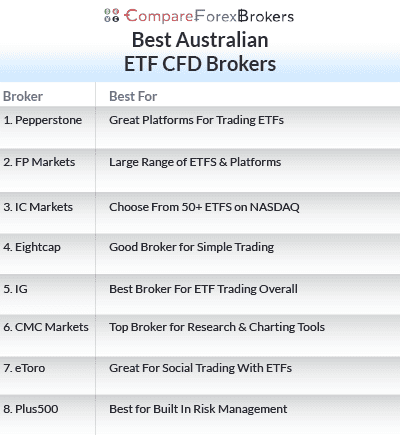

8 Best Australian ETF CFD Brokers

We compared the 39 ASIC-regulated trading accounts to determine the best ETF CFD broker in Australia. Our process included opening accounts, running tests, and comparing trading fees and ETF product ranges.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Our list of the best ETFs trading platforms is:

- Pepperstone - Great Platforms For Trading ETFs

- FP Markets - Large Range of ETFS & Platforms

- IC Markets - Choose From 50+ ETFS on NASDAQ

- Eightcap - Good Broker for Simple Trading

- IG Group - Best Broker For ETF Trading Overall

- CMC Markets - Top Broker for Research & Charting Tools

- eToro - Great For Social Trading With ETFs

- Plus500 - Best for Built In Risk Management

Which platform is best for EFT trading?

Interactive Brokers leads in ETF trading through comprehensive global market access, zero-commission US ETF trades, and advanced screening tools across its Trader Workstation and mobile platforms. We reviewed brokers on ETF selection breadth, trading costs including commissions and spreads, platform functionality for fund research and analysis, direct market access capabilities, and portfolio management tools to identify which platform provides the most cost-effective and feature-rich environment for ETF investors ranging from passive holders to active traders.

1. Pepperstone - Great Platforms For Trading ETFs

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Quick Pepperstone ETF Facts

- Number of ETFs = 95

- ETF CFD Cost = $0.02 per share

- ETF CFD Range = 100+ ETFS

Pepperstone earns my top spot for trading ETFs thanks to its wide range of products and trading platforms. They offer 100+ ETFs covering sectors like mining, energy, tech, retail, and fixed income. They’re affordable at just 2c per share, with exchange spreads and no markups, making them one of the best choices for low trading costs.

What gives Pepperstone top value in my review is the range of platforms you can trade on. They offer MTF, MT5, cTrader, TradingView, and a Pepperstone mobile app. Tests by our analysts also found Pepperstone has some of the fastest execution speeds in the industry.

Pros & Cons

- Only 2c per share

- 100+ ETF product range

- No minimum deposit required

- No traditional ETF investing

- Modest in size Vs IG/CMC

- No in-house research for ETFs

Broker Details

Pepperstone pricing is great

In my tests, Pepperstone performed well in the cost category. Commission is $0.02 per share per side, with no hidden spreads or markups. That makes Pepperstone very affordable for beginners and experts alike. And with access to 100+ of the major ETFs, this broker is likely to have everything you need to trade ETF CFDs.

Our analyst tests confirmed Pepperstone’s low-latency execution, with a limit order speed of just 77ms. While this won’t move the needle for long-term ETF trades, it’s essential if you’re trading short-term volatility or managing risk tightly with stop orders.

| Execution Speed Testing | ||||||

|---|---|---|---|---|---|---|

| Broker | Overall Speed Ranking | Limit Order Rank | Limit Order Speed (ms) | Market Order Rank | Market Order Speed (ms) | Broker Type |

| Blackbull Markets | 1 | 1 | 72 | 5 | 90 | ECN |

| Fusion Markets | 2 | 3 | 79 | 1 | 77 | ECN |

| Pepperstone | 3 | 2 | 77 | 10 | 100 | ECN |

| Octa | 4 | 4 | 81 | 6 | 91 | ECN |

| Oanda | 5 | 5 | 86 | 2 | 84 | Market Maker |

| Blueberry Markets | 7 | 6 | 88 | 7 | 94 | ECN |

| Global Prime | 9 | 7 | 88 | 9 | 98 | ECN |

| Axi | 15 | 8 | 90 | 25 | 164 | ECN |

| Tickmill | 10 | 9 | 91 | 11 | 112 | ECN |

| Exness | 6 | 10 | 92 | 3 | 88 | Market Maker |

| TMGM | 11 | 11 | 94 | 13 | 129 | ECN |

| City Index | 12 | 12 | 95 | 14 | 131 | Market Maker |

| Forex.com | 8 | 13 | 98 | 4 | 88 | Market Maker |

| Trading.com | 13 | 14 | 114 | 15 | 138 | Market Maker |

| Admirals | 22 | 15 | 132 | 27 | 182 | ECN |

| IC Markets | 17 | 16 | 134 | 22 | 153 | ECN |

| CMC Markets | 24 | 18 | 138 | 26 | 180 | Market Maker |

| Eightcap | 16 | 19 | 143 | 17 | 139 | ECN |

| IG | 23 | 26 | 174 | 19 | 141 | Market Maker |

Pepperstone has 4 trading platforms

Another core strength is that it offers all major CFD trading platforms. This includes their own trading app as well as MetaTrader 5, MetaTrader 5, cTrader and TradingView.

I prefer TradingView as it provides the best charting experience. It has the most built-in indicators and the best drawing tools which really help with my technical analysis.

Just note that if you prefer algo trading, then your best options are with MT4, MetaTrader 5, or cTrader. While TradingView does have Pine Script, you will need a bridge to make this work.

Regardless, Pepperstone makes ETF CFD trading affordable and flexible to suit your trading style.

2. FP Markets - Large Range of ETFS & Platforms

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.31

Trading Platforms

MT4, MT5, cTrader, TradingView, IRESS

Minimum Deposit

$100

Why We Recommend FP Markets

- Number of ETFs = 290+

- ETF CFD Cost = $0.02 per share ($2.00 minimum per side)

- ETF CFD Range = 300+ ETFs

If you’re after sheer ETF CFD volume, FP Markets is a great option. I found over 300 ETFs on offer in their trading platforms, giving great options for diversification across sectors, indices, bonds, and commodities.

FP Markets lists pricing at $0.02/share commission. But keep in mind, there’s a $2 minimum per side. You’ll want to factor that in if you plan to scale into positions gradually. They also offer access to MT4, MT5, cTrader, TradingView, plus IRESS if you want advanced equity tools and are based in Australia.

These platforms have one-click trading, faster processing of your orders, and access to Depth of Markets tools for advanced order flow analysis for scalping.

Pros & Cons

- Access to 300+ ETFs

- Multi-platform support

- Includes major global ETFs like SPY, QQQ, GLD, and VTI

- $2.00 minimum commission

- No portfolio tools or ETF research features

- Lack of advanced tools

Broker Details

FP Markets has a wide range of products

I found FP Markets to be one of the more ETF-heavy CFD brokers available in Australia. Their ETF CFD list includes top names like SPY, QQQ, GLD, and VTI, plus more niche options like AGG and ACWI.

Beyond ETFs, you can also trade a good range of CFD products with FP Markets. Over 70 Forex pairs are available with spreads averaging 1.18 pips for Standard account and 0.08 pips (plus $3.50 commission) for RAW ECN account when using EUR/USD.

Other products include over 10,000 CFD stocks, 9 types of metals, 5 energies and 8 agricultural products. You can also trade 15 indices and 2 bonds.

FP Markets offers 5 trading platforms

During testing, I used both TradingView and MT5. TradingView gave me a great charting experience, while MT5 offered smoother execution and integration with my algo tools. IRESS is also available for Australian traders and is a good choice if you’re trading at a pro level or need market depth features.

I usually recommend FP Markets as a great option for scalp trading but wider spreads and lower liquidity makes scalp trading is difficult to do with ETFs. Still, FP Markets stands out for ETF CFD exposure for its range of trading platforms. MT4, MT5, cTrader, TradingView, plus IRESS if you want advanced equity tools.

Our analyst (Ross Collins) tested 36 brokers that offer MT4 to gauge the market order speeds for each broker. Ross found FP Markets achieved 96ms on its market order speeds, placing the broker in 8th place on the recent test.

Competitive pricing for larger orders

In terms of cost, you can expect $0.02 per share, with a minimum $2 per side. That’s fair for large positions, but can add up on small trades.

3. IC Markets - Choose From 50+ ETFS on NASDAQ

Forex Panel Score

Average Spread

EUR/USD = 0.01 GBP/USD = 0.04 AUD/USD = 0.02

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$200

Why We Recommend IC Markets

- ETF CFD Cost = $0.02 per share

- ETF CFD Range = 3 NASDAQ, 33 NYSE ETFs

IC Markets gives you access to 36+ ETFs listed on U.S. exchanges. While that limits exposure to ASX-listed funds, you still get key U.S. ETFs like SPY, QQQ, and GLD. For traders focused on U.S. sectors, tech-heavy themes, or tracking the S&P 500, this list hits the mark.

With $0.02/share commissions and no markup, cost transparency is solid, especially for short-term traders managing risk closely. IC Markets is one of the largest brokers in the world with 500,000 traders per day, which shows the broker’s popularity with both experienced and beginner traders alike.

Pros & Cons

- Fast account opening

- Great for U.S. ETF access

- Infrastructure built for algo traders

- No ASX ETF access

- Smaller ETF CFD range than other brokers

- $200 minimum deposit

Broker Details

Okay product range but high-speed execution

While IC Markets don’t offer the greatest range of ETFs, they do offer access to 2,250+ other CFD products across forex, indices, commodities, bonds, futures and stocks.

I reviewed their ETF CFD range and counted 36+ live instruments, all U.S.-listed. You’ll find familiar names like QQQ, SPY, IWM, and GLD, but no access to ASX-listed ETFs or non-U.S. global options. That’s definitely a gap if you’re aiming for broader diversification.

Solid selection of trading platforms

Similar to Pepperstone, IC Markets offers a solid selection of trading platforms. These platforms include TradingView, MetaTrader 5, cTrader, and MT5, giving you the flexibility to trade with the tools and layout that suit your strategy.

I like that IC Markets supplements its MT4 and MT5 platforms with 20 premium trading tools that improve trading management on the platforms.

For example, I’m a fan of the Mini-terminal EA that provides an improved one-click trading feature allowing you to deploy your stop-loss and take profit orders with your order instantly.

Although not so relevant for ETFs, I found this helpful when scalping as it allowed me to add my risk management immediately, rather than appending the orders with the open position which risks unnecessary losses.

4. Eightcap - Good Broker For Simple Trading

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.1 AUD/USD = 0.2

Trading Platforms

MT4, MT5, TradingView, Capitalise.ai

Minimum Deposit

$100

Why We Recommend Eightcap

- ETF CFD Cost = $2 USD per lot

- ETF CFD Range = 34 ETFs

I chose Eightcap for its simple platform layout and decent pricing. ETF CFDs are priced at $2 USD per lot per side, with clear swap fees posted for overnight holding. If you go long, expect to pay around $6.82 per lot per night. Shorts get a credit of $1.82.

Although Eightcap has an excellent range of markets, including 56 Forex pairs and 137+ cryptocurrencies (the best crypto range I’ve seen), their ETF range is somewhat limited. I only found 44 ETFs available to trade, mainly U.S.-listed names covering core products like SPY, QQQ, and Vanguard’s top funds. That said, they do offer three crypto ETFs that track Bitcoin and Ethereum, something I haven’t found with other brokers.

That makes Eightcap ideal if you’re looking to mix your ETF exposure with crypto trades.

Pros & Cons

- Fixed commission of $2 per lot

- Capitalise.ai and FlashTrader

- Great for beginners

- Limited range of ETFs

- Research tools lack depth

- Education videos could be more detailed

5. IG Group - Best Broker For ETF Trading Overall

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, IG Web Platform, IG Mobile App, TradingView, L2 Dealer, ProRealTime

Minimum Deposit

$0

Why We Recommend IG Group

- ETF CFD Cost = Varies by region

- ETF CFD Range = 2,000+ ETFs across Australia, U.S., UK, EU, and NZ

I recommend IG Group if you want flexibility and access to the largest ETF selection I’ve seen. They offer over 2,000 ETF products across Australia, the U.S., and Europe. It’s the best option for those looking for hedging and diversification across the globe.

They have fantastic online trading courses available through their IG Academy, and no minimum deposit making them an excellent option for beginners. They also allow you to trade U.S.-listed ETFs outside U.S. trading hours, perfect for those in different timezones or wanting to react to macro news early.

Their pricing commissions vary by region and product. For example, Australian ETFs are charged 0.08% commission per side with a minimum charge of $7. U.S. listed products go for 2c per share, but with a minimum charge of $15. Fine for larger trades, but more expensive than other brokers for smaller trades.

Pros & Cons

- 2,000+ ETFs

- Pre-market and after hours U.S. ETFs

- Best for advanced traders

- U.S. ETF commission starts at $15

- Platform learning curve

- No social trading tools

6. CMC Markets - Top ETF CFD Broker for Research and Charting Tools

Forex Panel Score

Average Spread

EUR/USD = 0.5 GBP/USD = 0.9 AUD/USD = 0.6

Trading Platforms

MT4, TradingView, CMC Next Gen Platform

Minimum Deposit

$0

Why We Recommend CMC Markets

- ETF CFD Cost = Commission varies per region

- ETF CFD Range = 1,000+ ETFs

I tested CMC Markets and found they also have a fantastic range of ETFs, with 1,000+ ETFs available for trade. Platforms for trading include Next Gen, MT4 and TradingView.

What impressed me most during testing was their charting suite. Their Next Gen platform comes with over 115 indicators, 70+ price patterns, and 12 chart types, which is useful formaking short-term trades. You also get free access to Morningstar’s equity research, which is handy for screening ETFs based on fundamentals.

Beyond ETFs, CMC Markets offers 12,000+ financial products. These products cover shares, forex currencies, cryptocurrencies, commodities, indices, and bonds, giving you a solid multi-asset trading experience.

Pros & Cons

- 1,000+ ETF CFDs

- Advanced charting with 115+ indicators

- Free Morningstar ETF research

- ETF costs vary by region

- Platform has a learning curve

- Limited funding methods

7. eToro - Great For Social Trading With ETFs

Forex Panel Score

Average Spread

EUR/USD = 1 GBP/USD = 2 AUD/USD = 1

Trading Platforms

eToro Web and Mobile Trading Platform

Minimum Deposit

$50

Why We Recommend eToro

- ETF CFD Cost = 0.15% spread

- ETF CFD Range = 100+ ETFs

If you want to trade ETFs while copying experienced traders, eToro is the broker I recommend. In my opinion, no copy trading (or social trading) tool comes close to their CopyTrader platform.

With eToro you can simply tell the platform how much you want to invest and your maximum drawdown and eToro will help you find the right trader to mirror. Or you can engage with the eToro social network to grow your trading skills.

In my research, I found over 100 ETF CFDs available on the platform. While the trading tools are more limited for manual strategies, eToro makes up for it with no commission charges, your only cost is a spread of 0.15%. U.S. ETFs priced at $3 or less however do incur an extra fee of 2 cents per unit.

If ETFs are not for you, you can also use Smart Portfolios (or Investment portfolios). These are baskets of shares (like indices) based around themes (think crypto, real estate or politics) created using AI or by eToro experts.

Pros & Cons

- Best CopyTrading platform

- 0.15% spread

- Beginner-friendly platform

- Limited charting and analysis tools

- $5 withdrawal fees

- U.S. ETFs under $3 incur additional 2c per unit fee

8. Plus500 - Best for Built-In Risk Management

Forex Panel Score

Average Spread

EUR/USD = 0.9 GBP/USD = 1.6 AUD/USD = 1

Updated 06/02/2026

Trading Platforms

Plus500 WebTrader and Mobile App

Minimum Deposit

$100

Plus500 disclaimer: CFD service. Your capital is at risk. 80% of retail CFD accounts lose money

Why We Recommend Plus500

- ETF CFD Cost = Spread-only pricing (varies by ETF)

- ETF CFD Range = 116 ETFs

Plus500 is great if you’re focused on minimising your risk. In testing, I found 116 ETFs, mostly covering products in the U.S., EU, and Asian markets. They have zero commissions (other fees apply), charging only a spread that varies by region and product being traded.

What I liked most were their risk management features like guaranteed stop orders and negative balance protection. You can set your risk tolerance upfront and not worry about slippage during large market moves.

Plus500 only offers their native trading platform, but I didn’t find that to be a drawback. The Plus500 platform is well designed and very good in its own right.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

Pros & Cons

- Decent range of ETFs

- Risk management features

- Clean mobile and web interface with 100+ indicators

- No MetaTrader platform

- High minimum deposit

- Inactivity fee ($10/month after 3 months)