What Are The Best NZ Forex Brokers?

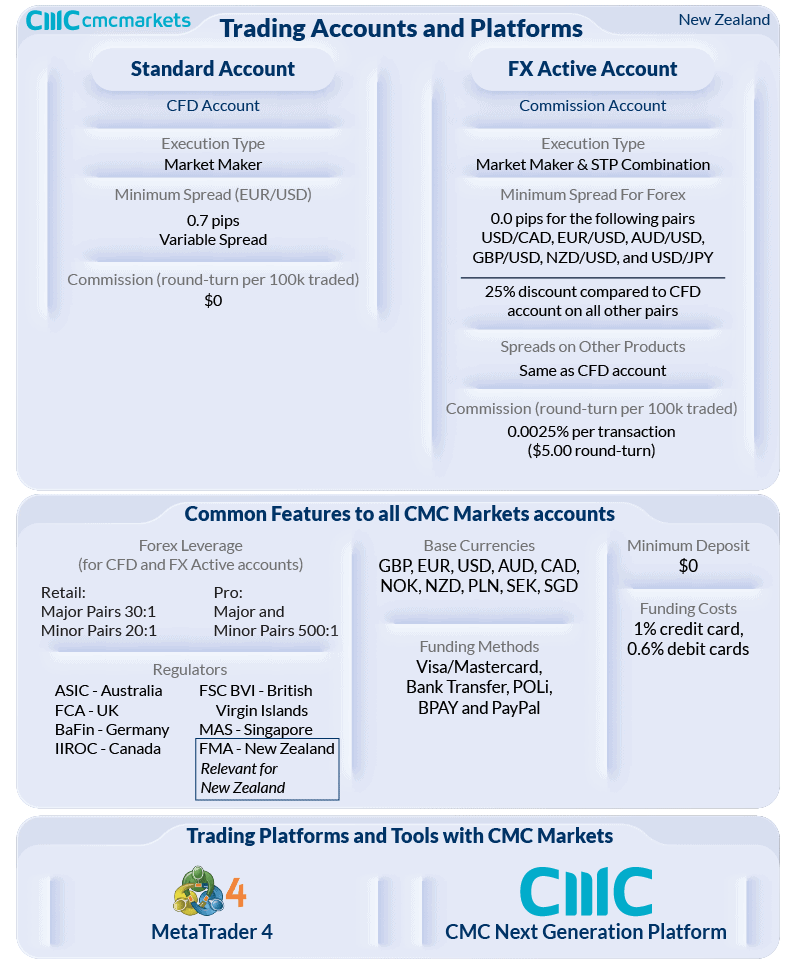

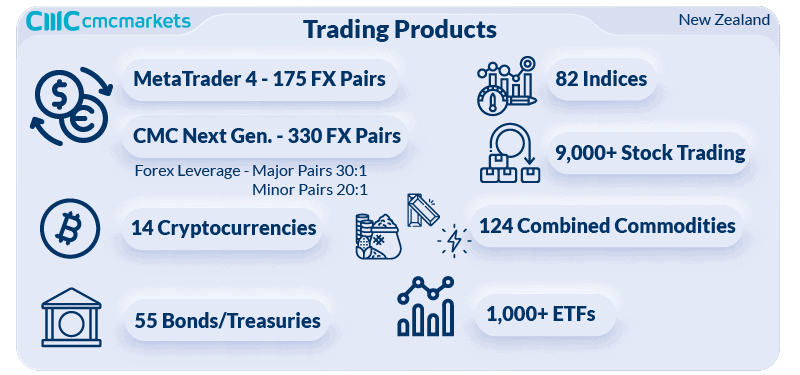

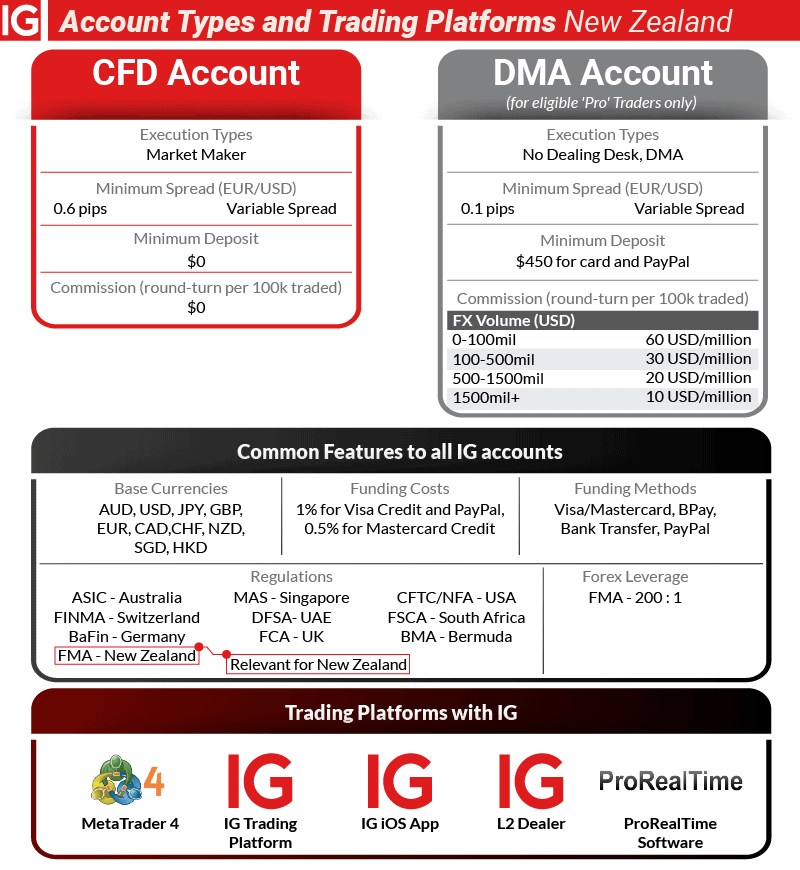

For the 5th year running, the CompareForexBrokers team compared all eight FMA-regulated forex brokers in NZ and gave them a ranking. The criteria we judged the brokers on are their spreads, trading platform, customer service and overall trading experience including execution speeds.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Blackbull was the best NZ broker in 2024 because of their:

Blackbull was the best NZ broker in 2024 because of their:

Ask an Expert

Are there any NZ forex brokers regulated by the Financial Markets Authority outside of this list?

Our page lists all of the FMA regulated brokers with Axitrader no longer listed as they lost their regulation in 2021. Each month we review the FMA website to see if any further brokers are regulated with several licences pending.

Does New Zealand have leverage restrictions for forex trading?

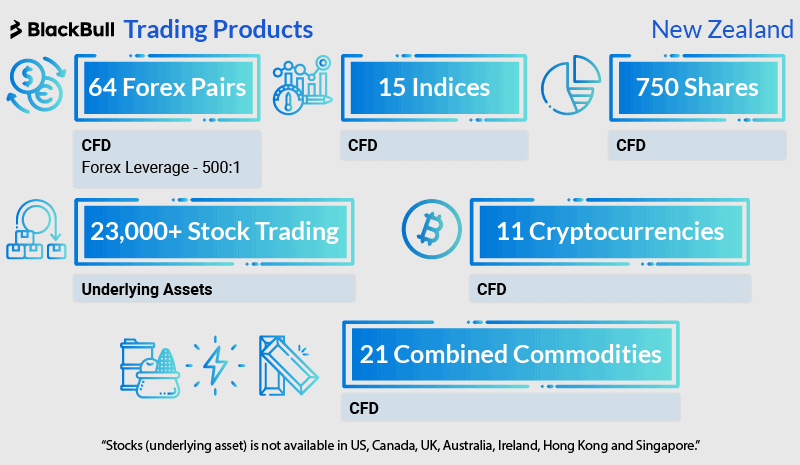

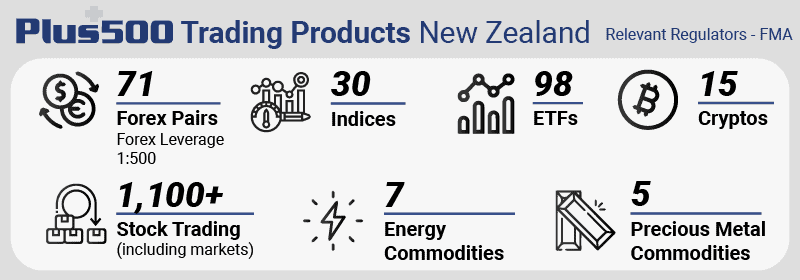

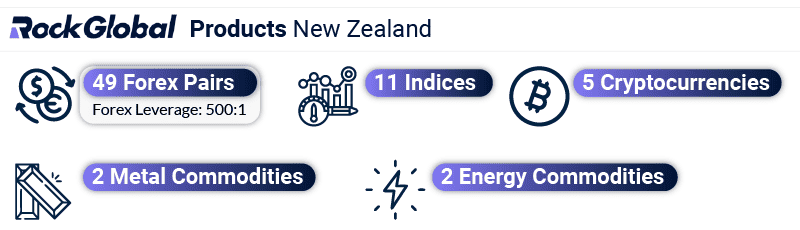

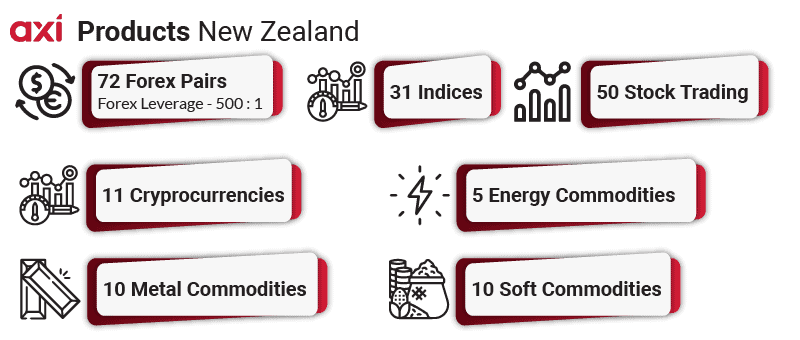

Brokers in NZ limit leverage to 500:1 forex. This is higher than found in Europe and Australia

Can I use an overseas CFD broker to trade currency like one regulated in Australia?

New Zealand Brokers Should use a broker regulated by the Financial Markets Authority (FMA) of New Zealand. This ensures the broker is legally able to offer their services to New Zealand residents and complies with the regulatory requirements of needed to offer financial services in the country.

Do I need to open a trading account in NZD or are their other more popular base currency options which may have lower spreads?

You can trade with any currency but when you deposit or withdraw it will convert with NZ and there will be conversion costs.

For example if you have a trading account with USD and you deposit with NZ it will convert to the USD it depends on the exchange rate.

What trading software do you recommend for trading CFDs in New Zealand? Does this impact which broker I should choose?

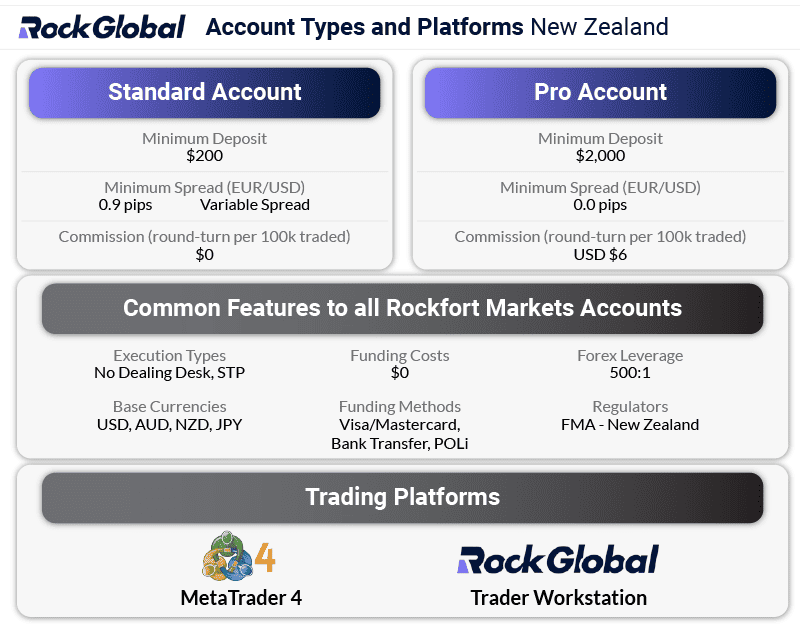

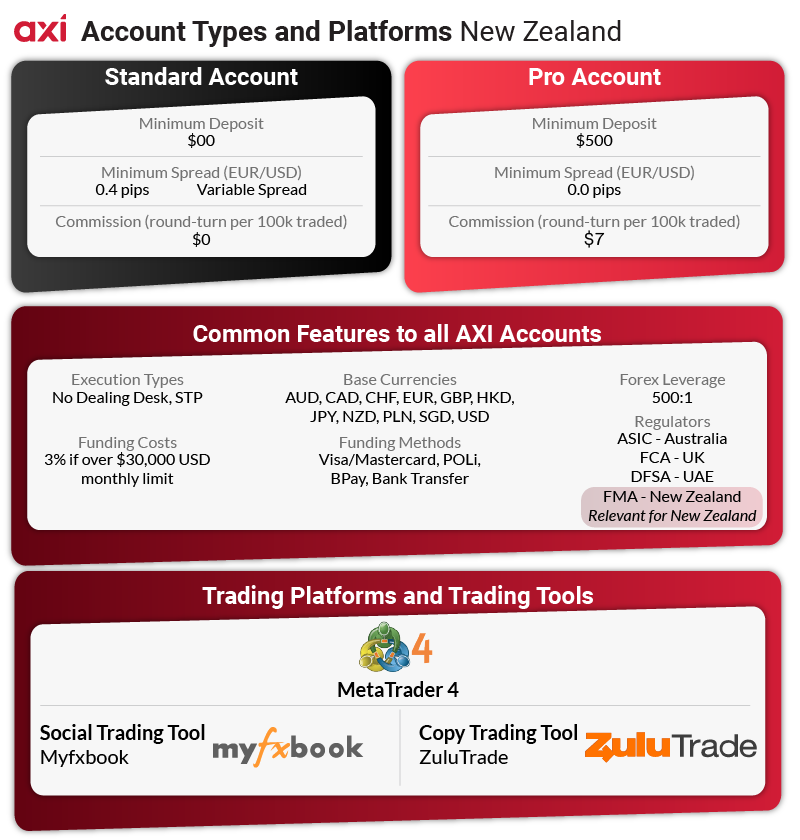

I think the key is to find a broker you like…then look for what platforms they offer for trading with. We suggest looking for a broker with MetaTrader 4, MetaTrader 5 and TradingView

What is the alternative to eToro in NZ?

If you are looking for a true social trading platform in a similar vein to etoro then there you won’t find one but brokers like BlackBull Markets offer 3rd party copy trading like Myfxbook, DupliTrade and MetaTrader Signals.

Is forex trading taxable in NZ?

Any earnings made through Forex trading in New Zealand is considered to be income. Taxes are as follows

In New Zealand, income is taxed as follows (indicative guide only):

1. $0- $14,000 – 10.5% tax rate

2. $14,001- $48,000 – 17.5% tax rate

3. $48,001- $70,000 – 30% tax rate

4. 70,001- $180,000 – 33% tax rate

5. More than $180,000 – 39% tax rate