Trading.com Review Of 2026

Trading.com offers trading services in the UK, Europe, Australia and the USA. We found Trading.com offers reasonable spreads without commission costs, but its product range and live chat support could be improved.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Trading.com Summary

| 🗺️ Regulation | NFA/CFTC, FCA, CySEC, ASIC |

| 💰 Trading Fees | Low Spreads |

| 📊 Trading Platforms | MetaTrader 5 (MT5), WebTrader, Mobile app |

| 💰 Minimum Deposit | $50 USD/EUR/GBP/AUD |

| 🎮 Demo Account | Yes |

| 🛍️ Instruments | Forex, Stocks, Indices, Commodities, Cypto (EU only), US-Spot (Forex) |

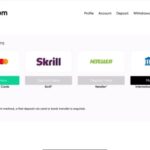

| 💳 Funding Methods | Credit/Debit Cards, Apple/Google pay, Wire Transfer, Automated Clearing House (ACH) |

Why Choose Trading.com

What stood out to me about Trading.com is the access it provides to over 1,400 CFD products, all available through a single login. I liked that there are no commissions on trades and that the minimum deposit is low, making it easy to get started. The platform supports MetaTrader 5 (MT5), along with Trading.com’s own WebTrader and mobile trading app, giving a smooth and flexible trading experience.

Depending on your region, the full range of products is available across the UK, EU, US, and Australia. I also appreciated that they’re regulated by respected authorities like the FCA, CySEC, CFTC/NFA, and ASIC, which adds a strong layer of credibility.

That said, there are a few downsides. Platform variety is limited — there’s no MT4, TradingView, or cTrader—and there aren’t any specialist copy trading tools. The educational content felt a bit basic, and there’s no RAW-style account option. Still, I found the spreads on the Standard account to be competitive, starting from 0.8 pips.

Trading.com Pros and Cons

- Regulated by A-Grade regulatory bodies

- Reasonable spreads with no commissions

- Easy deposit requirements and methods for UK Traders

- Easy deposit requirements and methods

- Sub-par educational and research programs

- Customer support weren’t technically proficient

- No RAW accounts

Trading.com DemoVisit Trading.com

The overall rating is based on review by our experts

Fees

Trading.com operates as a market-making broker, acting as the counterparty to client trades. The firm sources pricing from a network of liquidity providers to offer competitive spreads. Specific liquidity providers are not disclosed.

The quality of spreads is influenced by factors such as market volatility and liquidity. In volatile or illiquid conditions, liquidity providers may quote wider spreads, which can be passed on to clients.

Spreads

Trading.com offers access to the forex markets across multiple regions — UK, EU, US, and AU each operating under different regulatory frameworks and liquidity models. When comparing spreads across these regions, some differences appear, particularly on major forex pairs. These variations may result from regional liquidity providers, regulatory restrictions, or differing execution methods.

| Currency Pair/Spread | Trading.com UK | Trading.com US | Average Trading.com US |

|---|---|---|---|

| EUR/USD | 1.8 | 1.1 | 1.0 |

| GBP/USD | 2.0 | 1.6 | 1.6 |

| USD/CAD | 2.8 | 1.9 | 1.8 |

| USD/CHF | 1.9 | 1.5 | 1.8 |

| USD/JPY | 2.5 | 1.6 | 1.5 |

| NZD/USD | 2.8 | 2.4 | 2.5 |

| EUR/GBP | 1.7 | 1.5 | 1.6 |

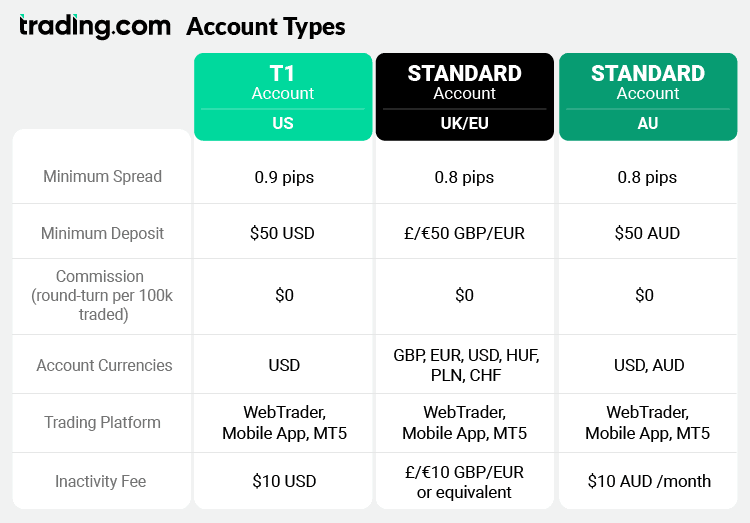

Account Types on Offer

Trading.com only offers a Standard account which is sometimes called a spread-only account since your commission costs are absorbed into the spread rather than in addition to the spread.

T1 Account for US Traders

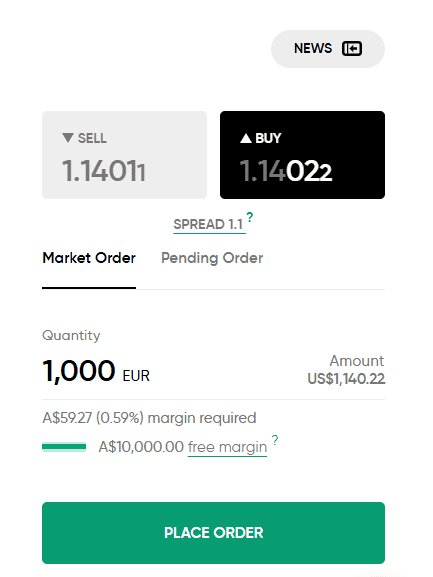

In the USA, this account is called the T1 account. To open this account, you will need to make a minimum deposit of $50 USD and the account currency will be in USD. Spreads with this account start from 0.9 pips.

My colleague, Ross Collins conducted a spread test of the T1 Account and I put it head-to-head with similar account types for other brokers. Looking at the average spreads for EUR/USD across competitors in the US, Trading.com’s 1.2 pip spread sits at the higher end of the range.

OANDA offers the most competitive pricing at just 0.6 pips, making it nearly half the cost of Trading.com on a per-trade basis. IG comes in at 1.13 pips, slightly more affordable than Trading.com. Forex.com matches Trading.com’s average exactly at 1.2 pips, making them equally priced in this respect.

So, while the broker’s spreads start as low as 0.9 pips, its average still reflects higher typical costs compared to OANDA and IG.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.20 | 1.60 | 1.60 | 1.50 |

| 1.40 | 1.40 | 1.70 | 2.00 | 1.40 |

| 1.20 | 1.80 | 1.60 | 1.70 | 1.60 |

| 1.20 | 1.40 | 1.90 | 1.90 | 1.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Trading Account – For UK, EU and Australian Traders

Trading.com’s Standard Trading Account is available in the UK, EU, and Australia, offering a consistent trading experience across regions. Features include low minimum deposits, commission-free trading, and access to over 1,400 instruments through MT5, WebTrader, and mobile apps. Account currencies differ slightly by region, and cryptocurrency trading is only available to EU clients.

Spreads, however, are a key drawback. While advertised from 0.8 pips (which is typical for competitive brokers in the industry, spreads are usually higher.

Another feature worth mentioning is that trading execution uses variable spreads (meaning they are floating) and has market execution so you won’t get requotes or rejections.

Lastly, we should mention that there is an inactivity of USD 5 per each month your account is dormant after 60 days of no use.

Swap-Free Account

Trading.com does not offer a swap-free account making the broker unsuitable for traders that need to comply with sharia law.

Demo Account

A practice account is available across all regions, allowing users to explore the platform risk-free. You can access it through MetaTrader 5, WebTrader, and the Trading.com mobile app—whether on desktop, browser, or mobile.

Pro Accounts

Trading.com does not offer Professional Accounts in any of its operating regions—UK, EU, US, or Australia. All clients are treated as retail traders, receiving the full set of regulatory protections and standard leverage caps as required by their local regulators.

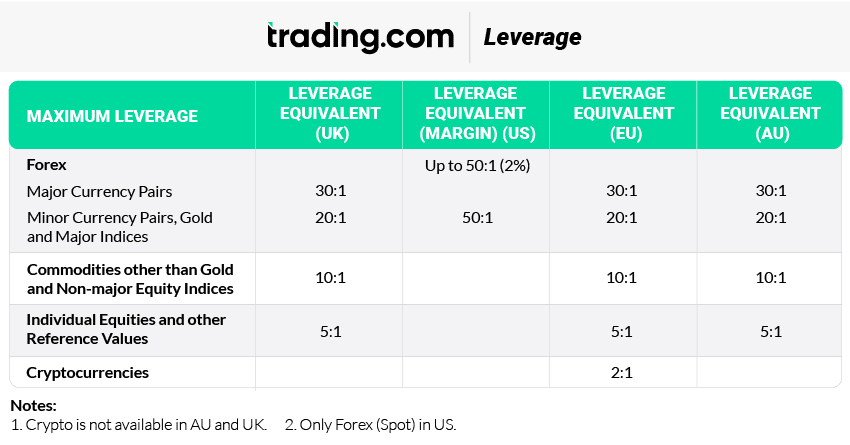

Leverage

Leverage is very subdued with Trading.com, but it’s completely understandable. The broker does need to abide by the requirements of their regulators so you won’t see crazy leverage levels of 500:1 for retail traders. Leverage limits at Trading.com are structured in compliance with local regulatory authorities.

Leverage With Trading.com US

Trading.com offers conservative leverage levels across all regions in compliance with local regulations. As expected, you won’t find high leverage options like 500:1 for retail traders.

In the US, where Trading.com is regulated by the CFTC and NFA, leverage is capped at 50:1 for major forex pairs and 50:1 for minors, gold, and major indices. Only spot forex trading is available — CFDs are not permitted under US regulations.

In the UK, EU, and Australia, leverage is aligned with regional regulatory caps. Major currency pairs are offered at 30:1, minor pairs, gold, and major indices at 20:1, commodities at 10:1, and individual shares at 5:1. Cryptocurrency trading is only available to EU clients with leverage limited to 2:1; crypto trading is not available in the UK or Australia.

While Trading.com’s leverage options may seem subdued compared to offshore brokers, they reflect a strong focus on trader protection and regulatory compliance. For most retail traders, these limits are reasonable and help reduce the risks associated with over-leveraging.

Our Verdict on Trading.com spreads

With a very simple account structure (they only have Standard accounts), it is clear Trading.com is sticking to its philosophy of making trading simple. For this reason, you will not find a RAW account with commission costs and confusing terminology such as Electronic Communication Networks (ECN) or Straight Through Process (STP) . You also won’t find fancy options like Islamic accounts or Pro accounts.

Our Verdict On Fees

Trading.com offers simple, commission-free pricing, but overall trading costs are not the most competitive. While spreads start from 0.8–0.9 pips, typical EUR/USD spreads tend to average higher, especially for UK and EU clients. In the US, spreads are more in line with industry norms but still lag behind the most cost-effective brokers like OANDA.

The broker’s straightforward account structure — a single Standard account across all regions — keeps things simple, but also limits options for traders seeking RAW spread accounts, Islamic accounts, or Pro account upgrades. While Trading.com is a solid choice for those prioritizing simplicity and regulatory protections, traders focused purely on minimizing costs may find better value elsewhere.

Trading Platforms

Trading.com offers MT5, Webtrader and Mobile App, works across the board on Windows, Mac, iOS, and Android.

| Trading Platform | Available With Trading.com |

|---|---|

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes (WebTrader, App) |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

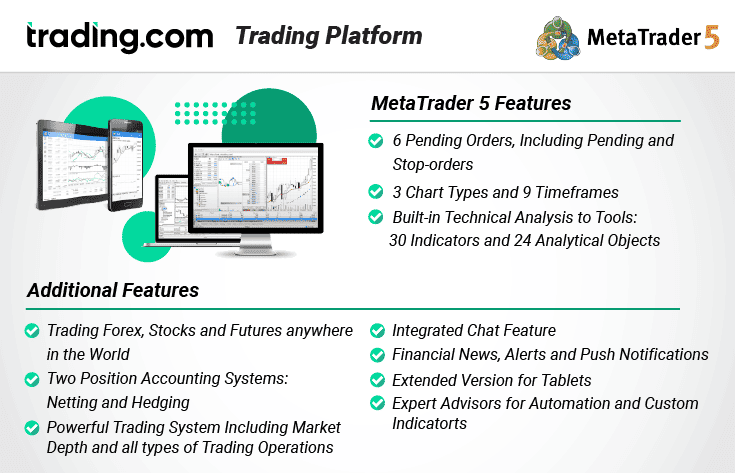

MetaTrader 5

Trading.com offers the MetaTrader 5 (MT5), one of the 4 most popular mainstream trading platforms (alongside MetaTrader 4, TradingView and cTrader) across the forex industry.

We are well acquainted with the platform, having tested MT5 with other brokers. Needless to say, there is a reason this platform is one of the most popular in the market. On the whole MT5 is an extremely solid all-rounder; it offers everything you need to trade. While some platforms might have a speciality or niche product, MT5 pretty much offers everything – wide range of charts and technical indicators, customisation, automation and even copy trading. These feature are available with with PC (Windows, Mac), Android, and iOS devices.

You can easily set up your desired technical analysis environment, with 21 timeframes, 3 chart types, and 38 technical indicators and analytic tools to work on your trading strategy. The platform even has tools for developing automated trading strategies.

Entering and exiting trades was super easy and intuitive, we were able to use 6 different order types that allowed us a few creative ways to enter, exit, and manage risk.

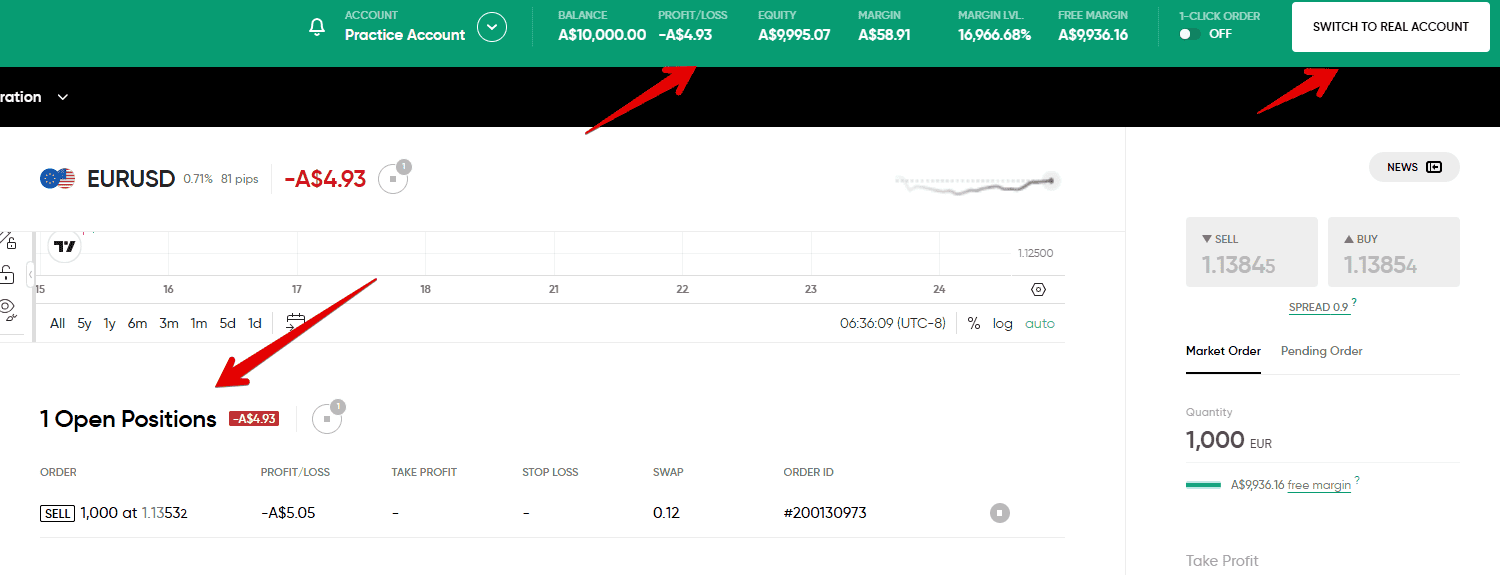

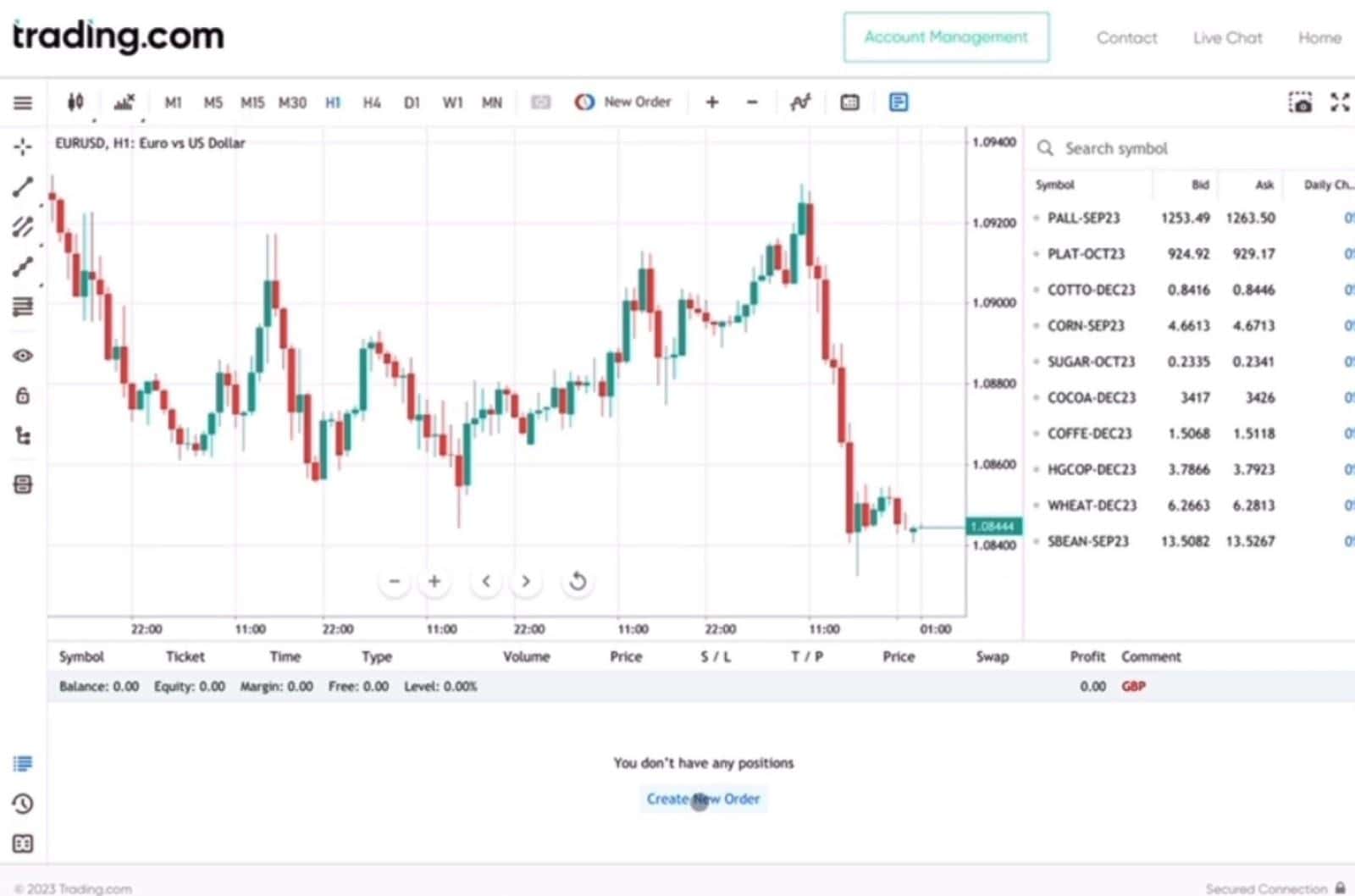

Trading.com WebTrader

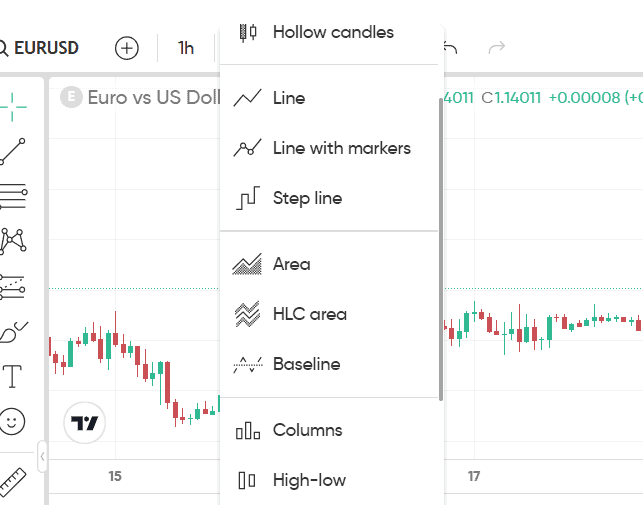

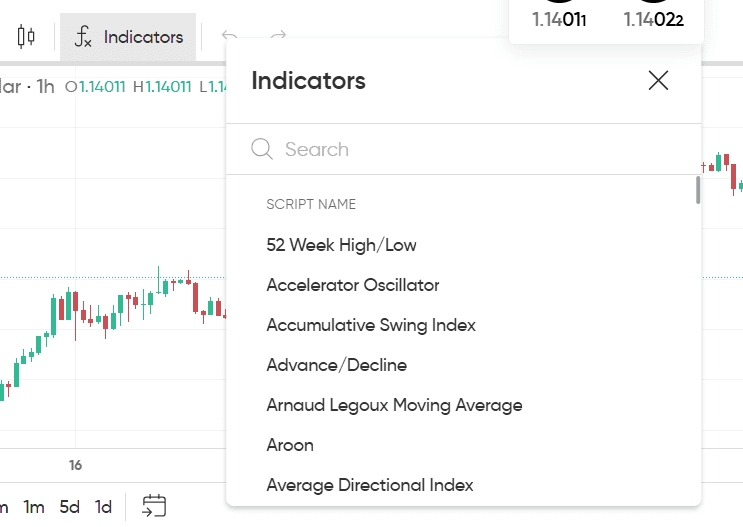

Besides MT5, Trading.com offers an advanced WebTrader, only available as a web-based platform as the name implies. Here are some of the key features I came across while testing it:

- Different chart types: Charting is powered by TradingView, offering an extensive selection of customisable charts which give you plenty of flexibility in how you view the markets. I counted 16 chart types including Bars, Candlesticks, Line, Columns and Area.

- Indicators: You can choose from more than 90 technical indicators to analyse price movements and identify potential trading opportunities. These include trend-following indicators like moving averages and momentum indicators (Oscillators) such as Stochastic Oscillator, MACD, Rate of Change (ROC) and more.

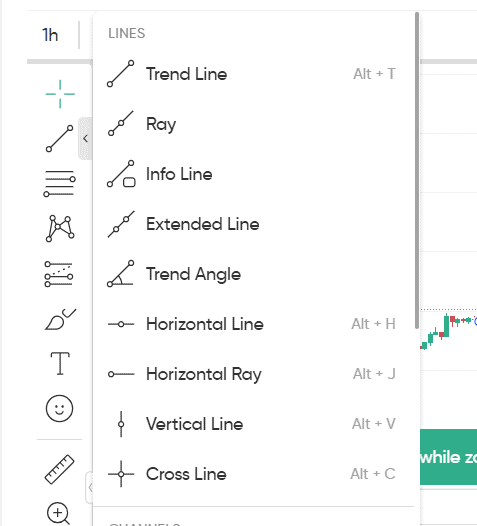

- Drawing tools: There are over 50 graphical tools available to support technical analysis and help you interpret price action visually. You’ll find everything from basic trend tools like Trend Line and Arrow, to more advanced options such as Gann & Fibonacci tools, e.g Fib Retracement and Patterns like XABCD Pattern.

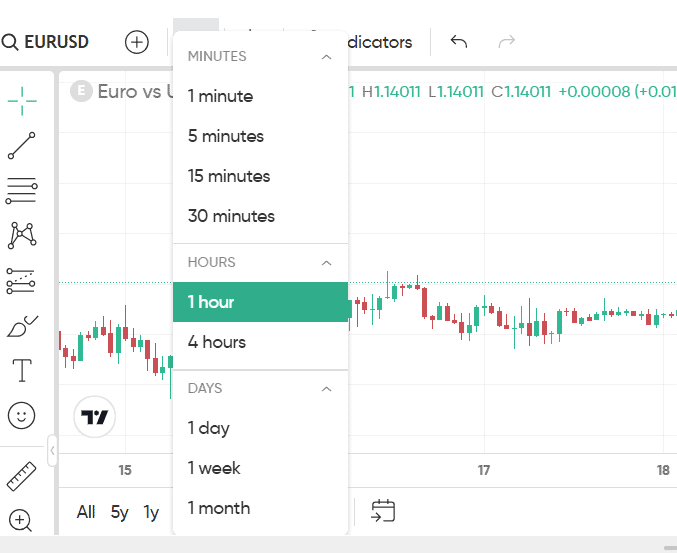

- Multiple timeframes: The platform supports 9 different timeframes, ranging from 1 minute to 1 month. I think this range is great as it allows you to view the market from both short-term and long-term angles which can help improve your analysis.

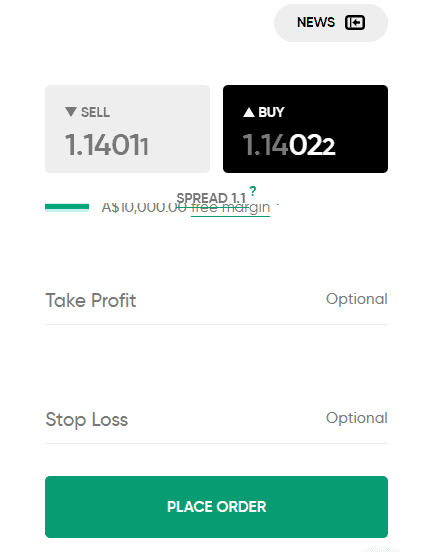

- Risk management: Before placing a trade, you can set a Take Profit to automatically close your position once it hits your target profit, or a Stop Loss to limit potential losses. These tools help you manage risk and protect your gains without having to monitor the market constantly.

- Order execution: You have full control over your trade execution with Trading.com WebTrader. You can place Market Orders for instant execution at the current price, or plan ahead with Pending Orders by setting custom entry points.

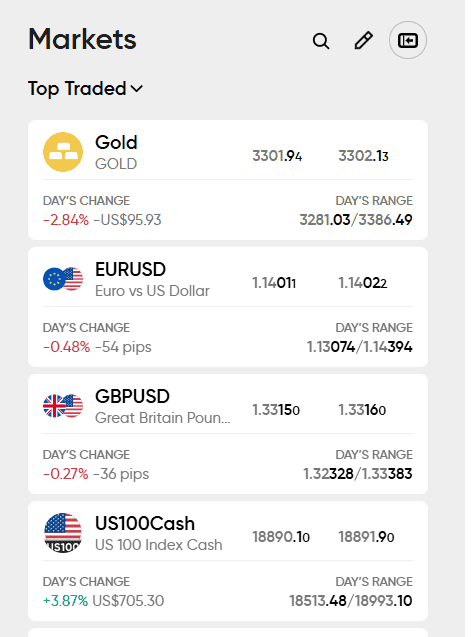

- Market watchlist: The customisable market watchlist gives you real-time updates on your favorite assets at a glance. It helps you stay focused, organised and also makes it easier to spot trading opportunities quickly by narrowing down on the instruments that align with your trading strategy.

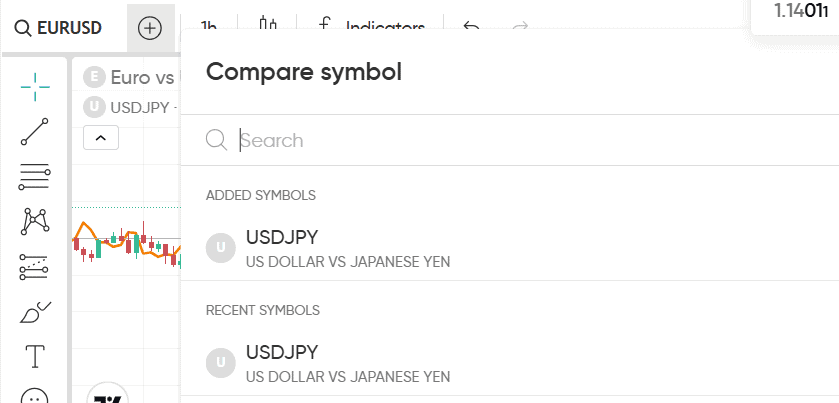

- Symbol comparison: The platform allows you to compare multiple trading instruments on a single chart. I find this useful for identifying correlations or divergences between different currency pairs or instruments.

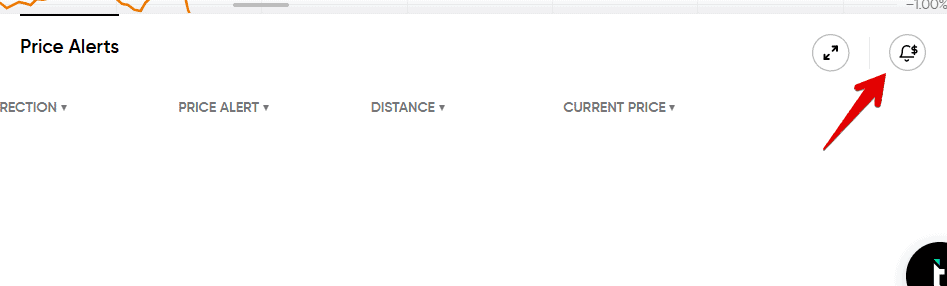

- Price alerts: You can set price alerts to get notified when an asset reaches a specific level, so you don’t have to watch the charts all day. I personally like them because they allow me to focus on other tasks while staying informed about the markets. Just keep in mind that alerts are for notification only and don’t guarantee trade execution at that price.

- Trade panel & Real-time account dashboard: You can easily track your open and closed trades, check your history, and manage deposits or withdrawals right from the Trade Panel. The dashboard keeps you updated with key info like equity, margin, and profit/loss and you can switch between the demo and real account with just a click.

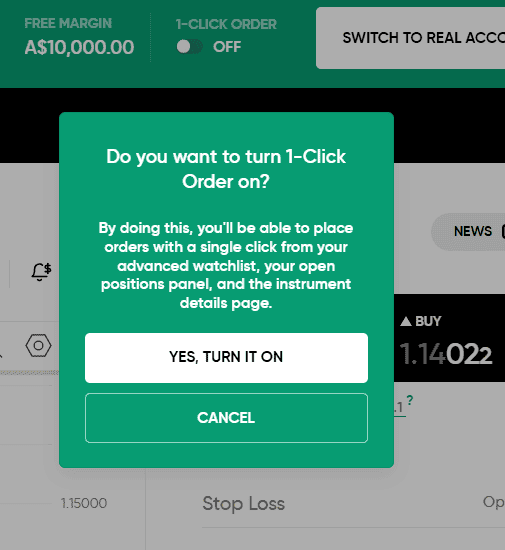

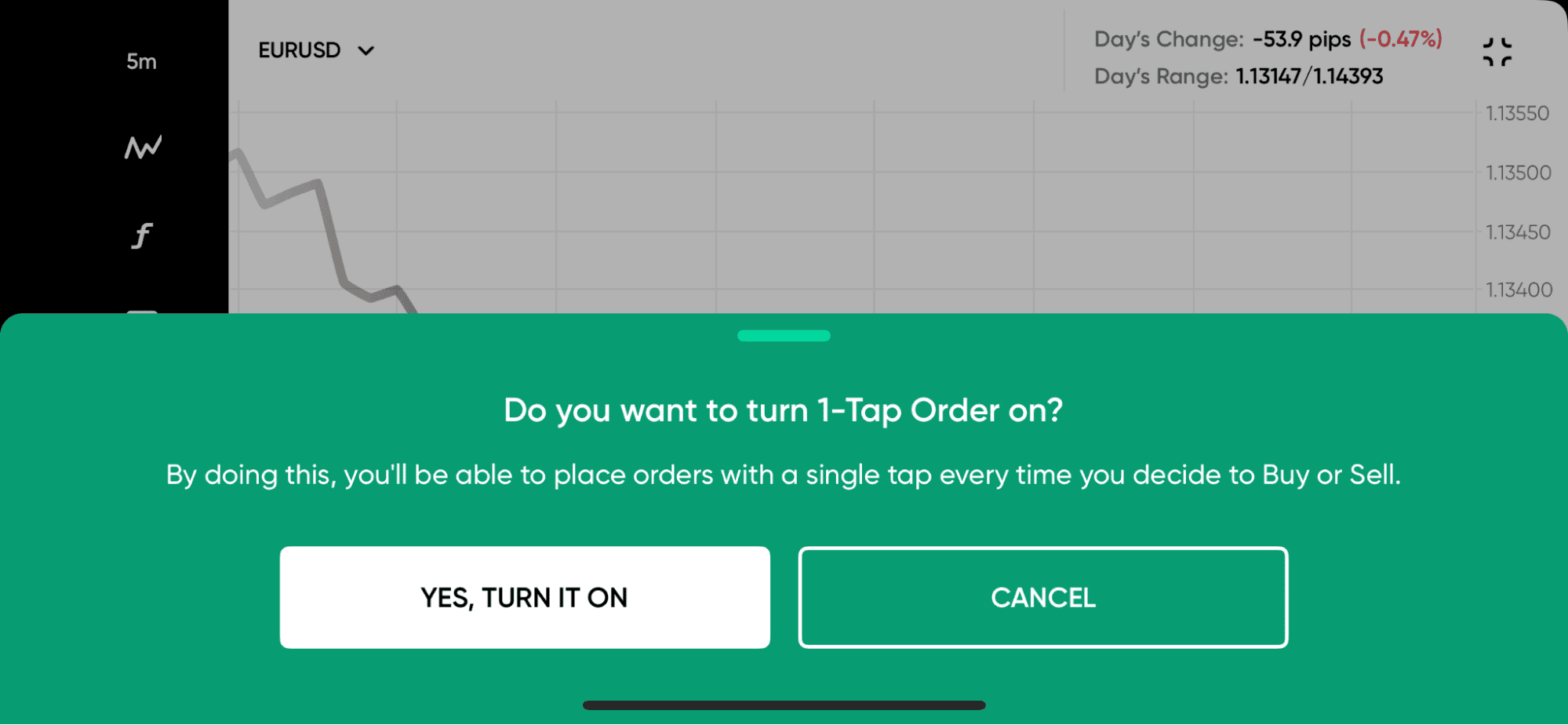

- One-click trading: With one-click trading, you can place market orders instantly without extra confirmation steps. It saves time and is super helpful when you need to act fast in volatile market conditions.

Trading.com App

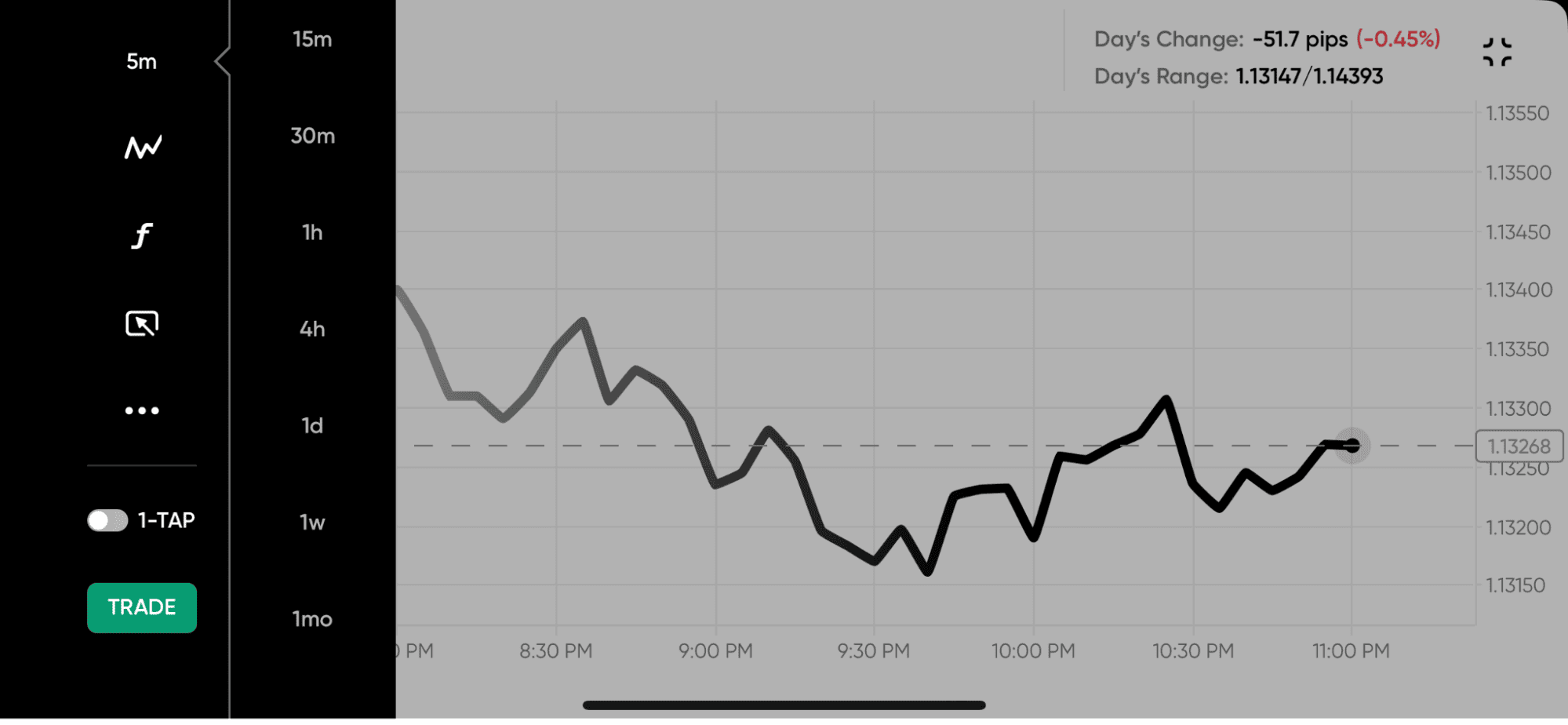

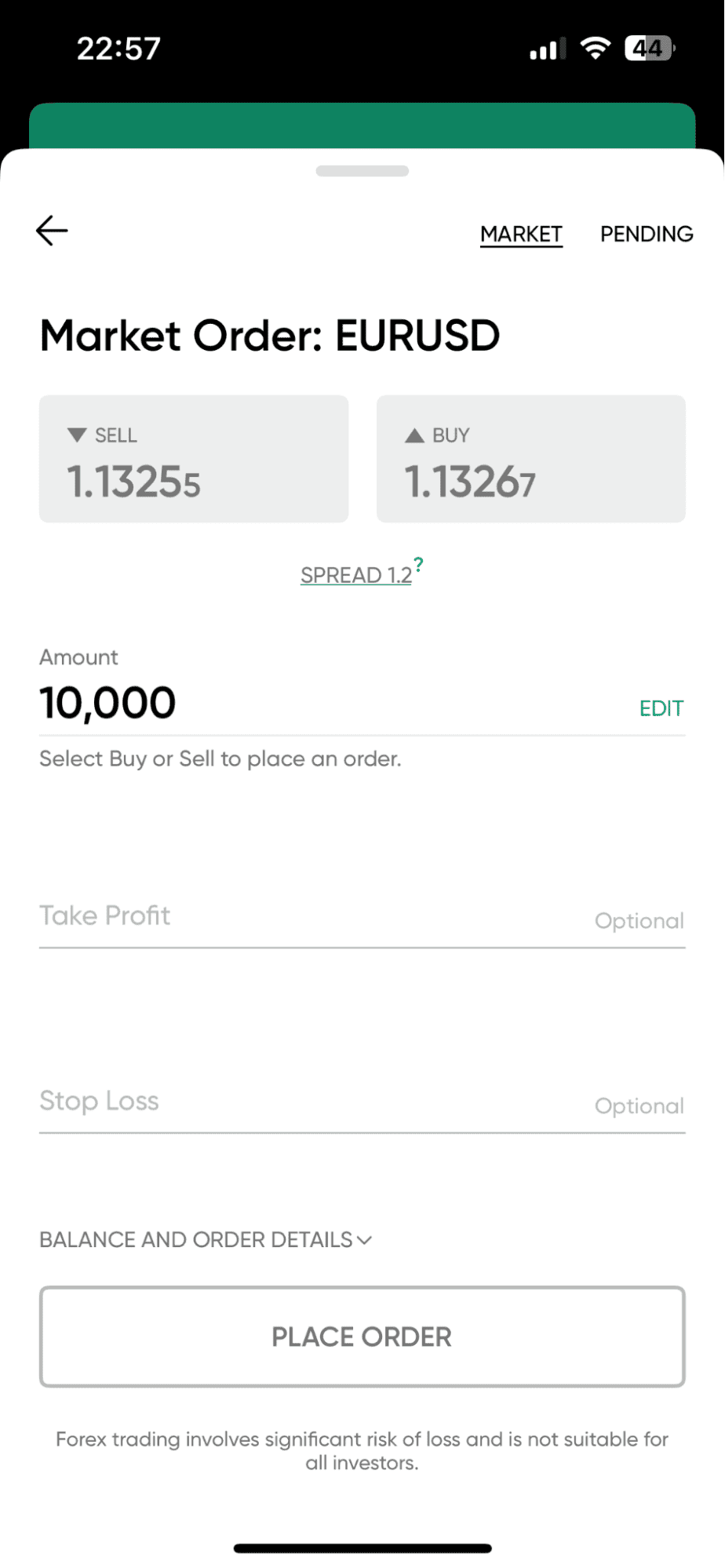

The Trading.com mobile app offers a compact version of its web platform, designed for seamless trading on the go. Available on both Android and iOS, it gives you access to some of the tools and features found on the WebTrader, such as:

- Advanced charting with TradingView: Just like on WebTrader, the mobile app uses TradingView’s powerful charting engine. However, you get access to fewer tools, for instance only 5 chart types, 5 timeframes, 25 technical indicators and around 20 drawing tools.

- Risk management & order execution: You can place Stop Loss and Take Profit to protect profits and cap losses automatically. The app also offers Market Execution and Pending Order types which give you more control over how and when your trades are triggered.

- One-click trading: Similar to the one on WebTrader, this feature lets you execute a trade with a single click without having to manually input trade details each time.

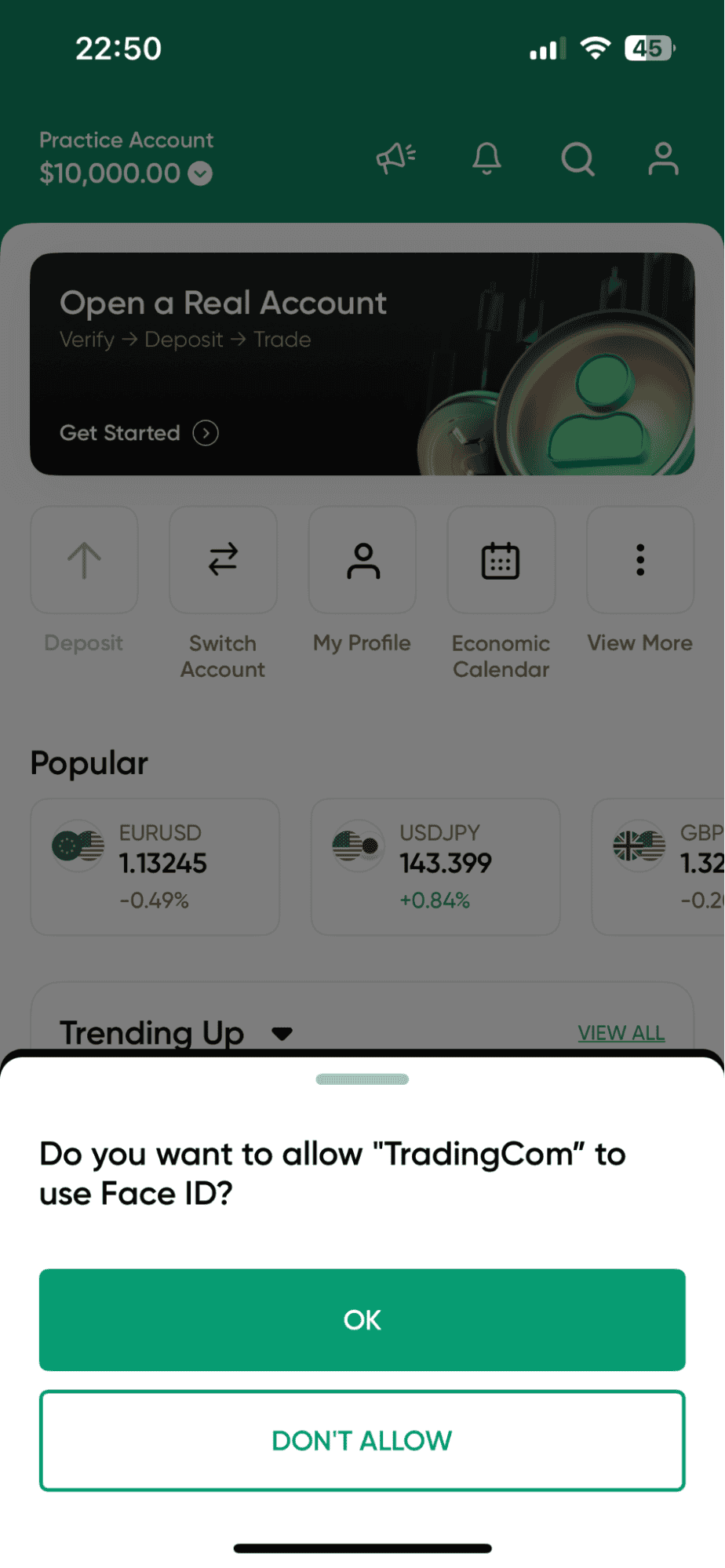

- Security: After account setup, you’ll be prompted to enable Face ID and a passcode. I appreciate this as it adds an extra layer of protection when it comes to keeping sensitive trading information secure and private.

My Verdict On Trading Platforms

Trading.com offers a decent lineup of trading platforms with MT5, WebTrader, and a mobile app that covers most of what you’d need to trade efficiently. Personally, I found the WebTrader and MT5 both responsive and packed with features, especially for charting and technical analysis.

The mobile app gets the job done, though it’s a bit more stripped down compared to what you’d get from brokers like Pepperstone or Plus500. Still, if you’re after consistency across devices and reliable execution, Trading.com is a worthy option.

Our Verdict On Trading Platforms With Trading.com

So, do we think it’s a negative that other platforms such as MetaTrader 4, or TradingView aren’t offered on Trading.com? Not necessarily.

We don’t expect very elite, or professional traders to use Trading.com. We view it as a simpler platform for keen amateur traders from the UK, EU, AU and USA. Therefore, MetaTrader5 should be good enough for the majority of the Trading.com customer base.

Safety And Regulation

Trading.com has a trust score of 75, from its regulation, reputation, and reviews.

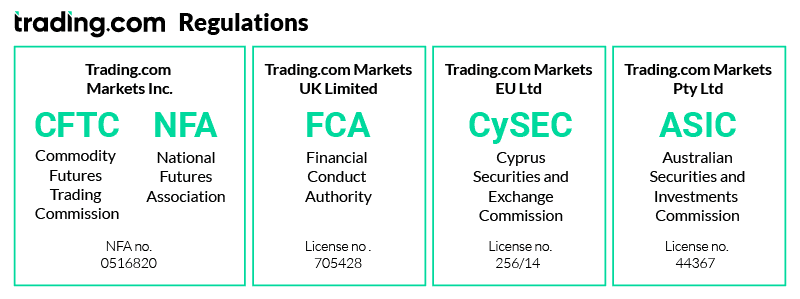

1. Regulation

Trading.com operates in multiple regions and is licensed by well-established financial regulators, which helps provide a degree of oversight and accountability for its operations.

The broker is authorized in the United States, United Kingdom, European Union, and Australia, with each regional entity regulated by the respective financial authority:

- US: CFTC and NFA

- UK: Financial Conduct Authority (FCA)

- EU: Cyprus Securities and Exchange Commission (CySEC)

- AU: Australian Securities and Investments Commission (ASIC)

These regulatory bodies are responsible for enforcing financial standards, safeguarding client funds, and ensuring fair trading practices. The presence of multiple licenses suggests that Trading.com follows region-specific rules and offers a level of protection in line with regulatory expectations in each jurisdiction.

| Trading.com Safety | Regulator |

|---|---|

| Tier-1 | NFA/CFTC FCA |

| Tier-2 | X |

| Tier-3 | X |

2. Reputation

Trading.com is part of the Trading Point Group, a privately owned financial services provider founded in 2009 in Cyprus. The group specialises in brokerage products and operates using a market maker execution model. Originally launched as Trading.com in 2019 under the entity Trading Point of Financial Instruments UK Limited, authorised by the FCA.

In 2022, Trading.com expanded into the US market, launching Trading.com Markets Inc., which is registered with the CFTC and is a member of the NFA.

Trading.com also operates in:

- The European Union, through Trading.com EU Ltd regulated by CySEC (license 256/14).

➝ Launched in 2024 - Australia, through Trading.com Pty Ltd, licensed by ASIC (license 443670).

➝ Launched in 2025

With approximately 9,900 monthly Google searches, Trading.com ranks as the 51st most popular forex broker among the 65 brokers we analyzed. Similarweb data from February 2025 shows the same positioning, with Trading.com ranking as the 34th most visited broker with 396,562 global visits.

| Country | 2025 Monthly Searches |

|---|---|

| India | 1,600 |

| United States | 1,300 |

| United Arab Emirates | 590 |

| Italy | 480 |

| Germany | 390 |

| Poland | 390 |

| United Kingdom | 260 |

| Spain | 260 |

| Pakistan | 260 |

| Brazil | 210 |

| Saudi Arabia | 170 |

| Australia | 140 |

| Philippines | 140 |

| South Africa | 140 |

| Indonesia | 110 |

| France | 110 |

| Mexico | 110 |

| Colombia | 110 |

| Malaysia | 90 |

| Canada | 90 |

| Nigeria | 90 |

| Bangladesh | 90 |

| Singapore | 50 |

| Netherlands | 50 |

| Cyprus | 50 |

| New Zealand | 50 |

| Switzerland | 50 |

| Peru | 50 |

| Uzbekistan | 50 |

| Sri Lanka | 50 |

| Vietnam | 40 |

| Japan | 40 |

| Turkey | 40 |

| Morocco | 40 |

| Kenya | 40 |

| Greece | 40 |

| Ethiopia | 40 |

| Thailand | 30 |

| Hong Kong | 30 |

| Austria | 30 |

| Argentina | 30 |

| Sweden | 30 |

| Ghana | 30 |

| Taiwan | 20 |

| Chile | 20 |

| Portugal | 20 |

| Egypt | 20 |

| Venezuela | 20 |

| Algeria | 20 |

| Dominican Republic | 10 |

| Cambodia | 10 |

| Mauritius | 10 |

| Ireland | 10 |

| Ecuador | 10 |

| Bolivia | 10 |

| Uruguay | 10 |

| Panama | 10 |

| Jordan | 10 |

| Costa Rica | 10 |

| Uganda | 10 |

| Tanzania | 10 |

| Mongolia | 10 |

| Botswana | 10 |

1,600 1st | |

1,300 2nd | |

590 3rd | |

480 4th | |

390 5th | |

390 6th | |

260 7th | |

260 8th | |

260 9th | |

210 10th |

3. Reviews

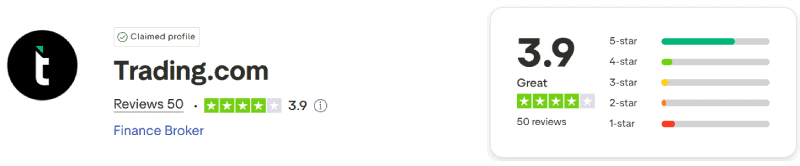

Trading.com holds a 3.9/5 Trustpilot rating based from 50 reviews.

Our Verdict On Regulation With Trading.com

We feel that due to the quality of the regulators, Trading.com is a rather safe broker for keeping your funds with.

Deposit and Withdrawal

We found Trading.com to be quite limited with regard to funding options for trading accounts.

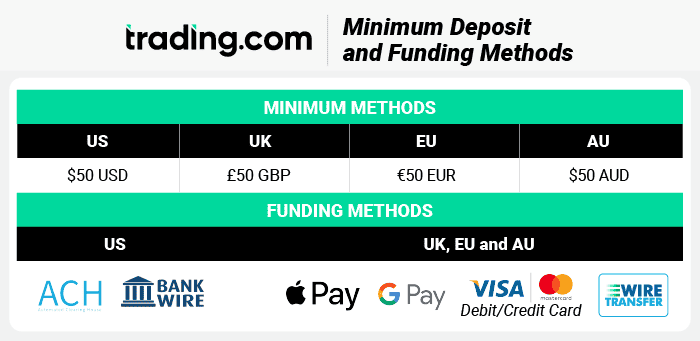

What is the minimum deposit at Trading.com?

The minimum deposit at Trading.com is consistent across all regions:

- US: $50 USD

- UK: £50 GBP

- EU: €50 EUR

- AU$50 AUD

Deposit Options and Fees

There are no deposit fees charged by Trading.com, but third-party fees (e.g. bank or payment provider) may apply depending on the method used.

Wire transfer deposits under $250 in the US may incur a small fee from the sending bank, not from Trading.com. In the UK, similar third-party fees can apply on international wire transfers under £200.

Deposit processing times vary by method, ranging from instant to up to 5 business days.

Ease To Open An Account

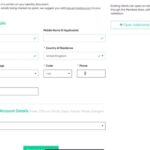

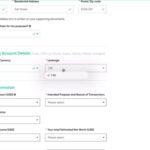

Opening an account with Trading.com was super quick and simple. First, we had to pick our account type, between a demo account or a real account. We decided on a real account, clicked Open Account, then had to share our name and contact details.

Next, we had to select the base currency for our account, and our chosen leverage amount. We chose GBP and 1:30.

After that, there were a few KYC (Know-Your-Client) regulatory questions that we needed to answer. These answers give Trading.com an idea about our financial position, risk tolerance, and trading experience.

After clicking through, we were set up, and we were finally able to log into our account.

Inside the account, things were very clean and simple. Our next step was to verify the account with proof of identity and residence.

We were required to upload a picture of a government ID, and something to prove where we lived.

Next up, it was time to deposit funds into our account. We elected for the debit card option – quick and easy.

Now it was time to set up MetaTrader 5, our trading platform. We chose WebTrader, the version that runs in our web browser.

Clicking around the MT5 web trader, things were super intuitive. Finding the right chart, and working out how to enter order was super simple.

Our Verdict on Trading.com Funding

We think it hard to fault the funding options with Trading.com, sure they could offer more choices like Paypal. Apple Pay or even cryptocurrencies but the essentials are there so chances are you will be fine.

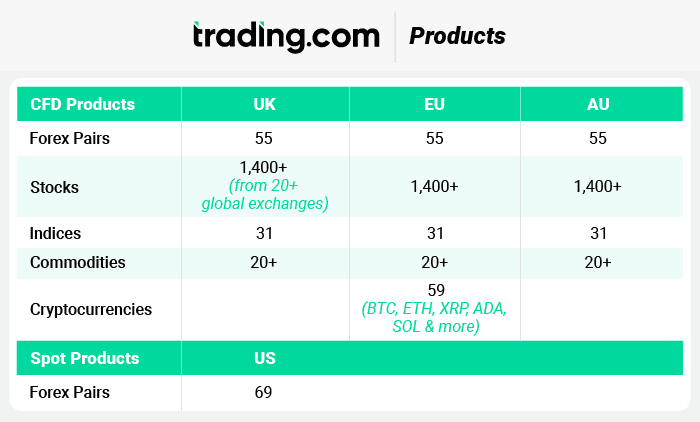

Product Range

Before we discuss nto the product offering, it’s important to clarify a key difference:

- US clients trade Spot FX due to local regulations.

- UK, EU, and AU clients trade CFDs (Contracts for Difference) across a broader set of asset classes

🇺🇸 Trading.com US – Spot FX Only

US traders can trade 69 currency pairs with no access to stocks, indices, commodities, or cryptocurrencies. This limitation is due to regulatory requirements set by the CFTC and NFA.

That said, 69 pairs is still a solid range, including all major pairs, plus a wide variety of minor and exotic FX pairs like USDZAR, USDTRY, GBPMXN, and more. These offer more volatility and potential opportunity though they do come with higher risk due to lower liquidity.

Tradable Asset Class:

✅ Forex only (Spot FX)

❌ No CFDs, commodities, stocks, crypto, or indices

🇬🇧 Trading.com UK – CFD Trading on 4 Asset Classes

UK clients can trade a wide selection of 1,400+ CFD instruments across 4 asset classes, including:

- 55 FX pairs

- 1,400+ Stock CFDs (from 20+ global exchanges)

- 31 Index CFDs

- 20+ Commodity CFDs

UK clients cannot trade crypto CFDs, as per FCA restrictions, but all other major markets are well represented, including shares from the US, UK, EU, Brazil, Canada, and Australia.

Tradable Asset Classes:

✅ Forex, Stocks, Commodities, Indices

❌ Crypto, Bonds, ETFs, Futures

🇪🇺 Trading.com EU – CFD Trading on 5 Asset Classes

EU traders get access to the widest range of instruments, including crypto CFDs, which are not available in other regions:

- 55 FX pairs

- 1,400+ Stock CFDs

- 31 Index CFDs

- 20+ CFD Commodities

- 59 Crypto CFDs (BTC, ETH, XRP, ADA, SOL & more)

This makes the EU entity the most diverse in terms of product offering, suitable for traders looking for both traditional and digital market exposure.

Tradable Asset Classes:

✅ Forex, Stocks, Commodities, Indices, Crypto

❌ Bonds, ETFs, Futures

🇦🇺 Trading.com AU – CFD Trading on 4 Asset Classes

Australian clients can trade over 1,400 CFDs across 4 major asset classes:

- 55 FX pairs

- 1,400+ Stock CFDs

- 31 Index CFDs

- 20+ CFD Commodities

Crypto CFDs are not available in Australia, but the range is otherwise extensive, offering access to global shares and a wide mix of market sectors.

Tradable Asset Classes:

✅ Forex, Stocks, Commodities, Indices

❌ Crypto, Bonds, ETFs, Futures

Our verdict On Range Of Markets

Trading.com has a well-structured offering in terms of product range and leverage, just more opportunities if you’re outside the US.

In the US, it’s strictly spot forex which feels limiting, but the 69 pairs do offer plenty of variety. Outside the US, things open up with CFDs on forex, stocks, indices, commodities, and crypto for EU clients.

Customer Service

Trading.com offers various ways to contact their customer support team, including email, phone, fax (for UK clients), and live chat. The support is available 24/5 and is provided by staff located in the Cyprus office.

While the team is polite and friendly, we found they may struggle with technical questions, as demonstrated by a UK live chat representative’s unfamiliarity with spread betting. Overall, we think the quality of service and responses can be considered average.

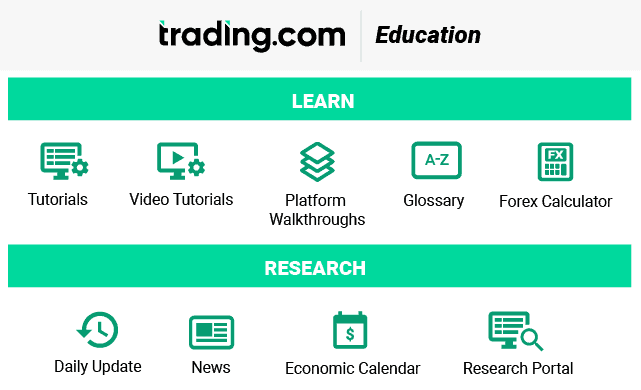

Research and Education

Trading.com provides a reasonably well-rounded selection of educational and research tools across its regional websites. Users can typically access daily market analysis, economic calendars, trading signals, and educational content such as videos and platform guides.

Topics tend to cover core areas like trading psychology, technical strategy, and platform usage. While the depth may vary slightly by region, the overall offering is geared toward beginner to intermediate traders and supports consistent learning over time.

Advanced or professional-level educational content is more limited, but for most retail traders, the available resources should be sufficient for developing foundational knowledge and staying informed on market developments.

Our Verdicts on Education With trading.com

We’re surprised that Trading.com hasn’t copied the American resources over the UK site, as most of the topics are entirely valid for UK traders. For beginners in the US, Trading.com is a good, fair choice, but not so for beginners in the UK.

Trading.com FAQs

What are the minimum deposit requirements?

For the US, the minimum deposit is $50, while for the UK, EU and Australia, it’s 50 for in their local currency.

What funding methods are available?

US clients can use ACH and wire transfers, while clients in the UK, EU and Australia have options like debit/credit cards, Skrill, Neteller, and wire transfers.

What is the maximum leverage offered?

In the US, leverage is capped at 50:1, while in the UK, EU and Australia, it varies, with major pairs at 30:1 and other products ranging between 5:1 and 20:1.

Does Trading.com offer demo accounts?

Yes, Trading.com provides a demo account with MetaTrader 5, available for 90 days.

Does Trading.com offer educational resources?

Yes, Trading.com offers educational resources, but they vary by region, with the US site offering more options compared to other regions.

Final Verdict on Trading.com

Trading.com delivers a good mix of 1400+ tradable assets with flexible region-specific leverage on a wide range of platforms that are feature-rich and easy to navigate. The broker is trustworthy, transparent, and backed by strong regulation across the US, UK, EU, and Australia.

Overall the brokers spreads are somewhat competitive for Australian and UK Trading Accounts but not the tightest, especially with the US Trading Account. For American forex traders, Trading.com could be a good choice as there aren’t too many forex broker options for Americans. For traders in the UK, Europe and Australia, if you’re looking for a simple broker to execute some trades in major FX pairs, or maybe some major stock indices, and need little or no education, Trading.com could be an ok choice.

If you’re an active trader and you want to actively trade markets (especially more exotic products), it is probably better to look toward other brokers since Trading.com does not offer a RAW/ECN or Pro style trading account.

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Verdict

Verdict  Fees

Fees  Trading Platforms

Trading Platforms  Safety

Safety  Funding

Funding  Product Range

Product Range  Support

Support  Market Research

Market Research

Ask an Expert