Best Forex Brokers In Singapore

To determine the best forex brokers in Singapore, I compared more than 30 candidates. My aim was to discover who provides the lowest trading costs with the best trading conditions.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

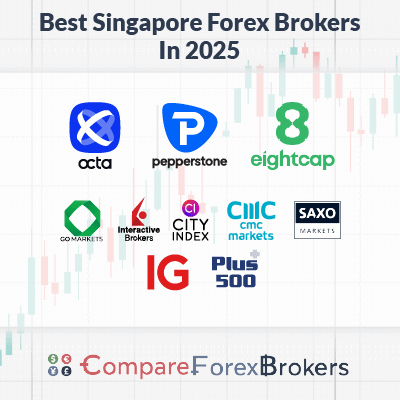

As of July 2025, my list of the best forex trading platforms in Singapore is:

- Octa - The Best Forex Brokers In Singapore Overall

- Pepperstone - Top Forex Broker With the Tightest Spreads

- Eightcap - Best Broker For Crypto Trading

- Interactive Brokers - Good Choice For Professionals

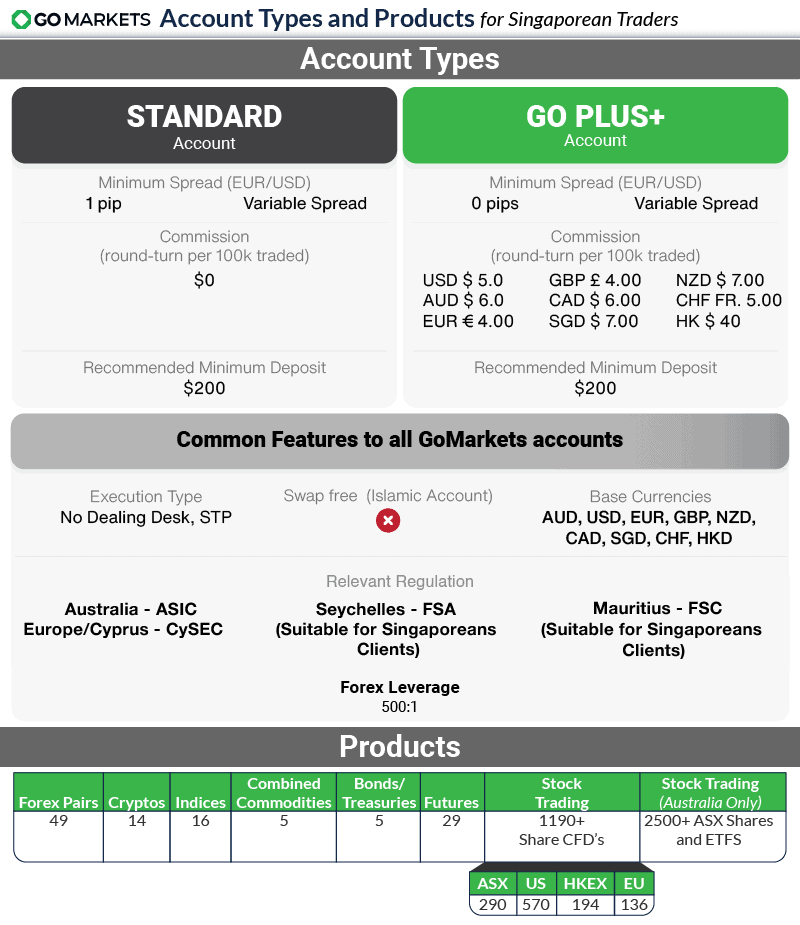

- GO Markets - Lowest Commission RAW Account

- City Index - Great Trading Tools

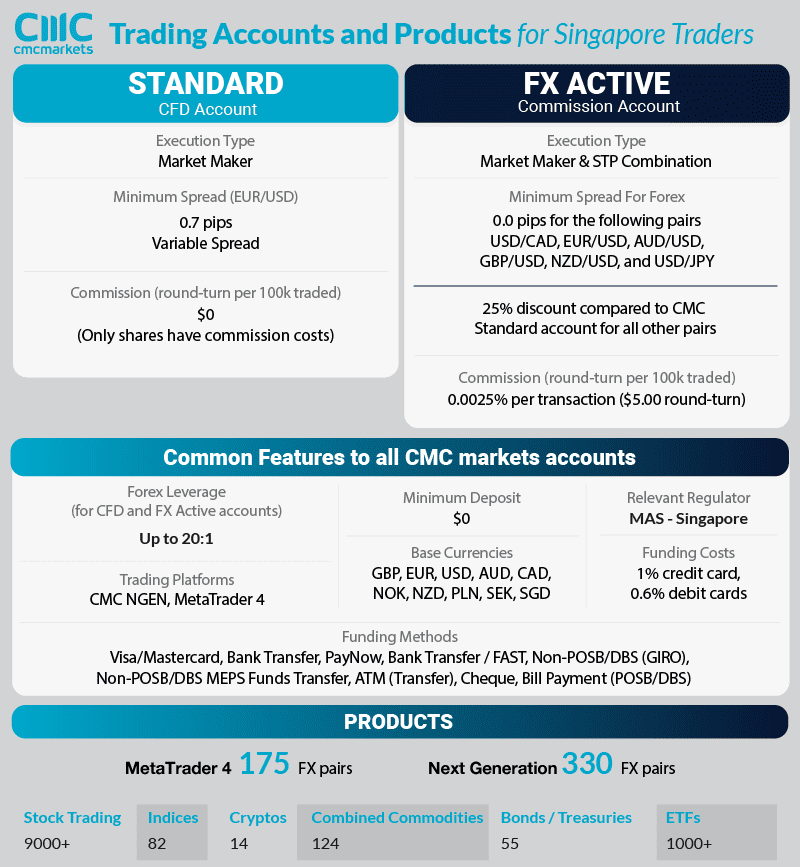

- CMC Markets - Top Choice Of Currency Pairs

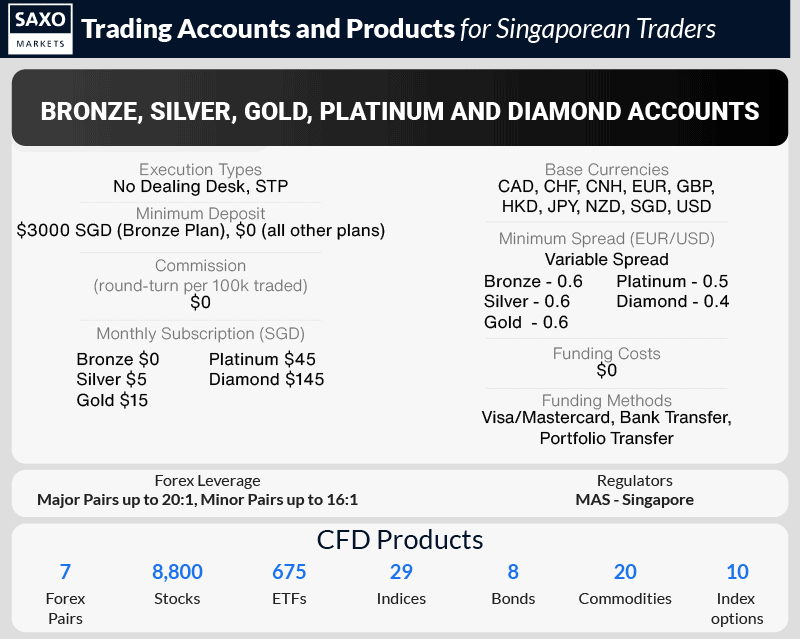

- Saxo Markets - Best Forex Trading Platform

- IG Group - Largest Range Of Products

- Plus500 - Best Islamic Account

| Broker Review | Our Rating | Regulation | Raw EUR/USD Spread |

Raw GBP/USD Spread |

Raw AUD/USD Spread |

Commissions (USD Base) |

Standard EUR/USD Spread |

Standard GBP/USD Spread |

Standard AUD/USD Spread |

MetaTrader 4 | MetaTrader 5 | cTrader | Execution Speed | Minimum Deposit | Currency Pairs | Crypto CFDs | Retail Leverage | Prof. Leverage | Visit Broker |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Read review ›

Read review ›

|

88 |

CySEC MISA, FSCA, FSC-M |

- | - | - | - | 0.90 | 1.40 | 1.70 |

|

|

|

81ms | $25 | 35 | 32 | 1000:1 | 1000:1 |

|

Read review ›

Read review ›

|

98 |

ASIC, FCA, BaFin CySEC, DFSA |

0.10 | 0.20 | 0.10 | $3.50 | 1.10 | 1.20 | 1.10 |

|

|

|

77ms | $0 | 83 | 20 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

96 |

ASIC ,FCA, CySEC |

0.06 | 0.23 | 0.27 | $3.50 | 1.0 | 1.2 | 1.2 |

|

|

|

143ms | $100 | 55 | 33 | 500:1 | 500:1 |

|

Read review ›

Read review ›

|

76 |

ASIC, CYSEC FSC, FSA, SCA |

0.2 | 0.5 | 0.2 | $2.50 | 1.0 | 1.3 | 1 |

|

|

|

144ms | $200 | 47 | 14 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

58 |

NFA, CFTC, CBI ASIC, FCA, MAS CIRO, JFSA |

- | - | - | 0.08%-0.2% | - |

|

|

|

110ms | $0 | 117 | 4 | 30:1 | 500:1 |

|

||

Read review ›

Read review ›

|

66 | ASIC, MAS, FCA | 0.07 | 0.011 | 0.8 | $2.50 | 0.70 | 1.1 | 2.2 |

|

|

|

95ms | $0 | 84 | 5+ | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

73 |

ASIC, MAS, FCA CIRO, FMA, BaFin |

0.5 | 0.9 | 0.6 | $2.50 | 1.3 | 1.5 | 1.5 |

|

|

|

138ms | $0 | 338 | 19 | 30:1 | 500:1 |

|

Read review ›

Read review ›

|

55 |

ASIC, FINMA FCA, MAS |

0.9 | 0.7 | 0.9 | - | 1.1 | 1.8 | 1.1 |

|

|

|

135ms | $2000 | 327 | 9 | 50:1 | 50:1 |

|

Read review ›

Read review ›

|

78 | ASIC, FCA, FMA | 0.16 | 0.59 | 0.29 | $6.00 | 1.13 | 1.66 | 1.01 |

|

|

|

174ms | $0 | 110 | 13 | 30:1 | 200:1 |

|

Read review ›

Read review ›

|

61 |

ASIC, CySEC, MAS FCA, FMA, DFSA EFSA, FSA, FSCA |

- | - | - | - | 1.2 | 1.7 | 1.1 |

|

|

|

140ms | $100 | 65 | 18 | 30:1 | 300:1 |

|

Who Are The Top 10 Best Forex Brokers In Singapore?

Of the 30+ brokers tested, only 10 made it to this list of the best forex brokers in Singapore. I personally opened trading accounts and tested the services of each one, while gathering technical data like average spreads to find which brokers truly save you money.

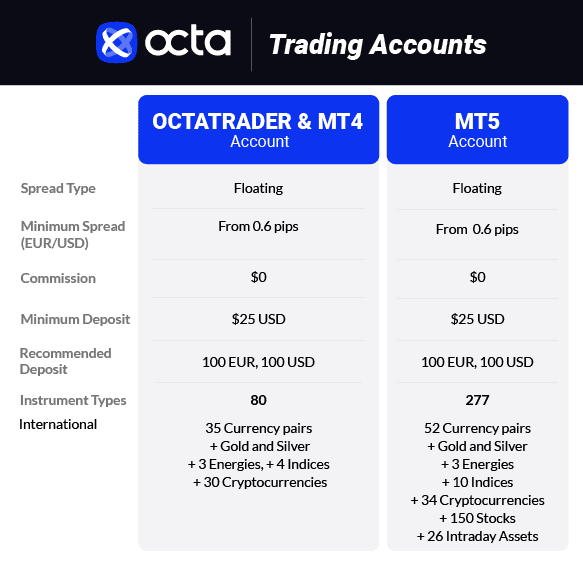

1. Octa - Best Forex Broker For Singapore Overall

Forex Panel Score

Average Spread

EUR/USD - 0.9

Trading Platforms

MT4, MT5, OctaTrader

Minimum Deposit

$25

Why We Recommend Octa

Octa earned a solid 88/100 in my broker review after they performed well in my tests. I was especially impressed by the trading costs, which are hard to beat.

You have tight spreads averaging 0.90 pips on EUR/USD, with no commissions and zero swaps or overnight fees. All this makes it a great pick for longer-term trading.

What boosted my score even further was the ECN execution speed, which ranked in 4th place overall. The decent choice of trading platforms was also impressive, allowing advanced technical analysis across 300+ markets.

Pros & Cons

- Zero-swap trading on all accounts

- Competitive spreads without commission fees

- Advanced social features via OctaTrader

- Round-the-clock support in local languages

- Lacks direct phone support options

- No TradingView integration

- Limited product range on OctaTrader

Broker Details

ECN Pricing Without The Commissions

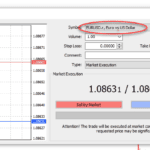

During my tests, I found Octa offers an ECN execution model, without the high commissions associated with RAW pricing accounts.

Instead, you get traditional spread-only pricing, while still benefiting from fast execution speeds. Octa came 4th overall for execution speeds, completing market orders in 91ms.

I liked the lower trading costs and no commissions on Octa’s trading accounts, which start from 0.60 pips on the EUR/USD. Using my MT5 platform, I tested Octa’s spreads during the Asian trading session. While I found that the spread drifted higher than the minimum, it did average out at 0.90 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

I think this is excellent considering it’s an ECN broker with no commissions. The spreads are much tighter than those of other Standard accounts from top brokers like Saxo, who average 1.20 pips.

Plus, the account is swap-free, giving you the opportunity to hold CFD positions longer for free.

See how Octa performs against your broker using my trading cost tool, and learn how much you can save:

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Access To Multiple Platforms With Octa

While using Octa, my platform choice was MetaTrader 5. I chose this due to its familiarity and the ability to add custom indicators, like my own variant of the Volume Profiles indicators.

The other option is OctaTrader, offering 19+ indicators. This is on the low side, but I did like the pattern tools available for automating analysis like candlestick patterns.

Copy trading is available through the Octa Copy app. This provides a gateway to leverage the expertise of experienced traders, as you mirror their trading.

Solid 24/7 Customer Service

I appreciated Octa’s customer service, offering multiple routes to contact their team. You can use email, phone, or a live chat that operates 24/7.

During my time using Octa, I found you could contact customer service using local languages or English, so you can get answers to questions in your preferred language.

2. Pepperstone - Top Forex Broker With Tightest Spreads

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.69

AUD/USD = 1.22

Trading Platforms

MT4, MT5, cTrader, TradingView, Pepperstone Trading App

Minimum Deposit

$0

Why We Recommend Pepperstone

Pepperstone outperformed in every category I tested. Particular standouts for me were trading costs and execution speeds (77ms) – two key attributes of the best brokers. This is why I rated them 98/100.

The Razor account is my favourite here, as you can receive zero-pip spreads on the EUR/USD pair. Plus, I found that the commission is low, which will help reduce your trading costs.

You can access 5 trading platforms, including top software like MT4 and TradingView. With these platforms, you can trade 2,400+ markets, including 93 pairs in the forex market.

Pros & Cons

- Best overall trading experience

- Lowest EUR/USD spreads

- Top-tier liquidity and fast execution

- Industry-leading platform range

- SGD base currency trading accounts

- Non-MAS regulated broker

- Doesn’t offer spot trading

- Demo account only for 30 days

- No local office in Singapore

Broker Details

0 pip Spreads On The Razor Account

The first thing I noticed when accessing Pepperstone’s markets was the tight spreads on its Razor account. The spread for EUR/USD was particularly impressive, remaining at 0.0 pips.

This was supported by my analyst, Ross Collins, who tested the broker’s spreads using SpreadMonitor EA on his MT4 platform. He confirmed that EUR/USD stayed at zero pips 100% of the time.

| Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY |

|---|---|---|---|---|---|---|

| Pepperstone | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| CityIndex | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Fusion Markets | 100.00% | 100.00% | 100.00% | 100.00% | 91.30% | 100.00% |

| IC Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| EightCap | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| FP Markets | 100.00% | 100.00% | 100.00% | 100.00% | 86.96% | 100.00% |

| TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% |

| Blueberry Markets | 100.00% | 100.00% | 91.30% | 100.00% | 78.26% | 95.65% |

| Blackbull Markets | 100.00% | 100.00% | 95.65% | 95.65% | 65.22% | 65.22% |

| CMC Markets | 100.00% | 95.65% | 65.22% | 86.96% | 65.22% | 78.26% |

Ross also uncovered other impressive results.

“I also found that the other major pairs like USD/JPY stayed at their minimum spreads during my tests,” Ross said.

“This makes Pepperstone’s Razor account the best choice for the tightest spreads in Singapore.”

Fast Execution Speeds For Improved Trading Conditions

Pepperstone is an ECN broker, so the broker can offer zero-pip spreads. It also helps optimise Pepperstone’s execution speeds.

Ross captured the average execution speeds across 36 brokers using his MT4 platform. Broker Latency Tester & ExTest_ForExpat EAs were activated too, to record the speeds.

His findings placed Pepperstone as the 3rd fastest broker overall, with limit orders averaging 77ms. This will help make sure your trades are filled at your expected price, while also supporting accurate stop-loss and take profit orders.

The average market order speed is 100ms. Anything under 100ms is excellent in my opinion, especially for scalping.

| Execution Speed | ||

|---|---|---|

| Broker | Limit Order Speed | Market Order Speed |

| Pepperstone | 77 | 100 |

| Octa | 81 | 91 |

| OANDA | 86 | 84 |

| CMC Markets | 138 | 180 |

| Eightcap | 143 | 139 |

| Go Markets | 144 | 145 |

| IG Group | 174 | 141 |

Decent Range of Trading Platforms

I like that the broker offers multiple platforms, which include MT4, MT5, cTrader, Pepperstone Platform, and TradingView.

If you like to analyse trade volumes, MT5, cTrader, and TradingView are solid options. You can use Pepperstone’s ECN network for accurate tick data and depth of markets tools.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘82% of retail CFD accounts lose money’

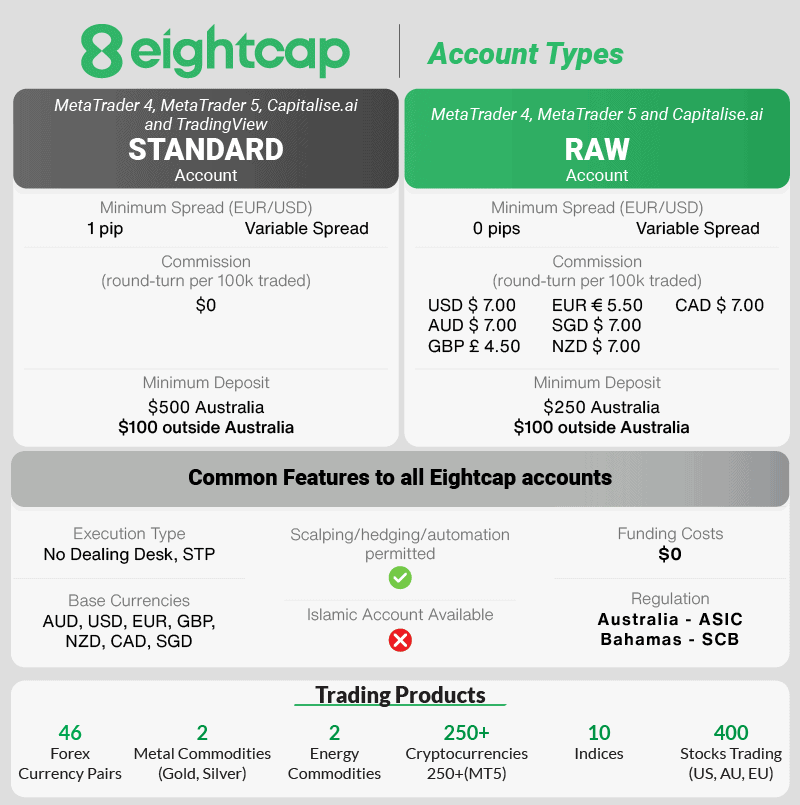

3. Eightcap - Top Selection Of Cryptocurrencies

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1

AUD/USD = 1.2

Trading Platforms

MT4, MT5, TradingView

Minimum Deposit

$100

Why We Recommend Eightcap

Eightcap topped my list because of its impressive selection of 95+ cryptocurrency products, almost 10 times more than many other brokers in Singapore.

Outside of crypto, I like that Eightcap has a decent range of markets covering forex and share CFDs, while offering low spreads from 0.0 pips on its RAW account. You also have a choice of top platforms, including TradingView, MT5, and MT4.

Pros & Cons

- Wide range of cryptocurrencies and stocks.

- Commission-free trading.

- Low minimum deposit and free deposits and withdrawals.

- 24-hour customer service

- They are not regulated by the MAS

- No demo account with TradingView

- Low commodities selection

- No proprietary trading platform

Broker Details

Largest Range of Crypto Markets

Eightcap produced the best range of 400+ instruments, covering the major markets and an impressive suite of 95+ cryptocurrencies. This is why I gave them 10/10 in my tests. For traditional markets, the broker offers 55 forex pairs and 150 share CFDs, providing plenty of opportunities for day trading.

If you want to trade cryptocurrencies, I think Eightcap is the best choice in Singapore. Eightcap offers the largest collection of crypto markets with more than 95, ranging from Bitcoin and Ripple to altcoins like DOGECOIN and PEPE.

As you can see in my table below, Eightcap far exceeds the crypto ranges of top brokers like Pepperstone and Octa:

| Broker | Crypto Markets Available |

|---|---|

| Eightcap | 95+ |

| Octa | 34 |

| Pepperstone | 20 |

| CMC Markets | 19 |

| Plus500 | 18 |

| Go Markets | 14 |

| IG Group | 14 |

| Saxo Markets | 9 |

| City Index | 5 |

| Interactive Brokers | 4 |

Low Trading Fees

Trading fees on Eightcap are competitive, with my tests showing that Eightcap’s RAW account averages 0.20 pips on EUR/USD. This is than the industry average of 0.27 pips. Commission on the RAW account is $3.50 per lot traded, which is what I’d expect from most forex brokers.

| EURUSD | Average Spread |

|---|---|

| TMGM | 0.15 |

| Tickmill | 0.15 |

| Fusion Markets | 0.16 |

| IC Markets | 0.19 |

| Pepperstone | 0.19 |

| FP Markets | 0.2 |

| EightCap | 0.2 |

| Admiral Markets | 0.21 |

| CityIndex | 0.22 |

| ThinkMarkets | 0.22 |

| Blueberry Markets | 0.27 |

| Go Markets | 0.38 |

| Axi | 0.43 |

| CMC Markets | 0.44 |

| Blackbull Markets | 0.46 |

| Industry Average: | 0.27 |

You do have the option of spread-only pricing through the Standard account, which I think is slightly more expensive than the RAW account once you’ve taken the commission into account. I found the Standard spreads averaged 1.16 pips – slightly more than the industry average.

Trade with TradingView, MT4, and MT5.

The Standard account is the only option on the TradingView platform. This, unfortunately, means you miss out on the tighter RAW spreads. That said, TradingView’s 110+ indicators do slightly counterbalance this – many forex traders may still want to opt for TradingView here.

With a RAW account, you can use MetaTrader 4 and MetaTrader 5.

Not sure which trading platform suits you? I developed a tool to help. Just answer 5 simple questions, and find the platform that best matches your needs. Try it below:

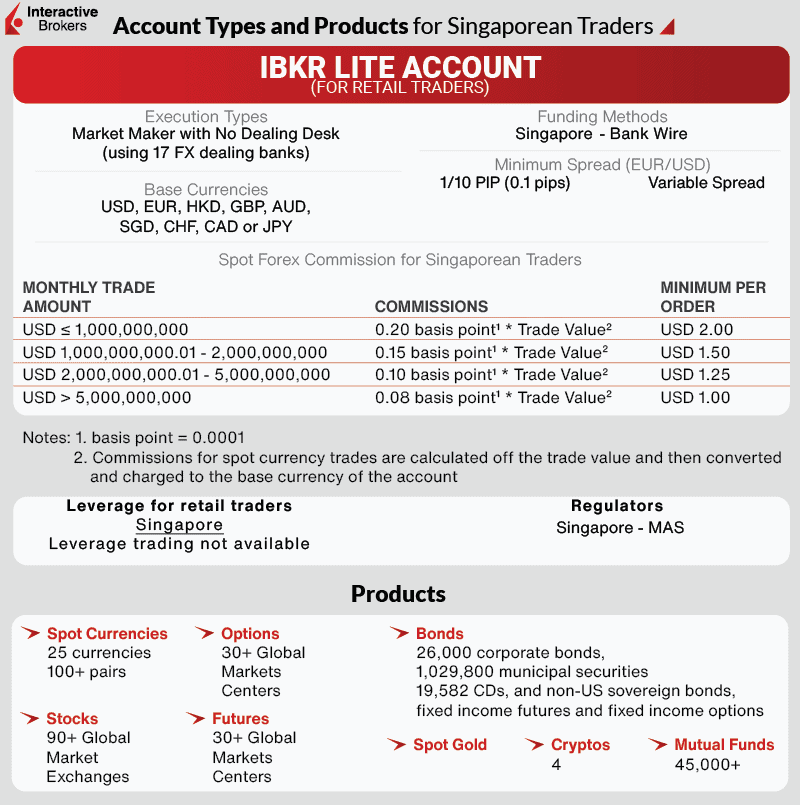

4. Interactive Brokers - Good Choice For Professionals

Forex Panel Score

Average Spread

EUR/USD = N/A

GBP/USD = N/A

AUD/USD = N/A

Trading Platforms

IBKR Workstation, IBKR Global Trader, IBKR Mobile

Minimum Deposit

$0

Why We Recommend Interactive Brokers

If you trade professionally, Interactive Brokers easily stands out as a good choice, with its advanced trading platforms and volume-based trading costs. These costs can go as low as $1 each way. Just bear in mind retail users won’t be able to trade on these commissions.

In 2025, Interactive Brokers upgraded its platforms, which are more user-friendly now after taking inspiration from TradingView’s interface. These platforms still pack advanced tools like Level II pricing and MultiSort Screener – very useful as you trade the broker’s 70,000+ markets.

Pros & Cons

- One of the largest brokers in the world, and listed on the NASDAQ.

- Only true ECN broker in Singapore.

- Low commissions based on trading volume

- Four proprietary trading platforms

- No available third-party trading platforms such as MetaTrader or cTrader

- Difficult to switch trading platforms

- No Forex CFDs

- Low levels of leverage

Broker Details

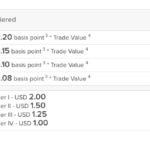

Lowest Trading Costs For Experienced Traders

I found Interactive Brokers offers some of the lowest trading costs I’ve tested. These can be as low as $1 each way for commissions, or $2 per trade. This beats the industry average of $3.50 by around 42%.

You can access spreads as low as 0.1 pips. However, there’s a catch – you’ll need a trading volume of over $5 billion per month. No retail trader is going to meet this.

Another catch is that these minimums are applied to smaller lot sizes too. If you’re trading anything less than 1 full lot, the saving isn’t quite so impressive. This is one of the reasons I recommend other brokers like Octa instead.

Upgraded And Easier To Use IBKR Platforms

The trading platforms on Interactive Brokers are brilliant if you can work with them. The IBKR platforms have been redesigned and have taken inspiration from platforms like TradingView and cTrader – in other words, they’re more user-friendly.

I found these platforms offer lots of technical indicators, while providing Level II pricing and professional ladder trading features.

These platforms are powerful for professional traders, with the MultiSort Screener letting you find opportunities from 70,000 stocks that meet your requirements. This makes it easy to find daily trading opportunities.

5. Go Markets - Lowest Commission RAW Account

Forex Panel Score

Average Spread

EUR/USD = 1

GBP/USD = 1.3

AUD/USD = 1

Trading Platforms

MT4, MT5, cTrader, TradingView, Go Markets Trading App

Minimum Deposit

$200

Why We Recommend Go Markets

I gave Go Markets a strong 76/100 score, after finding the cheapest retail commissions in Singapore from the broker.

With $2.50 per lot traded, you can save an average of 28% on your fees without needing a special account. If you’re a high-volume trader, Go Markets can reduce your fees by up to 30% through its rebate program.

While Interactive Brokers does beat this commission, IB is really only offering this to professional traders. Go Markets makes low commissions available to everyone.

I found the broker offers a decent range of trading platforms including cTrader, MT4, and MT5 while also giving you access to 1,200+ markets, ideal for day trading.

Pros & Cons

- Lowest commission and tight spreads

- Offers SGD as a base currency

- Access to full MetaTrader suite along with Genesis upgrade

- Offers social trading (Myfxbook) and specialist trading platforms (Trading Central and AutoChartist)

- No MAS license.

- No Swap-Free or Islamic Account.

- No customer support on weekends

- A relatively narrow range of trading instruments

Broker Details

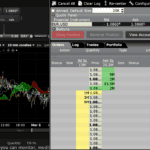

Low Commissions On the Raw Account

I rated GO Markets highly for its low commissions on the RAW account, at $2.50 per lot traded. On average, I found you’ll save 28% on your trading fees, which is significant if you day trade.

| Broker | USD |

|---|---|

| Tickmill | $2.00 |

| RoboForex | $2.00 |

| FXTM | $2.00 |

| Fusion Markets | $2.25 |

| CMC Markets | $2.50 |

| Go Markets | $2.50 |

| City Index | $2.50 |

| Pepperstone | $3.50 |

| EightCap | $3.50 |

| IC Markets | $3.50 |

| IG Group | $6.00 |

If you trade less than 1 lot, this is the broker to choose for lower trading commissions. I like having the added benefit of accessing popular platforms like MT4, MetaTrader 5, and cTrader – so you can customise your trading set-up to suit your trading style.

Spreads On the MT5 Platform

While using the MT5 platform, the spreads on the RAW account weren’t the cheapest. Ross tested the average RAW spreads of 15 brokers using the IceFX SpreadMonitor and found Go Markets offered an average of 0.38 pips. This is slightly more expensive than our industry average of 0.27 pips.

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

However, the $1 per lot saving on your commissions makes up for the wider spreads in my opinion.

If you trade more than $10,000,000 notional value (so 100 lots) per month, you can save up to 30% on your spread and commission fees. I like it when brokers reward you for trading, especially in high volumes. The improved prices will boost your bottom line, helping you take more of your profits home.

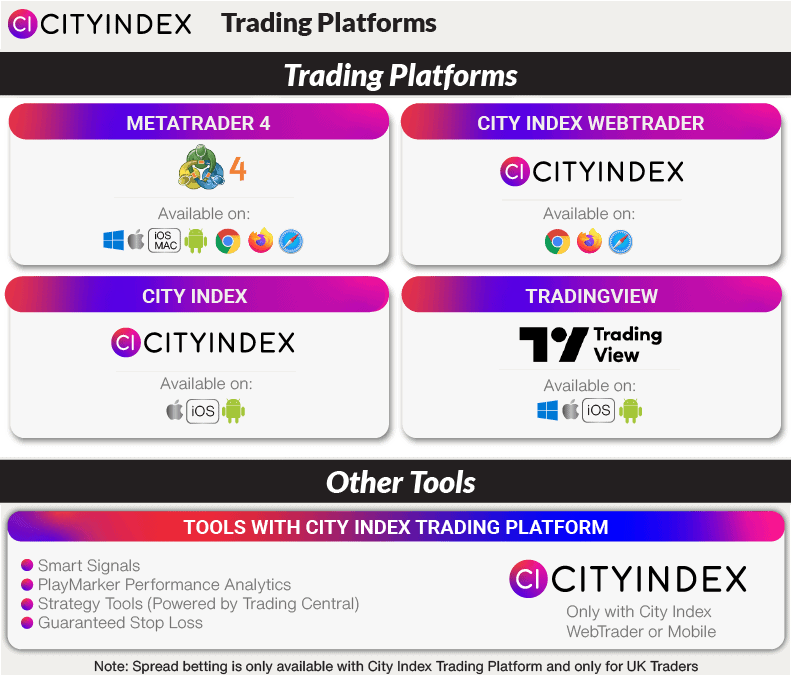

6. City Index - Great Trading Tools

Forex Panel Score

Average Spread

EUR/USD = 0.7

GBP/USD = 1.1

AUD/USD = 2.2

Trading Platforms

MT4, TradingView, City Index WebTrader

Minimum Deposit

$0

Why We Recommend City Index

I found that City Index supports you with the largest variety of trading tools out of any of the brokers I tested. The Performance Analytics and SMART Signals are some of the best tools I’ve seen. The Performance Analytics feature is a real-time coach, which highlights your strengths and weaknesses – something I’ve not seen from other brokers.

On top of the tools, you can trade 84 forex pairs, and over 5,000 products on its City Index web platform. I found City Index had the lowest Standard account spreads. The EUR/USD averages 0.70 pips with no commissions, making it a good pick if you’re looking to lower costs.

Pros & Cons

- Regulated by the MAS

- Wide range of trading instruments

- Great execution speeds

- Excellent knowledge base

- Does not offer MetaTrader 5 or cTrader

- Customer service unavailable on weekends

- Does not offer SGD as a base currency

Broker Details

Top Selection of Trading Tools

I found City Index had a decent selection of trading tools on the City Index Web Trader platform. These can help you find new trading opportunities while refining your trading performance.

The first tool I noticed was the SMART Signals, providing daily trading signals using chart patterns and support and resistance levels as triggers. I like that these tools can be applied right across the broker’s 5,000+ markets – which include forex, crypto, and commodity markets. This makes SMART Signals a useful tool for day trading.

Another excellent tool I found was Performance Analytics. This tool provides real-time feedback on your trading performance by reading your open and closed trading history. I feel that feedback is an important part of growing as a trader, and Performance Analytics helps you identify your strengths and weaknesses.

The tool helps you identify the best time to trade, and the most profitable assets to trade on. I think using this can help improve your performance, putting you on the right path to becoming a better trader.

I like that you are not locked into the Web Trader platform. You can choose to trade with MT4 or TradingView and still access the tools. Although using the broker’s Web Trader platform is the most convenient, especially for copying the signals.

Decent Standard Account Spreads

During my testing, I found City Index spreads are among the lowest available for standard accounts, averaging 0.7 pips on EUR/USD and 0.6 pips on USD/JPY.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | |

|---|---|---|---|---|---|---|---|---|

| City Index | 0.7 | 0.6 | 1.1 | 2.2 | 1.6 | 1.1 | 1.6 | 2.2 |

| Industry Average | 1.2 | 1.5 | 1.6 | 1.5 | 1.8 | 1.6 | 1.9 | 2.1 |

I found that these spreads were much lower than the industry average, with EUR/USD averaging 1.20 pips and USD/JPY 1.5 pips.

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

7. CMC Markets - Top Choice Of Currency Pairs

Forex Panel Score

Average Spread

EUR/USD = 1.12

GBP/USD = 1.3

AUD/USD = 1.64

Trading Platforms

MT4, CMC NGEN

Minimum Deposit

$0

Why We Recommend CMC Markets

CMC Markets is my top pick for forex trading. With access to 330+ currency pairs, the broker offers the largest collection out of the candidates I tested. The FX Active account is a great choice if you only trade forex, as this gives you tight spreads from 0.0 pips and $2.50 per lot commission. However, this account is only cheaper for forex trading.

I awarded CMC Markets 73/100 in my tests thanks to its large selection of 12,000+ markets and the CMC NGEN platform. This platform provides excellent trading tools like pattern recognition software.

Pros & Cons

- Wide range of trading instruments.

- Regulated by the MAS

- High-quality educational materials for traders to learn

- Great proprietary trading platform

- Does not offer any swap-free account

- Costly raw spreads compared to other brokers

- Does not offer MetaTrader 5, cTrader, or TradingView

- Slow execution speeds according to our tests

Broker Details

Trade The Largest Collection Of Currency Pairs

CMC Markets has the largest collection of currency pairs with over 330+ pairs, the most out of any of the brokers I’ve tested. This is almost three times the amount offered by IG Groups, and four times the industry average – as you can see from my findings below:

| Broker | CFD Currency Pairs | |||

|---|---|---|---|---|

| CMC Markets | 338 | |||

| Inreractive Brokers | 117 | |||

| IG Group | 110 | |||

| Pepperstone | 93 | |||

| City Index | 84 | |||

| Plus500 | 65 | |||

| Eightcap | 55 | |||

| Octa | 52 | |||

| Go Markets | 47 | |||

| Saxo Markets | 7 |

The broker’s range is ideal if you trade forex as it allows you to trade the most exotic pairs (including SGD crosses). So you can benefit from local economic news.

FX Active Makes Forex Trading Cheaper

CMC Markets offers its FX Active account, which will lower your trading costs if you trade forex. I found spreads from 0.0 pips with commissions of $2.50 per lot traded, which is cheaper than the broker’s Standard account.

If you want to trade more than forex, the Standard account offers some of the best spreads without commissions, according to my analyst Ross Collins. To get this data, Ross tested 15 Standard accounts using the IceFX SpreadMonitor EA to capture the spreads.

In Ross’ tests, CMC Markets averaged 0.80 pips on EUR/USD, 27% cheaper than the industry average spreads of 1.11 pips. CMC Markets also outperformed the industry with its spreads on AUD/USD, GBP/USD, USD/CHF, and USD/JPY as you can see below:

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

Trade 12,000+ Markets With CMC Markets

CMC Markets also offers a wide range of trading products, covering 12,000+ markets. On the CMC Markets NGEN platform, I found the broker offers 18 cryptocurrencies, 82+ indices, 1000+ ETFs, 9,000+ stocks, 124 commodities, and 55+ fixed-income markets.

8. Saxo Markets - Best Forex Trading Platform

Forex Panel Score

Average Spread

EUR/USD = 1.2

GBP/USD = 1.8

AUD/USD = 0.9

Trading Platforms

MT4, TradingView, SaxoTraderGo, SaxoTraderPro

Minimum Deposit

$0

Why We Recommend Saxo Markets

I found Saxo Markets’ SaxoTraderGO to be the best forex trading platform, thanks to its 64+ indicators and advanced charting tools for technical analysis. You also get access to Saxo Markets’ professional analyst research, which I found helpful for quickly understanding current market conditions.

On SaxoTraderGO, you have access to an impressive 8,800+ markets, combined with its professional analyst research and trading signals, making Saxo Markets a decent broker for day traders.

Pros & Cons

- Licensed by the MAS

- Wide range of trading instruments

- Offers proprietary trading platforms

- No minimum deposit required

- Customer support is only available 9-to-5

- MetaTrader 5 and cTrader trading platforms are not available

- Few payment options apart from Visa/Mastercard and wire transfers.

- Spreads are average when compared to other brokers.

Broker Details

SaxoTraderGO Is A Solid Trading Platform

In my testing, I used the SaxoTraderGO platform to experience what Saxo Markets offers. I found that the SaxoTraderGO platform has 64 indicators, including Ichimoku, VWAP, and Bollinger Bands, which is more than the basic versions of other platforms like MetaTrader 4.

To help with forex trading, I like that Saxo Markets has trading signals. These show you the exact chart pattern, and add a forecast on your chart. Even better, you can trade the signal directly from charts, preventing mistakes from copying the price levels and saving you time.

Expert Analysis From Saxo Markets

What stood out for me was the technical analysis commentary provided by Saxo’s analysts, which is provided in real time. I found the depth of the analysis was comprehensive – not like other brokers who provide generalised updates. Instead, the commentary is insightful and actionable.

The one negative I found using the platform is that it does not allow you to automate trades. If you need this automation, MetaTrader 4 is a better choice. Alternatively, if you prefer to use TradingView, you will be pleased that Saxo Markets lets you sync your account with the platform.

Trade A Large Range of Markets On SaxoTraderGO

SaxoTraderGO platform lets you trade the broker’s full range of financial instruments. This includes 100+ FX pairs, 8,800+ stocks, 29 indices, 675 fixed-income markets, and 12 commodities. MT4, on the other hand, has reduced access to these markets, and instead focuses on forex, indices, and commodities.

9. IG Group - Largest Range Of Products

Forex Panel Score

Average Spread

EUR/USD = 1.13

GBP/USD = 1.66

AUD/USD = 1.01

Trading Platforms

MT4, TradingView, IG Trading Platform, L2 Dealer

Minimum Deposit

$0

Why We Recommend IG Group

I gave IG Group a solid score of 78/100. The standout features were its 17,000+ markets and competitive spreads with no commissions. IG supports trading on many different instruments, from forex and crypto to stocks and indices. Standard account spreads average 1.13 pips on EUR/USD.

The broker offers a wide variety of trading platforms, including MT4 and ProRealTime.

Pros & Cons

- Widest range of trading instruments

- Decent trading platforms

- Excellent 24/7 customer service

- Regulated by the MAS

- Slow execution speeds

- No MetaTrader 5, cTrader, or TradingView

- Limited markets on MT4 platform

Broker Details

Trade The Largest Range of Markets With IG Group

IG Group had the largest range of CFD financial products out of all the brokers I tested, with 17,000 markets available. This led to me scoring them 9.50/10 in this category. Those markets break down to 110+ forex pairs, 13,000+ stocks, 13 cryptocurrencies, 130 indices, 41 commodities, and 6,000+ fixed-income markets.

If you like to hold your CFDs overnight or for longer periods, IG Group offers futures and options trading, protecting you from overnight financing fees.

With such a big choice of markets, I think IG Group is a solid pick if you day trade, as you’ll have access to all of the most volatile assets each day, on one account.

IG Trading Platform Is The Best All-Rounder

You’ll need the IG Trading platform to access the broker’s full range of markets. I found the platform easy to use, with an impressive charting package. There are 80+ indicators and drawing tools – more than MetaTrader 4’s default offering.

IG Group offers specialised trading platforms like MetaTrader 4, ProRealTime, and L2 Dealer, giving you a better choice of customisation options and automated trading tools.

As well as the IG Trading Platform, I also like the ProRealTime platform. I found it has unique features like the automated ProRealTrend tool that automates trend, support, and resistance lines. This tool makes price action trading faster, particularly when you are switching between different assets.

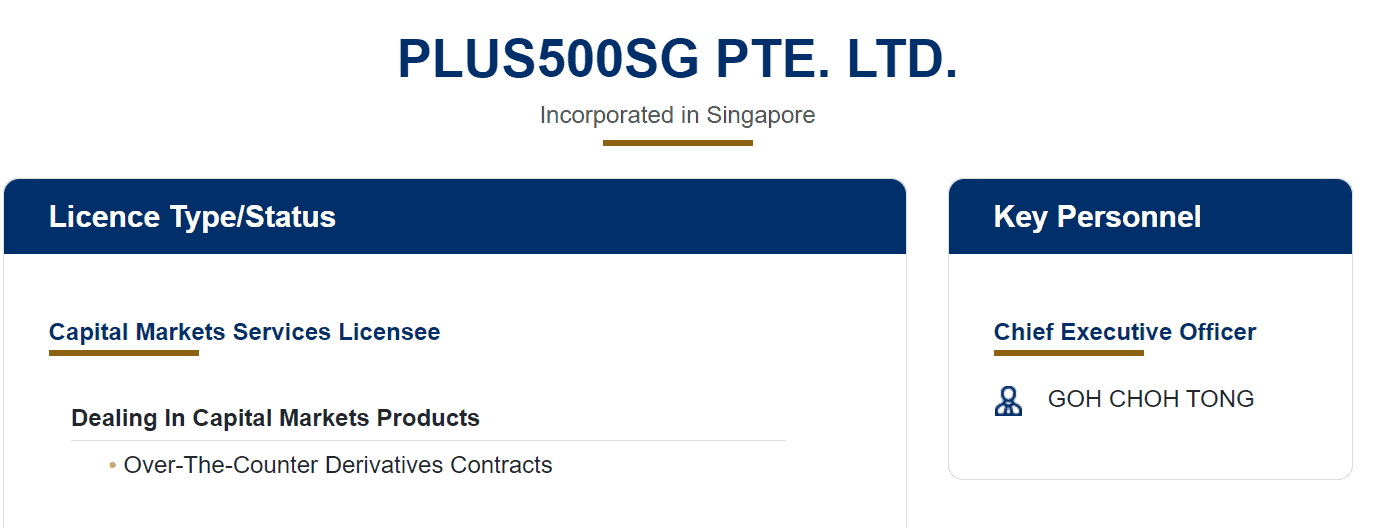

10. Plus500 - Best Islamic Account

Forex Panel Score

Average Spread

EUR/USD = 1.7

GBP/USD = 2.3

AUD/USD = 1.4

Trading Platforms

Plus500 Trading Platform

Minimum Deposit

$100

Why We Recommend Plus500

Plus500 stood out for its Islamic account, which does not apply interest to your trading positions if you hold them overnight. I found the broker’s trading platform good if you’re a beginner, offering 100+ indicators and 10+ advanced chart types, including Renko bars.

The broker is well-regulated and licensed by MAS. The company is listed on the London Stock Exchange with the FTSE 250, which also contributes to the broker’s high trust score.

Pros & Cons

- Offers swap-free Islamic account

- Decent trading costs with no withdrawal fee

- Won several awards for customer service

- Minimum deposit of only $100

- No MetaTrader 5, cTrader, or Trading View

- Dedicated account manager only for professional accounts

- No commission-based account

- Plus500 proprietary trading platform users may find it hard to switch to another trading platform.

Broker Details

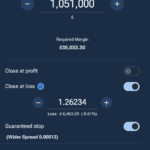

Best Islamic Account In Singapore

Plus500’s Islamic account is free from interest, in accordance with Islamic law. So you will not pay any overnight charges or swaps on your CFD positions. With Plus500’s Standard account, you do not pay commission, only spread fees. These are high compared to brokers like Octa, who also offer swap-free accounts.

While testing the broker, I found their EUR/USD spreads averaged 1.70 pips on the Web Trading account. I prefer seeing spreads at 1.20 pips maximum for EUR/USD, although the lack of swap-fees can make up for this.

Plus500 Has Top Risk Management Tools

I like that the Plus500 trading platform offers solid risk management tools, including guaranteed and trailing stop-loss orders. I found it easy to set the guaranteed stop-loss, as I could easily select the order type when placing the trade through an order ticket.

On top of the risk management tools, I liked the solid web-based trading platform with 100+ indicators and 10+ chart types. These include candlestick, Heikin-Ashi, and Renko. One problem I encountered, however, was that I could not trade directly off the chart. There was no one-click trading feature either – most other brokers will offer these.

Unfortunately, I noticed that Plus500 does not support any third-party trading platforms like MetaTrader 4 or TradingView. This also means I couldn’t find a way to automate my trades with Plus500. If automation is important, you should choose a broker like Pepperstone or Eightcap.

Ask an Expert

Is forex trading illegal in Singapore?

N0, forex trading is legal in Singapore however it is highly recommended to use a broker that is regulated by Singapore’s financial regulator known as the the Monetary Authority Singapore (MAS).

Brokers regulated by this authority include Oanda, CMC Markets, Swissquote, Plus500

What is the most popular commodity traded through Singapore CFD brokers? What leverage can I get trading it?

Gold is the most popular commodity to trade with Singapore CFD brokers. The leverage available is 5:1 (20% initial margin). Other commodities such as Silver, Oil also have the same leverage.

Octa is really gaining momentum in the financial industry. People even started comparing them with Interactive broker which says a lot about their authority. As far as I know, they don’t charge any swap commissions, is there someone who is trading with them, could you say is it true or nope?

That is correct – all trading accounts are swap-free by default.