Intermediate trading tutorials cover more complex topics such as chart patterns and order types. Lastly, the advanced tutorial guide addresses complex technical and fundamental analysis.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

Research and Education

To help customers develop trading strategies and manage the high risk of forex and CFD trading, ThinkMarkets provides the following research tools:

- Daily insights from ThinkMarkets in-house experts

- Economic calendar

- Technical analysis tools

Final Verdict on ThinkMarkets

With different account types, a wide range of markets and 3 top trading platforms, ThinkMarkets caters to all levels of trading experience from beginner traders to experienced investors. Those scalping, day trading or developing automated trading strategies are better suited to a ThinkZero account type that offers ECN-style trading and pricing. Beginner traders may benefit from the simplicity of ThinkMarkets standard account, where there are no additional commission fees.

Features that make ThinkMarkets one of the best brokers around include:

- Tight ECN-like spreads with STP execution

- Great market access with Forex, Cryptocurrency, and Share CFD trading

- MT4, MT5 and ThinkTrader trading platforms

- Oversight from top-tier financial regulators

- 24/7 customer support

- Fast execution with regional data centres.

open demo accountVisit ThinkMarkets

*Your capital is at risk ‘72.55% of retail CFD accounts lose money’

ThinkMarkets FAQs

Where are ThinkMarkets Data Centres Located?

To get the fastest trading execution speeds and reduce the chance of slippage, ThinkMarkets uses the largest trading ecosystem available, being Equinix trading servers. As every millisecond counts to get the bid and ask the price you want, ThinkMarkets has two Equinix data centres located in London and Hong Kong.

The LD5 centre – London

Equinix’s LD5 centre is located 11 miles from the centre of London and is where over 1000 exchanges, companies and liquidity providers operate. This data centre has an uptime record of 99.99% and offers some of the fastest available execution speed.

The Hong Kong centre – Hong Kong

This data centre is close to the financial hub of Asia. Over 455 companies are based in the Hong Kong hub.

What CFDs does ThinkMarkets offer?

ThinkMarkets offers a solid suite of CFDs for trade. These include

- 43 Forex pairs

- 15+ Global Indices plus 6 additional AUD-denominated Indices

- 3 Energies (Oil, Gas)

- 8 Metals (including Gold Zero, Silver Zero, Mini Gold and Mini Silver

- 16 Different cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple (not available in the UK)

- 1500+ Equities and ETFs

- 11 Futures (including Oil, Coffee, Cotton, Cocoa)

- 19 Cryptocurrency CFDs

Is ThinkMarkets a safe forex broker?

ThinkMarkets is overseen by top-tier regulatory bodies such as the FCA in the UK, and ASIC in Australia. With tier-1 oversight, ThinkMarkets is considered a safe broker with strong investor protection policies. You can view our Forex Brokers In Australia and the Forex Brokers In UK to see how the broker compares to the category leaders.

Compare ThinkMarkets Competitors

Justin Grossbard

Having traded since 1998, Justin is the CEO & Co-Founder of CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert

Can I trade normal shares on ThinkMarkets or only CFDs?

Clients with ThinkMarkets Australia and ThinkMarkets America can trade Shares as CFD or proper shares. Clients outside these regions can only purchase CFD shares

Does ThinkMarkets have inactivity fees?

No they don’t

Hi, I would like to know how safe it is to invest $1 million into a broker account. I’m not concerned about trading the market, on more concerned about the safety of my money being within any brokerage account if you’re investing that sort of money which brokerage would you use?Thank you.

A long as the broker is regulated, you can sure they are using a segregated bank account meaning the broker cannot touch your money. In this sense, your funds are safe.