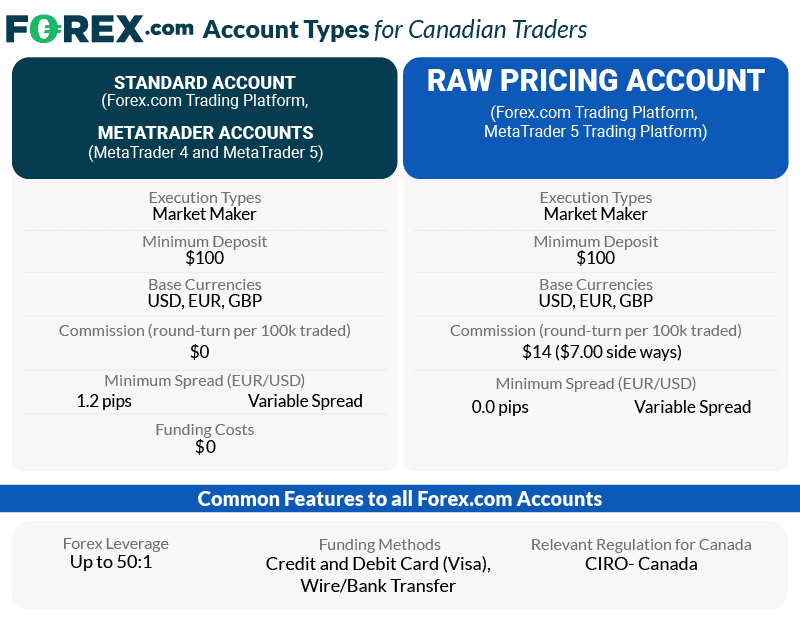

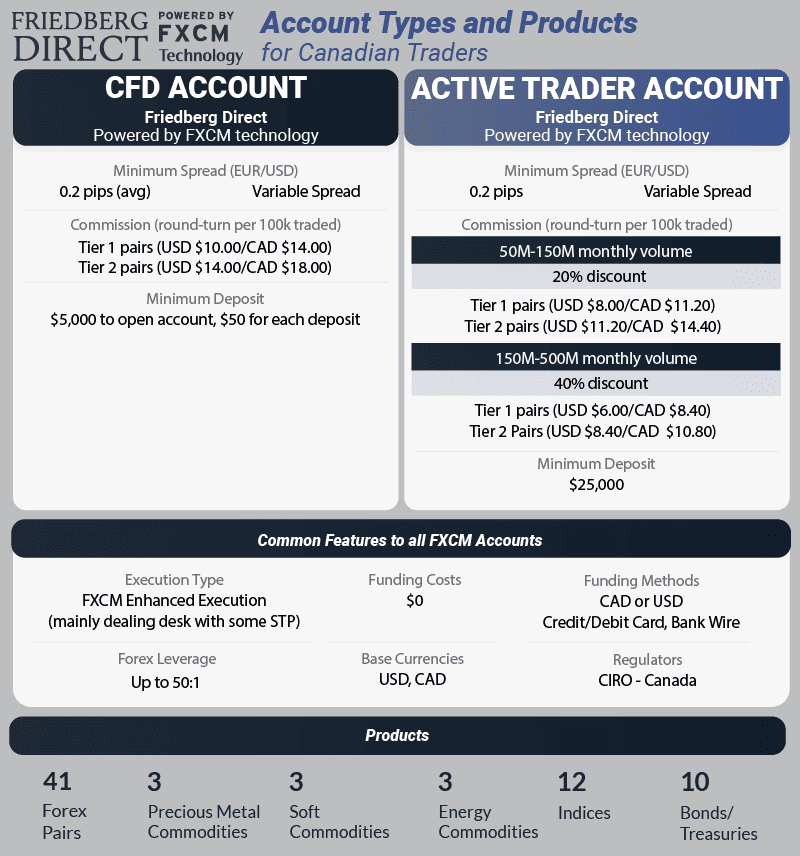

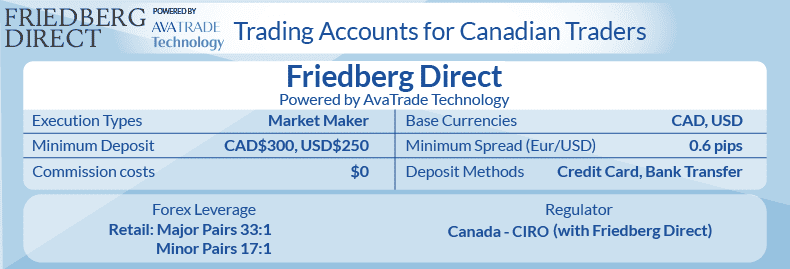

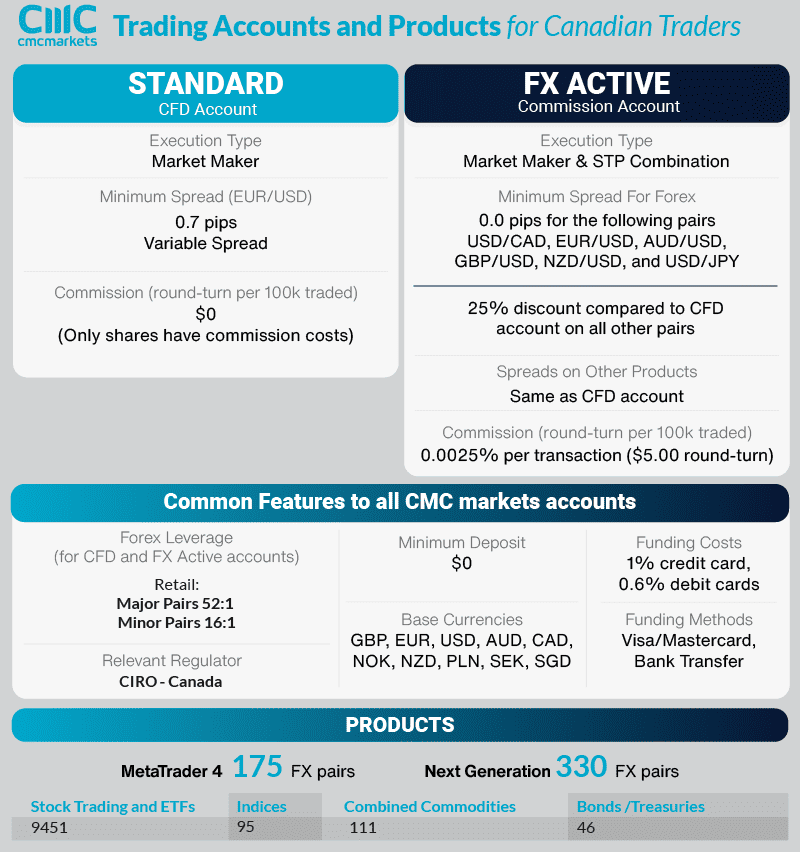

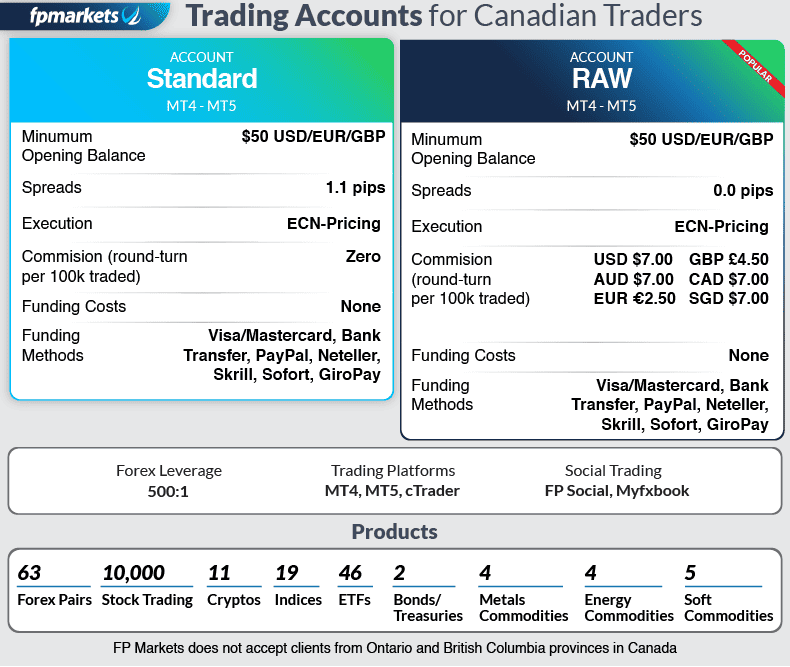

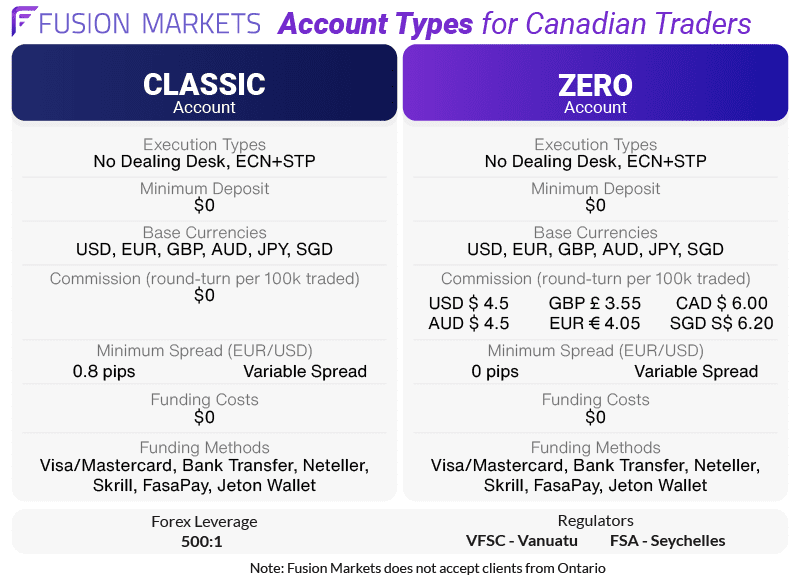

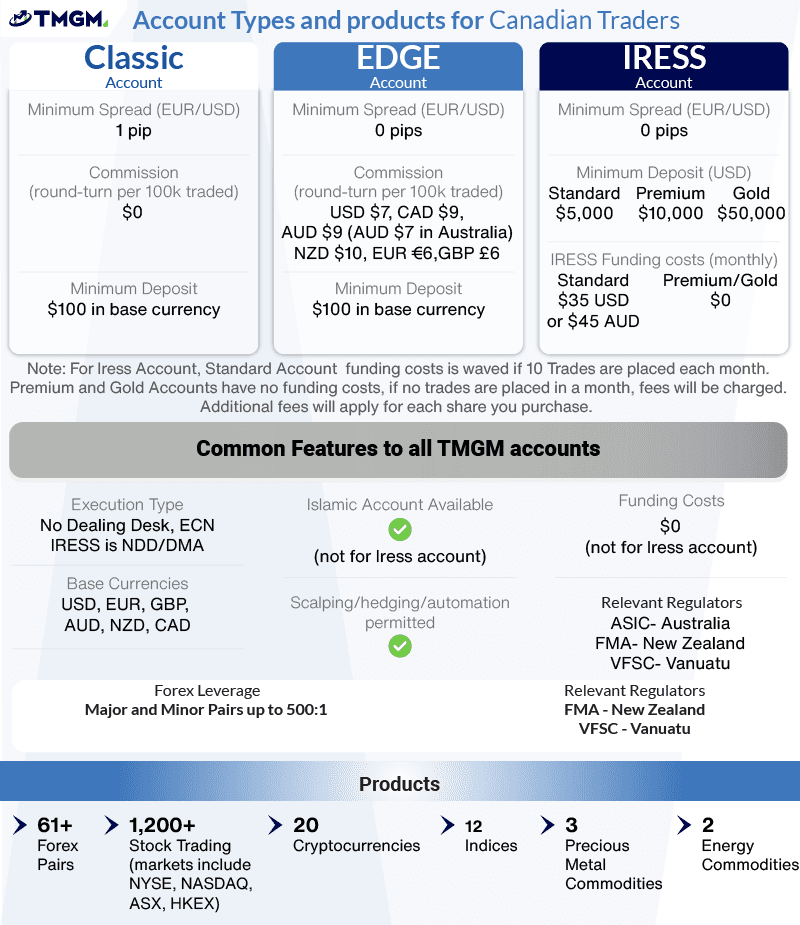

Lowest Spread Forex Brokers in Canada

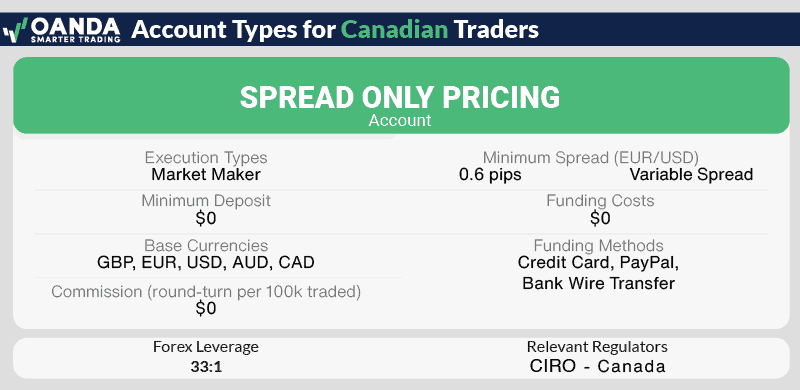

The Lowest Spread Forex Brokers in Canada have spreads that start from 0.0 pips for the EUR/USD currency pair. In this review, we look at the best spread brokers for standard ECN and fixed spread trading accounts for Canadian traders.

Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Ask an Expert