Lowest Spread Forex Brokers

Each month, the team compare the published average spreads of ASIC regulated forex brokers. We combined these findings in January 2026 with our own tests to determine the lowest spread forex brokers for Australian traders.

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

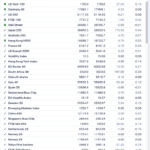

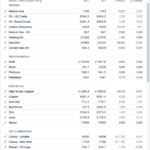

Broker Spread Comparison Table

Average spreads for the most traded currency pairs updated in January 2026.

| Broker | Average | USDJPY | EURUSD | GBPUSD | AUDUSD | USDCAD | EURGBP | EURJPY | AUDJPY |

|---|---|---|---|---|---|---|---|---|---|

| IC Markets | 0.22 | 0.14 | 0.02 | 0.23 | 0.03 | 0.25 | 0.27 | 0.3 | 0.5 |

| Eightcap | 0.30 | 0.23 | 0.06 | 0.23 | 0.27 | 0.2 | 0.3 | 0.59 | 0.49 |

| Fusion Markets | 0.33 | 0.27 | 0.11 | 0.24 | 0.12 | 0.22 | 0.39 | 0.48 | 0.84 |

| ThinkMarkets | 0.36 | 0.11 | 0.29 | 0.4 | 0.3 | 0.5 | 0.4 | 0.44 | 0.47 |

| Pepperstone | 0.40 | 0.10 | 0.2 | 0.2 | 0.1 | 0.4 | 0.2 | 1.1 | 0.9 |

| Go Markets | 0.40 | 0.10 | 0.3 | 0.2 | 0.2 | 0.5 | 0.3 | 1 | 0.6 |

| FP Markets | 0.43 | 0.10 | 0.3 | 0.4 | 0.3 | 0.4 | 0.3 | 0.8 | 0.8 |

| City Index | 0.48 | 0.16 | 0.6 | 0.18 | 0.97 | 0.43 | 0.47 | 0.46 | 0.54 |

| Blueberry Markets | 0.50 | 0.10 | 0.3 | 0.4 | 0.3 | 0.8 | 0.3 | 1 | 0.8 |

| IG | 0.59 | 0.16 | 0.24 | 0.59 | 0.29 | 0.7 | 0.54 | 0.68 | 1.5 |

Reference: RAW Accounts | January 2026

The table above records average spreads of brokers using an ECN account (also known as RAW) with the exception of CMC Markets, AvaTrade and eToro.

The unit of measurement is Pips

Broker Commission Rates

2026 Commissions charged by each broker based on their base currency.

| Broker | AUD Commission Rate | USD Commission Rate |

|---|---|---|

| IC Markets | $4.50 | $3.50 |

| Eightcap | $3.50 | $3.50 |

| ThinkMarkets | $3.50 | $3.50 |

| FP Markets | N/A | $3.00 |

| Pepperstone | $3.50 | $3.50 |

| Fusion Markets | $2.25 | $2.25 |

| IG | N/A | $6.00 |

Your commission rate charge is based on the base currency selected when opening an account. Most Australian traders select the Aussie Dollar to save on currency conversion fees and should therefore only view the AUD commission rate column.

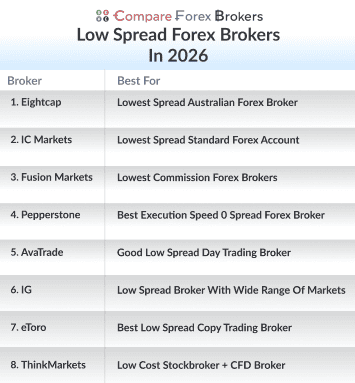

Our best forex broker list based on average spreads and commission charges is:

- Eightcap - Lowest Spread Australian Forex Broker

- IC Markets - Lowest Spread Standard Forex Account

- Fusion Markets - Lowest Commission Forex Brokers

- Pepperstone - Best Execution Speed 0 Spread Forex Broker

- AvaTrade - Good Low Spread Day Trading Broker

- IG - Low Spread Broker With Wide Range Of Markets

- eToro - Best Low Spread Copy Trading Broker

- ThinkMarkets - Low Cost Stockbroker + CFD Broker

Who Are The Lowest Spread Forex Brokers?

We combined all the published spreads of the ASIC regulated forex brokers in Australia and then did our own testing using EAs to determine which trading accounts have the lowest spreads. This was done for both standard accounts and RAW accounts with recommendations done for each account class.

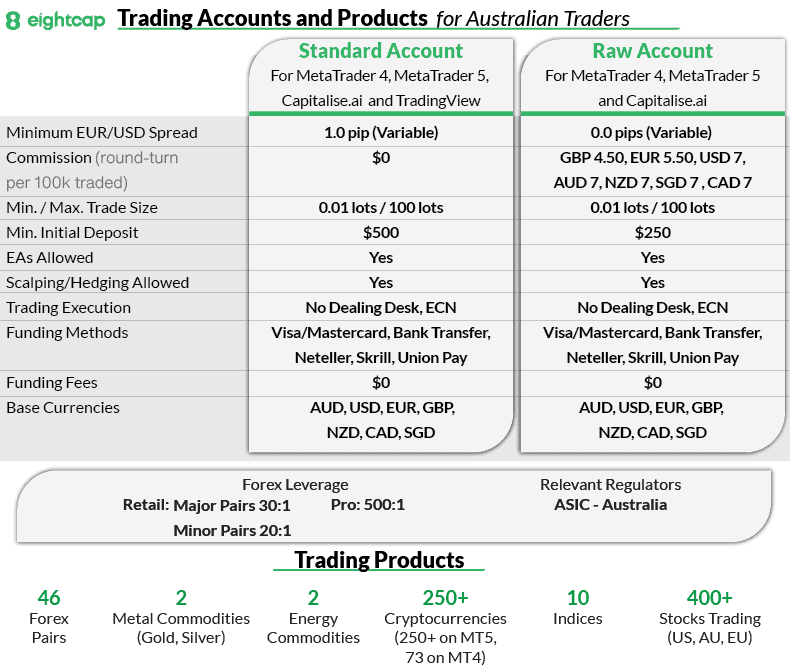

1. Eightcap - Lowest Spread Forex Broker In Australia

Forex Panel Score

Average Spread

EUR/USD = 0.06 GBP/USD = 0.23 AUD/USD = 0.27

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

100

Why We Recommend Eightcap

As one of our top-rated brokers, Eightcap secured a score of 67/100 in our evaluation. Notably, its low RAW average spreads, averaging 0.06 pips, outshine the industry average of 0.22 pips and stay at 0.0 pips 97.83% of the time outside rollover. This translates to lower trading costs, enhancing overall profitability.

We think the inclusion of diverse trading platforms, such as TradingView, MT4, and MT5, further contributes to Eightcap’s appeal.

Lastly, we should mention that Eightcap has 95 cryptos to choose from, far exceeding their competitors.

Pros & Cons

- Lowest RAW Spreads available

- Solid choice of Forex platforms

- Provides access to automated trading tools

- Has a minimum deposit

- Limited crypto range

- The market range is limited

Broker Details

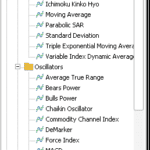

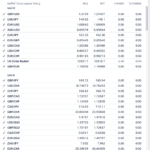

We like TradingView and think it’s one of the best platforms for technical analysis thanks to its impressive catalogue of 110+ indicators, which is always growing and being updated. In our experience, no other platform offers such routine updates to its platform, let alone improving its indicator choice.

One standout feature we appreciate is that the charts sync across all your devices, meaning your analysis performed on mobile will be available on your desktop and vice versa. This eliminates the need to replicate your analysis across different devices, which can be a hassle with platforms like MetaTrader 4, where charts are saved locally on the device.

From our testing, we found Eightcap to have tight RAW spreads, averaging 0.06 pips on EUR/USD, lower than the industry average.

Since the spreads are near zero, Eightcap charges a commission of $3.50 per lot traded. This commission-based pricing model offers transparency and predictability in trading costs (even in volatile markets), enabling you to manage your risk and expenses better if you are an active trader.

We also explored the markets available to trade on Eightcap, covering a range of markets, including 56 currency pairs, 586 shares, 16 indices, eight commodities, and 95 crypto markets. Eightcap’s cryptocurrency offering stood out to us as it is the largest selection we’ve found from a forex broker, giving you a decent platform to test the crypto market waters.

*Your capital is at risk ‘77.8% of retail CFD accounts lose money’

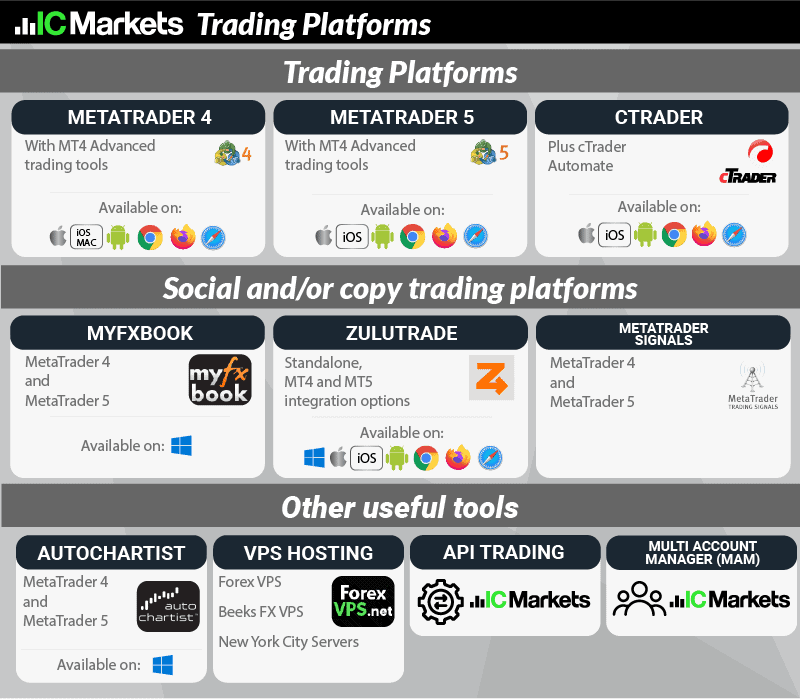

2. IC Markets - Lowest Spread Forex Standard Account

Forex Panel Score

Average Spread

EUR/USD = 0.02 GBP/USD = 0.23 AUD/USD = 0.03

Trading Platforms

MT4, MT5, cTrader, TradingView, IC Markets Mobile App

Minimum Deposit

$200

Why We Recommend IC Markets

We gave IC Markets an impressive 84/100 in our evaluation. Notably, their average spread when you combine the major pairs is just 0.16 pips for their RAW account, over 50% better than other brokers tested which you can view on our standard spread testing page.

Enjoying these low spreads is made easy on the MetaTrader 5 (or MetaTrader 5, cTrader and TradingView), a user-friendly platform with over 30+ indicators and convenient features like one-click trading, making IC Markets a compelling choice for traders seeking efficiency and cost-effectiveness.

Pros & Cons

- Winner for low spreads on RAW and Standard Accounts

- No fees for withdrawing

- Choice of MT4, MT5, cTrader and TradingView trading platforms

- Live chat customer service can be slow

- No guaranteed stop-loss orders

Broker Details

We think the MetaTrader 5 platform pairs nicely with IC Markets as the broker allows you to fully utilise all of MT5’s features, such as the depth of market tools. These tools provide valuable insights by displaying the order book and revealing an instrument’s real-time supply and demand.

We think the MetaTrader 5 platform pairs nicely with IC Markets as the broker allows you to fully utilise all of MT5’s features, such as the depth of market tools. These tools provide valuable insights by displaying the order book and revealing an instrument’s real-time supply and demand.

This level of transparency can be invaluable for identifying potential entry and exit points and gauging market sentiment. We think MetaTrader 5 is an excellent choice for traders seeking advanced technical indicators and order-flow management.

While exploring MetaTrader 5, we found that it offers a decent choice of 38+ indicators by default, along with over 20+ drawing tools. With access to indicators such as moving averages, MACD, RSI, and Bollinger Bands, you’ll find a solid foundation to develop a trading strategy on the MT5 platform.

As for trading costs, we found the RAW spreads exceptionally low, averaging a mere 0.02 pips on the EUR/USD pair, slightly lower than Eightcap’s.

| Broker | EUR/USD |

|---|---|

| IC Markets | 0.02 |

| Eightcap | 0.06 |

| Pepperstone | 0.1 |

| ThinkMarkets | 0.1 |

| Fusion Markets | 0.13 |

| IG | 0.16 |

| Industry Average | 0.22 |

The broker also maintained excellent spreads across other major pairs, averaging 0.16 pips, the lowest major average spread we tested. Based on these results, IC Markets is our top choice if you focus on trading the forex markets.

| Top 5 (EUR/USD. USD/JPY, GBP/USD, AUD/USD, USD/CAD) Average Spread | |

|---|---|

| Broker | Major Pair Average Spread |

| IC Markets | 0.16 |

| Fusion Markets | 0.17 |

| ThinkMarkets | 0.20 |

| Eightcap | 0.30 |

| IG | 0.32 |

| Pepperstone | 0.44 |

| Tested Average | 0.44 |

3. Fusion Markets - Lowest Commission Forex Broker

Forex Panel Score

Average Spread

EUR/USD = 0.14 GBP/USD = 0.39 AUD/USD = 0.14

Trading Platforms

MT4, MT5, cTrader, TradingView

Minimum Deposit

$0

Why We Recommend Fusion Markets

Fusion Markets impresses with a high score of 79/100 in our evaluation, primarily for its exceptional trading experience marked by low RAW spreads and commissions. The average RAW spread of just 0.22 pips on EUR/USD showcases cost-effectiveness. Notably, their RAW account commission, at only $2.25 per lot, stands significantly below the industry average by $1.10 per lot.

With low costs and a favourable trading environment, Fusion Markets emerges as a top choice for those seeking exceptional value in their trading journey.

Pros & Cons

- Tight average RAW spreads

- Good choice of trading tools

- Low commission trading

- A large number of Forex pairs

- It doesn’t offer TradingView

- The number of markets is limited

- Has an inactivity fee

Broker Details

While exploring MetaTrader 5, we found that it offers a decent choice of 38+ indicators by default, along with over 20+ drawing tools. With access to indicators such as moving averages, MACD, RSI, and Bollinger Bands, you’ll find a solid foundation to develop a trading strategy on the MT5 platform.

While exploring MetaTrader 5, we found that it offers a decent choice of 38+ indicators by default, along with over 20+ drawing tools. With access to indicators such as moving averages, MACD, RSI, and Bollinger Bands, you’ll find a solid foundation to develop a trading strategy on the MT5 platform.

| Broker | USD |

|---|---|

| Fusion Markets | $2.25 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

| ThinkMarkets | $3.50 |

This low cost can help maximise your profits by minimising the impact of commission fees on your overall trading costs, especially if you are a high-volume trader.

To test Fusion Markets’ spreads, we opened a Zero account, which is their commission-based trading account with tight spreads.

Our analyst, Ross Collins, used this account to assess Fusion Markets’ average spreads and found that they provide highly competitive raw spreads, averaging 0.16 pips on the EUR/USD pair. You can view his full analysis that required opening trading accounts with the most popular brokers on our tight spread page.

| EURUSD | Average Spread |

|---|---|

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| EightCap | 0.2 |

| ThinkMarkets | 0.22 |

Typically, if something is cheap, you’d be right to wonder what the broker is missing. Well, we found the broker well-rounded, offering over 300+ markets covering all major markets, from forex to equities. Although this is below the industry average for choice, it still covers the major and popular instruments – allowing you to benefit from the low commissions on the most liquid markets.

Plus, the broker’s execution speeds are fast. We found the broker to achieve a limit order speed of 79 ms, a fraction slower than Pepperstone, but the market order execution speed was the fastest at 77 ms. With fast execution speeds, the lowest trading costs, and access to major markets, we think Fusion Markets places itself as a top broker for scalpers.

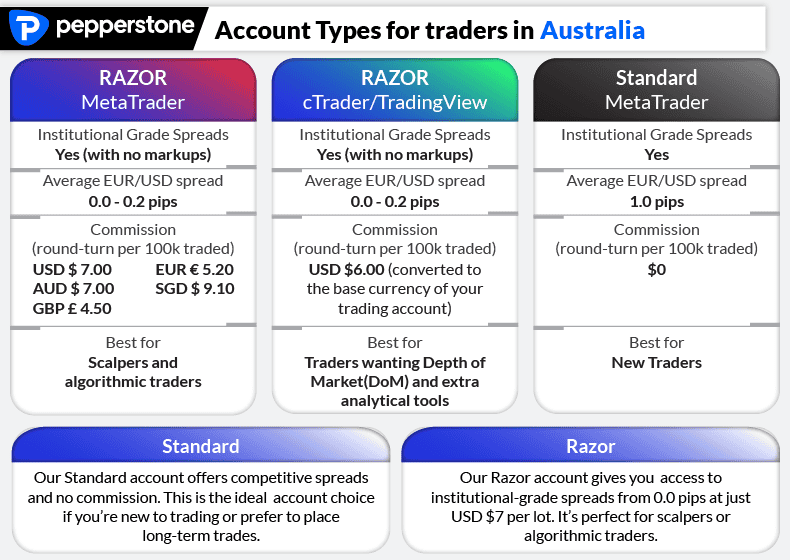

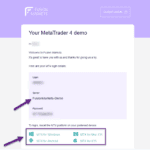

4. Pepperstone - 0 Spread Forex Broker With Fast Speeds

Forex Panel Score

Average Spread

EUR/USD = 0.1 GBP/USD = 0.3 AUD/USD = 0.1

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone earned an impressive 97/100 in our evaluation, standing out for its swift execution speed and zero spreads, with trades on the MT4 platform completing in just 77ms on average. View our execution speed test page to see the methodology to how we tested broker speeds.

Notably, Pepperstone’s Razor account offered zero spreads on EUR/USD throughout our testing period, making it an excellent choice for scalpers.

The diverse range of trading platforms, including MT4, MT5, cTrader, TradingView, and third-party apps like Capitalise.ai and DupliTrade, impressed us. Whether you prefer automated, chart, or copy trading, Pepperstone provides the right software for your needs.

Pros & Cons

- 100% zero spreads on EUR/USD

- Top 3 in our execution speeds testing

- Variety of trading platforms and 3rd party trading tools

- Lacks specialised risk management tools

- The demo account limited to 90 days

- Education resources are outdated

Broker Details

Our analyst, Ross Collins, used our RAW account with Pepperstone to test the broker’s execution on the MetaTrader 4 platform and compared the results against 14 other brokers.

Ross’ findings were impressive. Pepperstone achieved an outstanding 77 ms limit order execution speed, which ranked as the fastest out of all the brokers we tested.

This exceptional execution speed is crucial, as it directly impacts how swiftly your pending, stop loss and take profit orders are executed. In fast-moving markets, where every millisecond counts, Pepperstone’s lightning-fast execution can be the difference between securing a profitable trade and missing an opportunity entirely.

| Overall | Broker | Limit Order Speed | ||

|---|---|---|---|---|

| 1 | Pepperstone | 77 | ||

| 2 | Fusion Markets | 79 | ||

| 3 | IC Markets | 134 | ||

| 4 | Eightcap | 143 | ||

| 5 | ThinkMarkets | 161 | ||

| 6 | IG | 174 | ||

Pepperstone advertises zero-pip spreads on its RAW accounts, so we tasked our analyst Ross Collins with verifying whether this claim holds true and how frequently these favourable spreads are available.

Ross found that Pepperstone provided 0.0 pip spreads on its major currency pairs 100% of the time, which is an excellent achievement. This zero-spread structure eliminates one of the most significant trading costs, potentially increasing your profitability by allowing you to capture more of the market’s movements without the burden of spread-related expenses.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Grand Total |

|---|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Zero Spread Testing | |

|---|---|

| Broker | Time At Minimum Spread |

| Pepperstone | 100% |

| City Index | 100% |

| Fusion Markets | 98.55% |

| ThinkMarkets | 97.93% |

| IC Markets | 97.83% |

| FP Markets | 97.83% |

| Eightcap | 97.83% |

| Admirals | 95.60% |

| GO Markets | 87.68% |

| BlackBull Markets | 86.96% |

| GO Markets | 87.68% |

Only Pepperstone and City Index achieved top marks in our testing, reinforcing that Pepperstone is the top broker for zero spreads.

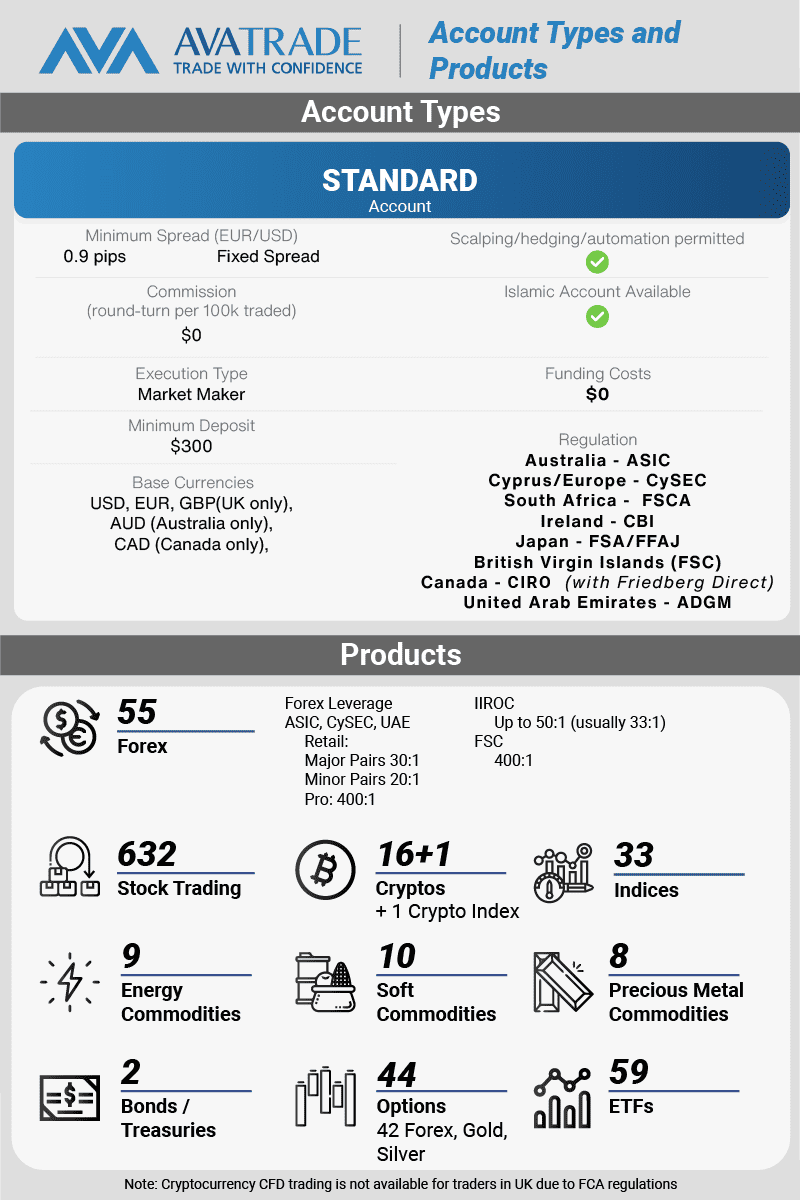

5. AvaTrade - Good Low Spread Broker For Day Trading

Forex Panel Score

Average Spread

EUR/USD = 0.8 GBP/USD = 1.2 AUD/USD = 0.9

Trading Platforms

MT4, MT5, AvaTradeGo, AvaOptions

Minimum Deposit

$100

Why We Recommend AvaTrade

AvaTrade is a decent broker and one of the few that offers fixed spreads on its markets, something other brokers seem to avoid. Interestingly, AvaTrade has a fixed spread of 0.9 pips on EUR/USD, lower than the industry average of 1.8 pips. More importantly, it is cheaper than variable spread brokers like FXCM and Tickmill.

Unusually for a market maker, they allow scalping, day trading and even social and copy trading. Lastly, we should mention that they have options trading with the AvaOptions mobile app, something few other brokers offer.

Pros & Cons

- Has stable spreads during volatile times

- AvaProtect for risk management (with AvaTradeGo)

- Has social and copy trading tools

- No RAW spread pricing

- AvaProtect limited to AvaTradeGO

- Has inactivity fees

Broker Details

If you engage in day trading or prefer to capitalise on volatile markets, we believe AvaTrade is an excellent choice, thanks to its fixed spreads with no commission structure.

We used AvaTrade’s Standard account during our testing and found that they offered a spread of 0.9 pips on the EUR/USD pair. While this may appear more expensive than other spreads in this list, it’s important to remember that there are no additional commissions.

In fact, we found their fixed spreads to be highly competitive, as they remain consistent even during volatile market conditions and price spikes. This stability can potentially save you money when day trading, as you won’t be subject to fluctuating spreads that can widen during periods of increased volatility.

| Broker | Spread* | Fixed or Variable |

|---|---|---|

| IC Markets | 0.62 | Variable |

| AvaTrade | 0.90 | Fixed |

| Fusion Markets | 0.93 | Variable |

| Eightcap | 1.00 | Variable |

| eToro | 1.00 | Variable |

| ThinkMarkets | 1.10 | Variable |

| Pepperstone | 1.12 | Variable |

| IG Group | 1.13 | Variable |

With the AvaTrade Standard account, you can access several platforms, including MT4, MT5, Web Trader, AvaTradeGO, and AvaTrade Options.

We tried the AvaTrade Web Trader, which featured an impressive market sentiment tool that integrated with the current market you were analysing. These sentiment tools can provide valuable insights by allowing you to gauge where AvaTrade’s clients believe the market will move.

For example, if over 60% of traders anticipate a rise in the EUR/USD pair, this is telling you most of AvaTrade’s clients are long on the major.

We believe tools like this can be especially beneficial for day traders, as they offer a quick and easy snapshot of market participants’ sentiment, which can be a valuable input when executing time-sensitive trades.

6. IG - Low Spread Broker For Exotic Markets

Forex Panel Score

Average Spread

EUR/USD = 0.16 GBP/USD = 0.59 AUD/USD = 0.29

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

IG Group is one of the biggest names in forex trading for having 17,000+ markets to trade, one of the largest range of markets of all brokers. Not only can you trade more Forex pairs, stocks, indices and hard and soft commodities than most CFD brokers offer, but you can also trade futures, options, sectors and interest rates. And spreads are low because there are no commission costs.

Pros & Cons

- User-friendly IG Trading Platform

- Widest choice of markets to trade

- Provides free technical analysis tools

- It doesn’t offer social trading tools

- MT4 has limited access to share CFDs

- Has a minimum deposit

Broker Details

IG Group offers an impressive 17,000+ markets, which stands out as the largest range we’ve seen from a CFD broker. In our tests, we found the broker to have 80+ FX pairs, 12,000+ stocks, 130 indices, 41 commodities, 6,000+ ETFs, and 7,000+ options markets.

Having a wide array of markets available through one account simplifies the trading process. It allows you to switch between markets without juggling multiple accounts or platforms, which can be critical in capitalising on market volatility across multiple assets.

In our tests, we found that IG Group only provides a Standard account, which is a spread-only account without commissions, as the commission is incorporated into the spread.

When testing the Standard account’s spreads across forex markets, we were pleased to discover that they were low compared to industry averages. Specifically, the broker averaged 1.13 pips on the EUR/USD pair, putting it on par with other low-spread brokers like Pepperstone.

| BROKER | EUR/USD |

|---|---|

| IC Markets | 0.62 |

| Fusion Markets | 0.93 |

| Eightcap | 1 |

| ThinkMarkets | 1.1 |

| eToro | 1 |

| IG | 1.13 |

| Pepperstone | 1.12 |

| Industry Average | 1.24 |

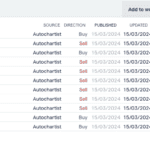

We liked that IG Group offers several trading platforms, including MetaTrader 4, the IG Group Trading Platform, L2 Dealer, and ProRealTime. However, if you aim to maximise IG Group’s benefits, we recommend their proprietary IG Trading Platform as the top choice. This platform has over 40 indicators and trading signals from Autochartist and PIA First, specialists in technical and price action trading.

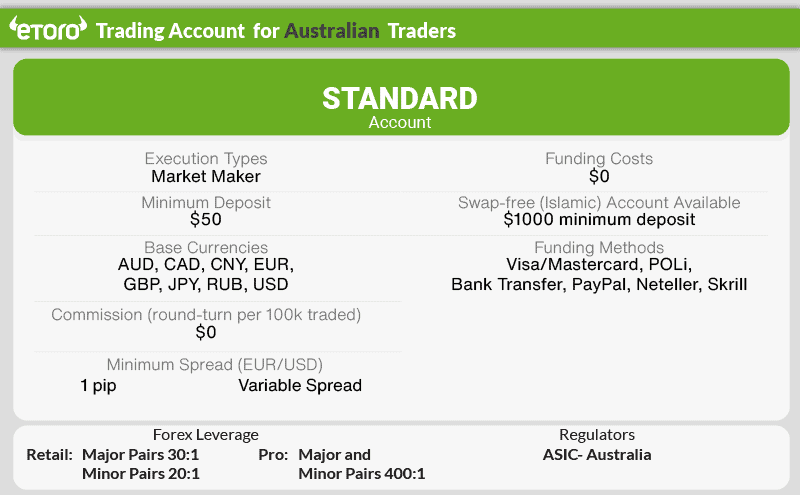

7. eToro - Low Spread Copy Trading Broker

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 2

AUD/USD = 1

Trading Platforms

eToro Trading Platform

Minimum Deposit

$500

Why We Recommend eToro

eToro stands out with a unique focus on a Copy Trading experience rather than the traditional approach. Through the CopyTrader platform, you can automatically replicate the trades of experienced traders, making it an ideal tool for those seeking high-risk trading without the need for personal expertise.

eToro average spreads of just one pip on EUR/USD, with no additional commission costs impressed us. Lower spreads translate to reduced trading costs, a crucial factor for maximising profitability in your trading journey.

Pros & Cons

- Simplified copy trading platform

- 30,000,000+ traders to copy from

- No commissions on trading

- Doesn’t support third-party trading platforms

- No RAW spread account pricing

- Charges you to withdraw funds

Broker Details

eToro’s web platform is designed for social trading, allowing us to find and follow traders and discuss the latest trends, current markets, or strategies with other traders.

During our testing, the platform reminded us of Facebook and how we engaged with other traders on their profiles rather than in an open forum. This feature can be valuable for networking with experienced traders, especially for beginners, as it provides a unique opportunity to observe, learn, and interact directly with them.

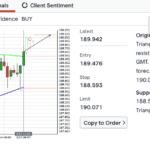

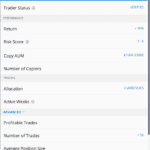

Alternatively, we tried eToro’s CopyTrader feature, which enables mirroring a trader’s positions. This functionality is particularly useful if you lack extensive trading experience or prefer a more hands-off approach, as it allows you to leverage successful traders’ expertise without making intricate trading decisions themselves.

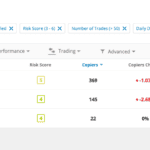

With features that simplify filtering eToro’s community of 30,000,000 traders, we could fine-tune the criteria to find traders who meet our requirements. This made finding traders to copy straightforward; when we did our due diligence, we knew the traders had already met our requirements. We could then allocate our funds via a percentage with eToro’s Copy tools, making it easy to fund and manage the Copy Traders.

As a broker focused on its trading platform, we were impressed with eToro’s competitive spreads, averaging one pip on EUR/USD and commission-free trading on stocks. We think this setup makes social trading better by letting traders follow their chosen strategies without high fees or commissions.

8. ThinkMarkets - Low Cost StockBrokers + CFD Broker

Forex Panel Score

Average Spread

EUR/USD = 0.11 GBP/USD = 0.4 AUD/USD = 0.3

Trading Platforms

MT4, MT5, TradingView, ThinkTrader

Minimum Deposit

$0

Why We Recommend ThinkMarkets

In the Forex brokerage arena, ThinkMarkets stands out for its unique offering of shares and ETF investing alongside CFD products.

With the ThinkTrader app, you can invest in over 3,100 ASX shares at just $8 per trade, in addition to trading 46 Forex pairs, 352 ETFs, 17 indices, 27 cryptos and even futures, metals, and energies with MT4 and MT5.

Boasting low average spreads, starting from just 0.1 pip on EUR/USD, ThinkMarkets provides a cost-effective trading environment, particularly beneficial for those employing frequent automated strategies.

Pros & Cons

- Competitive low RAW spreads

- Offers MetaTrader 4 and 5, ThinkTrader

- Decent selection of trading products (4000+)

- Minimum deposit for RAW spreads

- Cannot use RAW account with ThinkMarkets platform

- Charges an inactivity fee

Broker Details

We like ThinkMarkets’ extensive offering of over 3,000 markets for trading CFDs, shares, and Exchange Traded Funds. This broad range provides ample opportunities for diversification and exposure to various asset classes, catering to traders with diverse preferences and risk appetites.

Our tests found that ThinkMarkets covers most major markets, including 47 currency pairs, 59 ETFs, 23 indices, and 15+ commodities, ensuring that traders can access various instruments to suit their trading strategies.

We found ThinkMarkets trading costs to be reasonable. The $8 per trade charge and small spreads, which vary for each share, offer a competitive pricing structure.

For instance, during our tests, we observed a spread of $0.03 on Amazon shares, which is quite favourable compared to the industry average. This cost-effective approach can help lower your share dealing costs, improving your profit margin.

When it comes to the broker’s other markets, we were pleased with the competitive spreads on offer. The standard account provides spreads as low as 1.1 pips on the EUR/USD pair without commission.

If you want even tighter spreads, the ThinkZero account is an attractive option, offering average spreads from 0.1 pips on EUR/USD. While this account charges a commission of $3.50 per lot traded, it aligns with the industry average, balancing spread costs and commissions.

Ask an Expert

Generally, what account is better to get the lowest fees? A standard or ECN account?

Generally, an ECN account is cheaper than a standard account however this will vary depending on the spread for the standard and ECN account and the commission for the ECN account.

Looking for broker with lowest spread for xauusdi live in United States

The USD does not permit CFD trading but does allow spot trading. You can see our best brokers for spot trading on the best regulated forex brokers in USA page.

How about fxcc, valutrade,axitrader, and assetfx. They are also have such account with low commission and tight spread but not “zerro” spread

Hi Eddy

We have not previously reviewed FXCC and ValuTrades so can provide too much information about them at this time. Axi (formerly AxiTrader) are regulated in Australia (ASIC), UK (FCA) and UAE (DFSA) so they are a reputable broker in terms of regulation. Unfortunately, Axi doesn’t publish their average spreads, so lack transparency in this aspect. AssetFX is not a regulated broker so we can’t recommend them

I saw that brokers charge an overnight fee. How does this work as I thought currency markets are global?

Overnight fees are sometimes called swap fees or rollover fees, these fees are applied if you hold an open position overnight which means when trading markets close. While currency markets are global so technically never close since at least one of the Sydney, Tokyo, London and New York forex sessions are operating at any time during the work week, brokers apply overnight fees if your position is open at 17:00 New York time (which equates to 00:00 platforms time)

Swaps fees mean you will either be charged interest costs or earn interest on your open positions. Whether you are debited or credited will depend on factors such as the price movement of the currency pair, the interest rates in each country of the currency traded, the swaps points of the broker’s counterparty.

Overnight positions for Wednesday to Thursday carry a credit/debit charge of triple rate to account for the settlement of trades over the weekend since these days since the markets are closed these days meaning there are no swap rates charged.

Why IC Market is not appearing in the final list though they are in the top 2 in the above 2 tables ?

I don’t see IC Markets on this list but certainly, IC Markets is a top broker and one well worth considering. It was a toss up between IC Markets and some other brokers when we made this list

Is there a zero spread broker?

If you are after zero spreads, look for a no dealing desk or ECN style broker. You will know these brokers because they have a commission account, these accounts can achieve zero spreads because you pay commission in addition to the spread. You then need to time your buy in for when the spread is zero pips. Brokers include Pepperstone, IC Markets, Fusion Markets, Eightcap.

Does Eightcap offer MT5?

Hey John , yes Eightcap does offer mt4/5.

Is meta trader 4 also used in prop firms?

Yes that is correct MT5 can also be used with a prop firm.

Is a zero spread account good?

Zero spreads mean you don’t have a spread cost when trading, so zero spreads generally work in your favour

Could you further explain, is the terminology zero spread markup (I guess the bid-ask spread will always exist)?

Rather than mark up the spread to include the commission as occurs with a standard account, you pay the commission outside the spread. In this sense the spread has not been marked up by the broker.

What does 0.60 pips mean?

A pip means “percentage in point” and is the smallest whole unit price movement of a currency pair. Most currency pairs are quoted to the 4th decimal using fractional pips so if you have 0.0006 this would convert to 6.0 as a whole pip. So if you see 0.60 then the quote is in pippettes which is 0.00006 (I.e) to the 5th decimal.

Tight spreads sound great, but do these brokers sneak in high commissions on the side?

With raw accounts, commissions are part of the payment structure. This is a transparent way for the broker to show their fees, otherwise they bundle them in the spreads like on Standard account types. Because of this transparency, the accounts with commissions can be cheaper than the no-commission accounts.

Are zero-spread accounts better suited for scalping strategies?

By zero spread, you mean the spread is always zero? then yes, this is idea for scaling strategies since the spread is predictable BUT do check there are no other charges like higher commissions.

What are the Standard and raw accounts

A standard account when Forex trading simply means the brokers costs are included in the spread. A raw account means the broker charges a commission in addition to the spread.