IC Markets vs ThinkMarkets: Which One Is Best?

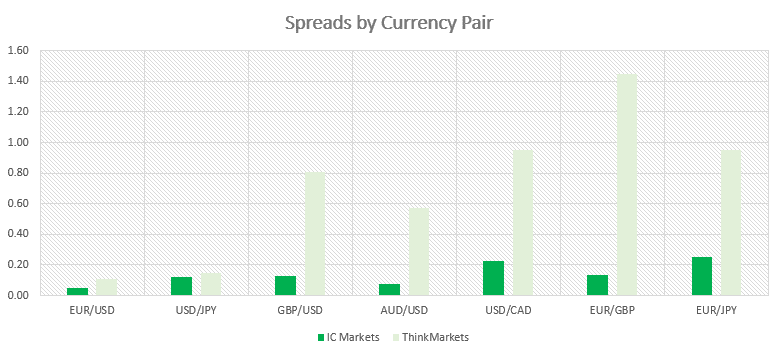

This IC Markets vs ThinkMarkets comparison found IC Markets has avg spreads of 0.02 to 0.20 for the Raw account, while ThinkMarkets has a min 0.4 pip spread for their standard account. Find out the winner in categories like platforms and regulations.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert