Blackbull Markets vs ThinkMarkets: Which One Is Best?

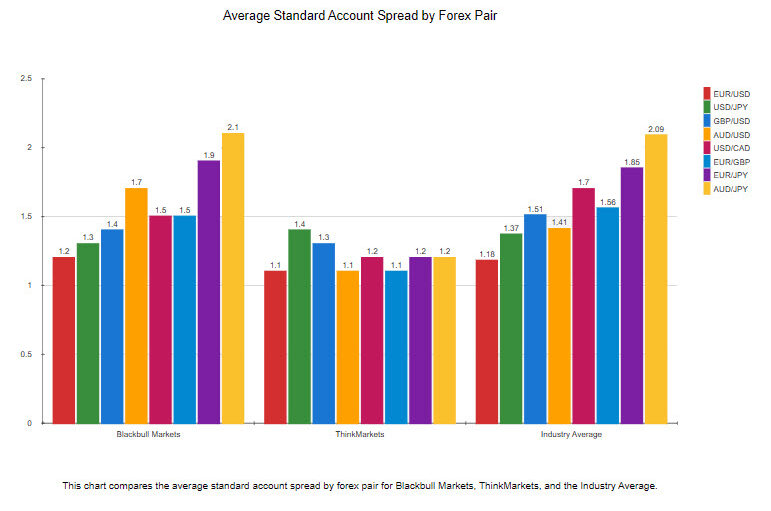

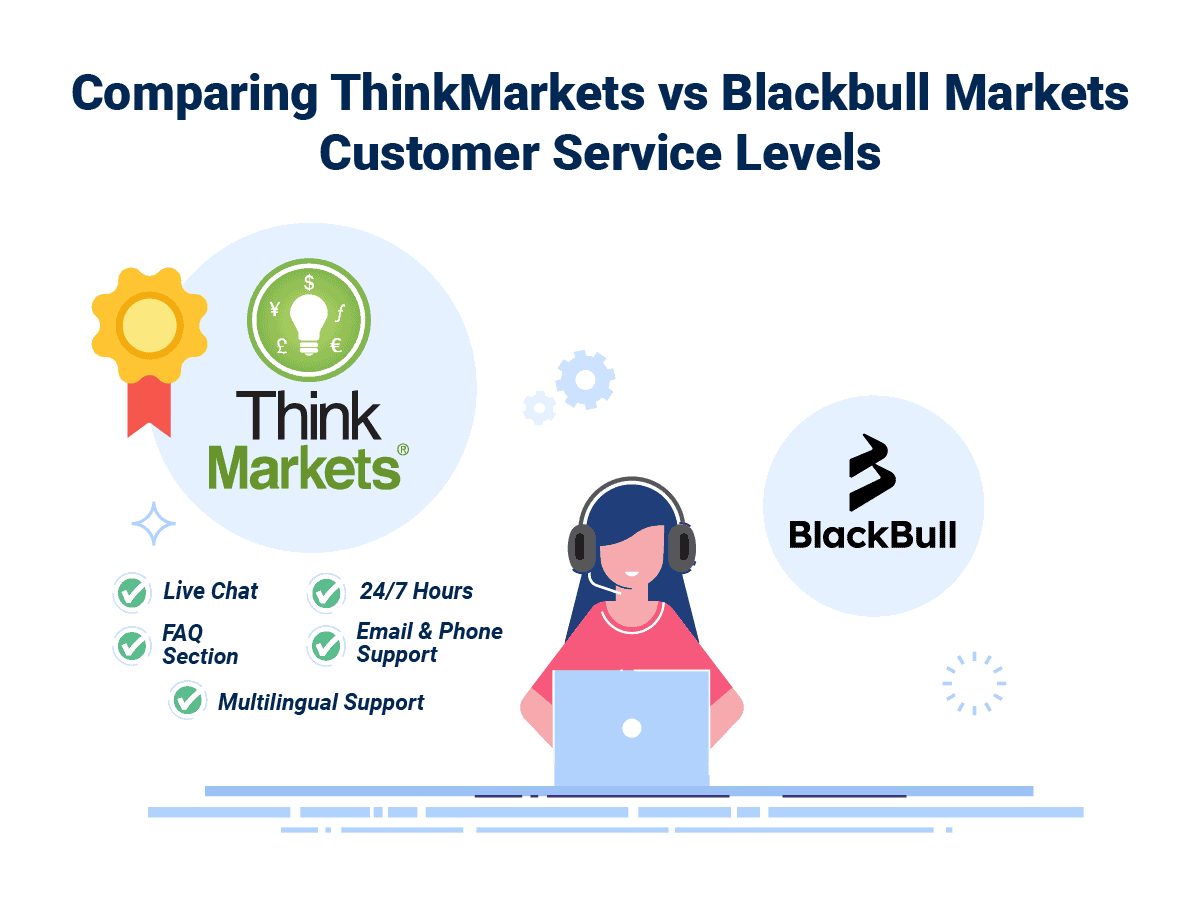

This BlackBull Markets vs ThinkMarkets Forex broker comparison found both brokers have similar trading execution, accounts, spreads and forex platforms and products for trade. Find out their similarities and differences.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert